2024-06-21 05:33

MUMBAI, June 21 (Reuters) - The Indian rupee inched higher on Friday recovering from a decline to its lifetime low in the previous session that was spurred by weakness in the Chinese yuan and likely dollar outflows. The rupee was at 83.61 against the U.S. dollar as of 10:00 a.m. IST, up from its previous close at 83.6525. The currency fell to a record low of 83.6650 on Thursday. The offshore Chinese yuan fell to 7.29 on Friday, its lowest in seven months, after a lower central bank guidance for the currency on Thursday spurred market speculations that authorities may be prepared to see it weaken. The rupee's decline to a record low came due to pressure from "multiple factors, including a weaker yuan, outflows and broad dollar strength against G10 currencies", said Apurva Swarup, vice president at Shinhan Bank. Traders pointed to outflows on account of UK-based Vodafone Group's (VOD.L) New Tab, opens new tab bigger-than-planned 18% stake sale in India's Indus Towers amid factors that hurt the local currency. On Friday, mild dollar sales from foreign banks helped the currency tick higher, a foreign exchange trader at a state-run bank said. The rebalancing of an FTSE equity index is expected to draw $250 million in inflows, according to Nuvama Alternative & Quantitative Research's estimate. "Likely dollar sales by the RBI (Reserve Bank of India), inflows on account of inclusion in the J.P. Morgan EM Bond Index and rebalancing of the FTSE Index could cap losses (for the rupee)," HDFC Bank said in a note. "We expect the pair to slip back into the 83.0-83.50 range over the coming month." The dollar index was near 105.6 after rising 0.4% on Thursday boosted by a second successive rate cut at the Swiss National Bank and Bank of England's signals for a rate reduction in August. Sign up here. https://www.reuters.com/markets/currencies/rupee-ticks-up-after-weaker-yuan-triggers-fall-record-low-2024-06-21/

2024-06-21 05:31

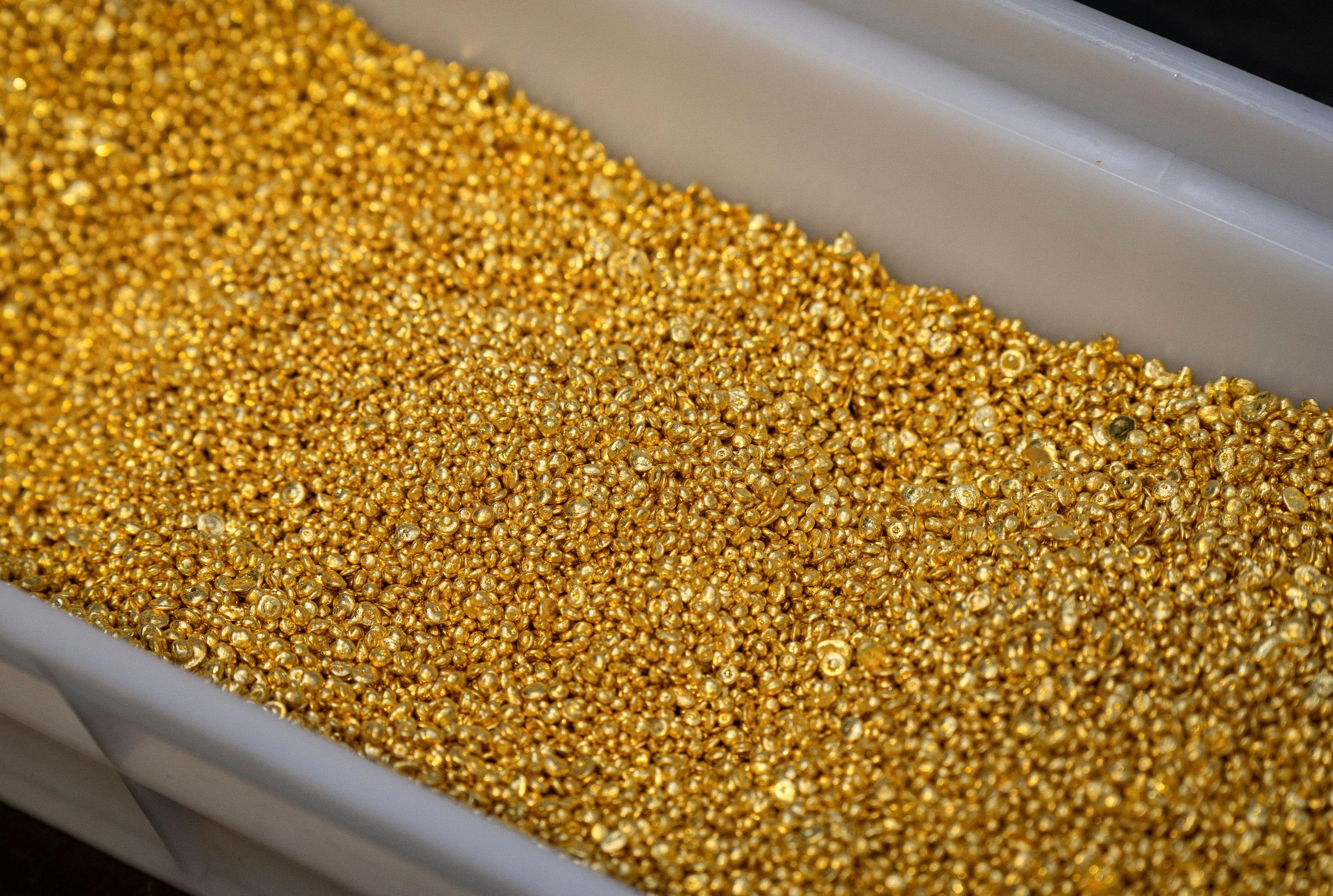

US business activity inches up in June Silver, platinum head for weekly gains Dollar scales seven-week high June 21 (Reuters) - Gold prices dropped more than 1% on Friday, weighed down by a stronger dollar and higher bond yields after data showed strong U.S. business activity, while auto-catalyst metal palladium jumped to a one-month high. Spot gold was down 1.7% at $2,319.95 per ounce as of 01:47 p.m. ET (1747 GMT). U.S. gold futures settled 1.6% lower to $2,331.20. "We're likely seeing a reaction to the bump in interest rates this morning and the continued strong dollar that is in the aftermath of the data that came out earlier," said Bart Melek, head of commodity strategies at TD Securities. U.S. business activity crept up to a 26-month high in June amid a rebound in employment. Data on Thursday showed first-time applications for U.S. unemployment benefits fell moderately last week. The dollar rose rose 0.2% to its highest level in more than seven weeks, making gold more expensive for other currency holder, while yield on 10-year U.S. Treasury notes edged higher after U.S. data. Traders are currently pricing in a 63% chance of Fed rate cut in September, little changed from late Thursday, according to CME FedWatch Tool. Lower interest rates reduce the opportunity cost of holding non-yielding bullion. Meanwhile, spot palladium was up 3.2% at $953.17 per ounce after rising as much as 11.2% to $1,027.04 earlier in the session. "There has been some significant palladium ETF buying recently which has caused a short-term physical shortage and brought the front of the forwards market into backwardation," said Tai Wong, a New York-based independent metals trader. "That has created some havoc on the EFP (Exchange of futures for physical) market which is thin to begin with and caused a lot of volatility and short-covering. I expect this volatility to continue for a few more days." Elsewhere, platinum was up 1.8% at $995.78 per ounce, while silver fell 3.7% to $29.57, but both metals were heading for a weekly gain. Sign up here. https://www.reuters.com/markets/commodities/gold-set-weekly-gain-us-rate-cut-optimism-geopolitical-woes-2024-06-21/

2024-06-21 04:34

TOKYO, June 21 (Reuters) - Japan will extend a gasoline fuel subsidy until the end of the year, Prime Minister Fumio Kishida said on Friday, and will temporarily reintroduce relief on utility bills over the summer, as the unpopular premier seeks to support households. The gasoline subsidy has been available to fuel wholesalers since January 2022 and was introduced to lower retail prices at gas stations nationwide. It has been extended seven times, previously to the end of June, despite some criticism of its impact on public finances. The relief on household utility bills had been in place until last month. Kishida said the government decided to resume it for three months from August "to counter the extreme summer heat" but as the measures go against decarbonisation they "shouldn't be carried on endlessly". The fuel subsidy and relief on electricity and gas bills would reduce the consumer inflation rate by more than 0.5 percentage point a month on average, he said. Kishida said the government would also consider additional cash handouts to pensioners and low income households, without clarifying how it would finance them. On macroeconomic policy, Kishida said the government has a goal of achieving a 1,000 trillion yen ($6.29 trillion) nominal gross domestic product by around 2040. Nominal GDP totalled 592 trillion yen in 2023. Kishida said Japan needs to improve productivity and expand the participation of women and elderly people in the workforce in order to achieve more than 1% real economic growth a year in the 2030s because an accelerated decline in the country's population risks curbing growth. ($1 = 158.8900 yen) Sign up here. https://www.reuters.com/markets/asia/japan-extend-gasoline-subsidies-year-end-nhk-reports-2024-06-21/

2024-06-21 04:33

A look at the day ahead in European and global markets from Kevin Buckland King dollar is exerting its authority to end the week at new heights. The yen, in particular, has been put in its place, sinking past the closely watched 159 per dollar level last seen in late April, when Tokyo was forced to spend a chunk of money on currency intervention to yank it back from the brink. The catalyst for the greenback's overnight surge wasn't any strong data that would have compelled the Federal Reserve to keep rates in place for longer. In fact, the latest round of figures on housing and the labour market were invariably soft, and economists forecast another weak reading for the U.S. leading index later on Friday. Instead, it's that by contrast to major global central banks, the Fed looks positively hawkish. Even the Bank of Japan, an outlier in hiking rates when its peers are cutting or standing by to cut, came across as dovish last week by kicking a decision on quantitative tightening to its July meeting. The Bank of England now looks poised to start cutting in August, and the Swiss National Bank is setting the pace with two consecutive reductions. The Fed could still hardly be called a hawk among doves. More like the dove with the sharpest claws. The dollar's surge against major currency rivals on Thursday was enough to put it on course for a third straight winning week, but only barely. A host of data releases over the European day could easily swing the pendulum. Britain, France, Germany and the euro area as a whole have flash PMI readings, and the UK sees retail sales as well, which could have benefitted from a warmer May. Away from currency markets, there's been little support from the easy policy outlook. Equities in Asia at least are set to end the week with a whimper, with a flat performance for Japan's Nikkei looking like the best market in the region. Chip stocks have been sold off everywhere, arguing for more of the same when Europe gets under way. Considering the 1.5% or so gains so far this week across the FTSE, DAX and STOXX 600, there's certainly room to fall. Key developments that could influence markets on Friday: - UK flash PMIs (June), retail sales (May) - France, Germany, euro zone flash PMIs (June) - US flash PMIs (June), leading index (May) Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-2024-06-21/

2024-06-21 04:30

June 21 (Reuters) - Food inflation in India, driven by supply-side factors like adverse weather affecting crops, has remained at around 8% year-on-year since November 2023 and is unlikely to ease any time soon, despite early arrival of monsoon rains and forecasts of above-normal rainfall. Elevated prices of food, which accounts for nearly half of the overall consumer price basket, has kept headline inflation above the central bank's target of 4%, preventing it from cutting interest rates. WHAT IS DRIVING FOOD INFLATION HIGHER? A drought last year and an ongoing heat wave have significantly reduced the supplies of foods like pulses, vegetables, and cereals. Curbs on food exports and reducing tariffs on imports have had little effect. Although vegetable supplies generally decrease during the summer months, this year's decline is much more pronounced. Temperatures in nearly half of the country are soaring 4-9 degrees Celsius above normal, spoiling harvested and stored vegetables and hindering the planting of crops such as onions, tomatoes, eggplant and spinach. Farmers usually prepare vegetable seedlings before the June-September monsoon rains and transplant them to the main fields afterward. However, this year, the excessive heat and water scarcity have disrupted both seedling planting and replanting, further exacerbating the shortage of vegetables. WHY HAS THE MONSOON NOT HELPED? The annual monsoon, on which India's agricultural output is dependent, arrived early in the southern tip of the country and advanced swiftly to cover the western state of Maharashtra ahead of schedule. However, this initial momentum soon waned, resulting in a 18% rainfall deficit so far this season. Besides triggering the heat wave, the weakened monsoon has delayed the planting of summer-sown crops, which can only proceed at full pace with sufficient rainfall. Despite June's patchy rains, India's weather office has forecast above average rainfall for the rest of the monsoon season. WHEN WILL PRICES COME DOWN? Vegetable prices are expected to fall from August onwards if the monsoon revives and covers the entire country as per the usual schedule. However, floods or a prolonged dry spell in July and August could disrupt the production cycle. Prices of milk, cereals and pulses are unlikely to decrease soon due to tight supplies. Wheat supplies are dwindling, and the government has announced no plans to import grain, which will allow wheat prices to rise further. Rice prices may increase as the government on Wednesday raised the minimum support price, or buying price, of paddy rice by 5.4%. Supplies of pulses, such as pigeon peas, black matpe and chickpeas, were severely affected by last year's drought, and will not improve until the new season crops are harvested. Sugar prices are likely to remain high as next season's production is expected to fall due to lower planting. CAN GOVERNMENT INTERVENTION HELP? Yes, government interventions such as restricting exports and easing imports can help bring down the prices of some food commodities. However, the government can do little when it comes to prices of vegetables, which are highly perishable and difficult to import. The government has implemented various measures to bring down food prices by restricting exports of sugar, rice, onions and wheat. However, these measures have proved unpopular among farmers, and led to losses in the general election for the ruling Bharatiya Janata Party in rural areas. State elections are approaching in Maharashtra and Haryana, where a significant farmer population will decide the outcome. The central government has been trying to win back farmers' support and may allow prices of some crops to rise instead of taking aggressive measures before the elections, which are due in October. Sign up here. https://www.reuters.com/world/india/why-food-prices-will-remain-high-india-2024-06-21/

2024-06-21 04:07

Modi's ruling party trying to claw back support among farmers India likely to consider easing export curbs on rice, onion Moderate increase in state-set crop prices won't satisfy farmers India faces tricky balancing act in managing food inflation MUMBAI/NEW DELHI, June 21 (Reuters) - Indian Prime Minister Narendra Modi is facing a policy conundrum after losing ground in the recent election: how to control food inflation without resorting to export curbs and more imports - steps that have angered farmers, a sizeable voting bloc. While Modi managed to retain power in a coalition government, his Bharatiya Janata Party (BJP) faces provincial elections later this year in two key agricultural states - Haryana and Maharashtra - that have strong farm lobbies. Losses in the two states could diminish the BJP's stature in the newly formed coalition government, weakening Modi as he seeks the consent of allies for policy initiatives for the first time since he took office a decade ago. "It is true that farmers have been angry with the government," said Rampal Jat, national president of the Kisan Mahapanchayat, or farmers' council. "Knee-jerk policy decisions to ban exports and allow cheaper imports into the country have undercut meagre agricultural incomes." To hold down consumer prices, Modi's administration clamped down, starting in 2022, on exports of staples such as rice, wheat, sugar and onions. It also lowered tariffs on pulse and vegetable oils, allowing cheaper imports. That did not go down well in the countryside, where more than 45% of India's 1.4 billion people make a living from agriculture. The BJP, which held 201 rural constituencies in the 543-member parliament, retained only 126 of them in the mammoth April-May election, according to a voter analysis. Jat said farmers were made a scapegoat for the government's inability to manage inflationary pressures. Since higher inflation was one of the factors that helped Modi sweep to power for the first time in 2014, his administration has focused on taming prices and used export curbs as a handy tool to rein in inflation. Still, food inflation has remained at around 8% year-on-year since November 2023, largely because of higher fruit and vegetable prices, pushing up overall retail inflation above the central bank's medium-term target of 4%. COURSE CORRECTION Ahead of assembly elections in Haryana and Maharashtra, the BJP will try to woo growers by trying to tilt the balance in favour of farmers, analysts and industry experts said. "There is a realisation that farmers cannot be endlessly penalised for higher inflation, and consumers will have to feel the pinch if prices go up," said Harish Galipelli, director of ILA Commodities Pvt Ltd. "Consumers, especially urban consumers, have deeper pockets these days but rural India is suffering." India's food ministry did not respond to a request for comment. Some decisions are imminent, like easing export curbs on at least two commodities to begin with, the experts said. Other longer-term measures could also be considered, like boosting crop yields and raising government-mandated support prices by bigger margins, they said. The government announced on Wednesday that it would increase support prices that are offered for summer-sown crops, but the raises were unlikely to placate farmers. Last year, the government raised the rice purchase price by 7%, and this year's increase is only about 5.4%, so it is disappointing, said Ravindra Kajal, a rice grower from Haryana state. "My feeling is that the government will open up rice and onion exports," said Ashok Gulati, India's leading farm economist. "Because rice stocks are three and a half times the required target and there is a forecast for good monsoon rains this year, the government should soon take a call on allowing exports," Gulati said. Despite the increase in stocks, rice prices are around 7% higher than last year, reflecting the increase in government-set support prices announced at the start of the sowing season in 2023. As the El Niño weather pattern threatened to curtail monsoon rains last year, India, the world's biggest rice exporter, banned overseas shipments of non-basmati white rice and imposed curbs on other grades. Now, state granaries are brimming over with rice stocks and the government is examining all possibilities, including exports, to cut back inventories, said a government source who declined to be identified in line with official rules. "There is a valid reason for allowing rice exports, and we have urged the government to look into this," said Prem Garg, president of the Indian Rice Exporters Federation. ANGRY OVER ONIONS In Maharashtra's onion-growing belt, the BJP lost all eight seats - reflecting anger over export curbs on one of the most ubiquitous food items in Indian households. To mollify farmers, Maharashtra Chief Minister Eknath Shinde said last week he would request the federal government to remove curbs on onion exports and instruct state agencies to buy the crop at government-set support prices. Because of export restrictions, farmers could not recover production costs, said Uttam Kahandal, an onion grower who said that for the first time in two decades, he did not vote for the BJP. Other than export curbs on onions, lower prices of cotton and soybean have fanned anger against the BJP in Maharashtra. Modest crop procurement rates have also hurt farmers in the state. During the ten years of Modi's rule, government-fixed minimum purchase prices for soybean and cotton rose 80% and 79% versus 175% and 115% over the previous decade, government data showed. "If the new government fails to make a serious effort to respond to agrarian distress, it should be willing to sit in the opposition in 2029," said Devinder Sharma, a farm policy expert, referring to the next general election. Sign up here. https://www.reuters.com/world/india/after-electoral-setback-modi-may-be-forced-amend-indias-food-policy-2024-06-21/