2024-06-28 06:41

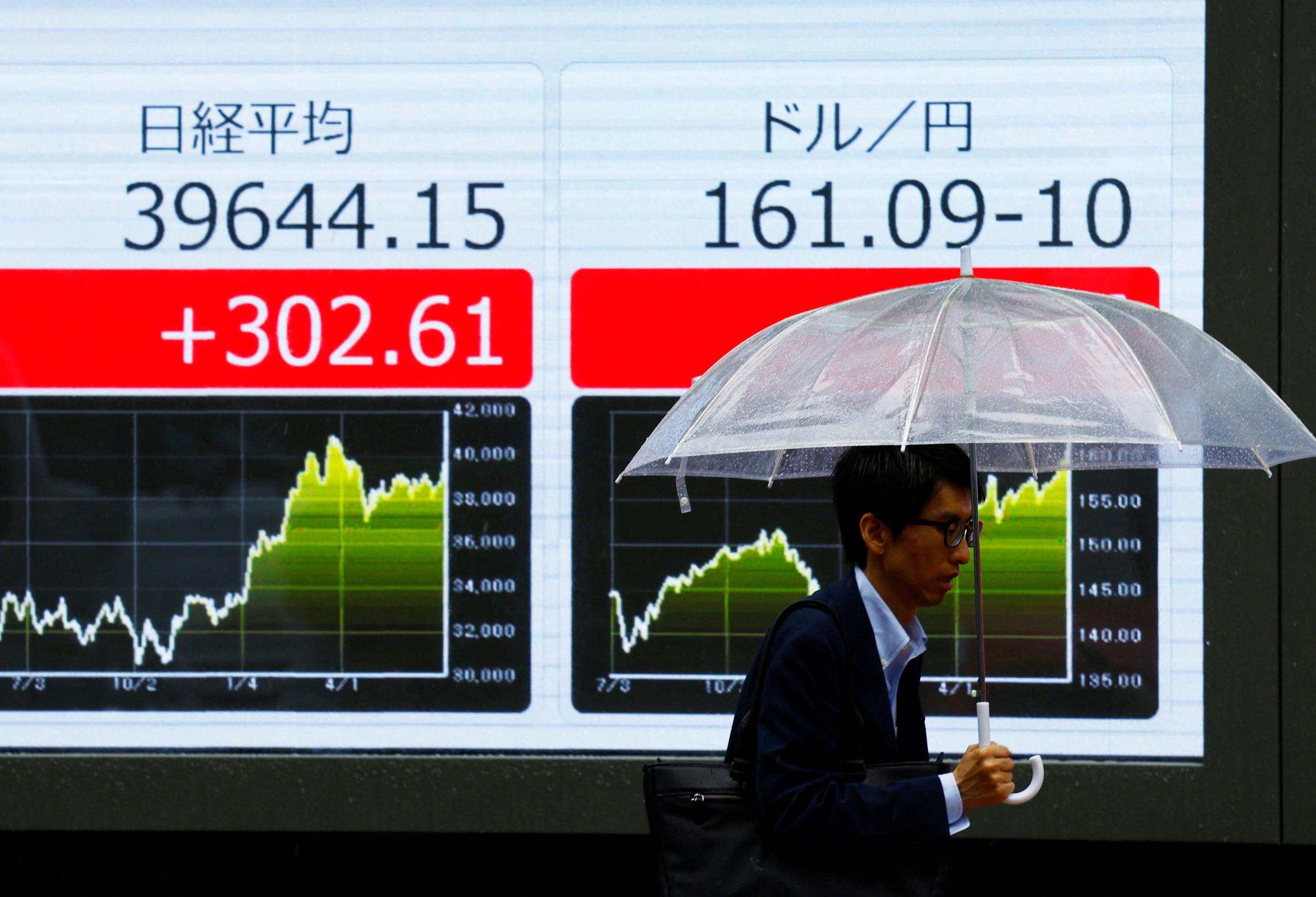

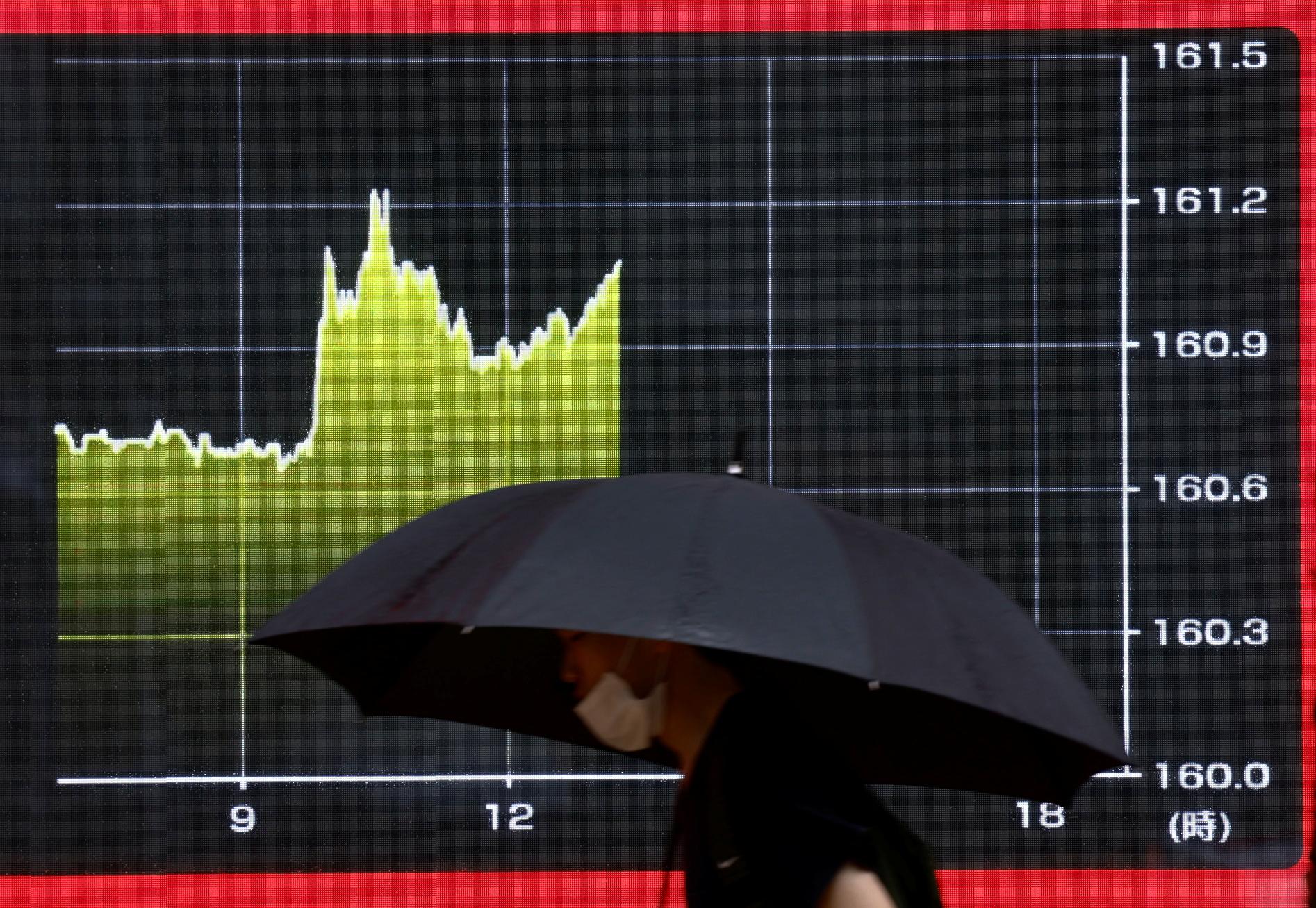

U.S. PCE index unchanged in May, up 2.6% year-on-year Chicago PMI index rises in June Fed funds futures slightly lift rate cut chances in September Dollar/yen up nearly 6% on the month, 1.9% on the quarter Euro on track for biggest monthly fall since January NEW YORK, June 28 (Reuters) - The U.S. dollar slipped on Friday after data showed inflation in the world's largest economy subsided last month, cementing expectations the Federal Reserve will start cutting interest rates this year. The dollar initially fell against the yen, the currency pair most sensitive to U.S. economic data because of a high, positive correlation to Treasury yields. The greenback, however, edged higher to trade flat on the day, with investors still focused on the wide interest rate differential between the United States and Japan. The dollar was last up slightly against the Japanese unit at 160.815 yen , after earlier hitting a 38-year high of 161.27 yen. Traders remained on high alert for intervention from Japanese authorities to boost its currency. The U.S. currency has posted monthly and quarterly gains versus the yen of about 1.9% and 5.9%, respectively. Data showed the U.S. personal consumption expenditures (PCE) price index, the Fed's preferred inflation measure, was unchanged last month, and followed an unrevised 0.3% gain in April, data showed. In the 12 months through May, the PCE price index increased 2.6% after advancing 2.7% in April. "The PCE report was mostly in line with expectations, which confirms the disinflationary trend as shown by the CPI (consumer price index), PPI (producer price index) numbers earlier this month," said Boris Kovacevic, global macro strategist at Convera in Vienna, Austria. "The macro data continues to point to a softening of the U.S. economy." Following the inflation data, fed funds futures slightly raised the chances of easing in September to around 67%, from about 65% late Thursday, according to LSEG calculations. The market is also pricing between one to two rate cuts of 25 bps each this year. A separate report on Thursday showed business activity in the Midwest came in better than expected, modestly helping the dollar. The Chicago purchasing managers' index (PMI) (USCPMI=ECI) New Tab, opens new tab jumped to 47.4 from 35 in May, and better than the 40 that economists projected. University of Michigan consumer sentiment, meanwhile, showed a reading of a better-than-expected 68.2 for June, also dollar-supportive. In addition, respondents to the sentiment survey expect near- and long-term inflation expectations to level out at 3%. Investors will now focus on next week's U.S. nonfarm payrolls report, in which Wall Street economists are forecasting a gain of 195,000 in June, compared with 272,000 in May. "Next week’s employment report will give us the opportunity to see if the job market is slowing," said David Donabedian, chief investment officer of CIBC Private Wealth, in emailed comments. "This number will have to be a big surprise to the downside to suggest the Fed will act in July to lower rates. We expect the Fed to stay pat unless the job market starts to falter." In other currencies, the euro was up 0.1% at $1.0709 . The euro, down 1.3% against the dollar in June, was on track for its biggest monthly fall since January as political uncertainty weighed in the run-up to France's general elections. For the second quarter, Europe's single currency fell 0.7%. Investors fear a new French government could increase fiscal spending, threatening the sustainability of the country's public debt and the financial stability of the bloc. Against the Swiss franc, the dollar was little changed at 0.8986 francs . Aside from the economic data, market participants were also focused on U.S. politics. Republican U.S. presidential candidate Donald Trump unleashed a barrage of at-times false attacks on President Joe Biden in their first campaign debate in Atlanta, with the dollar rising as Biden stumbled over his words a few times in early exchanges. The debate increased the odds of a Trump presidency and the imposition of import tariffs. Traders bought dollars overall as a Trump administration suggests more aggressive tariffs that could be inflationary and could trigger higher interest rates. Sign up here. https://www.reuters.com/markets/currencies/dollar-barges-past-161-yen-eyes-quarterly-rise-2024-06-28/

2024-06-28 06:41

Mimura replaces Kanda, who launched huge yen intervention Markets see little change in Japan's FX policy Policymakers continue to jawbone markets as yen keeps falling TOKYO, June 28 (Reuters) - Japan appointed a new top foreign exchange diplomat on Friday as the yen plumbed a 38-year low against the dollar, heightening expectations of imminent market intervention by Tokyo to shore up the battered currency. Atsushi Mimura, a financial regulation veteran, replaces Masato Kanda, who launched the biggest yen-buying intervention on record this year and aggressively jawboned speculators against pushing down the Japanese currency too much. While the change is part of a regular personnel reshuffle conducted every year, it comes as markets test Japan's resolve to arrest a renewed fall in the yen that adds pain to households and companies by pushing up import costs. "Kanda appeared to be someone aggressive, given his comments that authorities were on stand-by to intervene any time of the day," said Hideo Kumano, chief economist at Dai-ichi Life Research Institute, adding that his departure could affect how Japan communicates its currency policy. "But it's hard to say until we see how his successor steers policy. All in all, I don't think the big policy direction would change much." Japanese officials reiterated their warnings as the yen slid past 161 per dollar on Friday, well below levels that triggered the last bout of intervention in end-April and early May. "Excessive volatility in the currency market is undesirable," Finance minister Shunichi Suzuki told a news conference on Friday, adding that authorities will "respond appropriately" to such moves. He also said authorities were "deeply concerned" about the impact of the yen's "rapid and one-sided" moves on the economy. Japanese authorities are facing renewed pressure to stem sharp declines in the yen as traders focus on the interest rate divergence between Japan and the United States. A weaker yen is a boon for Japanese exporters, but a headache for policymakers as it increases import costs, adds to inflationary pressures and squeezes households. Under Kanda, who was FX diplomat for three years, Tokyo spent 9.8 trillion yen ($60.85 billion intervening in the foreign exchange market at the end of April and early May, after the Japanese currency hit a then 34-year low of 160.245 per dollar on April 29. The yen hit 161.27 per dollar on Friday, its weakest since 1986, ahead of a crucial U.S. inflation data due later in the day that could heighten market volatility. Market players see authorities' next line-in-the-sand as lying somewhere around 164.50. "If authorities want to prevent the yen from breaching that threshold, they will probably step in before the currency hits that level," said Daisaku Ueno, chief FX strategist at Mitsubishi UFJ Morgan Stanley Securities. NEW DIPLOMAT Mimura's appointment will take effect on July 31 after the meeting of the Group of 20 finance ministers and central bank governors in Rio de Janeiro from July 25. Little, however, is known about his stance on currency policy. Currently head of the ministry's international bureau, the 57-year-old will become vice finance minister for international affairs - a post that oversees Japan's currency policy and coordinates economic policy with other countries. Having spent nearly a third of his 35-year government career at Japan's banking regulator, Mimura has expertise and international ties in the area of financial regulation. During his three-year stint at the Bank for International Settlements in Basel, Mimura helped set up the Financial Stability Board in the midst of the 2008-2009 global financial crisis to reform financial regulation and supervision. At the finance ministry, he worked on the revision to the law over the Japan Bank for International Cooperation last year to expand the scope of the state-owned bank and make foreign companies key to Japan's supply chains eligible for loans from the bank. Mimura was also part of a government team that briefed foreign investors on the 2020 revisions to foreign ownership rules to dispel the notion that tighter rules were meant to discourage foreign investment in Japan. ($1 = 161.0600 yen) Sign up here. https://www.reuters.com/markets/asia/japan-appoints-atsushi-mimura-top-fx-diplomat-replacing-masato-kanda-2024-06-28/

2024-06-28 06:41

US stocks end down MSCI all country stock index hits record high early Dollar index dips NEW YORK, June 28 (Reuters) - Global stock indexes edged lower on Friday, reversing early gains, while Treasury yields rose and the U.S. dollar declined as investors absorbed data that showed U.S. monthly inflation was unchanged in May. The flat reading in the U.S. personal consumption expenditures (PCE) price index last month followed an unrevised 0.3% gain in April, the data showed. In the 12 months through May, the PCE price index increased 2.6% after advancing 2.7% in April. Last month's inflation readings were in line with economists' expectations. The data fueled optimism for some investors that the Federal Reserve could begin cutting interest rates in September. The MSCI world stock index, S&P 500 and Nasdaq all hit record highs in early trading but then retreated. On Wall Street, volume surged toward the closing bell when the FTSE Russell finalized the reconstitution of its indexes. It was the second-biggest daily volume of the year. "In the morning, the market seemed to be most focused on the PCE report," said Quincy Krosby, chief global strategist at LPL Financial in Charlotte, North Carolina. But, "you had the Russell reconstitution, and the expectations were that we could see - especially toward the afternoon and close - quite a bit of movement and churn in the market," she said. "You also had end-of-the-quarter repositioning and selling." The Dow Jones Industrial Average (.DJI) New Tab, opens new tab fell 45.20 points, or 0.12%, to 39,118.86, the S&P 500 (.SPX) New Tab, opens new tab lost 22.39 points, or 0.41%, to 5,460.48 and the Nasdaq Composite (.IXIC) New Tab, opens new tab lost 126.08 points, or 0.71%, to 17,732.60. For the quarter, with the S&P 500 gained 3.9%, the Nasdaq rose 8.3% and the Dow fell 1.7%. MSCI's gauge of stocks across the globe (.MIWD00000PUS) New Tab, opens new tab fell 1.74 points, or 0.22%, to 802.01. The STOXX 600 (.STOXX) New Tab, opens new tab index fell 0.23%. Investors were still digesting comments made during the U.S. presidential debate late Thursday between Democratic President Joe Biden and Republican rival Donald Trump ahead of the November election. The debate left some of America's allies bracing for a Trump return to office as president. Trump Media & Technology Group (DJT.O) New Tab, opens new tab shares rose early in the day but ended down 10.8%. U.S. Treasury yields were higher amid political uncertainty following the U.S. presidential debate and ahead of the French legislative elections. Yields, which move inversely to prices, had declined after the U.S. inflation reading. The yield on benchmark U.S. 10-year notes rose 10.4 basis points to 4.392%, from 4.288% late on Thursday. The first round of voting in France is on Sunday, but the final outcome will not be known until after a second round of voting on July 7. The U.S. dollar eased marginally after the inflation data. The dollar initially fell against the yen, the currency pair most sensitive to U.S. economic data because of a high, positive correlation to Treasury yields. The greenback, however, edged higher to trade near flat on the day, with investors still focused on the wide interest rate differential between the United States and Japan. The dollar was last up slightly against the Japanese yen at 160.815 yen , after earlier hitting a 38-year high of 161.27 yen. The yen's slide has fueled expectations of intervention by the Japanese authorities to stem the currency's weakness. The dollar index , which measures the greenback against a basket of currencies, fell 0.05% at 105.84, with the euro up 0.1% at $1.0713. Oil prices fell. U.S. West Texas Intermediate (WTI) crude futures fell 20 cents, or 0.24%, to settle at $81.54 a barrel. Sign up here. https://www.reuters.com/markets/global-markets-wrapup-1-2024-06-28/

2024-06-28 06:35

US gasoline demand fell in April -EIA US personal consumption inflation in line with forecasts US oil rig count hits lowest since December 2021 NEW YORK, June 28 (Reuters) - Oil prices fell on Friday as investors weighed weak U.S. fuel demand and took some money off the table at quarter-end, while key inflation data for May boosted the chances the Federal Reserve will start to cut interest rates this year. Brent crude futures for August settlement , which expired on Friday, settled up 2 cents at $86.41 a barrel. The more liquid September contract fell 0.3% to $85 a barrel. U.S. West Texas Intermediate (WTI) crude futures settled 20 cents lower, or 0.24%, to $81.54. For the week, Brent rose 0.02% while WTI futures posted a 0.2% loss. Both benchmarks gained around 6% for the month. While U.S. oil production and demand rose to a four-month high in April, demand for gasoline fell to 8.83 million barrels per day, its lowest since February, according to the Energy Information Administration's Petroleum Supply Monthly report published on Friday. "The monthly report from the EIA suggested the gasoline demand was pretty poor," said Phil Flynn, analyst at Price Futures Group. "Those numbers didn't really inspire more buying." Analysts said some traders took profits at the end of the second quarter after prices rallied earlier this month. The U.S. personal consumption expenditures (PCE) price index, the Fed's preferred inflation gauge, was flat in May, lifting hopes for rate cuts in September. Still, the reaction in financial markets was minimal. For oil traders, the release passed unnoticed, said Charalampos Pissouros, senior investment analyst at brokerage XM. Growing expectations of a Fed easing cycle have sparked a risk rally across stock markets. Traders are now pricing in a 64% chance of a first rate cut in September, up from 50% a month ago, according to the CME FedWatch tool. Easing interest rates could be a boon for oil because it could increase demand from consumers. "Oil prices have been converging with our fair value estimates recently, revealing the underlying strength in fundamentals through a clearing in the fog of war," Barclays analyst Amarpreet Singh wrote in a client note. Barclays expects Brent crude to remain around $90 a barrel over the coming months. Oil prices might not change much in the second half of 2024, with concern over Chinese demand and the prospect of higher supply from key producers countering geopolitical risks, a Reuters poll indicated on Friday. Brent crude is expected to average $83.93 a barrel in 2024 with U.S. crude averaging $79.72, the poll found. The U.S. active oil rig count, an early indicator of future output, fell by six to 479 this week, the lowest level since December 2021, energy services firm Baker Hughes (BKR.O) New Tab, opens new tab said. Money managers raised their net long U.S. crude futures and options positions in the week to June 25, the U.S. Commodity Futures Trading Commission (CFTC) said. Sign up here. https://www.reuters.com/markets/commodities/oil-prices-edge-higher-supply-risks-mount-2024-06-28/

2024-06-28 06:22

BENGALURU, June 28 (Reuters) - Demand for beer in India is at a multi-year high and air conditioner sales are skyrocketing as the intense, unprecedented heat scorching parts of the country becomes a boon for some consumer businesses. Temperatures in the Indian capital Delhi and the western state of Rajasthan soared to almost 50 degrees Celsius in recent weeks, with scientists saying the hot summer has become even more intense due to human-driven climate change. While rains lashed Delhi on Friday, many northern areas such as Punjab recorded New Tab, opens new tab temperatures above 40 C on Thursday. Beer sales volume are expected to jump 10% this summer and demand is at its highest since the onset of the COVID-19 pandemic, said Vinod Giri of Brewers' Association of India which represents leading beer makers Carlsberg, Anheuser-Busch InBev (ABI.BR) New Tab, opens new tab and United Breweries (UBBW.NS) New Tab, opens new tab. Beer in this scorching heat, Giri said, makes Indians "feel better without getting too high on alcohol." The heat has also driven power demand to a record peak as more people seek ways to cool down. B. Thiagarajan, managing director at ACs-to-air purifier maker Blue Star (BLUS.NS) New Tab, opens new tab, said he has not witnessed such strong sales for air conditioners in the more than 30 years he has worked in the industry. It's been a "mad rush ... anything called air conditioner would have got sold," he said. The number of affluent people in India is rising rapidly, and Thiagarajan said overall air conditioner sales will grow 50% in the April-June summer months, outstripping the industry's expected demand increase of 25% to 30%. Other businesses are also enjoying a strong summer. Quick delivery service Swiggy Instamart said it is seeing a sharp rise in orders for ice cream and cold beverages. Walmart-owned (WMT.N) New Tab, opens new tab Indian e-commerce website Flipkart said demand for top-end sunscreen products jumped 40% between February-May 2024 versus the previous year, with products such as sunscreen sticks proving particularly popular. "Heatwaves made me use sunscreens very frequently, like, 3 to 4 times a day," said S. Dinesh, 27, whose job demands him to stay out in the sun during the day. But even as the heat pushes up demand for some online products, it is causing logistical challenges as more delivery workers fall ill due to the high temperatures, said Ajay Rao, CEO of Emiza, a logistics company which counts Flipkart and Mamaearth (HONA.NS) New Tab, opens new tab among its customers. "People are not able to actually cope with the outside temperatures," he said. Sign up here. https://www.reuters.com/world/india/indians-battle-intense-heat-with-mad-rush-air-conditioners-beer-2024-06-28/

2024-06-28 06:08

LONDON, June 28 (Reuters) - If greater political uncertainty necessarily begets higher financial volatility, world markets are still half asleep - but the alarm clock may be set nonetheless. With a blizzard of political risks on the horizon, financial markets seem reluctant to second-guess hard outcomes - or material impacts on the economic, fiscal or corporate worlds that might be affected by changes of government and voter swings. With this week's first televised U.S. presidential debate sounding the starting gun for many for November's election race and French and British parliamentary polls heaving into view next week, a year of elections worldwide is reaching a crescendo. Each one has its own domestic saga and international policy implications, none more than the U.S. contest. But fear of change doesn't necessarily make for a great investment play when trying to parse the outcomes. For all the potential sharp edges and tensions in all three, there are few one-way macro market bets - not least as dominant themes of central bank policies and artificial intelligence-led tech booms cut across so many anxieties. Fiscal incontinence and debt sustainability issues are the clearly most cited worry. And government bond yields and implied volatility levels (.MOVE) New Tab, opens new tab are indeed historically elevated - though mostly well below levels of the past two years of inflation spikes and interest rate rises. Wobbling French debt and equity (.FCHI) New Tab, opens new tab have shown most sensitivity this month to the snap election - though how much that's down to the surprise as much as likely outcomes remains to be seen. British stocks are marginally off record highs too. And yet the euro and pound have barely flinched on the foreign exchanges - softening only mildly as poll dates approach. Wall Street and world stocks (.SPX) New Tab, opens new tab, (.MIWD00000PUS) New Tab, opens new tab remain near all time peaks and the VIX 'fear index' of implied S&P500 volatility (.VIX) New Tab, opens new tab, as well as the higher VIX futures out to the end of the year , are all but comatose relative to recent ructions around the pandemic and its aftermath - or even around the last contentious election. A puzzle or waiting game? If you can't be sure yet of the poll outcomes or indeed what political winners will actually do rather than what they now promise, then there's danger in jumping the gun in an otherwise relatively benign economic backdrop. And while Britain's result may seem a dead cert, French and U.S. results remain in the balance. Neither the far right nor far left in France are estimated to gain outright majorities, and would probably have to exist in a messy 'cohabitation' with centrist President Emmanuel Macron for the next three years anyway even if they did. U.S. President Joe Biden is still neck and neck with challenger Donald Trump in the White House race, meantime, and even if Trump returns, most investors see many of his sharper policy edges sanded down by likely gridlock in Congress. JUMP THE GUN Societe Generale's equity derivatives strategists Jitesh Kumar and Vincent Cassot think the elections - and perhaps the actual performance of any new governments - may ultimately provide a trigger to finally hedge heady equities. Just not yet. They think that's a story into 2025 rather than now, not least as they see the politics being more a catalyst for a shift that will be overdue anyhow on flagging growth momentum and still-lagged hits from higher interest rates. "Our models point to a substantial rise in volatility, and over a fairly short period of time," they told clients, pointing to the year-end period for the big shift even if political risks seem already hard to ignore. "While political uncertainty very rarely changes the broader volatility backdrop, it can act as a trigger or catalyst for an expected change in volatility regime." For currency markets primarily in thrall to shifting rate differentials and central banks, the picture is more complicated - not least as an already pumped up dollar may well stand to gain further from wider market nerves, threats of tariff wars or geopolitical stress. Not unlike subdued equity seismographs, most measures of currency volatility (.DBCVIX) New Tab, opens new tab, , are similarly under wraps at levels less than half those seen during the race to tighten interest rates and amid the UK bond shock of late 2022. They have ticked higher lately around elections in Mexico and India and, notably, the euro hiccup on the French surprise - even if the gauges remain low by historical standards. Barclays FX strategist Themos Fiotakis and team sketch out a more nuanced view of how to tread on the political minefield alongside the shifting interest rates - modeling how markets match up rate gaps, or 'carry', with options market bias for puts or calls on a currency, so-called 'risk reversals.' Carry and risk reversals are typically negatively correlated, in that the bigger the interest rate risk premium on a currency, the bigger the implied crash - a factor making sometimes lucrative 'carry trades' inherently risky. Judged on modelling this relationship, Fiotakis points out that the market's appetite for downside protection on many currencies has increased and its signal on risk aversion amounts to the most since 2020. "Risk tolerance has decreased considerably in FX markets lately in the wake of the various election surprises," he wrote, including emerging market ructions along with the majors. But he added: "The market being, on aggregate, more aware of political risks does not mean that it accurately prices those across all currency pairs." Crunching his model, the conclusion was that higher levels of risk aversion toward the euro and Japan's yen, already ailing at 38-year lows, was easily justified. But similar levels for Switzerland's franc may be mis-priced due to its traditional haven role around euro zone political ructions. On the flipside, the Barclays team reckoned only a modest positive bias toward the pound in pricing may understate the market's possible reaction to better post-Brexit UK relations with the European Union under a Labour Party government. And they felt that possible tariff threats ahead, property sector worries and competitive pressures from a weak yen meant the relatively sanguine reading on China's yuan may well warrant protection. Volatility may not be asleep after all, even if it needs another few minutes under the duvet. The opinions expressed here are those of the author, a columnist for Reuters. Sign up here. https://www.reuters.com/markets/political-risk-aversion-rubs-its-eyes-mike-dolan-2024-06-28/