2024-07-03 03:44

SEOUL, July 3 (Reuters) - South Korea's government on Wednesday vowed to support small businesses and the construction sector struggling due to high interest rates in the second half of 2024, as it revised up its forecast for this year's economic growth. "Small businesses are still in difficult conditions. Amid persistently high interest rates, their interest burden has increased, while wage and rent costs are also rising," President Yoon Suk Yeol said in a speech ahead of the government's bi-annual economic policy announcement. The government has prepared a total of 25 trillion won ($18 billion) worth of support measures, Yoon said. In its biannual economic policy agenda, the finance ministry forecast the economy would grow 2.6% in 2024, up from 2.2% seen in January. In 2023, the economy expanded by a three-year low of 1.4%. Economic growth will be led by exports, particularly of semiconductors, amid rising demand related to artificial intelligence, the ministry said. For 2025, it projected economic growth at 2.2%. For small businesses and the self-employed, the government will provide policy loans with extended repayment periods and lower interest rates, while seeking policy measures to lower fixed costs, such as rents and utility fees, the ministry said. The government will expand financial support for small businesses by 1 trillion won ($721.8 million) in the second half to help them pay utility costs, interests and wages, it added. On inflation, the ministry kept its forecast for this year unchanged at 2.6% and said it expected consumer prices to rise more slowly, by 2.1%, in 2025. It had not previously provided a forecast for 2025. South Korea's central bank extended its policy pause for an 11th straight meeting in May, keeping rates at a 15-year high, as it reiterated its warning on inflationary risks. Asia's fourth-largest economy grew in the first quarter at the fastest pace in two years, thanks to strong exports, but there are worries that the recovery might be uneven as high interest rates squeeze domestic demand. To revive the sluggish construction sector, the ministry said it would expand public-sector investments, infrastructure projects and policy financing in the second half by 15 trillion won more than previously planned. It would, at the same time, continue efforts to manage liquidity risks related to real estate project financing so that they did not spill over onto broader financial markets. The ministry also said it would prepare tax benefits to supplement the government's ongoing corporate reform push aimed at boosting the domestic stock market - the "Corporate Value-up Programme". It would offer tax exemptions on corporate income for increases in capital returns to shareholders, introduce separate taxes on shareholders' dividend income at lower rates than other financial income, and make changes to inheritance taxes so they were less burdensome on family-run companies. ($1 = 1,388.9400 won) Sign up here. https://www.reuters.com/markets/asia/south-korea-president-yoon-says-headline-inflation-is-stabilising-2024-07-03/

2024-07-03 00:29

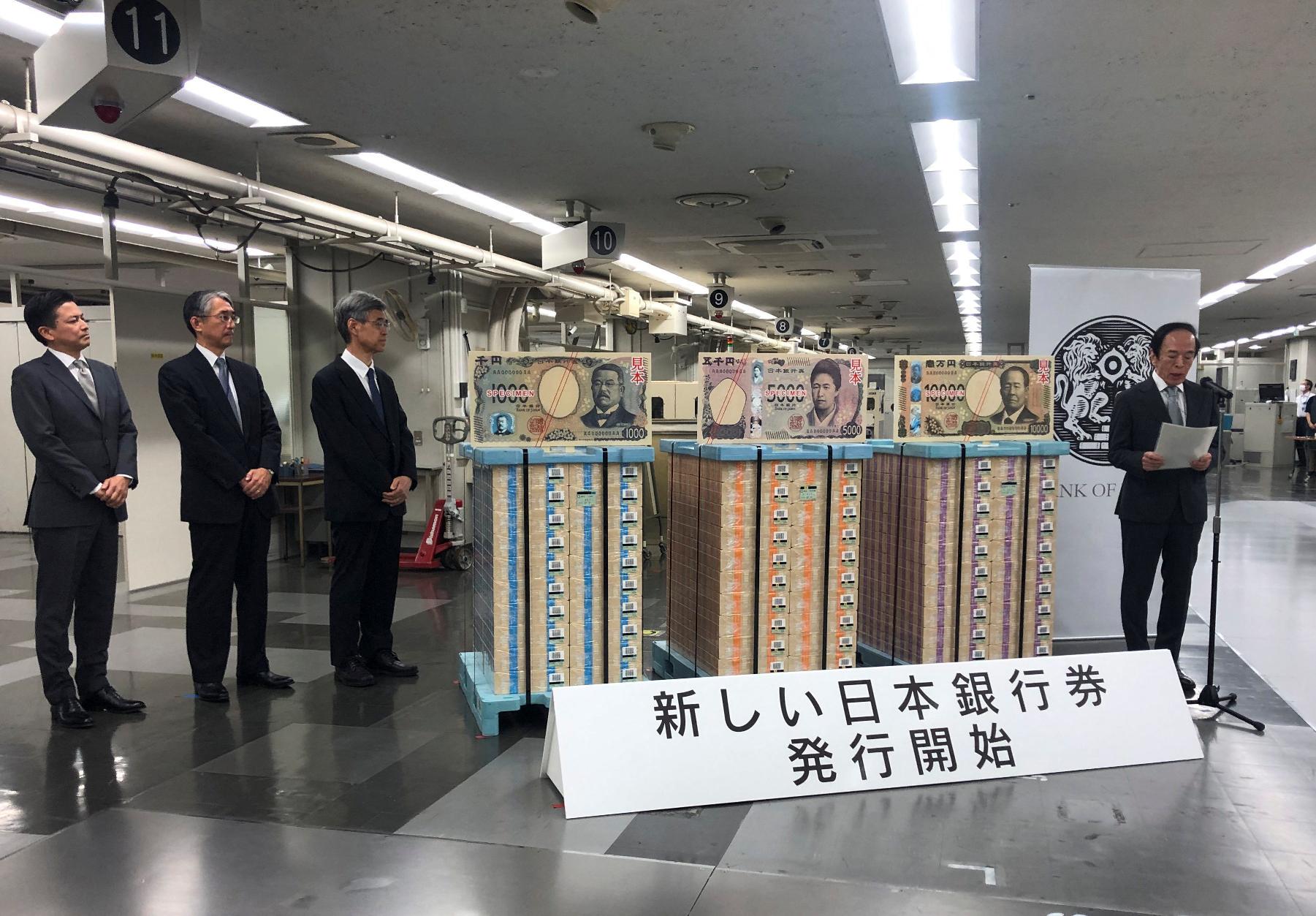

TOKYO, July 3 (Reuters) - Japan began circulating its first new banknotes in 20 years on Wednesday, featuring three-dimensional portraits of the founders of financial and female education institutions in an attempt to frustrate counterfeiters. The notes use printed patterns to generate holograms of the portraits facing different directions, depending on the angle of view, employing a technology that Japan's National Printing Bureau says is the world's first for paper money. "Faces of those representing Japan's capitalism, women's empowerment and technology innovation are on the new bills," Prime Minister Fumio Kishida said at a function. The step comes just as the economy moves into a growth-driven phase for the first time in three decades, he added. Key companies are raising workers' wages at the fastest rate in 33 years, but lingering inflation, fed by the rapid weakening of the yen currency, keeps consumption and the mood of business sluggish, recent economic data show. Existing bills will stay in use, but train stations, parking lots and ramen shops are scrambling to upgrade payment machines as the government pushes consumers and businesses to use less cash in its bid to digitise the economy. The new 10,000-yen ($62) note depicts Eiichi Shibusawa (1840-1931), the founder of the first bank and stock exchange, who is often called "the father of Japanese capitalism". The new 5,000-yen bill portrays educator Umeko Tsuda (1864-1929), who founded one of the first women's universities in Japan, while the 1,000-yen bill features a pioneering medical scientist, Shibasaburo Kitasato (1853-1931). While Kishida talked up the latest technology to fight counterfeiting, it is not a major problem in Japan. The 681 fake banknotes police detected in 2023 represented a sharp drop from a record high of 25,858 in 2004. Authorities plan to print about 7.5 billion newly-designed bills by the end of the current fiscal year, swelling the 18.5 billion banknotes, worth 125 trillion yen, in circulation by December 2023. "Cash is a secure means of payment that can be used by anyone, anywhere, and at any time, and it will continue to play a significant role" despite alternatives, said central bank governor Kazuo Ueda. The Bank of Japan has experimented with digital currencies, but the government has made no decision whether to issue a digital yen. 'NO SALES IMPACT' The first renewal of paper money since 2004 spurred businesses to upgrade payment machines for cash-loving customers. Cashless payments in Japan have almost tripled over the past decade to account for 39% of consumer spending in 2023, but still lag global peers and should rise to 80% to boost productivity, the government says. Nearly 90% of bank ATMs, train ticket machines and retail cash registers are ready for the new bills, but only half of restaurant and parking ticket machines, the Japan Vending Machine Manufacturers Association said. Almost 80% of the nation's 2.2 million drink vending machines also need upgrades, it added. "It might take until year-end to respond to this," said Takemori Kawanami, an executive at ticket machine company Elcom. "That's too slow, but we are short of components," he added, as client orders for upgrades exceeded expectations. Many Japanese fast-food restaurants such as ramen shops and beef bowl stores use ticket machines to cut labour costs, but some small business owners battling inflation are unhappy at the extra investment needed. "The machine replacement has no sales impact, so it's only negative for us, on top of rising costs of labour and ingredients," said Shintaro Sekiguchi, who spent about 600,000 yen for ticket machines at three ramen shops he runs in Tokyo. ($1=161.6500 yen) Sign up here. https://www.reuters.com/markets/currencies/japans-first-new-banknotes-20-years-use-holograms-defeat-counterfeits-2024-07-03/

2024-07-03 00:14

July 2 (Reuters) - LATAM Airlines (LTM.SN) New Tab, opens new tab said on Tuesday it intends to proceed with the process of re-listing American Depositary Receipts (ADRs) in tandem with the first secondary sale under the so-called registration rights agreement, which certain shareholders requested. The Santiago-based carrier started the process of re-listing ADRs on the new York Stock Exchange in April and said back then that the process could take up to six months. In a filing to Chile's stock exchange, the company said it intends to re-list ADRs at the same time as the secondary sale will take place, but pointed out that it is uncertain when those events will take place. About the secondary sale, LATAM Airlines said in the statement that it will occur exclusively in the United States and other jurisdictions outside of Chile, and it will be done through the emission of new ADRs. Sign up here. https://www.reuters.com/business/aerospace-defense/latam-airlines-proceed-with-re-listing-adrs-secondary-sale-2024-07-03/

2024-07-02 23:02

Tesla soars after Q2 delivery data Paramount Global gains on possible IAC bid Fed Chair Powell says risks becoming more balanced US job openings rise in May Indexes up; Dow 0.41%, S&P 0.62%, Nasdaq 0.84% July 2 (Reuters) - Wall Street's main stock indexes closed higher on Tuesday, boosted by gains in Tesla (TSLA.O) New Tab, opens new tab and megacap growth stocks, but volumes were thin ahead of the July Fourth holiday and the closely watched release of June nonfarm payrolls on Friday. The U.S. job openings and labor turnover survey, or JOLTS, showed job openings increased in May after posting outsized declines in the prior two months, but layoffs picked up amid slowing economic activity. The data is the first in this week's series of U.S. job reports, particularly Friday's release of June nonfarm payrolls, which will be crucial in assessing whether the U.S. labor market remains resilient against the backdrop of decades-high interest rates. The Dow Jones Industrial Average (.DJI) New Tab, opens new tab rose 162.33 points, or 0.41%, to close at 39,331.85, the S&P 500 (.SPX) New Tab, opens new tab gained 33.92 points, or 0.62%, to 5,509.01 and the Nasdaq Composite (.IXIC) New Tab, opens new tab gained 149.46 points, or 0.84%, to 18,028.76. Tesla surged to its highest level since the start of January after the EV maker reported a smaller-than-expected 5% drop in vehicle deliveries in the second quarter. Megacap stocks such as Apple (AAPL.O) New Tab, opens new tab rose 1.6%, while Amazon.com (AMZN.O) New Tab, opens new tab and Alphabet (GOOGL.O) New Tab, opens new tab also climbed, with U.S. Treasury yields slipping across the board. U.S. Federal Reserve Chairman Jerome Powell told a panel that recent economic data represented "significant progress," though he noted that the Fed needed to see more before changing policy. "What the Fed really wants to see is a further click up in unemployment and then a slowdown with regards to new job creation," said Genter Capital Management CEO Dan Genter, who added that the recent moderation in inflation could be a green light for the Fed to start considering rate cuts. AI chip leader Nvidia (NVDA.O) New Tab, opens new tab dropped 1.3%, with the trend in other chip stocks largely mixed. Nvidia is up more than 147% year-to-date. Investors are divided over the sustainability of the market rally in which the S&P 500 index has risen 14.75% in the first half of the year. "We see an additional 10% before year end, which is kind of frightening because if we're at 5500 or so (on the S&P 500), 10% on that means we really have to see earnings justify that type of multiple," said John Lynch, chief investment officer of Comerica Wealth Management. Volume on U.S. exchanges was 9.89 billion shares, compared with the 11.8 billion average for the full session over the last 20 trading days. Trading volumes are expected to be light throughout the week, with the equity market closing early on Wednesday and shut all day Thursday for U.S. Independence Day. The U.S. listing of Novo Nordisk (NOVOb.CO) New Tab, opens new tab fell almost 1.7%, after U.S. President Joe Biden and Senator Bernie Sanders called on the Danish drugmaker to cut prices of its Ozempic and Wegovy drugs. Rival Eli Lilly (LLY.N) New Tab, opens new tab also dropped. Paramount Global (PARA.O) New Tab, opens new tab climbed 5.7% after news that billionaire Barry Diller's digital-media conglomerate IAC (IAC.O) New Tab, opens new tab was exploring a bid to take control of the media giant. Advancing issues outnumbered decliners by a 2.06-to-1 ratio on the NYSE. There were 179 new highs and 97 new lows on the NYSE. The S&P 500 posted 15 new 52-week highs and 4 new lows, while the Nasdaq Composite recorded 39 new highs and 196 new lows. Sign up here. https://www.reuters.com/markets/us/futures-drop-megacaps-retreat-ahead-key-jobs-data-2024-07-02/

2024-07-02 23:00

SANTIAGO, July 2 (Reuters) - Latin America and the Caribbean should brace for the arrival of La Nina, the climate pattern seen fueling a highly active hurricane season in the Atlantic and greater climate variability across the region, experts said on Tuesday. The World Meteorological Organization organized a webinar on La Nina's threat as Hurricane Beryl, the 2024 Atlantic season's first hurricane and the earliest storm on record to reach the Saffir-Simpson Scale's maximum Category 5 level, was tearing across the eastern Caribbean. La Nina, a climate pattern that begins with colder-than-normal ocean temperatures in the central and eastern equatorial Pacific, is linked to both floods and drought, as well as an increase in the frequency of hurricanes in the Caribbean. "Again, now, (we are in) a transition to the La Nina phenomenon," said Jose Luis Stella, of the Regional Climate Center for Southern South America, warning that La Nina threatens to bring "rapid variability" to an already extreme climate. The experts on Tuesday said that La Nina could cause a repeat of historic droughts in South America similar to those recorded between 2020 and 2023. "We just went through three years with a fairly prolonged La Nina event that brought ... historic droughts, with great impact and then a fairly rapid transition to El Nino," said Stella. In Latin America, both La Nina and El Nino, which involves a warming of the tropical Pacific Ocean's surface and can affect jet stream winds above the Pacific, have had costly impacts on regional economies by hurting crops like wheat, rice and corn. Both patterns tend to last between nine and 12 months, and usually occur every two to seven years, although they do not have a regular calendar. Sign up here. https://www.reuters.com/world/americas/la-nina-threatens-latin-america-with-hurricanes-droughts-experts-say-2024-07-02/

2024-07-02 22:10

July 2 (Reuters) - Oilfield services company SLB (SLB.N) New Tab, opens new tab said on Tuesday it has received a second request for additional information from the United States Department of Justice in connection with its $7.75 billion acquisition deal for smaller rival ChampionX (CHX.O) New Tab, opens new tab. ChampionX also received a second request, SLB said, adding that it now expects the deal to close in the fourth quarter or the first quarter of 2025, compared to its previous forecast of end of the year. Several oil and gas firm deals have been delayed by second requests from antitrust regulators for additional information as part of their review process for mergers, since the consolidation wave began in 2023. In April, Chesapeake Energy (CHK.O) New Tab, opens new tab and Southwestern Energy (SWN.N) New Tab, opens new tab said the closing date of their proposed $7.4 billion merger had been pushed back to the second half of the year from second quarter, after receiving a second request from the Federal Trade Commission. Sign up here. https://www.reuters.com/markets/deals/slb-championx-get-second-request-doj-proposed-8-bln-deal-details-2024-07-02/