2024-05-24 10:08

NEW YORK, May 24 (Reuters) - Investors are bracing for a flood of U.S. government debt issuance that over time could dwarf an expected rally in bonds, as they see no end in sight for large fiscal deficits ahead of this year's presidential election. While bond markets so far this year have been driven mostly by bets on how deeply the Federal Reserve will be able to cut interest rates, fiscal concerns are expected to become more prominent as the Nov. 5 election nears. Analysts and investors say a reduction in deficit spending does not appear to be a policy priority for President Joe Biden and Republican challenger Donald Trump. Both candidates' teams dispute this notion. Some investors have already started to allocate funds in ways that would avoid losses if Treasury yields, which move inversely to prices, start surging because of supply and demand imbalances. Others are concerned that uncertainty over just how much debt will be needed for deficit spending could end up destabilizing the $27 trillion Treasury market, the bedrock of the global financial system. "If we take a step back away from the Fed and away from the next six months where we could still get substantial rate cuts, supply numbers are not healthy," said Ella Hoxha, head of fixed income at Newton Investment Management, who favors short-term maturities in Treasuries. Benchmark 10-year Treasury yields, now at around 4.4%, could go up to 8%-10% over the next several years, she said. "Longer term, it's not sustainable." So-called bond vigilantes - investors who punish profligate governments by selling their bonds - made a comeback last year, pushing 10-year Treasury yields to 5% for the first time in 16 years, but concerns over growing U.S. debt issuance subsided after the Treasury Department in November slowed down the pace of increases. In its latest refunding announcement this month, the Treasury Department said it plans to keep auction sizes steady over the next several quarters. Still, larger auctions for long-dated debt are expected already next year, analysts have said. Federal debt held by the public could grow by $21 trillion to $48 trillion by 2034, according to the Congressional Budget Office New Tab, opens new tab. Meanwhile, traditional sources of demand for U.S. government bonds are lagging. Foreign ownership is not keeping up with the growing size of the market and the Fed keeps shrinking its bond holdings. "One of the things we've been talking a lot about internally is not just the supply but the demand," said David Rogal, managing director and a member of the multi-sector team in BlackRock's global fixed income group. "An environment where you have a reduced buyer base and more supply definitely makes me think that over time you will see more term premium," he said, referring to a measure of the extra compensation investors demand for lending to the government over the long term. Democrats as well as Republicans have vowed to reduce deficit spending and debt levels. "After the prior administration increased the debt by a record $8 trillion and didn't sign a single law to reduce the deficit, President Biden has signed $1 trillion of deficit reduction into law and has a plan to lower the deficit by $3 trillion more," White House spokesperson Jeremy Edwards said. Anna Kelly, spokesperson for the Republican National Committee, said Trump's "pro-growth, anti-inflation economic policies will ... bring down interest rates, shrink deficits, and lower long-term debt levels." 'PROBLEM FOR TOMORROW' A sudden drop in demand for U.S. government bonds is unlikely given the dollar's leading reserve currency status and the size and depth of the Treasuries market. "The most predictable crisis in history ... is for the moment more a silent crisis," JPMorgan analysts said in a recent note. "A problem 'for tomorrow' but not right now," they wrote. Still, some market participants have started to take stock. Investor pressure on the Treasury Department to become more fiscally conservative would manifest itself with higher long-term yields relative to shorter-term ones, said Jonathan Duensing, head of U.S. fixed income at Amundi US. "We're much more in the front end and intermediate part of the yield curve right now and prefer to stay away in general from the longer-duration part of the Treasury curve," he said. In a sign of weakening demand, over the past year 10-year Treasury auctions have seen investors demand a concession to buy the paper more frequently than in recent years. Meanwhile, the U.S. Treasury 10-year term premium briefly moved back into positive territory New Tab, opens new tab last month. "Ahead of the elections you probably don't want to be owning as much very long-dated U.S. Treasuries," said Brij Khurana, a fixed income portfolio manager at Wellington Management. Others echoed those concerns. Craig Ellinger, head of Americas fixed income at UBS Asset Management, said short-term debt "seems like the safer place to be in case deficits do get out of control." Kathryn Rooney Vera, chief market strategist at StoneX, is positioning for a steeper yield curve partly because she anticipates large issuance will pressure long-term Treasuries. "The answer is reducing spending, and neither side wants to do that," she said. Sign up here. https://www.reuters.com/markets/us/rising-us-debt-burden-spooks-some-bond-investors-ahead-november-election-2024-05-24/

2024-05-24 10:00

A look at the day ahead in U.S. and global markets from Mike Dolan And then there was one. In an extraordinary turnabout in just five months, financial markets now fully price just one quarter-point interest rate cut from the Federal Reserve this year - compared to the six built into futures prices at the start of 2024. The good news is that's largely down to the sheer strength of the ongoing U.S. expansion - the bad news is that very strength makes it harder for the Fed to see inflation hitting its target and keeps it hesitating on a first rate cut. Thursday's reversal of fortunes on Wall St reflected all that clearly, with surprisingly strong business and labor market updates seeding the worst day of the month for S&P500 (.SPX) New Tab, opens new tab despite Nvidia's (NVDA.O) New Tab, opens new tab near 10% surge on another blowout earnings report infused by the artificial intelligence boom. Even though the broader tech sector (.SPLRCT) New Tab, opens new tab ended the day higher, the 10 other major stock sectors were left in the red. And the equal-weighted S&P500 (.EWGSPC) New Tab, opens new tab lost 1.4%. Fed fears 1 - AI 0. With just 35 basis points of Fed easing now priced for the year, two-year Treasury yields climbed back to within 4bps of the 5% threshold. The dollar (.DXY) New Tab, opens new tab jumped back to its best level since mid May and that in turn triggered a reversal in lofty gold prices - clocking their worst day in month and worst week of the year. The VIX (.VIX) New Tab, opens new tab bounced back more than a point from pre-pandemic lows. A so-called "bear-flattening" of the yield curve saw the inversion of the 2-10 year yield gap deepen to its most negative this year - with yields at both tenures rising but short rates up by more. The yield curve has been inverted for almost two years solid now and its reliability as a harbinger of recession has been shot to bits - underscoring the peculiarity of this particular cycle and how the Fed may be struggling to cool it down. Ahead of the U.S. Memorial Day holiday on Monday, all the major price indicators have given back a bit of Thursday's moves - with S&P futures up 0.2% ahead of the bell and both Treasury yields and the dollar off a touch. But the Fed rate jitters rippled across the world overnight, with bourses in Tokyo (.N225) New Tab, opens new tab, Seoul (.KS11) New Tab, opens new tab, Hong Kong (.HSI) New Tab, opens new tab and Shanghai (.CSI300) New Tab, opens new tab losing more than 1% on Friday. China's ongoing military exercises around Taiwan have not helped investor confidence. Europe's (.STOXX) New Tab, opens new tab two-day loss continued - with regional interest rate and political concerns of its own. Even though the European Central Bank is still nailed on to deliver its first rate cut next month, unexpected strength in May business readings and a surprising acceleration of negotiated wage settlements in the first quarter have dragged market pricing for full-year ECB easing back below 60bp. The rethink of the Bank of England's trajectory this week has been even more dramatic as sticky UK inflation readings combined with news of a snap election for July 4. Although Friday's data showed UK retail sales plunging far more than forecast last month, money markets have wiped out chances of a BoE cut next month and now only see a 1-in-3 chance of a move in August. Sterling, whose broader trade-weighted index is back up at 8-year highs to pre-Brexit referendum levels, recaptured some of Thursday's losses against the dollar . Elsewhere, traders monitored the G7 finance meeting in Italy and a Friday speech from Fed governor Chris Waller in Iceland. In company news, a 7.55% tumble in Boeing (BA.N) New Tab, opens new tab on Thursday after the U.S. planemaker forecast negative free cash flow in 2024 accounted for over 90 points to the downside for the blue-chip Dow Jones index (.DJI) New Tab, opens new tab. Ticketmaster-owner Live Nation (LYV.N) New Tab, opens new tab slumped almost 8% after the U.S. Justice Department along with a group of 30 states and the District of Columbia Thursday sued to break up the concert promoter. In Europe on Friday, shares of Renault (RENA.PA) New Tab, opens new tab rose 4% after the French carmaker announced a share buyback plan. And Britain's National Grid (NG.L) New Tab, opens new tab regained nearly all of Thursday's 10% plunge on plans to raise about 7 billion pounds ($8.9 billion) in a rights issue. Abrdn (ABDN.L) New Tab, opens new tab shares slipped after the UK fund manager's CEO Stephen Bird stepped down. Key diary items that may provide direction to U.S. markets later on Friday: * U.S. April durable goods orders, University of Michigan's final May household survey reading * G7 finance ministers and central bank Governors meet in Stresa, Italy * Federal Reserve Board Governor Christopher Waller speaks * U.S. corporate earnings: Workday Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-graphic-2024-05-24/

2024-05-24 09:59

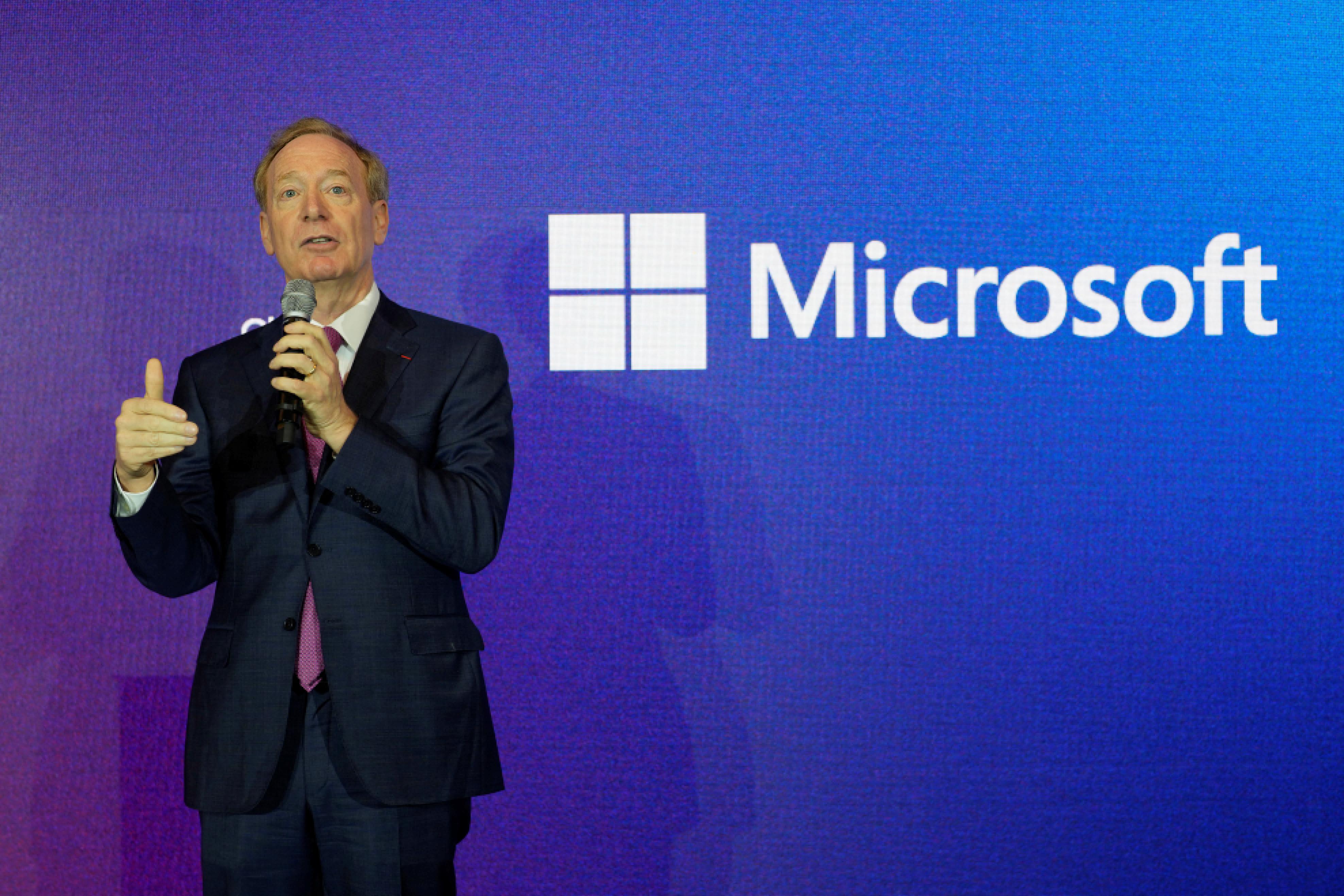

May 22 (Reuters) - Microsoft (MSFT.O) New Tab, opens new tab President Brad Smith said the tech company's high profile deal with the United Arab Emirates-backed AI firm G42 could eventually involve the transfer of sophisticated chips and tools - a move that a senior Republican congressman warned could have national security implications. In an interview with Reuters this week, Smith said the sales accord, many details of which are being reported here for the first time, could progress to a second phase that entails the export of crucial components of AI technology such as model weights, a crown jewel of AI systems that determine how powerful they are. Smith said there is no firm timeline for the second phase. U.S. officials have said that AI systems could pose national security risks, for example by making it easier to engineer chemical, biological and nuclear weapons New Tab, opens new tab. The Biden administration in October required the makers of the largest AI systems to share details about them with the U.S. government. To move forward, the deal would require the approval of the U.S. Department of Commerce. Microsoft executives said the agreement has safeguards to protect Microsoft's technology and prevent it from being used by Chinese entities to train AI systems. But those measures have not been made public, and some U.S. lawmakers question whether they are adequate. The closed-door nature of the negotiations between two private companies over the terms and safeguards on transfers of U.S. technology have alarmed some lawmakers. “Despite the significant national security implications, Congress still has not received a comprehensive briefing from the executive branch about this agreement," Michael McCaul, the Republican chairman of the foreign affairs committee in the U.S. House of Representatives, told Reuters. "I am concerned the right guardrails are not in place to protect sensitive U.S.-origin technology from Chinese espionage given the (Chinese Communist Party's) interests in the UAE.” The Commerce Department already requires notifications and, in several regions, export licenses to send AI chips abroad. But the Microsoft-G42 deal highlights gaps in U.S. laws as regulators rush to keep up with fast-moving technology. At present, for example, there is no regulation restricting the export of AI models, though McCaul and a bipartisan group of lawmakers this week advanced legislation that would give U.S. officials more explicit power to do so. Microsoft executives said the company welcomes a debate on a new legal framework governing the transfer of AI technology and that the deal with G42 requires the UAE firm to comply with U.S. regulations as they evolve. "Fundamentally, what we're focused on is trying to ensure that American technology can move around the world safely and securely," Smith said. BEYOND UAE When Microsoft and G42 announced the deal last month, it was billed as drawing G42 closer to the U.S. and spreading U.S. technology influence amid strategic competition with China. Microsoft is investing $1.5 billion in G42 with Microsoft's president, Smith, taking a seat on its board. The companies did not give details about which technologies might be transferred to the UAE or other countries or which specific security safeguards would be put in place. Some of those details are being reported here for the first time. The broad intent of the deal is for Microsoft and G42 to jointly take AI technology into regions where neither could do so as effectively alone. An early example is a deal in Kenya announced by the two companies on Wednesday. The Microsoft-G42 deal is an agreement between the two companies that requires each to give security assurances to their respective home governments, but there is no direct agreement between the U.S. and UAE governing the transfer of sensitive technologies. The two companies could seek to transfer those technologies to other markets beyond the UAE, including places like Turkey and Egypt, Microsoft executives said. Smith said many of the details of the deal remain to be worked out, including how to protect what are known as AI "model weights," which is the critical part of an AI model that defines how it responds to questions or prompts. Those weights are obtained by training an AI model with huge amounts of data, often at great expense. Model weights currently cannot be encrypted while in use, and Smith estimated the promising technical approaches for doing so remain at least a year away. Smith said Microsoft has considered several alternative options to protect its technology, including a "vault within a vault" that would involve physically separating parts of data centers where AI chips and model weights are housed and restricting physical access. "I suspect by the time we're done, we're going to end up with a regulatory regime or trade export control approach that will be applicable broadly and not just to Microsoft and G42," Smith said. Under the Microsoft deal, G42 will also follow a "know your customer" rule to determine who is using Microsoft's technology and will not allow Chinese firms to use it to train AI models, Microsoft executives said. U.S. regulators have proposed a similar rule, but they have not yet enacted it. "We adopted a strategic commercial decision to partner with U.S. companies when it comes to advanced technologies. And we're very clear on the fact that in order to do so, we will need to adhere to the requirements and our partners and government regulatory requirements or export control regulations," Talal Al Kaissi, an executive who handles partnerships for G42's AI work, told Reuters. Under the deal, Microsoft would have the ability to impose financial penalties on G42 and enforce them in arbitration courts in London, Microsoft said. That means Microsoft would not be forced to work through the UAE legal system to ensure G42 complies with its obligations and could seize assets in many countries if G42 is found in violation of the agreement, Microsoft said. Precisely how U.S. Commerce Secretary Gina Raimondo will allow the deal to move forward remains unclear. Smith said the provisions are "informal" and that "certainly with this Secretary of Commerce, one knows pretty clearly whether she approves or rejects something." In a statement, a Commerce Department spokesperson said any technology transfers would be governed by export controls, "including currently in force licensing requirements" for AI chips and "potential future controls." Sign up here. https://www.reuters.com/world/middle-east/microsofts-uae-deal-could-transfer-key-us-chips-ai-technology-abroad-2024-05-23/

2024-05-24 08:21

LONDON, May 24 (Reuters) - The pound eased on Friday after data showed wet weather hit UK consumer spending far more than expected in April, but evidence of sticky inflation, and the surprise announcement this week of a July general election kept sterling near two-month highs. Sales volumes dropped by 2.3% in April after a 0.2% fall in March, which was downwardly revised from a flat reading, the Office for National Statistics said. The data was worse than any economist predicted in a Reuters poll, which had pointed to a drop of around 0.4% on the month. However, a separate measure of consumer sentiment on Friday showed confidence is at its highest since late 2021. Sterling was last flat at $1.2697, having traded as high as $1.2761 after Wednesday's data showed UK inflation rose 2.3% in April, above forecasts for a rise of 2.1%, but still below March's 3.2% rate. The euro held in modestly positive territory against the pound , at 85.21 pence. Investors have slashed the chances of a June rate cut by the Bank of England to below 10%, from around 50% before Wednesday's inflation data. Two-year gilt yields , the most sensitive to shifts in expectations for the course of monetary policy, are heading for their largest weekly rise so far this year, as investors sold British government bonds. "With sterling being catapulted to multi-month highs against both the dollar and the euro after a measly 0.2% miss in inflation, I knew there was little steam in the engine from the start. The reaction was much too great than the reality justified," Caxton strategist David Stritch said. "However, the market is recovering from its knee-jerk reaction and the spike in gilt yields that followed and sterling is weakening as a result, although, sterling is showing remarkable resilience and has stemmed a fall towards its pre-inflation levels to simply plateau against its peers," he said. Wednesday's data miss aside, headline inflation is falling. Last month's rise in the national minimum wage, along with the fall in workers' national insurance contributions and this month's anticipated drop in energy bills have helped lift the mood among British consumers. So far in May, sterling is up against most major currencies and heading for its best monthly performance since November against the dollar, with a gain of 1.6%. Sign up here. https://www.reuters.com/markets/currencies/sterling-holds-near-two-month-highs-volatile-week-2024-05-24/

2024-05-24 08:03

OSLO, May 24 (Reuters) - Equinor (EQNR.OL) New Tab, opens new tab and its partners in the North Sea Troll gas field, Europe's largest, will invest 12 billion Norwegian crowns ($1.13 billion) to further boost production, the Norwegian energy company said on Friday. Norway is already Europe's largest supplier of natural gas after a sharp reduction in Russian deliveries since the start of the war in Ukraine in 2022. "The gas from Troll alone meets around 10% of Europe's demands," Equinor's head of exploration and production in Norway Kjetil Hove said in a statement. "This is a highly profitable project that will secure high gas production from the Troll field," Equinor's head of projects, drilling and procurement Geir Tungesvik said in the statement. The new infrastructure will accelerate production equivalent to about 55 billion standard cubic metres (bcm) of gas, and at its peak the annual contribution from the additional development will amount to around 7 bcm, Equinor said. Norway's full-year export of pipeline gas to Europe in 2023 stood at 109 bcm. Recent upgrades at the onshore Kollsnes processing plant have already raised Troll's maximum output capacity to 129 million standard cubic metres (mcm) of gas per day from 121 mcm previously, and this will rise further with the new investments. "Production from the new Troll wells will amount to about 20 million standard cubic metres of gas per day," Equinor said. The new investment, known as the second stage of the Troll Phase 3 project, includes eight new wells with a new gas flowline to the Troll A platform, with the first wells scheduled to come on stream at the end of 2026, Equinor said. Once processed at Kollsnes, the gas from Troll is sent via the Zeepipe pipelines and can be distributed onwards to receiving terminals in Germany, Belgium, France, Britain and Denmark. Operator Equinor holds a 30.58% stake in Troll while Norway state firm Petoro owns 56%, Shell (SHEL.L) New Tab, opens new tab has 8.10%, TotalEnergies (TTEF.PA) New Tab, opens new tab 3.69% and ConocoPhillips (COP.N) New Tab, opens new tab 1.62%. ($1 = 10.6607 Norwegian crowns) Sign up here. https://www.reuters.com/business/energy/equinor-boost-troll-gas-field-output-2024-05-24/

2024-05-24 07:57

HOUSTON, May 23 (Reuters) - U.S. government forecasters said on Thursday up to seven major hurricanes may form in an "extraordinary" 2024 Atlantic hurricane season beginning June 1. In a May forecast exceeding that issued ahead of 2005's record-breaking season that spawned hurricanes Katrina and Rita, forecasters expect between four and seven major hurricanes. Those events are among a projected eight to 13 hurricanes, which could result from an expected 17 to 25 named tropical storms, said Rick Spinrad, administrator of the U.S. National Oceanic and Atmospheric Administration. An average hurricane season produces 14 named storms (winds of at least 39 miles per hour or 63 kph), of which seven become hurricanes (winds over 74 mph or 119 kph) and three become "major," with wind speeds over 111 mph (178 kph). Warm sea temperatures and falling wind shear conditions at the height of the hurricane season in August and September are expected to contribute to more and stronger storms this year, the forecasters said. "This forecast has higher ranges than 2005," said lead forecaster Matthew Rosencrans in a news conference webcast from Washington, D.C. "These are the highest ranges we have ever forecast." In 2023 there were three major hurricanes that formed among seven hurricanes and 20 named storms, the fourth-greatest number of named storms since 1950. The most damaging, Idalia, tore up the west coast of Florida and made landfall as a Category 3 hurricane. NOAA's forecast is among several closely monitored by coastal communities and energy companies. The widely watched Colorado State University forecast issued in April projected five major hurricanes out of 11 total hurricanes that are part of a projection for 23 named tropical storms. The U.S. Gulf of Mexico accounts for 15% of total U.S. crude oil production and 5% of its dry natural gas output, and nearly 50% of the nation's oil-refining capacity resides on its shores. NOAA's forecast is in line with other initial outlooks. Private forecaster AccuWeather has said there is a 10-15% chance of 30 or more named storms in the 2024 hurricane season, which runs until Nov. 30. Sign up here. https://www.reuters.com/world/us/us-forecasters-see-extraordinary-2024-hurricane-season-2024-05-23/