2024-06-06 05:10

LONDON, June 6 (Reuters) - Global investment in clean energy technology and infrastructure is set to hit $2 trillion this year, twice the amount going into fossil fuels, an International Energy Agency report showed. Total energy investment is expected to exceed $3 trillion for the first time in 2024, the IEA said in its annual World Energy Investment report. Some $2 trillion is set to go to clean technologies – including renewables, electric vehicles, nuclear power, grids, storage, low-emissions fuels, efficiency improvements and heat pumps - with the rest directed towards gas, oil and coal. Combined investment in renewable power and grids overtook the amount spent on fossil fuels for the first time in 2023. "For every dollar going to fossil fuels today, almost two dollars are invested in clean energy," said IEA Executive Director Fatih Birol. "The rise in clean energy spending is underpinned by strong economics, continued cost reductions and by considerations of energy security," he added. China is set to account for the largest share of clean energy investment in 2024 with an estimated $675 billion, while Europe is set to account for $370 billion and the United States $315 billion. More spending is focused on solar photovoltaic (PV) than any other electricity generation technology with investment set to grow to $500 billion in 2024 due to falling solar module prices. Global upstream oil and gas investment is expected to increase by 7% in 2024 to $570 billion, following a similar rise in 2023. This was mostly led by national oil companies in the Middle East and Asia, the report said. However, there are still shortfalls in energy investment in parts of the world such as emerging economies and developing economies outside China, it added. Sign up here. https://www.reuters.com/sustainability/climate-energy/iea-expects-global-clean-energy-investment-hit-2-trillion-2024-2024-06-06/

2024-06-06 04:57

SYDNEY, June 6 (Reuters) - A Chinese mining investor has failed in a bid to join Australian rare earths mining company Northern Minerals' (NTU.AX) New Tab, opens new tab board on Thursday, days after Australia's Treasurer ordered the investor's private company to sell some of its shares. Treasurer Jim Chalmers earlier this week ordered several China-linked investors to dispose of Northern Mineral shares, amounting to 10.4% of its issued share capital, on national interest grounds. Yuxiao Fund had 60 days to offload 80 million Northern Minerals shares bought in September. The company was ordered not to lift its stake in February 2023. Australia and its Western allies are striving to build out a supply chain separate to dominant producer China, which supplies around 90% of the world's permanent magnets used in everything from wind turbines to electric vehicles to defence. Rare earths miners are increasingly relying on government support. Northern Minerals is producer of heavy rare earths, which are more sought after by China. It shares closed up 7%. The fund had sought Foreign Investment Review Board approval to raise its ownership to 19.9% in 2022, from 9.81% of Northern Minerals, but was declined last year. Northern Minerals has said the ultimate controller of Yuxiao Fund is Chinese national Wu Tao. Wu's nomination to join the Northern Minerals board was one of four that failed on Thursday, the company announced at its annual meeting. Wu Tao has mining interests in Mozambique and China, where his private company has developed and operated rare earth minerals businesses, Northern Minerals has said. Two other board candidates proposed by entities and individuals linked to Yuxiao Fund and named in the Treasurer's disposal order on Monday also failed at the meeting. The Australian government's order to several China-linked investors to dispose of shares was not connected with the company's revelation this week of a data leak by cyberhackers, Northern Minerals Executive Chairman Adam Handley said at the meeting. Northern Minerals said on Tuesday some of its corporate, operational and financial data had been released on the dark web, following a cyberattack in March. Handley said at the company's shareholder meeting in Perth on Thursday that the attack and the divestiture order were not linked. "As is typical with cyber security attacks on corporations like Northern Minerals, the hackers demanded a ransom from us. Northern Minerals, out of principle, refused to engage with the hackers on a ransom," he said. "The fact we disclosed the cyber security breach a day after the Treasurer's divestiture order was announced is a coincidence. There are no suggestions, contrary to some media speculation, that the two events are linked in any way." Sign up here. https://www.reuters.com/technology/cybersecurity/northern-minerals-cyberhacking-share-sale-order-unrelated-chairman-says-2024-06-06/

2024-06-06 04:31

A look at the day ahead in European and global markets from Ankur Banerjee After the Bank of Canada became the first G7 country to cut interest rates, the stage is set for the European Central Bank to lower rates too. But all eyes are sure to be on President Christine Lagarde as traders ponder: what comes next? While ECB policymakers clearly telegraphed their intention to lower borrowing costs in June, moving well ahead of the U.S. Federal Reserve, the path beyond has become uncertain. Recent economic data has underscored that inflation could prove perhaps to be stickier than expected in the euro area, as has been the case in the United States. That has brought the focus squarely on what Lagarde will say once the ECB delivers the widely expected rate cut on Thursday. Markets are pricing in 64 basis points of cuts this year. Ahead of the policy decision, the euro was 0.23% firmer at $1.08935, just shy of the two-and-half month peak touched earlier this week. Futures indicate European bourses are set for a higher open, taking their cue from U.S. and Asian stocks as a slew of U.S. labour data firms bets of a September rate cut from the Fed. Traders are pricing in a 69% chance of a cut in September versus around 50% chance last week. Non-farm payrolls are due on Friday and will be crucial in dampening or emboldening these renewed policy easing expectations ahead of next week's Fed meeting where the dot plot and comments from officials will take the spotlight. Chip stocks across the globe are once again basking in the afterglow of Nvidia (NVDA.O) New Tab, opens new tab after the AI chipmaker become the world's second-most valuable company and is now valued above $3 trillion. Meanwhile, Nvidia's CEO is in Taiwan this week getting pop star treatment. Jensen Huang, touted as the local boy who made good, is the subject of wall-to-wall coverage on Taiwanese television. No wonder, Taiwan stocks (.TWII) New Tab, opens new tab are on a roll, scaling a record high, powered by TSMC (2330.TW) New Tab, opens new tab, whose major clients include Nvidia and Apple (AAPL.O) New Tab, opens new tab. Key developments that could influence markets on Thursday: Economic events: ECB policy meeting, euro zone retail sales for April Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-2024-06-06/

2024-06-06 04:21

MUMBAI, June 6 (Reuters) - The Indian rupee weakened on Thursday despite broad gains in Asian currencies, which were pushed higher by improved odds of the Federal Reserve cutting policy rates later this year. The rupee was at 83.43 against the U.S. dollar as of 09:35 a.m. IST, down from its close at 83.37 in the previous session. While the currency came under pressure following a weaker-than-expected showing by the Prime Minister Narendra Modi-led coalition in the national elections on Tuesday, it partially recovered in the following session after intervention from the Reserve Bank of India. Traders expect the central bank to continue acting against sharp declines in the rupee but sustained equity related outflows may keep up pressure on the currency. Foreign investors have net sold over $2 billion worth of Indian equities over the last two trading sessions. Benchmark Indian equity indices, the BSE Sensex (.BSESN) New Tab, opens new tab and Nifty 50 (.NSEI) New Tab, opens new tab, were up about 0.7% each in early trading. "With RBI firmly in saddle ... the range for now looks to be broadly between 83 to 83.50," Anil Bhansali, head of treasury at Finrex Treasury Advisors said. Meanwhile, dollar-rupee forward premiums ticked higher with the 1-year implied yield up 2 basis points (bps) at 1.66% after US bond yields slipped following economic data which bolstered hopes that the Fed would cut rates twice this year. The dollar index fell 0.1% to 104.1 and most Asian currencies gained. Expectations that the central bank will intervene to cap rupee weakness is also likely to spur "natural offers (to sell dollars)," near 83.50, a foreign exchange trader at private bank said. Investors now await the RBI's monetary policy decision and the closely watched U.S. non-farm payrolls report, both due on Friday. Sign up here. https://www.reuters.com/markets/currencies/rupee-falls-though-asian-peers-gain-forward-premiums-tick-up-2024-06-06/

2024-06-06 04:12

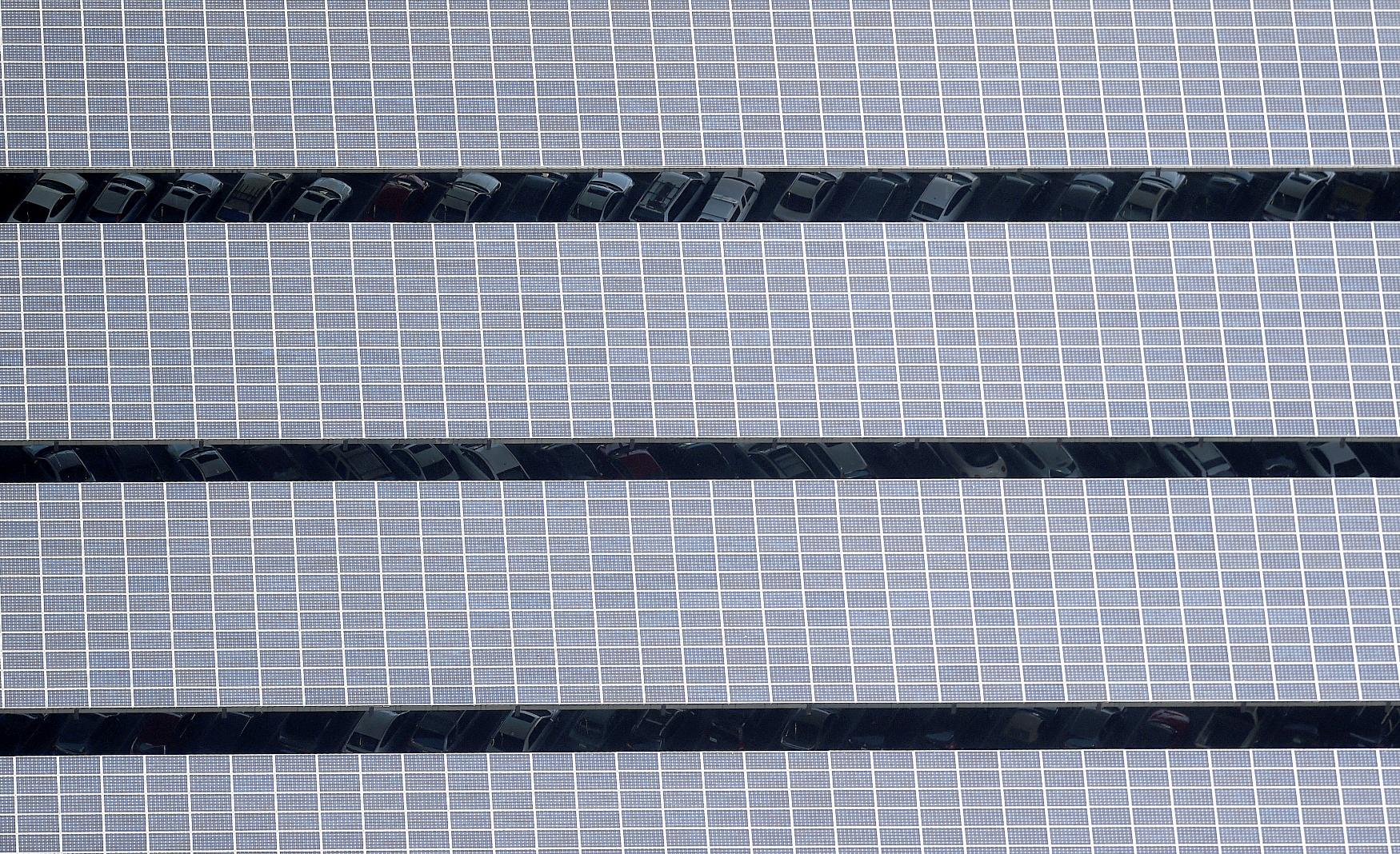

NEW YORK, June 6 (Reuters) - Solar accounted for 75% of electricity generation capacity added to the U.S. power grid early this year as installations of panels rose to a quarterly record, according to a report published by Wood Mackenzie and the Solar Energy Industries Association on Thursday. The country's solar industry saw 11.8 gigawatts of new capacity in the first three months of 2024 as electric utilities continued their rapid additions of the renewable power sources, the report said. U.S. solar has benefited from the increased availability of panels and from federal and state policies aimed at increasing the amount of clean energy on the electric grid to meet climate-driven emissions goals. "Not only has the global solar supply chain expanded, but module imports to the US have also risen significantly over the last year," according to the report. Supply chain bottlenecks eased and the cost of solar panels fell after Biden placed a two-year moratorium on imported panels believed to be produced with forced labor in China. From June 2023 through March 2024, the U.S. imported 49 GW of solar modules. Domestic solar panel manufacturing capacity, meanwhile, jumped to 26.6 gigawatts for the first three months of the year from 15.6 gigawatts the prior quarter. Florida, followed by Texas, California, and Nevada, installed the most panels, with utility-scale solar making up the majority of the additions. Home solar additions fell 25% year-over-year and 18% quarter-over-quarter, largely on rising interest rates and a slowdown in California's rooftop solar. The commercial solar sector was roughly flat quarter-over-quarter. The United States is expected to install roughly the same amount of solar capacity this year as 2023, which was a record of nearly 40 Gigawatts of additions, the report said. Sign up here. https://www.reuters.com/business/energy/us-solar-installations-hit-quarterly-record-making-up-75-new-power-added-report-2024-06-06/

2024-06-06 03:01

MUMBAI, June 6 (Reuters) - The Indian rupee is expected to open largely unchanged on Thursday amid foreign investors taking money out of equities post the election outcome and a broadly weaker dollar. The 1-month non-deliverable forwards indicate rupee will open nearly flat from 83.37 in the previous session. On the back of likely intervention by the central bank, the rupee managed a recovery on Thursday. "They (the Reserve Bank of India) sold quite a big amount yesterday, yet again telling the market that for now 83.50-83.55 is the ceiling (for dollar/rupee)," a currency spot trader at a bank said. "All are looking at (Indian) equities, which recovered and offered one more reason to exit shorts." India's Nifty 50 index (.NSEI) New Tab, opens new tab climbed 3.3% on Wednesday, recovering more than half of the decline suffered on the vote counting day. Foreign investors, however, remained wary of the election outcome, which put out a narrower mandate for Prime Minister Narendra Modi. Foreign investors took out $678 million on Wednesday, having withdrawn $1.5 billion in the previous session. Meanwhile, Asian currencies were mostly higher and the dollar index dipped to near 104 amid risk appetite. The increasing likelihood of a U.S. Federal Reserve rate cut at the September policy meeting is helping risk assets. The Bank of Canada trimmed its key policy rate on Wednesday, the first G7 country to do so. The European Central Bank will likely do the same later on Thursday. After Bank of Canada and the ECB, "could the Fed cut rates this year then? Markets think so, with 2 rate cuts now being priced in," MUFG Bank said in a note. KEY INDICATORS: ** One-month non-deliverable rupee forward at 83.44; onshore one-month forward premium at 7 paise ** Dollar index down at 104.04 ** Brent crude futures up 0.4% at $78.8 per barrel ** Ten-year U.S. note yield at 4.30% ** As per NSDL data, foreign investors sold a net $1,466.3mln worth of Indian shares on June 4 ** NSDL data shows foreign investors bought a net $103.3mln worth of Indian bonds on June 4 Sign up here. https://www.reuters.com/markets/currencies/rupee-pressed-by-equity-outflows-supported-by-soft-dollar-2024-06-06/