2024-07-09 18:54

NEW YORK, July 9 (Reuters) - A jury in Manhattan federal court began deliberations on Tuesday in the criminal case against Archegos Capital Management founder Sung Kook "Bill" Hwang, accused by prosecutors of manipulating stock prices before the 2021 collapse of his $36 billion private investment firm. Prosecutors and defense lawyers delivered closing arguments on Monday in the trial of Hwang and Patrick Halligan, his Archegos deputy and co-defendant. Hwang's lawyer told jurors that the prosecution has criminalized aggressive but legal trading methods. A federal prosecutor painted a different picture, saying Hwang and Halligan unlawfully pumped up stock prices and lied about the holdings of Archegos to the banks with which they traded. U.S. District Judge Alvin Hellerstein instructed jurors on the law before deliberations began. Hwang, 60, pleaded not guilty to one count of racketeering conspiracy and 10 counts of fraud and market manipulation. Halligan, 47, pleaded not guilty to fraud and racketeering conspiracy. If convicted, they face maximum sentences of 20 years in prison on each charge, though any sentence would likely be much lower and would be imposed by the judge based on a range of factors. The trial, which began in May, centers on the implosion of Archegos - a spectacular collapse that left global banks nursing billions in losses and, according to prosecutors, caused more than $100 billion in shareholder losses at companies in its portfolio. Prosecutors have accused Hwang of secretly amassing outsized stakes in multiple companies without actually holding their stock. They have said Hwang lied to banks about the size of Archegos' derivative positions to borrow billions of dollars that he and his deputies then used to inflate the underlying stocks. According to the U.S. Attorney's Office for the Southern District of New York, which brought the case, Hwang's positions eclipsed those of the companies' largest investors, driving up stock prices. At its peak, prosecutors said Archegos had $36 billion in assets and $160 billion of exposure to equities. When stock prices fell in March 2021, the banks demanded additional deposits, which Archegos could not make. The banks then sold the stocks backing Hwang's swaps, wiping out $100 billion in value for shareholders and billions at the banks, including $5.5 billion for Credit Suisse, now part of UBS (UBSG.S) New Tab, opens new tab, and $2.9 billion for Nomura Holdings (8604.T) New Tab, opens new tab. (This story has been corrected to say 'billions' instead of '$40 billion' in paragraph 9) Sign up here. https://www.reuters.com/legal/criminal-case-against-archegos-bill-hwang-heads-jury-manhattan-2024-07-09/

2024-07-09 18:48

July 9 (Reuters) - Goldman Sachs Asset Management (GSAM) executives expect the U.S. economy to grow at a slower clip of about 2% in the second half of 2024, they said on Tuesday, with equity indexes seen largely flat due to declining earnings growth and political anxieties. That makes the investment landscape more complex, but one that still presents opportunities, including a broader array of AI stocks, GSAM said in its mid-year outlook. "It's absolutely a soft landing," said Lindsay Rosner, head of multi-sector investing at the asset management arm of Goldman Sachs (GS.N) New Tab, opens new tab. "As the data comes through, that's what we're seeing." The BlackRock Investment Institute (BII), an arm of BlackRock (BLK.N) New Tab, opens new tab, also released its mid-year outlook on Tuesday morning. "There is a real probability" that investors will see interest rate cuts in the United States in the second half of 2024, Rosner added. She does not expect the Federal Reserve to begin cutting until September, but added that rate cuts could continue at a pace of 25 basis points per quarter. As interest rates fall, Rosner said she expected the fixed income market to benefit. She said she saw particularly interesting opportunities in the high-yield bond market and in structured credit. By far the biggest trend in the U.S. stock market this year has been the dominance of a small handful of companies linked to the artificial intelligence (AI) theme, notably semiconductor giant Nvidia (NVDA.O) New Tab, opens new tab. Only five stocks and that single trend generated half of all stock market returns in the first six months of 2024, said Alexis Deladerriere, global equity portfolio manager and head of developed markets at GSAM. "We think you need to move away from the early winners" in AI and diversify exposure to this trend, he said. As earnings growth decelerates overall and political anxieties mount both domestically and globally, Deladerriere said he anticipates U.S. stocks will remain largely flat in the second half of the year. "We are seeing decelerating earnings growth" and the potential for domestic and global political events to unsettle U.S. stocks, said Deladerriere. "Uncertain is just kind of the status quo right now," said Rosner. Deladerriere added GSAM views Indian and Japanese equities as particularly attractive at this point, as plays on trends ranging from AI to addressing climate change. He also noted the appeal of Japanese reforms to corporate governance. Sign up here. https://www.reuters.com/markets/us/goldman-sachs-asset-managers-see-us-economy-stocks-slowing-2024-07-09/

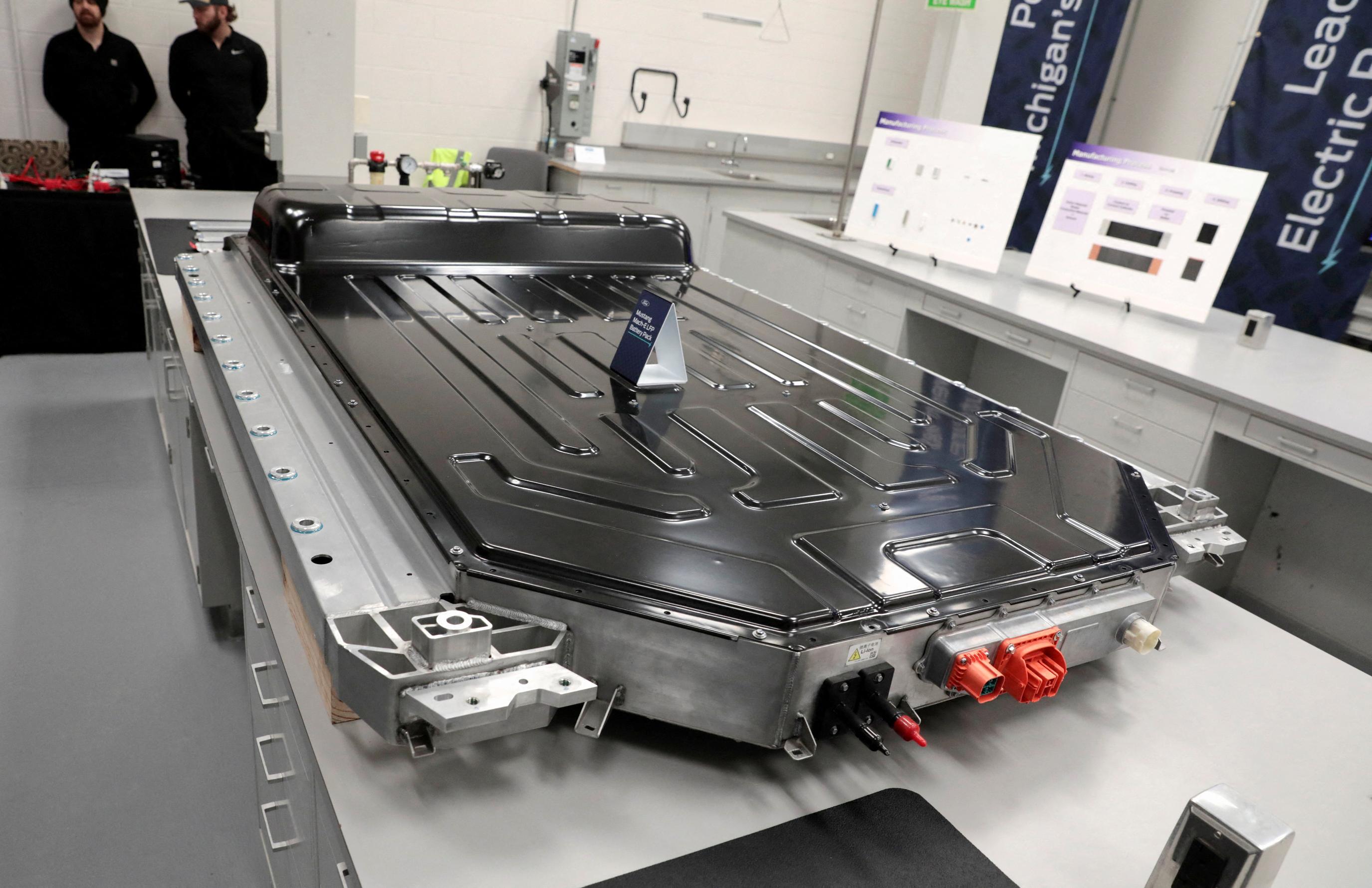

2024-07-09 18:01

DETROIT, July 9 (Reuters) - Ford Motor (F.N) New Tab, opens new tab is receiving a reduced incentive package from Michigan for its battery plant in the city of Marshall after the automaker cut expected production at the facility to match demand for electric vehicles. The Dearborn, Michigan-based car company is building the plant and plans to license technology to produce low-cost lithium-iron batteries at the facility from China's Contemporary Amperex Technology Co Ltd (CATL) (300750.SZ) New Tab, opens new tab, one of the world's largest battery manufacturers. The new package from the Michigan Strategic Fund provides a maximum incentive of $409 million, down from a previous $1.03 billion. Ford announced in November it would scale back expected battery production at the plant from a capacity of 35 gigawatt hours to 20 gigawatt hours, and employee numbers to 1,700 from 2,500. The automaker has scaled back this and other EV investments to match lower-than-anticipated demand for EVs. It is expecting to begin battery production at the Marshall plant in 2026. The plant has come under fire from politicians for its use of Chinese technology. Representative Mike Gallagher, a Republican who chairs the U.S. House committee on China, urged Ford to call off the deal late last year, saying it was "unethical" for the automaker to receive taxpayer subsidies for such a project. Ford has rejected such criticism and reiterated the plant will create thousands of U.S. jobs. The company said on Tuesday it was reacting to the slower growth in EV demand. “We are nimbly adjusting our manufacturing operations to match evolving customer demand and the Michigan Strategic Fund board is revising its incentive offers accordingly,” Tony Reinhart, Ford's director of state and local government affairs, said in a statement. Michigan also reduced incentives for a separate Ford investment project the company announced in June 2022 that would create thousands of new unionized jobs in the Midwest. The automaker revised that plan in January, scaling back production at its F-150 Lightning electric pickup plant, and adding a new shift to an assembly plant in Michigan that produces its popular Bronco and Ranger gasoline-powered vehicles. Michigan retracted a $100 million grant for the Lightning plant. Sign up here. https://www.reuters.com/business/autos-transportation/michigan-lowers-incentives-ford-ev-battery-plant-match-reduced-output-2024-07-09/

2024-07-09 17:52

New ship to be modeled after Disney Wish, operated by Oriental Land Company New ship will be ninth in Disney's fleet Disney's experiences business accounted for over one-third of revenue in March quarter URAYASU, Japan, July 9 (Reuters) - Walt Disney (DIS.N) New Tab, opens new tab and Japan's Oriental Land Company (4661.T) New Tab, opens new tab unveiled plans on Tuesday to launch a new cruise ship that will set sail from Tokyo in 2029, adding a ninth vessel to the brand's growing fleet. The new ship will be modelled after the Wish, the largest vessel in Disney's fleet. OLC, the operator of Tokyo Disneyland, will also operate the new cruise vessel. Disney currently has five cruise ships in operation. In addition to the Tokyo-based vessel, it has plans for three others, including one that will set sail from Singapore in 2025. The ship in Tokyo will have a maximum capacity of 4,000 passengers and is expected to bring in about 100 billion yen ($621.77 million) in annual sales within several years of launch, OLC said. "To set sail from Japan will make Disney vacations at sea more accessible to Japanese guests, who we know are some of our biggest fans," Thomas Mazloum, president of Disney Signature Experiences, told reporters. The cruise industry has been enjoying a rebound from a global shutdown during the COVID-19 pandemic. The Cruise Lines International Association expects the number of passengers to reach 34.7 million this year, up 17% from 2019. Josh D'Amaro, chairman of Disney Experiences, told Reuters in a recent interview that the ships provide the opportunity to bring themed entertainment to places not close to the company's theme parks, such as Melbourne or Vancouver. Disney also reaches a segment of the cruise market that had gone unaddressed - families. "Forty percent of the people on those ships today will say, 'The only reason I'm on a cruise ship today is because Disney's here,' which means we're creating a market," D'Amaro said. "When we are in Singapore, with this unbelievable ship that we're building, the same thing is going to happen," he added. "We know there's an insatiable demand for everything Disney." Disney's experiences business, which includes its domestic and international parks and cruise line, accounted for more than one-third of the company's revenue in the March quarter, and nearly 60% of its operating income. The company's stock tumbled in May after Chief Financial Officer Hugh Johnston warned about a "global moderation" in travel in the fiscal third quarter and other impacts, including higher wages and preopening expenses related to two of the new cruise ships and the new vacation island, Lookout Cay. The rising tide for Disney's cruise lines could help offset any softness in the company's domestic theme park business, UBS analyst John Hodulik said. The company said its second quarter booking occupancy is at 97% for all five ships. The rapid expansion of Disney's cruise capacity "helps de-risk the medium-term outlook" for the parks business, Hodulik said. Disney has announced a 10-year, $60 billion expansion of its theme parks and cruise business. Other recent investments include three new areas at the Tokyo DisneySea theme park, recreating the worlds of "Frozen," "Tangled" and "Peter Pan," the opening of a "Frozen"-themed area at Hong Kong Disneyland, and a "Zootopia" experience in Shanghai. The company is expected to announce plans for new attractions at Disneyland in California and Walt Disney World in central Florida in August, at its D23 fan convention. ($1 = 160.8300 yen) Sign up here. https://www.reuters.com/business/disney-add-new-ship-tokyo-expanding-cruise-business-2024-07-09/

2024-07-09 17:09

July 9 (Reuters) - Standard Chartered Plc's (2888.HK) New Tab, opens new tab, (STAN.L) New Tab, opens new tab crypto unit, Zodia Markets, is in talks to acquire billionaire hedge fund manager Alan Howard-backed Elwood Capital Management's OTC business, Bloomberg News reported on Tuesday. The acquisition of Elwood Capital would enable Zodia Markets to expand its focus on OTC settlement services in the British Channel Island of Jersey by obtaining essential licenses, the report said, citing people with knowledge of the matter. Spokespeople for Zodia Markets and Elwood declined to comment when contacted by Reuters. Sign up here. https://www.reuters.com/markets/deals/standard-chartereds-crypto-unit-talks-buy-alan-howard-backed-firm-bloomberg-2024-07-09/

2024-07-09 16:36

LONDON, July 9 (Reuters) - Shares in Novo Nordisk (NOVOb.CO) New Tab, opens new tab, maker of the wildly popular obesity drug Wegovy, were down 1.9% on Tuesday after the publication of a data analysis showing rival Eli Lilly's (LLY.N) New Tab, opens new tab own treatment Mounjaro leads to faster and greater weight loss. The analysis New Tab, opens new tab was published on Monday in JAMA Internal Medicine, a medical journal. It examined health records and other data to assess the pace and percentage of weight loss for overweight and obese people taking tirzepatide - the active ingredient in Lilly's Mounjaro and Zepbound - and semaglutide - the main ingredient in Wegovy and Ozempic. In the absence of head-to-head randomised controlled trials comparing the two drugs, researchers used the health records and pharmacy dispensing data to analyse weight loss trajectories in 9,193 patients receiving Mounjaro and the same number of closely matched patients receiving Ozempic. The average participant weighed 242 pounds (110 kg), and about half had type 2 diabetes. After accounting for individual risk factors, patients taking Mounjaro were 76% more likely to lose at least 5% of their body weight, more than twice as likely to lose at least 10%, and more than three times as likely to lose at least 15%, compared to patients taking Ozempic, the report found. Novo Nordisk in an emailed statement said: "This analysis compared the weight loss outcomes of semaglutide (Ozempic) and tirzepatide (Mounjaro) and did not include Wegovy even though weight loss was the main objective assessed." It said that the best way to compare the two weight-loss drugs is through a head-to head clinical trial, and noted that no such trial has yet been completed. A Lilly spokesperson declined to comment, saying that the company was not involved with the study. The spokesperson said that the company is currently studying tirzepatide and semaglutide in patients with obesity in a late-stage trial New Tab, opens new tab that is expected to finish later this year. The two drugmakers, the world's biggest producers of insulin, are the first-to-market with highly effective weight-loss drugs, a booming market that could be worth $150 billion in annual sales by the early 2030s, according to some analysts. Both are racing to increase production of their drugs, which are delivered in a once-weekly self-injection pen. The researchers noted that Ozempic and Mounjaro are both intended for use by people with type 2 diabetes, but half of the study participants were using the drugs for weight loss only, which may have impacted the results. The results of this analysis were initially published New Tab, opens new tab in November on the website medRxiv in advance of peer review. Shares in Novo and Lilly are at record highs on profits from the weight-loss drugs. Although Novo's Wegovy has been on the market in the United States since 2021, Lilly's version, sold as Zepbound in the U.S., only launched there late last year. Sign up here. https://www.reuters.com/business/healthcare-pharmaceuticals/novo-nordisk-shares-down-after-analysis-finds-lilly-drug-leads-better-weight-2024-07-09/