2024-05-30 11:49

PARIS, May 30 (Reuters) - The nickel processing plant of New Caledonian producer SLN will need supplies of ore in the coming days to ensure its furnaces keep working, the CEO of main shareholder Eramet (ERMT.PA) New Tab, opens new tab said on Thursday. SLN has stopped mining in New Caledonia due to riots this month sparked by an electoral reform and the firm's Doniambo plant has been at running at minimum capacity. "We urgently need to be able to bring ore to Doniambo," Eramet Chair and CEO Christel Bories told the group's annual shareholders' meeting. "If we're not able to re-supply Doniambo in the coming days, I would say the next 10 days, then we will start to enter a danger zone for the furnaces," she said. The plant has so far been able to use large stocks of ore that it typically holds at this time of year to offset the impact of the rainy season on mine output. While mining was still at a halt, loading of some stocks had started on Thursday at one of SLN's mines following discussions with protesters, Bories added. The unrest has deepened a crisis for New Caledonia's loss-making nickel sector, for which the French government has been trying to negotiate a rescue package. Eramet has stopped financing SLN due to the recurring losses and in February secured a deal to remove SLN's debt to the government from Eramet's balance sheet. The riots meant that the second quarter would be "even more difficult" for SLN than the previous quarter, Chief Financial Officer Nicolas Carre said, adding that the debt deal had removed the risk of financial impact on Eramet from its subsidiary. Eramet's nickel operations are now focused on Indonesia, where it operates the world's biggest nickel mine in partnership with Chinese steel group Tsingshan. Sign up here. https://www.reuters.com/markets/commodities/eramets-new-caledonia-nickel-plant-needs-supply-within-days-ceo-says-2024-05-30/

2024-05-30 11:45

Virus has spread to cows and three dairy workers since late March A pilot program for bulk testing milk begins in June USDA has confirmed H5N1 bird flu in cattle in nine states CHICAGO, May 30 (Reuters) - U.S. farmers will be able to test bulk supplies of milk from their dairy cows for bird flu rather than milk from individual cows before gaining approval to ship them across state lines, the Agriculture Department said on Thursday, in a move aimed at expanding testing. The change shows how government officials are trying to contain the disease while minimizing economic damage to farmers after the bird flu virus spread to cows and three dairy workers since late March. But some veterinarians warn the bulk tests may be insufficient. The U.S. Department of Agriculture (USDA) in late April began requiring lactating cows to test negative before being shipped across state lines. It later said the order likely helped prevent the spread of the virus to new states. USDA reported 2,492 pre-movement tests as of Wednesday but said that number does not equal the number of animals tested. A pilot program for bulk testing milk aims to ease the burden of pre-movement testing while reducing the spread of the virus, said Eric Deeble, USDA's acting senior advisor for bird flu. Farmers can start enrolling in it the week of June 3, he told reporters on a call that confirmed details of the program first reported by Reuters. USDA expects it may see an increase in herds testing positive because of the voluntary program and wants to encourage more testing, Deeble said. "This program is not loosening restrictions," he said. Agriculture officials in six states told Reuters on Wednesday they were reviewing USDA's plans for the program. USDA has confirmed the H5N1 virus in cattle in nine states. The U.S. Food and Drug Administration estimated that 20% of the U.S. milk supply shows signs of the virus, indicating a wider spread is likely. "Once it has support and participation from farms, the USDA program could help reduce the threat of H5N1 in dairy herds, further mitigate risk among farm workers, and continue to protect our nation's commercial milk supply," the International Dairy Foods Association said in a statement to Reuters. Farmers said testing milk from bulk storage tanks offers the chance to collect a sample from all the cows within a herd and would be more efficient than testing samples from individual animals. Under the new program, farms with herds that test negative for three consecutive weeks using bulk tank milk samples will be able to move cattle without additional pre-movement testing, USDA said. Farmers then need to submit milk samples from bulk tanks weekly to maintain their status, according to the agency. USDA said in documents seen by Reuters that it could establish disease freedom in states or regions if enough farmers participate. If a herd tests positive in the program, there would be an epidemiologic investigation and evaluation of movement for animals considered to be low risk, according to the documents dated May 24. The program would mostly benefit large dairies that move animals, veterinarians said. Three weeks of testing milk from bulk tanks is not enough to confirm a herd is free of bird flu, though, said Gail Hansen, a veterinary and public health consultant. Samples from healthy cows could dilute samples from a small number of infected cattle in the same herd when their milk mixes in the tank, she said. "It may give people a false sense of assurance," Hansen said. USDA said it is identifying states to participate in the pilot program, while state officials said they have questions about how it will operate. "Indiana's biggest concern is: How will the information gathered be used? Any finding in Indiana could place us in the affected-state category, subjecting Hoosier producers to increased restrictions from other states," said Bret Marsh, Indiana's state veterinarian, using a nickname for state residents. Michigan, which has the most confirmed cattle infections, is interested, said Tim Boring, director of the state's Department of Agriculture and Rural Development. The last two dairy workers to test positive were in Michigan. "One of the basic safeguards here is to look at restricting animal movement," Boring said. "The last thing we want to be doing is moving sick cattle around in different farms and thereby spreading the disease further." Sign up here. https://www.reuters.com/business/healthcare-pharmaceuticals/us-proposes-bulk-milk-testing-bird-flu-before-cattle-transport-2024-05-30/

2024-05-30 11:24

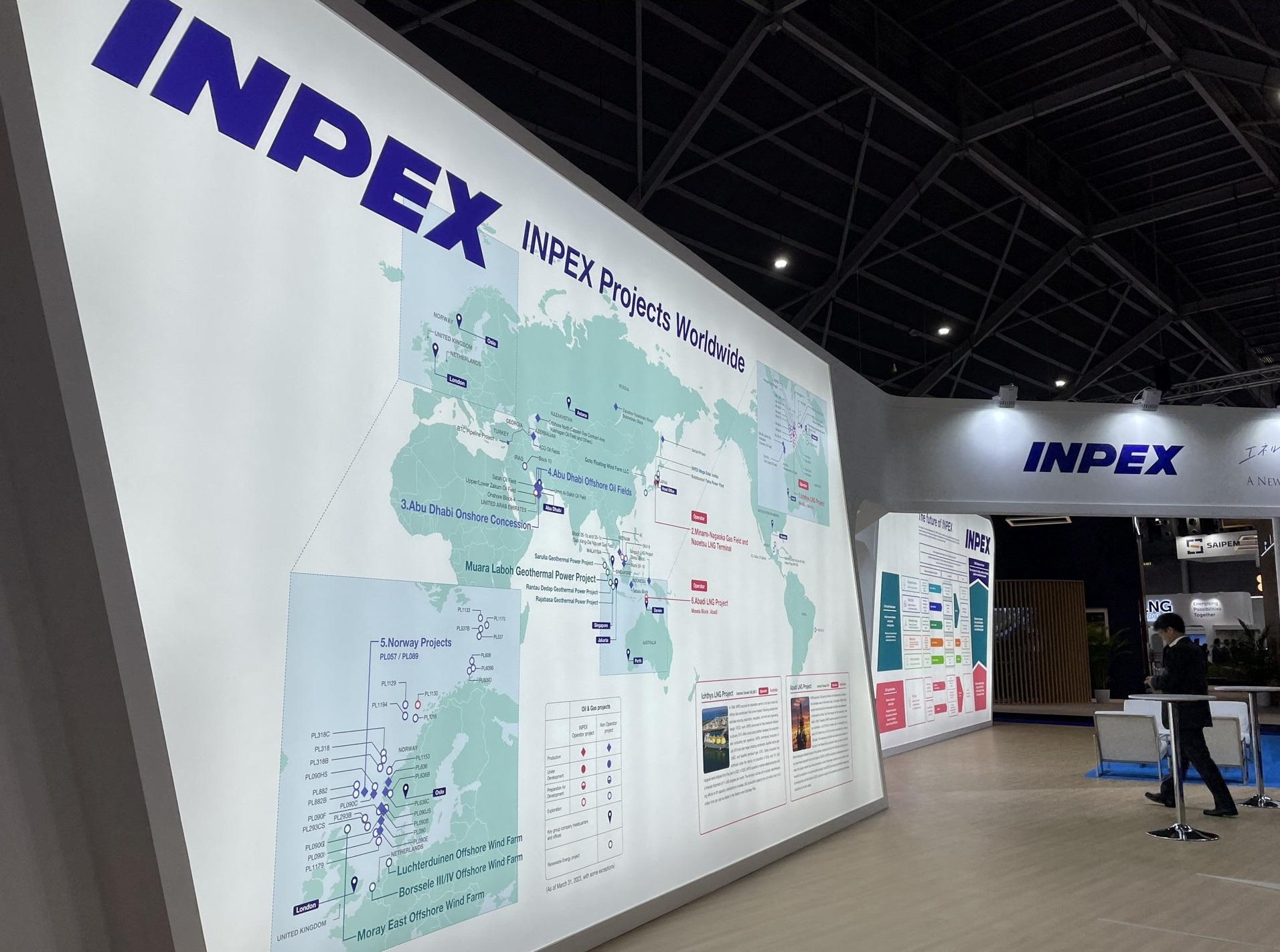

MOSCOW, May 30 (Reuters) - Japan's Inpex (1605.T) New Tab, opens new tab for the first time last month supplied crude oil from its share in the giant Kashagan oil field in Kazakhstan to a German refinery via Russia's Druzhba pipeline, three sources familiar with the shipment and export data told Reuters on Thursday. "It was a trial supply of oil from Kashagan in April, no supplies (are) planned in May", one of the sources familiar with the plans said. The shipment - to the Schwedt refinery - shows how Kazakhstan is developing oil exports via the Druzhba pipeline, which connects Russian oil fields to Europe and which otherwise would be empty due to the European Union embargo on Russian crude. Kazakhstan doesn't have a direct access to international sea routes and the lion's share of its oil exports pass through Russian territory. Druzhba's northern leg crosses Belarus and goes to Poland and Germany. Kazakhstan has been supplying oil to Germany since 2023 via Druzhba as the EU embargo doesn't forbid the purchase of non-Russian oil supplied via Russian pipelines. But up to now this has mostly been done by Kazakhstan oil producer Karachaganak Petroleum Operating (KPO), in which Eni (ENI.MI) New Tab, opens new tab and Shell (SHEL.L) New Tab, opens new tab are the largest shareholders. Another source added that the Inpex shipment went well and more supplies from Kashagan to Germany are being considered this year by the Japanese company and other shareholders, but the counterparts need to agree on the details of such supplies. Inpex declined to comment on the matter due to confidentiality obligations. Kashagan's operator, the North Caspian Operating Company (NCOC), and the Kazakh Energy Ministry did not immediately respond to a request for comment. NCOC is a consortium which includes Shell, Eni, TotalEnergies (TTEF.PA) New Tab, opens new tab and Exxon Mobil Corp (XOM.N) New Tab, opens new tab, as well as Inpex, Kazmunaigaz and China Petroleum Oil Corp. NCOC shareholders have been looking for additional export routes as alternatives to Kazakhstan's main export outlet - the Caspian Pipeline Consortium (CPC) - after multiple stoppages of exports via the pipeline in 2022. Kazakhstan's oil supplies to Germany have recently been challenged by a technical issue between Russia's Transneft pipeline operator and Poland's PERN, putting shipments at risk, but the matter has been resolved. Sign up here. https://www.reuters.com/markets/commodities/japans-inpex-supplied-oil-germany-kashagan-sources-say-2024-05-30/

2024-05-30 11:15

KYIV, May 30 (Reuters) - Ukraine's government will formally ban exports of sugar to the European Union for the remainder of this year as its EU quota has been filled, the acting farm minister said on Thursday. Taras Vysotskiy said sugar volumes exported to Europe had reached a limit established under new "trade benefits" regulations. Ukraine is Europe’s second-largest sugar supplier. "Other markets will be without limits, but the EU market will be opened only from January 1 and then it will become clear what export volumes there will be," Vysotskiy told an agricultural conference. EU curbs announced in April followed extensive protests from farmers in the region, who said they faced unfair competition from producers outside the bloc such as Ukraine who do not face the environment-related regulations and bureaucracy they do. Analysts said this month that Ukrainian sugar exports had reached 262,600 metric tons, the volume defined under EU rules as Ukraine's quota for 2024. Ukrainian producers exported about 493,000 tons of sugar to the EU in calendar 2023. Producers expect Ukraine to increase white sugar production by nearly 3% to 1.85 million metric tons in 2024 with an exportable surplus that could total 950,000 tons in the 2024/25 season. Sign up here. https://www.reuters.com/markets/commodities/ukraine-formally-halt-sugar-exports-eu-2024-quota-filled-2024-05-30/

2024-05-30 11:10

Macron called Trudeau over Canada sanctions on Russian titanium Canada granted waivers to Airbus after diplomatic pressure Titanium sanctions spat exposes wider critical mineral risks OTTAWA/PARIS, May 30 (Reuters) - French President Emmanuel Macron personally intervened to persuade Canadian Prime Minister Justin Trudeau to give Airbus and other aerospace firms relief from sanctions on Russian titanium, according to three people familiar with the matter. The sensitive request was made during a phone call between the two leaders in March, weeks after Canada broke ranks with allies and slapped sanctions on the strategic metal, alarming France-based Airbus and others that still rely on Russian supplies in plants located in Canada or elsewhere. A source close to the French leader said Macron had made a "significant effort" to convince Trudeau to grant an exemption for European companies. "Many messages were passed at all levels," the source added, referring to broad diplomatic and industrial pressure. A Canadian source familiar with the matter said Macron raised the topic in a call with Trudeau on March 29 in the run-up to a visit by French premier Gabriel Attal, who also addressed the issue when he was in Canada. At least one other European government also weighed in to support the lobbying effort, a separate source said. Ottawa initially stood firm, but within days modified its policy by granting Airbus and others waivers. The climbdown, first reported by Reuters, triggered a political dispute over sanctions policy and drew criticism from Ukraine's ambassador. "It was not easy to get the sanctions lifted. I think if the French government had not raised it continuously at that level, we would have held pretty firm," the Canadian source said. Offices of both leaders declined comment and Airbus said it was "complying with all applicable sanctions related to Russia". The sources spoke on condition of anonymity due to the sensitivity of the matter. CAUGHT OFF GUARD The high-level scramble to keep Russian titanium flowing highlights how difficult Western nations are finding it to punish Russia for its war against Ukraine without damaging the supply chains of industries that need to plan years ahead. Russia's state-backed VSMPO-AVISMA is historically the largest producer of aerospace-grade titanium, whose strength and light weight make it ideal for components that take the heaviest punishment, like engine parts and landing gear for big jets. Weaning industries off Russian titanium, and other critical minerals produced in countries like China, is proving difficult. "The problem is a new titanium mill ... takes years to build and it could take a year or two to get certified," said Kevin Michaels, managing director of AeroDynamic Advisory. While the West has ratcheted up sanctions on Moscow, it has previously avoided blocking access to VSMPO's specialist alloys and forgings for fear of hurting its aerospace industries. Canada's unexpected decision to ban imports from VSMPO coincided with the second anniversary of Moscow's invasion of Ukraine and caught the aerospace industry off guard. Fraught calls to Ottawa started "immediately, literally the same day," said a second Canadian source. Airbus found itself in the front line. All landing gear for its premier A350-1000 jet come from a single factory in Ontario. "Airbus was one of the larger voices lobbying and they did it through the French government as well," the first Canadian source said. Airbus and French officials declined comment. Canada's decision rippled down the supply chain. RIPPLE EFFECT U.S. aerospace giant RTX (RTX.N) New Tab, opens new tab is responsible for building A350-1000 landing gear through its Collins Aerospace subsidiary's Oakville plant outside Toronto. Faced with Ottawa's decision to ban Russian titanium, Collins halted raw material shipments, the sources said. RTX declined comment. In April it took a $175 million charge to cover new supplies, partly related to the Canadian sanctions. Canada's sanctions could also have damaged Airbus' rival Boeing (BA.N) New Tab, opens new tab, but the U.S. planemaker was spared disruption thanks to a separate waiver awarded to French equipment supplier Safran (SAF.PA) New Tab, opens new tab, industry sources said. Boeing announced in March 2022 it had stopped buying titanium directly from Russia and is widely seen as less exposed to the politically sensitive topic than its European rival. But like Airbus, Boeing buys landing gear made in Canada for its 787 Dreamliner. Two industry sources said the Toronto-area plant run by Safran (SAF.PA) New Tab, opens new tab continues to rely on VSMPO titanium while the company develops new sources in Europe. Safran said last month it had won an exemption from the Canadian sanctions in a move that supply chain experts said would allow it to keep Boeing supplied with 787 landing gear. Safran declined further comment. Boeing referred questions about the Russian exposure of sub-contractors to its suppliers. "Boeing currently sources titanium predominantly in the U.S. ... and we continue to take steps to ensure long-term continuity," a spokesperson said. Airbus, which said in December 2022 it would drop Russian titanium in "months not years", said it was working intensively to reduce dependence, but declined to give a target date. "This is already well underway and being carried out as quickly as possible," a spokesperson said. Canada has not said when waivers will expire but a person familiar with the plan said it gave the industry three years. Ukraine has urged Western nations to deepen their sanctions. Some fear the Canada dispute could aggravate another dilemma for aerospace firms: complaints against sanctions highlight their dependence for strategic materials on exporting countries, which in turn could use that power to hit back at the West. China said on Thursday it would control exports of some sensitive aviation and space components from July 1. Sign up here. https://www.reuters.com/business/aerospace-defense/help-airbus-macron-pressed-canada-ease-russia-titanium-sanctions-2024-05-30/

2024-05-30 11:01

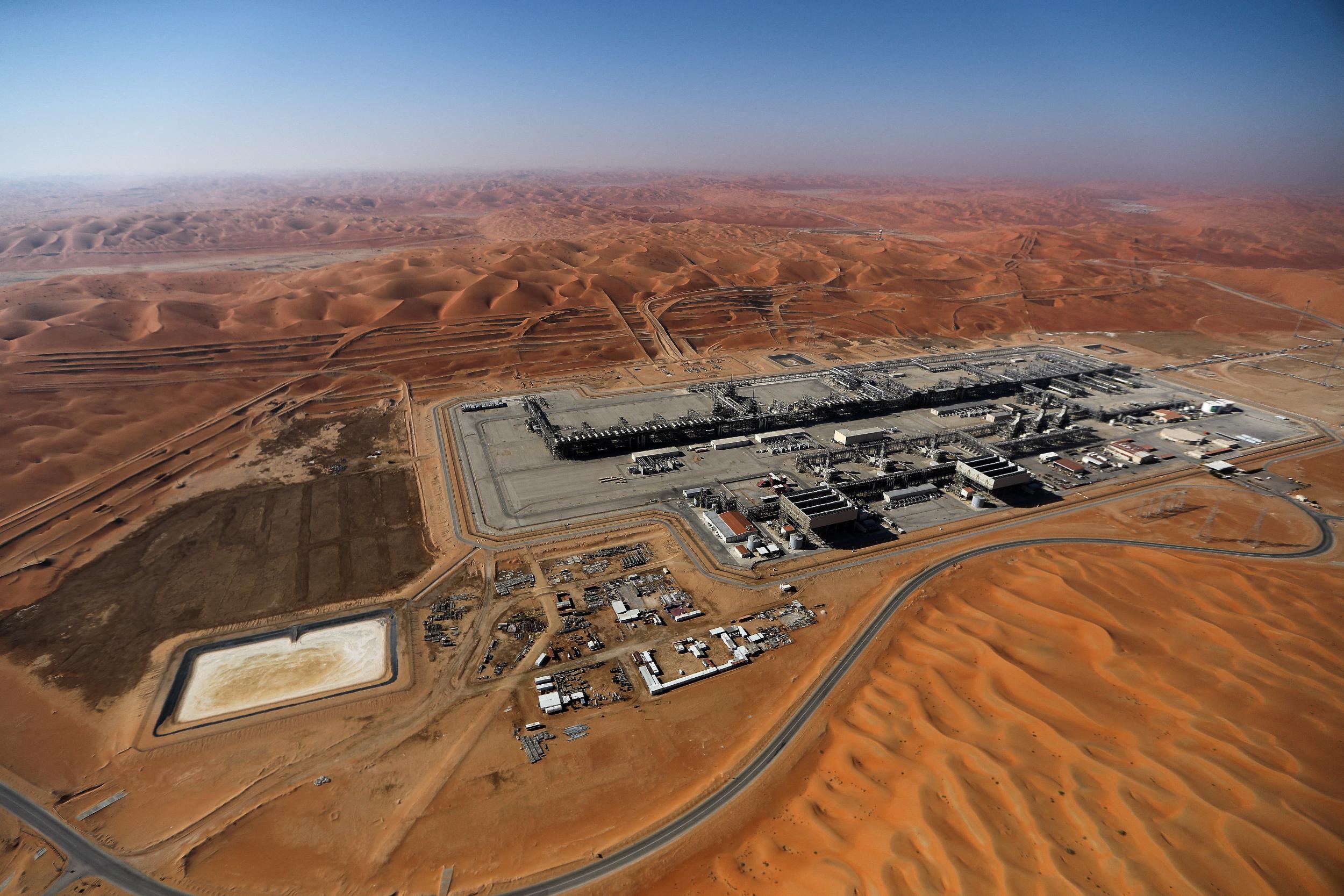

DUBAI, May 30 (Reuters) - Saudi Arabia may announce a landmark secondary share offering in oil giant Aramco (2222.SE) New Tab, opens new tab later on Thursday, pending final approval from Crown Prince Mohammed bin Salman, people with knowledge of the matter said. The landmark sale follows Aramco's record IPO nearly five years ago, as the kingdom pushes ahead plans to diversify its economy away from oil. Below are key facts about Aramco: HISTORY Explorers from the Rockefeller family's Standard Oil Company struck oil in Saudi Arabia in 1938. The venture became known as the Arabia American Oil Company and crude oil production hit 500,000 barrels per day in 1949. By 1980, the Saudi government had bought out all the original shareholders and owned 100% of the company. Eight years later, the Saudi Arabian Oil Company (Saudi Aramco) was officially established. Aramco has fuelled decades of prosperity in Saudi Arabia. The kingdom is the de facto leader of the Organization of the Petroleum Exporting Countries, or OPEC, helping engineer price moves on world oil markets. The crown prince, known as MbS, wants to diversify the Saudi economy away from oil. Announcing plans for an Aramco IPO in 2016, he said the kingdom must end its "oil addiction" to ensure it was no longer at the mercy of commodity price volatility. OIL RESERVES AND OUTPUT Aramco had 251.2 billion barrels of oil equivalent (boe) in 2023, larger than the combined reserves of ExxonMobil, Chevron, Shell, BP and TotalEnergies. That includes, as of end-December 2023, 191.35 billion barrels of crude and condensate and 33.8 billion boe of natural gas. The oil giant produced just over 9 million barrels per day (mbpd) in April, according to secondary sources used by OPEC, down from an average of 9.6 mbpd in 2023. Its average upstream lifting cost was $3.19 per boe in 2023, with upstream capital expenditure averaging $6.3 per boe. Just over two thirds of Aramco's crude oil was exported last year, as it shipped 6.6 mbpd, down from 7.1 mbpd in 2022. Asian customers bought 82% of Aramco's crude exports last year, up from 79% in 2022. DOWNSTREAM To diversify its oil business - and secure offtake of its crude - Aramco is expanding in refining and petrochemicals. Last year, Aramco bought Valvoline Inc's global products business for $2.76 billion. It also began construction of several petrochemical complexes: a $7 billion one in South Korea with S-Oil, an $11.8 billion project in China, via HAPCO, a joint venture with North Huajin and Xincheng, and an $11 billion one through its joint venture with TotalEnergies in the kingdom. It also bought a 10% stake in Chinese refiner Rongsheng Petrochemical for $3.4 billion. In 2020, it bought a majority stake in Saudi Basic Industries Corp (SABIC), one of the world's biggest petrochemical firms. Aramco produces, refines and exports oil from Saudi Arabia, but also has refining operations across the globe. Aramco's U.S. oil refining subsidiary Motiva Enterprises owns the 640,000 bpd Port Arthur refinery in Texas, the largest in the United States. It is looking to further expand its downstream business in "key high-growth geographies such as China, India and Southeast Asia," as well as other markets, it said in its annual report. Aramco had a net refining capacity of 4.1 mbpd last year. GAS Aramco aims to boost its gas production by 60% by 2030 from 2021 levels. Last year, it brought online an expansion to its Hawiyah Gas Plant and began producing at its unconventional field in South Ghawar. It also continues work on its giant Jafurah field, expected to begin producing gas next year. It also made its first investment abroad in liquefied natural gas, buying a minority stake in MidOcean Energy for $500 million, subject to approvals. Aramco also discovered two new natural gas fields in the kingdom's Empty Quarter. The company had 207.5 trillion cubic feet of gas reserves at the end of 2023. It produced 10.67 billion cubic feet of gas last year. SCALE The state-owned firm is one of the world's largest oil producers and top exporter, pumping nearly 10% of the world's supply. It is also among the globe's most profitable companies, raking in $27.3 billion in net profit in the first quarter, slightly more than oil majors ExxonMobil, Shell, Chevron and TotalEnergies made combined in the same quarter. Last year, Aramco made an annual net profit of $121.3 billion, its second-highest on record after it hauled $161.1 billion in 2022. In late 2019, Aramco raised $25.6 billion from its initial public offering, the world's biggest ever. It then sold more shares through an over-allotment option in January 2020 that boosted the IPO further to a total of $29.4 billion. With more than 73,000 employees in 2023, Aramco has energy industry operations, research facilities and offices scattered across the globe, in Asia, Europe and the Americas. It has offices in Beijing, Houston, London, New Delhi, New York, Seoul, Shanghai, Singapore, Tokyo, and elsewhere. Sign up here. https://www.reuters.com/business/energy/saudi-aramco-oil-colossus-2024-05-30/