2024-07-14 14:25

CAIRO, July 14 (Reuters) - Kuwait Petroleum Corporation (KPC) said on Sunday it had made a "giant" oil discovery in the Al-Nokhatha field east of the Kuwaiti island of Failaka, with oil reserves estimated at 3.2 billion barrels. KPC's CEO Sheikh Nawaf Saud Nasir Al-Sabah said in a video posted by the company on X that the new discovery's reserves were equivalent to the country's entire production in three years. The initial estimated area of the newly discovered oil well is around 96 square km, KPC said in its statement. It added that the preliminary estimates of the hydrocarbon reserves present at the well were estimated at approximately 2.1 billion barrels of light oil, and 5.1 trillion standard cubic feet of gas, which correspond to 3.2 billion barrels of oil equivalent. Sign up here. https://www.reuters.com/markets/commodities/kuwait-announces-giant-oil-discovery-2024-07-14/

2024-07-14 14:01

Kuwait, July 14 (Reuters) - Kuwait's budget is projected to show a deficit of 5.6 billion dinars ($18.33 billion) for the 2024-2025 fiscal year, with expenses estimated at 24.5 billion dinars and revenues at 18.9 billion dinars, the Ministry of Finance announced on Sunday. Government spending must be fixed at 24.5 billion Kuwaiti dinars in the 2027-2028 budget to control budget growth, it added. The liquidity of the General Reserve Fund, from which the budget deficit is financed, decreased to 2 billion dinars last March from 33.6 billion ten years ago due to increasing withdrawals, the Ministry of Finance said. ($1 = 0.3055 Kuwaiti dinars) Sign up here. https://www.reuters.com/world/middle-east/kuwait-says-government-spending-must-be-fixed-control-budget-growth-2024-07-14/

2024-07-14 13:45

MOSCOW, July 14 (Reuters) - The southern Russian city of Novorossiisk on the Black Sea declared a state of emergency on Sunday as forest fires spread across an area of 22 hectares, its mayor said. Intense heat, strong winds and dry thunderstorms have caused forest fires across Russia in recent weeks, from the remote Siberian region of Tuva to the Republic of Sakha, also known as Yakutia, in the Far East. Pictures published by the mayor of Novorossiisk, Andrei Kravchenko, showed firefighters battling blazes and vast expanses of scorched earth and trees. Kravchenko, writing on Telegram, said buses had been prepared to evacuate around 200 people from risk areas and that helicopters were extinguishing the blazes across mountainous terrain. Fires have spread across the broader southern Krasnodar region where Novorossiisk is located, on the Black Sea where many Russian holidaymakers head during the summer months. Sign up here. https://www.reuters.com/world/europe/russia-declares-state-emergency-novorossiisk-forest-fires-spread-2024-07-14/

2024-07-14 12:59

NEW YORK, July 12 (Reuters) - Looming U.S. interest rate cuts are presenting investors with a tough choice: stick with the Big Tech stocks that have driven returns for more than a year or turn to less-loved areas of the market that could benefit from easing monetary policy. Owning massive tech and growth companies such as Nvidia (NVDA.O) New Tab, opens new tab, Microsoft (MSFT.O) New Tab, opens new tab and Amazon (AMZN.O) New Tab, opens new tab has been a hugely profitable strategy for investors since early 2023, even as the stocks' market dominance has drawn comparisons to the dot-com bubble of the late 1990s. That calculus may start to change following Thursday's surprisingly cool inflation report, which solidified expectations for a near-term rate cut by the Federal Reserve. Lower rates are seen as beneficial to many corners of the market whose performance has lagged this year, including small-caps, real estate and economically sensitive areas such as industrials. Market action at the end of the week showed a nascent shift may have already begun. The tech-heavy Nasdaq 100 (.NDX) New Tab, opens new tab suffered its biggest drop of the year on Thursday while the small-cap Russell 2000 (.RUT) New Tab, opens new tab had its best day of 2024. The Nasdaq 100 has gained about 21% this year while the Russell 2000 is up just 6%. Also on Thursday, the equal-weight S&P 500 (.SPXEW) New Tab, opens new tab - a proxy for the average stock in the benchmark index - had its biggest relative gain since 2020 over the S&P 500, which is more heavily influenced by the largest tech and growth stocks. That chipped away at the huge advantage for the S&P 500, which remains up about 18% in 2024 against a 6.7% gain for the equal-weight index. "The trade got too one-sided and we're seeing some reversal of this," said Walter Todd, chief investment officer at Greenwood Capital. Small caps and the equal-weight S&P 500 extended their gains on Friday even as tech stocks rebounded. Investors cautioned that the moves could be a snap-back after the disparity in performance between tech and other market sectors reached extremes. Further, recent periods of market broadening have been short-lived: for example, small caps surged at the end of 2023, when investors believed rate cuts were imminent, only to lag in the following months. Still, there are reasons for optimism about the broadening trade. Fed fund futures on Friday were pricing in nearly 90% odds of a 25 basis point rate cut at the central bank's September meeting, according to CME FedWatch. Smaller companies, including biotech firms, that are heavily dependent on credit are among those that stand to benefit most from lower rates, said Matthew McAleer, president and director of private wealth at Cumberland Advisors. Industrial companies, which can rely on debt for capital intensive projects, also could be winners, McAleer said. Equity valuations across the market could also become more attractive if bond yields continue falling as traders price in lower rates. Lower yields mean bonds offer less competition to equities while stock valuations improve in many analysts' models. The benchmark 10-year Treasury yield, which moves inversely to prices, was last around 4.2%, down some 50 basis points below April highs. The S&P 500 was recently trading at 21.4 times forward earnings, compared to a historical average of 15.7, according to LSEG Datastream. "If we can start to stall (near 4%) ... I think you're going to see better breadth across multiple areas in the equity market," McAleer said. Many are skeptical that investors will stay away from shares of megacap companies, which are expected to be more resilient in uncertain economic environments. Big Tech could be an appealing destination if the U.S. economy starts to weaken more than expected after months of elevated interest rates, said Chuck Carlson, chief executive officer at Horizon Investment Services. Megacap tech stocks are also at the center of the artificial intelligence theme that has been exciting investors this year, said Rick Meckler, partner at Cherry Lane Investments. "You could see ... a broadening of stock buying," Meckler said. "But I think as long as the AI thesis is dominating the market, it's going to be difficult for these stocks to drop significantly." Any sustained move away from megacaps could spell trouble due to their heavy weightings in indexes. The S&P 500's year-to-date gains have been concentrated in stocks like Nvidia and Microsoft, and analysts have warned that any weakness in them could hurt the major indexes. If large cap tech stocks keep falling, "at some point, that will cause the entire market to decline," Matthew Maley, chief market strategist at Miller Tabak, said in a note on Friday. Sign up here. https://www.reuters.com/markets/us/wall-st-week-ahead-expected-us-rate-cuts-have-investors-looking-beyond-big-tech-2024-07-12/

2024-07-14 07:40

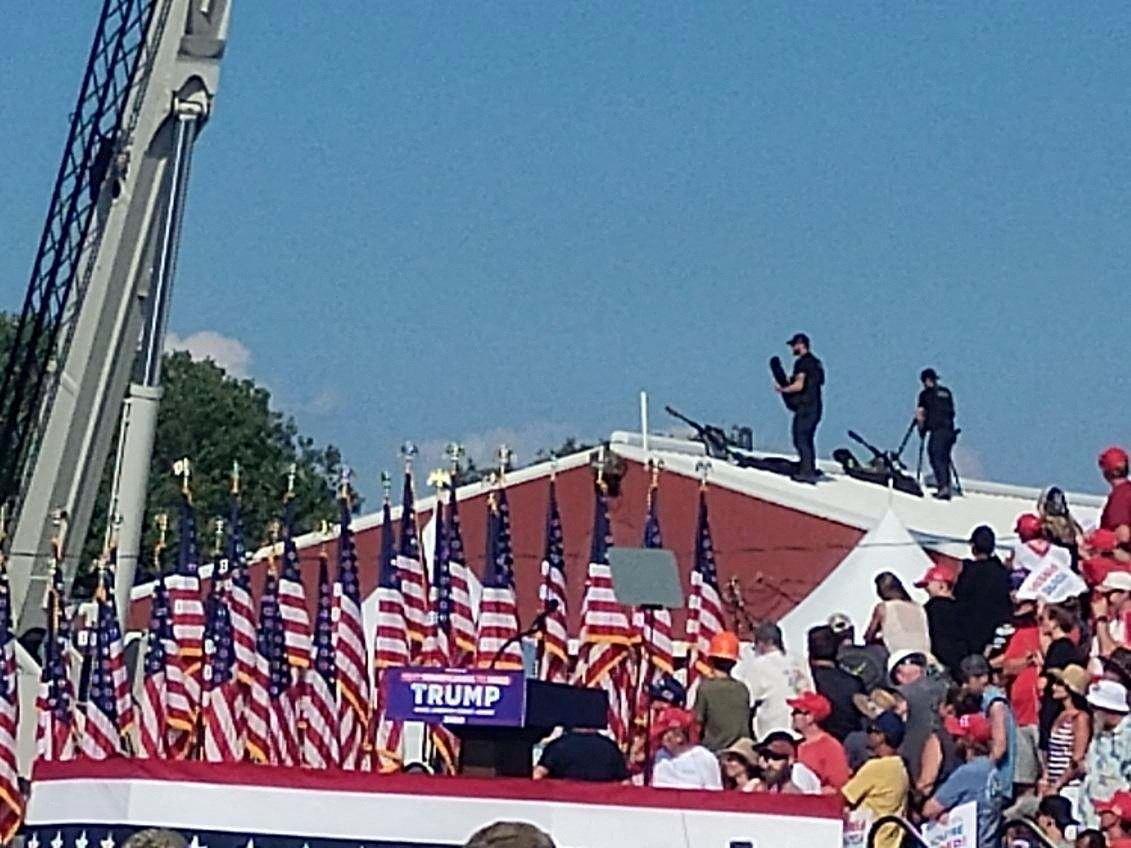

SINGAPORE, July 15 (Reuters) - Saturday's shooting at former U.S. President Donald Trump's election rally raises his odds of winning back the White House and betting on his victory will increase, investors said. Trump was shot in the ear during a rally in Pennsylvania in what authorities were treating as an assassination attempt. His face spattered with blood, Trump pumped his fist moments after the attack and his campaign said he was fine after the incident. Before the shooting, markets had reacted to the prospect of a Trump presidency by pushing the dollar higher and positioning for a steeper U.S. Treasury yield curve, and those moves extended a little in Asia trade on Monday morning. Ten-year Treasury futures dipped about 13 ticks and the dollar rose on the euro and yen. U.S. stock futures inched higher. The first shooting of a president or major candidate since a 1981 assassination attempt on Republican President Ronald Reagan could upend the Nov. 5 rematch between Republican Trump and President Joe Biden, a Democrat, which has been tight in polls. "The election is likely to be a landslide. This probably reduces uncertainty," said Nick Ferres, chief investment officer at Vantage Point Asset Management, citing polls that showed a surge in support for Reagan after the attempt on his life. World leaders and U.S. politicians condemned the shooting, while executives, including Tesla (TSLA.O) New Tab, opens new tab chief Elon Musk, and hedge fund manager Bill Ackman declared their support for Trump. Immigration and the economy have been the main issues for voters who, according to Reuters/Ipsos polls, see Trump as the better candidate for the economy, even as Biden seeks to benefit from solid growth, slowing inflation and low unemployment. TRUMP TRADES Under Trump, markets expect hawkish trade policy and looser regulation over issues from climate change to cryptocurrency. Bitcoin is up roughly 7% since the shooting. Investors also expect an extension of corporate and personal tax cuts, fuelling concerns about rising budget deficits. That could drive bond selling, said Michael Purves, CEO of Tallbacken Capital Advisors in New York and potentially add to inflation as interest rates fall. "If (Trump) wins and does this stuff he said he is going to do, you are going to see a much bigger selloff in the back-end of the bond market,” he said. “I think the bond market is the big (election) trade this year, rather than equities.” Trump also said in an interview in February he would not re-appoint Federal Reserve Chair Jerome Powell, whose second four-year term as chair will expire in 2026. To be sure, moves have not been particularly sensitive to election news so far, especially in equities, and even in the bond market the backdrop of economic data and fluctuations in interest rate expectations have had more effect. "Stock traders are not particularly good at pricing in events with a nebulous impact on revenues, earnings, cash flows, etc," said Steve Sosnick, chief strategist at Interactive Brokers in Greenwich, Connecticut. "This weekend's events fall into that category." Still, stocks have gained in the two weeks since shaky debate showing from Biden and both the S&P 500 (.SPX) New Tab, opens new tab and Dow Jones Industrial Average (.DJI) New Tab, opens new tab indexes hit record highs on Friday and the S&P 500 is up 18% this year. "Around the five presidential elections of the last 20 years, CEO confidence, consumer sentiment, and particularly small business optimism have shifted more favorably in response to Republican victories than Democratic victories," analysts at Goldman Sachs wrote. "To the extent improved sentiment leads to an increase in spending and investment, a Trump victory could boost the earnings outlooks for some firms even without substantial policy changes." Sign up here. https://www.reuters.com/world/us/trump-victory-trades-swell-after-shooting-investors-say-2024-07-14/

2024-07-14 07:20

July 14 (Reuters) - Following are investor and analyst reactions after Donald Trump was shot in the ear during a campaign rally in Pennsylvania on Saturday in what the FBI said it was treating as an assassination attempt. The Trump campaign later said the former president was "doing well" and appeared to have suffered no major injury besides a wound on his upper right ear. QUINCY KROSBY, CHIEF GLOBAL STRATEGIST, LPL FINANCIAL, CHARLOTTE, NORTH CAROLINA "As with any geopolitical event underpinned by mounting concern or outright fear - especially given the opening of the Republican convention - gold would have a strong bid, coupled with a pickup in demand for Treasuries. "In addition, the dollar - which has been softening due to the market's perception that the Fed seems poised to cut rates in September - could gain if the safety trade gains momentum. "If, however, a scenario unfolds that there's a broader threat aimed at U.S. officials, the equity market could open significantly lower, requiring the Fed to provide liquidity. At this point this narrative is highly unlikely." JACK ABLIN, CHIEF INVESTMENT OFFICER AT CRESSET CAPITAL, CHICAGO: "The specter of political violence introduces a whole new level of potential instability. "It's uncertainty and volatility, and of course markets don't like that. It's not an environment anyone wants to see. The attempted assassination probably enhances Trump's "reputation for strength," Ablin said. Bond markets may repeat a trading pattern similar to after President Joe Biden's debate performance against Trump, Ablin said, referring to a steeper Treasury yield curve. "Perhaps we see the market begin projecting longer-term rates higher, and anticipating lower short-term rates, because I think it's clear that as president, Trump would push for lower rates right away." STEVE SOSNICK, CHIEF STRATEGIST AT INTERACTIVE BROKERS, GREENWICH "I'll be looking to see if the October-December bump in VIX futures expands or if the Treasury yield curve steepens. The former indicates concerns about electoral and post-electoral volatility, while the latter would indicate bond market concerns about Trump's likelihood of replacing income taxes with tariffs. "I'm not sure that this will have much of an impact on equity markets. Stock traders are not particularly good at pricing in events with a nebulous impact on revenues, earnings, cash flows, etc. and this weekend's events fall into that category." JOHN CHAMBERS, FORMER CHAIRMAN SOVEREIGN RATINGS COMMITTEE, STANDARD & POOR'S, NEW YORK "Like everyone, I am appalled by the assassination attempt on former President Trump. "It could harbinger a return to political violence, the likes of which the U.S. experienced in the 1960s. Such an outcome would be grievous, but given the strength of U.S. institutions, I don't believe it would have an impact on ratings." BRIAN JACOBSEN, CHIEF ECONOMIST, ANNEX WEALTH MANAGEMENT, MENOMONEE FALLS, WISCONSIN "It was horrible to watch the video clips. From a purely markets perspective, the question is what it does to the odds of one candidate winning over the other? Will it throw Trump off his game, as these types of rallies are a key part of his campaign strategy? It could strengthen the resolve of his supporters to go to the voting booth. Voter turnout is the key to winning." TINA FORDHAM, GEOPOLITICAL STRATEGIST AND FOUNDER, FORDHAM GLOBAL FORESIGHT, LONDON "The shooting further complicates the election outlook for Democrats, already divided over Biden's future as a candidate. "U.S. political violence is sadly a feature and not a bug. ... The question now is how a nation, in which a significant proportion of citizens believe civil war is increasingly likely, will respond. "We don't expect there to be an initial reaction in financial markets. If anything, the near-term implication will be the acceleration of the consensus view in markets of a Trump victory." IAN BREMMER, PRESIDENT, EURASIA GROUP, NEW YORK "I deeply worry that it presages much more political violence and social instability to come. This is the kind of thing we have seen historically in lots of countries facing instability and frequently does not end well. "Democracy is not in crisis right now. This is a year of many, many elections and we've seen them in India, the world's most populous country, with 1.5 billion people. We've seen it across the European Union, the largest common market. We've seen it France, in the United Kingdom, in Mexico - rich countries, poor countries, democracies, all. "They have had free, fair elections with peaceful transitions. That is not what we are seeing right now in the United States. The U.S. is the only major democracy in the world today that is experiencing a serious crisis." KHOON GOH, HEAD OF ASIA RESEARCH, ANZ, SINGAPORE "The probability of Trump winning has increased to 70% in the betting markets after the assassination attempt. I am not sure how markets will respond. "The bitcoin rally could be (on) concerns of more civil unrest. We will likely see some risk off moves on the market open, but that should fade quickly." NICK TWIDALE, CHIEF MARKET ANALYST, ATFX GLOBAL, SYDNEY: "I think it probably increases his chances, and we will probably see some haven flows in the morning." RONG REN GOH, PORTFOLIO MANAGER, EASTSPRING INVESTMENTS, SINGAPORE "The shooting is likely to bolster Trump's support, and only further augments the positive momentum he has been enjoying following the presidential debates two weeks ago. "The market reaction function to a Trump presidency has been characterized by a stronger U.S. dollar and a steepening of the U.S. Treasuries curve, so we might observe some of that this coming week if his election odds are assessed to have further improved following this incident." NICK FERRES, CHIEF INVESTMENT OFFICER, VANTAGE POINT ASSET MANAGEMENT, SINGAPORE "The election is likely to be a landslide (for Trump). This probably reduces uncertainty. "Trump has always been more 'pro-market' - the key issue looking forward is whether fiscal policy remains irresponsibly loose and the implication that might have for (renewed) inflation and the future path of interest rates." Ferres cited polls showing a surge in support for Ronald Reagan after a 1981 assassination attempt. According to statistics recorded by the American Presidency Project at the University of California Santa Barbara, Reagan's approval rating, already rising sharply in the early months of his presidency, went up by a further 7 percentage points in the first poll conducted after the attempt. The increase was temporary and subsided over the course of the next three months. HEMANT MISHR, CHIEF INVESTMENT OFFICER, S CUBE CAPITAL, SINGAPORE "I do think this will have a shock reaction on a market that has been on tenterhooks on the U.S. election. "I see the odds of the Trump trade getting reinforced over the next few months till November, unless the Democrats can come up with a really credible alternative. "It just significantly improves the odds in his favour and will lead to a steepening of the U.S. curve over the next few months. (I) would bet on high growth, high inflation trades - financials and energy to do well, and negative for Asian currencies." Sign up here. https://www.reuters.com/world/us/investors-react-shooting-trump-election-rally-2024-07-14/