2024-06-28 05:47

Bullion up about 4% for the quarter Palladium up 5% for the day, down for third straight quarter June 28 (Reuters) - Gold prices steadied on Friday and were headed for a third straight quarterly gain after a key U.S. inflation report was broadly in line with expectations, boosting hopes that the Federal Reserve could cut interest rates by September. Spot gold was steady at $2,326.47 per ounce, as of 1833 GMT. Prices have gained over 4% for the quarter. U.S. gold futures settled 0.1% higher at $2,339.6. "We are continuing on trend in a very incremental slow pullback of inflation. As a result, we've seen yields continue to creep lower, bonds creep higher and that is somewhat supportive for the gold market," said David Meger, director of alternative investments and trading at High Ridge Futures. Gold was also supported by a decline in the U.S. Treasury yields, which makes the non-yielding bullion more attractive for investors. On Friday, market bets rose on hopes that the Federal Reserve would cut interest rates by September and again in December, after the Personal Consumption Expenditures Index showed inflation did not rise at all from April to May. The PCE followed an unrevised 0.3% gain in April data last month, while consumer spending rose moderately. Traders are currently pricing in about a 68% chance of a Fed rate cut in September, compared with 64% before the release of the inflation data, according to the CME FedWatch tool. San Francisco Federal Reserve Bank President Mary Daly - also a member of the 2024 Federal Open Market Committee - said the latest inflation data was "good news that policy is working". "The price of gold has been trading in a fairly tight range and will probably hold this range until the FOMC confirms they will be cutting rates," said Chris Gaffney, president of world markets at EverBank. Elsewhere, spot silver rose 0.3%, to $29.15 and platinum gained about 1%, to $997.13. Both metals were set for quarterly gains. Spot palladium rose about 5%, to $975.45, but was headed for a third straight quarterly drop. Sign up here. https://www.reuters.com/markets/commodities/gold-set-third-quarterly-gain-traders-await-us-inflation-data-2024-06-28/

2024-06-28 05:11

June 28 (Reuters) - The recent turmoil in France's bond market could mark a new chapter for the euro zone's wealthiest economies, with emerging political and fiscal risks fuelling volatility earlier associated with its high-debt members such as Greece or Spain. French President Emmanuel Macron's rattled markets with his shock decision on June 9 to call a snap election after his grouping got trounced by far-right parties in European parliamentary elections. French government bond yields are around 3.25%, near their highest level of the year. That has pushed their premium over German yields - the European benchmark - to the most since at least 2017, reflecting the extra return investors want for holding that debt. France is also now subject to European Union disciplinary measures over its budget deficit, together with Belgium, fellow member of what has been considered euro area's low risk "core", while former budget laggards Spain, Portugal and Greece are in the clear. The terms "core" and "periphery" became commonplace during the euro zone sovereign debt crisis, which has driven a wedge between the richer north and the more indebted southern "peripheral" countries, both politically and from an investment perspective. The "periphery" bonds were often the object of intense speculative trading at the first hint of any sort of setback. However, the last few years have seen yield spreads for the euro zone's rich-economy core widen, while those for the "periphery" countries have mostly shrunk, as they stuck to tough debt-reduction rules imposed after the crisis. In fact, out of that group, in the last five years, only Spain has seen its spread over Germany widen, while Greece's, Portugal's and Italy's have shrunk. The original core members, meanwhile, have all seen a widening, with France experiencing the largest increase. "We think French government bonds will increasingly behave more like 'peripheral' rather than 'core' assets," Felix Feather, economist at UK asset manager abrdn, said. "While this distinction does not have quite the bite it once did during the euro crisis, when the ongoing membership of the euro zone seemed like an open question for many peripheral countries, it does mean that French bonds are likely to trade with greater volatility, pro-cyclicality, and persistently wider spreads to Germany," Feather said. The spread between German and French 10-year yields spiked to as much as 82 basis points the week after Macron's announcement, prompting a warning from the French finance minister about the potential for a deeper crisis. It is currently around 77 basis points, compared with fellow core members Belgium at 64 basis points, Austria, with 56 basis points, and the Netherlands at 33 basis points. What has helped Spain, Portugal and Greece, largely contain their spreads, is investors' preference for higher-yielding assets, particularly as long-dated bonds yield less than shorter-dated ones right now, known as "yield curve inversion". "With inverted yield curves, finding assets that beat cash is difficult. That's why many people were holding on to their periphery bonds," said Andres Sanchez Balcazar, head of global bonds at Pictet Asset Management. Analysts said this stability was also due to credible debt reduction strategies implemented by some of peripheral countries and the pivotal role of the European Central Bank, which commits to prevent a potentially destabilising blow-out in spreads. POLITICAL FOCUS Marine Le Pen's far-right National Rally (NR) leads in the polls ahead of the first round of voting on Sunday, and investors worry about the risk of a new government taking the country down an unsustainable debt path. Various RN party members have sought to allay such fears by saying they would stick to Europe's fiscal rules, which dictate a country's budget deficit cannot exceed 3% of total national output. France is currently at 5.5%. For Barclays, that means an RN majority might help bring France's debt spreads down. Citi strategists, on the other hand, think this gap could blow out to as much as 100 basis points, closer to Italy's spread over Germany at around 156 basis points, if either a far-right or far-left government make big promises on spending. Konstantin Veit, portfolio manager at major bond investor PIMCO, said he was fairly neutral in terms of positioning between the euro zone's core and periphery, given how much Spanish and Portuguese spreads have narrowed. "It's true that over time if the current fiscal trajectory persists, you might expect Spain to trade closer to France and also see Spain trading through France," he said. Analysts and fund managers say politics remain in the spotlight for any issuer, not just France. Portugal's centre-right minority government could struggle to approve the 2025 budget. In Spain, its centrist parties contained a far-right surge in the European elections, but the centre-left government is expected to favour increased social spending. "We think that they both (Spanish and Portuguese spreads) have 15-20 bps of tightening left," Pictet's Sanchez Balcazar said, assuming that an NR-led government sticks to European budget rules, with no further spillover effects from France. While France is in hot water now over its finances, it is unlikely to be in the same category as Italy, the third-largest economy in the euro zone with the worst debt problems. "At the end of the day, I think that France's liquidity and the global safe-asset nature will keep its spread versus Germany a little bit tighter than that of Spain and Portugal," said Reinout De-Bock, head of the European rate strategy at UBS. Sign up here. https://www.reuters.com/markets/europe/french-bond-market-gets-taste-euro-zone-periphery-turmoil-2024-06-28/

2024-06-28 05:02

NEW YORK, June 28 (Reuters) - As U.S. stocks lock in a solid first half, investors are speculating whether political uncertainty, potential Federal Reserve policy shifts and big tech's market dominance could make the rest of 2024 a tougher slog. The S&P 500 is up 15% year-to-date thanks to strong corporate earnings, a resilient U.S. economy and enthusiasm over artificial intelligence that powered massive gains in stocks such as chipmaker Nvidia (NVDA.O) New Tab, opens new tab. The index’s steady march upward produced 31 new highs in the first half, the most for first half of any year since 2021. The first half has been "very much a Nirvana period for stocks," said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder. "The economy has been stronger than many people anticipated including the Fed." If history is any guide, the momentum in U.S. stocks is likely to continue: a positive first half has been followed by additional gains in the rest of the year 86% of the time, according to a CFRA study of markets during election years since 1944. But the ride could get bumpy. Political uncertainty is likely to be a more powerful factor on asset prices, as investors focus on the U.S. presidential election. A recent JPMorgan survey showed investors see political risk in the U.S. and abroad as the top potential destabilizing factor for stocks. Investors have also become increasingly concerned about the narrowness of the market’s advance, which has been concentrated in a handful of tech powerhouses. Nvidia alone - whose shares are up 150% this year - has accounted for about a third of the S&P 500's total return, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. Another key uncertainty is whether the economy can maintain the balance of gradually cooling inflation and resilient growth that has fueled investor confidence. A sharp deviation from that so-called Goldilocks scenario could upend the Fed’s plans to cut rates later this year. "With a wide range of potential macro outcomes in 2025, partly due to the U.S. election result, market volatility is likely to increase," wrote Jason Draho, head of asset allocation, Americas, for UBS Global Wealth Management. POLITICAL UNCERTAINTY While investors have mostly been focused on factors such as earnings and monetary policy this year, politics are expected to loom larger as the matchup between President Joe Biden, a Democrat, and Republican challenger and former president Donald Trump intensifies in the coming months. Futures tied to the Cboe Volatility Index (.VIX) New Tab, opens new tab reflect increased demand for protection against equity gyrations around the November vote, as polls continue to show the candidates neck and neck. Signs that one of the candidates is gaining the upper hand could ripple out into asset markets. For many, it comes down to divergent tax policies: a Democratic sweep of the White House and Congress could mean the party would have a freer hand to raise taxes, generally seen as a negative for equities, according to UBS Global Wealth Management. The first live debate of the 2024 election race late Thursday spurred a rise in U.S. stocks futures and the dollar in a move some investors interpreted as a reaction to a strong showing by Trump. One potential wildcard, according to strategists at Janus Henderson, is a contested or prolonged election. "Any commentary suggesting it's a real threat could create bouts of volatility in the coming months, and that volatility would likely continue until a victor is announced," they wrote. CONCENTRATION AI-fever and strong earnings have helped drive up equities in the first half, but gains have been concentrated in tech and growth stocks, including Nvidia, Microsoft (MSFT.O) New Tab, opens new tab and Amazon (AMZN.O) New Tab, opens new tab. The equal weight S&P 500 index - a proxy for the average stock - is up just 4% for the year, a fraction of the S&P 500’s gain. Many investors believe big tech dominance is well deserved, given strong balance sheets and leading positions at the top of their industries. But their growing heft could make markets unstable if the case for holding tech and growth stocks weakens and investors head for the exit all at once. "It's understandable why everyone has drifted to these names, but it's a bit of a game of musical chairs. If the music stops, there's going to be a problem," said Stephen Massocca, senior vice president at Wedbush Securities. Meanwhile, the 12-month forward price to earnings ratio of the tech-heavy Nasdaq 100 has risen to 26 from 20, two years ago, according to LSEG data. Some investors are looking to areas of the market that have underperformed in recent months, expecting the rally in tech to spread out into other sectors. Jack Ablin, chief investment officer at Cresset Capital, has been focused on "quality dividend companies" and small caps. "We think that perhaps the large cap has run a little too far and that we'll now see perhaps a broadening," Ablin said. GROWTH Most investors have cheered signs of cooling inflation and moderating growth this year, as it bolsters the case for the Fed to cut interest rates from a multi-decade peak. But a more pronounced economic slowdown could fuel worries that elevated interest rates are weighing more heavily on the economy. Fed officials have trimmed their projections to just one rate cut this year from a previous forecast of three, thanks to the economy’s strength and unexpectedly sticky inflation. Market reactions to past rate cutting cycles have largely hinged on whether the cut came during a period of comparatively strong economic performance or in response to a sharp slowdown in growth. While the S&P 500 has risen by an average of 5.6% in the 12 months after a cycle has begun, cuts that came along with a challenging economic environment coincided with far worse returns, an Allianz study examining rate cuts since the 1980s showed. For example, a rate cutting cycle that kicked off around the collapse of the dotcom bubble in 2000 saw the index down 13.5% a year later. "Every landing is a soft landing until it is not," said Julia Hermann, global market strategist at New York Life Investments. Sign up here. https://www.reuters.com/markets/election-fed-risks-loom-us-stocks-after-strong-first-half-2024-2024-06-28/

2024-06-28 04:34

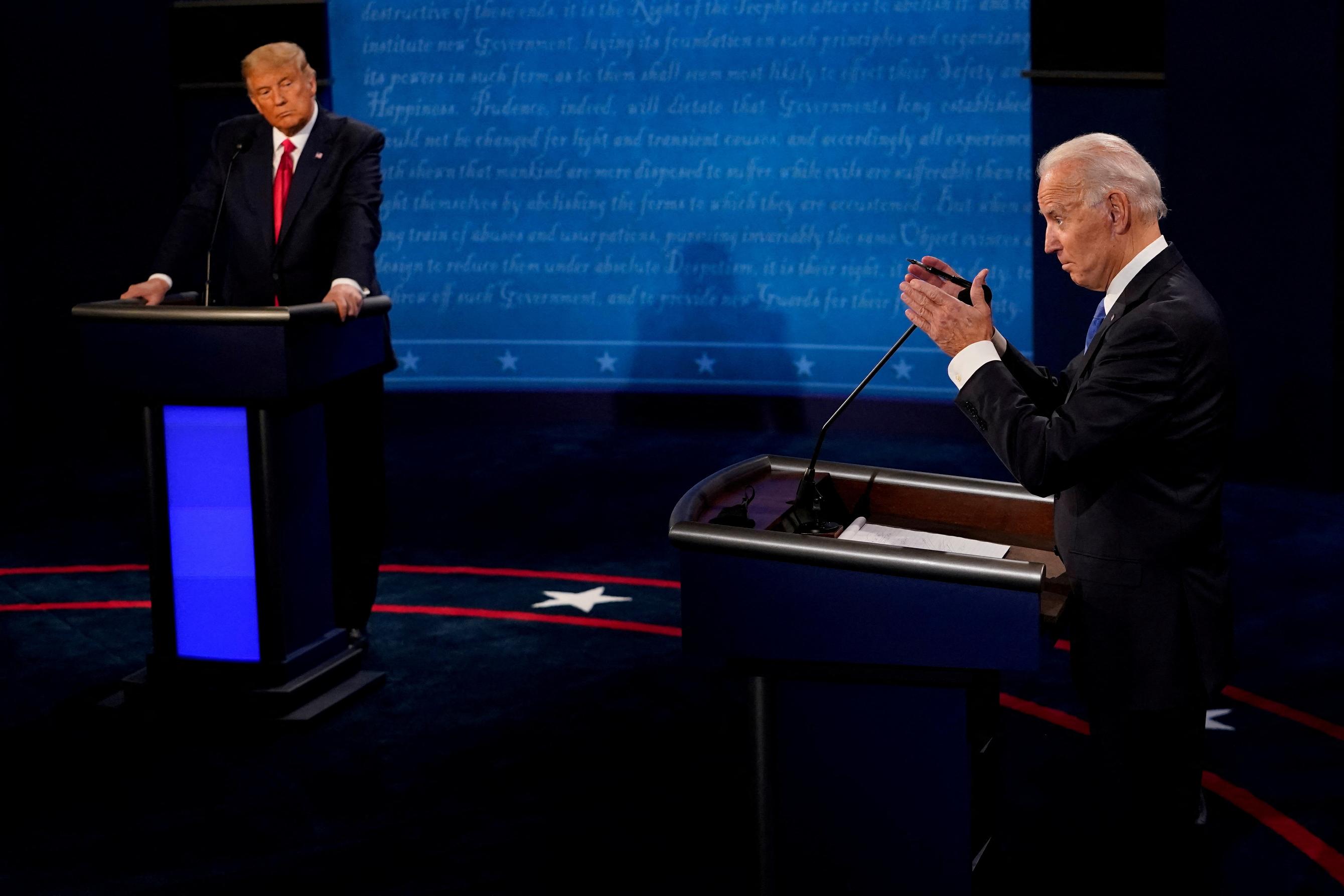

A look at the day ahead in European and global markets from Rae Wee Investors kept a close eye on the first U.S. presidential debate between Democratic President Joe Biden and his Republican rival Donald Trump in early Asian hours on Friday, as the two clashed on stage ahead of November's U.S. election. The debate was hardly market moving, though if anything, it probably did little to assuage concerns about the country's political and economic future. Biden - with his voice hoarse from a cold - notably stumbled over his words multiple times, while Trump said tariffs will decrease deficits and not increase inflation. Market odds have narrowed slightly for a Trump win in the wake of the debate, which could translate to upside risks in inflation. That would mean the Federal Reserve keeps rates higher for longer, U.S. Treasury yields stay elevated and the dollar remains resilient. The dollar rose to a 10-day high against the Mexican peso and climbed against other trade-sensitive currencies, including the Canadian dollar , in the wake of the debate. The main market event is the release of the U.S. core personal consumption expenditures (PCE) price index - the Federal Reserve's preferred measure of inflation, later on Friday. Expectations are for the core PCE price index to have risen 2.6% on an annual basis in May, a slowdown from April's 2.8%. Should the data line up with forecasts, that would likely bolster bets the Fed will kick off its easing cycle in September. Analysts, however, are sceptical about the dollar's downside. Major central banks elsewhere have already begun monetary easing and there are a number of risks plaguing other economies, such as political turmoil in Europe. The first round of French elections is due to kick off this Sunday. Perhaps the biggest victim of the dollar's relentless strength is the yen , which on Friday again tumbled to a 38-year low. The dollar effortlessly barged past the 161 yen level to peak at 161.27 yen, while the euro similarly touched a record high against the Japanese currency. That kept traders on their toes for potential intervention from Tokyo, with the country's appointment of a new top foreign exchange diplomat on Friday fuelling expectations that a move from authorities to shore up the yen could be imminent. Also on Friday, separate data showed core inflation in Japan's capital accelerated in June, while factory output rebounded nationally in May. Key developments that could influence markets on Friday: - U.S. core PCE price index (May) - UK Q1 GDP - Germany import prices (May) Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-2024-06-28/

2024-06-28 03:44

NEW YORK, June 27 (Reuters) - U.S. stock futures and the dollar rose in early Asian trading on Friday as 2024 presidential election candidates Joe Biden and his predecessor Donald Trump sparred in their first debate, with Trump viewed as putting in a stronger showing than his opponent. While the election is four months away, investors anticipate a Trump presidency would mean lower corporate taxes, tougher trade relations and therefore higher stock prices and bond yields. "Wall Street indices have crept higher over the past hour, which could be taken as a sign that Trump made the better case - as we all know he is Wall Street friendly," said Matt Simpson, senior market analyst at City Index in Brisbane. The U.S. dollar rose to a 10-day high against the Mexican peso and climbed against other trade-sensitive currencies, including the Canadian dollar . Stock futures extended gains as the debate progressed, with the S&P 500 E-minis rising 0.3% and Nasdaq 100 E-minis up 0.46%. China's benchmark CSI300 (.CSI300) New Tab, opens new tab edged up 0.4% while Hong Kong's Hang Seng Index (.HSI) New Tab, opens new tab was flat as the two U.S. presidential candidates debated tariffs on China, with Trump criticizing Biden for not doing more. Biden, sounding hoarse and tentative at times, stumbled over his words on several occasions during the debate's first half-hour. Trump rattled off one attack after another including about Biden's handling of the economy, though fact-checkers deemed many of his comments misleading or false. Biden acknowledged that inflation had driven prices substantially higher than at the start of his term but said he deserves credit for putting "things back together again" following the coronavirus pandemic. Trump asserted he had overseen "the greatest economy in the history of our country" before the pandemic struck and said he took action to prevent the economic free-fall from deepening even further. Karl Schamotta, chief market strategist at payments company Corpay in Toronto, said Biden turned in a "disastrous performance" that had triggered a sharp rise in the odds of a Trump victory. "This is translating into a tumble in trade-sensitive currencies," he said. Both Biden and Trump have favored a tough trade stance by imposing and threatening tariffs, on China in particular. But investors are leery about the impact of tariffs on inflation. Online prediction market PredictIt's 2024 presidential general election market showed Biden's odds down to 39% from 45% a day earlier, while Trump's were up to 61% from 55%. U.S. Treasury yields rose slightly, with those on 10-year notes up 2 basis points to 4.313% and 5 basis points higher for the week but still off 20 basis points for June so far. Analysts at JPMorgan noted Trump's team had proposed wide-scale tariffs on imports, which would lift prices, while restrictions to immigration would put upward pressure on wages and extended tax cuts would likely add to government debt. "Investors are hedging against a more isolationist turn in the United States after the November election," Corpay's Schamotta said. Some investors, however, warned against reading too much into the move in stock market futures. "We are in the early days with more to go. Don't assume an outcome," said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder. Sign up here. https://www.reuters.com/markets/us/wall-street-wants-drama-free-presidential-debate-watching-comportment-much-2024-06-27/

2024-06-28 02:59

TOKYO, June 28 (Reuters) - Japanese Finance Minister Shunichi Suzuki said on Friday that the authorities were "deeply concerned" about the impact of "rapid and one-sided" foreign exchange moves on the economy, as the yen declined to 38-year lows past 161 per dollar. Speaking at a regular press conference, Suzuki said authorities would respond appropriately to excessive currency moves and that confidence in the Japanese currency is maintained. "The government is closely monitoring developments in the foreign exchange market with a high sense of urgency," Suzuki said, adding efforts to continue forging ahead with fiscal reform is crucial. The yen fell to its weakest since 1986 at 161.155 per dollar on Friday morning, with neither an overnight drop in U.S. yields nor data showing solid consumer price gains in Tokyo arresting the downward slide in Japan's currency. Finance ministry officials have been ramping up warnings against the sliding yen this week, signalling readiness to intervene in the currency market. Japanese authorities are facing renewed pressure to stem sharp declines in the yen as traders focus on the interest rate divergence between Japan and the United States. Tokyo spent 9.8 trillion yen ($60.91 billion) intervening in the foreign exchange market at the end of April and early May, after the Japanese currency hit a then 34-year low of 160.245 per dollar on April 29. ($1 = 160.8900 yen) Sign up here. https://www.reuters.com/markets/asia/japan-deeply-concerned-about-rapid-one-sided-forex-moves-finance-minister-says-2024-06-28/