2024-05-23 21:03

May 23 (Reuters) - Tesla (TSLA.O) New Tab, opens new tab has left out its goal of delivering 20 million vehicles a year by 2030 in its latest impact report published on Thursday, another sign the company was moving away from electric cars as it shifts focus to robotaxis. CEO Elon Musk had said in 2020 that Tesla aspired to sell 20 million vehicles by the end of the current decade - twice as many as those sold by Toyota (7203.T) New Tab, opens new tab, the world's largest automaker. It had reiterated the goal in its 2021 and 2022 impact reports. But the company changed tack recently, dropping plans to produce an all-new model that was expected to cost $25,000, while touting autonomous driving technology as its main source of growth. It plans to host a launch event for its robotaxi on Aug. 8. Robotaxis and the company's humanoid robot Optimus will be "incredibly profound" for Tesla, Musk said on Thursday through a video-link at the annual "Viva Technology" conference in Paris. He declined to answer a question on the timeline for Tesla's low-cost cars at the event. Musk said in April that Tesla plans to bring forward the launch of new models, including affordable cars, to as early as late this year. But Tesla said it plans to use current product lines for new affordable vehicles instead of new facilities, making a strategic change that would result in smaller cost reductions than expected and modest volume growth. Reuters first reported that Tesla shelved its next-generation, cheaper electric cars in favor of robotaxis. "A healthy proportion of Tesla's 2030 goal would have been the company's hitherto longstanding promise to introduce affordable cars at the $25,000 mark," said Sandeep Rao, senior researcher at Leverage Shares, which owns Tesla shares. "While the company currently promises to introduce 'more affordable' models in the future, this doesn't necessarily equate to cars costing $25,000 being rolled out." Tesla shares were down 3.5% on Thursday, falling about 30% this year. Slowing growth in EV demand and tough competition have hit demand for Tesla's vehicles. Its sales grew 38% in 2023, below the long-term annual growth target of 50% and Tesla warned in January that growth in deliveries would be notably lower this year. Tesla posted its first year-on-year sales drop in nearly four years during the January to March period this year. In a bid to restructure, Tesla laid off over 10% of its staff this year, including disbanding the Supercharger team. The 2023 impact report also showed Tesla's fast-charging network had an uptime of 99.97%, the highest in at least five years. However, some analysts and former employees have warned the division's performance could suffer due to the layoffs. Tesla also did not compare the diversity of its workers to other companies in the report and it no longer states that a majority of its employees are from underrepresented groups. Sign up here. https://www.reuters.com/business/autos-transportation/tesla-drops-reference-its-goal-delivering-20-mln-vehicles-annually-impact-report-2024-05-23/

2024-05-23 21:01

May 23 (Reuters) - CVS Health Corp (CVS.N) New Tab, opens new tab has been seeking a private equity partner to fund growth at Oak Street Health, a primary care provider it bought a year ago, Bloomberg News reported on Thursday. The company has been working with financial advisers to help find capital to back new clinics that will be opened by Oak Street, the report said, citing people familiar with the matter. The deliberations are in a preliminary stage and the structure could change, while there is no guarantee a deal will be reached, according to the report. CVS declined a request for comment from Reuters. A potential CVS-private equity partnership would help lessen the capital investment burden associated with the build out of the Oak Street Health clinic base, Leerink Partners analyst Michael Cherny said in a note. "Overall, we see this move as prudent on the surface, but need more details on the potential joint venture," he added. The U.S. healthcare conglomerate bought Oak Street Health for about $9.5 billion in February last year. CVS had said in February it planned to nearly double the business to 300 clinics by 2026 and aimed to grow the number of Oak Street patients over time. Sign up here. https://www.reuters.com/business/healthcare-pharmaceuticals/cvs-seeks-investor-fund-growth-oak-street-health-bloomberg-reports-2024-05-23/

2024-05-23 20:39

TSX ends down 0.7% at 22,200.79 Posts lowest closing level since May 3 Materials sector falls 1.3% Metal prices pull back from record highs May 23 (Reuters) - Canada's main stock index fell to a near three-week low on Thursday, with resource shares among the biggest decliners as commodity prices fell and economic data fueled worries the Federal Reserve would delay a move to interest rate cuts. The Toronto Stock Exchange's S&P/TSX composite index (.GSPTSE) New Tab, opens new tab ended down 145.97 points, or 0.7%, at 22,200.79, its lowest closing level since May 3. "The entire commodity complex is trading lower due to hawkish comments from the U.S. Federal Reserve sparking fears that higher for longer interest rates could hurt global growth and keep the U.S. dollar elevated," said Brandon Michael, senior investment analyst at ABC Funds. On Wednesday, minutes of the Fed's latest meeting showed U.S. central bank officials still had faith price pressures would ease, but slowly, due to disappointment over inflation reading. Wall Street also fell, even as a strong revenue forecast for Nvidia (NVDA.O) New Tab, opens new tab prompted a surge in its shares. "We still believe we are in a secular bull market," Michael said. "You could do exceptionally well if you are in the right areas of the market and have a little bit of patience." The materials group (.GSPTTMT) New Tab, opens new tab fell 1.3% as gold and copper prices pulled back from recent record highs. Energy (.SPTTEN) New Tab, opens new tab was also a drag, falling 0.5%, as the price of oil settled 0.9% lower at $76.87 a barrel. Toronto-Dominion Bank (TD.TO) New Tab, opens new tab shares were down 1.6%. The bank reported better-than-expected quarterly earnings even as its U.S segment struggled amid probes related to its anti-money laundering program. Canada is due on Monday to shorten the trade settlement period to one day from two days, keeping it aligned with U.S. trading. U.S. markets will move to the new standard, commonly called T+1, on Tuesday, following a market holiday. Sign up here. https://www.reuters.com/markets/tsx-futures-rise-nvidia-optimism-2024-05-23/

2024-05-23 20:34

MEXICO CITY, May 23 (Reuters) - Claudia Sheinbaum, front-runner in Mexico's presidential race, aims to overhaul water governance in the agriculture sector, the top user of the country's scarce supply, with a potential investment of 20 billion pesos ($1.2 billion) per year. Julio Berdegue, a member of Sheinbaum's campaign team focused on water and the agricultural sector, told Reuters the candidate's six-year plan will review existing water concessions, crack down on illegal use, update irrigation technology and revamp national water entity CONAGUA. He cautioned the plan, details of which have not previously been reported, was still in development and could change. Sheinbaum has said she plans to reform the National Water Law and develop a strategy to confront pervasive issues in Mexico, which is suffering from crippling drought, widespread water shortages, and heat waves in recent days so severe that howler monkeys are dropping dead from trees. One of her main focuses will be Mexico's powerful agriculture sector which uses nearly 80% of the country's water to produce corn, wheat, soy, coffee, beans and avocados. "(Mexico) requires a new general water law, appropriate for a country in climate change, where there is more population, where there is less water, where there are many industries that we want to reach with near-shoring that need water," Berdegue said. With elections just over a week away, the impacts of climate change are front and center for many Mexicans amid record temperatures. More than 70% of the country is dealing with some level of drought, according to government data. Water shortages, especially in the metropolitan area surrounding capital Mexico City, have become routine. Rather than come out entirely of the national budget, Sheinbaum's government will look to secure other sources of financing, Berdegue said. Experts have anticipated that Sheinbaum, a climate scientist and former mayor of Mexico City, will make water a main priority, though they predict a sweeping overhaul - especially within the agriculture sector - will face major challenges in confronting long-standing corruption and political polarization. "It's very uncomfortable because no one likes when farmers are protesting ... but it's the top water-consuming sector, and we have to find ways to figure out solutions to tackle this issue," said Franck Gbaguidi of Eurasia Group. Juan Cortina, president of the CNA, Mexico's top farm lobby, said Sheinbaum's proposed changes would be mostly welcome in the sector. A reform or new law, however, wasn't the most important priority, he said, but, rather, enforcement. "The truth is that we have not invested in the national water system for many decades," Cortina said. "This requires more than a change in the law." Berdegue, a former official at the United Nation's Food and Agriculture Organization, stressed Sheinbaum's government would not revoke legal concessions. Instead, he said, it would crack down on those who break concession limits or sell water instead of using it themselves. Berdegue estimated that between 40% and 50% of water that moves through the current system is lost to evaporation. Sheinbaum's plan would aim to recover that loss and ultimately secure more water for agriculture and domestic use. The plan may include technology to monitor water usage according to concessions and control access once limits had been reached. By the end of Sheinbaum's six-year term, about 750,000 hectares would be updated and modernized, which would increase by 50% the current area in Mexico that has modern irrigation systems. About 4.2 million hectares were deforested in Mexico between 2001 and 2021, just over 6% of the country's total forests, according to official data, mostly to expand agriculture area. Sheinbaum would also seek to stem deforestation with an end-goal of stopping it completely, Berdegue said. The plan could imply big changes for some producers, a delicate issue to navigate, Berdegue said, but farmers and industry groups would be invited to participate in talks. ($1 = 16.6207 Mexican pesos) Sign up here. https://www.reuters.com/world/americas/mexico-front-runner-sheinbaum-aims-reform-water-heavy-agriculture-sector-2024-05-23/

2024-05-23 20:11

May 23 (Reuters) - Power use in Texas was on track to break the record for the month of May on Friday for a second time this week and could top that again over the Memorial Day weekend as homes and businesses crank up air conditioners to escape a heat wave. The Electric Reliability Council of Texas (ERCOT), which operates most of the state's power grid for 27 million customers, said the system was currently operating normally with enough supply available to meet expected demand all week. ERCOT projected power demand would peak at 75,296 megawatts (MW) on May 24 and 75,952 MW on May 26, which would top the current record for the month of May of 72,261 MW on May 20. The grid's all-time peak was 85,508 MW on Aug. 10, 2023. Analysts expect ERCOT electric use will top that all-time high this summer with economic and population growth in Texas and demand for power from data centers, artificial intelligence (AI) and cryptocurrency mining rising fast. One megawatt can usually power about 800 homes on a normal day but as few as 250 on a hot summer day in Texas. High temperatures in Houston, the biggest city in Texas, were forecast to rise from 92 degrees Fahrenheit (33.3 Celsius) on Thursday to 99 F on May 27, according to meteorologists at AccuWeather. The normal high in Houston at this time of year is 88 F. Over the next week, ERCOT projected supplies would exceed demand by as much as 42,500 MW during the morning of May 26 when the sun starts to energize solar panels and by as little as 6,600 MW in the evening of May 24 after the sun goes down and solar panels stop working. That comfortable level of supply assumes nothing changes, but ERCOT said it already experienced the "sudden loss of generation" totaling 1,438 MW on May 22. That reduced supplies. The outage was at Panda Energy's natural gas power plant in Temple, Texas, and was likely caused by a tornado that passed through the area last night, according to energy data and analytics company Wood Mackenzie. Panda Energy was not immediately available for comment. There were, however, over 110,000 homes and businesses without power Thursday morning due to storms overnight. Those new outages reduced power demand and came after Texas utilities restored service to most customers knocked out in severe storms last week. Sign up here. https://www.reuters.com/markets/us/texas-power-demand-break-may-record-heat-wave-friday-2024-05-23/

2024-05-23 19:44

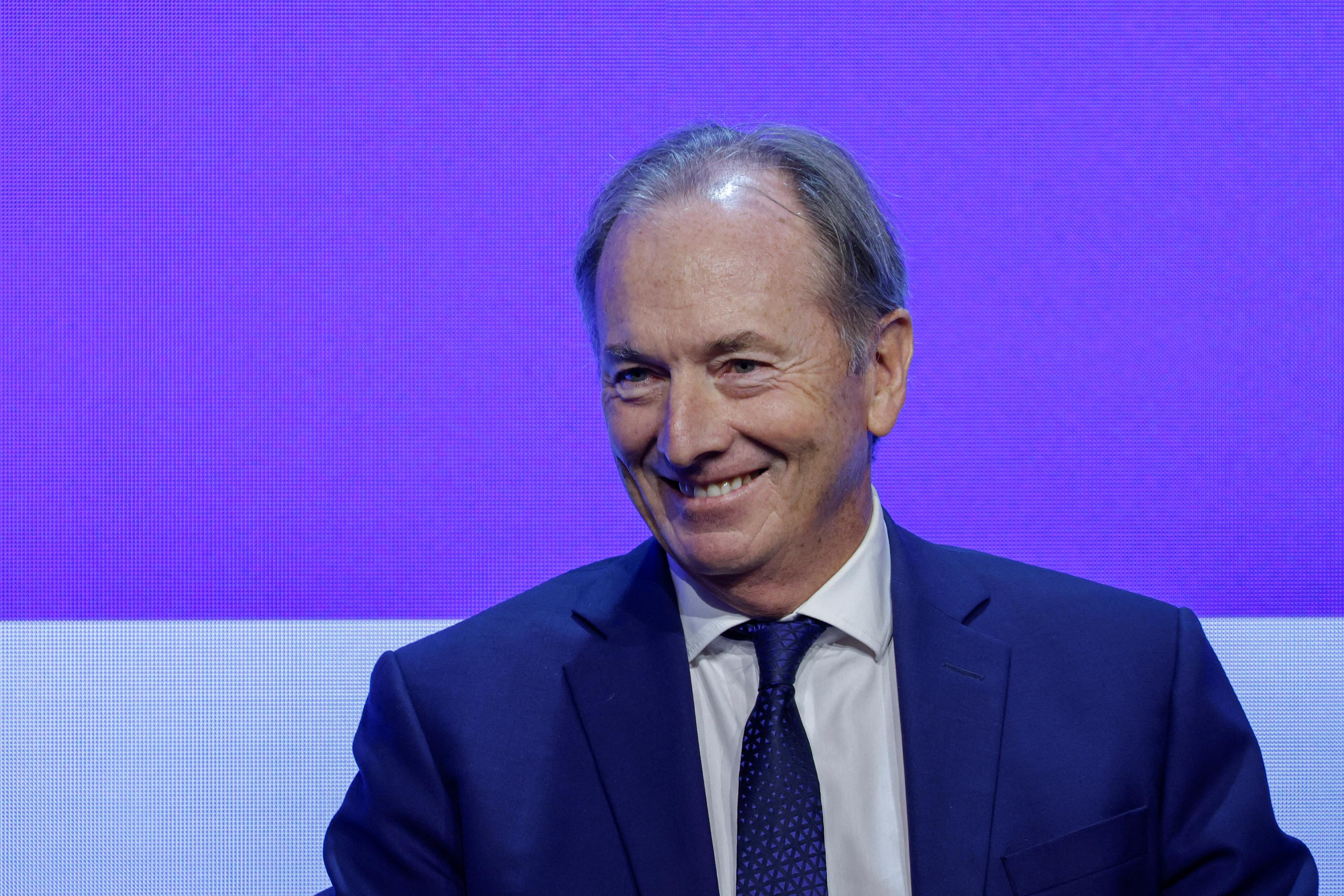

NEW YORK, May 23 (Reuters) - Morgan Stanley's (MS.N) New Tab, opens new tab executive chairman James Gorman told the bank's annual shareholder meeting on Thursday that he would step down on Dec. 31. The former CEO cited the "successful transition" of his successor Ted Pick into the top job at the start of this year. The bank's stock fell nearly 1% in morning trading. The former CEO spent 14 years at the helm and is credited with transforming the bank into a wealth management powerhouse. He also orchestrated a succession plan in which Ted Pick took the reins at the same time as retaining the two other CEO candidates, executives Andy Saperstein and Dan Simkowitz, a rarity on Wall Street. The shareholders approved all of management's proposals on Thursday including election of directors and approving executives pay. Meanwhile, all shareholder proposals were rejected. Influential proxy adviser Glass Lewis had urged shareholders to vote against the bank's proposal for executive pay. Gorman was awarded $37 million by the company's board, while Pick and two other CEO candidates were given $20 million one-time awards. Morgan Stanley's first-quarter profit beat estimates, fueled by a resurgence in investment banking and growth in wealth management. In an annual meeting that ran just under a half hour, Gorman concluded by saying that this was the fastest shareholder meeting in 15 years which is proof of the "stellar start" his successors have made. Sign up here. https://www.reuters.com/business/finance/morgan-stanley-executive-chairman-james-gorman-will-step-down-year-end-2024-05-23/