2024-07-03 19:16

NEW YORK, July 3 (Reuters) - High fuel costs and the threat of a hurricane are not expected to dampen Americans' desire to hit the road this summer, with vacationers preparing for record travel to kick off Fourth of July holiday festivities. Motorist group AAA expects a record of almost 71 million people to travel around the U.S. Independence Day holiday, growth similar to a pre-pandemic trajectory. Some 60 million people will drive with nearly 6 million flying to their destinations, while around 4.6 million people will take buses, trains or cruises during the holiday period, according to AAA's forecast. "We've never seen numbers like this," AAA spokesperson Andrew Gross said. "2024's travel seems to be what 2020 would have been, had it not been for the pandemic," he added. U.S. summer travel will be closely watched from multiple fronts this year, as it could offer central bank officials and policymakers an important measure of consumer sentiment in an election year. Inflation was unchanged in May even as consumer spending rose, boosting hopes that the U.S. Federal Reserve might be able to control inflation while avoiding a recession. Gasoline prices have eased over the past few months, with the national average price for a gallon of motor fuel at $3.50 on Tuesday, a 3-cent decline from last year. Domestic airfare is 2% cheaper than last year, with an average domestic round trip costing $800, according to AAA booking data. 'WANTING TO TRAVEL' Despite recent declines, fuel prices remain well above historical levels. The average price for a gallon of gasoline was $2.74 during the July Fourth week in 2019, and the weekly average price from 2015 through 2019 was under $2.50 a gallon, according to U.S. Energy Information Administration data. Still, vacationers' travel plans are largely unaffected by higher prices this year, according to a survey of over 1,000 people New Tab, opens new tab by auto retail group American Trucks. Four-week average U.S. gasoline demand hit a one-year high of 9.2 million barrels per day (bpd) last week as retailers stockpiled ahead of the holiday, EIA data showed on Wednesday. Four-week average jet fuel demand was at 1.7 million bpd, identical to a seven-month high hit earlier in June. "What we have noticed is that it's more about the rate of change than the price itself that affects the psyche of consumers," said John LaForge, head of real asset strategy at Wells Fargo Investment Institute. Since the price of gasoline has not moved dramatically higher or lower in the past six months, consumer psyche is largely unaffected by it, LaForge said. For now, U.S. vacation travel is unlikely to be affected by Hurricane Beryl, which has brought devastation to some Caribbean Islands since Monday, but is expected to weaken considerably as it reaches Mexico's Yucatan Peninsula by Thursday night. U.S. fuel inventories are also better stocked than they have been in recent years, providing motorists a buffer from sudden price shocks in case the hurricane disrupts refining operations. U.S. gasoline stockpiles stood at around 231.7 million barrels in the week ended June 28, 5.6% higher than the same time last year, EIA data showed. Jet fuel stocks were 4.7% higher than last year. "Americans are optimistic and wanting to travel, there's no denying it," GasBuddy analyst Patrick De Haan said. Sign up here. https://www.reuters.com/markets/us/americans-look-past-fuel-cost-bad-weather-set-july-fourth-travel-record-2024-07-03/

2024-07-03 17:53

ST.PETERSBURG, July 3 (Reuters) - Russia's central bank told businesses they should use "multiple choice solutions" including cryptocurrencies and other digital assets to facilitate payments with foreign partners to counter Western sanctions imposed over the Ukraine conflict. Russia’s booming trade with China, India, the United Arab Emirates, Turkey and other countries which have not imposed sanctions has suffered major setbacks in the last few weeks. Recent Western sanctions have targeted major Russian financial institutions, including the Moscow Stock Exchange and Russia's domestic alternative to the SWIFT global payments system. Elvira Nabiullina, governor of the central bank, admitted that payments problems were one of the key challenges for the Russian economy. "New financial technology creates opportunities for schemes which did not exist before. This is why we softened our stance on the use of cryptocurrencies in international payments, allowing the use of digital assets in such payments," Nabiullina told a financial conference in St.Petersburg. "Different alternatives are being discussed. Businesses have become very flexible, very enterprising. They find ways to solve this and often don’t even share them with us," she said. Nabiullina said Russia’s business partners in various countries were under "tremendous pressure" but said a new global payments system not involving Western institutions would gradually emerge since many countries felt vulnerable using only one international payment system with no alternatives. Nabiullina said Russia and other countries from the BRICS grouping of countries were in discussions over the BRICS Bridge payments system, which would be designed to bridge the financial systems of member countries. But she added that the discussions were difficult and that it would take time to create such a system. Andrei Kostin, head of Russia’s second largest lender VTB, which recently had sanctions imposed on its branch in Shanghai and was sitting alongside Nabiullina, said that any information about mechanisms to facilitate international payments should be made a "state secret" by law due to its sensitivity. "I can see very well that right now somewhere at the U.S. embassy, a second secretary is sitting and writing down every public statement of ours. Maybe he is even sitting here. Whatever steps we take, we can see that the reaction [from Western countries] is very quick," he said. Sign up here. https://www.reuters.com/business/finance/russian-regulator-encourages-use-crypto-counter-sanctions-2024-07-03/

2024-07-03 17:29

ORLANDO, Florida, July 3 (Reuters) - If history is any guide, uncertainty surrounding the U.S. presidential election will rise as the November vote draws closer, which would be an additional headwind for an economy already showing signs of losing momentum. Economic policy uncertainty indexes capturing these trends have not kicked in yet. But assuming they do, the heightened anxiety could herald a softer second half of the year not only for the economy but for Wall Street too. Much of this year's stock-market strength has been built on solid earnings growth forecasts. These are likely to be revised if economic growth, consumer spending, corporate investment or hiring cools further. Institute for Supply Management data this week shows that manufacturing activity shrank in June for a third straight month, and service-sector employment and new orders slumped. This is the economic landscape four months from a November election that is still expected to fought between frontrunners President Joe Biden and former President Donald Trump, despite the incumbent's widely-panned TV debate performance last week. Populism, polarization and an expected tight race produce a perfect storm for a surge in the economic policy uncertainty index New Tab, opens new tab, (EPU) a news-headline-based index created in 2016 by economics professors Steven J. Davis, Scott R. Baker and Nick Bloom. Rising EPU occurs when a muddied outlook for government policy forces consumers to delay spending and businesses to put investment and hiring on ice. Analysts at Brandywine Global say this may be happening. They note that the University of Michigan's current economic conditions index is below the expectations index, a rare occurrence that suggests consumers are unusually anxious. "Our take on this development is that this year's election cycle, whether warranted or not, is already having an impact on the U.S. consumer and, by default, the corporate sector," the analysts wrote last week. SLOW DOWN Davis, senior fellow at the Hoover Institution and co-founder of the EPU index, said the current level of EPU in the United States is "a bit of a puzzle", given the fiscal, monetary policy and geopolitical uncertainty already swirling ahead of the election. "I expect to see more elevated levels of EPU," in the coming months, Davis said, noting that at the aggregate level, the drag on GDP growth from a somewhat elevated EPU is modest. "But there are episodes in which high levels of uncertainty can have quite a negative impact and materially amplify recessionary forces," Davis said. The U.S. economy is not in recession yet, at least not officially. But the Atlanta Fed's GDPNow second-quarter tracking estimate has slumped to 1.5% real GDP growth from over 4% in mid-May, and U.S. economic surprises are the most negative in two years. Davis' 2016 research found that on a micro level, policy uncertainty is associated with greater stock-price volatility, and reduced investment and employment in policy-sensitive sectors like defense, healthcare, finance and infrastructure construction. The results at the macro level are less clear-cut, but rising uncertainty tends to foreshadow declines in investment, output, and employment. And EPU usually rises around election time. RAZOR-THIN MARGINS In a 2020 follow-up working paper "Elections, Political Polarization, and Economic Uncertainty" New Tab, opens new tab, Davis and colleagues found that EPU increases by 18% in the November of a "typical" presidential election. When elections are close - with a winning margin of less than 5% - and polarized, EPU jumps by 28% in the month of the election. This is backed up by the findings of a 2018 paper "Partisan Conflict and Private Investment" New Tab, opens new tab by Marina Azzimonti, a senior economist and research advisor at the Richmond Fed, that suggested a rise in partisan conflict in Washington can reduce corporate investment by as much as 27%. High levels of partisan conflict in the U.S. can also slow foreign direct investment. Studying data over a 30-year period from 1985 to 2016, Azzimonti estimates New Tab, opens new tab that a 10% rise in her "trade partisan conflict index" corresponded with a 7% decline in FDI from the mean. The recent market ructions in Mexico, India and France are stark reminders to investors that they underestimate or ignore political risk at their peril. There are signs that the U.S. bond market is beginning to price in a Trump victory and the tax-cutting largesse that might entail. U.S. betting markets have swung heavily in favor of Trump in the wake of last week's TV debate. But there is a long way to go, and the last two elections show how thin the margins of victory and defeat can be. Although nearly a quarter of a billion people are eligible to vote in November, it's worth remembering that in 2016 Hillary Clinton lost Pennsylvania, Michigan and Wisconsin by just 77,000 votes, and in 2020 Joe Biden defeated Donald Trump by only 44,000 votes in Wisconsin, Arizona and Georgia. With the outcome potentially resting on razor-thin margins in a handful of states, there is plenty of scope for a higher EPU in the coming months. And if growth is already waning, markets could be in for a rocky ride. (The opinions expressed here are those of the author, a columnist for Reuters.) Sign up here. https://www.reuters.com/markets/us/us-election-uncertainty-slowdown-heady-mix-markets-mcgeever-2024-07-03/

2024-07-03 15:44

LONDON, July 3 (Reuters) - Global banking regulators have approved templates for banks to disclose their exposure to crypto assets from January 2026, they said on Wednesday, a year later than originally indicated. "These disclosures aim to enhance information availability and support market discipline," the Basel Committee on Banking Supervision said in a statement. The committee, made up of banking regulators from the world's main economies who commit to applying agreed standards, discussed the prudential or impact on capital of tokenised deposits and stablecoins, a cryptocurrency backed by an asset such as the dollar. Based on current market developments, risks from these are "broadly captured" by existing Basel standards, an indication that additional capital rules are not being planned for now. "The Committee will continue to monitor this area and other developments in the cryptoasset markets," the statement added. Basel members also agreed to take a more hands-on approach to dealing with risks for banks from their increasing use of third parties, such as for cloud computing to run key activities. The committee said it would consult later this month on principles to replace looser guidance currently in force. It also updated on a now closed public consultation into new rules for banks to disclose their climate-related financial risks New Tab, opens new tab under so-called "Pillar III" of their capital rules. "It agreed to continue to work on finalising such a framework as part of its holistic approach to addressing climate-related financial risks," the statement said. Sign up here. https://www.reuters.com/business/finance/banks-publish-crypto-asset-exposure-january-2026-say-global-regulators-2024-07-03/

2024-07-03 12:44

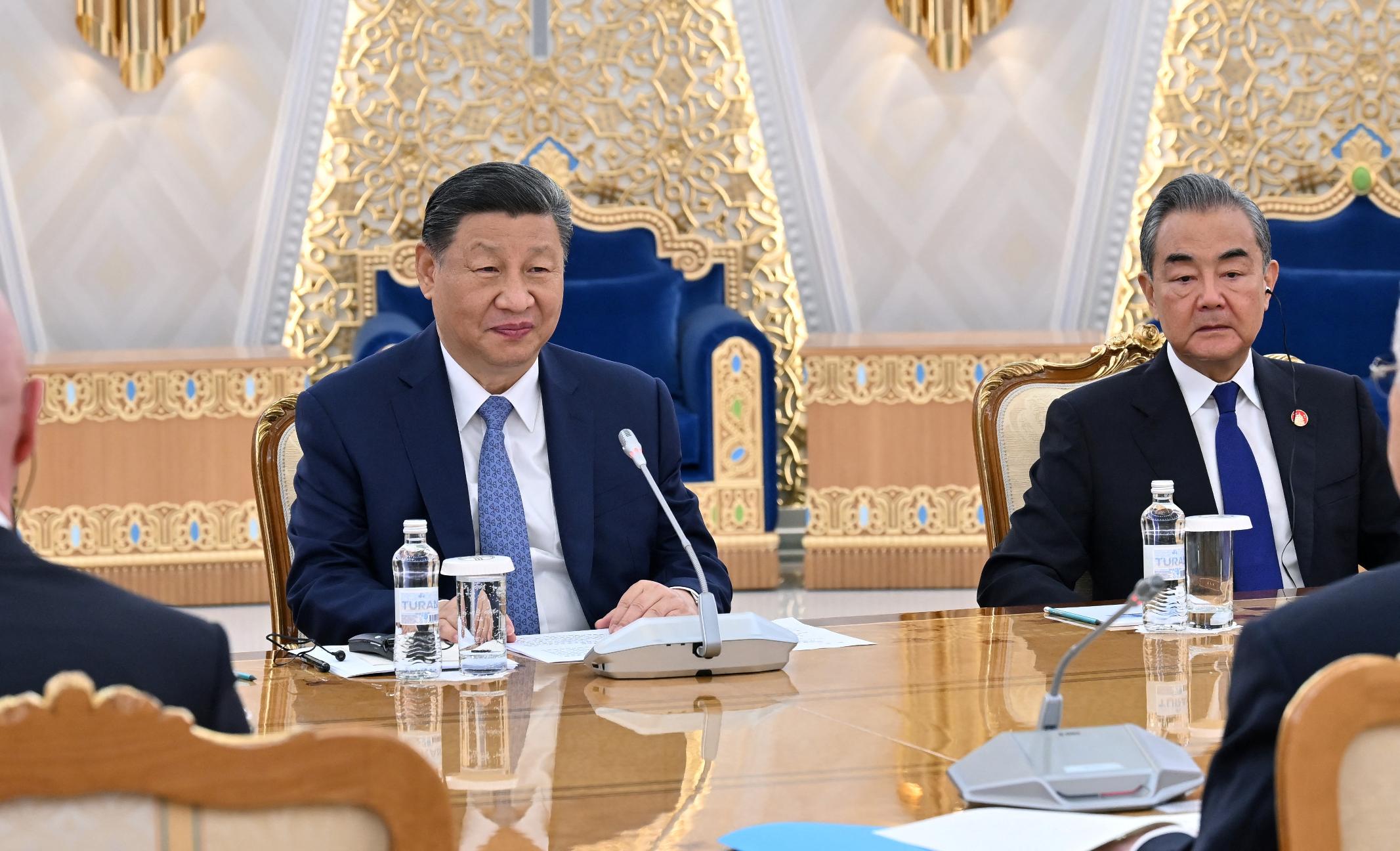

BEIJING, July 3 (Reuters) - China's President Xi Jinping said he supports Kazakhstan joining the BRICS bloc, Chinese state media reported on Wednesday, as the group of developing nations mulls further expansion to rival a Western-dominated world order it sees as outdated. Speaking to the press alongside Kazakh President Kassym-Jomart Tokayev following a meeting in the Central Asian state's capital, Xi encouraged Kazakhstan to "play the role of a middle power on the international stage and make its due contribution to global governance", while endorsing Astana's accession. China and Russia are pushing for the expansion of the BRICS grouping, which also includes Brazil, India and South Africa, as they seek to counter Western economic dominance. Originally an acronym coined by Goldman Sachs chief economist Jim O'Neill in 2001, the bloc was founded as an informal four-nation club in 2009 and added South Africa a year later. Last August, the BRICS bloc agreed to admit Saudi Arabia, Iran, Ethiopia, Egypt, and the United Arab Emirates. However, Saudi Arabia has not yet joined the group. Argentina had planned to join BRICS, but President Javier Milei withdrew his country soon after taking office in December. Xi is in Kazakhstan to attend a heads of state meeting of the Shanghai Cooperation Organization from July 3-4. During his meeting with Tokayev, China and Kazakhstan also agreed to double their two-way trade as soon as possible and deepen cooperation in oil and gas exploration, extraction and processing, the report added. Crude oil and petroleum gases made up the bulk of Kazakhstan's exports to China last year, according to United Nations COMTRADE data, with outbound shipments to the world's No.2 economy worth $3.8 billion and $1.5 billion, respectively. As such, Xi and Tokayev agreed to take measures to ensure the long-term, safe and stable operation of the crude oil pipeline running between their respective countries and the Kazakhstan section of the China-Central Asia natural gas pipeline running from China's Xinjiang region to Turkmenistan, the report said. The two leaders also pledged to strengthen cooperation in clean energy, including wind, solar and nuclear power, with Chinese companies stepping in to help upgrade Kazakhstan's energy grid and power stations. Chinese firms have invested $9.5 billion in Kazakhstan since Xi first proposed his flagship Belt and Road Initiative during a state visit in 2013, data from the American Enterprise Institute think tank shows, almost all of which has been in the state's petroleum or nuclear energy industries. Sign up here. https://www.reuters.com/world/china-supports-kazakhstan-joining-brics-president-xi-says-2024-07-03/

2024-07-03 12:38

SAO PAULO, July 3 (Reuters) - Industrial production in Brazil fell 0.9% in May from April (BRIO=ECI) New Tab, opens new tab, government statistics agency IBGE said on Wednesday, below the 1.7% decline estimated by analysts polled by Reuters. Still, Brazilian factories posted their second-consecutive month-on-month drop, down a cumulative 1.7% in the period. Production in May retreated 1.0% from a year earlier , also better than the 1.7% fall expected by analysts, but well below the 8.4% annual rise in April. According to IBGE survey manager Andre Macedo, Brazil's industrial output was impacted in May by historic rains and floods in the country's southernmost state of Rio Grande do Sul. Industrial production in Brazil now stands 1.4% below pre-pandemic levels. It is down 17.8% when compared to its May 2011 record high, according to IBGE. The largest factors dragging down output in May were from the automotive sector, which fell 11.7% from April, and food products, which were down 4.0%. Sign up here. https://www.reuters.com/markets/brazils-industrial-output-falls-less-than-expected-may-2024-07-03/