2024-06-04 06:52

BENGALURU, June 4 (Reuters) - Indian Prime Minister Narendra Modi's alliance was heading towards a majority in vote counting trends in the general election on Tuesday, but the numbers so far showed the margin of victory may not be as large as exit polls suggested, leading to a rout across markets. MARKET REACTION: STOCKS: Indian shares posted their worst session in more than four years, with the Nifty index (.NSEI) New Tab, opens new tab closing 5.7% lower. RUPEE: The Indian rupee weakened 0.47% versus the U.S. dollar, and was quoted at 83.53 per dollar. BONDS: India's benchmark 10-year bond was quoted at 100.40 rupees, with the yield up 10 bps at 7.0411%, after hitting their highest in nearly two weeks earlier. Here are some top reactions from market analysts: KEN PENG, HEAD OF INVESTMENT STRATEGY, ASIA, CITI GLOBAL WEALTH, SINAGPORE "The key question is whether BJP can retain single party majority. If not, then would its coalition be able to deliver economic development, particularly infrastructure?" "The Indian equity market had essentially been flat for three months ahead of this election and this new political uncertainty is likely to cause some moderate de-rating for Indian equities for several reasons." "There may be more expansionary fiscal policy to strengthen welfare and other local government spending... past episodes of fiscal slippage had been associated with weaker equity and currency." NEELESH SURANA, CHIEF INVESTMENT OFFICER, MIRAE ASSET MUTUAL FUND "The current market reaction is largely stemming from unmet expectations. This overreaction reflects a sense of disbelief." "However, despite the verdict, there will likely be underlying continuity in government policies. Stocks in sectors within industrial, capital goods, and government companies, which surged too rapidly during the last one year, were ripe for correction given that many companies saw their stock prices outpace earnings growth." "There has been a frenzy of activity in the market over the past two days. Individual investors, buoyed by the perception of a one-way ascent in stock prices, exacerbated market fluctuations through derivatives trading. Corrections do get amplified in such situations as derivatives positions tend to magnify market movements in either direction." NICK FERRES, CHIEF INVESTMENT OFFICER, VANTAGE POINT ASSET MANAGEMENT, SINGAPORE "Although the Modi government will likely be returned, the slimmer majority has raised some concern about continuity of the policy agenda and macro stability. To be clear, we are not bearish on the market but the price you pay matters for your future return. The way price has responded to news suggests that a lot of hope in future growth had been priced." JOHNNY CHEN, PORTFOLIO MANAGER, EMERGING MARKETS DEBT WILLIAM BLAIR, SINGAPORE "While the markets will likely price out election uncertainty, they could swiftly redirect their attention to the government's 2025 budget in July and ongoing reforms, including long-term fiscal consolidation plans, land and labor laws changes, and measures to attract foreign investment inflows with Indian government bonds entering the GBI index later this month." MANISH BHARGAVA, FUND MANAGER AT STRAITS INVESTMENT MANAGEMENT, SINGAPORE "Foreign investors are closely monitoring the election outcome. A stable government encourages foreign inflows, while uncertainty can trigger outflows." "In the absence of a decisive win for the ruling party, we may witness a reversal of recent gains in the Indian equity markets, and the Indian rupee is also likely to weaken further. Additionally, uncertainty surrounding a convincing BJP victory could lead to a spike in bond yields, causing volatility as market participants will reassess the political landscape." DIPAN MEHTA, FOUNDER DIRECTOR AT ELIXIR EQUITIES, MUMBAI "The biggest disappointment for the market is the fact that Bharatiya Janata Party (BJP) does not have a majority (yet). I don't need to say more, but that opens up Pandora's box because all the other players ... are all quite volatile." VASU MENON, MANAGING DIRECTOR OF INVESTMENT STRATEGY, OCBC, SINGAPORE "A narrower-than-expected victory for Modi's alliance may raise doubts about the new government's ability to push through politically difficult reforms seen as crucial to sustain India's economic growth, which is already the world's fastest." "Despite this the fact remains that the BJP-led alliance is still set to win a third term, which means continuity in the government's infrastructure and manufacturing-led drive to boost economic growth." Sign up here. https://www.reuters.com/world/india/market-analysts-react-votes-are-counted-indias-giant-election-2024-06-04/

2024-06-04 06:21

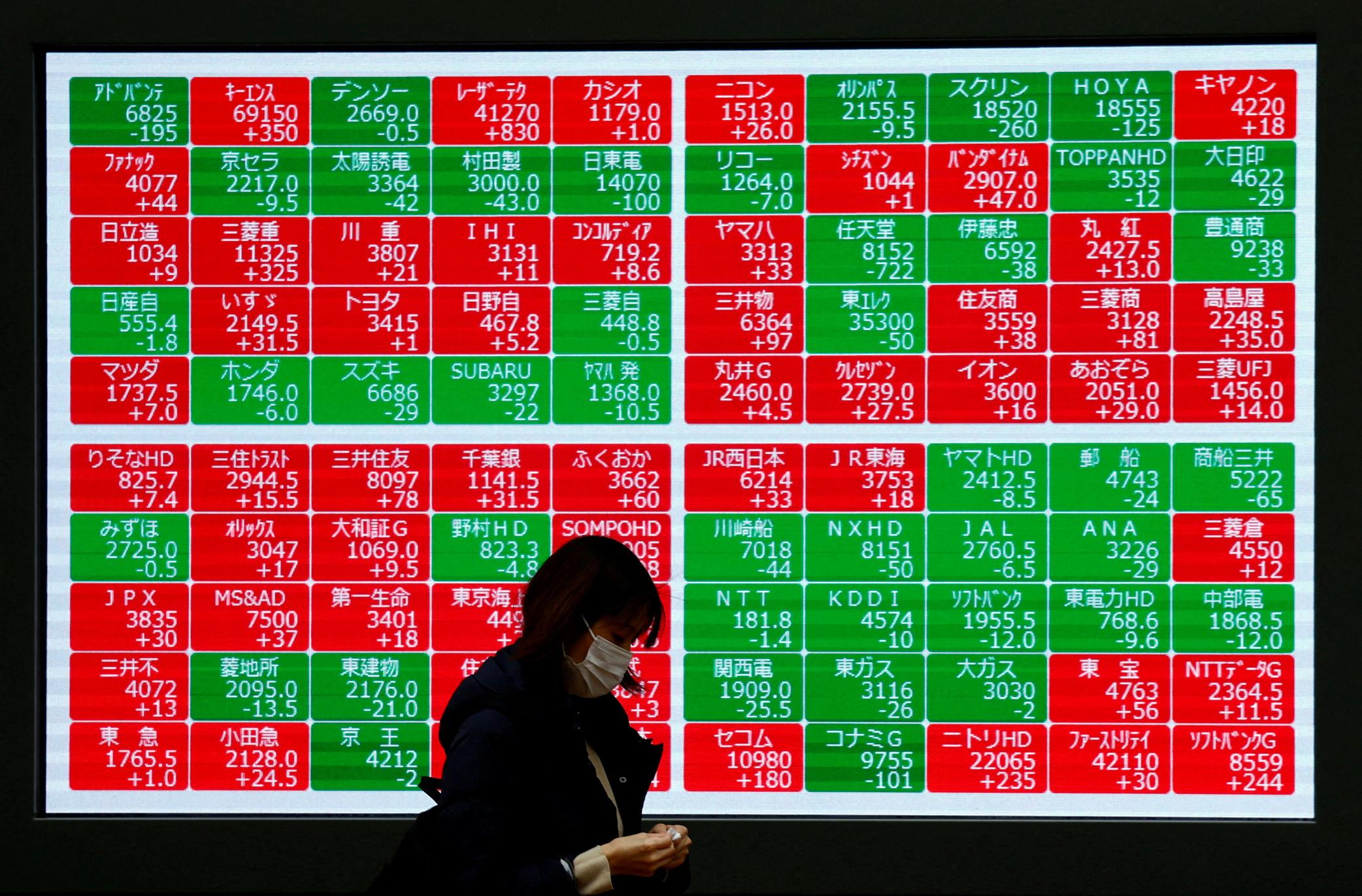

JOLTS data showed job openings fell to more than three-year low Treasury yields decline, dollar pares gains NEW YORK/LONDON, June 4 (Reuters) - World stocks and commodities slid on Tuesday as investors turned uneasy about evidence that the U.S. economy's "exceptionalism" may be starting to unwind, after data showed surprising weakness in business activity. The risk that the U.S. economy might be softening more than expected was brought to the fore again after Tuesday's data showed job openings fell more than forecast in April to the lowest in more than three years. That helped to reinforce some investor speculation that the Federal Reserve could be on track to lower interest rates this year as a cooling economy tempers inflation pressures. In response, Treasury yields briefly extended their declines early in the session, before recovering somewhat. "Markets are back to thinking two rate cuts is the likeliest path of Fed rate policy over the rest of the year," said Nicholas Colas, the co-founder of DataTrek Research. "The past week's softer-than-expected economic data explains the rethink." By the end of the session in New York, the MSCI All-World index (.MIWD00000PUS) New Tab, opens new tab was down 0.2%. On Wall Street, major stock indices reversed losses to eke out modest gains. The S&P 500 index (.SPX) New Tab, opens new tab added 0.2%, the Dow Jones Industrial Average (.DJI) New Tab, opens new tab rose 0.4% and the Nasdaq Composite (.IXIC) New Tab, opens new tab was up 0.2%. Several measures of volatility picked up, reflecting a degree of nervousness among traders, while classic safe-haven assets like bonds and the dollar remained in positive territory. Oil, copper and gold also fell in the face of the stronger U.S. currency. Earlier in the day, the dollar touched its lowest in over two months against the euro and the pound, as investors have bought into the idea that the U.S. economy is slowing enough to warrant rate cuts this year. "It is understandable why the market behaved as it did in the first quarter, but if one looked at broader indicators, there have always been certain signs that maybe the story isn't quite as strong as might have been expected," Daiwa Capital economist Chris Scicluna said. "Most people would have assumed that where the fed funds rate is right now is in restrictive territory. That is bearing down on underlying inflation and bearing down on some of the dynamism in spending," he said. Stocks in Europe slid, led by energy, mining and banking shares, pushing the STOXX 600 (.STOXX) New Tab, opens new tab down by as much as 0.9%. It trimmed losses and to finish down 0.5%. Wall Street's so-called "fear index," the VIX (.VIX) New Tab, opens new tab rose by the most in a week, echoing a sharp rise in the Euro STOXX volatility index (.V2TX) New Tab, opens new tab to a one-month high. In India, share markets sold off sharply after early vote counting showed Prime Minister Narendra Modi's Bharatiya Janata Party (BJP)-led alliance was not headed for a landslide win as predicted. A Modi victory had been expected to be positive for the country's financial markets, according to analysts, on the hope India will undertake further economic reform. The reduced prospect of Modi's alliance winning an overwhelming majority rattled investors. The Nifty index (.NSEI) New Tab, opens new tab dropped as much as 8.6% before recovering some of those losses, while the BSE index (.BSESN) New Tab, opens new tab dropped almost 6%. Both indexes had touched all-time highs on Monday. Political jitters also knocked the Mexican peso and South Africa's rand . Both currencies fell about 1.1%, following election results in those countries. JOBS, JOBS, JOBS This week brings a slew of major data. Non-farm payroll figures for May are out on Friday, following Tuesday's Job Openings and Labor Turnover Survey. On Monday, U.S. Treasury yields fell to the lowest point in two weeks, after the country's manufacturing activity slipped for the second consecutive month in May. Benchmark 10-year note yields fell 7 basis points to 4.332% and got as low as 4.314%, the lowest since May 16. Two-year note yields fell 5 basis points to 4.773% and reached 4.749%, also the lowest since May 16. "The sharper move at the long-end is a sign that weaker manufacturing data is unlikely to shift the dial on Fed rate cuts near term, but is perhaps a signal of the market's view of neutral interest rates as U.S. economic exceptionalism fades," Westpac economist Jameson Coombs said in a note. In Europe, investors expect the European Central Bank on Thursday to cut the benchmark rate by 25 basis points to 3.75%. The dollar fell 1% against the yen, viewed by many as a safe-haven asset because of the low interest rate it bears, to 154.71 , around its lowest for two weeks and over 3% down from late April's multi-year high at 160.03. The euro fell 0.2% to $1.08795, while sterling slipped 0.3% to $1.2769. The dollar index , which tracks the greenback against a basket of currencies of other major trading partners, was up 0.1% on the day at 104.15. U.S. crude oil fell 1.2% to $73.33 a barrel. Brent crude also fell 1% to $77.56. Both benchmarks hit four-month lows on Monday after the Organization of the Petroleum Exporting Countries and allies, together known as OPEC+, agreed to start unwinding some production cuts from October. Gold dropped 1% to $2,326.98 an ounce, while copper , which hit record-highs last month, rose 1.5% to $10,193 a tonne. Sign up here. https://www.reuters.com/markets/global-markets-global-markets-2024-06-04/

2024-06-04 06:21

MUMBAI/SINGAPORE, June 4 (Reuters) - Indian stocks suffered their worst intraday fall since March 2020 on Tuesday and foreign investors sold the most on record, as vote counting trends in the general election suggested Prime Minister Narendra Modi's alliance was unlikely to win the overwhelming majority predicted by exit polls. With over half the votes counted, Modi's own Bharatiya Janata Party (BJP) looked unlikely to secure a majority on its own in the 543-member lower house of parliament and would need allies in the National Democratic Alliance (NDA) to form the government. That could lead to some uncertainty over economic policies, such as the push for investment-led growth, which has been the cornerstone of the Modi government's rule. The Indian economy grew 8.2% in the financial year ended March 2024. "The key question is whether BJP can retain single-party majority. If not, then would its coalition be able to deliver economic development, particularly infrastructure?" said Ken Peng, head of investment strategy, Asia, at Citi Global Wealth. The NSE Nifty 50 index (.NSEI) New Tab, opens new tab closed down 5.93% at 21,884.5 points, and the S&P BSE Sensex (.BSESN) New Tab, opens new tab fell 5.74% to 72,079.05. The indexes fell as much as 8.5% earlier in the day, after hitting record highs on Monday. At the day's low, the indexes saw their biggest intraday fall since March 2020, when stocks were battered by the first lockdown during the COVID pandemic. "Due to the dependency on coalition partners, the upcoming NDA government may shift its focus towards a welfare-oriented approach rather than concentrating on reforms during the July budget," said Puneet Sharma, CEO and fund manager at Whitespace Alpha. Indian markets are likely to now derate due to higher risk perception, said analysts at brokerage Emkay Global, which believes that difficult reforms like changes to land and labour policies, along with privatisation of state-run enterprises, were "off the table". Exit polls over the weekend had projected a big win for Modi's NDA, catapulting markets to all-time highs on Monday as investors were buoyed by expectations of sustained economic growth. Benchmark indexes had more than tripled in value since Modi became prime minister in May 2014, as of Monday's close. Foreign investors, who poured a net $20.7 billion into Indian equities last year but pulled back ahead of the election, had been widely expected to turn buyers if the Modi alliance secured a decisive mandate. On Tuesday, Foreign institutional investors (FIIs) sold a record 124.36 billion rupees (about $1.5 billion) worth of Indian shares, according to provisional data released Tuesday evening. They had bought shares worth a net 68.51 billion rupees ($824.4 million) on Monday. "In our view, the important thing is that the NDA returns to form the next government, which represents policy continuity," said Mike Sell, head of global emerging market equities at Alquity in London. "Whether they win by 20 or 120 impacts the amount of structural reform that can take place, but ultimately a win is a win and the increasing positivity around the Indian structural growth story will be undiminished." The lack of clarity on the margin of victory for the NDA saw intraday volatility on the share index rise to its highest level in 26 months. Traders said that selling by high-frequency traders accelerated the drop and the sharp fall triggered margin calls. The market is witnessing a significant correction due to margin calls as retail investors were carrying heavily leveraged positions, said Rupak De, senior technical analyst at LKP Securities. Some investors saw the decline as a buying opportunity. "Regardless of the final election count, the India economy will continue to benefit from longer-term tailwinds of favourable population demographics and the ongoing geopolitical tensions between China and U.S.," said Gary Tan, portfolio manager at Allspring Global Investments. Investors expect the Modi government to continue focusing on turning the country into a manufacturing hub - a project that has courted foreign companies including Apple (AAPL.O) New Tab, opens new tab and Tesla (TSLA.O) New Tab, opens new tab to set up production as they diversify beyond China. The rupee ended at 83.53 against the dollar, down 0.5% on the day, marking its worst single-day fall in 16 months. The benchmark 10-year bond yield rose 10 basis points on day, its biggest on day rise in eight months, ending at 7.0382%. ($1 = 83.4800 Indian rupees) Sign up here. https://www.reuters.com/world/india/india-stocks-perched-record-highs-vote-counting-set-begin-2024-06-04/

2024-06-04 06:12

Zambia's debt restructuring has taken nearly 4 years Country has been test case for G20 Common Framework mechanism Other indebted countries have voiced concerns about process LONDON, June 4 (Reuters) - More than three-and-a-half years, or 1,300 days, after resource-rich Zambia formally declared itself bankrupt it is about to drag itself out of default, leaving some hard lessons for richer nations about how their much-vaunted debt relief plan performed. Tuesday will see its international bondholders vote through their part of a $13.4 billion debt restructuring and make Zambia the first to complete a full-blown rework under the G20-led 'Common Framework' architecture. Hakainde Hichilema, Zambia's president, has already described it as a historic moment and the head of the International Monetary Fund (IMF), Kristalina Georgieva, has hailed it as a important sign of multilateral cooperation. But for many involved in the day-to-day work - and repeated delays - it will be more of a weary cheer than a celebratory fist shake. "It was painful for Zambia - we fully recognise that," William Roos, the co-chair of both the 'Paris Club' of richer Western creditor nations and of Zambia's Official Creditor Committee that included Zambia's biggest lender China, said at a debt conference in Paris on Friday . "So we have to improve. But we delivered." The overall restructuring is estimated to cut around $900 million dollars from Zambia's debt and spread its future payments over a much longer time frame. It has been its role as a Common Framework guinea pig though that has made it prominent. Launched during COVID-19 in 2020, the Framework was designed to bring all the different lenders to poorer countries under one roof -- particularly China whose lending exploded in the decade before the pandemic. It was regarded as a breakthrough but the extraordinary length of time Zambia's restructuring has taken, as well as others still ongoing in Ghana and Ethiopia, has led to criticism of delays and complexity. Officials and creditors in all three countries have complained about a lack of transparency. Spats emerged early on when China called for the big Western-led multilateral development banks to also swallow losses, while in November the official creditor group, led by China and France, temporarily torpedoed a government and IMF-approved agreement with private sector bondholders in the grounds it did not provide enough debt relief. "The G20 framework... I do not think I want to recommend that to any country," Ghana's central bank governor, Ernest Addison, said at the same event Paris Club co-chair Roos was speaking at, when asked about his country's experiences. BATTLEGROUND Zambia's deal New Tab, opens new tab will see official sector creditors reschedule $6.3 billion worth of their loans while three of the country's main bonds, worth a combined $3 billion, will be rolled into two with new payment schedules and conditions. A modest amount of bank and other loans remain to be restructured. Former IMF General Counsel Sean Hagan and sovereign debt specialist Brad Setser highlight how clauses inserted in the new deals mean Zambia - which is Africa's second largest copper producer - will make extra payments if it recovers fast. Those additional payments though could push its debt back up to a level where the IMF says it is at high risk of debt distress again though. Backers of the Common Framework nevertheless insist that its difficulties are being ironed out. Allison Holland, who heads the IMF's Debt Policy Division, believes lessons learnt in Zambia meant Ghana was able to get from IMF staff level agreement to programme approval far quicker. She added that official creditors now have a better understanding of each other’s concerns and constraints and that the setting up of a Global Sovereign Debt Roundtable means the process can now be continually be improved. Bondholder committee member Thys Louw at South Africa-based investment firm NinetyOne thinks, however, that the struggles in Zambia were deep rooted and that the idea that restructurings have lots of "common" features is a fallacy. "We were always optimistic in terms of engagement, but Zambia became essentially the battleground, the collateral damage in the broader themes at play," Louw said, pointing to both the West's hawkishness towards China and the concern initially that a wave of defaults was approaching. REAL WIN One of Zambia's legal advisors, Melissa Butler at law firm White & Case, also pointed to how China was singled out for criticism. "There was a lot of finger pointing (at China) in early days that was somewhat unfair, because there was a learning process going on," Butler said. "They have demonstrated that they want to engage with the rest of the international community, and in Zambia they delivered. That to me is the real win here". China's foreign ministry spokesman Wang Wenbin said at a regular briefing on Friday that Beijing's efforts had been "highly appreciated" by all sides and that it would, "continue to coordinate and cooperate with all parties concerned." Zambia was supposed to have concluded a review of its IMF Extended Credit Facility (ECF) but that process has been delayed by another crisis - the country's worst drought in 40 years - which means it has another $900 million funding gap to cover. But will getting its restructuring over the line clear the path for the next Common Framework default wherever it crops up? "It think it could be easier, but do I think it will get less complex? No," White and Case's Butler said. Sign up here. https://www.reuters.com/world/africa/zambias-debt-restructuring-limps-over-line-painful-test-case-2024-06-04/

2024-06-04 06:05

AMSTERDAM, June 4 (Reuters) - Deutsche Bank (DBKGn.DE) New Tab, opens new tab will work with Bitpanda to process customer deposits and withdrawals for the Austrian crypto broker, the companies told Reuters. The crypto industry has previously struggled to find banking partners, particularly after the 2023 collapse of Silvergate Capital Corp, Signature Bank and Silicon Valley Bank, which had a high concentration of crypto-related clients. But in the latest sign of the crypto world moving closer to mainstream finance, Deutsche will provide Bitpanda users in Germany with local bank account numbers. This means that deposits or withdrawals of fiat currencies from Bitpanda will go through Germany's largest bank. Some banks do not allow customers to transfer funds to crypto exchanges. Vienna-based Bitpanda, which was founded in 2014, says it has more than 4 million users and offers products including fractional stocks, cryptocurrencies and precious metals. Regulators have raised concerns about crypto market upheaval spilling into mainstream finance as ties between the two deepen, although analysts say connectivity between them remains limited. Deutsche's global head of cash management Ole Matthiessen said it has taken a "very cautious" approach. "We only work with very selective partners and clients who demonstrate strong compliance processes, operate in a regulated environment and meet our heightened expectations from a risk perspective," Matthiessen said in emailed comments. Deutsche does not get involved in the transfer of any crypto through the Bitpanda agreement but instead helps clients transferring in and out of their portfolio while supporting Bitpanda's treasury and payment processes, Matthiessen said. Kilian Thalhammer, global head of merchant solutions at Deutsche, said it wanted to be "the bank of choice for the high-potential platforms" in the world of virtual asset investing. A Deutsche spokesperson said that the bank has a similar partnership with Hong Kong-based crypto exchange Hashkey, but that Bitpanda is the first such client in its Europe, Middle East and Africa region. Bitpanda is already a corporate client of Deutsche's in Austria and Spain but these are not customer-facing, a spokesperson for the broker said. (This story has been corrected to show Bitpanda is a broker, and not an exchange, in paragraphs 1 and 12) Sign up here. https://www.reuters.com/technology/deutsche-bank-ties-up-with-bitpanda-cautious-crypto-shift-2024-06-04/

2024-06-04 05:39

CANBERRA, June 4 (Reuters) - Highly pathogenic avian influenza has been detected at a third poultry farm near Melbourne, but it is not the same strain that has spread globally and raised fears of human transmission, the Victoria state government said on Wednesday. Hundreds of thousands of birds have already been destroyed after bird flu was found at two Australian egg farms last month. The third farm is within a few kilometres of the first to report infection and both have the same H7N3 strain of the virus, while the other farm had an H7N9 strain, the state government said. All three farms have been placed in quarantine with restrictions on movement in surrounding areas. "The detection of avian influenza at this additional property is not unexpected and is the result of ongoing surveillance activities within the Restricted and Control Areas," said Graeme Cooke, Victoria's chief veterinary officer. The outbreak poses no risk to consumers of eggs and poultry products, the government said. Australia has seen nine outbreaks of Highly Pathogenic Avian Influenza (HPAI) since 1976, all of which were contained and stamped out. In recent years a different strain of bird flu - H5N1 - has swept the globe, killing huge numbers of farmed and wild birds. It has also spread to tens of mammal species and through the U.S. cattle herd and infected three people in the United States and one in Australia. Sign up here. https://www.reuters.com/world/asia-pacific/h7-bird-flu-found-third-poultry-farm-australia-2024-06-04/