2024-07-02 11:25

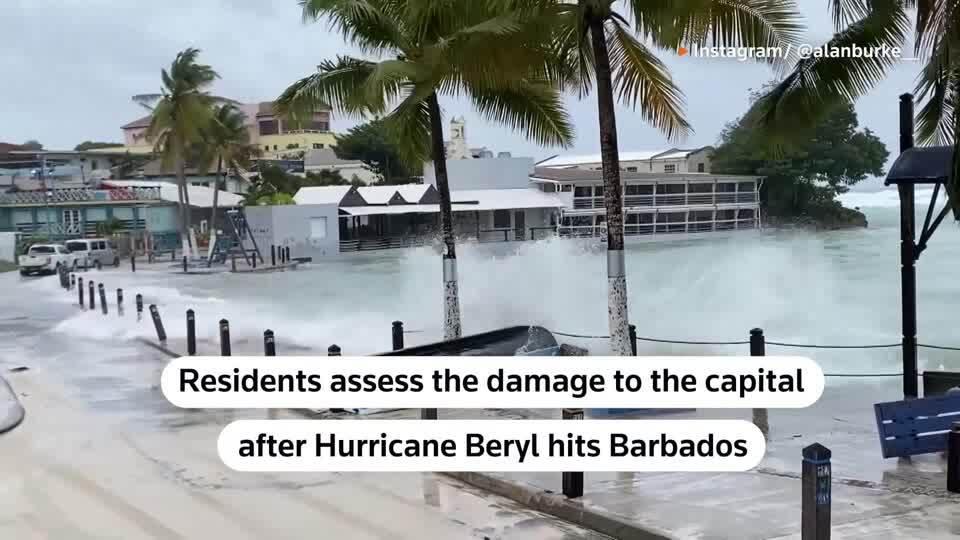

GENEVA, July 2 (Reuters) - Hurricane Beryl, which has strengthened to a Category 5 storm, is setting the tone for a "very dangerous" hurricane season, the World Meteorological Organization said on Tuesday. Beryl swept through Grenada and St Vincent and the Grenadines, leaving many households without power, and is expected to hit Jamaica on Wednesday and the Cayman Islands later in the week. "It's the earliest Category 5 hurricane on record in the Atlantic, Caribbean and Central American basin," WMO spokesperson Clare Nullis told reporters in Geneva. "It sets a precedent for what we fear is going to be a very, very, very active, very dangerous hurricane season, which will impact the entire basin." A Category 5 hurricane under the five-step Saffir-Simpson Hurricane Wind Scale brings winds of 252 kilometers an hour (157 miles per hour) or higher, capable of causing catastrophic damage including the destruction of homes and infrastructure. "We need to bear in mind that it only takes one land-falling hurricane to set back decades of development," Nullis said. "We fear what is happening with Hurricane Beryl, which has hit very, very small islands in the Caribbean that are not used to this size of hurricane." Anne-Claire Fontaine, scientific officer for the WMO Tropical Cyclone Programme, said one reason for Beryl developing so early in the season was linked to warmer ocean temperatures. "The Main Development Region (MDR), the place in the ocean where the hurricanes are developing... is the warmest ever." Sign up here. https://www.reuters.com/world/americas/beryl-sets-precedent-very-dangerous-hurricane-season-world-met-agency-says-2024-07-02/

2024-07-02 11:09

MADRID, July 2 (Reuters) - Spanish oil and gas company Cepsa has reached an agreement with PreZero Spain, part of the environmental division of German supermarket group Lidl's owner Schwarz Group, to develop biomethane plants using organic waste. Owned by Abu Dhabi fund Mubadala and the Carlyle Group (CG.O) New Tab, opens new tab, Cepsa is investing up to 8 billion euros ($8.6 billion) through 2030 to shift its business toward low-carbon fuels, such as green hydrogen and biofuels. The companies said on Tuesday they will together develop plants to produce biomethane from organic waste. The first such plant will have a capacity of up to 100 GWh and will feed Cepsa's planned green hydrogen and biofuels facilities around Huelva, in southern Spain. Under the deal, PreZero will also supply biomethane to Cepsa, and, among other initiatives, the companies will team up to recover organic waste to produce biofuels. "This alliance with PreZero will allow us to expand access to circular raw materials to produce alternative energies that will facilitate the energy transition, such as green hydrogen and second-generation biofuels," Carlos Barrasa, executive vice president of commercial & clean energies at Cepsa, said. Biofuels are seen as essential in decarbonising transportation, such as aviation, which is hard to electrify. Second-generation biofuels are made from non-food organic materials such as wood and agriculture waste, as opposed to the first-generation ones made from sugar-starch or oilseed crops. ($1 = 0.9333 euros) Sign up here. https://www.reuters.com/business/energy/spains-cepsa-signs-biofuels-agreement-with-lidls-owner-2024-07-02/

2024-07-02 10:55

STOCKHOLM, July 2 (Reuters) - The European Commission on Tuesday approved a 3 billion euro ($3.21 billion) Swedish scheme to support carbon capture and storage aimed at helping the country meet its goal of zero net emissions by 2045. The scheme will support projects that permanently capture and store CO2 emissions from biomass plants that use recycled wood, and other waste to produce fuel, electricity and heat. The aid will be awarded through a competitive bidding process, with the first auction expected this year, the Commission said in a statement. Under 15-year long contracts, companies will receive grants for projects with the capacity to capture and store at least 50,000 tonnes of biogenic CO2 per year. ($1 = 0.9335 euros) Sign up here. https://www.reuters.com/sustainability/european-commission-approves-swedish-carbon-capture-aid-plan-2024-07-02/

2024-07-02 08:39

LONDON, July 2 (Reuters) - The pound neared its lowest in almost two months against a robust dollar on Tuesday, as the U.S. currency got a lift from a pop higher in Treasury yields, while the euro extended its modest rally over the last week. Investors in U.S. assets are contemplating the prospects of a second Donald Trump presidency, after President Joe Biden's faltering debate performance last week and Monday's Supreme Court ruling that the former president has broad immunity from prosecution over attempts to overturn his 2020 election loss, said Chris Weston, head of research at Pepperstone. With the dollar broadly in the ascendant, sterling traded around 0.25% down on the day at $1.2618, skimming last week's low at $1.2616, its weakest since May 15. Against the euro meanwhile, the pound held steady at 84.935 pence , but is hovering around its lowest since early June. European Central Bank President Christine Lagarde on Monday said the central bank was in no rush to cut interest rates, which gave the euro a boost against the pound the day before, but did little to lift the single European currency on Tuesday. "Funnily enough, the biggest casualty of Lagarde's comments and the French election has been the pound, whose decline in value against the euro has sent the overall pound index to its lowest level for five weeks," Caxton strategist David Stritch said. A first round of voting in French elections at the weekend resulted in the far-right National Rally (RN) taking the largest share of the vote, but less than many had initially anticipated, which has supported the euro. Markets are currently pricing in the prospect of at least one more ECB rate cut this year, but the chance of a second have faded slightly. Meanwhile, Britain heads to the polls on Thursday. The opposition Labour party is widely expected to win, ending 14 years of Conservative government. The UK's tight finances mean any new government will have little room to up spending, potentially removing a catalyst of sterling weakness and keeping volatility contained . Sign up here. https://www.reuters.com/markets/currencies/sterling-dented-by-one-two-punch-dollar-euro-2024-07-02/

2024-07-02 08:05

TOKYO, July 2 (Reuters) - The Bank of Japan (BOJ) could hike interest rates twice by the end of March 2025 to reach 0.5%, reflecting the real growth rate of the Japanese economy, the head of Mizuho Financial Group's (8411.T) New Tab, opens new tab banking arm said. But rapid rate hikes won't be a tool to arrest the weakening yen, which has plunged to a 38-year low against the dollar, Masahiko Kato, chief executive officer of Mizuho Bank, said in an interview with Reuters. "If (the BOJ) raises rates too strongly, the economic growth that has finally set in will deteriorate," Kato said. "I don't have the impression they'll raise interest rates too hastily." The central bank ended negative interest rates after eight years in March, and economists are split over whether another rate increase will come at the next monetary policy later this month. While inflation translates to higher costs for companies who have to hike wages, this in turn spurs them to adopt new growth strategies such as mergers and acquisitions (M&A), carve-outs, and expansion abroad to boost earnings, Kato said. Mizuho Bank has identified mid-cap listed companies as a new customer base for its financing and advisory services, as Japan's acute labour shortage means many such firms lack the specialist knowhow to pursue growth, for instance, through M&A. The fact that so many companies struggle to raise their corporate value after listing lies behind activist investors' growing involvement in Japanese firms, as well as the Tokyo Stock Exchange's campaign to boost corporate value, Kato said. Mizuho established a seven-person mid-cap growth support team last year, which in April became a standalone department of 70 people. "Until now it was permissible for companies to have little concept of raising their corporate value," Kato said. "But with the Tokyo Stock Exchange's reforms and now the economy has started moving again, all of a sudden the conditions are in place." Sign up here. https://www.reuters.com/markets/asia/japan-interest-rates-could-rise-05-by-march-2025-says-mizuho-bank-ceo-2024-07-02/

2024-07-02 08:02

LONDON, July 2 (Reuters) - Shell (SHEL.L) New Tab, opens new tab will pause construction work at one of Europe's largest biofuel plants due to weak market conditions, the latest low-carbon project to suffer a setback as CEO Wael Sawan strives to boost returns. While it is rare for companies to suspend development of projects underway, rival BP (BP.L) New Tab, opens new tab also said last week it was pausing two biofuel projects in Germany and the U.S. Under Sawan, who took office in January 2023, Shell has scrapped and sold renewable and hydrogen projects, retreated from European and Chinese power markets and sold refineries in order to focus on the most profitable operations, primarily in oil and gas. Shell shares were up 1.3% at 1106 GMT, and have gained more than 12.5% so far this year. The company gave the green light for the development of the 820,000-ton-a-year plant in the Netherlands in September 2021, with plans to bring it online in 2025. The project is now expected to start production towards the end of the decade. The facility at Shell's chemicals park in Rotterdam was slated to produce sustainable aviation fuel and renewable diesel made from waste. Biofuel prices have come under pressure in recent months due to weaker demand in Europe, including after Sweden cut a biofuel mandate, and rising supplies in the U.S. The market is expected to remain well supplied in the coming years as more production comes on line, analysts said. Shell said in a statement that following the decision to pause construction, "contractor numbers will reduce on site and activity will slow down, helping to control costs and optimise project sequencing". UBS analyst Joshua Stone said the pause was consistent with Shell's strategy to focus on returns. "The delays further highlight that the advanced biofuels market is not an easy one. The oil majors have dipped their toes and found it challenging," Stone said. Shell will also consider an impairment for the project and will provide further details in its quarterly trading update on Friday, it said. "Temporarily pausing on-site construction now will allow us to assess the most commercial way forward for the project," Shell's downstream head Huibert Vigeveno said in a statement. "We are committed to our target of achieving net-zero emissions by 2050, with low-carbon fuels as a key part of Shell's strategy," he added. Sign up here. https://www.reuters.com/business/energy/shell-pause-construction-dutch-biofuels-facility-2024-07-02/