2024-06-27 20:32

Walgreens plunges on 2024 profit forecast cut, store closures Levi Strauss drops after revenue misses estimates Indexes up: Nasdaq 0.3%, S&P 0.09%, Dow 0.09% June 27 (Reuters) - U.S. stocks ended Thursday around the unchanged mark as investors awaited fresh inflation data, with the Nasdaq able to eke out a slight gain after data showed a continued slowdown in economic activity, raising investors' hope for rate cuts. "The market is in a bit of a holding pattern here for the PCE because there hasn't been a lot of big catalysts," said Ross Mayfield, investment strategy analyst at Baird, about the release of the monthly personal consumption expenditures (PCE) price index - the Federal Reserve's preferred inflation gauge - on Friday. Data showed new orders for key U.S.-manufactured capital goods unexpectedly fell in May, while core durable goods orders fell 0.1% versus forecasts for a 0.2% rise, boosting investor beliefs that a weaker economy could prompt the Federal Reserve to cut interest rates in September. Weekly jobless claims fell to 233,000, missing expectations of 236,000. Further, a final print showed the U.S. economic growth increased more than estimated in the first quarter. Benchmark 10- and 2-year yields, which move inversely to prices, dropped after the data showed a continued, but moderated slowdown in economic activity, while the 7-year yields edged lower after a $44 billion auction. Megacap stocks, such as Alphabet (GOOGL.O) New Tab, opens new tab and Meta Platforms (META.O) New Tab, opens new tab, firmed as U.S. Treasury yields slipped, up 0.83% and 1.25%. Amazon (AMZN.O) New Tab, opens new tab rose 2.19% after hitting $2 trillion in market value for the first time on Wednesday. The Dow Jones Industrial Average (.DJI) New Tab, opens new tab rose 36.53 points, or 0.09%, to 39,164.33, the S&P 500 (.SPX) New Tab, opens new tab gained 5.16 points, or 0.09%, to 5,483.06 and the Nasdaq Composite (.IXIC) New Tab, opens new tab gained 53.53 points, or 0.30%, to 17,858.68. Market participants have highlighted concerns over the rally's sustainability and have called out for the need to diversify portfolios to hedge against possible sharp losses. Meanwhile, investors have largely stuck to their view of around two rate cuts this year, as per LSEG's FedWatch data, even though the Fed has projected only one, and a 59.5% chance of a cut in September. In a policy essay, Atlanta Fed President Raphael Bostic said inflation "appears to be narrowing" and that should allow rates cuts later this year, while governor Michelle Bowman reiterated that she is still not ready to support a central bank rate cut with inflation pressures still elevated. "What we've been looking forward for most of the week is kind of that preponderance of evidence to tip the scales on what is the direction for inflation," said Rob Haworth, senior investment strategist at U.S. Bank Wealth Management. Micron (MU.O) New Tab, opens new tab fell 7.11% after an in-line fourth-quarter revenue forecast disappointed investors hoping for more upside from the memory chipmaker's performance in the artificial intelligence boom. Nvidia (NVDA.O) New Tab, opens new tab was down 1.90%, continuing its recent turbulent ride. Walgreens Boots Alliance (WBA.O) New Tab, opens new tab slumped 22.16% after cutting its 2024 profit forecast and announcing plans to close more underperforming U.S. stores. Denim maker Levi Strauss (LEVI.N) New Tab, opens new tab tumbled 15.4% after falling short of expectations for second-quarter revenue. Advancing issues outnumbered decliners by a 1.62-to-1 ratio on the NYSE. There were 168 new highs and 78 new lows on the NYSE. The S&P 500 posted 9 new 52-week highs and 2 new lows while the Nasdaq Composite recorded 41 new highs and 118 new lows. Volume on U.S. exchanges was 9.49 billion shares, compared with the 11.74 billion average for the full session over the last 20 trading days. Sign up here. https://www.reuters.com/markets/us/futures-dip-micron-drags-down-chip-stocks-ahead-economic-data-2024-06-27/

2024-06-27 20:20

BUENOS AIRES, June 27 (Reuters) - Argentine oilseed crushers workers union SOEA has kicked off a strike to protest a proposed labor reform awaiting a vote in the lower house of Congress, a union leader said on Thursday. The proposals are part of a major package of reforms pushed by libertarian President Javier Milei. "We started the strike, but this time we did it without issuing a statement," SOEA's union leader Daniel Succi told Reuters. The union canceled a prior strike earlier this month under pressure from the government. The CIARA-CEC chamber of oilseed producers and grains exporters questioned the legality of what it called an "unplanned" strike. The strike is "totally foreign to the industry and is politically motivated," the chamber said on social media network X. The SOEA operates in the port towns north of Rosario, Argentina's main agricultural exports hub. The country is one of the largest international exporters of soybean oil and soybean flour. Sign up here. https://www.reuters.com/markets/commodities/argentine-oilseed-workers-union-strikes-labor-reform-up-vote-2024-06-27/

2024-06-27 20:20

TSX ends up 0.7% at 21,942.16 Posts its highest closing level since June 12 Energy adds 1.3%; oil settles 1% higher BlackBerry up 10.5% on Q1 revenue beat June 27 (Reuters) - Canada's main stock index rose to a two-week high on Thursday, with heavily weighted financials and energy among the sectors to make headway in a broad-based move as long-term borrowing costs eased and commodity prices climbed. The Toronto Stock Exchange's S&P/TSX composite index (.GSPTSE) New Tab, opens new tab ended up 148.26 points, or 0.7%, at 21,942.16, its highest closing level since June 12. "It's been a tough few weeks for the TSX, especially in comparison with the S&P," said Christine Tan, a portfolio manager at SLGI Asset Management Inc. "In the last couple of days, we've seen the TSX come back a little bit." The Toronto market was still on course to post a monthly decline, with the index down 1.5% since the beginning of June. U.S. benchmark the S&P 500 has advanced 3.9% over the same period. "Our managers are really waiting to see what the earning season looks like and more importantly what guidance sounds like before we really get a good sense where the TSX is headed," Tan said. All 10 major sectors on the Toronto market ended higher, including a gain of 1.3% for energy as the price of oil settled 1% higher at $81.74 a barrel. Gold also rallied. That helped lift metal mining stocks, with the materials group gaining 0.4%. Financials added 0.6%, while technology was up 1.4%, helped by a 10.5% gain for the shares of BlackBerry Ltd (BB.TO) New Tab, opens new tab after the company beat first-quarter revenue estimates. Bond yields eased as U.S. economic data showed a continued slowdown in activity. That helped boost interest rate sensitive stocks, with real estate adding 1.6% and utilities up 0.7%. MDA Space Ltd (MDA.TO) New Tab, opens new tab shares jumped 13.5% after the company was awarded a contract to design and deliver a space robotics system. Sign up here. https://www.reuters.com/markets/tsx-futures-muted-us-inflation-data-focus-2024-06-27/

2024-06-27 19:47

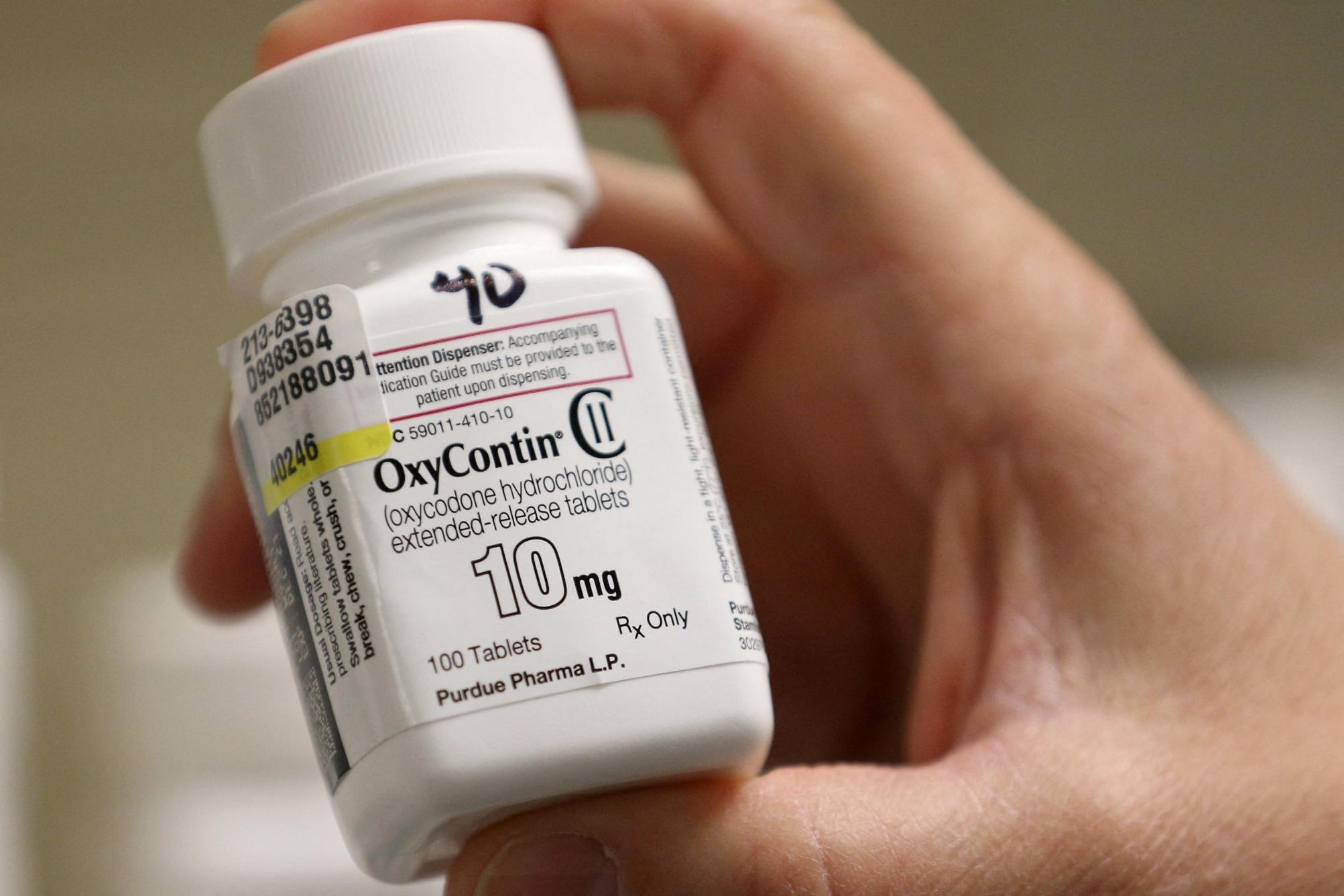

WASHINGTON, June 27 (Reuters) - The U.S. Supreme Court on Thursday blocked OxyContin maker Purdue Pharma's bankruptcy settlement that would have shielded its wealthy Sackler family owners from lawsuits over their role in the nation's deadly opioid epidemic. The 5-4 decision reversed a lower court's ruling that had upheld the plan to give Purdue's owners immunity in exchange for paying up to $6 billion to settle thousands of lawsuits accusing the company of unlawful misleading marketing of OxyContin, a powerful pain medication introduced in 1996. The ruling represented a victory for President Joe Biden's administration, which had challenged the settlement as an abuse of bankruptcy protections meant for debtors in financial distress, not people like the Sacklers who have not filed for bankruptcy. Conservative Justice Neil Gorsuch wrote the ruling, which was joined by fellow conservative Justices Clarence Thomas, Samuel Alito and Amy Coney Barrett, as well as liberal Justice Ketanji Brown Jackson. "The Sacklers have not filed for bankruptcy and have not placed virtually all their assets on the table for distribution to creditors, yet they seek what essentially amounts to a discharge. They hope to win a judicial order releasing pending claims against them brought by opioid victims. They seek an injunction 'permanently and forever' foreclosing similar suits in the future," Gorsuch wrote. "And they seek all this without the consent of those affected." Purdue filed for Chapter 11 bankruptcy in 2019 to address its debts, nearly all of which stemmed from thousands of lawsuits alleging that OxyContin helped kickstart an opioid epidemic that has caused more than half a million U.S. overdose deaths over two decades. At issue in the case was whether U.S. bankruptcy law lets Purdue's restructuring include legal protections for the members of the Sackler family, who have not filed for personal bankruptcy. These so-called "non-debtor releases" originally arose in the context of asbestos litigation, but their use has been expanded by companies looking to use such protections as a bargaining chip. The Stamford, Connecticut-based company estimates that its bankruptcy settlement, approved by a U.S. bankruptcy judge in 2021, would provide $10 billion in value to its creditors, including state and local governments, individual victims of addiction, hospitals and others who have sued the company. The Biden administration and eight states challenged the settlement. All the states dropped their opposition after the Sacklers agreed to contribute more to the settlement fund, but the U.S. Trustee - the Justice Department's bankruptcy watchdog - and some individual opioid plaintiffs maintained their opposition. Purdue issued a statement expressing disappointment in the court's decision. "Today's ruling is heart-crushing because it invalidates a settlement supported by nearly all of our creditors - including states, local governments, personal injury victims, schools and hospitals - that would have delivered billions of dollars for victim compensation, opioid crisis abatement, and overdose rescue and addiction treatment medicines," it said. Justice Brett Kavanaugh wrote a dissenting opinion that was joined be fellow conservative Chief Justice John Roberts, and liberal Justices Sonia Sotomayor and Elena Kagan. "Today's decision is wrong on the law and devastating for more than 100,000 opioid victims and their families," Kavanaugh wrote. 'I'LL SEE THEM IN COURT' Several state attorneys general issued statements praising the ruling, with some saying that it would bring Purdue back to the negotiating table. "Purdue and the Sacklers must pay so we can save lives and help people live free of addiction," said Josh Stein, attorney general of North Carolina. "If they won't pay up, I'll see them in court." Purdue, in its statement, said the company "will immediately reach back out to the same creditors who have already proven they can unite to forge a settlement in the public interest." In a statement, members of the Sackler family said they "remain hopeful about reaching a resolution that provides substantial resources to help combat a complex public health crisis." A group comprising more than 60,000 people who have filed personal injury claims stemming from their exposure to Purdue opioid products had told the Supreme Court they support the settlement, including legal immunity for members of the Sackler family. In upholding the settlement in May 2023, the Manhattan-based 2nd U.S. Circuit of Appeals concluded that federal bankruptcy law permits legal protections for non-bankrupt parties like the Sacklers in extraordinary circumstances. It ruled that the legal claims against Purdue were inextricably linked to claims against its owners, and that allowing lawsuits to continue targeting the Sacklers would undermine Purdue's efforts to reach a bankruptcy settlement. The Supreme Court in August 2023 paused bankruptcy proceedings concerning Purdue and its affiliates when it agreed to take up the administration's appeal of the 2nd Circuit's ruling. Lawsuits against Purdue and Sackler family members accused them of fueling the opioid epidemic through deceptive marketing of its pain medication. The company pleaded guilty to misbranding and fraud charges related to its marketing of OxyContin in 2007 and 2020. Members of the Sackler family have denied wrongdoing but expressed regret that OxyContin "unexpectedly became part of an opioid crisis." Sign up here. https://www.reuters.com/legal/us-supreme-court-blocks-purdue-pharma-bankruptcy-settlement-2024-06-27/

2024-06-27 19:41

June 28 (Reuters) - Seven people died and five others were injured when a train collided with a bus at a crossing in Slovakia on Thursday evening, emergency services said. The collision occurred near Nove Zamky, 110 km (68 miles) east of the capital Bratislava, as the international train travelled from Prague to Budapest, state railway company ZSSK said. Slovak and Czech media reported that none of the victims were on the train, which was carrying more than 100 passengers. The cause of the accident was not immediately known. Sign up here. https://www.reuters.com/world/europe/slovak-train-crash-kills-five-people-injures-least-five-others-2024-06-27/

2024-06-27 19:34

SANTIAGO, June 27 (Reuters) - Chilean President Gabriel Boric pitched a decision to raise electricity rates over the next few months as a necessary if unpopular measure that will promote healthier public finances. Power rates had been frozen since 2019, which has led to an accumulated debt of some $6.5 billion, Boric said in an interview on Thursday with Radio Presidente Ibanez, located in southern Chilean city of Punta Arenas. "We have to make this adjustment, which is difficult (but) necessary," he said. He was not thinking of the next election, but instead about the sustainability of public finances, he added. In April, Chilean lawmakers approved an electricity rate stabilization law to pay down accumulated debt, with the first rate hike set for July, rising to a 60% increase by 2025. Earlier this month, the central bank cited the power rate hike for regulated consumers as a major factor in adding 1.45 percentage points to its estimate of inflation for the next 12 months. Boric noted that around 1.5 million families benefit from power subsidies, and that he is working with legislators to expand the benefit. "We're going to look for the best mechanisms, but I think it's also important to be very responsible, because for me the easiest thing would be to say it should be postponed and that the next government will pay for it," he said. "But that would ultimately end up harming Chileans." Sign up here. https://www.reuters.com/world/americas/chiles-president-defends-power-rate-hike-after-five-year-freeze-2024-06-27/