2024-07-03 07:44

FTSE 100 up 0.5%, FTSE 250 adds 0.4% Copper miners lead gains JD Sports falls after Barclays downgrades to underweight UK election in focus July 3 (Reuters) - London stocks rebounded on Wednesday, led by a rise in metal miners and renewed hopes of U.S. interest rate cuts, but caution on the eve of UK parliamentary elections capped further gains. The blue-chip FTSE 100 (.FTSE) New Tab, opens new tab was up 0.5% after it closed at a more than two-month low on Tuesday, while the mid-cap FTSE 250 (.FTMC) New Tab, opens new tab added 0.4%, as of 0716 GMT. U.S. Federal Reserve Chair Jerome Powell on Tuesday said that the country was on a "disinflationary path" but policymakers need more data before cutting interest rates. His comments bolstered hopes that the central bank will cut rates sooner rather than later. Industrial (.FTNMX551020) New Tab, opens new tab metal miners led gains on the benchmark with a 1.8% rise as copper prices ticked higher. Most sectoral indexes traded higher, with the exception of investment banking and brokerage stocks (.FTNMX302020) New Tab, opens new tab that fell 0.5%. Investors, however, exercised caution ahead of UK parliamentary elections, due on Thursday, where Conservatives look set to be replaced after 14 years of power, as per opinion polls. Keir Starmer and Rishi Sunak kicked off the last day of campaigning before the polls, each warning voters of dire economic consequences if the other man wins. On the radar now are non-farm payrolls data in the U.S., due on Friday, which will provide more clues on the Fed's monetary policy path. Among individual stocks, JD Sports (JD.L) New Tab, opens new tab sank to the bottom of the FTSE 100 with a 3.7% decline after Barclays downgraded the retailer to "underweight" from "equal-weight". British tile retailer Topps Tiles (TPT.L) New Tab, opens new tab dropped 4.2% after it said that challenging market conditions had persisted into the second half of the fiscal year amid weakness in the home repair and sales segments. Sign up here. https://www.reuters.com/world/uk/london-stocks-rebound-gains-metal-miners-ahead-elections-2024-07-03/

2024-07-03 07:11

July 3 (Reuters) - Oil prices steadied on Wednesday after trading higher as industry data showed a bigger-than-expected draw in U.S. crude stockpiles, with gains capped by economic headwinds from China and the euro zone. Brent crude futures inched up 15 cents, or 0.17%, to $86.39 per barrel at 1210 GMT. U.S. West Texas Intermediate (WTI) crude futures gained 11 cents or 0.13% to $82.92 per barrel. On Tuesday, both benchmarks rose to their highest since the end of April but closed down on the day as fears faded that Hurricane Beryl would disrupt production in the Gulf of Mexico. U.S. crude oil inventories fell by 9.163 million barrels in the week ended June 28, according to market sources citing American Petroleum Institute figures on Tuesday. However, gasoline inventories rose by 2.468 million barrels, and distillates fell by 740,000 barrels. "This decline in crude levels might just have saved more of a sell off after the hurricane news", PVM Oil analyst John Evans said in a note. Analysts in a Reuters poll had expected a 700,000 barrel draw in crude inventories, a 1.3 million barrel drop in gasoline stocks, and a 1.2 million barrel fall in distillates stocks. The Energy Information Administration, is due to release its weekly data on Wednesday at 1430 GMT. Traders will also be focusing on U.S. gasoline demand, which is expected to ramp up as the summer travel season picks up with the Independence Day holiday this week. The American Automobile Association has forecast that travel during the holiday period will be 5.2% higher than in 2023. Elsewhere, surveys showed that China's services activity expanded at the slowest pace in eight months and confidence hit a four-year low in June dragged by slower growth in new orders, while overall business growth across the euro zone also slowed sharply last month. OPEC output also rose in June for a second consecutive month, a Reuters survey found on Tuesday, as higher supply from Nigeria and Iran offset the impact of voluntary supply cuts by other members and the wider OPEC+ alliance. "OPEC+ was reported to have increased production in June despite pledges to keep quotas in check through third quarter, and lingering concerns over a tepid recovery in China sent a bearish signal," said Panmure Gordon analyst Ashley Kelty. Sign up here. https://www.reuters.com/markets/commodities/oil-prices-inch-up-large-us-crude-stock-draw-2024-07-03/

2024-07-03 07:03

SINGAPORE, July 3 (Reuters) - The Civil Aviation Authority of China (CAAC) launched the country's first technical centre for sustainable aviation fuel (SAF) that focuses on standard setting and product research, a report published in the aviation regulator's news channel showed late on Tuesday. The new centre, based in the southwestern city of Chengdu, will take the lead in mapping out industry policy and setting up standards for products and quality control, according to two SAF industry executives with direct knowledge of the launch. China, the world's second-largest aviation market which consumes about 11% of the jet fuel used globally, is expected to unveil this year its policy on the use of SAF for 2030 that could spur billions of dollars of investment, Reuters reported in May. Despite a few test flights,China does not produce SAF commercially for domestic use. Biofuel firms are pouring more than $1 billion into building China's first plants to turn waste cooking oil into aviation fuel for export and meet domestic demand once Beijing mandates the fuel's use on airplanes to cut emissions. CAAC also aims to establish a Chinese certification system for sustainable fuel. The centre is setting up test facilities for new products, according to the report on the regulator's news site, which added that China's total aviation fuel consumption is likely to exceed 50 million metric tons per year by 2030 and the use of SAF could reach 2.5 million tons per year. SAF can be made from sustainably sourced renewable waste and residues such as used cooking oil and animal fat waste, or processed from renewable power-based hydrogen. Sign up here. https://www.reuters.com/business/energy/china-regulator-launches-countrys-first-green-jet-aviation-fuel-centre-2024-07-03/

2024-07-03 06:58

Euro hits record high vs yen Euro hits three-week high vs dollar U.S. private sector jobs rise less than expected in June U.S. weekly jobless claims increase in latest week U.S. ISM services sector reading falls in June NEW YORK, July 3 (Reuters) - The yen sank to a 38-year low against the U.S. dollar and a record trough versus the euro on Wednesday, as the Japanese unit continued its downward spiral, with market participants on high alert for Japanese intervention to boost the currency. The dollar, on the other hand, fell after a slew of softer-than-expected U.S. economic data that bolstered expectations that the Federal Reserve will likely start cutting interest rates later this year. It declined after data showed that U.S. private payrolls rose slightly less than expected in June and initial jobless claims increased, both consistent with a slowing labor market. A report indicating that the U.S. services sector contracted last month and factory orders fell also weighed on the dollar. With the greenback on the defensive, the euro remained resilient, helped by a stubbornly high inflation reading on Tuesday that suggested the European Central Bank would take its time before cutting interest rates again. Sterling, meanwhile, gained before Thursday's UK election. Ahead of the July 4th holiday in the United States, the yen remained the main focus as it fell to 161.96 per dollar for the first time since December 1986. The dollar was last up 0.1% at 161.64, after earlier falling to a session low below 161 following weak U.S. data. The yen also hit an all-time low of 174.48 against the euro . The euro was last up 0.4% at 174.22 yen. "The BOJ (Bank of Japan) might actually have to wait until the Fed cuts interest rates and adopt a sort of 'benign neglect' policy," said Helen Given, FX trader, at Monex USA in Washington. "U.S. yields are simply still too high for an intervention to take hold - it's going to take a catalyst on the U.S. dollar side to bring them lower and that could come from the Fed." Japanese authorities have been largely quiet on the yen this week, with Finance Minister Shunichi Suzuki only commenting on Tuesday that moves were being watched vigilantly. He refrained from repeating the often used warning that the ministry stood ready to act. WEAK DATA SLAMS US DOLLAR Wednesday's data overall depicted a U.S. economy that is slowing down, undermining the dollar. Initial applications for U.S. unemployment benefits increased last week, while the number of people still on jobless rolls rose further to a 2-1/2 year high toward the end of June. First-time jobless claims rose to a seasonally adjusted 238,000 for the week ended June 29. The number of people receiving benefits after an initial week of aid increased to a seasonally adjusted 1.858 million in the week of June 22, the highest since late November 2021. Separately on Wednesday, the ADP Employment report showed private payrolls grew by 150,000 jobs in June after rising 157,000 May. Economists polled by Reuters had forecast private employment increasing by 160,000. "The economic data surprises in the U.S. are now undershooting expectations relative to other major economies, which has generally coincided with periods of dollar weakness," wrote Jonas Goltermann, deputy chief markets economist, at Capital Economics in a note after Wednesday's data. "Taken together, we think the next major move in the greenback will be lower. We forecast the (dollar index) to end this year around 106, near its current level, before falling to 98 by the end of 2025." The dollar index , which measures the currency against six major counterparts, slid 0.2% to 105.41. It dropped to a three-week low earlier in the session. The euro rose to a three-week high against the dollar, and was last up 0.3% at $1.0781. Further pressuring the dollar was a weak U.S. services report from the Institute for Supply Management. The data showed a reading of 48.8, a four-year low, from 53.8 in May. It was the second time this year that the PMI had dropped below 50, which indicates contraction in the services sector. U.S. factory orders also eased 0.5% in May, below expectations for an increase. Following the barrage of U.S. data, U.S. rate futures have priced in a 74% chance of a rate cut in September, up from 69% late on Tuesday, according to LSEG calculations. The market has also priced two rate cuts in 2024. Fed officials at their last meeting acknowledged the U.S. economy appeared to be slowing and that "price pressures were diminishing." They still advocated for a wait-and-see approach before committing to interest rate cuts, according to minutes of the two-day gathering held on June 11-12. The focus now shifts to Friday's nonfarm payrolls report, which is expected to show an increase of 190,000 jobs in June after rising 272,000 in May, according to a Reuters poll of economists. The unemployment rate is forecast to be unchanged at 4.0%. Sign up here. https://www.reuters.com/markets/currencies/dollar-defensive-amid-lower-yields-yen-hovers-near-38-year-trough-2024-07-03/

2024-07-03 06:16

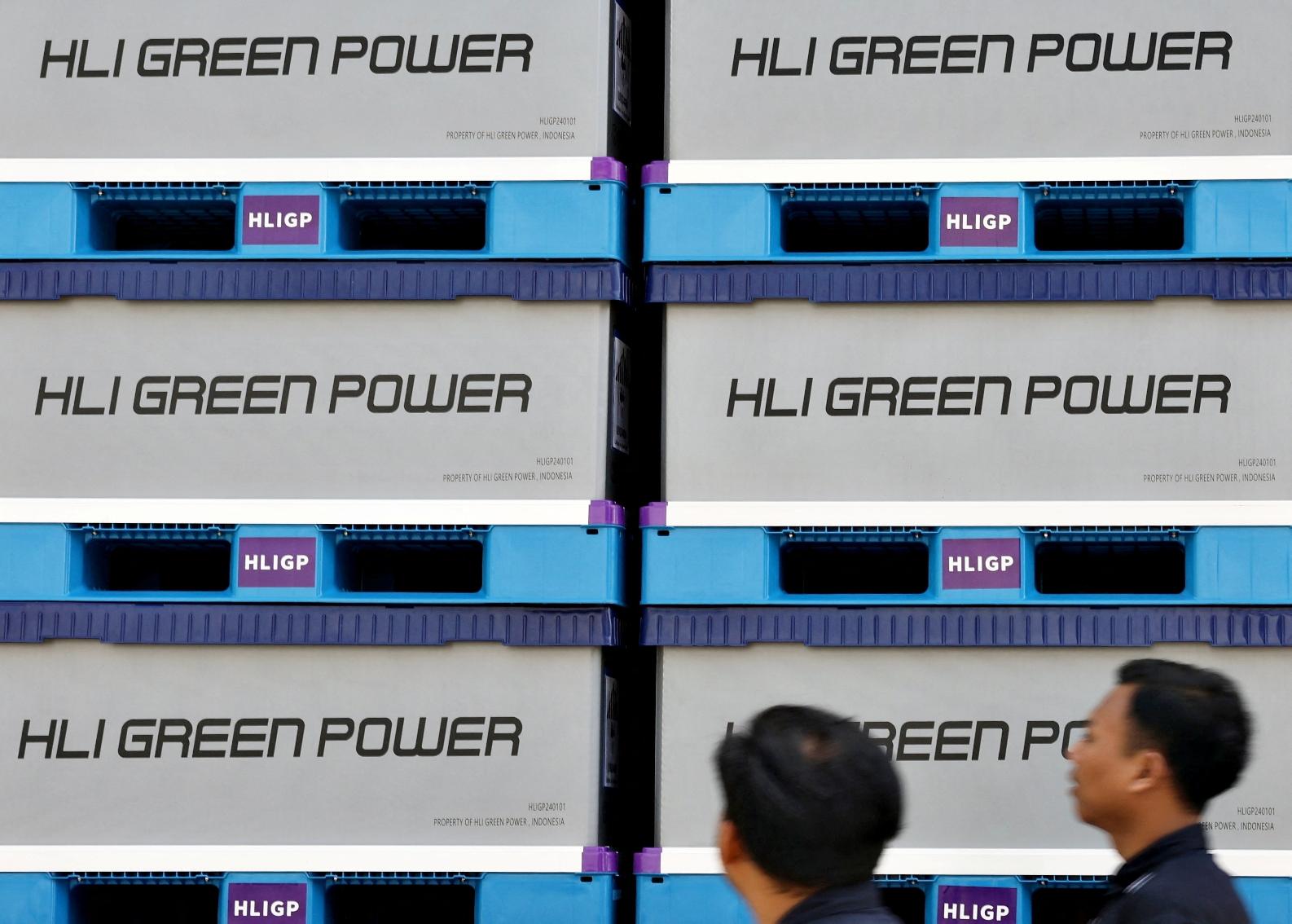

JAKARTA, July 3 (Reuters) - South Korea's Hyundai Motor Group and LG Energy Solution (LGES) on Wednesday inaugurated Indonesia's first battery cell production plant for electric vehicles with an annual capacity of 10 Gigawatt hours (GWh) of battery cells. The plant is part of a commitment by Hyundai Motor and LGES to invest up to $9.8 billion New Tab, opens new tab in Southeast Asia's largest economy to develop an EV supply chain, the Indonesian government said, to benefit from rich resources of nickel and copper. "Mineral resources of this nation, such as iron and nickel are important components in batteries that will mobilise millions of EVs globally," Hyundai Motor Group Executive Chair Euisun Chung, said at the factory's opening ceremony. The plant is integrated with Hyundai's auto factory where the company is set to start producing 50,000 units per year of Kona Electric, an SUV that would use Indonesian-made batteries. Hyundai and LGES are also preparing to start developing the second phase of the battery plant, which involves an investment of $2 billion to add 20 GWh capacity to the plant. The companies announced in 2021 that they were investing $1.1 billion in the battery cell plant in West Java province. It has enough annual capacity to produce batteries that can power more than 150,000 battery-based electric vehicles. President Joko "Jokowi" Widodo said the plant would cement Indonesia's key position in the EV global supply chain as it establishes a domestic processing industry. "This is the first and largest EV battery cell plant in Southeast Asia, and I am sure we will be able to win this competition with other countries because the nickel, bauxite and copper are here," Jokowi said at the same event. Indonesia, the world's top producer of nickel, banned exports of raw nickel in 2020 to encourage investment into domestic processing of the metal. Indonesia's Investment Minister Bahlil Lahadalia and South Korea's Minister for Trade Cheong Inkyo also met on Wednesday to discuss cooperation in electric vehicles, petrochemicals and the clean energy technologies such as carbon dioxide capture and storage, South Korea's trade ministry said in a statement. Sign up here. https://www.reuters.com/business/autos-transportation/hyundai-motor-lg-energy-solution-launch-indonesias-first-ev-battery-plant-2024-07-03/

2024-07-03 06:13

TOKYO, July 3 (Reuters) - Nippon Steel's (5401.T) New Tab, opens new tab vice chairman plans to return to the United States next week again to discuss its proposed acquisition of U.S. Steel (X.N) New Tab, opens new tab, a company spokesperson said on Wednesday. The planned visit by Takahiro Mori, the Japanese firm's key negotiator for the deal, follows trips to the U.S. in May and June, highlighting the importance of the $15 billion takeover offer to the world's No. 4 steelmaker. U.S. Steel's management has backed the bid but the deal faces resistance from the White House and the powerful United Steelworkers (USW) union. Nippon Steel declined to provide further details of Mori's next visit. According to a source familiar with his travel plans who declined to be identified, Mori will travel to several states where U.S. Steel has operations and meet with local officials, community leaders and workers. On his last trip, Mori met with U.S. Steel employees and community leaders to gain a better understanding of their views and saw a positive reaction, the company said. Sign up here. https://www.reuters.com/markets/commodities/nippon-steels-mori-visit-us-again-next-week-talks-us-steel-takeover-2024-07-03/