2024-06-20 04:35

A look at the day ahead in European and global markets from Ankur Banerjee British inflation may have returned to its 2% target for the first time in nearly three years, setting the stage for the Bank of England to cut interest rates - just not on Thursday. An unchanged rate decision will be a disappointment for Prime Minister Rishi Sunak looking for an economic boost ahead of the general election next month. His Conservative Party is around 20 points behind the opposition Labour Party in pre-election polls. Wage growth and underlying pricing pressure remain a concern for the central bank, which has said a return of inflation to its target is not enough on its own to start cutting interest rates. Data on Wednesday showed annual consumer price inflation in May came in at 2%, slowing from April's 2.3%, although services price inflation, which the BoE thinks gives a better picture of medium-term inflation risk, was 5.7%, above estimates. So, things under the hood look murky, leaving Bank of England Governor Andrew Bailey little choice but to wait out, with markets fully pricing in a rate cut only in November. Bailey opened the door early last month to a rate cut, saying he was "optimistic that things are moving in the right direction" but data since then has been less assuring. Almost all 65 economists polled by Reuters last week expect the bank to move in August, with traders pricing in a 30% chance of that happening. With Bailey and his colleagues cancelling public events when Sunak called the election on May 22, markets have had very little to gauge what the central bank is thinking and a surprise could well be in store. Economist polled showed there will however be no surprise should the Swiss National Bank trim its key policy rate by 25 basis points later in the day in the wake of steady inflation. Norway's central bank is widely expected to stand pat. Futures contracts indicate a subdued start to European bourses after Asian stocks took a breather following a tech rally driven by U.S. chipmaker Nvidia (NVDA.O) New Tab, opens new tab. Focus will again be on French markets after the European Commission said on Wednesday that France and six other countries should be disciplined for running budget deficits in excess of EU limits. French stocks and the euro have been under pressure as political uncertainty in France and the possibility of a far-right-dominated parliament sapped sentiment in the wake of President Emmanuel Macron's decision to call a snap vote. Key developments that could influence markets on Thursday: Economic events: Policy decision from Bank of England, Norway's Norges bank and the Swiss National Bank Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-2024-06-20/

2024-06-20 04:11

MUMBAI, June 20 (Reuters) - The Indian rupee is likely to open largely unchanged on Thursday amid a decline in Asian peers and a widely held expectation that the currency will not drop below a key level. Non-deliverable forwards indicate the rupee will open at 83.44-83.46 to the U.S. dollar, compared with 83.4550 in the previous session. The rupee hit an intraday high of 83.3350 on Wednesday before changing course. With the "mild" rally on the currency in the wake of inflows "looking done", it was back to watching the 83.50-83.55 level, a currency trader at a bank said. The Reserve Bank of India has broadly defended that range to keep the rupee from dipping below the 83.5750 all-time low. "With the RBI decisive on its defence, you would think the way to play is to be short (on the dollar/rupee). And we have the index inclusion coming up." Foreign inflows into Indian bonds will hit a decade-high of $2 billion around June 28 when they will be included in a widely tracked JPMorgan index. Asian currencies were down on the day and the dollar inched higher against a basket of its major peers. U.S. markets were closed on Wednesday. The outlook of Asian currencies largely centres on what happens to U.S. interest rates. Following soft inflation data and tentative signs that growth in the United States may be slowing, investors are back to pricing in two rate cuts by the Federal Reserve this year. The odds of a September Fed rate cut have now climbed to more than 60%. "Next week we'll get a very subdued PCE (Personal Consumption Expenditures) deflator report, and that will harden the build of a rate cut discount for September," ING Bank said in a note. KEY INDICATORS: ** One-month non-deliverable rupee forward at 83.50; onshore one-month forward premium at 7.25 paise ** Dollar index up at 105.25 ** Brent crude futures up 0.1% at $85.1 per barrel ** Ten-year U.S. note yield at 4.25% ** As per NSDL data, foreign investors bought a net $188.8mln worth of Indian shares on June 18 ** NSDL data shows foreign investors bought a net $264.5mln worth of Indian bonds on June 18 Sign up here. https://www.reuters.com/markets/currencies/rupee-squeezed-by-weak-asia-be-likely-boosted-by-positional-flows-2024-06-20/

2024-06-20 03:12

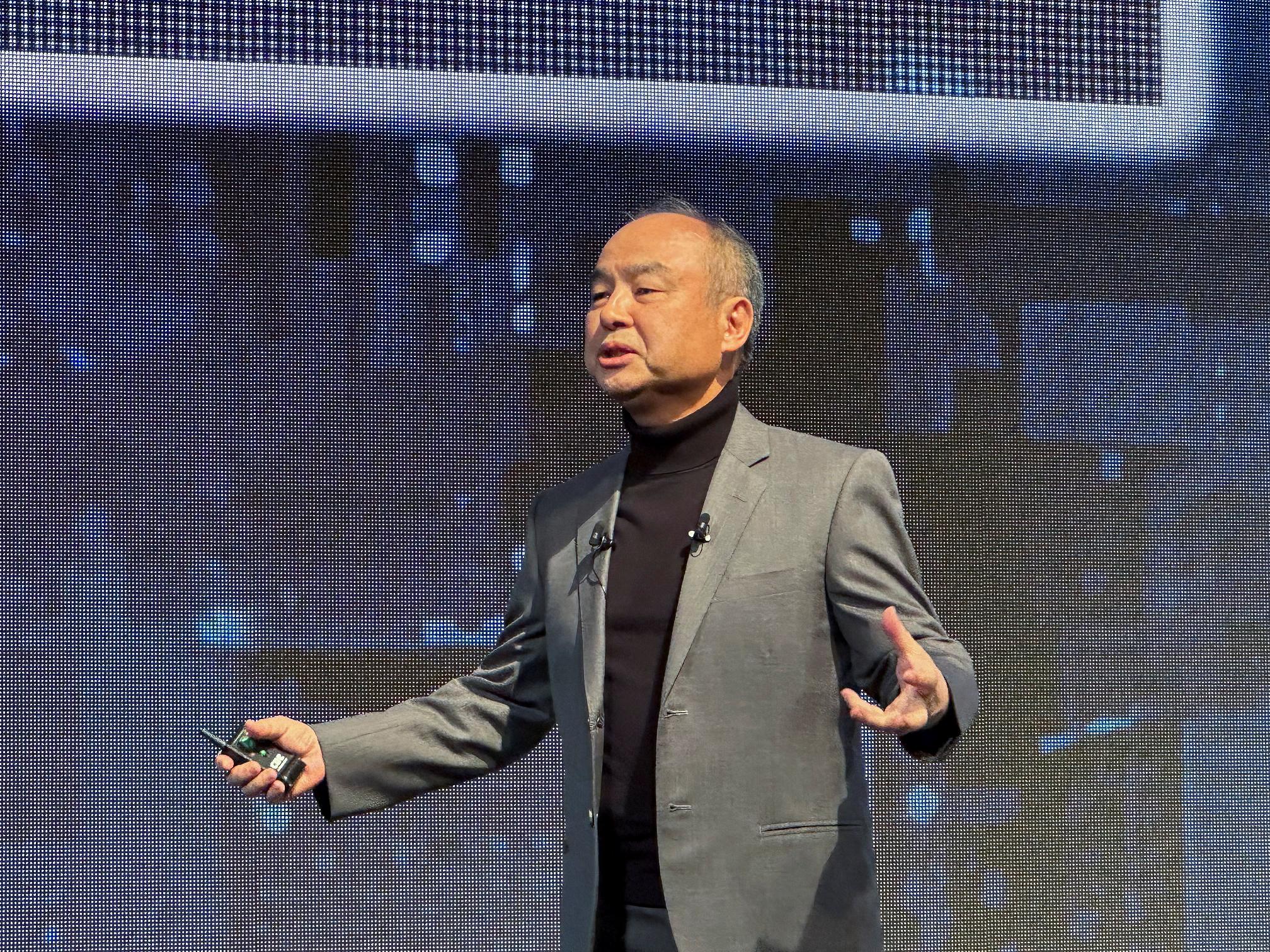

TOKYO, June 20 (Reuters) - Japan's SoftBank Group (9984.T) New Tab, opens new tab will ramp up its power generation business primarily in the United States to supply power to generative artificial intelligence projects worldwide, founder Masayoshi Son said on Thursday. SoftBank Group-backed SB Energy develops and operates renewable electricity businesses across the United States. Son also said the group will look for "seeds of new evolution" of investments, mainly outside Japan. He was speaking at the annual shareholder meeting of the group's telecom arm SoftBank Corp (9434.T) New Tab, opens new tab, where he is a board member. Sign up here. https://www.reuters.com/technology/artificial-intelligence/softbanks-son-will-ramp-up-us-power-business-generative-ai-2024-06-20/

2024-06-20 03:00

SYDNEY, June 20 (Reuters) - A bitcoin exchange-traded fund (ETF) launched on Australia's main stock market for the first time on Thursday as fund managers debut products to satisfy investors returning to cryptocurrency markets following a boom in prices. The VanEck Bitcoin ETF (VBTC.AX) New Tab, opens new tab launched with around A$990,000 ($660,429) in assets on the Australian Securities Exchange and is the culmination of over three years of negotiations with operator ASX (ASX.AX) New Tab, opens new tab. The fund will not own bitcoin directly, but invest in the U.S.-listed VanEck Bitcoin Trust (HODL.Z) New Tab, opens new tab, which launched in January. VanEck's European subsidiary also manages 12 similar cryptocurrency funds. Investors have poured billions of dollars into cryptocurrency ETFs in the U.S. after regulators approved several products in January. Hong Kong followed in April with the launch of six funds, although interest there has been more muted. VanEck Australia said in March the greenlight from U.S. regulators triggered a jump in requests from brokers and financial advisers for similar products. The price of bitcoin has almost tripled since 2023, although prices have stalled since a peak in March. A competitor exchange in Australia run by the local subsidiary of CBOE Global Markets (CBOE.Z) New Tab, opens new tab already hosts several bitcoin ETFs. However, the VanEck Bitcoin ETF is the first fund to launch on the main exchange, where it will share the tickertape with some of the country's most well-known corporations such as BHP (BHP.AX) New Tab, opens new tab and Commonwealth Bank (CBA.AX) New Tab, opens new tab. ($1 = 1.4990 Australian dollars) Sign up here. https://www.reuters.com/markets/bitcoin-etf-launches-australias-main-stock-exchange-first-time-2024-06-20/

2024-06-20 02:39

TOKYO, June 19 (Reuters) - Japan had more than 3 million visitors for a third straight month in May, official data showed on Wednesday, as the weak yen helped continue a record pace for inbound tourism. The number of foreign visitors for business and leisure was 3.04 million last month, steady from the level in April, and down slightly from the all-time monthly record in March, data from the Japan National Tourism Organization (JNTO) showed. Arrivals last month were up 60% from the same period last year and 9.6% higher than in May 2019. Japan had a record 31.9 million visitors in 2019 before the COVID-19 pandemic shut global borders. The weak yen, languishing at a 34-year low against the dollar, is helping fuel a tourism boom in Japan. That's good news for the economy, with travellers spending a record 1.75 trillion yen ($11.1 billion) in the first quarter of 2024, according to the JNTO. But the influx has raised concerns of "overtourism" at visitor hot spots. On Monday, the mayor of Himeji in western Japan floated the idea of charging foreigners three times the standard 1,000 yen fee to enter the city's famous samurai-era castle, the Asahi newspaper reported. In explaining new trail fees to curb overcrowding on Japan's sacred Mt. Fuji, Yamanashi prefecture governor Kotaro Nagasaki told reporters this week the country should focus on attracting "higher spending visitors" over sheer masses of people. Chinese travellers, previously the biggest contingent of Japanese tourists, are still about 30% lower than pre-pandemic levels. But travellers from other markets are picking up the slack, such as Indian visitors who reached a monthly record in May, JNTO data showed. Dalia Feldman, marketing director for Tourist Japan, said her firm has seen an 11-fold increase in inquiries from India in the past year, while those from the United Arab Emirates are up almost eight fold. "It appears it is the Japanese cuisine and natural sights that attract them the most," Feldman said. "Most of our Indian and UAE customers will ask to include some more food tours in their itinerary as well as external trips to remote and scenic areas." ($1 = 157.8200 yen) Sign up here. https://www.reuters.com/world/asia-pacific/japan-visitors-top-3-mln-third-month-yen-fuels-boom-2024-06-20/

2024-06-19 23:09

LONDON, June 20 (Reuters) - Global fossil fuel consumption and energy emissions hit all-time highs in 2023, even as fossil fuels' share of the global energy mix decreased slightly on the year, the industry's Statistical Review of World Energy report said on Thursday. Growing demand for fossil fuel despite the scaling up of renewables could be a sticking point for the transition to lower carbon energy as global temperature increases reach 1.5C (2.7F), the threshold beyond which scientists say impacts such as temperature rise, drought and flooding will become more extreme. "We hope that this report will help governments, world leaders and analysts move forward, clear-eyed about the challenge that lies ahead," Romain Debarre of consultancy Kearney said. Last year was the first full year of rerouted Russian energy flows away from the West following Moscow's invasion of Ukraine in 2022, and also the first full year without major movement restrictions linked to the COVID-19 pandemic. Overall global primary energy consumption hit an all-time high of 620 Exajoules (EJ), the report said, as emissions exceeded 40 gigatonnes of CO2 for the first time. "In a year where we have seen the contribution of renewables reaching a new record high, ever increasing global energy demand means the share coming from fossil fuels has remained virtually unchanged," Simon Virley of consultancy KPMG said. The report recorded shifting trends in fossil fuel use in different regions. In Europe, for example, the fossil fuel share of energy fell below 70% for the first time since the industrial revolution. "In advanced economies, we observe signs of demand for fossil fuels peaking, contrasting with economies in the Global South for whom economic development and improvements in quality of life continue to drive fossil growth," Energy Institute Chief Executive Nick Wayth said. Industry body the Energy Institute, together with consultancies KPMG and Kearney, has published the annual report since 2023. They took over from BP (BP.L) New Tab, opens new tab last year, which had authored the report, a benchmark for energy professionals, since the 1950s. Fossil fuel accounted for almost all demand growth in India in 2023, the report said, while in China fossil fuel use rose 6% to a new high. But China also accounted for over half of global additions in renewable energy generation last year. “China adding more renewables than the rest of the world put together is remarkable," KPMG's Virley told reporters. Here are some highlights from the report on 2023: CONSUMPTION OIL NATURAL GAS COAL RENEWABLES EMISSIONS Sign up here. https://www.reuters.com/business/environment/fossil-fuel-use-emissions-hit-records-2023-report-says-2024-06-19/