2024-05-28 06:55

MADRID, May 28 (Reuters) - Spanish energy company Repsol (REP.MC) New Tab, opens new tab is seeking to sell a stake in an 800 megawatt (MW) U.S. renewable asset portfolio, newspaper Expansion reported on Tuesday, citing unidentified sources in the renewable market. The assets, which are already operating or close to completion, are valued at about 600 million euros ($652.6 million), the newspaper said. Repsol did not immediately respond to a request for comment. Like other power utilities, Repsol is raising cash to invest in new projects by selling stakes in more advanced ones, a process it calls "asset rotation". Its CEO Josu Jon Imaz said last month the company expected to close a first asset rotation agreement in the U.S. State-controlled oil company Saudi Aramco is interested in buying a stake in Repsol's renewable unit, two people familiar with the matter told Reuters last week. ($1 = 0.9194 euros) Sign up here. https://www.reuters.com/markets/deals/repsol-seeks-sell-stake-us-renewable-asset-portfolio-expansion-says-2024-05-28/

2024-05-28 06:39

SEOUL, May 28 (Reuters) - North Korea's latest satellite launch exploded in a fireball before dropping into the Yellow Sea just minutes after lifting off, but analysts say the attempt showcased new strides in the nuclear-armed country's race for space. North Korea said New Tab, opens new tab its latest attempt to launch a military reconnaissance satellite failed in flight on Monday during the rocket's first stage, which featured a new "liquid oxygen and petroleum engine". An initial analysis suggested that the cause of the failure involved the newly developed liquid-fuel rocket motor, but other possible causes were being investigated, a report carried by state media KCNA said. Although state media did not name the rocket or release photos, analysts said it was most likely different from the Chollima-1 rocket used in the successful satellite launch in November 2023. The Chollima-1, which also suffered several explosive test failures, uses hypergolic fuels, substances that can be stored at room temperature but ignite on contact each other, requiring careful handling. U.S. officials and independent analysts said the Chollima-1 appeared to be based on systems developed for North Korea's nuclear-tipped intercontinental ballistic missiles, which typically do not use liquid oxygen because of frigid temperatures required for storage. A petroleum fuel and liquid oxygen engine may suggest that Russia, which vowed last year to help North Korea's satellite programme, may have provided assistance, said Lee Choon-geun, an honorary research fellow at South Korea's Science and Technology Policy Institute. "Even if it failed, it is a huge leap," he said, noting that some of South Korea's space rockets were initially developed with Russia decades ago and use similar technology. "Russia is the strongest country for liquid oxygen-kerosene fuel, and our Naro and Nuri rockets have adopted it through technical cooperation with Russia." Liquid oxygen boils at -183°C (–297°F), and requires specialised fuel storage and other equipment, Lee said. That may account for why North Korea conducted multiple static rocket tests late last year, he added. "It is quite difficult to solve combustion instability problems of this fuel system and apply materials and parts that can withstand extremely low temperatures," Lee said. Some analysts questioned why North Korea would switch engine types, but Lee said it could allow Pyongyang to separate its civilian space program from the ballistic missiles banned by the United Nations Security Council. Russian experts have visited North Korea to help with the satellite and space rocket program, Yonhap news agency reported, citing an unnamed South Korean senior defence official. Neither Moscow nor Pyongyang have detailed what aid is being provided. Shin Jong-woo, a senior researcher at the Korea Defense and Security Forum, said that if Russia helped design the new rocket or satellite, North Korea would also most likely need Russian components well into the future, deepening the cooperation. "North Koreans can re-launch soon if they obtain and analyse data correctly for that two-minute flight," Shin said. South Korea's military, however, said it could take North Korea some time before it can try to launch again. South Korea released video footage on Tuesday that its military said showed the moment the launch ended in failure. The one-minute black-and-white video provided by the South's Joint Chiefs of Staff (JCS) showed what appeared to be an explosion in the sky followed by flashes. The footage was filmed by an observation device on a South Korean patrol vessel, the JCS said. Footage released on Monday by Japanese broadcaster NHK, filmed from the Chinese border city of Dandong, showed a similar ball of flame that officials said was probably exploding fuel. Nuclear envoys of South Korea, the United States and Japan had a phone call on Tuesday and strongly condemned the launch as a direct violation of the U.N. Security Council resolutions banning the North's use of ballistic missile technology, Seoul's foreign ministry said. The launch came hours after China, South Korea, and Japan wrapped up a rare three-way summit in Seoul. Sign up here. https://www.reuters.com/world/asia-pacific/south-korea-says-video-shows-north-koreas-failed-satellite-launch-2024-05-28/

2024-05-28 06:29

MUMBAI, May 28 (Reuters) - The Indian rupee was little changed on Tuesday, unable to gain from an uptick in most Asian peers, with traders anticipating rangebound moves until the outcome of India's general election. The rupee was at 83.1325 against the U.S. dollar as of 09:40 a.m. IST, barely changed from its close at 83.13 in the previous session. The currency hovered between 83.1075 and 83.1375 in early trading. The dollar index dipped 0.1% to 104.4 while most Asian currencies rose, with the Korean won up 0.6%, leading gains. Analysts expect the rupee to mostly trade sideways heading into the India's election results, due on June 4. "Expect rangebound behaviour going into results, possibly between 82.90 and 83.30," Anindya Banerjee, head of foreign exchange research at Kotak Securities said. Equity-related flows will also influence the rupee heading into the elections results. Overseas investors have net sold $2.7 billion worth of stocks in May so far, the highest outflow since January. The rupee may gain slightly towards the end of the week, with the rejig of the MSCI Global Standard index expected to draw about $2 billion in passive inflows, according to an estimate by Nuvama Alternative & Quantitative Research. The MSCI "passive flow will come later this week but positioning by active trading funds could spur some inflows earlier as well," a trader at a foreign bank said. Remarks from Federal Reserve speakers will be in focus later on Tuesday for cues on when the central bank may begin to ease policy rates. Odds of the Fed keeping rates unchanged in September have risen to 50%, up from about 38% a week earlier, according to CME's FedWatch tool. Sign up here. https://www.reuters.com/markets/currencies/rupee-lingers-narrow-band-even-most-asian-currencies-inch-up-2024-05-28/

2024-05-28 06:20

U.S. dollar slips to a more than one-week low Higher-for-longer US interest rates seen limiting gains OPEC+ meets on June 2 to set output policy NEW YORK, May 28 (Reuters) - Oil prices gained more than $1 a barrel on Tuesday on the expectation that OPEC+ will maintain crude supply curbs at its June 2 meeting, while the start of U.S. summer driving season and a weaker dollar also boosted the commodity. Brent crude futures for July delivery settled up $1.12, or 1.4% at $84.22 a barrel. U.S. crude ended at $79.83 a barrel, gaining $2.11, or 2.7% from Friday's close, having traded through Monday's U.S. mark Memorial Day holiday without a settlement. For the online meeting of OPEC+ oil producers coming up on Sunday, traders and analysts are predicting 2.2 million barrels per day of voluntary production cuts to stay in place. "We expect OPEC+ to extend the current cut for at least another three months at its upcoming meeting," UBS analysts said in a note. "This week's upside follow through is being facilitated by a significant weakening in the dollar and a growing consensus that OPEC+ will extend production cuts at the upcoming weekend meeting," said Jim Ritterbusch of Ritterbusch and Associates. The dollar slipped 0.1% to a more than one-week low. Oil extended a more than 1% rise in trade on Monday that was muted due to the holiday, with hopes of a demand boost from the first tradable day since the start of the U.S. summer driving and vacation season providing support. Worries over U.S. interest rates remaining elevated for a longer period contributed to a weekly loss for crude last week. Higher rates boost the cost of borrowing, which can dampen economic activity and demand for oil. Investors will watch the U.S. core personal consumption expenditures price index (PCE), which is a main inflation gauge for the Federal Reserve, due on Friday. "Despite the indisputably brighter mood seen in the last two days, interest rate concerns will most plausibly act as a (brake) on further attempts to send oil prices meaningfully higher in the immediate future," said Tamas Varga of broker PVM. Air travel data also helped to buoy oil prices, with U.S. seat numbers on domestic flights for May rose by 5% month on month and almost 6% year on year to slightly above 90 million, data from flight analytics company OAG showed, surpassing 2019 levels. Continuing conflict in the Middle East, which on Monday included the death of a Egyptian security service member in an exchange of gunfire with Israeli forces, also helped boost oil prices, said Bob Yawger of Mizuho bank. Sign up here. https://www.reuters.com/markets/commodities/oil-prices-steady-investors-await-inflation-data-opec-meeting-2024-05-28/

2024-05-28 06:18

NEW YORK/LONDON, May 28 (Reuters) - A global equities gauge fell slightly on Tuesday while U.S. Treasury yields rose to multi-week peaks as investors waited cautiously for inflation data due later in the week with hopes for clues on the outlook for U.S. interest rates. U.S. Treasury yields gained ground after a weak auction. They had risen earlier after data showed U.S. consumer confidence unexpectedly improved in May amid optimism about the labor market after deteriorating for three consecutive months. In addition, U.S. house price growth slowed sharply in March, likely as rising mortgage rates weighed on demand. Equity investors were most focused on waiting for price data that is not due out until Friday. The Federal Reserve's preferred inflation barometer, the U.S. core Personal Consumption Expenditures Price Index report, is expected to hold steady on a monthly basis for April. "It's a holiday-shortened week so volume is likely to be pretty low all week. That's combined with the fact that markets are focused on one key data point due out Friday," said Gene Goldman, chief investment officer at Cetera Investment Management in El Segundo, California, referring to Monday's U.S. Memorial Day holiday. "The market is anxiously sitting on the sidelines waiting to get confirmation that inflation is slowing towards the Fed's target," Goldman said. MSCI's gauge of stocks across the globe (.MIWD00000PUS) New Tab, opens new tab fell 1.28 points, or 0.16%, to 792.07. Still, on Wall Street, the Nasdaq managed to rise past 17,000 level, and close above it for the first time as AI leader Nvidia (NVDA.O) New Tab, opens new tab hit a record high. The Dow Jones Industrial Average (.DJI) New Tab, opens new tab fell 216.73 points, or 0.55%, to 38,852.86, the S&P 500 (.SPX) New Tab, opens new tab gained 1.32 points, or 0.02%, to 5,306.04 and the Nasdaq Composite (.IXIC) New Tab, opens new tab gained 99.09 points, or 0.59%, to 17,019.88. Earlier Europe's STOXX 600 (.STOXX) New Tab, opens new tab index closed down 0.6%. In Treasuries, yields rose after two lackluster debt auctions raised doubts about demand for U.S. government debt while investors also digested the economic data, which fueled uncertainty about the Fed's monetary policy outlook. "With $297 billion in nominal supply on Tuesday between coupons and bills, I think some indigestion is to be expected," said Tom Simons, U.S. economist at Jefferies in New York. The yield on benchmark U.S. 10-year notes rose 6.7 basis points to 4.54%, from 4.473% late on Friday, while the 30-year bond yield rose 7.9 basis points to 4.656%. The 2-year note yield, which moves in step with interest rate expectations, rose 2.1 basis points to 4.9742%. In currencies, the dollar index gave back earlier losses as Treasury yields rose and managed a slight gain. "The bond market has turned around (on Tuesday) and the dollar with it," said Adam Button, chief currency analyst at ForexLive in Toronto, citing the weak auctions and noting that the improving consumer confidence report reflects "stronger growth." The index, which measures the greenback against a basket of currencies including the yen and the euro, gained 0.04% at 104.60, with the euro unchanged at $1.0858. Against the Japanese yen , the dollar strengthened 0.18% at 157.14. Oil prices gained more than $1 a barrel on the expectation that OPEC+ will maintain crude supply curbs at its June 2 meeting, while the start of U.S. summer driving season and a weaker dollar also boosted the commodity. U.S. crude futures settled up 2.71% at $79.83 a barrel while Brent settled at $84.22, up 1.35%. Gold prices rose slightly, as spot gold gained 0.33% to $2,358.58 an ounce. U.S. gold futures gained 1.17% to $2,359.70 an ounce. Sign up here. https://www.reuters.com/markets/global-markets-wrapup-1-2024-05-28/

2024-05-28 06:15

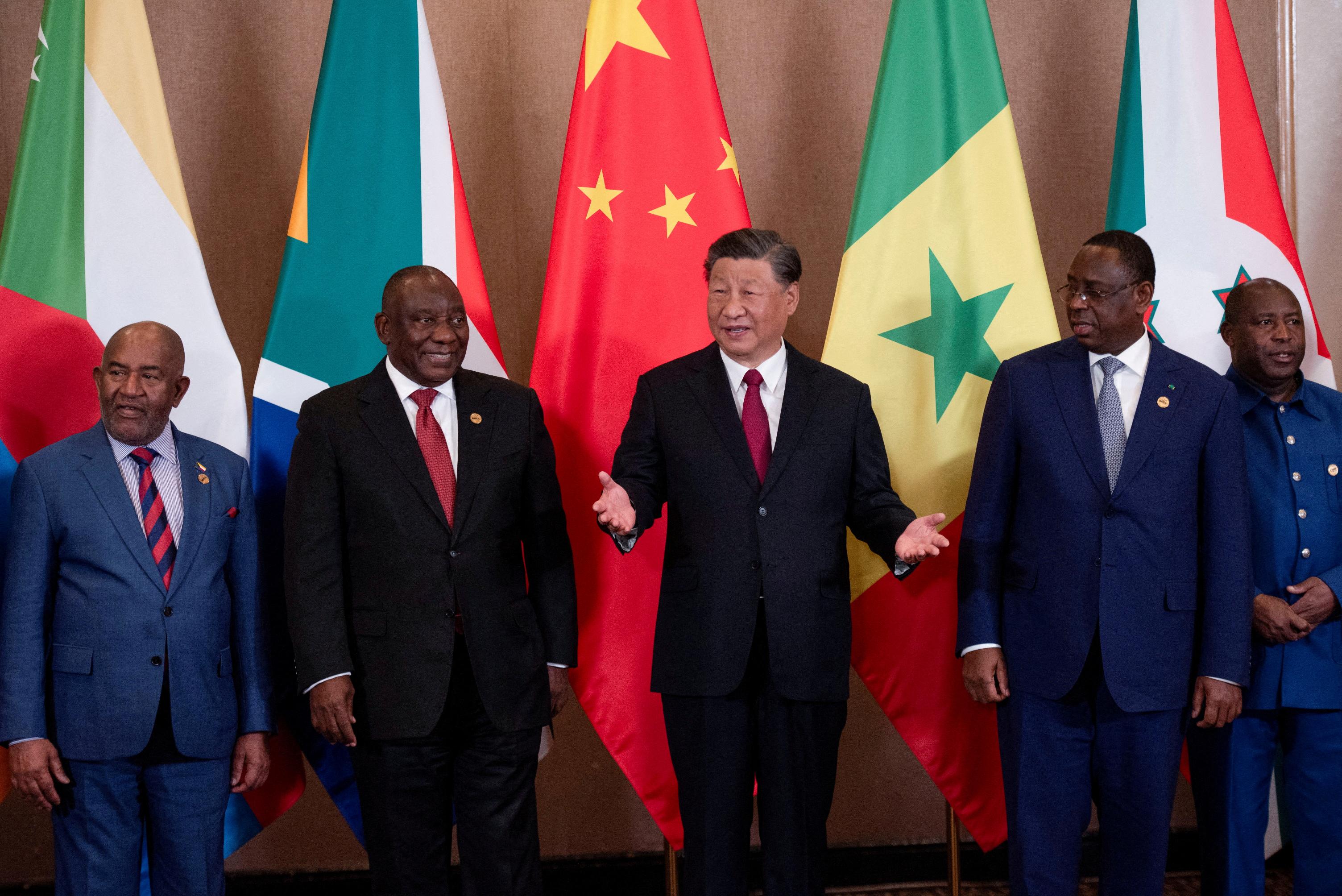

Chinese overseas investment, construction bouncing back Africa major focus of post-pandemic engagement Activities weighted towards minerals extraction Trade up, but Africa's deficit with China ballooning JOHANNESBURG/NAIROBI, May 28 (Reuters) - China's flagship economic cooperation program is bouncing back after a lull during the global pandemic, with Africa a primary focus, according to a Reuters analysis of lending, investment and trade data. Chinese leaders have been citing the billions of dollars committed to new construction projects and record two-way trade as evidence of their commitment to assist with the continent's modernisation and foster "win-win" cooperation. But the data reveals a more complex relationship, one that is still largely extractive and has so far failed to live up to some of Beijing's rhetoric about the Belt and Road Initiative, President Xi Jinping's strategy to build an infrastructure network connecting China to the world. While new Chinese investment in Africa increased 114% last year, according to the Griffith Asia Institute at Australia's Griffith University, it was heavily focused on minerals essential to the global energy transition and China's plans to revive its own flagging economy. Those minerals and oil also dominated trade. As efforts falter to boost other imports from Africa, including agricultural products and manufactured goods, the continent's trade deficit with China has ballooned. Chinese sovereign lending, once the main source of financing for Africa's infrastructure, is at its lowest level in two decades. And public-private partnerships (PPPs), which China has touted as its new preferred investment vehicle globally, have yet to gain traction in Africa. The result is a more one-sided relationship than China says it wants, one that is dominated by imports of Africa's raw materials and that some analysts argue contains echoes of colonial-era Europe's economic relations with the continent. "This is something late-19th century Britain would recognise," said Eric Olander, co-founder of the China-Global South Project website and podcast. China rejects such assertions. "Africa has the right, capacity and wisdom to develop its external relations and choose its partners," China's foreign ministry wrote in response to Reuters' questions. "China's practical support for Africa's path of modernisation in accordance with its own characteristics has been welcomed by an increasing number of African countries." A PIVOT WITH POTENTIAL? China's engagement in Africa, a focus of the Belt and Road Initiative (BRI), grew rapidly in the two decades before the COVID-19 pandemic. Chinese companies built ports, hydropower plants and railways across the continent, financed mainly through sovereign loans. Annual lending commitments peaked at $28.4 billion in 2016, according to the Global China Initiative at Boston University. But many projects proved unprofitable. As some governments struggled to repay loans, China cut lending. COVID-19 then pushed it to turn inward, and Chinese construction projects in Africa fell. A rebound in sovereign lending is not expected. Policymakers in Beijing have instead been pushing Chinese companies to take equity stakes and operate infrastructure they build for foreign governments. The aim, China analysts say, is to help companies win higher-value contracts and, by giving them skin in the game, ensure the projects are economically viable. Lending to Special Purpose Vehicles (SPVs), perhaps the most common means of PPP infrastructure investment, has been growing as a proportion of China's overseas loans, according to figures shared exclusively with Reuters by AidData, a research centre at U.S. university William & Mary. The $668-million Nairobi Expressway, a public-private partnership built and run by the state-owned China Road and Bridge Corporation (CRBC), could be proof of concept for the model in Africa. Since it opened in August 2022, the toll road has been allowing commuters to speed above the Kenyan capital's notorious traffic snarls, beating revenue and usage targets. Daily average use in March was already 57,000 vehicles, exceeding a 2049 target of around 55,000 set by CRBC in a 2019 presentation on the project's economic viability seen by Reuters. But few companies are following CRBC's example in Africa. While globally some 45% of Chinese non-emergency lending was to SPVs from 2018 to 2021, the most recent year for which AidData figures are available, the figure was only 27% for Africa. Analysts point to a number of likely reasons, including a lack of legal frameworks for PPPs in many African countries and the view among some Chinese companies - many of them relative newcomers to PPPs - that African markets are risky. China's foreign ministry did not directly address a request for comment on the lower SPV figures for Africa. But it said the government encourages Chinese companies to "actively develop new modes of cooperation" such as PPPs to bring more private investment to Africa. GROWING ENGAGEMENT The Griffith Asia Institute put China's total engagement in Africa - a combination of construction contracts and investment commitments - at $21.7 billion last year, making it the largest regional recipient. Data from the American Enterprise Institute, a Washington-based think tank, showed investments hitting nearly $11 billion in 2023, the highest level since it began tracking Chinese economic activity in Africa in 2005. Some $7.8 billion of that went to mining, like Botswana's Khoemacau copper mine, which China's MMG Ltd bought for $1.9 billion, and cobalt and lithium mines in countries including Namibia, Zambia and Zimbabwe. The hunt for critical minerals is driving infrastructure construction as well. In January, for example, Chinese companies pledged up to $7 billion in infrastructure investment under a revision of their copper and cobalt joint venture agreement with Democratic Republic of Congo. Western and Gulf powers are also racing to lead the world's energy transition, with the United States and European governments backing the Lobito Corridor, a rail link to bring metals from Zambia and Congo to Africa's Atlantic coast. African leaders have struggled, however, to raise financing for some other priority projects. Despite the success of the Nairobi Expressway, for example, work on several Kenyan roads stalled when the government ran out of money to pay the Chinese construction firms. During a visit to Beijing last October, President William Ruto asked for a $1 billion loan to complete the projects. A Chinese foreign ministry spokesman, Wang Wenbin, said discussions about the request were ongoing. Kenya's finance ministry did not respond to a request for comment. The final phase of a railway line intended to traverse Kenya from its main port to the border with Uganda has been in similar limbo since Chinese financing dried up in 2019. Uganda cancelled the contract for its portion of the line in 2022, after Chinese backers pulled out. When asked about the decline in lending for African infrastructure, Chinese officials point to a pivot to trade and investment, arguing that BRI-generated trade boosts Africa's wealth and development. Two-way trade reached a record $282 billion last year, according to Chinese customs data. But at the same time, the value of Africa's exports to China fell 7%, mainly due to a decline in oil prices, and its trade deficit widened 46%. Chinese officials have sought to assuage the concerns of some African leaders. At a summit in Johannesburg last August, Xi said Beijing would launch initiatives to support the continent's manufacturing and agricultural modernisation - sectors African policymakers consider key to closing trade gaps, diversifying their economies and creating jobs. China has also pledged to increase agricultural imports from Africa. Such efforts, for now, are coming up short. With one of Africa's largest trade deficits to China, Kenya has been pushing to increase access to the world's second-largest consumer market, recently gaining it for avocados and seafood. But cumbersome health and hygiene regulations mean Chinese consumers remain out of reach for many producers. "The Chinese market is a new one," said Ernest Muthomi, CEO of the Avocado Society of Kenya. "It was a challenge because you have to install the equipment for fumigation." Of 20 billion shillings ($150.94 million) worth of avocados exported last year, just 10% went to China. Overall, Kenyan exports to China fell over 15% to $228 million, Chinese customs data showed, as a decline in titanium production led to a drop in shipments of the metal - a key export to China. But Chinese manufactured goods kept coming. That's not sustainable, said Francis Mangeni, an advisor at the Secretariat of the African Continental Free Trade Area. Unless African nations can add value to their exports through increased processing and manufacturing, he said, "we are just exporting raw minerals to fuel their economy." ($1 = 132.5000 Kenyan shillings) Sign up here. https://www.reuters.com/markets/commodities/post-covid-china-is-back-africa-doubling-down-minerals-2024-05-28/