2024-07-02 21:47

July 3 (Reuters) - A look at the day ahead in Asian markets. Third time lucky for Asian stocks? Having followed Monday's listless start to the quarter with a 0.5% decline on Tuesday, Asian stocks are poised to rebound on Wednesday thanks to a triple-boost from tech-fueled rise in U.S. and global stocks, falling Treasury yields New Tab, opens new tab and a weaker dollar. That's as positive a global backdrop as investors in Asian equities can expect, although it may be altered by the slew of service sector purchasing managers index reports from around the continent including economic powerhouses China and Japan. Cross-asset volatility should provide a helping hand too - the VIX index slipped to a five-week low on Tuesday and currency market vol eased across the board. Even overnight and one week dollar/yen vol fell, suggesting investors are not overly concerned about the prospect of Japanese intervention. Tuesday's market-friendly conditions were in large part laid by Federal Reserve Chair Jerome Powell's comments at the ECB's annual policy conference in Sintra, Portugal. While the Fed needs more data before cutting interest rates, the U.S. is back on a "disinflationary path," Powell said. Bond yields retraced some of Monday's steep rise, the dollar dipped, and stocks rose - a collective easing of financial conditions that is usually good for risk appetite and emerging market assets. The tech sector was a solid performer on Wall Street again, with Tesla shares up 9% to a fresh six-month high and bringing the gains so far this week up to 15%. Having significantly lagged most Big U.S. Tech this year, they are on track for their best week in 18 months. Investors cheered the fact that the automaker reported a smaller-than-expected 5% drop in vehicle deliveries in the quarter, and analysts said that sales in China were higher than expected too. Strength across the broader tech complex and especially in mega caps pushed the NYSE FANG index to another record high on Tuesday. Can this feelgood factor spread to Asia? It hasn't lately, and Asian tech has underperformed badly in recent weeks. The Hang Seng tech index fell again on Tuesday - its seventh decline in eight sessions - to its lowest since April 24. It has lost 15% since mid-May, in which time the S&P info tech index has risen 15%. Time for a bounce on Wednesday? On the economic front, the calendar on Wednesday will be dominated by service sector PMIs from China, Japan, Australia, Singapore and India. China's is the 'unofficial' Caixin PMI index, which shows that services activity expanded in May at its fastest pace since July last year and has been consistently growing since January 2023. Here are key developments that could provide more direction to markets on Wednesday: - China, Japan, India, Australia services PMIs (June) - Euro zone services PMI (June) - South Korea FX reserves (June) Sign up here. https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-07-02/

2024-07-02 21:03

July 2 (Reuters) - The U.S. Department of Energy said on Tuesday five companies including British oil giant BP (BP.L) New Tab, opens new tab and Swiss commodity trader Vitol have been awarded contracts for the sale of 1 million barrels of gasoline from the U.S.-managed stockpile in northeastern states. The sale will help in lowering prices ahead of the U.S. Independence Day holiday, as per the DoE. Five companies responded to invitation for bids announced in May and all of them were awarded the contracts. The remaining winning bidders were George E. Warren LLC, Freepoint Commodities and Irving Oil. CONTEXT The energy department had created the supply reserve for the Northeast in 2014 after Superstorm Sandy created a supply shortage for gasoline. But closing of the reserve was mandated by the bipartisan legislation signed by President Joe Biden, as storing refined fuel is costlier than storing crude oil. East Coast gasoline prices were up about 3 cents compared to last week at $3.39 per gallon after the week ended July 1, according to the Energy Information Administration data. BY THE NUMBERS The American Automobile Association expects a record 60.6 million people to travel by car during the Independence Day week this year, a 4.8% rise compared to 2023. The energy department said the barrels were sold at an average price of $2.34 per gallon to five companies, with BP getting 500,000 barrels, Vitol buying 200,000 barrels and Freepoint Commodities, Irving Oil and George E. Warren purchasing about 100,000 barrels each. WHY IT IS IMPORTANT Gasoline prices are likely to be under a microscope this year as the United States prepares for presidential elections in November, with both the Democrats and the Republicans trying to use the issue to their advantage. Democrats have claimed the reserve sale will ensure sufficient supplies, while Republicans say it is a political move. Meanwhile, analysts say the sale is unlikely to have any meaningful impact on gasoline prices. The United States consumes around 8 million to 9 million barrels of gasoline a day on average, making the million barrel reserve sale a drop in the ocean. Sign up here. https://www.reuters.com/markets/commodities/us-completes-sale-1-mln-barrels-gasoline-curb-prices-northeast-2024-07-02/

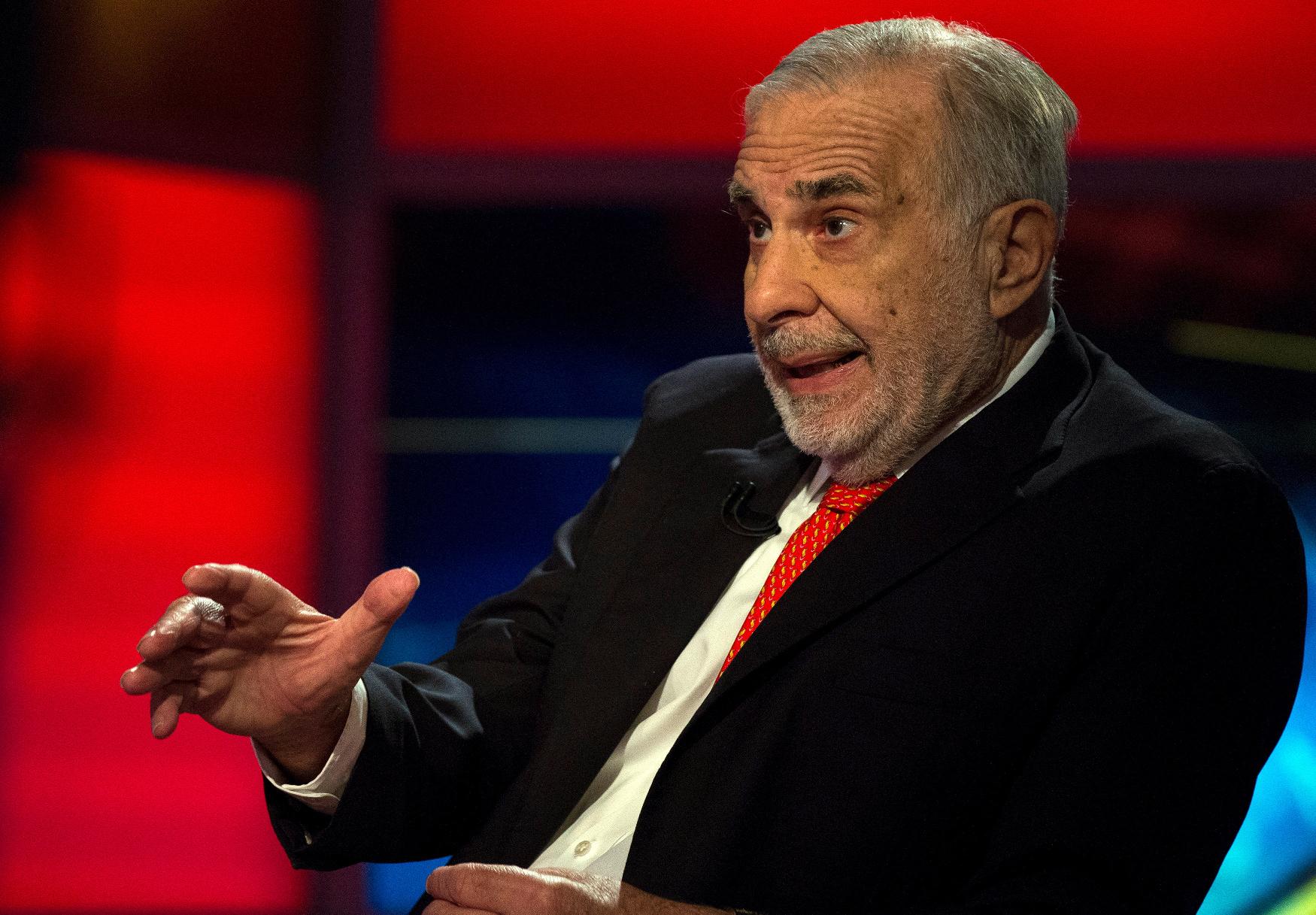

2024-07-02 21:02

HOUSTON, July 2 (Reuters) - Oil refiner CVR Energy (CVI.N) New Tab, opens new tab, controlled by billionaire investor Carl Icahn, has submitted a binding offer in an ongoing auction of shares in the parent of Venezuela-owned Citgo Petroleum, according to three people familiar with the matter. Icahn controls about 66% of shares in CVR, based in Sugar Land, Texas. CVR operates two U.S. refineries, the 115,000 barrel-per-day (bpd) Coffeyville in Kansas, and the 75,000-bpd Wynnewood in Oklahoma. A U.S. court in Delaware is auctioning the shares to pay creditors that have $21.3 billion in claims against Venezuela for defaults and expropriations. The court has so far accepted bids from CVR, trading house Vitol (VITOLV.UL) and others as part of the historic sale process of one of the parents of Citgo, the seventh largest U.S. oil refiner. CVR is working with investment bankers at Wells Fargo (WFC.N) New Tab, opens new tab to raise the financing for its bid, the people said. The company has the support of Icahn Enterprises in its offer, the people added. Icahn Enterprises, CVR's CEO, David Lamp, and Wells Fargo declined to comment. CVR's mid-continent oil refineries would make a solid geographic match to Citgo's refineries in Texas, Louisiana and Illinois, one of the people familiar with its bid said. "The bid advantage that CVR has is its synergies (to Citgo)," the person said. "Citgo is primarily a Gulf Coast refiner and CVI operates in the middle of the country." Hedge fund Elliott Investment Management was weighing another bid, while a group of creditors represented by Centerview Partners aimed to lure ConocoPhillips (COP.N) New Tab, opens new tab to join a separate offer, people close to the matter said in April. In recent weeks, financial allies began to build to support some of the bids, including firms JP Morgan (JITAX.O) New Tab, opens new tab, Morgan Stanley (MS.N) New Tab, opens new tab and Rotschild & Co. A representative of a court officer overseeing the auction said on Tuesday in a hearing that the second bidding round was "successful," with several competitive offers received. The bidders were not identified. The special master of the court is scheduled to inform the parties about the winning bid around July 31. U.S. District Judge Leonard Stark, who is leading the case, on Tuesday approved a motion to postpone the final hearing to Sep. 19. Sign up here. https://www.reuters.com/business/energy/icahn-owned-oil-refiner-cvr-bidding-citgo-share-auction-sources-say-2024-07-02/

2024-07-02 20:58

WASHINGTON, July 2 (Reuters) - The U.S. Interior Department on Tuesday approved the ninth commercial-scale offshore wind project, bringing the Biden administration closer to its goal of deploying 30 gigawatts of offshore wind capacity by 2030. KEY QUOTE "Today's milestone is yet another step toward our ambitious goal of deploying 30 gigawatts of offshore energy by 2030," said Interior Secretary Deb Haaland. WHY IT IS IMPORTANT The approval for the New Jersey project brings the U.S. over a third of the way to the 2030 goal - a key part of President Joe Biden's climate change agenda - amid setbacks to other offshore wind projects. Soaring materials costs, high interest rates and delays in supply chain last year led project developers including Orsted (ORSTED.CO) New Tab, opens new tab, Equinor (EQNR.OL) New Tab, opens new tab, BP (BP.L) New Tab, opens new tab, Avangrid (AGR.N) New Tab, opens new tab and Shell (SHEL.L) New Tab, opens new tab to cancel or seek to renegotiate power contracts for planned commercial-scale U.S. wind farms, with operating start dates between 2025 and 2028. CONTEXT In addition to economic hurdles, offshore wind has become a target of Republican presidential candidate Donald Trump, who pledged to halt offshore wind projects if he wins the November elections. Trump has repeatedly cited false claims being circulated by opposition groups that turbines kill whales and fish. THE DETAILS The Atlantic Shores South wind project is expected to generate up to 2,800 megawatts of electricity, enough to power close to one million homes, the Interior Department said. The project is approximately 8.7 miles offshore New Jersey. Sign up here. https://www.reuters.com/business/energy/us-inches-toward-2030-offshore-wind-target-with-ninth-approved-project-2024-07-02/

2024-07-02 20:34

Hurricane Beryl lashes Jamaica At least 10 dead across Caribbean St. Vincent and the Grenadines hard hit Union Island 'flattened,' says PM Mexico tourist hotspot on guard KINGSTON, July 4 (Reuters) - Hurricane Beryl steamed towards the Cayman Islands and Mexico on Thursday, after thrashing Jamaica with intense wind and rain, causing floods and power outages after forging a destructive path across smaller Caribbean islands over the past couple of days. The death toll from the powerful Category 4 hurricane climbed to at least 10 across the region, and is widely expected to rise further as communications return on islands damaged by flooding and deadly winds. As Beryl moved away from Jamaica early on Thursday, the island discontinued its hurricane warning but kept a flash flood watch, the Meteorological Service of Jamaica said on X. By late Wednesday, the storm's eye was about 100 miles (161 km) west of Kingston, according to the U.S. National Hurricane Center (NHC), as its core headed toward the Cayman Islands. Packing maximum sustained winds of 130 miles per hour (209 kph), Beryl was expected to dump 4-6 inches (10-15 cm) of rain on the Cayman Islands into Thursday, where a hurricane warning was in effect and life-threatening surf and rip currents were possible, NHC said. A hurricane warning was also in force for the eastern coast of Mexico's Yucatan peninsula. Around 0900 GMT, the Category 3 hurricane was just 55 miles from Grand Cayman and about 440 miles off Tulum Mexico, NHC said. JAMAICA Beryl's eyewall skirted Jamaica's southern coast, pummeling communities as emergency groups evacuated people from flood-prone areas. "It's terrible. Everything's gone. I'm in my house and scared," said Amoy Wellington, a 51-year-old cashier who lives in Top Hill, a rural farming community in southern St. Elizabeth parish. "It's a disaster." A woman died in Jamaica's Hanover parish after a tree fell on her home, Richard Thompson, acting director general at Jamaica's disaster agency said in an interview on local news. Nearly a thousand Jamaicans were in shelters by Wednesday evening, Thompson added. The island's main airports were closed and streets were mostly empty after Prime Minister Andrew Holness issued a curfew for Wednesday, which was extended Thursday as storm conditions continued. WARMING OCEAN The loss of life and damage wrought by Beryl underscores the consequences of a warmer Atlantic Ocean, which scientists cite as a sign of human-caused climate change fueling extreme weather. Ralph Gonsalves, prime minister of St. Vincent and the Grenadines, said in a radio interview that the country's Union Island was "flattened" by Beryl and that it would "be a Herculean effort to rebuild." Nerissa Gittens-McMillan, permanent secretary at St. Vincent and the Grenadines' agriculture ministry, warned on state media of possible food shortages after half the country's plantain and banana crops were lost, with significant losses also to root crops and vegetables. Power outages were widespread across Jamaica, while some roads near the coast were washed out. 'ARMAGEDDON-LIKE' Confirmed fatalities included at least three in St. Vincent and the Grenadines, a senior official told Reuters, where Union Island suffered destruction of more than 90% of buildings. In Grenada, Prime Minister Dickon Mitchell described "Armageddon-like" conditions with no power and widespread destruction, while also confirming three deaths. In Venezuela, President Nicolas Maduro told state television that three people had died and four were missing, with over 8,000 homes damaged. Beryl is the 2024 Atlantic season's first hurricane and the earliest storm on record. The U.S. National Oceanic and Atmospheric Administration (NOAA) has forecast a large number of major hurricanes in an "extraordinary" season this year. In tourist epicenter Cancun, workers filled bags with sand and boarded up doors and windows of businesses for protection and officials said supplies of wooden boards were dwindling. Laura Velazquez, head of Mexico's civil protection agency, encouraged tourists in Cancun and nearby Tulum to hunker down in hotel basements as the storm approached, in comments to local broadcaster Milenio. Sign up here. https://www.reuters.com/world/americas/hurricane-beryl-churns-towards-jamaica-bringing-floods-least-two-reported-killed-2024-07-02/

2024-07-02 20:11

TORONTO, July 2 (Reuters) - Shares of Canadian miner First Quantum Minerals (FM.TO) New Tab, opens new tab closed 5% higher on the Toronto Stock Exchange on Tuesday after Panama said it would conduct an environmental audit of the company's Cobre Panama mine to decide whether it can safely reopen. Panama's government ordered the closure of the Cobre Panama mine, one of the newest and biggest copper mines in the world, in December after protests calling for more environmental protections erupted across the country and a court ruling deemed the contract to run the mine unconstitutional. President Jose Raul Mulino, who took office on Monday, made the announcement of an environmental audit in his first address as the head of the government. "I will order a strict environmental audit of the mine, with the best international experts, so that the country knows the truth about the state of the site...," he said on Monday. He added that Panama will choose an auditing company and that will not generate any costs for the government. "The plan to open and definitively close the mine in a safe and positive manner for our country will depend on the results of that environment study," Mulino said. Trade and Industry Minister Julio Molto told Reuters that Panama's government is going to "review and analyze all the information available to make an informed and responsible decision." First Quantum did not want to comment on the President's speech. Last week, Reuters reported that First Quantum was planning to launch a formal arbitration proceeding against Panama this month. Sign up here. https://www.reuters.com/markets/commodities/first-quantum-minerals-jumps-6-panama-plans-mine-environmental-audit-2024-07-02/