2024-05-28 11:29

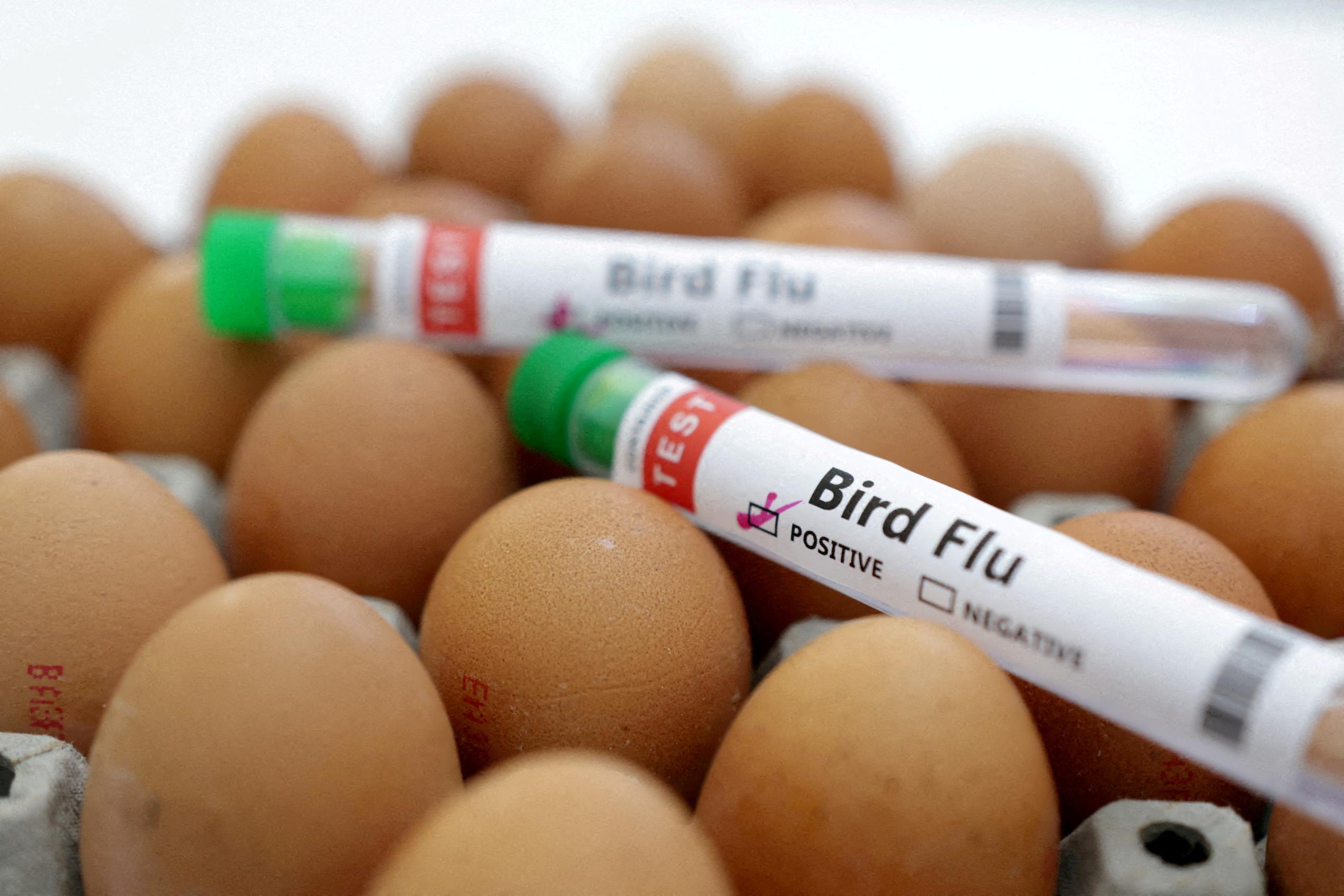

PARIS, May 28 (Reuters) - Emmanuelle Soubeyran, head of France's veterinary services, was elected director general of the World Organisation for Animal Health (WOAH) on Tuesday, succeeding her compatriot Monique Eloit as the world grapples with a severe outbreak of bird flu. Soubeyran, who had been chosen as the candidate for the European Union as a whole, is also France's deputy director general for food. She takes the helm of the WOAH as bird flu is increasingly spreading to mammals, including dairy cows in the United States, raising concern that it could mutate into a virus that could easily spread between humans. She is familiar with the virus since she had been in charge of implementing France's bird flu vaccination of poultry, the first of its kind in Europe. Soubeyran said before her election that her main goals would include boosting links with other international organisations such as the World Health Organisation (WHO) and the United Nations' FAO, after recent crises have shown close ties between animal and human health. She will also encourage private funding, in addition to public contributions, to fight animal diseases and promote research, she told Reuters. Sign up here. https://www.reuters.com/business/healthcare-pharmaceuticals/frances-soubeyran-elected-head-world-animal-health-body-2024-05-28/

2024-05-28 11:27

May 28 (Reuters) - Novelis, owned by Indian billionaire Kumar Mangalam Birla's Hindalco Industries (HALC.NS) New Tab, opens new tab, is targeting a valuation of up to $12.6 billion in its initial public offering in the United States, the aluminum products maker said on Tuesday. The world's largest recycler of aluminum, whose customers include Coca-Cola, Ford, Jaguar LandRover, said its parent is looking to raise up to $945 million through the sale of 45 million shares at a price of $18 to $21 per share. After being on ice for the last two years, the IPO market is on the road to recovery as a booming stock market and economic resilience spur companies to list their shares. Social media company Reddit (RDDT.N) New Tab, opens new tab and Chinese electric vehicle maker Zeekr (ZK.N) New Tab, opens new tab received strong responses to their stock flotations earlier in the year. The IPO calendar for the second half also looks solid with companies such as healthcare payments firm Waystar and Mexican airline Grupo Aeroméxico aiming to go public. Waystar said earlier in the day that it was targeting a valuation of up to $3.83 billion in a fresh listing. Novelis, which has rolling and recycling facilities across North America, South America, Europe and Asia, will list on the New York Stock Exchange under the symbol "NVL". The Atlanta, Georgia-based company was acquired in 2007 by aluminum and copper manufacturing company Hindalco, a unit of Indian multinational conglomerate Aditya Birla Group, headquartered in Mumbai. Morgan Stanley, BofA Securities and Citigroup Global Markets are the lead underwriters for the offering. Sign up here. https://www.reuters.com/markets/commodities/novelis-targets-up-126-bln-valuation-us-ipo-2024-05-28/

2024-05-28 11:11

BRUSSELS, May 28 (Reuters) - EU competition regulators on Tuesday approved a 1.4-billion-euro ($1.52 billion) joint hydrogen project funded by seven EU countries and a separate 1-billion-euro ($1.1 billion) joint healthcare project funded by a group of six EU countries. Estonia, France, Germany, Italy, Netherlands, Slovakia and Spain will provide up to 1.4 billion euros in public funding, for the hydrogen project which is expected to unlock an additional 3.3 billion euros in private investments, the European Commission said in a statement. It said 11 companies, including Airbus (AIR.PA) New Tab, opens new tab, BMW (BMWG.DE) New Tab, opens new tab and Michelin (MICP.PA) New Tab, opens new tab, will take part in 13 projects. The healthcare project will be funded by Belgium, France, Hungary, Italy, Slovakia and Spain to support research and innovation and is expected to unlock an additional 5.9 billion euros in private investments, the Commission said. Sanofi (SASY.PA) New Tab, opens new tab, Euroapi (EAPI.PA) New Tab, opens new tab and 11 other companies will participate in 14 healthcare schemes. Both schemes are so-called Important Project of Common European Interest (IPCEI) which allows EU governments to fund them under looser EU state aid rules. ($1 = 0.9193 euros) Sign up here. https://www.reuters.com/world/europe/eu-okays-15-bln-state-funded-joint-hydrogen-project-11-bln-joint-healthcare-2024-05-28/

2024-05-28 11:05

DUBAI/CAIRO, May 28 (Reuters) - A bulk carrier already taking on water after a Houthi missile attack off the coast of Yemen on Tuesday has reported further damage from a second strike, the United Kingdom Maritime Trade Operations said on Tuesday. Maritime security and shipping sources earlier in day identified vessel as the Marshall Islands-flagged Laax. Yemen's Iran-aligned Houthis have launched more than 50 attacks in the Red Sea region since November in what they say is solidarity with Palestinians. They since have expanded to the Indian Ocean. The Houthis have sunk one ship, seized another vessel, killed two crew members and disrupted global shipping by forcing vessels to avoid the nearby Suez Canal and reroute trade around Africa. Crew members involved in Tuesday's attacks are safe and their vessel is proceeding to its next port of call, the UK maritime security body said in the updated incident report. The ship's next scheduled port of call was in the United Arab Emirates. The additional damage occurred 33 nautical miles northwest of Al Mukha, Yemen, the report said. The Laax issued a distress call earlier on Tuesday, saying it had sustained damage to the cargo hold and was taking on water about 54 nautical miles southwest of Yemen's port city of Hodeidah, British security firm Ambrey said. Greek shipping sources said the Laax was sailing to a port nearby to assess the extent of the damage. Reuters was not immediately able to determine if that was in the UAE. Its Greece-based operator Grehel Ship Management did not immediately reply to a request for comment. Sign up here. https://www.reuters.com/world/middle-east/vessel-tilts-off-yemens-coast-after-attack-by-missiles-ambrey-says-2024-05-28/

2024-05-28 10:01

A look at the day ahead in U.S. and global markets from Mike Dolan Wall Street looks set for a sleepy but positive start to a shortened week after Monday's Memorial Day break, with the consumer back in focus in May updates later today. S&P500 futures were higher again ahead of Tuesday's open after the cash index (.SPX) New Tab, opens new tab eked out its fifth straight weekly gain last week - the longest such streak since early February. U.S. consumer confidence is expected to have cooled a touch this month in the Conference Board's monthly survey due later today, although the big release of the week is clearly Friday's PCE inflation gauge. Even though Federal Reserve interest rate expectations have receded to little more than one cut over the remainder of the year, broader financial conditions captured by the Chicago Fed index are at their easiest since November 2021 - four months before the Fed began its tightening campaign. This leaves the Fed with an ongoing conundrum as to whether its restrictive monetary policy has been enough to drag inflation durably back to its 2% target as economic growth keeps humming. Annual core PCE inflation is expected to have held at 2.8% in April - even if monthly price gains eased a touch to below 0.3%. Although on the hawkish side of the Fed's policymaking council, Minneapolis Federal Reserve Bank President Neel Kashkari on Tuesday continued to hold out the possibility of another rate hike if necessary. And if it is not needed, Kashkari said it would take "many more months of positive inflation data" to give him confidence enough to ease. Another hawk, Fed board governor Michelle Bowman, even said she would have supported either waiting to start slowing the run-off in the U.S. central bank's balance sheet or a more moderate tapering process than announced earlier this month. Despite all that, and awaiting another heavy week of debt sales, Treasury yields edged lower on Tuesday. Two and five-year notes come under the hammer later in the day. Both stock (.VIX) New Tab, opens new tab and bond market (.MOVE) New Tab, opens new tab volatility gauges remain subdued. Although the U.S. economic surprise index remains in negative territory, it has picked up considerably since last week's punchy May business surveys and the Atlanta Fed's real-time economic growth estimate is tracking 3.5% for the quarter. Oil prices too picked up a touch on Tuesday ahead of Sunday's online meeting of OPEC+ producers, where traders expect 2.2 million barrels per day of voluntary production cuts to stay in place. Although U.S. retail gasoline prices have retreated this month, they remain up about 15% for the year to date. Taking a cue from softer Treasury yields, the dollar (.DXY) New Tab, opens new tab was down for the third session in a row. The euro nudged higher despite money markets seeing almost a 90% chance the European Central Bank will start its rate cutting cycle as soon as next week - even if more buoyant economic soundings and wage numbers of late have scaled back full-year easing expectations a touch there too. "Barring a surprise, the first rate cut in June is a done deal, but afterwards we have several degrees of freedom," French central bank chief Francois Villeroy de Galhau told Monday's edition of Germany's Boersen Zeitung. Supporting the ECB's move to jump the Fed gun, surveys on Tuesday showed euro zone household inflation expectations for the next 12 months edged below 3% in April for the first time since 2021. Overseas stock markets more generally were subdued - mixed in Asia and slightly positive in Europe. Elsewhere, U.S. markets are set for a new dawn of sorts on Tuesday, when the settlement time for U.S. equities, corporate municipal bonds and other securities will be halved to one day, or T+1, following the adoption of a new Securities and Exchange Commission rule. Little disturbance was evident as overseas investors adjusted to the changes. In corporate news, Apple's shares (AAPL.O) New Tab, opens new tab rose 2% ahead of the open on data showing its iPhone sales in China jumped 52% in April from a year earlier as overall smartphone sales in the country increased by more than 25%. Key diary items that may provide direction to U.S. markets later on Tuesday: * US May consumer confidence, Dallas Fed's May manufacturing survey, March house prices; Canada April producer prices * German Chancellor Olaf Scholz and French President Emmanuel Macron speak at Franco-German summit in Schloss Meseberg north of Berlin * Federal Reserve Board Governor Lisa Cook and Minneapolis Fed President Neel Kashkari speak; European Central Bank policymaker Klaas Knot and Bank of England policymaker Catherine Mann both speak * U.S. Treasury sells 2- and 5-year notes, 3- and 6-month bills Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-2024-05-28/

2024-05-28 09:35

May 28 (Reuters) - The pound held close to multi-month highs versus the euro and hit a fresh two-month high against the dollar as expectations for Bank of England (BoE) rate cuts and growing investor risk appetite supported the British currency. Investors are awaiting key inflation data from major economies this week that could offer clues on the global interest rate outlook. German inflation figures will be released on Wednesday and the wider euro zone's reading on Friday, along with the U.S. core personal consumption expenditures (PCE) price index - the Federal Reserve's preferred measure of inflation. Sterling was flat at $1.2768 after hitting $1.2783 earlier in the session, its highest level since March 21. The euro rose 0.14% against the pound at 85.14 pence per euro, after hitting 84.94 on Monday, its lowest level since August 2023. Strong services inflation in the April data and other key economic indicators on both sides of the Atlantic shifted expectations for the BoE's first rate cut firmly until after August, strengthening the view that monetary policy will not be a headwind while appetite for risky assets can still boost sterling, analysts said. They also mentioned the pound’s correlation with the U.S. stocks indexes. S&P 500 future contracts inched higher on Tuesday, with Wall Street reopening after a long weekend. Money markets fully price in 25 basis points of BOE monetary easing in November , a 60% chance of such a move in September and a 40% chance in August. "The pound is looking expensive versus the euro at current levels, in our view," said Francesco Pesole strategist at ING. "We still expect an August cut, and see any views for delayed easing due to the UK vote as misplaced," he added. Investors expect the outcome of the July 4 UK general election will not significantly influence the British currency. Analysts stressed that both Labour and the Conservatives have emphasised that they will stick to the existing fiscal rules overseen by the independent Office for Budget Responsibility. British Prime Minister Rishi Sunak is facing a mass departure of lawmakers, with the number of resignations surpassing the level the Conservative Party suffered before a landslide defeat in the 1997 election. Sign up here. https://www.reuters.com/markets/currencies/sterling-hits-fresh-2-month-high-versus-dollar-ahead-inflation-data-2024-05-28/