2024-07-02 07:21

TOKYO, July 2 (Reuters) - A fire broke out at Idemitsu Kosan's (5019.T) New Tab, opens new tab Chiba refinery early Tuesday afternoon, a company spokesperson said, adding that no further details were available for now. Idemitsu Kosan, Japan's second-biggest oil refiner, operates a 190,000-barrel-per-day crude distillation unit (CDU) at the Chiba refinery near Tokyo. It was not immediately known if the unit continued to operate, the spokesperson said. The fire broke out at about 0230 p.m. JST (0530 GMT) and fire department crews are on site, the spokesperson said. The fire was at a lubricating oil production facility, public broadcaster NHK reported, showing video footage of fumes in the site. One person is believed to be injured, NHK said, adding that the fire department received an initial report from a staff member at the refinery that cited incidents of hazardous materials on fire and oil leakage. Sign up here. https://www.reuters.com/business/energy/fire-breaks-out-idemitsus-chiba-refinery-spokesperson-says-2024-07-02/

2024-07-02 06:56

ATHENS, July 2 (Reuters) - Greek firefighters battled a blaze on the islands of Kos for a second day on Tuesday, as hundreds of tourists and locals who had been forced to evacuate overnight returned to their hotels and homes. As the wildfire reached the seaside village of Kardamaina overnight, people took refuge in a sports centre and other venues, Christos Efstratiou, deputy governor for the Dodecanese islands, told Reuters. The wildfire had abated by Tuesday morning, letting people return, and there was no damage to buildings, Efstratiou said. Video footage showed tourists waiting in the morning to board buses that would take them back to hotels and rented homes. Wildfires are common in the eastern Mediterranean country. But hotter, drier and windier weather that scientists link to the effects of climate change has increased their frequency and intensity. More than 100 firefighters, assisted by a helicopter, were still tackling the blaze on Kos, to stop it flaring up again, the fire brigade said. On the nearby island of Chios, more than 170 firefighters assisted by 36 engines and 10 aircraft were trying to tame another fire that broke out on Monday afternoon. "The situation appears improved on both fronts," a fire brigade official said, referring to both blazes. Emergency crews assisted by water-carrying planes also fought a wildfire on the island of Crete on Tuesday. Prime Minister Kyriakos Mitsotakis warned this week of a dangerous summer of wildfires following a prolonged drought and unusually high gusts of wind for the season. Last year, forest fires killed 20 people in the north of the country and forced 19,000 people to flee the island of Rhodes. Since then the country has been increasingly using drones to locate the blazes early. It now plans to increase its unmanned aircraft to 35 systems and beef up the number of trained drone operators to 139 from 104. Sign up here. https://www.reuters.com/world/europe/greece-battles-wildfire-kos-island-second-day-2024-07-02/

2024-07-02 06:53

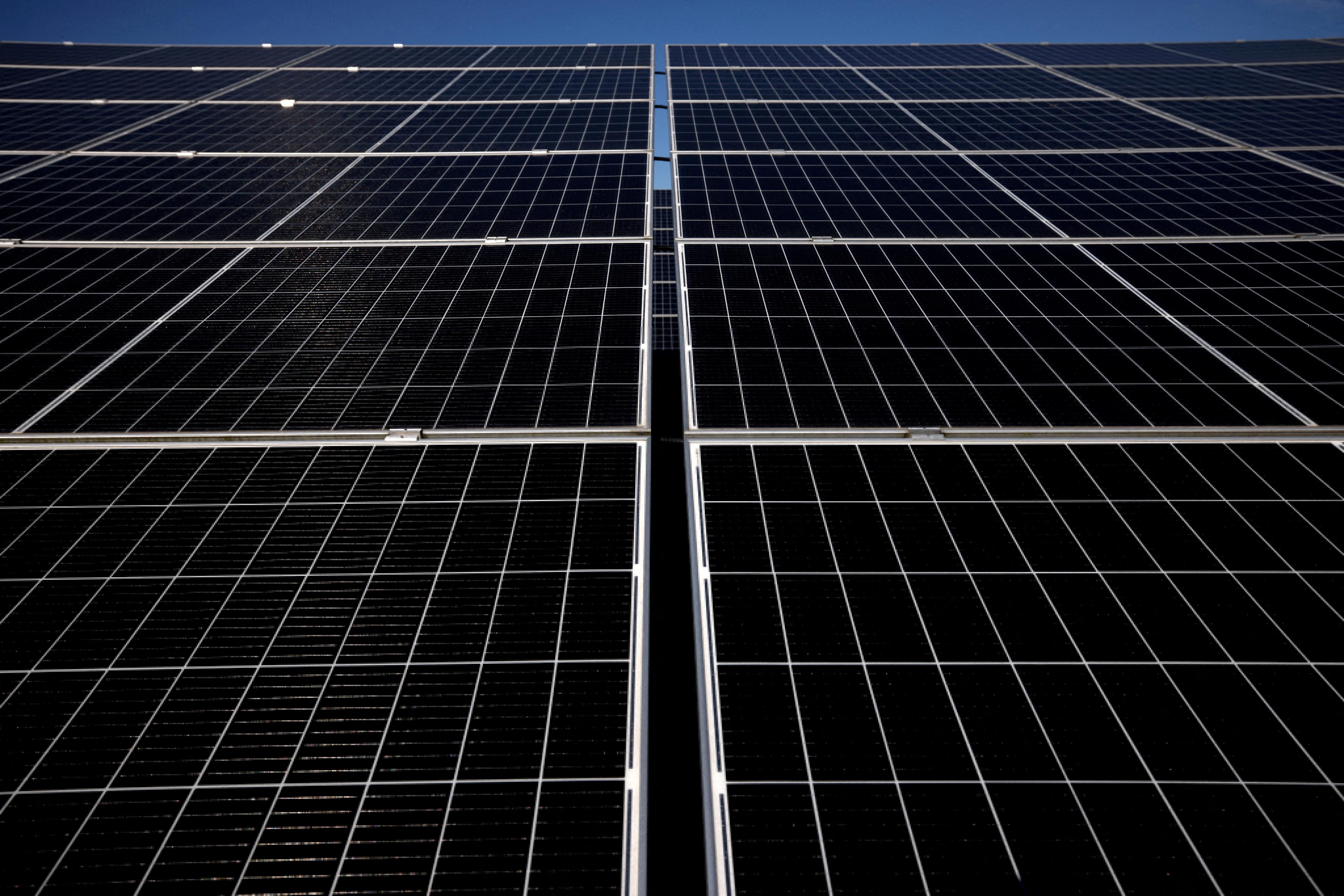

Industrial, commercial solar installations up 81% in early 2024 Energy savings and future price stability are key incentives Large rooftop solar subsidies tender bids up 107% y/y BERLIN, July 2 (Reuters) - For months, Philip Matthias tried to convince his father to install solar panels on their company's roof in the eastern German state of Thuringia, aiming to cut electricity costs and carbon emissions at the metal products factory. Initially sceptical of the 2.3-million-euro ($2.5 million) investment, a substantial sum for the medium-sized Tridelta, his father crunched the numbers and decided to nearly double the project capacity, opting to install photovoltaic modules that could power around 900 households in addition to the factory. "The PV systems amortize after about 7-1/2 years. The manufacturer gives a guarantee of 20 years. That means this is an extremely lucrative investment," Matthias told Reuters. Since the war in Ukraine and the sudden drop in Russia fossil fuel exports to Germany, Berlin has introduced laws to accelerate solar power expansion, part of its plan to cover 80% of the country's energy from renewables by 2030. Encouraged by a feed-in tariff providing a guaranteed price to renewable energy producers selling their power, as well as reduced solar panel costs, German companies are increasingly turning to solar to get around high energy costs. Although Germany has Europe's biggest capacity of solar and wind power generation, its small and medium-sized companies have yet to benefit from lower electricity prices because of high grid fees and taxes they must pay. By generating their own solar power, they avoid those fees and taxes. Companies consumed around 69% of Germany's national electricity in 2023, data by the BDEW utilities association showed. "As electricity prices in Germany show no signs of decreasing as previously anticipated, companies are increasingly recognising the economic viability of installing solar panels," said Marie-Theres Husken, an energy expert for the BVMW association for small- and medium-sized businesses. CORPORATE SOLAR SHIFT Newly installed photovoltaic capacity on business rooftops rose by 81% year-on-year in the first four months of the year, outpacing the 1% growth in the residential sector, data by the BSW solar power association shows. A May survey by pollster YouGov showed more than half of German companies with suitable roofs planned to install solar power systems in the next three years. BVMW forecasts that nearly all manufacturing companies in Germany will use solar energy by 2030. In response to increasing demand, Germany's largest residential solar power developer, Enpal, said in April it was expanding into the commercial sector. "The demand was not as instant... but the growth is going to be very sustainable," Melchior Schulze Brock, CEO of commercial and industrial solar startup Enviria. An April study by the Freiburg-based Institute for Applied Ecology showed there was potential to install up to 287 gigawatts (GW) of solar capacity, more than enough to meet Berlin's 2030 target of 215 GW, along German roads, railways, parking lots, and industrial areas. This could significantly reduce reliance on agricultural land where permitting and planning approvals can take up to a decade. A drop in solar panel prices globally since last year has spurred companies to embrace solar energy. "The market is overrun with cheap but good panels from China. That means that the system that we are building now is about 20% cheaper than a year ago," Matthias said. A German legislative package passed in April easing regulation and increasing subsidies for large rooftop systems as well as a pending tax investment reform for real estate funds operating rooftop solar panels, is expected to drive demand further. State feed-in subsidies for large scale rooftop photovoltaic projects, introduced in 2021 and which are selected via tender, have also boosted the trend. The last tender for the subsidised projects in February saw a 107% rise in the number of offers year-on-year, data by the federal grid network agency showed. A feed-in tariff of 9.3 euros cents per kilowatt-hour, higher than Tridelta's power purchasing price, makes it currently cheaper for the company to sell future generated electricity to the grid and buy it back, Matthias said. Germany's economy ministry declined to comment on companies' electricity trading strategies. "There's a high correlation between the feed-in tariffs and the build-up of solar PV roof top projects," Hugo Willink, Executive Director at solar roofs developer Sunrock told Reuters. Sunrock, which won an order from Mercedes Benz in May to build a 23-megawatt solar project on the carmaker's factory roofs, sees Germany as its core market for the coming year. ($1 = 0.9334 euros) Sign up here. https://www.reuters.com/business/energy/german-industry-turns-solar-race-cut-energy-costs-2024-07-02/

2024-07-02 06:51

JOHANNESBURG, July 2 (Reuters) - The South African rand extended losses early on Tuesday on concerns over future challenges for the government of national unity (GNU) and after trading turbulently on Monday following the announcement of President Cyril Ramaphosa's cabinet. At 0641 GMT, the rand traded at 18.44 against the dollar , almost 0.5% weaker than its previous close. The dollar was up around 0.09% against a basket of global currencies. "The rand is trading weaker... this morning on what seems to be a 'buy the rumour, sell the fact' move," Andre Cilliers, currency strategist at TreasuryONE, said. "The GNU remains a fragile agreement and investors are concerned over the many obstacles that need to be overcome going forward," Cilliers added. Ramaphosa's African National Congress (ANC) lost its parliamentary majority for the first time in 30 years in the May 29 election and has formed a unity government with former rivals as a way to stay in power. South African assets gave up some gains on Monday as the initial optimism shown by the markets waned a day after the new cabinet was formed. It included former opposition leader John Steenhuisen as agriculture minister. The U.S. Federal Reserve's Jerome Powell will speak later on Tuesday and markets will listen for hints on the future interest rate path of the world's biggest economy. The risk-sensitive rand often takes cues from global drivers like U.S. monetary policy in addition to local factors. South Africa's benchmark 2030 government bond was weaker in early deals, with the yield up 5 basis points to 10.005%. Sign up here. https://www.reuters.com/markets/south-african-rand-extends-losses-concerns-over-unity-government-obstacles-2024-07-02/

2024-07-02 06:49

July 2 (Reuters) - Siemens Energy (ENR1n.DE) New Tab, opens new tab plans to recruit more than 10,000 employees as it invests 1.2 billion euros ($1.29 billion) in its electricity grid business over the next six years amid a surge in demand for power, a company executive said on Tuesday. "In the next 15 years, we will see global investments in the grid as large as those made in the last 150 years," said Tim Holt, head of Grid Technologies. "We want to participate in this boom," he said. The Grid Technologies division has earmarked the 1.2 billion euros for new factories and higher manufacturing capacity in the United States, Europe and Asia, according to the Financial Times, which had reported on the recruitment plans earlier in the day. About 40% of the new jobs will be added in Europe, while the U.S. and India will each receive 20% and the rest will go elsewhere in Asia and Latin America, according to the FT report. A spokesperson for Siemens Energy told Reuters the jobs in Europe would be created in Germany, the UK, Austria, Croatia and, to a lesser extent, Romania. There could be some hold-ups in getting backing for expansion and refurbishment plans from capital markets hesitant to fund energy transition investments, the FT report said, quoting Holt. "The market is getting tighter and tighter and we are going to have to look at alternative ways to fund it," he told FT. Siemens Energy, which was spun off in 2020, has seen its shares fluctuate massively as it grapples with issues at its loss-making wind turbine business Siemens Gamesa, which in May unveiled sweeping changes as it strives for profitability. ($1 = 0.9318 euros) Sign up here. https://www.reuters.com/business/energy/siemens-energy-plans-10000-hires-electricity-grid-unit-ft-says-2024-07-02/

2024-07-02 06:42

Latest forecasts show Beryl tracking south of offshore platforms WTI traded up $1 on Tuesday morning on storm worries AAA says gasoline demand to rise for Independence Day holiday HOUSTON, July 2 (Reuters) - Crude oil prices fell on Tuesday as fears faded that Hurricane Beryl would disrupt supplies as the storm will avoid most oil fields as it barrels toward Jamaica. Brent crude futures settled down 36 cents, or 0.42%, at $86.24 a barrel. U.S. West Texas Intermediate crude settled at $82.81 a barrel, down 57 cents or 0.68%. Earlier on Tuesday, WTI rose $1 to $84.38 on fears Beryl might have a wider impact in offshore oil production areas in the U.S.-regulated northern Gulf of Mexico as U.S. demand for motor fuels is increasing. Both benchmarks gained about 2% in the previous session. But as new forecasts emerged on Monday, traders were less fearful of supply problems, said Phil Flynn, analyst with the Price Futures Group. "Markets came to the realization that Beryl is not going to shut down any major amounts of offshore oil production," Flynn said. "We may see some shut, but it's going to have a minimal impact on platforms." Hurricane Beryl is a dangerous Category 4 hurricane tearing through the Caribbean Sea. It is expected to have weakened into a tropical storm by the time it enters the Gulf of Mexico late this week, according to the U.S. National Hurricane Center. "We dodged a bullet on Beryl," said John Kilduff, partner with Again Capital LLC. "But, there definitely is an understanding that any storm that develops in the Gulf is going to be a big one." Sources said on Tuesday after that American Petroleum Institute figures for last week showed U.S. crude oil and distillates inventories fell while gasoline rose. The API figures showed crude stocks were down by 9.163 million barrels in the week ended June 28, the sources said, speaking on condition of anonymity. Gasoline inventories rose by 2.468 million barrels, and distillates fell by 740,000 barrels. Sign up here. https://www.reuters.com/business/energy/oil-holds-near-two-month-high-higher-demand-outlook-possible-rate-cut-2024-07-02/