2024-06-11 11:05

SANTIAGO, June 11 (Reuters) - The Humboldt penguin population has dramatically decreased in areas along the central coast of Chile, making them one of the most vulnerable of the world's 18 penguin species and putting them at risk of extinction, experts warn. Last year, scientists surveyed two islands off the central Chilean coast and detected 842 breeding pairs or active nests. This year they found just one breeding pair. Paulina Arce, a veterinarian who specializes in penguins, says that penguin populations in all islands surveyed decreased or remained the same. "This could lead to an even more drastic scenario, which could be the extinction of the species," Arce said. Humboldt penguins (Spheniscus humboldti) inhabit colonies along the Pacific coasts of Chile and Peru. They get their name because they bathe in the cold Humboldt Current. These flightless birds can weigh up to 5 kg (11 pounds) and measure up to 70 cm (2 feet 3 inches) tall when adults. Diego Penaloza, president of the Safari Conservation Foundation, says the main threats to penguins in the wild are marine pollution, lack of pet supervision, and disturbance of nesting sites. Additionally, avian flu, exacerbated by the El Nino weather phenomenon, has wreaked havoc on penguin populations and other wildlife. As a result, Humboldt penguin reproduction rates have plummeted to almost zero, according to Javiera Meza, head of Biodiversity Conservation at national forestry office Conaf. "It was the avian flu plus the El Nino phenomenon that shifted all the food towards the southern zone, and therefore, in the entire northern Chile, reproduction dropped to almost zero levels, and on top of that, many penguins died," Meza said. "It was like the perfect storm." Sign up here. https://www.reuters.com/world/americas/chiles-humboldt-penguins-could-face-extinction-population-plummets-2024-06-11/

2024-06-11 11:00

BEIJING, June 11 (Reuters) - Chinese automakers' plans to invest in Europe won't be deflected by the EU's anti-subsidy probe into Chinese-made electric vehicles, a leading Chinese auto industry association said on Tuesday. "Chinese enterprises will continue to unswervingly develop in Europe and integrate into local markets," said Cui Dongshu, secretary general of the China Passenger Car Association (CPCA) He made the remarks while announcing a rare drop in Chinese car exports for May amid an ongoing slide in domestic sales. The European Union alleges Chinese automakers benefit unfairly from state subsidies and accuses them of dumping excess production on Europe, charges that Beijing denies. The EU is this week expected to announced the tariffs it plans to impose on Chinese electric vehicles in a move that could prompt retaliation. "The traditional carmaking industry plays a big part in generating employment in Europe ... Chinese firms won't take aggressive measures or low-pricing moves to disrupt the stability of employment in Europe," Cui said. Chinese exports of new energy vehicles (NEVs) - which include electric cars and plug-in hybrids - fell 4% year-on-year in May and were down 18.8% from the previous month, CPCA data showed. NEV exports as a percentage of overall car exports stood at 24.8%, a rare yearly fall of 6.8 percentage points. Overall, passenger vehicle exports fell 9% from a record high in April to 378,000 vehicles in May, the data showed. "Export growth didn’t meet our expectations," Cui said. Domestic vehicle sales were down 2.2% following a 5.8% decline in April, in a sign weak demand is becoming entrenched in the world's biggest auto market amid a sputtering economy. Sales of NEVs in China made up 46.7% of total car sales in May, a fresh monthly high. EV sales rose 27.4% after a 12.1% increase in April, while plug-in hybrid sales rose 61.1% versus a 64.2% jump the month before. Stiff competition and the threat of EU tariffs, which China labels as protectionism, have done little so far to deter Chinese EV makers from ramping up production and exploring overseas markets. Nio (9866.HK) New Tab, opens new tab, the eighth biggest EV maker in China by sales, has won regulatory approval to build a third factory in China that would boost its total approved production capacity to 1 million cars, Reuters reported. The company also opened its first showroom in Amsterdam in May. Sales of NEVs in China have been helped by government subsidies for trade-in schemes worth 11.2 billion yuan ($1.55 billion) this year, and contrast with a continued decline in demand for gasoline cars. ($1 = 7.2445 Chinese yuan renminbi) Sign up here. https://www.reuters.com/business/autos-transportation/chinese-automakers-committed-europe-despite-ev-tariff-probe-industry-group-says-2024-06-11/

2024-06-11 10:59

NEW YORK, June 10 (Reuters) - Bond investors, worried about persistently sticky inflation, have reduced their exposure to longer-dated U.S. Treasuries ahead of the Federal Reserve's two-day monetary policy meeting this week in which it is likely to hold interest rates steady. The U.S. central bank's policy-setting Federal Open Market Committee is widely expected on Wednesday to keep its benchmark overnight interest rate in the 5.25%-5.50% range for a seventh consecutive meeting. In his press conference after the end of the meeting, Fed Chair Jerome Powell is expected to continue emphasizing an easing bias, although he is likely to show little urgency to cut rates in the near term given persistent inflationary pressures and a still robust labor market. The U.S. rate futures market has scaled back expectations for policy easing this year and is now pricing in one 25 basis-point rate cut in 2024, most likely in November or December, according to LSEG calculations. Investors will also focus on the Fed's updated quarterly economic projections, including interest rate forecasts, referred to as the "dot plot." The last dot plot in March pointed to three rate cuts in 2024. Market participants expect that to be whittled down to two cuts or one. "We are underweight the longer end of the (Treasuries) curve, in particular 20- to 30-year maturities ahead of the Fed meeting," said Noah Wise, senior portfolio manager for the Plus Fixed Income team at Allspring Global Investments, with assets under management of $570 billion. "That's where we see more of the risk because inflation is structurally higher. The services side of the economy continues to run hotter than the goods side. And what we've seen in our analysis indicates that those price changes tend to be stickier." Higher growth and inflation expectations typically prompt a sell-off on the long end of the curve, pushing those yields higher. Inflation overall has moderated but remains above the Fed's 2% target. The personal consumption expenditures (PCE) price index, the Fed's preferred measure of inflation, rose 2.7% in April on a year-on-year basis, while the consumer price index (CPI) posted an annual rise of 3.4% in April. CPI data for May is due to be released on Wednesday. Wage inflation also increased last month. Average hourly earnings rose 0.4% while wages increased 4.1% in the 12 months through May. Annual wage growth in the 3.0%-3.5% range is viewed as consistent with the Fed's 2% inflation goal. Boris Kovacevic, global macro strategist at global payments company Convera, said there are signs price pressures could remain elevated as goods inflation has started to pick up again with the rise in commodity prices. FADING LONG BETS Going into this week's Fed meeting, bond investors have been paring their net long positions on Treasuries with longer maturities in the futures market. Data from the Commodity Futures Trading Commission showed money managers reduced net long positions on U.S. 10-year note futures last week to 1,214,934 contracts , the lowest in about two months. Net longs on this maturity have been falling since the first week of May. They also curbed net longs on ultra-long U.S. bond futures to 724,972 , the smallest in 1-1/2 months. Their net longs have been decreasing since May 14. "The challenge for everyone trying to invest in these markets is that with the yield-curve shape like it is, any long-duration positions are negative carry in the sense that cash rates (money market funds) are north of 5%, while bond yields are below 5%," said Brendan Murphy, head of fixed income for North America at Insight Investment, which oversees $825.3 billion in assets. "So any time you extend your duration, essentially you're giving up some yield to do that." Extending duration implies buying more long-dated assets. In contrast, fixed-income investors have been generally long on the shorter-end, particularly U.S. 2-year to 5-year Treasuries, or the so-called belly of the curve, the sectors likely to outperform the long end when the Fed cuts rates. Institutional investors increased net longs on U.S. 2-year note futures in the week ended June 4 , data showed. Those net longs have increased for two straight weeks. Asset managers also have remained net long on U.S. 5-year note futures , hitting a record high in late May before tapering off a little bit last week. "Investors think the front end of the curve has peaked and the Fed is not going to need to raise interest rates again. That should hold the front end relatively steady," said Chip Hughey, managing director of fixed income at Truist Advisory Services. Sign up here. https://www.reuters.com/markets/us/long-dated-treasury-holdings-downsized-fed-faces-tough-inflation-choices-2024-06-10/

2024-06-11 10:56

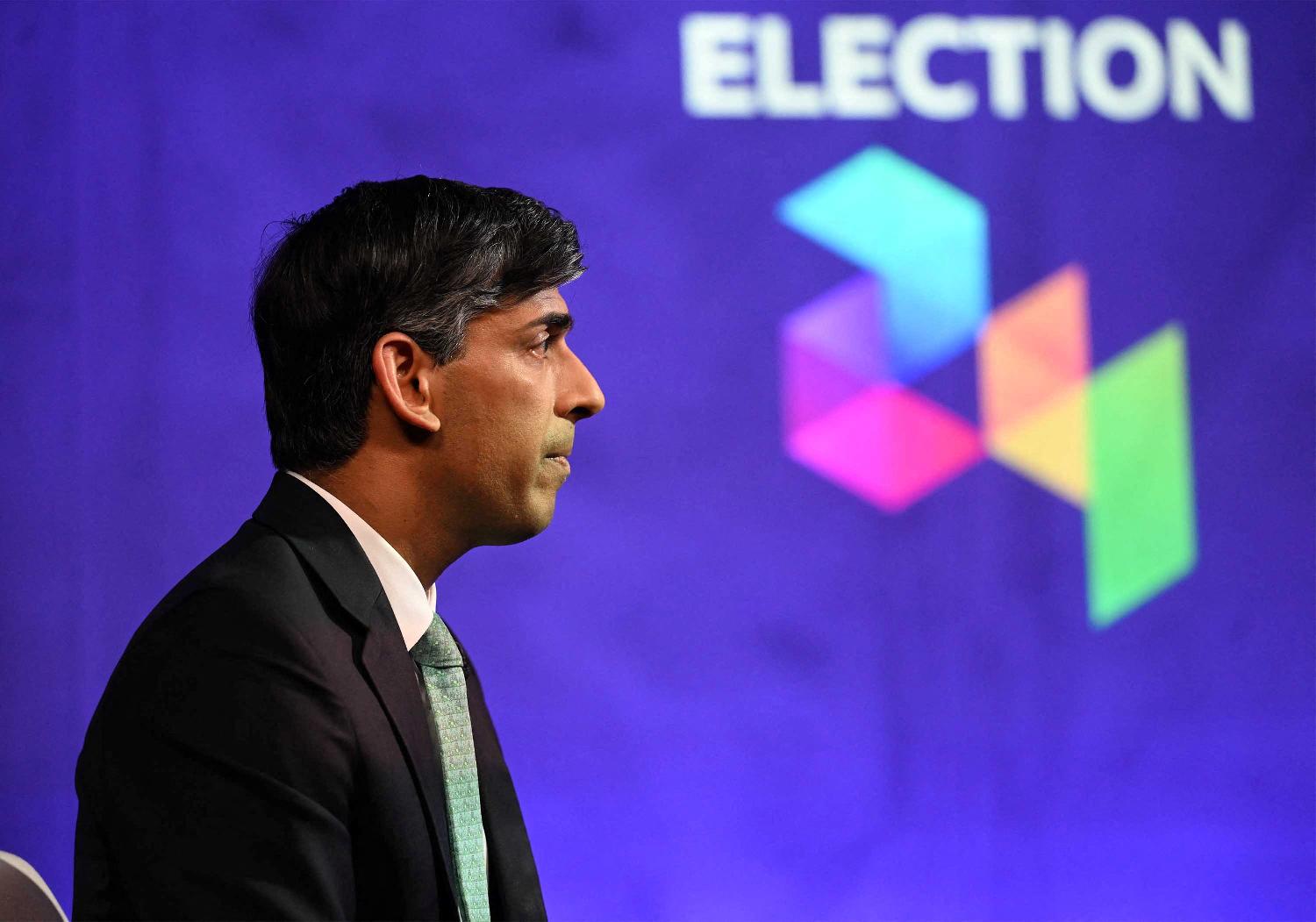

SILVERSTONE, England, June 11 (Reuters) - Britain's governing Conservatives promised voters on Tuesday that they would cut social security contributions again if they win next month's national election and said they would also not raise income tax or value added tax. In a manifesto, outlining its policy plans ahead of the July 4 election, the Conservative Party said it would lower the rate of National Insurance contributions by employees by two percentage points by April 2027 and abolish the main rate paid self-employed people by end of the next parliament. "We will also not raise the rate of income tax or VAT," the manifesto said. Prime Minister Rishi Sunak and finance minister Jeremy Hunt have already cut NICs on two occasions since November as they seek to reverse some of the sharp rise in Britain's tax burden. But the Conservatives remain far behind the opposition Labour Party in the opinion polls. Sign up here. https://www.reuters.com/world/uk/uk-conservatives-promise-new-cut-social-security-levy-election-pledge-2024-06-11/

2024-06-11 10:55

June 11 (Reuters) - Sterling hit a 22-month high versus the euro after a sharp rise the day before and was roughly unchanged against the dollar on Tuesday as investors await U.S. inflation data and the outcome of the Federal Reserve's policy meeting. The single currency dropped on Monday after the gains of eurosceptics in the elections for the European Parliament and France called an election. With a potential right-wing victory in France, the political landscape could pose significant challenges to the European Union's efforts to deepen integration, weakening the euro. Britain's labour market showed more signs of cooling in April with a rise in the unemployment rate but failed to trigger a significant price action of the British currency. The dollar hovered near a one-month peak against the euro as traders braced for U.S. data and the Fed rates forecasts. Sterling rose 0.25% to 84.33 pence per euro , its highest since August 2022. It was up 0.05% at $1.2738. Derek Halpenny, head of research, global markets at MUFG, flagged that the euro has broken below important technical support at the 0.8500 level, which has been tested and held over the past year. He expects the single currency to rise back up into the 0.8500-0.8600 trading range if Marine Le Pen's National Rally (RN) fails to become the largest party in France and to fall towards the lows in early 2022 at closer to the 0.8300 if the RN party becomes the largest party but falling short of being able to form a majority in parliament. The NR was forecast on Monday to win a snap election in France but fell short of an absolute majority. "Sterling largely held its own off the back of the data, as while rapidly rising wages could delay the start to Bank of England interest rate cuts, the increase in joblessness bodes ill for the UK's growth outlook," said Matthew Ryan, head of market strategy at global financial services firm Ebury. Money markets discounted a 40% chance of a 25 basis points BoE rate cut in August while more than fully pricing the same move in November. Sign up here. https://www.reuters.com/world/uk/sterling-hits-22-month-high-versus-euro-edges-up-vs-dollar-2024-06-11/

2024-06-11 10:04

A look at the day ahead in U.S. and global markets by Amanda Cooper. To anyone watching the stock market over the last year, it would seem the letters "AI" are akin to a magic wand that will pump up the share price of any company involved in it. That sprinkle of pixie dust has made chipmaker Nvidia the world's second-most valuable company after Microsoft, which in turn has seen its own shares rise 30% in the last 12 months, leaving Apple in the number three spot. So when loyal fans - and tech analysts - around the world gathered to watch Apple's annual Worldwide Developers Conference (WWDC 2024) on Monday, it was with the expectation of seeing a dazzling array of AI features that would put the iPhone maker in good standing to compete in this area with market-leader Microsoft. In a nearly two-hour long presentation, CEO Tim Cook, along with a string of other execs, unveiled how the new "Apple Intelligence" technology will be folded into the existing suite of apps including Siri, along with OpenAI's chatbot ChatGPT. Wall Street offered a tepid response. Shares in Apple fell around 2% in regular trading and are drifting in this morning's premarket, down around 0.5%. Tesla boss Elon Musk said on X he would immediately ban Apple devices at his companies if the iPhone maker integrates ChatGPT at the operating system level. Yet analysts say Monday's event was about more than just folding AI into its devices for Apple - it's also about reversing a decline in sales of its flagship iPhone. As far as the market is concerned, for once, there are bigger fish to fry than AI mania today. Political turbulence in Europe after right-wing gains in elections and a snap poll in France have injected a degree of uncertainty into stocks, bonds and currencies. The Federal Reserve releases its decision on interest rates tomorrow, along with updated projections for inflation, monetary policy and growth - the so-called "dot plot". After Friday's blockbuster jobs report, the focus is squarely on how many rate cuts Fed policymakers believe will be forthcoming this year. Even Siri can't answer that question right now. Key developments that should provide more direction to U.S. markets later on Tuesday: * U.S. NFIB Small Business Optimism Survey * U.S. Treasury 10-year auction Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-2024-06-11/