2024-06-17 19:46

June 17 (Reuters) - Power provider Southern Company (SO.N) New Tab, opens new tab CEO Chris Womack said on Monday he expects more industry commitments to build gigawatt-scale light water nuclear reactors in the U.S. before 2030. Southern Company began commercial operations on its Vogtle 4 reactor this year as part of the first nuclear power plant to be constructed in the country in more than 30 years. "You're seeing them now show up in a number of integrated resource planning processes," Womack said at the American Nuclear Society conference in Las Vegas. "The question becomes: is there willingness to push through?" Womack said he expected announced plans in 2027 or 2028 to construct similar reactors, which are larger than the advanced small modular reactors that have not yet been built in the country, although he did not specify which companies would make the announcements. Sign up here. https://www.reuters.com/business/energy/southern-company-ceo-expects-more-industry-commitments-lightwater-nuclear-2024-06-17/

2024-06-17 19:40

Canadian dollar gains 0.1% against the greenback Non-commercial net shorts climb to record high Canadian home sales fall 0.6% in May Bond yields rise across the curve TORONTO, June 17 (Reuters) - The Canadian dollar edged higher against its U.S. counterpart on Monday as investors awaited further insight into the Bank of Canada's move to cut interest rates and after speculators raised their bearish bets on the currency to a record high level. The loonie was trading 0.1% higher at 1.3725 to the U.S. dollar, or 72.86 U.S. cents, after trading in a range of 1.3722 to 1.3764. As of June 11, non-commercial accounts had increased their net short positions in the Canadian dollar to 129,493 contracts from 91,639 in the prior week, data on Friday from LSEG and the U.S. Commodity Futures Trading Commission showed. . It marked the largest net short position in the currency in data going back to 1986. "The jump in Canadian dollar shorts is a cyclical trade," said Adam Button, chief currency analyst at ForexLive. "Global markets are sensing that high interest rates will lead to an economic slowdown, particularly in Canada due to high leverage and housing exposure." Canada's economy is particularly sensitive to higher borrowing costs due to elevated household debt and a short mortgage cycle, according to analysts. The typical loan term is five years or less in Canada, versus 30 in the United States. The BoC this month became the first G7 central bank to begin cutting interest rates. Minutes from the June 5 policy decision are due to be released on Wednesday. Canadian home sales fell 0.6% in May from April and were down 5.9% on an annual basis, data from the Canadian Real Estate Association showed. Canadian government bond yields moved higher across the curve, tracking moves in U.S. Treasuries. The 10-year was up 3.5 basis points at 3.319%, extending its rebound from a four-month low that it touched during Friday's session at 3.260%. Sign up here. https://www.reuters.com/markets/currencies/c-rises-bearish-bets-currency-reach-all-time-high-2024-06-17/

2024-06-17 19:38

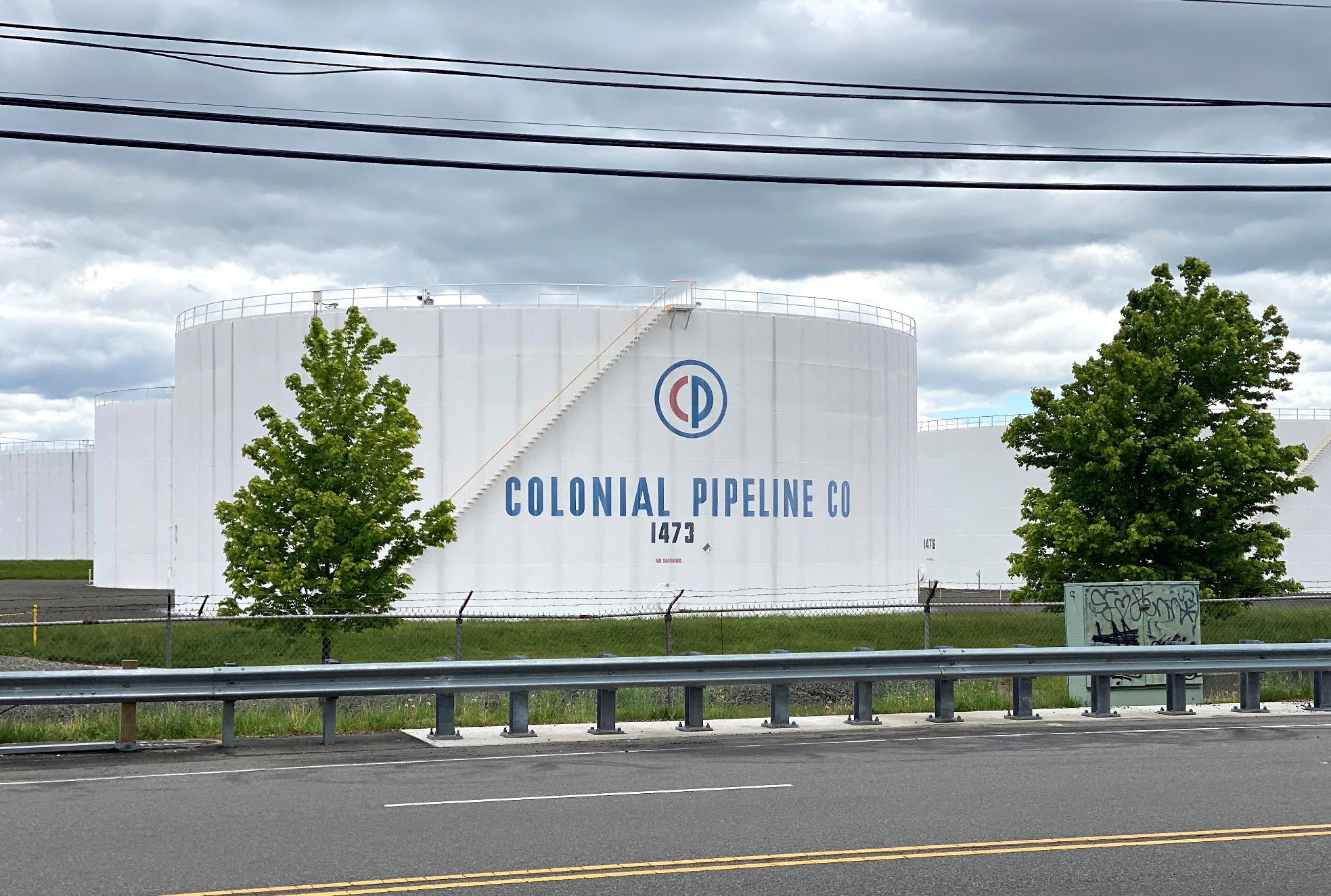

June 17 (Reuters) - Some of Colonial Pipeline's owners are exploring divesting their stakes, hoping they can fetch prices that would value the largest U.S. fuel transportation system in excess of $10 billion, according to people familiar with the matter. Growing U.S. energy consumption has raised demand for pipeline capacity. Any deal would test the company's value three years after a major cyberattack disrupted its operations. Canadian pension fund Caisse de dépôt et placement du Québec (CDPQ) has begun working on the sale of its 16.6% stake in Colonial, while three co-owners that collectively account for 55.3% of the equity in Colonial are discussing whether to follow suit, the sources said. These three parties are oil major Shell (SHEL.L) New Tab, opens new tab and investment firms IFM Investors and KKR (KKR.N) New Tab, opens new tab, the sources added. Infrastructure funds, public pension funds and sovereign wealth funds are among potential buyers, according to the sources. A subsidiary of Koch Industries, the remaining co-owner, has indicated it plans to keep its 28.1% stake in Colonial, one of the sources said. The sources cautioned that no transaction is certain and asked not to be identified because the matter is confidential. A spokesperson for Colonial directed all questions on ownership to its owners. CDPQ and KKR declined comment. IFM, Koch and Shell did not immediately respond to comment requests. Colonial's pipeline system stretches over 5,500 miles from Houston in Texas to New York's harbor. It moves 100 million gallons of fuel daily, including gasoline, jet fuel, diesel and heating oil, according to its website. The pipeline offers the least expensive route to move product from low-cost production centers near the Gulf Coast to markets in the Southeast and across the Eastern Seaboard, credit rating agency Fitch said in a note last month. A cyberhack caused a days-long shutdown of Colonial's pipeline in 2021, disrupting fuel supplies to thousands of filling stations and airports. Colonial had failed to plan and prepare for a manual restart and shutdown operation, which exacerbated the fallout, the U.S. Department of Transportation's Pipeline and Hazardous Materials Safety Administration found at the time. CDPQ bought its stake in Colonial for $850 million in 2012 from ConocoPhillips (COP.N) New Tab, opens new tab. IFM and KKR acquired their respective 15.8% and 23.4% holdings in 2007 and 2010. Shell consolidated its 16.13% into a single holding in 2019, while Koch has held its current position since 2003. North American energy pipelines have become prized holdings in the last two years because of the growth in U.S. energy production and difficulty of permitting and building new lines. This has led to heightened dealmaking in the sector. Sign up here. https://www.reuters.com/business/energy/some-colonial-pipeline-owners-eye-stake-sales-10-bln-plus-company-valuation-2024-06-17/

2024-06-17 17:05

June 17 (Reuters) - The U.S. Federal Reserve would be able to cut its benchmark interest rate once this year, Philadelphia Fed President Patrick Harker said on Monday, if his economic forecast plays out. "If all of it happens to be as forecasted, I think one rate cut would be appropriate by year's end," Harker said in prepared remarks to an event hosted by the regional central bank in Philadelphia, after outlining his view that he sees slowing but above-trend economic growth, a modest rise in the unemployment rate, and a "long glide" back to target for inflation as his base case. The U.S. central bank kept interest rates unchanged in the 5.25-5.50% range at its policy meeting last week as it seeks to keep pressure on the economy to cool inflation back to the Fed's 2% target rate. Inflation by the Fed's preferred measure was running at a 2.7% annual rate in April. Harker said that while last week's Consumer Price Index reading was "very welcome," progress on inflation so far this year has been modest and he needs to analyze more data over the coming months in order to take a decision given the overall choppiness. The Fed's policy rate needs to remain unchanged for now, Harker added, in order to also mitigate upside risks, such as the potential long-term stubbornness of elevated shelter inflation and "the continually high rate of inflation in the services sector, notably auto insurance and repairs." Harker nevertheless did not rule out changing his view on rates as more economic data is parsed. "I see two cuts, or none, for this year as quite possible if the data break one way or another...we will remain data dependent," he said. At the latest policy meeting, the median forecast among the Fed's 19 policymakers was for a single interest rate cut this year while financial markets currently expect two rate cuts by year-end. Sign up here. https://www.reuters.com/markets/rates-bonds/feds-harker-one-interest-rate-cut-this-year-my-base-case-2024-06-17/

2024-06-17 17:05

WASHINGTON, June 17 (Reuters) - The U.S. Supreme Court agreed on Monday to hear a bid by Nvidia (NVDA.O) New Tab, opens new tab to scuttle a securities fraud lawsuit accusing the artificial intelligence chipmaker of misleading investors about how much of its sales went to the volatile cryptocurrency industry. The justices took up Nvidia's appeal made after a lower court revived a proposed class action brought by shareholders in California against the company and its CEO Jensen Huang. The suit, led by the Stockholm, Sweden-based investment management firm E. Ohman J:or Fonder AB, seeks unspecified monetary damages. Santa Clara, California-based Nvidia is a high-flying company that has become one of the biggest beneficiaries of the AI boom, and its market value has surged. In 2018, Nvidia's chips became popular for cryptomining, a process that involves performing complex math equations in order to secure cryptocurrencies like bitcoin. The plaintiffs in a 2018 lawsuit accused Nvidia and top company officials of violating a U.S. law called the Securities Exchange Act of 1934 by making statements in 2017 and 2018 that falsely downplayed how much of Nvidia's revenue growth came from crypto-related purchases. Those omissions misled investors and analysts who were interested in understanding the impact of cryptomining on Nvidia's business, the plaintiffs said. U.S. District Judge Haywood Gilliam Jr. dismissed the lawsuit in 2021 but the San Francisco-based 9th U.S. Circuit Court of Appeals in a 2-1 ruling subsequently revived it. The 9th Circuit found that the plaintiffs had adequately alleged that Huang made "false or misleading statements and did so knowingly or recklessly," allowing their case to proceed. Nvidia urged the justices to take up its appeal, arguing that the 9th Circuit's ruling would open the door to "abusive and speculative litigation." Nvidia in 2022 agreed to pay $5.5 million to U.S. authorities to settle charges that it did not properly disclose the impact of cryptomining on its gaming business. The justices agreed on June 10 to hear a similar bid by Meta's (META.O) New Tab, opens new tab Facebook to dismiss a private securities fraud lawsuit accusing the social media platform of misleading investors in 2017 and 2018 about the misuse of its user data by the company and third parties. Facebook appealed after a lower court allowed a shareholder lawsuit led by Amalgamated Bank (AMAL.O) New Tab, opens new tab to proceed. The Supreme Court will hear the Nvidia and Facebook cases in its next term, which begins in October. Sign up here. https://www.reuters.com/legal/us-supreme-court-hear-nvidia-bid-scuttle-shareholder-lawsuit-2024-06-17/

2024-06-17 13:34

LONDON, June 17 (Reuters) - Hedge fund managers making bets on mergers and acquisitions outperformed those deploying other strategies with a return of 7.7% in the first five months of 2024, Goldman Sachs said in a note to clients, as deal-making rebounded. Although Goldman did not offer a year-earlier figure for comparison, Barclays prime brokerage noted at the time that such fund mangers had returned a negative 0.8% on investment from January to May 2023, as high interest rates curtailed deal making. While seeing a resurgence this year as companies gain confidence from declining interest rates and a stabilising economic backdrop, global deal-making has yet to return to 2021's record levels. Worldwide M&A was worth $1.3 trillion during the first five months of 2024, a 23% increase versus the same period of 2023, but below the $1.8 trillion recorded in January-May 2022, according to LSEG data. According to LSEG, U.S.-targeted M&A has accounted for 56% of overall global M&A this year, the highest year-to-date share since 1998. Deals have included consumer bank Capital One's (COF.N) New Tab, opens new tab $35.3 billion bid for credit card issuer Discover Financial Services (DFS.N) New Tab, opens new tab in February and ConocoPhillips’ (COP.N) New Tab, opens new tab $22.5 billion offer for Marathon Oil (MRO.N) New Tab, opens new tab in May. Hedge funds generally averaged around a 7% return on investment through end-May, Goldman Sachs said. Stock trading hedge funds returned 7.4%, helping to lift the average of the group. Hedge funds that bet on the relative price of two assets performed the least strongly, returning about 5% for the year, said the bank. Sign up here. https://www.reuters.com/markets/hedge-flow-ma-focused-hedge-funds-lead-pack-may-goldman-sachs-says-2024-06-17/