2024-06-24 12:04

MUMBAI, June 24 (Reuters) - Indians bought a record 500,000 metric tons of sunflower oil for June delivery, as competition between leading suppliers Russia and Ukraine made it cheaper than soyoil and palm oil, two leading buyers and a customs official told Reuters. Higher sunflower oil purchases by the world's biggest importer of vegetable oils will help to reduce sunflower oil inventories in the Black Sea region and lift sunoil prices. A leading buyer who declined to be named said sunoil was trading at a discount to soyoil and even palm oil, which was tempting Indian buyers especially given robust demand in southern states. A few weeks ago, crude sunoil was available at $940 a metric ton, including cost, insurance and freight (CIF), in India for June delivery, while soyoil and palm oil were offered around $1,015 and $950 a ton, respectively, dealers said. Sunoil usually holds a premium of more than $100 per ton over soyoil and palm oil, Rajesh Patel, managing partner at edible oil trader and broker GGN Research, said. Russia and Ukraine, as well as another big supplier Argentina, were aggressively competing and offered sunoil at a lower price than other oils, another buyer based in Hyderabad said. He has reduced palm oil and soyoil purchases to make space for sunoil. The currencies of Russia and Ukraine have depreciated since the war started in February 2022, allowing them to offer sunflower oil at competitive prices in dollar terms, the buyer said. Russia and Ukraine account for more than 70% global shipments of sunoil. Around 320,000 metric tons of sunflower oil have been discharged at various Indian ports so far this month, said a custom official, who also declined to be identified as he was not allowed to speak to media. India on an average bought 250,000 tons of sunflower oil every month in the last marketing year, mostly from Black Sea region. The industry will need time to refine and distribute the 500,000 tons of sunflower oil imported in June, which will reduce imports in July, the Hyderabad based buyer said. In January 2023, India had imported a record 461,458 tons of sunflower oil. India buys palm oil mainly from Indonesia, Malaysia and Thailand, while it imports soyoil from Argentina, Brazil, and United States. Sign up here. https://www.reuters.com/markets/commodities/india-buys-record-amount-sunoil-ukraine-russia-fight-market-share-cuts-price-2024-06-24/

2024-06-24 11:39

HONG KONG, June 24 (Reuters) - Shein confidentially filed papers with Britain's markets regulator in early June for a potential London listing, two sources said, as the online fast-fashion retailer moves ahead with what could one of the largest IPOs globally this year. The China-founded company, which was valued at $66 billion in a fundraising round last year, started engaging with its financial and legal advisors to explore a listing on the London Stock Exchange early this year, Reuters reported in May, citing sources. A spokesperson for Shein declined to comment. The Financial Conduct Authority (FCA), the UK markets watchdog, did not immediately respond to Reuters request for comment. Both the sources, who have knowledge of the deal, declined to be named as they were not authorised to speak to the media. It is not immediately clear when Shein, known for its $5 tops and $10 dresses, plans to launch the initial public offering (IPO). Shein has updated China's securities regulator officially about its change of listing venue, said the sources. The company however has yet to receive a nod from the China Securities Regulatory Commission (CSRC), one of them said. The CSRC did not immediately respond to a Reuters request for comment. Shein's London filing marks a shift from its long-running U.S. IPO plan, which has run into obstacles at home and abroad, Reuters has reported. The group confidentially filed for an IPO with the U.S. Securities and Exchange Commission in November and approached the CSRC to seek Beijing's nod in the same month, sources have said. The CSRC earlier this year informed Shein that the regulator would not recommend a U.S. IPO due to the company's supply chain issues, Reuters has reported. Sign up here. https://www.reuters.com/business/retail-consumer/fast-fashion-retailer-shein-filed-london-listing-early-june-sources-say-2024-06-24/

2024-06-24 11:35

ROME, June 24 (Reuters) - Italian energy group Eni (ENI.MI) New Tab, opens new tab expects to complete the sale of a minority stake in its biofuel unit Enilive by the end of 2024, Chief Executive Claudio Descalzi said on Monday. "The (sale) plan is in progress, there are still issues that are being discussed... our goal is to close by the end of this year, (talks) have accelerated," Descalzi said, when asked about the sale at a conference organised by daily Il Giornale in Milan. Reuters reported in April that the sale of minority stakes in both Enilive and bioplastic unit Novamont could fetch around 1.3 billion euros ($1.4 billion) in total and be completed by year-end. The disposal of a minority stake in the biofuel unit is part of Eni's broader strategy to create separate entities dedicated to specific businesses - called 'satellites' - and develop them with the help of deep-pocketed investors. "When we announced the strategy (in March) we were thinking (to clinch a deal) a little further ahead, but I think there is a good chance we will close (an agreement on) Enilive, with the same approach as Plenitude, by the end of this year," Descalzi said. Eni in March sold a minority stake in its retail and renewable unit Plenitude to Swiss asset management Energy Infrastructure Partners in a deal that has valued its unit around 10 billion euros ($10.7 billion), including debt. ($1 = 0.9328 euros) Sign up here. https://www.reuters.com/business/energy/italys-eni-likely-finalise-enilive-stake-sale-by-year-end-ceo-says-2024-06-24/

2024-06-24 11:31

June 24 (Reuters) - Americans from New York to Washington may finally get a reprieve on Monday from the oppressive heat wave of the past week, although sizzling temperatures threaten much of the Southeast and Southwest, weather forecasters said. The heat wave will likely peak in the Southwest, Mid-South and Plains early this week, with heat index readings exceeding 110 degrees Fahrenheit (43 Celsius) in some places, the National Weather Service (NWS) said. Meanwhile, the Upper Midwest can expect severe thunderstorms on Monday while the Southwest may get monsoon-like conditions due to moisture coming from the remnants of Tropical Cyclone Alberto that could produce flash flooding. Although the final day of the heat wave in the New York-Washington corridor was forecast for Sunday, heat advisories were still in effect throughout the country. "Instead of cooler, it may be appropriate to say not quite as hot. In DC tomorrow we're still looking at a high temperature of 88 to 90 degrees (31 to 32 C)," said Rich Bann, a meteorologist with NWS's Weather Prediction Center. "In many ways it still does pose hazards. That's why we continue to message the idea of stay hydrated, stay cool, and worry about others who don't have air conditioning," Bann said. More than 100 million people across the U.S. were under heat warnings on Sunday, when temperatures surpassed 100 degrees Fahrenheit (38 degrees Celsius) in many places. Palm Springs, California, hit a high of 112 F (44 C) on Sunday while Las Vegas recorded a high of 109 F (43 C). Death Valley, a remote part of the California desert that is 282 feet (86 meters) below sea level and often has the nation's high temperature, reached 121 F (49 C) on Sunday. Monsoon conditions may help cool off parts of the scorching Southwest, Bann said. Climate change has fueled dangerous heat waves across the Northern Hemisphere and will continue to deliver dangerous weather for decades to come, research shows. Extreme heat is suspected of causing hundreds of deaths across Asia and Europe as it has taken over cities on four continents. More than 1,000 have died during Haj, the annual pilgrimage to Mecca in Saudi Arabia, amid sweltering temperatures this year, according to a Reuters tally. Sign up here. https://www.reuters.com/world/us/us-northeast-may-finally-get-relief-punishing-heat-wave-2024-06-24/

2024-06-24 11:30

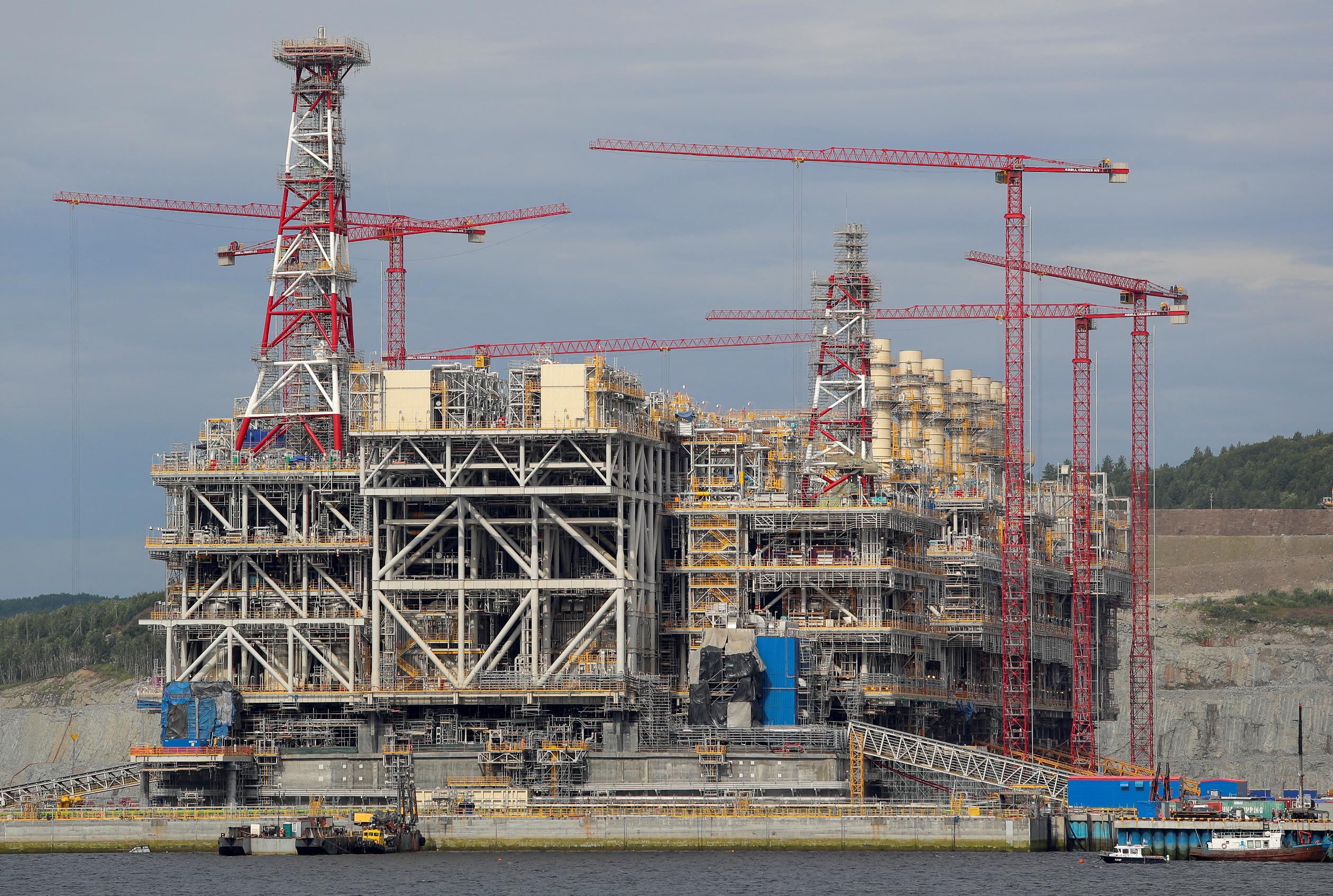

BRUSSELS, June 24 (Reuters) - The European Union will add 27 vessels, including oil and liquefied natural gas tankers, to its list of entities under sanctions as part of its latest measures against Russia, two sources familiar with the matter said on Monday. EU countries adopted the 14th package of sanctions against Russia earlier on Monday. These included a ban on trans-shipments of Russian LNG off EU ports that will take effect after 9-month transition period. The full details will be published later in the EU's Official Journal. The latest list, seen by Reuters, includes 19 tankers, including two Russian floating gas storage units (FSU) - the Saam and Koryak - as well as ships run by Russia's state-owned shipping firm Sovcomflot. Owned by Russia's top LNG exporter Novatek, the two ships - already under US sanctions - were meant for trans-shipping LNG from its new Arctic LNG 2 project. Russia has a shortage of ice-class LNG ships and relies on trans-shipments to keep those it has in the Baltic Sea area. The list also includes ships that have transported defence equipment for Russia as well as the Enisey cargo ship, which the EU says has moved stolen Ukrainian grains. Moscow has been more adept than western powers expected at circumventing sanctions, including the Group of Seven (G7) nations price cap on Russian oil. Russian oil exporters are charging more for their oil in major market India than at any time since the war in Ukraine started as a growing number of shippers and intermediaries take part in the trade. The impact of the listing may not be immediate given the vessels already operate around western restrictions. However, it is likely to complicate Russia's ambitions to gain a fifth of the global LNG market share by 2030-2035 from around 8% now. “If you’re looking for spare parts, engineers, insurance, financing, in some cases local pilots - anything that involves some contact with the EU in the broadest sense, including countries mirroring EU sanctions - this all will become more difficult. For instance, navigation, safety and security equipment,” Nicoleta Tuominen, a partner at Dentons law firm, told Reuters. “If an EU company developed such a system, others could fix it, but not to the same standard. The EU does not have the extra-territorial reach of US sanctions nor their leverage over certain flag states. Tankers are put on the sanctions list because ownership in that sector is elusive and at least this way, you might see some impact at some point.” The following is a list of vessels to be added to the EU's official journal: Sign up here. https://www.reuters.com/business/energy/eu-place-sanctions-19-energy-related-ships-including-lng-vessels-2024-06-24/

2024-06-24 11:26

LONDON, June 24 (Reuters) - The pound edged higher against a broadly softer dollar on Monday, as markets looked beyond Britain's upcoming general election New Tab, opens new tab and instead set their focus on the outlook for monetary policy. The pound was last up almost 0.2% against the dollar at $1.2664, having fallen to $1.2622 on Friday, its lowest level since May 15. Britain heads to the voting booth on July 4 but with polls steady and signalling the opposition Labour Party is likely to win a majority, markets are showing little concern about the outcome. "Given the stability in the polls, a Labour victory looks like a foregone conclusion," said Simon Harvey, head of FX analysis at Monex. "There's not much room for fiscal manoeuvre whoever comes in so it doesn't make the UK election a major market event." Instead, much of the focus remains on the outlook for monetary policy. The Bank of England last week held its main interest rate steady at a 16-year high of 5.25%, but the prospect of a future rate cut moved closer as some policymakers said their thinking was now "finely balanced". "We believe the Bank of England took a step in the direction of an August rate cut last week," ING FX strategist Francesco Pesole said. Money markets imply around a 50% chance of a quarter-point rate cut at the central bank's August meeting. "We see the Bank of England joining the global easing cycle but they are starting from a higher base than others," Monex's Harvey said, citing the European Central Bank and Swiss National Bank, who have both already lowered interest rates in this global easing cycle. "We are bullish on sterling but we prefer to express it in crosses just because the dollar dynamic is posing a lot of uncertainty," Harvey added. The U.S. dollar index , which measures the currency against six others, was down 0.3% on Monday but remained close to an almost eight-week high reached last week as the Federal Reserve's more patient rate outlook continues to diverge from peers. The pound was down around 0.2% to 84.75 pence per euro its weakest level in two weeks. Sign up here. https://www.reuters.com/markets/currencies/sterling-edges-up-against-softer-dollar-2024-06-24/