2024-07-11 11:17

NEW DELHI, July 11 (Reuters) - Parts of north-west Delhi were flooded on Thursday after a breach in a canal that supplies water from a nearby state, and repair work was being carried out to minimize the impact, a senior local official said in a social media post. Residents of the capital have experienced a series of extreme weather events in the past two months, from sizzling temperatures to floods and heavy rainfall that caused a roof collapse at the city's airport. "Today (in the) early morning there has been a breach in one of the sub-branches of Munak Canal ... Water has been diverted to the other sub-branch of the canal," Delhi Water Minister Atishi said in a post on X. Visuals from ANI news agency, in which Reuters has a minority stake, showed residents wading through knee-deep muddy water in the district of Bawana in north-west Delhi. The Munak canal is situated on the Yamuna river near Delhi's northwestern border with the state of Haryana, which also runs the canal. No casualties have so far been reported from the latest flooding. Parts of Delhi have recently suffered from a severe water shortage after the hottest summer on record, and Atishi went on a brief hunger strike to demand more water for the city. Delhi relies for most of its water on the Yamuna river that runs through the capital and which flooded a year ago after heavy rains. Multiple rivers in India's eastern state of Bihar are also close to breaching their banks as water flows downstream from neighbouring Nepal, parts of which were also flooded earlier this week. Heavy rainfall in Assam in the east of the country has triggered flash floods in recent weeks in which at least 79 people were killed and thousands displaced. (This story has been refiled to remove an extraneous word in the headline) Sign up here. https://www.reuters.com/world/india/parts-northwest-delhi-flooded-after-canal-breach-2024-07-11/

2024-07-11 10:40

FRANKFURT, July 11 (Reuters) - German energy company E.ON (EONGn.DE) New Tab, opens new tab and Volkswagen subsidiary MAN Truck & Bus plan to set up a pan-European electric charging network for trucks, starting this year, they said on Thursday. Europe has set itself the goal of reducing emissions from heavy commercial vehicles by 90% by 2040 compared with 2019. So far, however, zero-emission electric trucks are rare in Europe, while the take-up of passenger electric cars has grown steadily, although it is beginning to slow. The lack of charging infrastructure is often a decisive factor for companies when deciding whether to opt for battery-electric trucks. E.ON and MAN said joining forces would allow them to overcome the hurdles, in a joint statement issued at a signing event in Essen, western Germany. "We are investing heavily to give the infrastructure for electric heavy goods transport a decisive boost and to set the course for sustainable logistics and green supply chains," E.ON's chief executive Leonhard Birnbaum said. MAN Truck & Bus head Alexander Vlaskamp said he was delighted with the partnership with E.ON. A first site in the multi-country network will open this year, with around 80 to follow by the end of 2025 and 170 locations planned long term, of which 125 will be in Germany, the statement said. Additional sites are being built in Austria, Britain, Denmark, Hungary, Italy, Poland and the Czech Republic. Initially, each site will be equipped with several 400 kilowatt charging stations, allowing an average electric truck to recharge for a range of up to 300 kilometers (km) in about 45 minutes. Subsequently, they would install infrastructure to allow more rapid charging. MAN plans to launch a truck with a daily range of up to 800 km later this year. Neither company gave detail of how much they were spending on the project. Sign up here. https://www.reuters.com/sustainability/vws-man-eon-cooperate-electric-truck-charging-2024-07-11/

2024-07-11 10:27

BERLIN, July 11 (Reuters) - Germany's state railways will on Monday close for five months a main line connecting the financial centre of Frankfurt with the south to carry out a 1.3 billion euro ($1.4 billion) upgrade to creaking infrastructure. WHY IT'S IMPORTANT Tracks between Frankfurt and Mannheim are congested, and delays can have a major impact elsewhere in Germany's 33,000-kilometre (20,000-mile) network, as well as on trains to neighbouring countries like Switzerland and France. The state of German railways has been in the international spotlight during the Euro 2024 soccer tournament, with fans complaining of crowded trains and travel disruptions. CONTEXT While rail operator Deutsche Bahn (DBN.UL) has bought hundreds more modern high-speed ICE trains in recent years, many tracks, signal boxes and other infrastructure need repairs or upgrades. In June, just over half of all long-distance trains were on time, according to Deutsche Bahn statistics. In reality, more connections are affected because the company classifies a train as delayed if it is at least six minutes late. Cancelled connections are not counted. BY THE NUMBERS Deutsche Bahn's planned investment of 1.3 billion euros in this project is up from an initial estimate of 500 million euros. Over the next five months, it will rebuild 140 kilometres of tracks and overhead wires, improve 20 stations and replace more than 150 switches. WHAT'S NEXT? Deutsche Bahn hopes disruptions on its overhauled main lines will decline by 80%. In total, the company plans to renovate 40 rail corridors to stabilise the system. The next major renovation is scheduled for next year between Berlin and Hamburg, Germany's most populous cities. ($1 = 0.9233 euros) Sign up here. https://www.reuters.com/world/europe/german-railways-shuts-main-line-five-months-revamp-2024-07-11/

2024-07-11 10:22

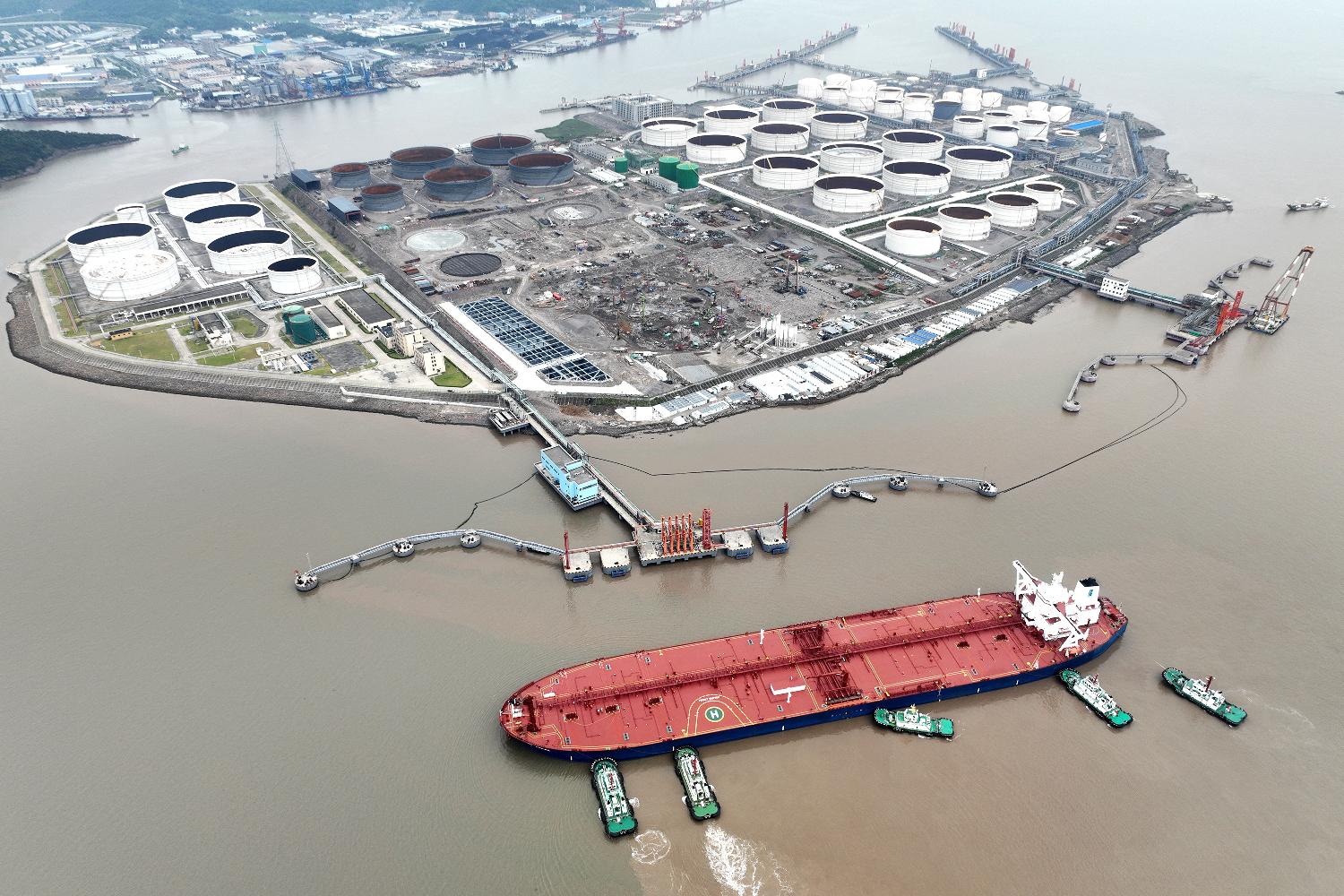

LONDON, July 11 (Reuters) - Global oil demand growth will slow to just under a million barrels per day (bpd) this year and next, the International Energy Agency (IEA) said, as Chinese consumption contracted in the second quarter due to economic problems. Global demand in the second quarter rose by 710,000 bpd year on year in its lowest quarterly increase in over a year, the IEA, which advises industrialised countries, said in its monthly oil report. "China's pre-eminence (is) fading. Last year the country accounted for 70% of global demand gains – this will decline to around 40% in 2024 and 2025," the IEA said. Oil forecasters are split more widely than usual on the strength of oil demand growth for this year and the medium term, partly due to differences over the pace of the world's transition to cleaner fuels. On Wednesday, producer group OPEC maintained its much higher forecasts. The IEA left its forecast for relatively low oil demand growth of 970,000 bpd this year largely unchanged from its outlook last month, and trimmed its growth forecast for next year by 50,000 bpd to 980,000. By contrast, OPEC expects oil demand to rise by 2.25 million bpd this year, more than double the IEA's prediction, with China providing a significant chunk of the growth. As the post-COVID economic rebound flattens out worldwide, the IEA added, lacklustre economic growth, increased energy efficiency and the rise of electric vehicles will act as headwinds for growth this year and next. At the same time the IEA said oil supply growth this year would hit 770,000 bpd, boosting total supply to a record 103 million bpd. That growth is set to more than double next year to reach 1.8 million bpd, with United States, Canada, Guyana and Brazil leading gains. Despite sluggish demand generally, the IEA sees demand for oil from the OPEC+ producer group far outstripping its current reined-in production, suggesting that the bloc could pump more. "Our current non-OPEC+ supply and global demand forecasts show the call on OPEC+ crude at 42.2 million bpd in 3Q24 and 41.8 million bpd in 4Q24 – roughly 800,000 bpd and 400,000 bpd above its June output, respectively." Next year, however, the call on OPEC+ crude is set to fall to 41.1 million bpd in the face of rising output from outside the bloc. Sign up here. https://www.reuters.com/markets/commodities/iea-sees-oil-demand-growth-slowing-chinas-share-ebbs-2024-07-11/

2024-07-11 10:17

A look at the day ahead in U.S. and global markets from Mike Dolan If Federal Reserve boss Jerome Powell had any inkling of the June U.S. inflation readout when speaking to Congress this week, then today's critical report doesn't look like it will prove a game changer. But given the buoyancy of U.S. (.SPX) New Tab, opens new tab and world stocks (.MIWD00000PUS) New Tab, opens new tab at record highs and pretty serene Treasury and interest rate markets, that doesn't seem much of a bother for global markets right now. As is now typical, the latest U.S. consumer price report grabs all the attention on Thursday. And an encouraging down tick in headline annual inflation is expected to be twinned by a "core" rate still stuck at a punchy 3.4%. Powell remained cautious during the second leg of his congressional testimony on Wednesday. And yet futures stay wedded to two quarter-point Fed rate cuts this year, while 10-year Treasuries easily absorbed the latest sale of new paper. Powered by yet another lift for artificial intelligence bellwethers - this time spurred by another earnings beat from Taiwan's TSMC - the SP500 jumped 1% on Wednesday and vaulted 5,600 for the first time, clocking seven straight daily gains for the first time this year. TSMC (2330.TW) New Tab, opens new tab scaled a record high on Thursday, cementing its position as Asia's most valuable company and topping a trillion-dollar value for the first time. Micron Technology (MU.O) New Tab, opens new tab jumped 4%, Nvidia (NVDA.O) New Tab, opens new tab climbed 2.7% and Advanced Micro Devices (AMD.O) New Tab, opens new tab added 3.9%. Big banks kick off the second quarter U.S. earnings season in earnest on Friday. Equity markets in Europe and Asia rallied in the slipstream, with even China's beaten-down CSI300 (.CSI300) New Tab, opens new tab catching a rare break ahead of next week's government plenum. The Communist Party leadership meeting is expected to outline efforts to promote advanced manufacturing, revise the tax system to curb debt risks, manage a vast property crisis, and boost domestic consumption. A tall order, no doubt. But the trigger for Thursday's rise was more likely a move by the China Securities Regulatory Commission to further curb short-selling. With the dollar on the back foot again (.DXY) New Tab, opens new tab, much of the action early on Thursday was in currency markets. Buoyed by last week's expected UK election landslide for the Labour Party and data showing the economy accelerated more than expected in May, sterling jumped to its highest level in four months. The 0.4% GDP beat reinforced Wednesday's speech by Bank of England chief economist Huw Pill, seen as a swing voter in the split BoE monetary policy council. Pill dampened hopes for a summer UK rate cut by stressing services inflation and wage growth showed "uncomfortable strength", and money markets now ascribe less than a 50% chance of first BoE rate cut next month. But the euro was on the rise too - hitting its best level in more than a month as French markets calmed further following the indecisive election result there at the weekend. France's benchmark CAC40 stock index (.FCHI) New Tab, opens new tab rose 0.6%, while the French 10-year government debt premium over Germany squeezed as low as 62 basis points for the first time in almost a month. Bank of France head François Villeroy de Galhau said on Thursday he hoped the country's political gridlock would be resolved by September, when the parliament of the euro zone's second-largest economy must vote on the country's budget. Elsewhere, the focus was on fractious U.S. politics, with more pressure building on President Joe Biden to step aside ahead of November's White House race. Democratic party heavyweights Nancy Pelosi and George Clooney, who may influence other Democratic lawmakers and financial donors, and two Senate Democrats cast more doubt on Biden's fitness to run. Senate Majority Leader Chuck Schumer, meanwhile, has privately signaled he's open to a Democratic candidate other than Biden, according to Axios. Schumer, however, reiterated his support for Biden in a statement following the Axios report. With Republican challenger Donald Trump now far ahead in betting markets to win the race, the relative calm in U.S. markets was notable. Even currency markets where Trump's tariff and immigration pledges may hit hardest seemed steady. Mexico's peso , Brazil's real and China's yuan were firmer on Thursday - the first two near their best levels in a month. Oil prices were steady but the annual gain in crude fell below 10% for the first time in a month. Global oil demand growth will slow to just under a million barrels per day this year and next, the International Energy Agency said, as it said Chinese consumption contracted in the second quarter. Key developments that should provide more direction to U.S. markets later on Thursday: * US June consumer price index, weekly jobless claims, June Federal budget * US corporate earnings: PepsiCo, Conagra Brands, Delta Air Lines * St. Louis Federal Reserve President Alberto Musalem and Atlanta Fed President Raphael Bostic both speak * US Treasury auctions $22 billion of 30-year bonds Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-2024-07-11/

2024-07-11 10:12

MUMBAI, July 11 (Reuters) - The Indian rupee ended slightly weaker on Thursday, pressured by dollar demand from state-run banks and importers, although most of its Asian peers gained ahead of a key U.S. inflation report. The rupee ended at 83.56 against the U.S. dollar, moderately lower than its close at 83.52 in the previous session. While the local unit shuffled in a tight band in the first half of the session, bids from state-run banks pushed it lower towards the latter half, a foreign exchange trader at a private bank said. "Expecting a decent-sized downmove (on USD/INR) post the U.S. CPI (consumer price index) data," the trader added. The inflation report for June, due later on Thursday, follows a string of soft U.S. economic data that has helped push up the odds of a September rate cut by the Federal Reserve to more than 73%, according to CME's FedWatch tool. Economists polled by Reuters forecast month-on-month core U.S. CPI holding steady at 0.2% in June. Despite mostly soft economic data, Fed officials have urged caution on the future path of rate cuts. Fed Chair Jerome Powell said on Wednesday that he was not ready to conclude that inflation is moving sustainably down to the central bank's 2% target, though he has "some confidence of that." The dollar index was down 0.1% at 104.8 on Thursday while most Asian currencies rose on the day, with the Korean won up 0.4% and leading gains. Investors will also keep an eye on U.S. jobless claims data and remarks from Fed officials slated to speak later in the day. Weakness in the rupee may extend to 83.70 on a negative surprise on U.S. CPI, Abhilash Koikkara, head of forex and rates at Nuvama Professional Clients Group, said. On the other hand, strength in the rupee should remain capped near 83.20-83.30, Koikkara added. Sign up here. https://www.reuters.com/markets/currencies/rupee-ends-weaker-pressured-by-state-run-banks-dollar-bids-eye-us-inflation-2024-07-11/