2024-06-30 22:14

BRUSSELS, July 1 (Reuters) - Three-quarters of the European Union's electricity has been generated by CO2 emissions-free sources so far this year, making it the bloc's greenest power mix to date, industry data showed on Monday. Emissions-free sources produced 74% of EU electricity in January-June, of which 50% was from renewable sources like wind and solar, and 24% from nuclear, industry association Eurelectric said. "The electricity generation of Europe has never had such a low-carbon profile before," Eurelectric Secretary General Kristian Ruby told Reuters. Coal produced 9% of EU electricity and gas 13% - the lowest shares for each fossil fuel for the same period in any year to date. The main driver of Europe's changing energy mix is the rapid installation of renewable energy capacity. The EU built 56 gigawatts of new solar power capacity in 2023 - the highest in any year to date - and 16GW of new wind capacity. However, Europe's electricity demand has also decreased, making it easier for green sources to cover a bigger share of the overall mix. EU power demand was 5.8% lower in the first half of this year than in the same period in 2021. European energy prices surged to record highs in 2022 after Russia slashed gas supplies to Europe. The resulting energy crisis forced industries and consumers to use less energy to curb their bills - with some industries yet to recover production to pre-crisis levels, depressing their energy consumption. More renewable energy will help Europe meet its climate targets and reduce reliance on imported fossil fuels. But there are signs countries' ageing power grids are struggling to cope with the changing energy mix. Belgian power grid operator Elia (ELI.BR) New Tab, opens new tab warned last month that a recent jump in Belgium's solar power capacity will cause periods of surplus cheap energy this summer, making it harder to balance the grid. Ruby urged policymakers to invest in upgrading power grids to cope with bigger shares of renewable capacity, including by adding storage capacity to absorb cheap excess power so it doesn't go to waste. "We need a physical build-out of the grid with quite a bit of urgency," he said. Sign up here. https://www.reuters.com/sustainability/climate-energy/eus-power-mix-2024-greenest-yet-industry-data-show-2024-06-30/

2024-06-30 21:49

July 1 (Reuters) - A look at the day ahead in Asian markets. Asian market trading on Monday kicks off the new week, quarter and second half of the year with investors' focus locked on a data-heavy economic calendar, especially the latest snapshot of Chinese factory activity. The Caixin manufacturing purchasing managers index report for June will go a long way to showing whether the recovery in the world's second largest economy is gathering momentum, struggling, or going into reverse. China bulls will be hoping it's the former. Some indicators in the first half of the year pointed in that direction, but the overall picture was pretty bleak - growth is patchy, deflation risks persist, stocks and the exchange rate are under heavy pressure, and more stimulus is needed. A Reuters poll of economists expect the 'unofficial' manufacturing PMI index to fall back to 51.2 from 51.7 in May. That would show continued expansion in activity - anything above 50.0 indicates growth - but at a slower pace. The 'official' manufacturing PMI from China's National Bureau of Statistics on Sunday came in at 49.5, unchanged from May and marking the second month in a row that manufacturing activity has declined. The wider picture is perhaps even bleaker - the services PMI sank to 50.2, a five-month low, and the construction PMI slipped to 52.3, the weakest reading since July last year. Both indicate growth, but it is clearly slowing. Manufacturing PMIs from several other countries across Asia will be released on Monday, including Japan, India, South Korea and Australia. If there are financial market ripples from the first round of voting in the French election, they may be felt first in Asia on Monday. The far-right eurosceptic National Rally party won the first round, exit polls showed, but the final result will depend on days of horsetrading before next week's run-off. The broader macro and market backdrop to the start of the week is reasonably strong. World stocks hit a record high last week and ended the quarter up 2.4%, the sixth quarterly rise from the last seven. Asian stocks jumped 5.5% in Q2. Inflation figures from the U.S. on Friday were in line with fairly benign expectations, enough to keep the 'soft landing' narrative on track and maintain the prospect of two quarter-point rate cuts from the Fed this year. Could the first of these come before the November presidential election? But there are signs that the bullish momentum is losing steam, especially in Big Tech, and across markets pockets of uncertainty and volatility are appearing. In currencies, this is playing out most obviously in the Japanese yen, which slumped to a 38-year low against the dollar last week. Here are key developments that could provide more direction to markets on Monday: - Manufacturing PMIs from across Asia, including China (June) - Indonesia inflation (June) - Australia retail sales (May) Sign up here. https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-06-30/

2024-06-30 20:40

LONDON, July 1 (Reuters) - The euro touched a two-week high during Asian hours on Monday, after the first round of France's shock snap election put the far-right in pole position, but offered little clarity on the final outcome, leaving investors bracing for further volatility. Marine Le Pen's National Rally (RN) party emerged ahead in the first round, confirming expectations, although analysts noted her party won a smaller share of the vote than some polls had initially projected. But uncertainty prevailed, as the final result will depend on how parties decide to join forces in each of the country's 577 constituencies for the second round, with horse-trading already under way ahead of next Sunday's runoff. One poll showed the RN potentially winning an absolute majority. The euro , which has weakened 0.8% since President Emmanuel Macron called the election on June 9, rose to a more-than-two-week top of $1.076175, according to LSEG data. It was last up 0.4% at $1.075425. "I think it's a slight 'well, there were no surprises', so there was a sense of relief there," said Fiona Cincotta, senior markets analyst at City Index. "Le Pen had a slightly smaller margin than some of the polls had pointed to, which may have helped the euro a little bit higher on the open." The shock vote has rattled markets, as the far-right, as well as the leftwing alliance that came second on Sunday, have pledged big spending increases. Investors have been alarmed, given France's already high budget deficit that has prompted the EU to recommend disciplinary steps. Last week, the premium that bondholders demand to hold France's debt over Germany's surged to its highest since 2012, during the euro zone debt crisis. Shares in three heavyweight lenders - Societe Generale (SOGN.PA) New Tab, opens new tab, BNP Paribas (BNPP.PA) New Tab, opens new tab and Credit Agricole (CAGR.PA) New Tab, opens new tab - have dropped between 9% and 14%, leading losses of nearly 7% in the Paris CAC 40 stock index (.FCHI) New Tab, opens new tab. Analysts expect little meaningful recovery in France's bonds. European stocks were set for a much higher open, with Eurostoxx 50 futures jumping 1.18%, while French OAT bond futures rose 0.22% during Asian hours. "We struggle to see a material and sustainable snap back," said Peter Goves, head of developed market debt sovereign research at MFS Investment Management. Markets had calmed after the initial turmoil that followed the election announcement, as the RN party toned down some of its more radical plans and said it would respect EU's fiscal rules that require France to cut its deficit, but they took another hit on Friday. "Markets are especially worried about the fiscal implications of a potential far-right victory on France's budget deficit and debt dynamics," said Vasu Menon, managing director of investment strategy at OCBC in Singapore. NO RESPITE Markets were expected to stay volatile, given the high uncertainty over next week's final results. Much depends on political dealmaking. Candidates through to the run-off have until Tuesday evening to decide whether to stand down or run. The leftwing alliance would withdraw candidates who finish third on Sunday from the runoff, said Jean-Luc Melenchon, leader of the France Unbowed party. French bonds could recover if alliances to block the RN from taking power start to look credible, said Kathleen Brooks research director at trading platform XTB. Fuelling uncertainty, Sunday's high turnout suggests France is heading for a record number of three-way run offs - expected to benefit the RN much more than two-way contests. "Markets are looking into another week of really high uncertainty. Probably fear, as it is still possible for RN to gain an absolute majority next week," said Carsten Brzeski, global head of macro at ING. Sign up here. https://www.reuters.com/markets/currencies/euro-gains-after-france-far-right-win-first-round-vote-2024-06-30/

2024-06-30 20:39

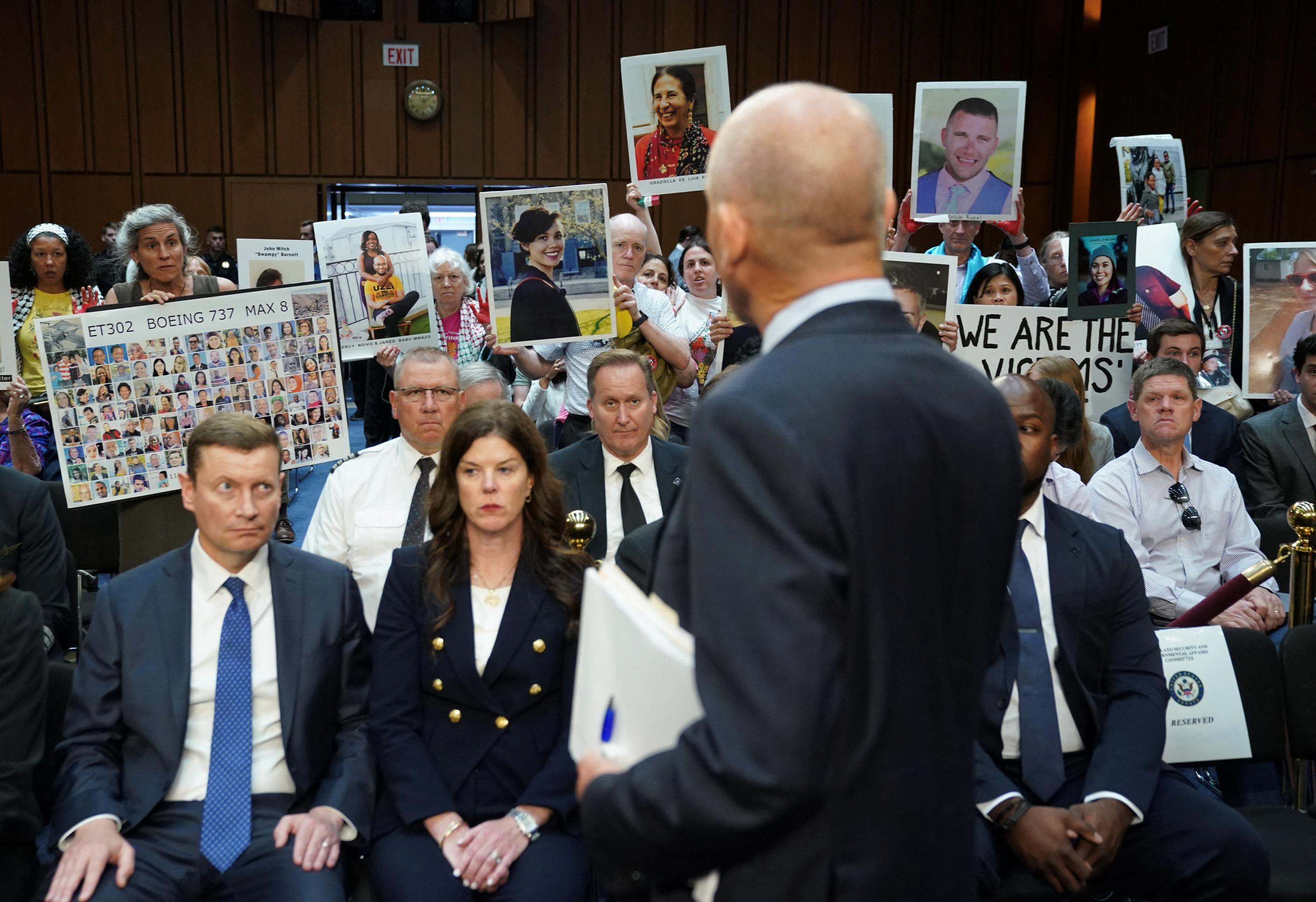

DOJ's proposed plea deal includes $487.2 million penalty, half credited from previous settlement Boeing may face three years of probation and independent safety audits Victims' families informed of DOJ's decision before Boeing June 30 (Reuters) - The U.S. Justice Department will criminally charge Boeing (BA.N) New Tab, opens new tab with fraud over two fatal crashes and ask the planemaker to plead guilty or face a trial, two people familiar with the matter said on Sunday. The Justice Department planned to formally offer a plea agreement to Boeing later in the day, which includes a financial penalty and imposition of an independent monitor to audit the company's safety and compliance practices for three years, the sources said. Justice Department officials plan to give Boeing until the end of the week to respond to the offer, which they will present as nonnegotiable, the sources said. Should Boeing refuse to plead guilty, prosecutors plan to take the company to trial, they said. Boeing and the Justice Department declined to comment. Reuters was first to report the Justice Department's decision to prosecute Boeing and seek a guilty plea. The Justice Department decided to charge Boeing after finding it violated a 2021 agreement that had shielded it from prosecution over the fatal crashes involving 737 MAX jets. The deadly crashes took place in 2018 and 2019, killing 346 people. The decision to move toward criminally charging Boeing deepens an ongoing crisis engulfing the planemaker, exposing the company to additional financial ramifications and tougher government oversight. A guilty plea could also carry implications for Boeing's ability to enter into government contracts such as those with the U.S. military that make up a significant portion of its revenue. Companies with felony convictions can receive waivers, and it remained unclear to what extent the Justice Department's proposed plea deal addresses the issue. Justice Department officials revealed their decision to victims' family members during a call earlier on Sunday. The proposal would require Boeing to plead guilty to conspiring to defraud the U.S. Federal Aviation Administration in connection with the fatal crashes, the sources said. The Justice Department's push for Boeing to plead guilty follows a separate January in-flight blowout that exposed continuing safety and quality issues at the planemaker. A panel blew off a new Boeing 737 MAX 9 jet during a Jan. 5 Alaska Airlines (ALK.N) New Tab, opens new tab flight, just two days before a 2021 deferred prosecution agreement with the Justice Department expired. That agreement had shielded Boeing from prosecution over the 2018 and 2019 fatal crashes. Boeing has previously said it "honored the terms” of the settlement and formally told prosecutors it disagrees with the finding that it violated the agreement. The proposed agreement also includes a $487.2 million financial penalty, only half of which Boeing would be required to pay, they added. That is because prosecutors are giving the company credit for a payment it made as part of the previous settlement related to the fatal crashes of the Lion Air and Ethiopian Airlines flights. The penalty is the maximum legally allowed for the charge. Boeing could also likely be forced to pay restitution under the proposal's terms, the amount of which will be at a judge's discretion, the sources said. The offer also contemplates subjecting Boeing to three years of probation, they said. The plea deal would also require Boeing's board to meet with victims' relatives, they said. Victims' relatives expressed anger toward Justice Department officials during the call, viewing the proposed plea deal as failing to hold Boeing accountable for the fatal crashes, said Erin Applebaum, one of the lawyers representing victims’ relatives. Family members wanted the company to face additional charges and stiffer financial consequences, she said. “The 737 MAX families vigorously oppose the shameful new sweetheart deal between Boeing and the Department of Justice,” said Applebaum. She called the proposed plea agreement’s financial penalty “negligible” and said victims’ families will oppose the deal in court. The Justice Department declined to comment on the families' reaction. It is unusual for the Justice Department to inform other interested parties of its plans before notifying the company in its crosshairs, a third source said. But the Justice Department, led by Attorney General Merrick Garland, has sought to change its tack after facing backlash from the victims' families over the original 2021 agreement. Victims' relatives found out about the 2021 deal only after it had been negotiated. U.S. lawmakers in June grilled Chief Executive Dave Calhoun over Boeing's tarnished safety record. Lawyers for victims' family members have cited criticism from Capitol Hill when pressing the Justice Department to prosecute the planemaker and impose a fine of up to $24.78 billion. Boeing previously paid $2.5 billion as part of the deal with prosecutors that granted the company immunity from criminal prosecution over a fraud conspiracy charge related to the 737 MAX's flawed design. Boeing had to abide by the terms of the deferred prosecution agreement for a three-year period that ended on Jan. 7. Prosecutors would then have been poised to ask a judge to dismiss the fraud conspiracy charge. But in May, the Justice Department found Boeing breached the agreement, exposing the company to prosecution. Sign up here. https://www.reuters.com/legal/us-pushes-boeing-plead-guilty-connection-with-fatal-crashes-sources-say-2024-06-30/

2024-06-30 20:34

LIMA, June 30 (Reuters) - Peruvian copper producer Southern Copper (SCCO.N) New Tab, opens new tab , controlled by Grupo Mexico, plans on Monday to restart development of the long-postponed Tia Maria project, according to an internal document seen by Reuters. The Tia Maria mine, in the Islay province of Peru's Arequipa region, has been on hold for years amid community opposition over fears of the mine's environmental impact. Protests against the mine left six people dead between 2011 and 2015. An internal memorandum issued by Grupo Mexico (GMEXICOB.MX) New Tab, opens new tab and Southern Copper on Friday and reviewed by Reuters notified employees about the start of work on Monday. A source with knowledge of the plans told Reuters that the document was authentic. Grupo Mexico did not immediately respond to a Reuters request for comment. In May, Southern Copper's vice president of finance, Raul Jacob, told Reuters that the $1.4 billion mine was slated to break ground by the end of the year or in the first half of 2025. In 2019, the Peruvian government agreed with Southern Copper that development of the project could proceed when there were adequate social conditions. Jacob told Reuters in May that these conditions had improved. The mine is eventually expected to produce 120,000 tons of copper annually. Peru is struggling to accelerate its copper production, after Democratic Republic of Congo displaced it as the world's second largest copper producer in 2023. Sign up here. https://www.reuters.com/markets/commodities/southern-copper-restart-development-peru-mine-monday-document-2024-06-30/

2024-06-30 12:59

NEW YORK, June 28 (Reuters) - A series of upcoming economic reports and Congressional testimony from Federal Reserve Chairman Jerome Powell could jolt U.S. government bonds out of a narrow trading range. Yields on benchmark U.S. 10-year Treasuries, which move inversely to bond prices, have bounced between about 4.20% and 4.35% since mid-June, as the market digested data showing slowing inflation and signs of cooling economic growth in some indicators. The 10-year yield stood at 4.33% on Friday. So far, the economic numbers have failed to dispel doubts over how deeply the Fed will be able to cut interest rates this year, keeping Treasury yields range-bound. But next week's U.S. employment data, followed by inflation numbers and Powell's appearance could change that outlook. "The market has settled into a narrative that we may see incremental softness but not a growth scare," said Garrett Melson, a portfolio strategist at Natixis Investment Managers Solutions. "That will continue to keep us in this range, but the one thing that will push it meaningfully lower is an increase in the unemployment rate." U.S. monthly inflation as measured by the personal consumption expenditures (PCE) price index was unchanged in May, a report released on Friday showed, advancing the narrative of slowing inflation and resilient growth that has tamped down bond market gyrations and buoyed stocks in recent weeks. Yet futures linked to the fed funds rate showed traders pricing in just under 50 basis points of rate cuts for the year. Market reactions to employment data, due next Friday, could be exacerbated by low liquidity during a week when many U.S. bond traders will be on vacation for the July 4th U.S. Independence Day holiday, said Hugh Nickola, head of fixed income at GenTrust. "The market is waiting for the other shoe to drop." A recent survey by BofA Global Research showed fund managers the most underweight bonds since November 2022. Some believe that means yields could fall further if weakening data bolsters the case for more rate cuts and spurs increased allocations to fixed income. Other highlights for the month include consumer price data scheduled for July 11. Powell is scheduled to give his semiannual testimony on monetary policy on July 9 at the Senate Banking Committee, said the office of its chairman, Senator Sherrod Brown, on Monday. If tradition holds, the Fed Chair will deliver the same testimony at the House Financial Services committee the following day. Some investors are not convinced Treasury yields have much further to fall. Despite its recent cooling, inflation has proven more stubborn than expected this year, forcing the Fed to rein in expectations for how aggressively it can cut rates. A recent unexpected inflationary rebound in Australia underscored how difficult it has been for some central banks to keep consumer prices under control. At the same time, some investors believe inflation is unlikely to return to pre-pandemic levels and the U.S. economic is likely to show a higher level of underlying strength, limiting the longer term downside for bond yields, said Thierry Wizman, global FX and rates strategist at Macquarie Group. "The market has become much more acclimated to the idea that when the Fed cuts rates, they won't cut by as much as people surmised a few months ago," Wizman said. "People have adjusted their expectations but there's a limit to how much yields can fall on one month of bad data." Sign up here. https://www.reuters.com/markets/us/wall-st-week-ahead-jobs-inflation-data-may-break-us-treasury-market-out-narrow-2024-06-28/