2024-06-17 22:56

NEW YORK CITY, June 17 (Reuters) - A high-pressure weather system could bring record-breaking temperatures to central and eastern parts of the United States this week, National Weather Service forecasters said on Monday, threatening a large swath of the country with multi-day excessive heat. Some 80 million people are currently under a heat advisory or warning as heat is expected to surpass 90 degrees Fahrenheit (32.2 degrees Celsius) and flirt with 100 degrees in some areas, which is 20 degrees above average this time of year, meteorologist Andrew Orrison of the National Weather Service said. The heat wave comes as the nation prepares to observe Wednesday's Juneteenth holiday, which commemorates the end of U.S. slavery in 1865. While it become an official federal holiday in 2021, Black Americans, especially in Texas, have traditionally celebrated the day with barbecues and other outdoor activities. Officials are advising that people stay hydrated, limit strenuous activity in the sun and wear lightweight clothing. The temperatures do not factor in humidity that will make it feel even hotter. The heat index in parts of Indiana, Ohio and Michigan, as well as New England, could touch triple digits, the NWS said. In New York City, a joint statement from the emergency management and health departments said cooling centers will open starting Tuesday and warned that high heat is a "silent killer." Older adults and young children, as well as people with chronic conditions or who are pregnant, are the most at risk. Chicago has also announced that it will open cooling centers. The NWS warned against leaving children and pet unattended in cars, given that sunlight can make the inside of a car heat up very quickly and cause vehicular heatstroke. Temperatures are expected to remain elevated until the weekend. Sign up here. https://www.reuters.com/world/us/excessive-heat-forecast-central-northeast-us-juneteenth-holiday-nears-2024-06-17/

2024-06-17 22:31

MELBOURNE, June 17 (Reuters) - Global supply chains for rare earths are realigning to diversify away from top producer China to make permanent magnets used in products from electric vehicles to wind turbines and drones. Below are companies that have or are building production facilities for rare earth compounds, metals and magnets to reduce the West's current near-total dependence on imports from China. Rare earths processing occurs in two main stages. The first involves extracting the rare earths from ores containing other minerals and concentrating them into a mixed rare earth concentrate or carbonate. The second is a more complex stage that separates the rare earths into individual oxide compounds. From there the products are turned into metals used to produce magnets. LYNAS RARE EARTHS Lynas Rare Earths (LYC.AX) New Tab, opens new tab is the world's biggest supplier of rare earths compounds outside China, from its Mount Weld mine in Australia. It has processing operations in Australia and Malaysia and is building a heavy rare earths processing plant in Texas, with the help of $288 million in U.S. defense funding, expected to come online in fiscal 2026. It will be able to process third-party material. SOLVAY Belgian chemicals maker Solvay (SOLB.BR) New Tab, opens new tab is expanding rare earths processing at its La Rochelle operations in France, aiming to launch separation and production of rare earth oxides needed for permanent magnet production in 2025. Currently Solvay processes rare earths for other uses, such as for auto catalysts. In March, Solvay signed a memorandum of understanding with French rare earths partner Carester to look at manufacturing opportunities for the permanent magnets supply chain in Europe. It also has an agreement to buy rare earth oxides from recycled material from Canadian clean tech start-up Cyclic Materials. France-based Carester aims to recycle 2,000 metric tons of magnets and separate 5,000 tons of heavy rare earth concentrates from mining per year from 2026. VACUUMSCHMELZE Germany's Vacuumschmelze (ONEQPV.UL), one of the biggest permanent magnet producers outside of China, has manufacturing operations in Germany, Slovakia, Finland, China and Malaysia. It was bought by U.S. private equity firm Ara Partners in October. It was awarded U.S. government funding of $111.6 million to build a neodymium-iron-boron magnet plant in South Carolina. The plant is expected to be finished by late 2025. The company has a magnet supply agreement with General Motors (GM.N) New Tab, opens new tab and supplies the U.S. Department of Defense. LESS COMMON METALS UK-based Less Common Metals produces rare earth metals/alloys from its base in northern England and is part of the European Supreemo project to establish a European rare earths value chain. REETEC REEtec in Norway, backed by Swedish miner LKAB, is building a commercial rare earth separation plant due to come into production in 2025. It is in discussions with companies to provide concentrate for the plant. ILUKA Australian mineral sands producer Iluka Resources (ILU.AX) New Tab, opens new tab is building its Eneabba rare earths refinery in the country's northwest that will process heavy rare earths from its own mines and from third parties like Northern Minerals (NTU.AX) New Tab, opens new tab. Commissioning is expected at the end of 2026. Iluka has been awarded an A$1 billion ($660 million) loan from the Australian government for what will be Australia's first fully integrated rare earths refinery. POSCO, STAR GROUP South Korea's Posco International (047050.KS) New Tab, opens new tab will provide permanent magnets produced by Star Group to German and U.S. automakers from 2025, sourced from the U.S., Australia and Vietnam. Privately held Star Group is the sole manufacturer of rare earth permanent magnets in South Korea. JAPAN Japan has a well developed magnet market that supplies its automotive and high tech industries. Among the biggest producers are Shin-Etsu Chemical (4063.T) New Tab, opens new tab, TDK Corp (6762.T) New Tab, opens new tab and Proterial. VTRE Vietnam rare earth processor VTRE, which had partner agreements with Australian rare earth developers Blackstone Minerals (BSX.AX) New Tab, opens new tab and Australian Strategic Materials (ASM.AX) New Tab, opens new tab, suspended production late last year after its chairman was arrested for violating mining regulations. NEO PERFORMANCE MATERIALS Toronto-listed Neo Performance Materials (NEO.TO) New Tab, opens new tab produces rare earth oxides, magnetic powders and permanent magnets. It has facilities around the world including in China, the U.S., Germany, Canada, Thailand and the UK. It plans to launch a new permanent magnet plant in Estonia next year. SASKATCHEWAN RESEARCH COUNCIL Canada's Saskatchewan Research Council received C$31 million ($22.57 million) in government funding to build a rare earths processing plant. It has a supply agreement with Vietnam's Hung Thinh Group (HTG) to import up to 3,000 tons of rare earth carbonate per year for five years beginning in June 2025. UCORE Canada's Ucore Rare Metals (UCU.V) New Tab, opens new tab is building a heavy and light rare earths separation facility in Louisiana set to come online in late 2025. RAINBOW RARE EARTHS Rainbow Rare Earths (RBWR.L) New Tab, opens new tab, backed by Dublin-based private investment firm TechMet, has begun a rare earth oxide separation process at a K-Technologies facility in Florida for rare earths carbonate that it aims to produce from its Phalaborwa project in South Africa. MP MATERIALS MP Materials (MP.N) New Tab, opens new tab is building a rare earth magnet manufacturing facility in Texas, helped with $58.5 million New Tab, opens new tab in government funding. It currently ships rare earth concentrate to China but expects to be producing finished magnets by late 2025 which it will supply to General Motors. It made a wider than expected loss in the first quarter due to weak rare earths prices. ENERGY FUELS Energy Fuels (UUUU.A) New Tab, opens new tab, a U.S. producer of uranium and rare earth elements, said on June 10 it had started to produce commercial quantities of separated rare earths at its Utah operations, where it expects to produce up to 1,000 tons of neodymium-praseodymium a year. FIEMG Brazil's state of Minas Gerais Federatio of Industries (FIEMG) is building a proof-of-concept magnet factory set to open in the second half of this year that will have capacity to produce 100 tons of magnets a year when at full capacity. ($1 = 1.3737 Canadian dollars, 1.5147 Australian dollars) Sign up here. https://www.reuters.com/markets/commodities/western-rare-earths-supply-chain-springs-into-gear-2024-06-17/

2024-06-17 22:31

Brazil attractive for its cheap labour, clean energy Western governments offer incentives Price slump, technical challenges hinder growth MELBOURNE/RIO DE JANEIRO, June 17 (Reuters) - Mining giant Brazil has big ambitions to build a rare earths industry as Western economies push to secure the metals needed for magnets used in green energy and defence and break China's dominance of the supply chain. Working to its advantage are low labour costs, clean energy, established regulations and proximity to end markets, including Latin America's first magnet plant which would provide a ready buyer for the metals. But low rare earths prices, technical challenges and nervous lenders pose challenges to the Latin American nation's hopes to propel itself into the world's top five rare earths producers. The pace at which Brazil's rare earths projects come together will be a test for how successful the West may be at building a new advanced industry almost from scratch to break China's grip. Brazil holds the world's third-largest rare earth reserves. The country's first rare earths mine, Serre Verde, started commercial production this year. Output is set to grow, analysts, mining CEOs and investors say, supported by Western government incentives that are also accelerating a global rare earths refining and processing industry. "Brazil as a source of potential rare earths is a very exciting proposition because there have been some very meaningful discoveries made in the past couple of years," said Daniel Morgan of Barrenjoey investment bank in Sydney. "I do think outside of China, Brazil’s projects are the most economic greenfield projects available." The U.S. and its allies, almost entirely dependent on China for rare earths metals and magnets, set out to build a separate supply chain by 2027 after deliveries were disrupted during the COVID-19 pandemic early this decade. LONG HAUL China produced 240,000 metric tons of rare earths last year, more than five times the next biggest producer, the United States, according to U.S. Geological Survey data. It processes around 90% of the global supply of rare earths into permanent magnets used in everything from wind turbines to electric vehicles and missiles. For countries like Australia, Vietnam and Brazil looking to catch up, progress is slow. Serra Verde has taken 15 years to get into production. It is expected to produce 5,000 tons once ramped up and could double output by 2030, its CEO said. "Serra Verde and Brazil have significant competitive advantages that could underpin the development of a globally significant rare earths industry over the long term," Serra Verde CEO Thras Moraitis told Reuters. Those include attractive geology, access to hydropower, established regulations and a skilled workforce, he said. "It is still a nascent sector which will require continued support to establish itself in a highly competitive market. Key processing technologies are controlled by a small number of players," he said. Brazil could have two or three more rare earths mines by 2030, potentially exceeding Australia's current annual output, said Reg Spencer, an analyst at broker Canaccord. BASEMENT PRICES One major obstacle is a 70% slump in rare earths prices over the past two years that has made it difficult for companies to raise funds for mines and processing. "Getting money at the moment is tough," Nick Holthouse, chief executive of Australian-listed developer Meteoric Resources (MEI.AX) New Tab, opens new tab, told Reuters. Meteoric is targeting an investment decision in late 2025 for its Caldeira project in Brazil’s Minas Gerais state which will produce light and heavy rare earths. In March, the U.S. Export-Import Bank (EXIM) expressed interest in providing Meteoric up to $250 million for the project. The company also has a preliminary deal to supply rare earth oxides to a separation plant in Estonia run by Toronto-listed Neo Performance Materials (NEO.TO) New Tab, opens new tab. Brazilian Rare Earths (BRE.AX) New Tab, opens new tab, too, is in the early stages of developing a large rare earths deposit in the country's northeast, backed by Australia's richest person, Gina Rinehart. Its CEO, Bernardo Da Veiga, highlighted Brazil's low operating costs as an advantage over rivals like Australia, where he said a truck driver at an iron ore mine would earn up to A$200,000 ($133,200) a year plus food and accommodation. "That same truck driver in Brazil, doing the same job, earns like $15,000 a year and he rides his bike to work and brings his lunch. There's just no comparison." COMPLEXITIES While labour is cheap, developers face technical hurdles. Unlike in China, many Western companies are still perfecting the complex processes for producing rare earth metals, a costly challenge that has stalled projects for years. To spur developments, the Brazilian government launched a 1 billion reais ($194.53 million) fund in February to finance strategic minerals projects, including rare earths. It also wants to build an industry for transforming these minerals into alloys for batteries, wind turbines and electric motors, the Ministry of Mines and Energy said in a statement. The challenge is to stimulate production and build partnerships to promote element separation technologies and supply chain development, the ministry said. It is also looking into rare earths recycling. Among companies talking to the government about recycling technology is Australia's Ionic Rare Earths (IXR.AX) New Tab, opens new tab, which has a pilot recycling plant in Belfast and a tie up with Brazilian developer Viridis Mining and Minerals (VMM.AX) New Tab, opens new tab, its CEO Tim Harrison said. Brazil is also building a magnet factory due to start operating later this year as a proof of concept, Flavio Roscoe, president of Minas Gerais' state Federation of Industries (FIEMG) said. "Our objective is to be a developer, a multiplyer of this technology," Roscoe said. "Brazil has the opportunity to be the world's option to China." ($1 = 1.5015 Australian dollars) (This story has been corrected to clarify that Serra Verde will produce 5,000 tons of rare earth oxides once ramped up, not this year, in paragraph 11) Sign up here. https://www.reuters.com/markets/commodities/brazil-joins-race-loosen-chinas-grip-rare-earths-industry-2024-06-17/

2024-06-17 21:54

June 18 (Reuters) - A look at the day ahead in Asian markets. The start of the trading week has shown that it is becoming increasingly difficult to navigate, never mind predict, markets right now, with many asset correlations being weakened by strong cross-currents of news flow and drivers. Some markets, like the S&P 500 and Nasdaq, are taking on a momentum of their own, and others, like the U.S. Treasury market and the dollar, are sending contradictory signals. Rising U.S. bond yields on Monday failed to support the dollar, the relentless tech and AI boom delivered record highs for two of Wall Street's three main indexes yet again, while a near-2% slump in Japan's Nikkei came out of the blue. This is the rather fragmented backdrop to the Asian market open on Tuesday, which is further complicated by the political turmoil in France that is rocking French assets and markets across the euro zone. Will investors in Asia take their cue on Tuesday from higher Treasury yields, the lower dollar, the U.S. tech frenzy or the ongoing deterioration in Chinese data and sentiment? The economic calendar across the continent is light, but the main event is a big one - the Reserve Bank of Australia's interest rate decision, and guidance from the accompanying statement and press conference from Governor Michele Bullock. Economists polled by Reuters are unanimous in their view that the RBA will hold its cash rate at 4.35% for a fifth straight meeting. With inflation remaining above the central bank's 2% to 3% target since late 2021 and the jobless rate easing to 4%, an early rate reduction seems unlikely. A near 90% majority, 38 of 43, predicted interest rates to remain unchanged next quarter, followed by a 25 basis point cut to 4.10% in the final quarter of this year. Australian rates markets are even more hawkish - traders are pricing in only 15 basis points of easing this year, and barely 50 bps in total by the end of 2025. Excluding the Bank of Japan, which is in the early stages of tightening policy, that's among the most hawkish pricing for any G10 central bank. In China, meanwhile, stocks are at a two-month low and the yuan is its weakest this year after a weak batch of data on Monday - especially house prices - did little to lift the economic gloom. Trade tensions are intensifying too. China has opened an anti-dumping investigation into imported pork and its by-products from the European Union, a tit-for-tat response to curbs on its electric vehicle exports. Warren Buffett's Berkshire Hathaway, meanwhile, has trimmed its stake in China's BYD, the world's largest seller of electric vehicles. The change in stake is tiny, but potentially symbolic of foreigners' angst at the brewing trade wars. Here are key developments that could provide more direction to markets on Tuesday: - Australia interest rate decision - Singapore non-oil trade (May) - Fed's Barkin, Collins, Kugler, Musalem, Logan, Goolsbee speak Sign up here. https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-06-17/

2024-06-17 21:32

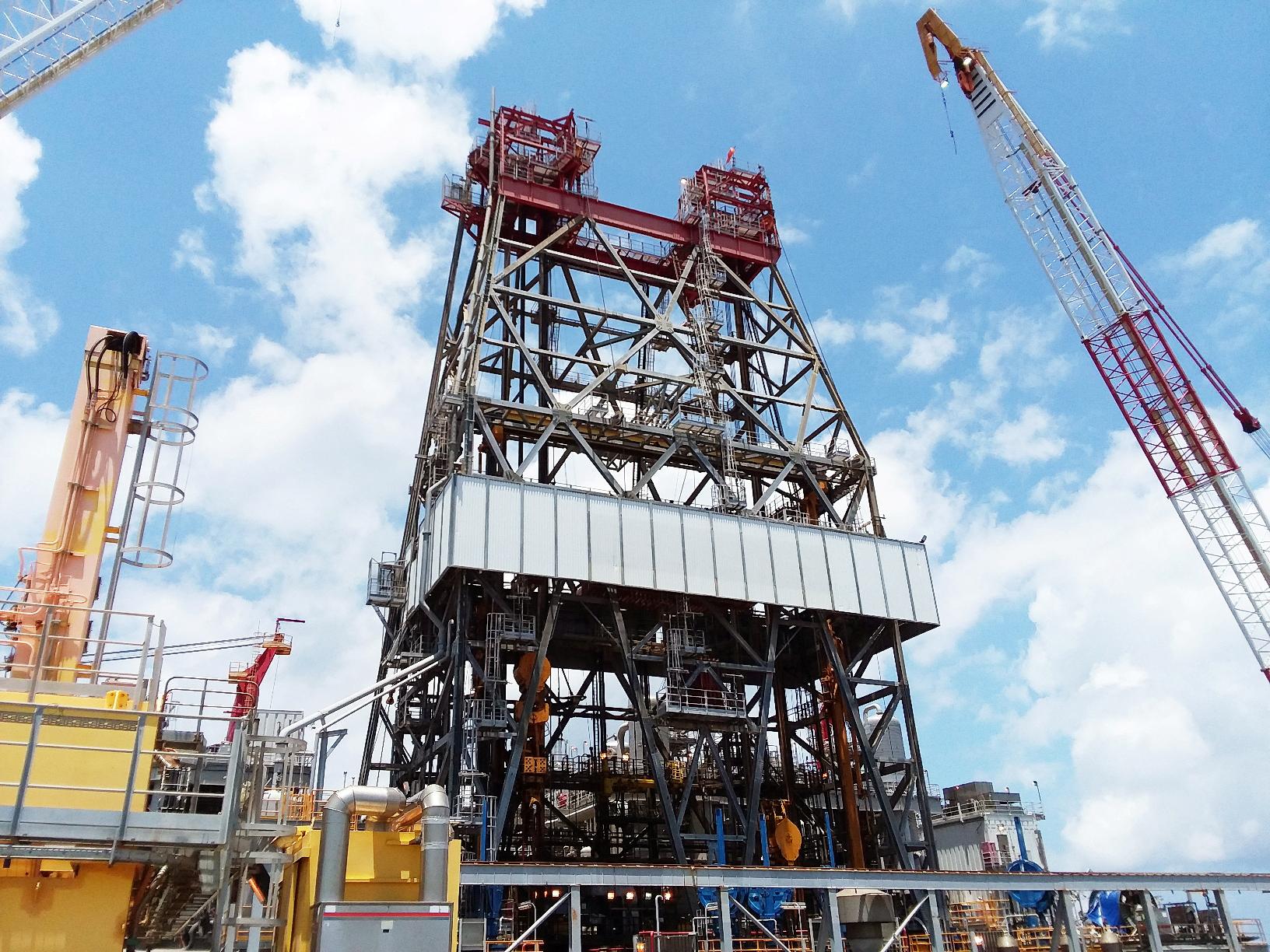

HOUSTON, June 17 (Reuters) - Texas, Louisiana and Mississippi on Monday sued the U.S. government to block the Biden administration's proposed rule that would require the offshore oil and gas industry to provide nearly $7 billion in financial assurances to cover costs of dismantling old infrastructure. The rule, which would take effect later this year, will predominantly affect smaller companies that do not have investment grade ratings or sufficient proven oil reserves. Oil majors are more likely to meet the credit criteria or have large reserves. The lawsuit was filed against the U.S. Bureau of Ocean Energy Management (BOEM), which has said the rule could affect around three quarters of operators in the Gulf of Mexico. The BOEM declined to comment on the lawsuit. When the rule was announced in April, the Department of the Interior said it was "to protect taxpayers from covering costs that should be borne by the oil and gas industry when offshore platforms require decommissioning." Decommissioning old wells can cost billions of dollars and that expense could fall to taxpayers if companies fail to meet their obligations due to bankruptcies or the transfer of assets from large to smaller companies with fewer resources. Louisiana Attorney General Liz Murrill filed the lawsuit in a Louisiana federal district court and was joined by attorney generals of Texas and Mississippi. "This is a really egregious direct assault on intermediate level producers of oil and gas, and that affects a lot of business in our state," Murrill told Reuters in an interview. "The new regulation is a solution in search of a problem, imposing unnecessary financial burdens that will have far-reaching impacts to many small to mid-size energy producers and all Americans," said Kevin Bruce, executive director of the Gulf Alliance, a coalition of leading independent offshore oil and natural gas producers joining the legal challenge against the BOEM. Some 37 offshore oil and gas operators have filed for bankruptcy since 2009, according to a U.S. government agency. "This is a significant cost to our industry that would really put a lot of people out of business," said Mike Minarovic, CEO of Arena Energy, which operates more than 100 platforms in the Gulf of Mexico that produce some 50,000 barrels per day of oil equivalent The new rule could cost Arena Energy some $800-850 million in surety bonds, plus the costs of the bonds themselves, Minarovic said, citing government estimates of decommissioning cost. Minarovic pointed to an outflow of money from surety markets in the past five years and said securing the bonds required to guarantee fiduciary and contractual obligations "will just be a requirement the government has that cannot be fulfilled." As of June 2023, more than 2,700 wells and 500 platforms were overdue for decommissioning in the Gulf of Mexico, according to the U.S. Government Accountability Office, pushing the government to require operators offer additional surety bonds in a bid to protect taxpayers from footing the bill. The BOEM held around $3.5 billion in supplemental bonds to cover between $40 billion and $70 billion in total estimated decommissioning costs. Under the new rule, the BOEM will allow current lessees and grant holders to request phased-in payments over three years to meet the new supplemental financial assurance demands required by the rule. It was unclear yet whether the ruling would pressure offshore production. Minarovic said there could be shut ins if companies are unable to provide the bonds in time. The U.S. Gulf of Mexico produces roughly 1.8 million barrels per day of oil, according to the last government figures, about 14% of total U.S. output. "These (oil) companies should pay their fair share and clean up the mess they leave behind, and that starts with assurances like this one", Mike Scott, Sierra Club national oil and gas campaign manager told Reuters. Sign up here. https://www.reuters.com/legal/states-sue-us-block-rule-requiring-oil-industry-pay-dismantling-old-wells-2024-06-17/

2024-06-17 21:29

June 17 (Reuters) - A unit of global commodities trader Trafigura has agreed to pay a $55 million civil fine to settle U.S. Commodity Futures Trading Commission charges of fraud, manipulation and impeding whistleblower communications. Trafigura Trading LLC, a Houston firm that is part of Trafigura Beheer BV, violated U.S. law and regulations by trading gasoline with material nonpublic information, by manipulating an oil pricing benchmark and by requiring current and former employees to sign agreements that barred them from sharing company information, including with regulators, the CFTC said in a statement on Monday. The agreements with employees illegally impeded them from voluntarily communication with the CFTC's enforcement staff during their investigation. The charge marked the first time the CFTC has brought an action against a firm for impeding whistleblower communications, the regulator said. Trafigura, which neither admitted nor denied the CFTC's findings, said it has voluntarily sought to boost its compliance program and has agreed to modify its non-disclosure provisions in employment and severance agreements. Between 2014 and 2019, Trafigura traded gasoline while possessing material nonpublic information it knew or should have known was misappropriated from a Mexican trading firm, regulators said. The firm in February 2017 also manipulated a fuel oil benchmark to benefit its futures and swaps positions, the CFTC said. In 2021, Reuters revealed that the trading arm of Mexican state energy company Pemex temporarily banned new business with Trafigura as investigations into the energy trader's conduct in several countries deepened. Neither the CFTC nor Trafigura named Pemex in its recent statements by name. Pemex did not immediately respond to a request for comment. Back then, Pemex traders in Mexico told Reuters they had been asked to honor existing deals but not take on new ones. Two months after the ban, the energy ministry suspended at least five Trafigura import permits. A federal court later lifted the suspensions. Sign up here. https://www.reuters.com/markets/commodities/cftc-orders-trafigura-pay-55-million-over-fraud-2024-06-17/