2024-07-10 06:23

SEOUL, July 10 (Reuters) - South Korea's national rail company on Wednesday suspended some regular routes and slowed bullet trains because of heavy rain in the central region that caused flooding and landslides. The city of Gunsan received nearly 100mm (4 inches) of rain within an hour early on Wednesday and a number of areas in the central region received precipitation of more than 200mm a day, according to the weather agency. The Ministry of Interior reported four people died and also said property, roads and infrastructure had been heavily damaged. There are landslide warnings for more than 50 areas and more than 3,500 people have been displaced, it said. Korail, the national rail service, said the Saemaeul and Mugungwha trains have been suspended on six central regional routes, with some service halted for a few hours and some until midnight. The KTX bullet trains were operating but were running at reduced speeds through some areas, Korail said. The month of July is annually the monsoon season in the country but it has experienced extreme weather in the summer months in recent years, which President Yoon Suk Yeol has said should be anticipated due to climate change. Sign up here. https://www.reuters.com/business/environment/rains-pound-south-korea-causing-landslides-bullet-trains-slowed-2024-07-10/

2024-07-10 06:06

LONDON, July 10 (Reuters) - The remarkable thing about investor reaction to the UK's new Labour government is how much just a modicum of stability, consistency and competence is being richly applauded. With exposure to British assets at such a low ebb after a decade of Brexit upheaval, seemingly endless leadership switches and 2022's almost farcical budget flub, it's a low bar to jump to please the financial crowd right now. And that's probably just as well. Mindful of limited fiscal space for any outsize signature spending push, Labour's proposals have been modest and hinge mostly on lifting growth with supply-side reforms such as simpler planning laws or seeding private-sector investment with grains of limited public sector cash. Coupled with moves to improve Britain's battered relations with European Union trading partners and a huge parliamentary majority that sees it comfortably in power for much of the rest of the decade, the temptation for global fund managers to tilt back toward unloved UK assets is clear. And "softly, softly" music rather than "crash, bang, wallop" is perhaps what's most soothing to the ear, not least in a year of noisy and confusing politics elsewhere. "(Prime Minister) Keir Starmer's first task is simply to rebuild faith in government," reckoned Jason Thomas, Carlyle's head of investment strategy. "Even modest success could prove a boon to UK asset prices." That may already have shifted the dial for some. "We turn overweight UK stocks," BlackRock Investment Institute Chairman Tom Donilon flagged on Tuesday as the world's biggest asset manager published its half-year outlook in the wake of last week's election. "The potential for relative political stability and attractive valuations may pull in foreign investors." The global snub of UK equity - where the FTSE 100 (.FTSE) New Tab, opens new tab trades near a record 50% valuation discount to Wall Street's (.SPX) New Tab, opens new tab and which has seen billions of pounds exit over 44 straight months of net outflows through June - has long seemed ready for a rethink on even a whisper of growth or change in overseas sentiment. What's more, analysis by fund tracker EPFR New Tab, opens new tab suggests there has been more interest from active managers tracking FTSE250 midcap stocks (.FTMC) New Tab, opens new tab for some quarters than the dire cumulative outflows suggest. That's also true for the pound - which on a trade-weighted basis is back to levels not seen since it was sunk by the Brexit referendum eight years ago and where speculative net longs have returned in recent weeks leading to the election. CFTC data showed net sterling long-jumped to 62,041 contracts in the week to July 2 - the largest since March. BORING NOT BAD BlackRock claims it remains neutral on British gilts - the epicentre of the market quake surrounding 2022's budget blowout under then-Prime Minister Liz Truss. But it said long-term gilts now "stand out" again as a strategic play and it also likes inflation-linked sovereign bonds. What is for sure is that the first gilt auction of the new government on Tuesday saw linker debt go like hotcakes. The Debt Management Office said it sold 4.5 billion pounds of an inflation-linked 30-year debt - where orders had topped a whopping 66 billion from record 222 bidders. And that chimed with the take from Europe's biggest asset manager Amundi, whose response to the election result last week was to say gilts came "a step closer to becoming a safe haven" due to improving UK inflation and fiscal dynamics. "A re-rating is merited and would be a big turnaround after the volatility seen during the years of UK political uncertainty that started with Brexit in 2016 and continued through Liz Truss' short tenure," it said. Gabriella Dickens, G7 economist at French asset manager AXA Investment Managers suggests a quiet return of understated UK stability could have profound long-term implications. "The UK appears, for the first time in a while, bright compared to its peers," she said, adding the so-called King's Speech on the government's legislative plans on July 17 would likely retain the predictable tone Labour campaigned on. "Boring is not a bad thing for economies," she said, stressing a recovery of external investment into the UK would be "a material tailwind for growth and an unseen boon for the new government." Germany's Deutsche Bank this week said there were "upside risks" to its 2024 forecast of 0.8% - accelerating to 1.5-1.6% over the next two years. "The new Labour government will likely benefit from a post-election growth dividend, with cyclical tailwinds strengthened." And as to a better post-Brexit settlement with the European Union, advice from many in that sphere is also that an open and cordial approach is better than new demands or a dramatic change of tack. Starmer on Monday promised improved post-Brexit trading rules and a revamp of the "botched deal" signed by former premier Boris Johnson - but he may just need to knock on some doors again to reap rewards. "A period of calm, predictable and constructive diplomacy would do wonders for the UK's reputation," wrote Charles Grant at the Centre for European Reform in an open letter to Starmer on ways to re-engage with the EU on a host of different levels. To be sure, market reaction since Thursday's results has not been overly dramatic. Long prepared by months of opinion polls pointing to a Labour landslide, the pound, gilts and UK stocks have given back some of the early modest gains. But the bar for Labour to deliver what most international investors seem to want is clearly not that high and is already being jumped. The opinions expressed here are those of the author, a columnist for Reuters. Sign up here. https://www.reuters.com/markets/labour-faces-low-bar-re-attracting-foreign-funds-mike-dolan-2024-07-10/

2024-07-10 05:56

July 10 (Reuters) - The dollar dipped on Wednesday after Federal Reserve Chair Jerome Powell indicated that the U.S. central bank is getting closer to cutting interest rates but wants to see further declines in inflation. It comes before consumer price index (CPI) data on Thursday is expected to show that headline prices eased on an annual basis in June. Powell is "still interested in seeing some more trends and I think we're going to have to see with CPI," said Paula Comings, head of foreign exchange sales at U.S. Bank in New York. "He's continuing to hedge his bets and be very fair and balanced." Economists polled by Reuters expected Thursday's report to show that headline prices rose 0.1% on the month, while core prices gained 0.2%. That would put annual gains at 3.1% and 3.4%, respectively. (USCPI=ECI) New Tab, opens new tab, (USCPF=ECI) New Tab, opens new tab Powell said on Wednesday he was not ready to conclude that inflation is moving sustainably down to 2% though he has "some confidence of that." His comments on his second day of testimony before Congress largely mirrored those made on Tuesday, when he also acknowledged the cooling labor market and noted that "we now face two-sided risks" in the economy. “Powell took a relatively cautious approach,” said Karl Schamotta, chief market strategist at Corpay in Toronto. “But there were enough dovish hints within his narrative to help risk appetite improve in markets.” “The idea that the labor market is no longer generating the inflation pressure that the U.S. economy was struggling with, and that the Fed was trying to counteract, is helping to reduce the likelihood of further rate hikes and also put a September rate cut more firmly on the table,” Schamotta said. Traders now have around 73% odds for a rate cut by September, with a second cut also seen likely by December, according to the CME Group’s FedWatch Tool. The dollar is expected to weaken when the Fed begins cutting rates but traders are in no rush to fully price in such a move until it appears more certain, especially as U.S. interest rates remain above peers. "It just goes back to the divergence," said Comings, noting that any dollar weakness will also depend on the pace and level of rate cuts, or hikes, by other central banks. The dollar index , which measures the U.S. currency against six others including the euro and yen, was last down 0.07% at 105.05. The euro gained 0.1% to $1.0823 as investors came to terms with a hung parliament in France. The unexpected outcome of the snap election, in which the left benefited from a surprise surge but no group won an absolute majority, has plunged France into uncertainty, with no obvious path to a stable government. The dollar strengthened 0.29% to 161.77 Japanese yen , getting closer to a 38-year high of 161.96 reached last week. The Japanese currency has suffered from the wide differential between U.S. and Japanese interest rates. Many Japanese private banks who met with the Bank of Japan on Tuesday called for the central bank to halve its monthly bond purchases by around 2026, two officials with direct knowledge of the deliberations told Reuters. The findings will be taken into account when the BOJ finalizes its taper plan at its policy meeting on July 30-31. Sterling hit a four-week high after Bank of England Chief Economist Huw Pill said on Wednesday the central bank was moving closer to cutting interest rates but services price inflation and wage growth remained uncomfortably strong. It was last up 0.48% at $1.2842 and earlier reached $1.2847, the highest since June 12. Meanwhile, the kiwi dropped after the Reserve Bank of New Zealand opened the door to possible rate cuts should inflation slow as expected. The RBNZ, which held rates steady as widely expected, expressed confidence that inflation would return to its target band this year, spurring bets for early policy easing. At the previous meeting in May, policymakers had flagged the potential for an additional rate hike. The New Zealand currency was last down 0.75% versus the greenback at $0.6077. In cryptocurrencies, bitcoin fell 0.57% to $57,584. Sign up here. https://www.reuters.com/markets/currencies/dollar-firm-powell-caution-kiwi-bides-time-before-rates-decision-2024-07-10/

2024-07-10 05:46

Fed's cautious optimism raises hopes for rate cuts Dollar edges down against euro, sterling gains on dollar Oil rises as data shows larger than expected crude draw NEW YORK/LONDON, July 10 (Reuters) - A global equities gauge rose to record levels on Wednesday while U.S. Treasury yields edged down with comments from Federal Reserve Chair Jerome Powell fuelling hopes for interest rate cuts as investors awaited key U.S. inflation data. Powell told lawmakers in Congress that he was not yet ready to declare inflation beaten but that the U.S. remained on a path back to stable prices and continued low unemployment and that the Fed was "very focused on staying on that path." The U.S. dollar edged lower while the euro rose slightly and sterling rallied as comments from the Bank of England's chief economist dampened expectations for an August rate cut. On Tuesday, Powell had told Congress that since the U.S. economy was no longer running too hot the central bank has to weigh risks and would be able to cut rates once inflation makes more progress. "Powell's reiterating the message that if inflation continues to cool the Fed should be ready to move rates. It does also feel like he's added a bit more emphasis on the labor market as well," said Mona Mahajan senior investment strategist at Edward Jones in New York. "It looks like September and December are back on the table for rate cuts." Added to Powell's comments, Mahajan said the slight dip in bond yields appeared to be supporting equities too. Investors are also waiting for June's Consumer Price Index report (CPI), due out on Thursday, and the Producer Price Index (PPI) report, which comes on Friday, and expect the data to add to optimism that the Fed will be able to cut rates this year. Traders are currently pricing in a 46% probability that the Fed will have cut rates by two notches by the end of December's meeting and a 70% probability for the first cut in September, according to CME Group's FedWatch tool. On Wall Street, the Dow Jones Industrial Average (.DJI) New Tab, opens new tab rose 429.39 points, or 1.09%, to 39,721.36, the S&P 500 (.SPX) New Tab, opens new tab gained 56.93 points, or 1.02%, to 5,633.91 and the Nasdaq Composite (.IXIC) New Tab, opens new tab gained 218.16 points, or 1.18%, to 18,647.45. For the S&P 500, Wednesday marked its sixth straight record high close and the Nasdaq's record closing high was its seventh in a row. MSCI's gauge of stocks across the globe (.MIWD00000PUS) New Tab, opens new tab rose 7.03 points, or 0.86%, to 824.81. This marked the global index's sixth record high close out of the last 7 sessions as well as its biggest one-day percentage gain since June 12. Europe's STOXX 600 (.STOXX) New Tab, opens new tab index earlier closed up 0.91%. In Treasuries, Powell's dovish-leaning comments sent yields lower and a solid U.S. 10-year note auction also marginally added bids to Treasuries that weighed on yields as well. The yield on benchmark U.S. 10-year notes fell 1.8 basis points to 4.282%, from 4.3% late on Tuesday while the 30-year bond yield fell 2.5 basis points to 4.4702%. The 2-year note yield, which typically moves in step with interest rate expectations, fell 0.6 basis points to 4.6221%, from 4.628% late on Tuesday. In currencies, the dollar edged lower with the prospect for rate cuts still in focus as Powell wrapped up his testimony. “Powell took a relatively cautious approach,” said Karl Schamotta, chief market strategist at Corpay in Toronto. “But there were enough dovish hints within his narrative to help risk appetite improve in markets.” The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, fell 0.09% to 105.02. The euro was up 0.13% at $1.0826 while sterling strengthened 0.48% at $1.2844. But against the Japanese yen , the dollar strengthened 0.26% to 161.73. In commodities, oil prices settled higher after data showed that a jump in U.S. refining activity last week prompted a bigger draw than expected from gasoline and crude inventories but gains were capped as Hurricane Beryl brought minimal supply disruptions. U.S. crude settled up 0.85%, or 69 cents at $82.10 a barrel and Brent settled at $85.08 per barrel, up 0.5%, or 42 cents on the day. Gold prices rose on raised expectations for U.S. interest rate cuts, while investors waited for Thursday's inflation data with a view to bolstering those expectations. Spot gold added 0.36% to $2,372.25 an ounce. U.S. gold futures gained 0.72% to $2,377.00 an ounce. Sign up here. https://www.reuters.com/markets/global-markets-wrapup-1-2024-07-10/

2024-07-10 04:35

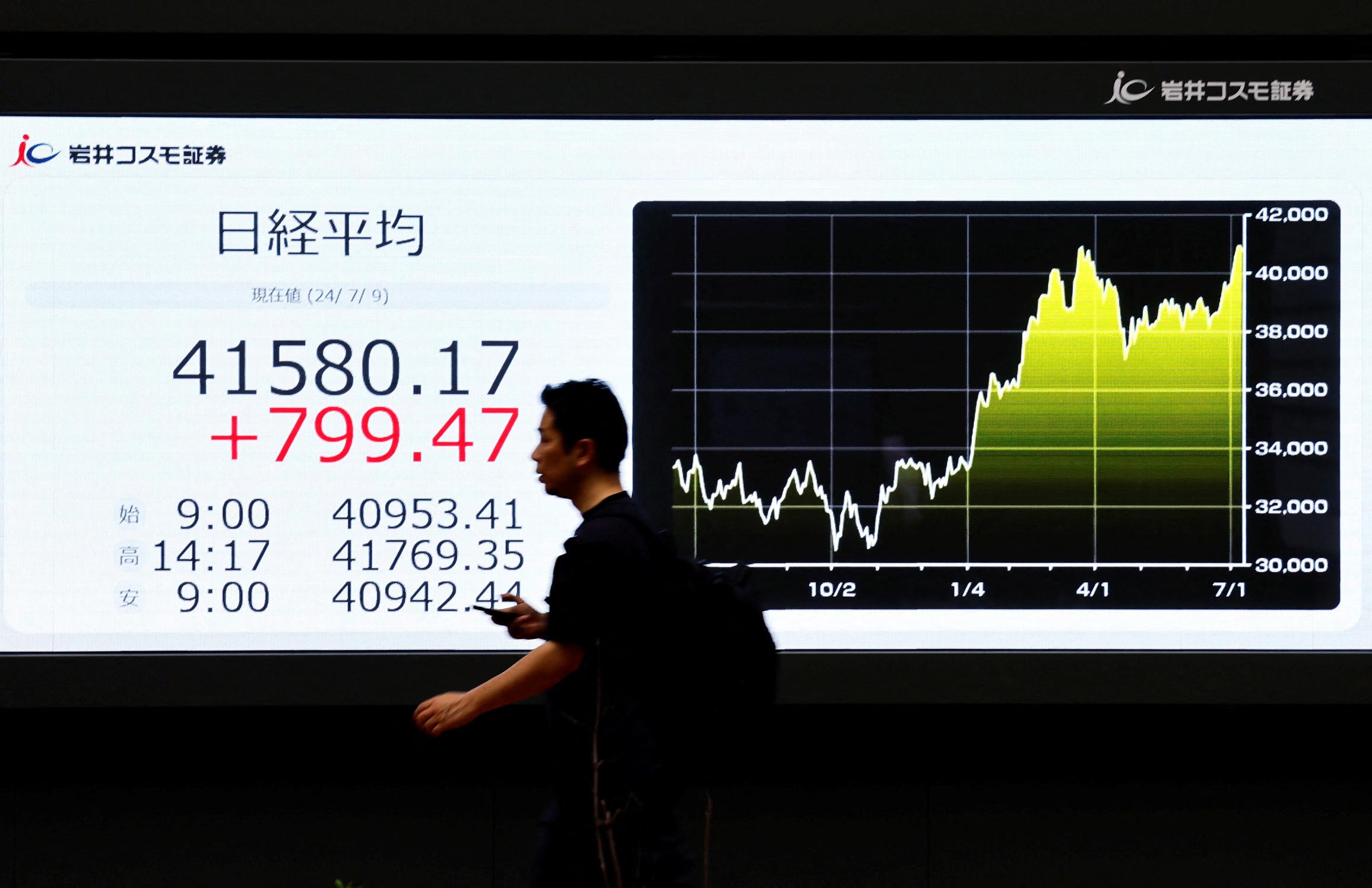

A look at the day ahead in European and global markets from Rae Wee Central bankers across the globe are finally showing increasing confidence that markets may be entering an era of lower rates, after victory over inflation proved elusive for a long time. The Reserve Bank of New Zealand (RBNZ) said on Wednesday at the conclusion of its policy meeting that headline inflation is expected to return to within the 1% to 3% target range in the second half of this year - a markedly less hawkish tone than what was conveyed in May. Traders wasted no time in ramping up bets for rate cuts in New Zealand later this year, which in turn sent the kiwi sliding some 0.7%. The RBNZ decision comes a day after Federal Reserve Chair Jerome Powell said in remarks to Congress that the U.S. is "no longer an overheated economy" with a job market that has cooled from its pandemic-era extremes, even though he provided little clues on how soon an easing cycle could commence. Still, the market pricing of an over 70% chance of a Fed cut in September has come a long way from a near-even chance a month ago, based on the CME FedWatch tool. Powell returns to Capitol Hill later on Wednesday to testify before the House Financial Services Committee, though focus will likely be on Thursday's U.S. inflation report. A surprise spike there could throw the case for rate cuts into doubt. Japan, meanwhile, remains an exception to the rate-cut story, with an acceleration in the country's wholesale inflation in June keeping alive market expectations for a near-term rate hike by the central bank. The Bank of Japan will likely trim this year's economic growth forecast in July but project inflation will stay around its 2% target in coming years, sources told Reuters. Rates aside, data on Wednesday showed China's consumer prices grew for a fifth month in June but missed expectations, while producer price deflation persisted, as anaemic domestic demand continues to plague the world's second-largest economy despite Beijing's support measures. China's retailers have discounted goods, from cars to coffee, as they navigate through sluggish consumer spending amid a shaky economic outlook. The downbeat data did little to help the yuan , which on Wednesday again fell to its weakest level since November. Key developments that could influence markets on Wednesday: - UK RICS Housing Survey (June) - Reopening of 14-year German government debt auction - Powell continues his testimony, this time before the House Financial Services Committee Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-2024-07-10/

2024-07-10 03:51

July 11 (Reuters) - More than 1.3 million homes and businesses in Texas were still without power early on Thursday after Hurricane Beryl slammed through the region, according to data from PowerOutage.us. The number was down from a peak of close to 2.7 million homes and businesses without power on Monday. Beryl lost strength quickly upon making landfall, and it was downgraded to a post-tropical cyclone by Tuesday. Provider Centerpoint Energy (CNP.N) New Tab, opens new tab said it has restored power to over 1 million customers of the 2.26 million impacted. Here are the major outages by utility: Sign up here. https://www.reuters.com/business/energy/more-than-300000-homes-without-power-texas-due-hurricane-beryl-2024-07-08/