2024-06-06 13:58

OTTAWA, June 7 (Reuters) - Canada posted a smaller-than-expected merchandise trade deficit of C$1.05 billion ($765 million) in April, as energy and gold helped exports grow faster than imports, data showed on Thursday. Analysts polled by Reuters had forecast a C$1.40 billion deficit in the month. The March deficit was downwardly revised to C$1.99 billion from C$2.28 billion reported initially. Total exports rose 2.6% in April, while imports increased by 1.1%, Statistics Canada said. By volume, exports grew 1.7% and imports declined by 0.2%. The rise in exports was led by energy products and unwrought gold. The energy category benefited from higher natural gas, crude oil and natural gas liquids exports, helping offset a decline in exports of refined petroleum products and nuclear fuel, Statscan said. The increase in unwrought gold exports was primarily attributable to higher prices. The Canadian dollar was little changed after the numbers were released with the loonie trading 0.04% weaker at 1.3697 to the U.S. dollar, or 73 U.S. cents. Exports to the United States, which is Canada's biggest trading partner and accounts for over three quarters of exports, grew 2.4%, helping to widen its trade surplus to its neighbor south of the border. "We are seeing ... softening demand in the United States which is certainly not an ideal backdrop for Canadian exporters to sell into," said Stuart Bergman, chief economist at Export Development Canada. Canada's economic growth is expected to have resumed in April after stalling in March, helped by mining, quarrying, and oil and gas extraction, Statscan said in preliminary GDP forecast released last week. On Wednesday, the Bank of Canada lowered its key policy rate for the first time in four years and said further cuts were possible if inflation - last measured at 2.7% - continues to edge towards the bank's 2% target. Further cut in rates by the BoC will make it diverge from the U.S. Federal Reserve more which could weaken the currency and could be good for exports, Bergman said. Import growth in April was led by cars, ships and unwrought gold. Motor vehicles and parts imports rose for the third consecutive month, helped by imports of sport utility vehicles and other light trucks from the United States. Inbound delivery of ships, including a ferry from China that will run between Newfoundland and Nova Scotia, also aided import numbers, Statscan said. Overall, 8 of the 11 export product categories rose in April, while 6 of the 11 import product recorded growth. ($1 = 1.3688 Canadian dollars) Sign up here. https://www.reuters.com/markets/canadas-energy-gold-exports-help-narrow-trade-deficit-april-2024-06-06/

2024-06-06 13:51

LONDON, June 6 (Reuters) - Interest rate cuts from the European Central Bank and Bank of Canada this week mean monetary easing is under way in the world's big economies, even if there's an abundance of caution over when others will join in. Following the most aggressive global rate-hiking cycle in decades, here's where leading central banks stand and what they are expected to do next: 1/ SWITZERLAND The Swiss National Bank lowered rates by 25 basis points (bps) to 1.50% in a surprise move in March. But its next move is a coin toss and markets put the chance of a cut at the June 20 meeting at about 50-50. While inflation is within the SNB's target range, SNB chairman Thomas Jordan has warned it may tick higher if the franc weakens and import prices rise. 2/ SWEDEN Sweden's Riksbank lowered borrowing costs to 3.75% from 4% in May and is expected to hold them steady at its June 26 meeting before embarking on small cuts from August. Swedish inflation has dropped from a peak of more than 10% in 2022 to just above the central bank's 2% target, but the economy has rebounded from a slowdown in 2023 caused by price rises and rate hikes. 3/ CANADA The Bank of Canada became the first G7 nation to cut rates on Wednesday, trimming benchmark borrowing costs by 25 bps to 4.75% and promising more easing to come. The BoC's first cut in four years was widely expected after inflation hit a three-year low of 2.7% in April. Traders expect two more 25bp cuts this year. 4/ EURO ZONE The ECB cut rates for the first time in five years on Thursday, lowering its record-high deposit rate by 25 basis points to 3.75%. But the ECB raised its inflation forecasts and stressed that any further rate reduction would depend on incoming data. It reaffirmed that borrowing costs needed to remain high enough to keep a lid on prices. Markets price in a further 36 bps of rate cuts by year-end. 5/ BRITAIN The Bank of England is widely expected to hold rates at the 16-year high of 5.25% at its June 20 meeting and traders will be straining for any clues about what comes next. This is the only event before the July 4 election when BoE policymakers will speak publicly. Traders, uncertain about how the election might sway BoE thinking and unsettled by hot services inflation, have scrapped earlier bets for a first cut in June or August. September is now seen as the most likely start date for easing. 6/ UNITED STATES The Fed has kept rates in the 5.25% to 5.5% range since July 2023 and appears unlikely to make changes at its June 12 meeting, while the world's largest economy stays strong and inflation remains above target. A recent soft core inflation reading could tilt Fed policymakers towards a September cut, but they are expected to stay cautious after that. Traders, who back in January expected 150 bps of Fed cuts this year, now expect about 44 bps worth. 7/ NEW ZEALAND Money markets predict the Reserve Bank of New Zealand will keep its cash rate on hold at 5.5% until November. High rates have hobbled New Zealand's economy but the central bank at its May meeting prioritised battling inflation, running at 4%. 8/ AUSTRALIA The Reserve Bank of Australia has held rates at a 12-year high of 4.35% since November, and is not expected to lower borrowing costs until well into 2025. Australian consumer inflation for April unexpectedly picked up to a five-month high of 3.6%, year-on-year. 9/ NORWAY Norway's central bank warned in May that rates might stay at 16-year highs of 4.5% for "longer than previously thought". Since then, data has shown that Norway's economy grew in the first quarter of 2024 and that core inflation, at 4.4% year-on-year in April, fell less than expected. Markets see Norges Bank holding rates steady at its June 20 meeting, with no cuts until November. 10/ JAPAN The Bank of Japan is the outlier, raising rates out of negative territory in March in its first hike in 17 years. Markets expect another 25 bps hike this year as policymakers focus on the yen, which hit its weakest level in 34 years in April, prompting government intervention. Governor Kazuo Ueda said on Thursday the central bank should reduce its huge bond purchases. Investors are watching to see whether it begins that at its June 13-14 meeting. Sign up here. https://www.reuters.com/markets/rates-bonds/ecb-canada-cut-rates-easing-among-big-economies-gets-going-2024-06-06/

2024-06-06 13:41

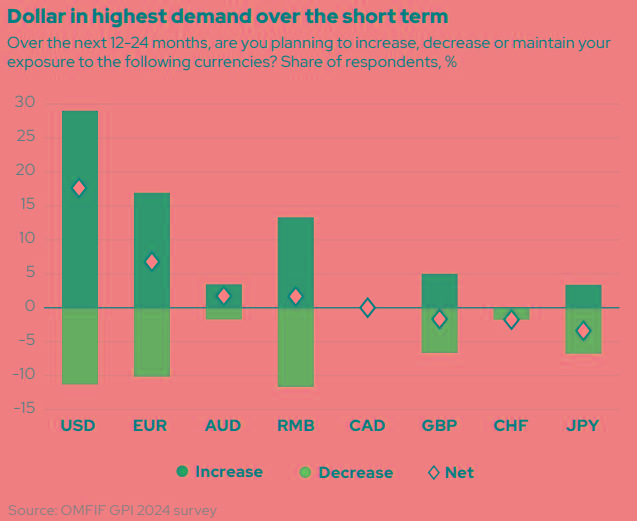

ORLANDO, Florida, June 6 (Reuters) - After two decades of the dollar's share of global foreign exchange reserves gradually eroding to less than 60%, economic, financial and geopolitical stars are aligning to halt that trend in the next few years and possibly even reverse it. At least temporarily. That's the indication from an annual survey New Tab, opens new tab of central banks and reserve managers conducted by the Official Monetary and Financial Institutions Forum, which chimes with recent research and analysis from leading figures in the world of FX reserves. The emergence of the euro and China's explosive rise to the world's second-biggest economy have diminished the dollar's FX reserve status, and an ongoing desire for diversification is likely to ensure it is never quite as omnipotent again. But according to the OMFIF's 'Global Public Investor 2024' survey of 73 central banks in charge of managing $5.4 trillion of reserves, a net 18% of reserve managers plan to increase their dollar holdings over the next 12-24 months. That's two and a half times more than the second-highest currency, the euro, which a net 7% of respondents plan to increase exposure to. Perhaps more significantly, it is three times higher than the net 6% in last year's survey who said they would raise their dollar share. That's a hugely positive swing in sentiment. DISTANT LAGGARDS The dollar continues to enjoy overwhelming dominance in international trade, invoicing and financing flows, and U.S. debt markets offer a depth of liquidity that no market on the planet comes close to matching. OMFIF's 'Global Public Investor 2024' survey found that 27% of reserve managers say the most important investment objective this year is ensuring liquidity, up from 20% last year. On top of that, cyclical factors are increasingly playing into the dollar's favor - U.S. economic growth and rates of return relative to global peers are high and look likely to remain so over the next couple of years. This would signal a shift in central bank thinking. In a May 29 post, New York Fed economists New Tab, opens new tab argue that relative returns on sovereign assets have not been a significant factor in the dollar's share of official reserves. What the OMFIF survey, New York Fed and other analysis all point to is the rise in global geopolitical tensions and need for liquidity, which will draw reserve managers to the dollar more than any other currency. "For the dollar share to fall, another currency's share has to rise. Then you have to question, which one? Which of the others is a truly global currency," said Hiro Ito, professor of economics at Portland State University and a renowned authority on global FX reserves and capital flows. "The dollar's dominance is so strong. There's no most powerful second currency, and certainly no most powerful third, fourth, or fifth currency," he says. SANCTIONS While debate around the dollar's FX reserves status is often conflated with doomsday scenarios about the collapse of the U.S. currency and economy, much less is said about the euro's failure to capitalize on the gradual erosion of the dollar's dominance. According to the International Monetary Fund's composition of official exchange reserves (Cofer) New Tab, opens new tab data, the euro's share of the $12 trillion total last year was just under 20%, exactly where it was in 2015 and well down from its peak of 28% in 2009. Geopolitics must be on central banks' minds here too. The freezing of Russian assets and sanctions on Russia after it invaded Ukraine will affect the euro more than the dollar - Moscow had sold all its U.S. Treasuries and greatly reduced the dollar share of FX reserves before the invasion, and most Russian money overseas is in Europe, not the United States. Equally, if freezing Chinese assets abroad is a possibility, will countries in Asia - or anywhere, for that matter - want to be exposed to the renminbi? That's before China's capital controls are even taken into account. SMALL COHORT, BIG IMPACT A New York Fed paper New Tab, opens new tab in March found that countries that are more politically distant from the United States, and perhaps more likely to be subject to financial sanctions, tend to have a higher dollar share in official reserves, all else equal. It is countries that already have large reserves, well in excess of emergency liquidity needs and already with a high dollar share, that are more liable to divest out of dollars on geopolitical grounds. According to the March research, the seven percentage point decline in the dollar's share of global reserves between 2015 and 2021 was driven by a small group of countries - notably China, India, Russia, and Turkey - and the large increase in Switzerland's euro reserves accumulated through FX intervention. "It is therefore not the case that countries are moving away from dollars en masse," they write, adding that out of the 55 countries for which there are estimates, 31 increased the dollar share of reserves in that period. (The opinions expressed here are those of the author, a columnist for Reuters.) Sign up here. https://www.reuters.com/markets/currencies/demise-dollars-fx-reserve-omnipotence-greatly-exaggerated-mcgeever-2024-06-06/

2024-06-06 13:10

June 6 (Reuters) - The U.S. Treasury Department said on Thursday it is seeking public comments on the use of artificial intelligence in the financial services sector. The agency is looking to improve its understanding of the opportunities and risks presented by the development and application of AI within the sector. Regulators have cautioned that the rapid adoption of AI could create new risks for the U.S. financial system if the technology is not adequately monitored. U.S. Treasury Secretary Janet Yellen will warn that the use of AI in finance could lower transaction costs but comes with "significant risks," according to excerpts from a speech to be delivered to a Financial Stability Oversight Council and Brookings Institution AI conference on Thursday. The Treasury said it is seeking inputs from a broad set of stakeholders and is particularly interested in understanding how AI innovations could help promote inclusive and equitable access to financial services. The agency has encouraged members of the public to submit their comments within 60 days. Sign up here. https://www.reuters.com/technology/us-treasury-seeks-public-comments-ai-use-financial-services-sector-2024-06-06/

2024-06-06 12:36

June 6 (Reuters) - When the Biden administration announced new U.S. auto-emissions regulations in March, it made concessions to industry allowing for a much slower electric-vehicle transition than it had proposed a year earlier. Instead of aiming to convert two-thirds of new vehicles to EVs by 2032, it lowered that target and said automakers could comply by producing more gas-electric hybrids. Then Environmental Protection Agency (EPA) chief Michael Regan made a surprising claim - that the relaxed rules would deliver essentially the same pollution reductions as the administration's original proposal. A Reuters examination of the rule changes and the agency's emissions projections show the concessions will result in substantially more pollution than originally foreseen in two ways: by delaying stricter emissions limits for years; and by retaining an outdated formula for plug-in hybrids that the EPA concedes underestimates their real-world pollution. Using the EPA projections, Reuters calculated that the rules allow the average-per-mile carbon emissions of light-duty vehicles to be 14% higher between 2027 and 2032 than in the original proposal. Moreover, the plug-in-hybrid formula estimates their emissions to be between about 25% to 75% lower than they really are, depending on the vehicle's battery range, according to data from researchers and California regulators. That's because the EPA formula assumes drivers charge their cars more (and use their combustion engines less) than most people do in reality. Reuters compared the EPA formula with one using real-world vehicle-charging data from the International Council on Clean Transportation, a Washington-based think tank, and California automotive regulators. In its original proposal, the EPA called for replacing the 14-year-old formula for plug-in-hybrid emissions with a measure "determined from real world data" on charging, but it decided under pressure from automakers to keep it until 2031. Some automakers argued a more restrictive formula would stifle plug-in innovation. The EPA said in a statement to Reuters the new rules provide "significant" pollution reductions that are "achievable and affordable" for automakers and give consumers wide-ranging options. The agency said it delayed changing the hybrid formula because of "extensive public comment," from automakers and others, and considerations of "appropriate lead time" for developing cleaner vehicles. INCENTIVIZING HYBRID TRUCKS, SUVS? The impact of the generous regulatory treatment could be magnified if the rules incentivize more plug-in-hybrid production. These vehicles currently account for just 2% of U.S. retail auto sales, according to automotive analytics firm J.D. Power. All hybrids account for 11.9%, a share that has been rising. Environmental advocates expressed concern that Detroit automakers, which depend on truck-and-SUV sales, could respond to the EPA regulations with plug-in versions of popular gas-guzzlers that might be only marginally more efficient. The EPA said its rules will not incentivize inefficient plug-ins because automakers would have to offset them with more efficient vehicles. Stellantis (STLAM.MI) New Tab, opens new tab, which makes Jeep SUVs and Ram pickups, has proven the concept of applying plug-in technology to relatively inefficient SUVs. The automaker may see the biggest benefit from the hybrid-friendly rules because it's among America's most prolific tailpipe polluters and the nation's leading seller of plug-in hybrids, including "4xe" versions of its Jeep Wrangler and Grand Cherokee. Stellantis said in a statement that its 4xe models offer lower emissions for customers wanting a powerful off-road vehicle. Reducing pollution, Stellantis said, requires automakers to produce cleaner vehicles that serve "a wide range of consumer demands." General Motors (GM.N) New Tab, opens new tab said in January, shortly before the EPA announced the new rules, that it planned to build plug-in hybrids for North America after previously eschewing all hybrids as a distraction from EVs. Ford (F.N) New Tab, opens new tab has recently seen surging sales of traditional hybrids, including pickups, and sells a plug-in Escape SUV. GM said it expects plug-in hybrids to grow from a "small niche" into a bigger opportunity over three years, adding: "We'll be ready." Ford said its hybrid strategy predates the EPA decision. EMISSIONS VARY WIDELY EVs produce zero tailpipe emissions but hybrid pollution varies widely by model. Plug-ins travel short distances on electric-only power before their gasoline engines are needed. Some are highly efficient, such as Toyota's Prius Prime, which travels 44 miles on electricity and gets 52 mpg thereafter. But the Jeep Wrangler 4xe, America's best-selling plug-in hybrid, isn't exactly a green machine. The appeal of this electrified off-roader, in fact, may be based more on the power rather than the efficiency its battery provides, according to a Reuters review of online comments from 4xe owners. The electrified Wrangler produces a prodigious 375 horsepower and 470 pound-feet of torque, significantly more than standard gasoline-powered Wranglers. But its electric-only range is just 21 miles, after which the vehicle gets only 20 mpg – slightly worse than a gasoline-powered Wrangler with the same turbocharged engine. Stellantis said the 4xe model, which accounts for about half of Wrangler sales, helps it comply with regulations but that it has bigger plans for clean vehicles, including 25 U.S. EV models it aims to launch by 2030. Electric versions of its Ram pickup, Jeep Wagoneer and Dodge Charger will go on sale this year. HYBRIDS FOR 'TORQUE AND SPEED' The EPA's outdated plug-in-hybrid formula gives automakers outsized credit for pollution reductions because it assumes drivers charge daily and rarely burn gas. "Unfortunately, none of those things appear to be true in the real world," said Aaron Isenstadt, a senior researcher at the International Council on Clean Transportation. The EPA formula gives Stellantis a reduction of about 40% in estimated pollution for a plug-in Wrangler, compared to its emissions while using gasoline. The allowance is based on its electric-only range. A Reuters review of online Jeep forums found some owners touting the 4xe's efficiency but others saying they don't regularly charge it because they bought it for other reasons. One Reddit user this year reported charging twice a week and driving longer than the electric range daily: "Really it's the torque and speed I love my 4xe for." Jeep tries to ease drivers' charging anxieties. "Do I need to charge my 4xe vehicle every night?" it asks in a "your questions answered" section of its website. "No! You only need to charge your 4xe vehicle when you want to." Stellantis said that its customer feedback shows most regularly charge, and that Jeep offers an "Eco Coaching" app to help owners drive efficiently. POLLUTION POLITICS The EPA's original proposal aimed for a 67% EV market share for new cars in 2032, compared to less than 8% in 2023. Under the final rules, the EPA projects slower adoption in a wide range — between 35% and 56% by 2032 — rather than with a specific target, reflecting the flexibility to comply using hybrid engines and other technologies. The EPA's retreat came amid political pressure on Democratic U.S. President Joe Biden as he seeks re-election in November. Biden and his Republican rival, Donald Trump, both need to win Michigan, an auto-industry hub and a critical election battleground. Trump trashes EVs as a job-killer. The EPA standards, while less strict than proposed, do require substantial pollution reductions over the rules they will replace. The agency told Reuters that the differences between pollution allowed in its original proposal and final rule will become smaller over time, once the strictest standards are in place. It said that, when projected through 2055, the final rule would achieve 94% of the carbon-emission reductions predicted in its original proposal. But it remains unclear whether the toughest restrictions, which don't take effect until after 2030, will survive in future administrations. Automakers have a history of lobbying to delay strict regulations for years - then working to reverse them. That happened in the transition between the administrations of Barack Obama and Trump. Detroit automakers agreed to support stricter emissions standards in 2011 after talks with the Obama administration. But the industry convinced Trump's administration to weaken them after he took office in 2017, before the toughest provisions took effect. Sign up here. https://www.reuters.com/business/autos-transportation/plug-in-polluters-how-bidens-emissions-rules-go-soft-hybrid-trucks-suvs-2024-06-06/

2024-06-06 12:32

BERLIN, June 6 (Reuters) - Former Chancellor Gerhard Schroeder has lost another legal bid to reverse a decision to strip him of his government-funded office taken after the Kremlin's invasion of Ukraine amid public outcry over his ties to Russia. The Bundestag said in 2022 that Schroeder, Social Democrat Chancellor from 1998 to 2005, was no longer carrying out duties in his capacity as former chancellor so did not deserve the publicly-funded office and staff to which he had been entitled. The decision came amid public anger at Schroeder over his refusal to distance himself from Russian President Vladimir Putin, whom the former chancellor has described as a personal friend. He lost a case with a Berlin court to reverse the decision last year. On Thursday, a spokesperson for the Upper Administrative Court in Berlin said he lost that bid too. Schroeder visited the Russian leader in Moscow in 2022 and said afterwards that Russia wanted a negotiated solution to the war in Ukraine. Ukrainian President Volodymyr Zelenskiy branded Schroeder's behaviour as "disgusting". Long criticised for his close links to the Russian energy sector, including the Nord Stream gas pipeline, Schroeder stood down from the board of Russia's state-owned oil company Rosneft and declined a nomination for a board position at Gazprom. Last year, the SPD decided Schroeder could remain a party member as he had not violated any party rules. A local chapter of the SPD had sought to expel him. Sign up here. https://www.reuters.com/world/europe/former-german-chancellor-schroeder-loses-case-get-bundestag-office-back-2024-06-06/