2024-07-10 11:48

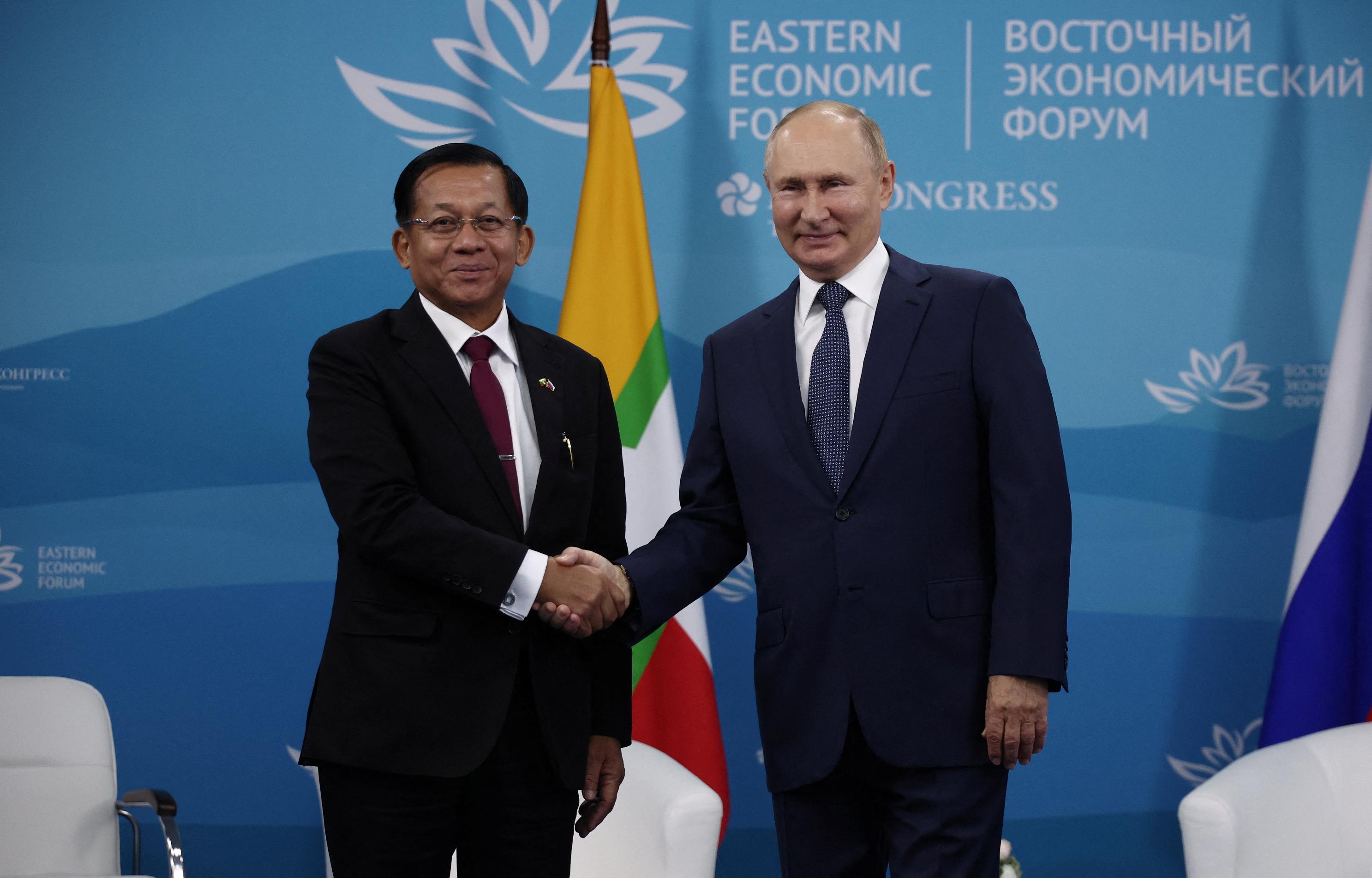

MOSCOW, July 10 (Reuters) - Russia and Myanmar have discussed the participation of Russian companies in energy infrastructure construction in the south-east Asian country, Russia's energy ministry said on Wednesday. It also said a first working group meeting on energy cooperation had been held recently, without elaborating. Russia has become Myanmar's closest ally since the military coup that overthrew Aung San Suu Kyi's elected civilian government in February 2021. Last October, top energy officials from Russia and Myanmar held discussions in Moscow on Russia's participation in the construction of a gas pipeline to the country's main city Yangon, while Russia has also had plans for a nuclear research reactor in the country. Sign up here. https://www.reuters.com/business/energy/russian-firms-eye-myanmar-energy-infrastructure-2024-07-10/

2024-07-10 11:22

HARARE, July 10 (Reuters) - Zimbabwe has revised its economic growth forecast downwards as southern Africa's worst drought in decades ravages crop yields, its finance minister told Reuters on Wednesday, but a bounceback in growth is likely in 2025. Finance Minister Mthuli Ncube said economic growth is forecast at 2% for 2024, down from 3.5% forecast in November, due to an El Niño-induced drought which has led to widespread crop failure. El Niño is a natural climate phenomenon in which surface waters of the central and eastern Pacific become unusually warm, causing changes in global weather patterns. Zimbabwe is among the hardest hit by drought in the region, impacting crop yields. Neighbours Zambia and Malawi have declared states of disaster as a result of the drought. Last month, the International Monetary Fund also said it expected Zimbabwe's growth to fall to 2%, down from 5.3% last year. "We are all downgrading our growth targets for 2024 because of deeper than expected impact on our agriculture, but next year is brighter," Ncube said. Growth is expected to recover to above 5% in 2025, he added. In May, the Zimbabwean government forecasted that staple maize production will drop 72% in the 2023/24 season. Ncube said the drought had affected agriculture output and the country expects to import 1.4 million metric tonnes of grain. To ease hunger across the country, Zimbabwe received around $32 million drought insurance last week from an African Union agency. Government has also appealed to international donors to assist with food aid. Ncube will give the mid-term budget review later this month. Sign up here. https://www.reuters.com/world/africa/lower-growth-forecast-zimbabwe-drought-ravages-crop-yields-finmin-2024-07-10/

2024-07-10 11:05

BAMAKO, July 10 (Reuters) - Mali is currently unable to refuel commercial aircraft in its capital Bamako due to fuel shortages and is asking airlines to refuel elsewhere until next week, its transport ministry told Reuters. "There are a lot of flight operations these days and that has affected the fuel stock," Ould Mamouni, a ministry spokesman, said on Tuesday night. "This is to announce to companies that given the limited fuel stock, they will not be able to refuel in Bamako; they can consider obtaining supplies in neighbouring countries before coming to Mali." In a letter seen by Reuters late Tuesday, the director general of the West African country's National Civil Aviation Agency asked the representative to Mali of regional air traffic control agency ASECNA to notify airlines of the measure, which would last from July 9 until July 15. "I invite you to take the necessary steps to issue a notice to air users on the unavailability of Jet A1 fuel at President Modibo Keita-Senou International Airport," he wrote. Airlines including Turkish Airlines and Ethiopian Airlines service Bamako. Sign up here. https://www.reuters.com/world/africa/mali-advises-airlines-refuel-elsewhere-due-aviation-fuel-shortage-2024-07-10/

2024-07-10 11:03

LONDON, July 10 (Reuters) - BP (BP.L) New Tab, opens new tab expects oil demand to peak next year and wind and solar capacity to grow rapidly in both of the two main scenarios in its annual Energy Outlook, a study of the evolution of the global energy system to 2050 it published on Wednesday. Carbon emissions, caused predominantly by the burning of fossil fuels, also peak in the mid 2020s in both scenarios, which are as follows: - The Current Trajectory scenario is based on climate policies and carbon reduction pledges already in place. - The Net Zero scenario assumes a significant tightening of climate policies aligned with the 2015 U.N.-backed Paris climate agreement to cut the world's carbon emissions by around 95% by the middle of the century. Following are key points from the report: ENERGY DEMAND AND CARBON EMISSIONS Primary energy demand in the Current Trajectory rises up to the mid-2030s before broadly plateauing as continuing increases in energy consumption in emerging economies, excluding China, are broadly offset by declines in developed economies and eventually in China. By 2050 energy demand in this scenario is around 5% higher than in 2022. By contrast, energy demand peaks in the middle of the current decade under the Net Zero scenario before declining thereafter. Energy demand is around 25% lower in 2050 compared with 2022. Under the Current Trajectory scenario, carbon emissions are far off the net zero ambition which most of the world's largest economies have committed to achieving. OIL Oil demand is expected to peak by 2025 at around 102 million barrels per day (bpd) under both scenarios. It however declines at a different pace in either outlook, driven primarily by the pace of falling oil use in road transport. In the Current Trajectory, oil consumption gradually declines over the second half of the outlook to around 75 million bpd in 2050. The drop in oil use is more pronounced in Net Zero, with demand falling to 25 million-30 million bpd 2050. The declining use of oil in road transport by 2035 is offset in the Current Trajectory by the increasing use of oil as a feedstock, especially in the petrochemicals sector as rising prosperity boosts consumption of plastics, textiles, and other oil-based materials. NATURAL GAS AND LNG In the Current Trajectory scenario, natural gas demand continues to grow throughout the outlook, expanding by around a fifth by 2050. The trend is driven by more than 50% demand growth in emerging economies, excluding China, chiefly in the power and industrialized sectors. Chinese gas demand broadly plateaus in the 2040s and by 2050 is around a third higher than its 2022 level. Under the Net Zero scenario, gas demand peaks by around the middle of this decade and by 2050 is around half of its 2022 level, driven by a rapid switch to alternative energies in developed economies. Around 80% of natural gas consumption is abated through carbon capture and storage (CCS) technology by 2050. In both scenarios, demand for liquefied natural gas, a super-chilled fuel that can be transported, grows rapidly until 2030, rising by 40% and 30% above 2022 levels in the Current Trajectory and Net Zero, respectively. LNG demand increases by more than 25% over the subsequent 20 years. This demand growth requires 300 Bcma of additional liquefaction capacity to come online post 2030. In contrast, the gains in LNG demand out to 2030 in Net Zero are reversed over the following decade, and by 2050 global trade in LNG is around 40% below its 2022 level, implying that no additional liquefaction capacity beyond that already under construction is required. WIND AND SOLAR Wind and solar capacity increases around eight-fold by 2050 in the Current Trajectory scenario and by a factor of 14 in Net Zero from 2022 levels. Until 2035, the buildout of new capacity is concentrated in China and developed economies, each of which account for around 30% to 45% of the increase in new capacity across the two scenarios. The rapid expansion in wind and solar power is underpinned by further cost declines as technology and energy production costs continue to benefit from ever-increasing deployment levels. Sign up here. https://www.reuters.com/business/energy/bp-energy-outlook-both-main-scenarios-see-2025-oil-peak-rapid-renewables-growth-2024-07-10/

2024-07-10 11:00

BEIJING, July 10 (Reuters) - China, the world's largest beef importer and Brazil, the biggest supplier, will set up a pilot scheme as part of efforts to make beef production more sustainable, state media said on Wednesday. Beef is regarded as one of the most emissions-intensive forms of food, especially in Brazil where food production has been associated with clearance of tracts of carbon-trapping forest. China's State Administration for Market Regulation has met with Brazilian institutions to discuss methods to ensure the transparency of the beef supply chain and the establishment of a cross-border traceability platform, CCTV said. It did not provide further information on timing. The countries agreed a unified global standard would be central to the traceability system, which would also help to combat counterfeit beef. Chinese companies have long prioritised price over sustainability, but are slowly gaining interest in greener supplies. In contrast to sustainability efforts in the West that have often been consumer-led, China's shift is driven first of all by policy signals as well as investor pressure. Traders and sustainability analysts, however, say higher costs and logistical challenges are likely to limit demand for sustainable goods. Cattle ranching in Brazil is linked to nearly 24% of global annual tropical deforestation and approximately 10% of total global greenhouse gas emissions, according to environmental organisation The Nature Conservancy. Cattle pasture is the most common initial use for deforested areas in the Amazon and neighboring Cerrado savanna, a practice that faces strict legal limits but continues illegally. China imported 2.74 million metric tons of beef in 2023, with more than 40% sourced from the South American producer, according to Chinese customs. Sign up here. https://www.reuters.com/sustainability/land-use-biodiversity/china-brazil-try-out-beef-traceability-plan-2024-07-10/

2024-07-10 10:47

BEIJING, July 10 (Reuters) - China's securities regulator on Wednesday announced more curbs on short-selling and pledged tighter scrutiny of computer-driven programme trading in its latest effort to bolster a flagging stock market. Short-selling, involving the sale of borrowed shares, is often blamed in China by regulators and investors for exacerbating market declines. The China Securities Regulatory Commission (CSRC) said securities re-lending - in which brokers borrow shares for clients to short sell - would be suspended. In addition, margin requirements would be raised for short-sellers. The CSRC also urged stock exchanges to publish detailed rules to regulate programme trading, especially high-frequency trading. The new measures come after seven straight weeks of losses for China's blue-chip CSI300 index (.CSI300) New Tab, opens new tab amid concerns over the health of the country's economy. China has taken a series of measures to discourage short-selling since last August, and the latest moves are "in response to investor concerns, and aimed at stabilising the market," the CSRC said in a statement. The latest curbs are "timely, and will help boost market sentiment," said Yang Delong, chief economist at First Seafront Fund Management Co. New securities re-lending will be suspended from Thursday, while existing contracts must lapse by the end of September, the regulator said. Meanwhile, stock exchanges will raise the minimum margin requirement ratio to 100% from 80% for short-selling, the CSRC said, adding the bar would be higher for hedge funds. The regulator, which launched a crackdown on computer-driven quant funds early this year, said it would further restrict high-frequency trading to ensure a fair market. High-frequency trading accounts have slumped more than one fifth so far this year to about 1,600 at the end of June, according to the watchdog. Sign up here. https://www.reuters.com/markets/asia/chinese-regulator-suspend-securities-relending-curb-short-selling-2024-07-10/