2024-06-03 14:45

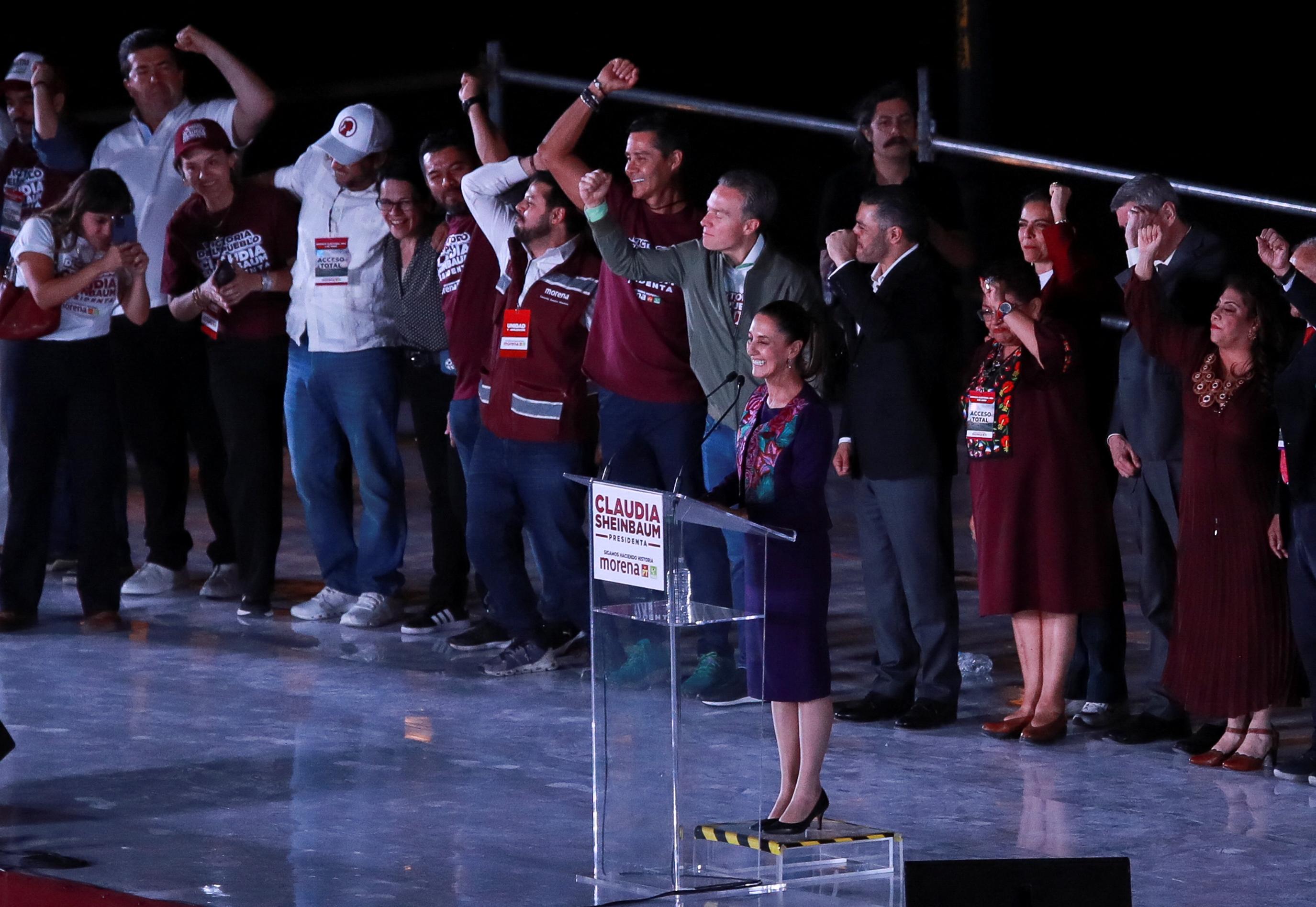

MEXICO CITY, June 3 (Reuters) - Mexican president-elect Claudia Sheinbaum will face the unenviable task of making good on campaign promises to boost social programs even after an election-year spending binge by her predecessor lifted the budget deficit to its highest since the 1980s. After winning investors' confidence with tight spending policies for most of his term, leftist President Andres Manuel Lopez Obrador loosened the purse strings in his final year in office to finish flagship infrastructure projects and cover a surge in welfare programs for Mexico's poor. That boosted the deficit to 5.9% of gross domestic product in 2024, from 4.3% in prior years. Those moves will force Sheinbaum's incoming administration to either hold the line on spending, or risk a hit to Mexico's creditworthiness. Lopez Obrador's finance minister, Rogelio Ramirez de la O, is set to join Sheinbaum's cabinet for some time. "It gives a lot of peace of mind in terms of the economy, and that will smooth the transition," the outgoing president said. The solution for Latin America's second-largest economy, according to economists, analysts, and former top government officials, is some form of tax overhaul which would boost government revenues – despite Mexico's next leader saying she has no plans to raise taxes. Sheinbaum handily won Sunday's election on a platform to expand her predecessor's popular social programs, including increasing pensions for senior citizens and student scholarships. MARKET JITTERS In her victory speech, Sheinbaum promised to continue with Lopez Obrador's policy of "republican austerity", maintain financial and fiscal discipline, and respect the autonomy of the Bank of Mexico. Despite those pledges, the election sent shockwaves through the market as the ruling Morena party and its coalition partners look primed for a congressional super-majority, which would make constitutional change easier and diminish checks and balances. The final seat counts are still being tallied, but Mexico's peso fell as much as 4% against the dollar before recovering some losses and trading down 3% while Mexico's main stock index fell 3% on Monday. In February, Lopez Obrador proposed sweeping constitutional reforms, including measures to overhaul the judiciary, electoral law, pensions, and environmental regulations. "Some bills are perceived as leading to institutional erosion and weakening the current checks and balances, and several are not viewed as market friendly. With full control of the House, and for practical purposes likely the Senate as well, the probability that a significant part of this broad agenda is approved increased significantly," said Alberto Ramos, chief Latin America economist at Goldman Sachs. NO FISCAL REFORM IN SIGHT Sheinbaum, who will take office as Mexico's first woman president in October, has said she will look to cut red tape and improve the efficiency of tax collection at customs, among other proposals, but is not planning fiscal reform. "I'm not thinking about a deep tax reform, I think there are still many opportunities for (tax) collection," Sheinbaum said days prior to the election at a televised forum. Just the cost of pensions, servicing public debt and federal government transfers to support Mexican states accounted for more than half of the country's 9.07 trillion pesos ($535 billion) budget this year, while indebted state oil firm Pemex is no longer the cash cow it was for previous Mexican governments. "The challenge is big," said former finance minister Ernesto Cordero. "If they want to finance their proposals and their way of seeing the country, they need to think about how they are going to do it." Still, the possibility of a super majority could make the politically unpalatable changes needed to boost tax take easier to push through. PRESSURED FROM ALL SIDES With Mexico's public finances pressured from all sides and the current avenues for boosting much-needed tax take drying up, experts suggest changing the inefficient way properties and cars are taxed, tweaks to taxes on corporate profits, "green taxes," and royalties on Pemex. "The idea of tax reform is a debate we should have," said political analyst Fernando Dworak. "Everyone is talking about what they are going to do, but nobody mentions how they are going to pay for it." Neither does it look like economic growth will help plug any gap, with the Bank of Mexico projecting a lackluster 1.5% rise in GDP for next year. The last fiscal reform dates back a decade, when former President Enrique Pena Nieto hiked taxes for the highest earners and new levies were imposed on soft drinks, junk food, and financial market profits. During his administration Lopez Obrador managed to increase tax revenue by clamping down on evasion and forcing big corporations to settle tax disputes worth billions of dollars. That brought a 48% rise in tax revenue in nominal terms from 2018 through 2023, but experts warn it is not a repeatable policy. "Six years ago there was room for savings on the spending side and improvements in the state's ability to collect taxes," said former Bank of Mexico deputy governor Gerardo Esquivel last month at a roundtable hosted by the National Autonomous University of Mexico. Now, Esquivel added, the new president will have to find different solutions to a worsening budget conundrum. Mexico's tax take still lags far behind its peers, amounting to only 16.9% of GDP in 2022, far below the 34% average for member nations of the Organization for Economic Co-operation and Development, of which Mexico is a member. Even more striking, Mexico was below the average of 21.5% among Latin America countries. Political scientist Dworak cautioned that without the means to pay for an expansion of social program, the president-elect's promises are wishful thinking, something akin to "letters to Santa Claus." ($1 = 16.9636 Mexican pesos) (This story has been refiled to delete a repeat of paragraph 4) Sign up here. https://www.reuters.com/markets/mexicos-next-president-will-have-boost-tax-take-pay-social-programs-2024-06-03/

2024-06-03 14:27

JOHANNESBURG, June 3 (Reuters) - South Africa's rand, stocks and government bonds gained on Monday, as investors bet on the prospect of the African National Congress (ANC) striking a coalition deal with a market-friendly party after failing to get a majority in last week's election. The assets tumbled last week on worries of a tie-up with the more radical parties like the far-left Economic Freedom Fighters (EFF) or former president Jacob Zuma's uMkhonto we Sizwe (MK), compared to a coalition that brings in the pro-business Democratic Alliance (DA). Financial and political analysts said on Monday the chances of an ANC-DA pact were higher than one involving MK or EFF. "The most likely result of South Africa's May 29 election is a deal between the ruling African National Congress and the centrist Democratic Alliance, which would keep key economic policies unchanged and slightly improve the country's fiscal and growth outlook," BMI analysts said in a research note. The ANC got 40.2% of the vote last week, with the DA coming second at 21.8%, MK third at 14.6% and the EFF fourth at 9.5%. At 1351 GMT, the rand traded at 18.6225 against the U.S. dollar , up around 0.8% from Friday's close. On the Johannesburg Stock Exchange, the Top-40 index (.JTOPI) New Tab, opens new tab was up about 1.4%. The yield on the benchmark 2030 government bond fell 10.5 basis points to 10.595%, reflecting a stronger price. Johann Els, chief economist at investment group Old Mutual, said markets would view a coalition between the ANC, DA and the socially conservative Inkatha Freedom Party (IFP) favourably due to "the promise of more policy reform, stronger implementation, and a firm stance against corruption". The IFP got 3.9% of the vote in the election. Els cautioned that markets were likely to remain volatile over the coming weeks and that a negative coalition outcome would spark a selloff. Local media have reported that the DA could be open to entering a cooperation pact with the ANC, supporting it in key decisions in exchange for top jobs in parliament. Political parties have two weeks to work out a deal before the new parliament sits and chooses a president, still likely to be ANC leader Cyril Ramaphosa since the party remains the biggest force. Sign up here. https://www.reuters.com/markets/currencies/south-african-assets-gain-rising-hopes-market-friendly-coalition-2024-06-03/

2024-06-03 12:44

OSLO, June 3 (Reuters) - Norway's gas exports to Europe fell sharply on Monday as a shutdown of the offshore Sleipner hub halted operations at the Nyhamna onshore processing plant, pipeline operator Gassco said, lifting European prices to their highest level this year. The outage was caused by a crack discovered in a two-inch pipeline onboard Norway's offshore Sleipner Riser platform, the company said. It was not yet known how long this will take to repair, but the situation is not considered dangerous, it added. "This has big consequences from a supply perspective," Alfred Hansen, head of pipeline system operations at Gassco, told Reuters. Norway in 2022 overtook Russia as Europe's biggest gas supplier after Moscow's invasion of Ukraine severed decades-long energy ties. Sleipner Riser is a connection point for the Langeled North and Langeled South pipelines connecting the Nyhamna plant on Norway's west coast with the Easington terminal in northeast England. Both terminals were shut on Monday, transparency data showed, with Norwegian gas supply nominations falling to 255 million cubic metres (mcm) per day, from 300 mcm/day nominated on Friday, according to Gassco data. While options exist for bypassing Sleipner, this is time-consuming and not without risk, Hansen said. Europe's benchmark gas price, the Dutch front-month contract , was up 7.2% to 37.1 euros/MWh by 1214 GMT, down from an earlier peak of 38.56 euros, its highest level since early December. Gassco is working with Sleipner operator Equinor (EQNR.OL) New Tab, opens new tab to resolve the situation, a Gassco spokesperson said separately. "We are working... with a plan for repairs and with a plan for compensatory measures to deliver the highest possible volume to Europe," the spokesperson said. While Nyhamna plant operator Shell confirmed the issue was related to Sleipner, an Equinor spokesperson referred any questions on the issue to Gassco. Nyhamna is able to process up to 79.8 mcm per day, with the current shutdown resulting in a real loss of 56.7 mcm on Monday, according to Hansen. Britain's Easington terminal has a capacity of 72.50 mcm/day. Both plants will also be offline on Tuesday, an update on Gassco's website showed. Sign up here. https://www.reuters.com/markets/commodities/norway-gas-export-plummets-sleipner-outage-shuts-nyhamna-plant-2024-06-03/

2024-06-03 12:42

VIENNA, June 3 (Reuters) - It will be unsafe to restart the Russian-held Zaporizhzhia nuclear power plant in Ukraine as long as war rages around it despite Moscow's hopes to fire up the complex, U.N. nuclear watchdog chief Rafael Grossi said on Monday. Grossi held a meeting with Russia on the issue last week after officials including President Vladimir Putin told him Moscow hopes to restart Europe's biggest nuclear power plant, where the six reactors are now shut down as the International Atomic Energy Agency has recommended on safety grounds. "The idea, of course, they have is to restart at some point. They are not planning to decommission this nuclear power plant. So this is what prompts the need to have a discussion about that," Grossi told a news conference on the first day of a quarterly meeting of the IAEA's 35-nation Board of Governors. Russia said after last week's meeting it is not currently planning to reactivate the plant. Grossi said some important steps need to be taken before it can restart safely. "In terms of what needs to happen ..., there shouldn't be any bombing or any activity of this type," Grossi said. "Then there should be a more stable assurance of external power supply. This requires repairs, important repairs of existing lines, which at the moment, and because of the military activity, are very difficult to envisage." Russia and Ukraine have blamed each other for periodic shelling that has downed the plant's power lines. Last month the plant was attacked by drones that hit a reactor building in the worst such incident since November 2022, though nuclear safety was not compromised, the IAEA said at the time. "The attacks and the frequent disconnection of the off-site power lines due to military activity are creating a grave situation," Grossi said in a statement to the Vienna-based IAEA Board earlier on Monday. External power is essential to prevent a potentially catastrophic meltdown at a nuclear power plant like Zaporizhzhia since it is needed to cool fuel in the reactors even when those reactors are shut down. Zaporizhzhia is currently reliant on one of its four main power lines and a backup line for external power. Since Russia seized the plant weeks after it invaded Ukraine in February 2022, the plant has lost all external power eight times, forcing it to rely on emergency diesel generators for power. Sign up here. https://www.reuters.com/business/energy/iaeas-grossi-says-its-far-safe-restart-zaporizhzhia-nuclear-plant-2024-06-03/

2024-06-03 12:38

RABAT, June 3 (Reuters) - Morocco's police said they seized 18.243 tonnes of cannabis resin in the coastal town of Sidi Rehal south of Casablanca on Monday. Five people were arrested in the operation as they unloaded the banned substance from a truck into rapid inflatable boats, the police said in a statement. They have begun investigating the arrested individuals' connections with local and international drug trafficking networks, they said. In recent months, Morocco has stepped up its crackdown on drug trafficking, including seizing 10.7 tonnes of cannabis in March in the Atlantic coast city of Agadir. Last June, it seized 19.5 tonnes of cannabis resin stashed in a truck loaded with octopus bound for Spain. Morocco is a major cannabis producer and has allowed the cultivation, export and use of the drug for medicine or in industry since 2021, but it does not allow it to be used for recreational purposes. Sign up here. https://www.reuters.com/world/africa/morocco-seizes-182-tonnes-cannabis-resin-south-casablanca-2024-06-03/

2024-06-03 12:35

ISTANBUL, June 3 (Reuters) - Turkey's IC Holding wants to build the country's second and third nuclear plants and is looking at winning more construction contracts abroad, particularly in Vietnam and Saudi Arabia, its CEO Murad Bayar told Reuters. IC, which was established in 1969, has been one of the top contractors for major government projects and works on infrastructure engineering and construction, road and ports operations and electricity production. It is best known for building Turkey's first nuclear plant, together with Russia's Rosatom affiliate Titan-2 as part of a $9.3 billion engineering, procurement and construction (EPC) contract. The first reactor at the 4,800-megawatt (MW) Akkuyu plant is expected to come on line no later than 2025. IC will bid for contracting work on Turkey's planned second and third nuclear plants, Bayar said in an interview. "It could be with Russians or with others. If there's a tender we will definitely submit bids," he said, adding that IC may also work as a nuclear plant operator. Turkey wants to follow up with a second plant in the north and a third in the northwest. It has been in talks with Korea and Russia for the second, and with China for the third plant. IC expects revenues of $5.5 billion this year, up from $4.5 billion last year, and is interested in large-scale engineering and construction projects abroad, Bayar said. Last year, it won the contract to build Long Thanh airport in Vietnam's Ho Chi Minh City as part of a consortium and has secured an EPC contract for a bridge in Saudi Arabia worth more than $1 billion, Bayar said. It is looking at construction contracts for Saudi Arabia's massive NEOM development project among others, he said, adding: "We think we have a chance in those that require extensive engineering expertise". Bayar said IC is also looking into projects in Vietnam, Malaysia and Pakistan. "We think we have sufficient know-how when it comes to infrastructure operation abroad. We have sizable capacity, we will be looking into these projects as well," Bayar said, adding that it is planning to bid for a Qatar road operation tender. Bayar also said that IC has mandated JP Morgan for a eurobond issue to finance its around 500-MW battery storage renewable energy and construction projects. Earlier this year, IC listed IC Enterra (ENTRA.IS) New Tab, opens new tab, a holding company for hydroelectric and solar assets. It also plans further initial public offerings for other assets. Sign up here. https://www.reuters.com/business/energy/turkeys-ic-bid-work-more-nuclear-plants-ceo-says-2024-06-03/