2024-07-05 20:41

Lobbying campaign to launch ahead of US political conventions Reviving the bureau would require new funding from Congress Critics argue revived Bureau of Mines would not solve existing issues July 5 (Reuters) - Mining trade groups plan to push Washington to revive and expand the long-dormant Bureau of Mines, an effort aimed at streamlining how the U.S. government regulates and supports critical minerals production and timed to coincide with the 2024 presidential election. The lobbying campaign, details of which have not previously been reported, is set to launch this month ahead of the Republican and Democratic political conventions. It will contrast scattered U.S. mining oversight with Australia and other countries where senior mining-related agencies report directly to heads of government, according to three sources with direct knowledge of the effort. Lithium, copper and other critical minerals are used in many electronics and demand is expected to surge further in coming years for production of electric-vehicle batteries. China is the world's largest producer or processor of many critical minerals. U.S. mining policy is currently administered through multiple agencies, including the Bureau of Land Management, the Fish and Wildlife Service, and the Mine Safety and Health Administration. The bureau closed in 1996 during budget cuts. The push to resuscitate it and add new responsibilities would, supporters argue, allow Washington to craft a unified critical minerals policy for permitting, research funding, and industry grants and loans that could stretch between presidential administrations and help the U.S. better compete with China. "Mining decisions right now are spread across multiple government agencies, and that makes transparency and accountability very difficult," said Rich Nolan, head of the National Mining Association trade group, which is spearheading the push alongside the American Exploration & Mining Association and the Society for Mining, Metallurgy & Exploration (SME). The SME, which represents academics and others conducting mining-related research, is crafting a position paper that the two other groups will use to lobby members of Congress, according to one of the sources. The groups acknowledged that they are not likely to succeed this year but hope to in the next Congress, which runs from 2025 to 2027, the source said, adding that there is no estimate yet for how much funding a revived bureau would need. "If a new bureau could bring some efficiency to a duplicative and inefficient permitting process, it could be a huge benefit to the country," said Mitch Krebs, CEO of Coeur Mining (CDE.N) New Tab, opens new tab, a Chicago-based silver miner. Critics of this latest plan note that the original Bureau of Mines never oversaw mine permitting and that mines could still face opposition from conservation groups and environmental regulators. "The Bureau of Mines coming back into existence is not going to fix any of that," said Michelle Michot Foss, the fellow in energy, minerals and materials at Rice University's Baker Institute for Public Policy. "There's nothing serious on the table that would make the mining industry function better than it is now." Additionally, the bureau would need to be elevated to a cabinet-level agency if the goal is to have it report directly to the president, a step that would require congressional approval. "We continue to advance responsible and sustainable mining through the efforts of federal agencies such as" the Department of the Interior, Department of Energy and Department of Defense, White House spokesperson Angelo Fernandez Hernandez told Reuters. Founded in 1910 after a string of mining disasters, the bureau grew to a staff of more than 4,000 by 1960 that inspected mines, conducted minerals-related research, studied specialized metals for the space age and operated a helium-separation plant that supplied NASA. In 1996, its $152 million annual budget was eliminated as part of a budget deal between Republicans and then-President Bill Clinton. Rhea Graham, who was appointed by Clinton in 1994 as the first Black woman to lead the bureau, was given only 90 days to close it. "When the bureau was closed, a signal was sent about how we as a nation valued science and how science funding was more precarious than perhaps people think it is," Graham said. Sign up here. https://www.reuters.com/markets/commodities/us-miners-push-washington-revive-long-dormant-bureau-mines-2024-07-05/

2024-07-05 19:03

July 5 (Reuters) - A wildfire in northern Alberta that forced Suncor Energy (SU.TO) New Tab, opens new tab to shut in some oil sands production has not moved closer to any infrastructure, Alberta's wildfire agency said on Friday, although it added that crews expect another challenging day. Suncor, Canada's second-largest oil company, temporarily curtailed some production and evacuated non-essential workers from its 215,000 barrel-per-day (bpd) Firebag site on Wednesday because of a fire roughly eight kilometres (5 miles) away. The Calgary-based company did not specify how much production was shut in but said Firebag will be kept ready to resume full output as soon as conditions were safe. Alberta Wildfire said the out-of-control blaze about 70 kilometres (43 miles) northeast of the oil sands hub of Fort McMurray, is around 12,000 hectares (29,700 acres) in size. "Yesterday, there was no significant growth towards any infrastructure," the agency said in a statement. However the eastern flank of the fire, furthest from Firebag, grew significantly, Alberta Wildfire added. There are 142 firefighters and 14 helicopters tackling the blaze, including two that can fly at night. Sign up here. https://www.reuters.com/business/environment/uncontrolled-alberta-wildfire-continues-blaze-near-suncor-oil-sands-site-2024-07-05/

2024-07-05 16:29

LONDON, July 5 (Reuters) - The amount of cryptocurrency stolen in hacks globally more than doubled in the first six months of 2024 from a year earlier, driven by a small number of large attacks and rising crypto prices, blockchain researchers TRM Labs said on Friday. Hackers had stolen more than $1.38 billion worth of crypto by June 24, 2024, compared with $657 million in the same period in 2023, TRM Labs said in a report. The median theft was one-and-a-half times larger than the year before, the report said. "While we have not seen any fundamental changes in the security of the cryptocurrency ecosystem, we have seen a significant increase in the value of various tokens - from bitcoin to ETH (ether) and Solana - compared to the same time last year," said Ari Redbord, global head of policy at TRM Labs. This means that cybercriminals are more motivated to attack crypto services, and can steal more when they do, Redbord said. Crypto prices have generally recovered from the lows hit in late 2022 in the aftermath of the collapse of Sam Bankman-Fried's crypto exchange, FTX. Bitcoin hit an all-time high of $73,803.25 in March this year. Among the largest crypto losses so far this year was the roughly $308 million worth of bitcoin stolen from Japanese crypto exchange DMM Bitcoin, in what the company called an "unauthorised leak". Cryptocurrency companies are frequent targets for hacks and cyberattacks, although losses of this scale are rare. Stolen cryptocurrency volumes in 2022 were around $900 million, Redbord said, partly due to the more than $600 million stolen from a blockchain network linked to the online game Axie Infinity. The United States has linked North Korean hackers to that theft. The United Nations has accused North Korea of using cyber attacks to help fund its nuclear and missile programs. North Korea has previously denied allegations of hacking and other cyberattacks. (This story has been refiled to specify the time period in the headline) Sign up here. https://www.reuters.com/technology/crypto-hacking-thefts-double-14-bln-first-half-researchers-say-2024-07-05/

2024-07-05 16:28

BRUSSELS, July 5 (Reuters) - The European Commission said on Friday it had requesting Amazon (AMZN.O) New Tab, opens new tab provide more information on the measures the U.S. e-commerce giant has taken to comply with its Digital Services Act (DSA) obligations. "In particular, Amazon is asked to provide detailed information on its compliance with the provisions concerning transparency of the recommender systems (...)," the EU said in a statement. Amazon must provide the requested information by July 26, it said. The DST requires Big Tech players to do more to tackle illegal and harmful content on their platforms. Amazon said it was reviewing the EU's request. "We are reviewing this request and working closely with the European Commission. Amazon shares the goal of the European Commission to create a safe, predictable and trusted shopping environment," said a spokesperson for Amazon. "We think this is important for all participants in the retail industry, and we invest significantly in protecting our store from bad actors, illegal content, and in creating a trustworthy shopping experience. We have built on this strong foundation for DSA compliance," added the spokesperson. Sign up here. https://www.reuters.com/technology/eu-asks-amazon-more-info-digital-services-act-compliance-2024-07-05/

2024-07-05 15:13

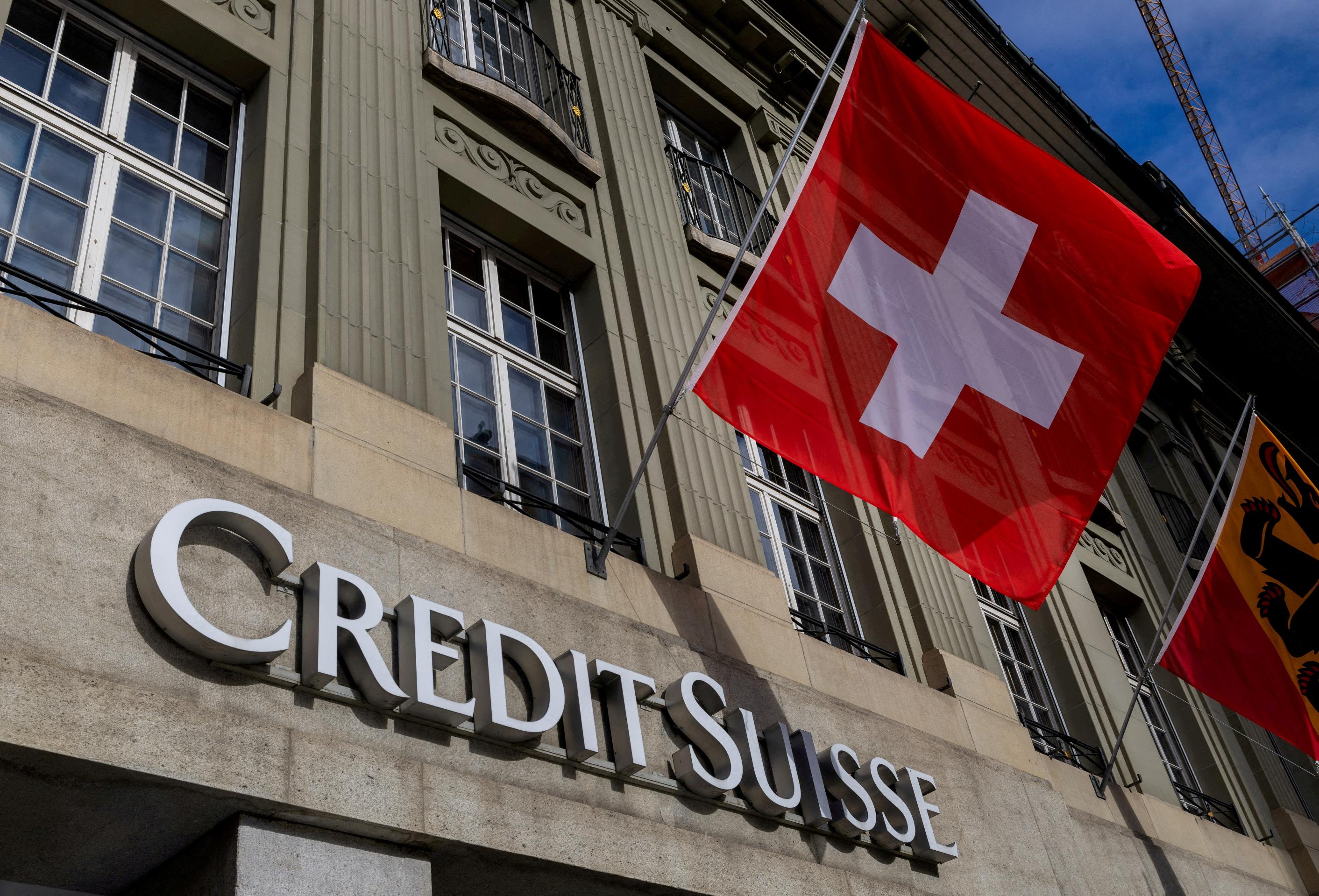

ZURICH, July 5 (Reuters) - Credit Suisse's collapse was caused by the bank's management, not by Swiss financial authorities, Swiss National Bank Chairman Thomas Jordan was quoted as saying on Friday. "It was the result of bad decisions by the bank's management," Jordan told newspaper Le Temps in an interview. "The Swiss authorities were well prepared, and we took the necessary measures to avoid a global financial crisis." The state-brokered takeover of Credit Suisse by UBS (UBSG.S) New Tab, opens new tab last year was the best option available, said Jordan, who argued there were limits to how far the SNB could have intervened. "The SNB can't say 'Whatever it takes, we're going to save a bank,' because that's not our job," he said, noting that it was for politicians to make such decisions. "You have to commit public money, and that's not a decision the SNB can take." Still, he added, lessons must be learned, with drawing up banking regulations a task for the SNB along with the government and financial market regulator FINMA. The government has already outlined measures including stricter capital requirements for UBS and other systemically relevant banks, without stipulating precise sums. Jordan called the proposals a good start, noting it was important to calculate the amount of equity capital banks required "prudently and realistically." They should hold enough to absorb losses in a crisis, he said. Banks also needed to ensure they had enough assets to serve as collateral to secure emergency liquidity support, he added. Finally, the option of resolution - an orderly winding down or restructuring of a bank - should be credible, Jordan said, noting: "We need a system where a bank can disappear without destabilising the financial system or the economy." Turning to monetary policy, Jordan said that while interest rates were the SNB's main policy tool, it was also ready to intervene in foreign currency markets if necessary. He was relaxed about inflation, which the SNB has forecast to be around 1% in the medium term. "It's important to continue monitoring the situation, but for the moment it's relatively comfortable," Jordan said. Sign up here. https://www.reuters.com/business/finance/snbs-jordan-blames-credit-suisse-bosses-banks-crash-2024-07-05/

2024-07-05 14:30

NEW YORK, July 5 (Reuters) - Hopes that the U.S. stocks rally will broaden beyond megacaps like Nvidia (NVDA.O) New Tab, opens new tab will be tested in coming weeks as investors learn whether profit growth from other companies is starting to catch up with that of the tech-related leaders. The S&P 500 (.SPX) New Tab, opens new tab has rallied 16% so far in 2024, driven by a handful of massive stocks poised to benefit from emerging artificial intelligence technology. Only 24% of stocks in the S&P 500 outperformed the index in the first half, the third-narrowest six-month period since 1986, according to BofA Global Research strategists. Meanwhile, the equal-weight S&P 500 (.SPXEW) New Tab, opens new tab -- a proxy for the average stock -- is only up around 4% this year. As of Tuesday, about 40% of S&P 500 components were down for the year. Second-quarter earnings kick off next week with major banks including JPMorgan (JPM.N) New Tab, opens new tab and Citigroup (C.N) New Tab, opens new tab reporting on July 12. Investors will be watching whether profits from other companies are catching up with the "Magnificent 7": Nvidia, Microsoft (MSFT.O) New Tab, opens new tab, Apple (AAPL.O) New Tab, opens new tab, Alphabet (GOOGL.O) New Tab, opens new tab, Amazon (AMZN.O) New Tab, opens new tab, Meta Platforms (META.O) New Tab, opens new tab and Tesla (TSLA.O) New Tab, opens new tab, many of which rebounded from struggles in 2022. Investors generally view a narrow rally as more fragile, because weakness in just a few big stocks could sink indexes, but some hope gains will spread during the second half. More companies are projected to post improved earnings as many investors expect the economy to navigate a soft landing, which could boost stocks trading at more moderate valuations than market leaders. "If we're looking for a catalyst to have broader participation in this rally this year, the second-quarter earnings reporting season may well be the start of that," said Art Hogan, chief market strategist at B Riley Wealth. The S&P 500 is trading at about 21 times forward earnings estimates, but if the top 10 stocks by market value are excluded that figure drops to 16.5 on average for the rest of the index, Hogan said. In a further sign of the narrow rally, the information technology (.SPLRCT) New Tab, opens new tab and communication services (.SPLRCL) New Tab, opens new tab sectors, which include most of the Magnificent 7, are the only two of 11 S&P 500 sectors to outperform the broader index this year. Earnings among the Magnificent 7 rose 51.8% year-on-year in the first quarter compared to 1.3% earnings growth for the rest of the S&P 500, according to Tajinder Dhillon, senior research analyst at LSEG. That gap is expected to shrink, with forecasts for Magnificent 7 year-on-year earnings rising 29.7% in the second quarter and earnings among the rest of the index up 7.2%, according to LSEG. "We think greater balance in profitability could lead to broader market participation in the coming quarters," Chris Haverland, global equity strategist with the Wells Fargo Investment Institute (WFII), said in a note on Tuesday. The WFII suggests investors trim gains in the technology and communication services sectors to take advantage of weakness in energy, healthcare, industrials and materials. Later in the year, the Magnificent 7's profit advantage is expected to diminish further. The group's year-on-year earnings growth is expected to be 17.4% in the third quarter and 18.3% in the fourth. That compares with rest-of-index earnings growth of 6.8% in the third quarter and 13.9% in the fourth. "We anticipate that we're going to have nearly all sectors of the S&P participating in earnings growth in 2024," said Katie Nixon, chief investment officer for Northern Trust Wealth Management. Not everyone is convinced that other groups are poised to catch up, as AI remains a dominant theme. Robert Pavlik, senior portfolio manager at Dakota Wealth Management, said he had doubts about earnings growth meeting expectations, due to weak consumer spending, sticky inflation and other concerning economic indicators. Data on Friday showed U.S. job growth slowed marginally in June, with major stock indexes little changed in morning trade following the report. In coming days, investors could get a clearer view of the economy's health and when the Federal Reserve will start cutting interest rates, which could also trigger broader market gains. Fed Chair Jerome Powell is due to testify before Congress on Tuesday, while Thursday's release of the monthly consumer price index provides a crucial look at inflation. Sign up here. https://www.reuters.com/markets/us/wall-st-week-ahead-earnings-season-test-hopes-broader-stocks-rally-2024-07-05/