2024-06-27 11:07

WASHINGTON, June 27 (Reuters) - The U.S. Treasury and the U.S. Agency for International Development are calling leaders of multilateral development banks into an urgent meeting on extreme heat and its devastating impact on developing countries, according to Treasury officials. The private, virtual meeting on Thursday morning - the first of its kind - is aimed at finding ways to shift more resources to help countries build climate resilience and adaptation to reduce extreme heat damage amid a summer of record temperatures globally, the Treasury officials told Reuters. While investments to fight climate change have increased dramatically in recent years, much of that growth has gone towards the transition to clean energy sources and reducing carbon emissions, not in helping countries adapt to the harmful impacts, including more severe droughts, wildfires, violent storms and rising ocean levels. As heatwaves grip the world and claim at least hundreds of lives, U.S. Treasury Secretary Janet Yellen will use the meeting to tie the urgent needs of developing countries hardest hit by devastating temperatures to broader work that multilateral development banks are doing to increase their lending capacity to help fight climate change and other global crises. "Extreme weather events, including heat waves, continue to become increasingly severe and frequent, from the East Coast of the United States to India," Yellen said in remarks to the MDBs seen by Reuters. "Mitigating and responding to these events, and addressing climate change more generally, is a key priority for the Treasury Department." Yellen will tell the World Bank and its sister institutions that they should link temperature increases to their assessments of developing countries' climate resilience and adaptation. The meeting will include USAID Administrator Samantha Power, who in March launched a summit and an "action hub" New Tab, opens new tab to focus international donors and finance institutions on providing financing to mitigate extreme heat. The agency is investing over $8 million in heat-resilient schools in Jordan, as extreme temperatures sap learning and shut schools. World Bank Senior Managing Director Axel van Trotsenburg will participate on behalf of World Bank President Ajay Banga, while Inter-American Development Bank (IDB) President Ilan Goldfajn and Asian Development Bank President Masatsugu Asakawa will attend. Heads of the African Development Bank, the European Bank for Reconstruction and Development and the Japan International Cooperation Agency also will participate, Treasury officials said. An IDB source said Goldfajn will emphasize that heat mitigation is a key part of the bank's climate strategy. The bank in 2023 provided $100 million in technical assistance on climate issues and extreme heat, including helping Chile develop strategies to keep cities cooler by using green roofs, green space corridors and reflective infrastructure surfaces. Goldfajn also will discuss the bank's work in helping lead the MDBs to work in a more coordinated fashion to achieve greater scale and impact to fight climate change. That has included the development of innovative financing instruments such as the use of International Monetary Fund reserve assets to back hybrid capital, the source said. Sign up here. https://www.reuters.com/business/environment/us-treasury-usaid-call-development-banks-urgent-talks-extreme-heat-2024-06-27/

2024-06-27 10:59

June 27 (Reuters) - Wildfires above the Arctic Circle in June have unleashed carbon emissions that are the third highest for the time of year in two decades of monitoring, European scientists said on Thursday. As climate change raises Arctic temperatures, wildfires have shifted north where they blaze through boreal forest and tundra, releasing vast amounts of greenhouse gases from carbon-rich organic soils. The latest data from European Union's Copernicus Atmospheric Monitoring Service (CAMS) showed some 6.8 megatonnes of carbon have been released this month, only less than in June 2019 and June 2020, which saw roughly double the emissions. The majority of fires are burning in the Sakha Republic in Russia's Far North. This region experienced extensive wildfires in 2021, with nearly 19 million hectares of forests destroyed. The northeastern Arctic has experienced the largest increase in extreme wildfires over the last two decades. "Fire emissions in the Arctic have been at fairly typical levels for the last three summers but we have observed the recent fires developing following warmer and drier conditions, similar to the widespread wildfires in 2019 and 2020," Mark Parrington, a CAMS senior scientist, said. Wildfires tend to reach a peak in the Northern Hemisphere in July and August. Bordering on the Arctic Ocean in the north, Sakha is prone to extreme weather. The 2021 wildfires' smoke reached the North Pole for the first time in recorded history. Russia state news agency TASS cited Sakha deputy minister of ecology, nature management and forestry Andrey Konoplev as saying more than 160 wildfires in the Republic had affected nearly 460,000 hectares as of June 24. Sign up here. https://www.reuters.com/business/environment/arctic-wildfire-emissions-rise-blazes-sweep-russias-north-2024-06-27/

2024-06-27 10:53

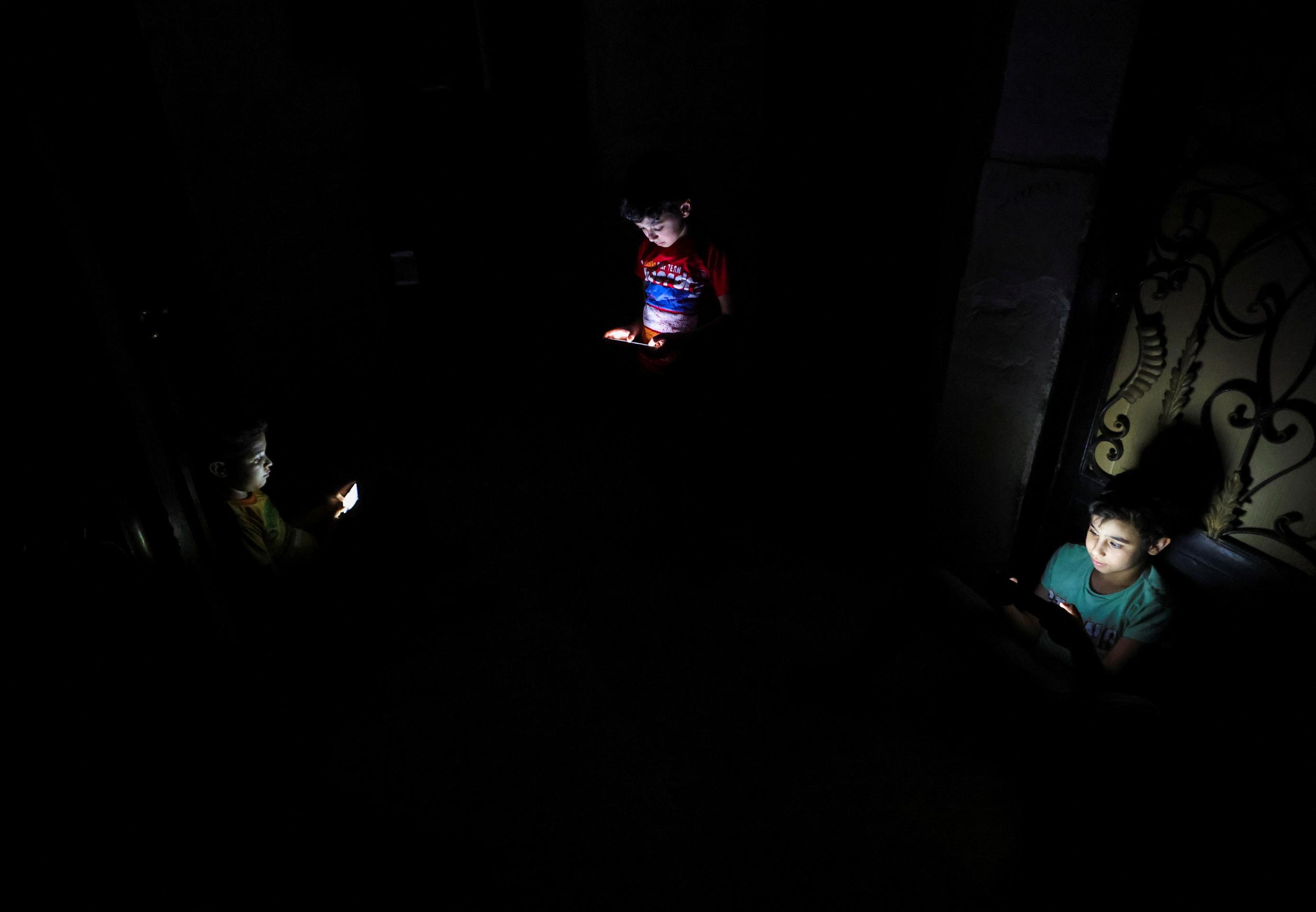

CAIRO, June 27 (Reuters) - One of Egypt's largest fertiliser companies said on Thursday it would partially switch to hydrogen supplies as the country struggles with a shortage of natural gas that has led to widespread blackouts. Abu Qir Fertilizers - along with three other major companies in the fertiliser and chemicals sector, Mopco, Sidi Kerir Petrochemicals, and KIMA - had said this week it would halt production due to the shortage of natural gas, a key input. The closures coincided with a worsening of regular blackouts that Egyptians have experienced since last year, due to a surge in summer power consumption and the shortage of gas. Egyptian Prime Minister Mostafa Madbouly blamed the shortage on a production halt in a neighbouring country, an apparent reference to Israel, and pressures on dollar resources. He said on Tuesday Egypt would spend more than $1 billion to import enough gas to end the blackouts this summer. Egypt, the most populous Arab country, on Wednesday awarded a tender to buy 17 cargoes of liquefied natural gas to help meet demand, and is seeking three more cargoes for delivery in August-September, sources familiar with the matter said. The tender was announced earlier this month and it is not clear if it was included in the plan announced by Madbouly. The closures this week are the second time chemical and fertiliser companies have shut plants this month. The first shutdowns came after the government temporarily reduced gas supplies to plants. However one of the companies, Sidi Kerir Petrochemicals, said in a stock exchange release on Thursday that its gas supply had resumed and its plants would restart on Thursday. Sign up here. https://www.reuters.com/business/energy/egyptian-fertiliser-company-turns-hydrogen-amid-gas-shortage-2024-06-27/

2024-06-27 10:36

LONDON, June 27 (Reuters) - The pound edged up on Thursday, heading for its first weekly gain in a month, as the dollar eased ahead of U.S. inflation data that could prompt the Federal Reserve to cut interest rates more than markets currently anticipate. Sterling was up 0.2% at $1.265, set for a weekly rise of 0.1%, its first weekly increase since the end of May. The euro was flat at 84.60 pence. Friday's report on the core U.S. personal consumptions expenditure index (PCE), which excludes food and energy prices, is expected to show it has moderated to a rate of 2.6% in May, from 2.8% in April. This is the Fed's preferred measure of consumer inflation and could influence traders' thinking on where U.S. rates could go this year. Futures markets show investors are sure the Fed will cut rates at least once this year, with roughly a 50/50 chance of a second cut, largely in line with expectations for the Bank of England. , More immediately, however, the focus for markets and for sterling in particular, are the upcoming elections in France and Britain. Opinion polls right now show the UK is likely to see a Labour government for the first time in 14 years, while in France, there is a strong chance that the far right take a majority of the votes, bringing with it the risk of higher spending that could further undermine France's already fragile finances. "Political risk in Europe is clearly having a bigger impact on the performance of the euro than the pound," MUFG strategists said. "Market participants remain comfortable with the prospect of a big Labour majority which could bring more stability to UK politics and open up the potential for relations between the EU and UK to improve in the coming years," they said. A surprise outcome, such as a poorer showing by Labour or no decisive majority by any party could put pressure on the pound, MUFG said. Sterling is still the best-performing major currency against the dollar so far this year, with a loss of just 0.16%, compared with the yen , which is the worst performer, with a drop of closer to 12%. Sign up here. https://www.reuters.com/markets/currencies/sterling-heads-first-weekly-gain-month-2024-06-27/

2024-06-27 10:30

ROME, June 27 (Reuters) - Italy's Eni (ENI.MI) New Tab, opens new tab said on Thursday it had signed a binding agreement to sell its Nikaitchuq and Oooguruk upstream offshore assets in Alaska to U.S. private company Hilcorp. The value of transaction will be announced at closing, the Italian energy group said. Financial analysts estimated potential proceeds of $428-855 million for the deal with one source pointing to the high end of that range. "This transaction is consistent with Eni's strategy focused on the rationalisation of the upstream activities by rebalancing its portfolio," the state-controlled group added in a statement. Under its business plan, Eni aims to raise 8 billion euros ($8.56 billion) in net proceeds in the 2024-2027 period by selling upstream assets, reducing ownership in its main exploration discoveries and tapping new investors to fund the growth of its low-carbon units. "The news can have positive implications for the stock as it would make it possible to realise the net divestment target for this year together with the disposal of Saipem's stake," Italian broker Equita said in a research note. Eni this month sold 10% of the share capital of energy services group Saipem (SPMI.MI) New Tab, opens new tab, raising 393 million euros. Shares in Eni were up 0.6%, outperforming the Italian blue chip index (.FTMIB) New Tab, opens new tab which was down 0.5% at 1015 GMT. The fields of Nikaitchuq and Oooguruk in 2023 generated a net production of approximately 20,000 barrels of oil per day or 1.2% of Eni's consolidated production. Eni acquired full control of the Oooguruk oilfield in 2019, when it bought from Caelus Natural Resources Alaska LLC the 70% of the asset it did not already own. The field, located in the Beaufort Sea approximately 5 kilometres off Alaska's North Slope coast, has been in production since 2008. The Nikaitchuq offshore oilfield is approximately 13 kilometres northeast of Oooguruk. ($1 = 0.9352 euros) Sign up here. https://www.reuters.com/markets/deals/italys-eni-agrees-sell-two-alaska-upstream-assets-hilcorp-2024-06-27/

2024-06-27 10:29

A look at the day ahead in U.S. and global markets from Mike Dolan With a frenetic week of politicking ahead in the United States, France and Britain, world stock markets held the line on Thursday, sovereign bonds were edgier and the dollar was buoyant. U.S. President Joe Biden and Republican former president Donald Trump face off in a TV debate later today - sounding the klaxon in markets for November's election campaign. A second debate is scheduled for Sept. 10. France holds the first round of its snap parliamentary election on Sunday and Britain heads to the polls next Thursday. Despite some steep single-stock swings this week, the S&P500 (.SPX) New Tab, opens new tab is hovering close to record highs with gains of more than 17% for the year to date. The VIX (.VIX) New Tab, opens new tab volatility gauge remains subdued below 13 and, although November VIX futures are higher at 17.4, they too have slipped back this week. French (.FCHI) New Tab, opens new tab and British (.FTSE) New Tab, opens new tab stocks were slightly lower. Irked by sticky inflation updates from Australia and Canada this week and another heavy diary of new debt sales, U.S. Treasury yields popped up to two-week highs. French 10-year yields and debt spreads over Germany also nudged higher , . While Friday's release of the U.S. PCE inflation gauge tops the week's economic schedule, Treasuries first have to navigate Thursday's latest jobless update and first-quarter GDP revision. But the dollar (.DXY) New Tab, opens new tab remains buoyant around the world, not least against the ailing Japanese yen , which swooned to its weakest level since 1986 at just under 161 per dollar on Wednesday despite repeated warnings from Japanese officials about possible intervention. It steadied earlier today at about 160.50. With uncertainty about the Bank of Japan's next policy moves, some bond market players who participated in meetings with the central bank in June called on it to trim bond purchases in several stages to improve market liquidity, minutes of the meeting released by the BOJ showed on Thursday. The euro and sterling also recovered some lost ground on Thursday ahead of the political events of the week ahead. Sweden's central bank held its key interest rate at 3.75% as expected but, in a dovish twist, it said that if inflation prospects remain the same, the policy rates can be cut two or three more times during the second half of the year. In May, when it cut the policy rate for the first time in eight years, the Riksbank said it saw two more cuts in 2024. In China, the yuan steadied from new year-lows but Chinese stocks fell again - with the CSI300 (.CSI300) New Tab, opens new tab losing another 0.75% after news that China's industrial profits rose at a sharply slower pace in May. Back on Wall Street, it has been a sparky end to the first half for many individual stocks. After Nvidia's sudden plunge over the past week on nerves about the lofty valuations of artificial intelligence stocks, Micron Technology (MU.O) New Tab, opens new tab dropped more than 7% overnight in out-of-hours trading. Although Micron beat estimates for third-quarter revenue on Wednesday, its current-quarter forecast disappointed investors who were upbeat about the chipmaker's performance in the AI boom. Nvidia (NVDA.O) New Tab, opens new tab slipped 2% in sympathy in overnight trade. Shares in Amazon (AMZN.O) New Tab, opens new tab jumped almost 4% earlier on Wednesday, bringing the company's market value above $2 trillion - the fifth U.S. corporation to cross that level. Rivian (RIVN.O) New Tab, opens new tab soared 23% as German automaker Volkswagen (VOWG_p.DE) New Tab, opens new tab said it will invest up to $5 billion in the U.S. electric-vehicle maker. And appliances manufacturer Whirlpool (WHR.N) New Tab, opens new tab surged 17.1% after Reuters reported that German engineering group Robert Bosch is weighing a bid. Elsewhere, the Federal Reserve's annual "stress test" exercise on U.S. banks showed the biggest lenders would have enough capital to withstand severe economic and market turmoil - but firms faced steeper hypothetical losses this year due to riskier portfolios. The exercise found 31 big banks would weather a spike in the jobless rate, severe market volatility, and dives in the residential and commercial mortgage markets and still retain enough capital to continue lending. In South America, Bolivian armed forces pulled back from the presidential palace in La Paz late Wednesday evening and a general was arrested after President Luis Arce slammed a "coup" attempt against the government and called for international support. Key developments that should provide more direction to U.S. markets later on Thursday: * US weekly jobless claims, May durable goods orders, May trade balance, May wholesale/retail inventories, May pending home sales, Q1 GDP revision/corporate profits and Kansas City Fed's June business surveys; Mexico May jobless and trade * Mexican central bank policy decision * International Monetary Fund Managing Director Kristalina Georgieva briefing on conclusion of IMF's Article IV consultation on US economy * European Union summit in Brussels on new EU Commission * US Treasury sells $44 billion of 7-year notes * US corporate earnings: Nike, Walgreens Boots Alliance, McCormick Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-2024-06-27/