2024-07-12 06:08

LONDON, July 12 (Reuters) - While investors are still scrambling to get on board the shiniest new mega-trends and what seems like a runaway stock market, a slower-moving juggernaut from the past could well cut across the equity fast lane. One of the biggest supercycles of all - the course of nearly $40 trillion of U.S. retirement savings and its glacial shifts - is creeping back on the radar for some long-term strategists just as indiscriminate, passive stock index plays looks to many like the only vehicle in town. A bias to passive equity due to the multi-decade shift from "defined benefit" (DB) pensions, where employers or government take the risk in guaranteeing stable salary-linked income after retirement, to "defined contribution" (DC), where the onus is on workers to save and ensure their own retirement income, may now be fading. That's no bolt from the blue - but it's a flag for savers hogging record-high stock index holdings and considering the years ahead. To be sure, talk of headwinds to U.S. and global equity indexes that have loaded another 20% to 30% of gains over the past year is hardly a popular take right now. Mid-year updates from global asset managers suggest the artificial intelligence boom may only be in its infancy, green investment opportunities are building, economic and earnings growth is still humming and all against a backdrop of falling interest rates. Active managers parse the hotspots and laggards of course. Ever-patient "value managers" still pray for some rotation to better-priced smaller stocks, sectors or countries. But for most savers, relatively cheap equity index trackers - even though flattered by big tech megacaps adding twice those index gains over the past 12 months and single-stock treblings of AI plays like Nvidia - have proven to be low-hanging fruit. And while handwringing over the influence of handful of megacaps abounds, that equity performance is only partly explained by such concentration - at least in the United States. The equal-weighted S&P 500 (.EWGSPC) New Tab, opens new tab that adjusts for the influence of outsize stock leaders has indeed lagged the main index over the past 10 years - but it has still doubled over the decade and beaten global benchmarks to boot. 'DIY PENSIONS' What then of the pensions' influence? JPMorgan's long-term investment seers Jan Loeys and Alexander Wise took a deep dive and posited the 50-year shift in pensions provisions from once dominant DB to DC schemes has been a significant boon to risk-taking and equity exposure - and it's a trend that is hitting its high watermark. Replicated to differing degrees around the world, U.S. statistics show an almost 9-1 split in participants in DC over DB schemes now compared to equal pegging 40 years ago. Initially popular due to easy switching from job to job and with more discretion in how much and where to save, the DC "DIY pension" has left savers prone to the vagaries of the market and a structural need to accumulate more money for retirement than pooled DB schemes. And that's simply seen savers seek higher-returning investments than more conservative DB funds to maximise retirement nesteggs. For some 20 years, DC schemes have held more equity than equivalent DB funds - with stock holdings up rising by more than 10 percentage points as a share of those plans over that time to more than 60% now, compared to less than 40% held in DB. But greater freedom in how much to save has led to increasingly inadequate DC savings on aggregate - in turn prompting regulators to seek ways to bolt in more participation and to ease access to lifetime annuities from insurers that then translate DC pools to reliable income when working life ends. "We thus expect to see a secular rise in the demand for simple lifetime annuities, indexed to inflation, that will boost the demand for credit and inflation-linked bonds products that backstop these annuities," wrote Loeys and Wise. "This should be one factor...that is likely to induce U.S. investors to reduce some of their record-high allocations to equities." Corporate bonds being higher-yielding now than they have been for more than a decade only amplifies that, they reckon. SUNSET FOR DC FLOWS In an analysis of the preference for passive equity index investing, GMO strategists Ben Inker and John Pease also touched on the DC versus DB debate in their quarterly letter this week. Inker and Pease reckon the move to DC schemes has encouraged passive equity index investment over active fund managers - in part due to sponsors seeing less of risk being sued for underperformance. What's more, this preference seemed oblivious to changes in relative valuations and may have smothered relative market shifts. "As it is incredibly difficult to successfully sue over being placed in a cheap passive index fund, it is little surprise that the overwhelming direction of flow in the defined contribution space is to passive strategies," they said, adding these then were just automatically directed to shift over time with employee age through "target date" funds. And this, they say, reduces the efficiency of markets in accurately pricing new information as passive target date funds by construction wholly disregard relative shifts in real bond yields or equity valuations themselves, with allocations barely changed over 10 years despite in shifts in equity risk premia. Like Wise and Loeys, they warn of a sunset for this flow. "The transition to defined contribution is coming to an end," the GMO team concluded, pointing out that U.S. DB plans and annuities have already gone from making up 82% of retirement assets in 1974 to just 37% last year. "While passive may continue to grow as a fraction of assets outside the pension arena, the profound incentive shift that occurs when assets move from defined benefit to defined contribution is absent." While neither of these arguments strictly counters the near-term equity bullishness of so many mid-year outlooks, it may challenge the sometimes heretical assumption that equity indexes remain your friend forever. After that, timing - and perhaps age - may be everything. Opinions expressed here are those of the author, a columnist for Reuters. Sign up here. https://www.reuters.com/markets/us/fading-passive-equity-bias-rumbling-us-pension-savings-mike-dolan-2024-07-12/

2024-07-12 06:01

SHANGHAI/SINGAPORE, July 12 (Reuters) - China's central bank is widely expected to leave a medium-term interest rate unchanged and drain some cash from the banking system when rolling over such maturing loans on Monday, a Reuters survey showed. While the economy continues to sputter, a weak Chinese currency has remained the key constraint limiting Beijing's monetary easing efforts, as that could further widen the yield gap with other major economies, particularly the United States, and trigger more capital outflows. In a Reuters poll of 35 market watchers conducted this week, 34, or 97%, of respondents expected the PBOC to keep the interest rate on the one-year medium-term lending facility (MLF) loan unchanged at 2.50% from the previous operation. The lone outlier in the poll projected a marginal rate reduction. Market participants believe the significance of the medium-term lending facility (MLF) rate will gradually diminish as the People's Bank of China (PBOC) tries improve the effectiveness of its interest rate corridor. The PBOC introduced a new cash management mechanism this week and its Governor Pan Gongsheng said recently that the seven-day reverse repo rate "basically fulfils the function" of the main policy rate "The importance of MLF rate may decline, with PBOC more focusing on buying or selling Chinese government bonds (CGB) around the reverse repo rate in the short tenor," said Ju Wang, head of Greater China FX & rates strategy at BNP Paribas. The new liquidity mechanism should allow the seven-day reverse repo rate to move first, followed by other rates, including the MLF rate, said a bond fund manager. Meanwhile, a vast majority of 28, or 80% of all participants in the poll predicted that the central bank would only conduct a partial rollover, compared with 103 billion yuan ($14.18 billion) worth of MLF loans due this month. "Investors contemplate as to whether PBOC will only partially roll over MLF in the months ahead to gradually reduce the outstanding amount of the facility," said Frances Cheung, rates strategist at OCBC Bank. Some bond traders also pointed out that demand for the MLF loans were hampered by signs of loosening cash conditions in the banking system. The interest rate on one-year AAA-rated negotiable certificates of deposit (NCDs) , which measures short-term interbank borrowing costs, stayed well below the MLF rate. It last traded at 1.9642%. Apart from the PBOC's effort to revamp its monetary policy transmission channel, it has sounded warnings and introduced a flurry of measures, including plans to sell treasury bonds, to cool a long-running bond rally. "The PBOC may reduce the need to frequently adjust various monetary policy tools, such as one-year MLF, one-year and five-year loan prime rate (LPR), seven-day reverse repo, and reserve requirement ratio (RRR), which might ease upward pressure on the dollar-yuan pair," analysts at Societe Generale said in a note. The monthly fixing of the LPR is due on July 22. ($1 = 7.2636 Chinese yuan) Sign up here. https://www.reuters.com/world/china/china-cbank-seen-holding-medium-term-lending-rate-steady-monday-2024-07-12/

2024-07-12 05:52

MUMBAI, July 12 (Reuters) - The Indian rupee was marginally higher on Friday after a soft U.S. inflation reading boosted hopes of rate cuts by the Federal Reserve and drove U.S. bond yields lower which also helped lift dollar-rupee forward premiums. The rupee was at 83.5275 against the U.S. dollar as of 10:05 a.m. IST, moderately stronger than its previous close at 83.56. The dollar index was up 0.1% in Asia trading after slumping to a one-month low of 104.07 on Thursday as data showed that headline U.S. consumer prices unexpectedly fell in June, while the core month-on-month consumer price index (CPI) stood at 0.1%. Odds of a September rate cut by the Fed rose above 90% after the data, according to the CME's FedWatch tool, driving U.S. bond yields lower as well. There are "decent offers present (on USD/INR) but, as usual, there seems to be sufficient dip-buying interest", a foreign exchange trader at a state-run bank said. Meanwhile, dollar-rupee forward premiums ticked up with the 1-year implied yield up 2 basis points at 1.68%, its highest in little over a month. The 1-year U.S. Treasury yield fell to its lowest since early March at 4.89% on Thursday before nudging up in Asia hours. The rupee "keeps oscillating around 83.50 levels with an overall downside bias, led by a softer dollar and chunky inflows in the domestic market and waiting for the RBI to loosen its grip and let the currency appreciate", said Amit Pabari, managing director at FX advisory firm CR Forex. The Reserve Bank of India's (RBI) routine interventions have kept the rupee largely rangebound and have driven near-term volatility expectations to near multi-month lows. Investors now await U.S. producer price inflation data and India's consumer inflation reading due later in the day. Sign up here. https://www.reuters.com/markets/currencies/rupee-gains-marginally-forward-premiums-tick-up-us-bond-yields-drop-2024-07-12/

2024-07-12 05:39

Almost 33 million were affected, with 322 dead or missing Direct economic losses were biggest since 2019 Snow, rains, droughts affected 3.17 mln hectares of crops Agricultural loss from drought offset by better irrigation BEIJING, July 12 (Reuters) - (This July 12 story has been corrected to fix the period reference from whole of 2023 to first half of 2023, in paragraph 4) Natural disasters such as flooding, drought and extreme temperatures cost China 93.16 billion yuan ($12.83 billion) in the first half of this year, with almost 33 million people affected, the government said on Friday. Heavy snow, 22 strong earthquakes including one of 7.1 magnitude in the northwestern region of Xinjiang, landslides and mudslides in southwestern regions and flooding on the Yellow River and in southern provinces all added to the burden. The 32.38 million people affected included 322 who died or disappeared, the ministry told a news briefing. About 856,000 people faced emergency resettlement, 23,000 houses were destroyed, and around 3.17 million hectares of crops damaged. The number of people impacted compares with just 48.76 million people in the first half of 2023, when 95 people died or went missing, according to the ministry's report from last year. The impact on the economy in January-June this year was also worse than the year-earlier period, when the country logged 38.23 billion yuan worth of loss. It was the biggest first-half disaster-related loss since 2019, according to data available on the Emergency Management Ministry website. China has seen larger swings in temperature breaking historical records in recent years while precipitation - rain or snow - has grown more erratic, signs that point to the impact of climate change on the country's weather. Funds channelled into disaster management have reached 4.17 billion yuan so far this year, according to a Reuters tally, with 546 million yuan allocated last month for agricultural production and disaster relief. Long durations of icy weather and intense snow in the winter months severely disrupted people and their livelihoods, ministry spokesperson Shen Zhanli said. Parts of southern China such as the Guangxi region, Guangdong and Fujian provinces were hit hard by frequent and extreme rains as the annual rainy season began earlier than usual. Dozens have died from floods or rain-induced landslides. Around the same time, droughts developed quite quickly and covered large areas in the north and around the North China Plain, impacting local agricultural production. At the peak, some 6.2 million hectares of farmland faced moisture shortages compared with the average 2.67 million hectares in other years. But losses were capped as many of the affected areas had better irrigation and water storage systems, the ministry said. The drought season afflicted some 1.29 million people in 10 northern provinces, resulting in an economic loss of 1.46 billion yuan - lower than the average for the same period. With the summer flood season approaching, all kinds of risks have increased significantly, the ministry said, emphasising the need for a greater sense of responsibility and urgency over safety, disaster prevention and mitigation as well as relief work. Sign up here. https://www.reuters.com/world/china/natural-disasters-china-caused-13-bln-economic-loss-january-june-2024-07-12/

2024-07-12 05:38

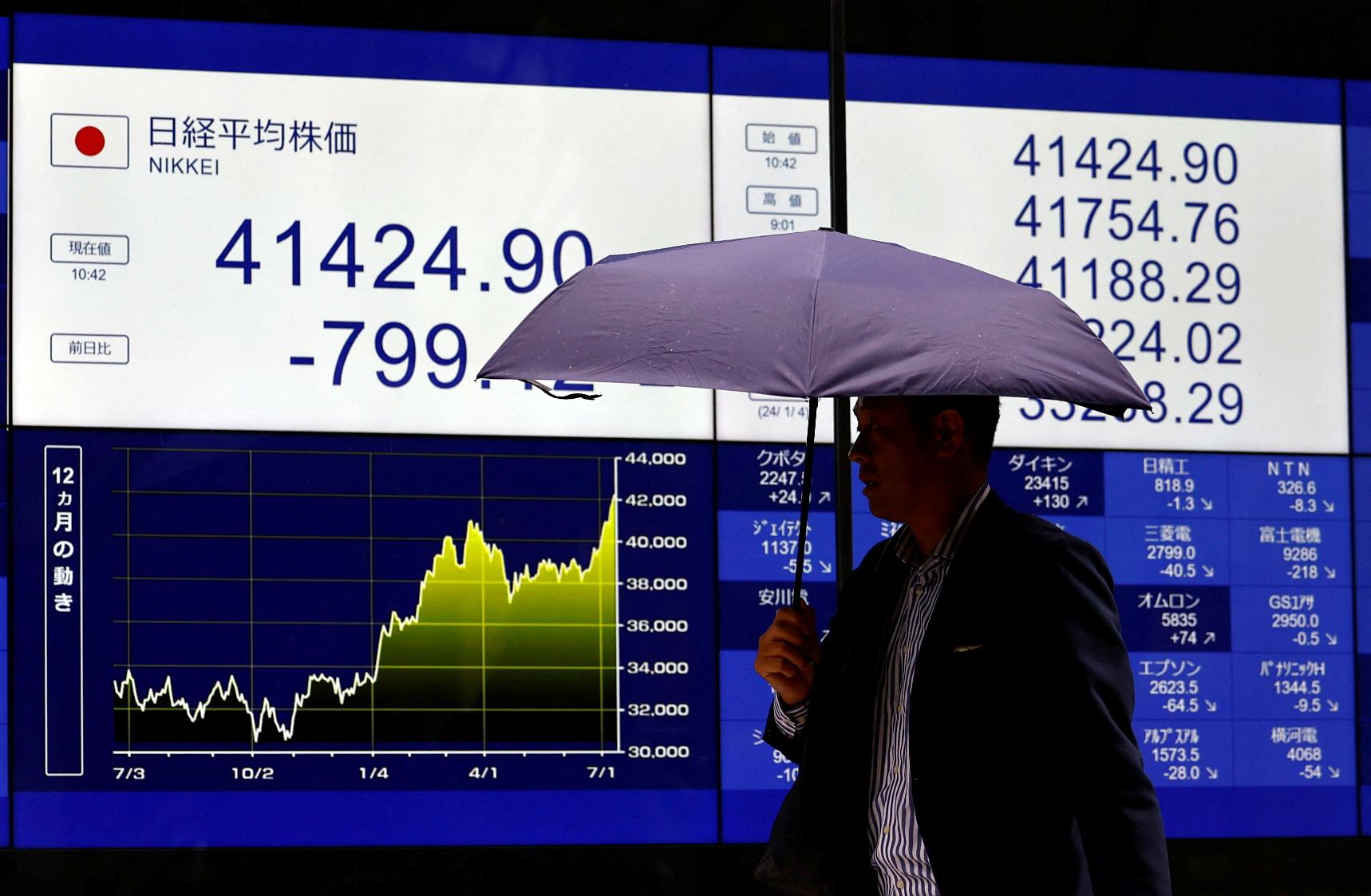

Currency markets edgy after suspected yen interventions PPI comes in higher than expected but CPI still the focus Wall Street indexes rally 1%, MSCI ACWI hits record NEW YORK/LONDON, July 12 (Reuters) - The dollar fell sharply against the yen for the second straight day, raising questions as to whether Japan was intervening, while a global equities index rose on Friday as investors turned their focus to U.S. Federal Reserve interest-rate cuts. The benchmark 10-year U.S. Treasury yield lost steam after earlier gaining modestly when the producer price index (PPI) report showed prices rose more than expected in June. But investors still seemed to be celebrating Thursday's lower-than-expected consumer price index (CPI) report, which boosted bets that the Fed's rate cuts would start in September. "As much data and earnings reports as there were this week, all the market seems to care about is the CPI report. It was more confirmation inflation is fading," said Emily Roland, co-chief investment strategist at John Hancock Investment Management. "PPI tends to be more volatile so markets are shrugging it off." And while the University of Michigan's survey showed U.S. consumer sentiment fell in July, investors focused on the fact that it showed improving expectations for inflation for the next year and beyond. "Right now we're living in a 'bad news is good news' environment. Disinflation is good in some ways but it's also a signal that growth is slowing," Roland said. "We're not there yet. Right now we're signaling a soft landing, but we don't have the clarity yet to know that the Fed can achieve that. Momentum in markets is a powerful force." Also on Friday, the second-quarter earnings season started with the S&P 500 bank index (.SPXBK) New Tab, opens new tab underperforming the broader market as big U.S. banks' earnings and guidance did not impress. "Earnings season hasn't gotten off to a great start but we're still very early. We're seeing some companies talking about their ability to control expenses. We're looking for more clarity as the season goes on," said Celia Hoopes, portfolio manager at Brandywine Group in Philadelphia. On Wall Street, the Dow Jones Industrial Average (.DJI) New Tab, opens new tab closed up 247.15 points, or 0.62%, to 40,000.90, the S&P 500 (.SPX) New Tab, opens new tab advanced 30.81 points, or 0.55%, to 5,615.35 and the Nasdaq Composite (.IXIC) New Tab, opens new tab gained 115.04 points, or 0.63%, to 18,398.45. MSCI's All Country World Price index (.MIWD00000PUS) New Tab, opens new tab rose 4.28 points, or 0.52%, to 828.55, after earlier hitting a record intraday high. The index was set for its seventh record high close in nine sessions and a weekly gain of around 1.3%. Europe's Stoxx share index (.STOXX) New Tab, opens new tab earlier closed up 0.88% after hitting its highest level since June 7 and eyeing a second consecutive week of gains for the first time since May. In currencies, the yen jumped to an almost four-week high against the dollar, putting traders on alert for signs of fresh intervention by Japan, which likely stepped in on Thursday to prop up a currency still close to its lowest in 38 years. While Tokyo had not confirmed any move on Thursday to prop up the flailing yen, the Bank of Japan's daily operations report on Friday suggested between 3.37-3.57 trillion yen ($21.18-22 billion) had been spent on strengthening the currency. "If they intervened (on Thursday), it makes it likely that they intervened (on Friday). And I think it's good strategy to keep the market off balance," said Steve Englander, head of global G10 FX research and North American macro strategy at Standard Chartered Bank NY Branch. Against the yen , the dollar weakened 0.6% to 157.85. The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, fell 0.24% at 104.09, with the euro up 0.36% at $1.0904. Meanwhile, sterling strengthened 0.57% to $1.2982, hitting its highest level in almost a year and after comments from Bank of England policymakers and better-than-forecast GDP data this week, dampening bets for an August rate cut. In Treasuries, yields turned lower with the 2-year yield hitting its lowest level since early March in its second straight day of declines. The yield on benchmark U.S. 10-year notes fell 1.2 basis points to 4.181%, from 4.193% late on Thursday while the 30-year bond yield fell 1 basis points to 4.3941% from 4.404% late on Thursday. The 2-year note yield, which typically moves in step with interest rate expectations, was last down 5.4 basis points to 4.4535%, from 4.507% late on Thursday. Global oil prices fell, as investors weighed weaker consumer sentiment against optimism about U.S. rate cuts. U.S. crude settled down 0.5%, or 41 cents at $82.21 a barrel and Brent ended at $85.03 per barrel, down 0.4% or 37 cents. Gold prices were roughly flat after a strong rally in the previous session, although bullion was still on track for its third straight weekly rise on bets around U.S. rate cuts. Spot gold lost 0.14% to $2,411.31 an ounce. Sign up here. https://www.reuters.com/markets/global-markets-wrapup-1-2024-07-12/

2024-07-12 05:05

Japan will take action as needed in FX market, says Kanda Chief cabinet secretary says ready to take all means vs yen Finance minister mum on whether Japan made rate checks BOJ data suggest Japan may have spent $22.4 bln to prop up yen TOKYO, July 12 (Reuters) - Japan's top currency diplomat said on Friday authorities would take action as needed in the foreign exchange market, resuming his jawboning after the yen's spike overnight raised market speculation about currency intervention. Bank of Japan (BOJ) data released later on Friday suggested Japan may have spent up to 3.57 trillion yen ($22.4 billion) intervening in the foreign exchange market to prop up the sagging currency. Masato Kanda, who is vice finance minister for international affairs, declined to comment on whether authorities had intervened in the currency market to prop up the yen, but told reporters recent yen moves were out of line with fundamentals. Chief Cabinet Secretary Yoshimasa Hayashi also told reporters on Friday that authorities were ready to take all possible action on exchange rates. The remarks on the yen break the recent silence among Japanese officials, who have refrained from commenting on their readiness to intervene as analysts question the effectiveness of jawboning in stopping sharp yen declines. "I've found recent big currency moves strange, from the perspective of whether they were in line with fundamentals, and it would be highly concerning if the excessive volatility, driven by speculation, pushes up import prices and negatively affect people's lives," Kanda said. "Currency interventions should certainty be rare in a floating rate market, but we'll need to respond appropriately to excessive volatility or disorderly moves," he added. Finance Minister Shunichi Suzuki also told a regular news conference on Friday that rapid, one-sided moves in the foreign exchange market were undesirable. The yen surged nearly 3% on Thursday in its biggest daily rise since late 2022, shortly after U.S. consumer price figures revived market expectations the Federal Reserve will cut interest rates in September. GUESSING GAME Some local media had attributed the yen's abrupt spike to a round of official buying to prop up a currency that has languished at 38-year lows. The dollar climbed back to 158.88 yen on Friday, after falling to as low 157.40 yen on Thursday. "Japan likely intervened as otherwise, the yen won't move that much so suddenly," Takahide Kiuchi, an economist at Nomura Research Institute, said of the yen's overnight jump. "Japan's past interventions were made when the yen was plunging, some of which weren't necessarily effective. This time it worked because authorities took action just when the weak-yen trend was turning around," he said. Meanwhile, the Nikkei newspaper reported that the BOJ conducted rate checks with banks on the euro against the yen on Friday, citing several sources. Finance minister Suzuki declined to comment on whether authorities made rate checks, which are seen by traders as a precursor to actual yen-buying intervention. Japanese authorities have recently made it standard practice to not confirm whether they have intervened in the currency market or not. Tokyo spent 9.8 trillion yen ($61 billion) intervening in the foreign exchange market at the end of April and early May, official data showed, after the Japanese currency hit a 34-year low of 160.245 per dollar on April 29. Back then, authorities were suspected to have intervened in several stages to create a buffer to defend the 160 mark against the dollar. If Tokyo were to have stepped in on Thursday, it would have been more aimed at accelerating the yen's rebound against the dollar that occurred shortly after the weaker-than-expected U.S. inflation data. Some analysts doubt whether intervention will work to reverse the weak-yen tide. "You can't change the market's trend with intervention. Whether the market's phase would change depends largely on fundamentals," said Tsuyoshi Ueno, an economist at NLI Research Institute. Sign up here. https://www.reuters.com/markets/asia/japan-top-fx-diplomat-says-authorities-take-action-needed-yen-2024-07-11/