2024-05-22 06:31

LONDON, May 22 (Reuters) - The pound jumped on Wednesday after data showed UK inflation neared the Bank of England's target in April, but did not slow as much as expected, leaving the chances of a June rate cut unchanged at around 50%. British consumer prices rose by 2.3% in annual terms in April, slowing from a 3.2% increase in March, the Office for National Statistics said. The Bank of England and economists polled by Reuters had forecast an annual rate of 2.1%. Sterling rose by as much as 0.3% to a new two-month high of $1.27520, and was last trading at $1.2749. The euro fell against the pound to two-month lows and was last down 0.3% on the day at 85.16 pence. Headline consumer inflation fell, driven in large part by a decline in household energy prices. But other measures of price pressures, such as services inflation, picked up more than expected, complicating the chances that the BoE could cut rates as soon as June. Pepperstone strategist Michael Brown said the data cast some doubt on the BoE cutting rates as soon as the next Monetary Policy Committee meeting in June. "That said, one must recall that there is still one further inflation report before the June MPC meeting, albeit the bumpier- and slower-than-expected disinflationary path signalled by today's data increases the likelihood that policymakers seek to err on the side of caution, and delay any such cut until August," Brown added. FTSE-100 share futures dropped 0.36%, underperforming EuroStoxx 50 futures which were flat. Sign up here. https://www.reuters.com/markets/currencies/sterling-jumps-after-uk-inflation-slows-less-than-forecast-2024-05-22/

2024-05-22 06:19

LITTLETON, Colorado, May 22 (Reuters) - United States electricity consumption from electric vehicles (EVs) over the first two months of 2024 jumped by over 50% from the same months in 2023 as EVs continue to penetrate the U.S. car market and impact electricity flows. Total electricity use by EVs through February 2024 was 1.58 million megawatt hours (MWh), compared with 1.04 million MWh during the same period in 2023, according to the U.S. Energy Information Administration (EIA). That 52% rise in EV electricity use from early 2023 exceeded the 40% growth rate posted in 2023 from January-February 2022, and indicates that the impact from rapidly expanding EV sales continues to increase in electricity markets. EVs accounted for 16% of all light-duty vehicle sales in the U.S. in 2023, when collective electricity use by EVs overtook electricity demand by U.S. railways for the first time, according to the EIA's latest Electric Power Monthly report. ANNUAL TRENDS Total electricity consumption by EVs in 2023 was 7.6 million MWh, up 45% from 2022's total. The growth lagged the record 49.2% growth in EV electricity demand posted in 2022, but was the second largest annual growth rate on record and brings the five-year average annual growth rate for EV electricity demand to 37.2%. The top state for EV electricity consumption was California, the most populous U.S. state, where EV's consumed 2.58 million MWh of electricity and accounted for just under 34% of total national EV electricity demand. That share was down from 35.2% in 2022, indicating that EV electricity demand grew faster in other states last year. Florida (458,767 MWh), Texas (417,027 MWh), New York (337,367 MWh) and Washington (308,724 MWh) round out the top five states for EV electricity demand in 2023. In terms of vehicle type, battery electric vehicles accounted for nearly 72% of total EV electricity use, while plug-in hybrids accounted for 28.3%. STATE STANDOUTS Beyond the top five electricity-consuming states for EVs, 13 other states consumed 100,000 MWh or more electricity for EV charging in 2023. These states cover a wide geographic span from Maryland to Illinois and from North Carolina to New Jersey, and indicate rapid uptake of EVs in car fleets throughout the country. The state with the largest year-on-year growth in electricity demand for EV charging was Oklahoma, which posted a 74% expansion in EV electricity use last year, to 73,058 MWh. A rapid expansion in the installation of public chargers, plus local government incentives for home-based charging equipment, helped accelerate EV uptake in Oklahoma. The states with the lowest electricity demand for EVs last year were North Dakota, Wyoming and South Dakota, which have the lowest per capita ownership rates of EVs in the country, according to the U.S. Department of Energy. Limited public charging infrastructure and concerns about the impact of harsh winter weather on battery life are some of the factors keeping EV growth in check in those states. However, more charging stations are planned throughout the U.S. in 2024 and beyond, while EVs with battery ranges of 300 miles or more are becoming common in manufacturer offerings. In addition, EV prices are under pressure due to high dealer inventories, so the U.S. car fleet looks set to become increasingly electrified going forward. That in turn will fuel even greater demand for electricity at home and from public charging ports, and may place additional strain on utilities to ensure round-the-clock electricity availability. The opinions expressed here are those of the author, a columnist for Reuters. Sign up here. https://www.reuters.com/business/energy/us-electricity-demand-evs-jumps-new-highs-early-2024-maguire-2024-05-22/

2024-05-22 06:13

LONDON, May 22 (Reuters) - Even as consensus builds inside and outside the Bank of England on UK interest rate cuts this summer, the thorny issue for banks and bond markets of when it stops its steep balance sheet rundown seems a bit murkier. Rising take-up of a key BoE short-term lending facility launched in October 2022 following severe budget-related bond market turmoil that month has raised questions this year about whether banks are being starved of liquidity already as the central bank sticks by its ongoing sales of government bonds. Last week, the BoE allotted more than 14 billion pounds ($18.30 billion) of one-week funds in its short-term securities repurchase operation, the largest usage to date of the facility after several weeks of rising demand. Much like the U.S. Federal Reserve and other peers, the BoE is at pains to separate interest rate management and monetary policy from what its sees as a secular move to downsize a pandemic-bloated balance sheet to an adequate "steady state" going forward. The problem for all of these central banks - including the Fed, which recently slowed its balance sheet runoff - is that it's not entirely clear what that "new normal" is and they may only find out when liquidity stress emerges in the banking system. As the size of its balance sheet dictates the amount of reserves in the financial system for onward lending, the BoE's so-called quantitative tightening - late 2022's shock aside - has proceeded relatively smoothly to date and in tandem with its restrictive interest rate stance. With a relatively aggressive mix of direct gilt sales and allowing other bonds to mature and roll off, the BoE has lopped more than 200 billion pounds off the pile over two years to leave it at 760 billion pounds now - about 30% of annual gross domestic product. If there was serious stress building already at these still-elevated levels, it would be considerable cause for concern - not least with the balance sheet still almost 300 billion pounds and 10 percentage points of GDP above pre-pandemic levels. After all, the BoE still pays interest on those reserves at its prevailing policy rate and the UK Treasury is ultimately on the hook for it. Earlier this month, however, BoE Deputy Governor Dave Ramsden dismissed the rising draw on the weekly repo facility (STR) as a sign of any reserves shortage among banks per se. "There's always going to be stuff happening in the repo market but the STR is doing its job," he said after the policy meeting. "We're not seeing some ratcheting up more in rates that might make you think 'Oh right, so reserves are becoming a bit scarce'." MAPPING A STEADY STATE The BoE uses the weekly repo to help keep money market rates close to its policy rate, which is currently at 5.25%, though expected to be cut by a quarter point by August if not next month. In monitoring the situation, strategists at Morgan Stanley partly concurred with Ramsden that some one-off factors, including some outsize gilt redemptions, may be spurring the draw on the STR. But they also pointed out there is some evidence of shrinking liquidity in rising spreads of overnight repo rates (RONIA) over the BoE policy rate and also in the equivalent gap between sterling overnight rates (SONIA) creeping back toward positive territory. What's more, Morgan Stanley strategists said they see active gilt sales at least temporarily halting next year when plans are laid out in September. That's largely because direct sales probably won't be needed to keep the balance sheet roll-off at the current pace, due mainly to a huge 90 billion of redemptions from the stash through September 2025. But they said sales may have to resume after that if estimates of that slightly elusive "steady state" for the overall balance sheet are to met. What's that magic level? According to banking surveys done by the BoE's markets division New Tab, opens new tab last year, the comfortable steady state is anywhere between 330 billion and 495 billion pounds - the top end amounting to about 20% of GDP - and meaning at least another 260 billion pounds or more could yet come off without major ructions. BoE boss Andrew Bailey weighed in on the issue on Tuesday saying the repo usage was not a major problem, temporary in nature and the facility was designed to be used flexibly anyway - even if perceived stigma in drawing the money made some banks wary of using the window. Echoing last year's survey, Bailey said a 345 billion to 490 billion pounds steady state estimate was not a bad starting point and that could well be hit by the second half of next year. The speech chimed with what the International Monetary Fund New Tab, opens new tab indicated earlier in the day in its annual review of the British economy - that the steady state for BoE reserves could be hit late next year. "The QT strategy should continue to be guided by the (BoE's) key principles, which include leaving Bank Rate as the active monetary policy instrument and not disrupting smooth market functioning," the IMF report said. "The BoE should continue to monitor signs of any undue pressure on short-term money market rates and gilt yields and adjust QT implementation as needed." Is all this spooking bond investors? With BoE policy rates set to fall while all of the balance sheet spaghetti disentangles and as 2022's risk premium fades, many investors are convinced gilts are still very cheap. Russell Silberston at asset manager Ninety One reckons 10-year gilts yields are "compelling" and could fall by 65 basis points from the current 4.15% to meet his fair value estimate. The opinions expressed here are those of the author, a columnist for Reuters. Sign up here. https://www.reuters.com/world/uk/boe-scopes-steady-state-balance-sheet-downsizing-mike-dolan-2024-05-22/

2024-05-22 06:09

New solar build drops 32% year-on-year in March Forecasts vary sharply for China's 2024 solar build Panel manufacturing growth to outpace solar rollout Market pricing, grid constraints deter new projects BEIJING, May 22 (Reuters) - China's breakneck build-out of solar power, fuelled by rock-bottom equipment prices and policy support, is slowing as grid bottlenecks pile up, market reforms increase uncertainty for generators, and the best rooftop space runs short. Last year, China expanded its solar fleet by 55%. The momentum continued through the first two months of 2024, but in March new solar build fell 32% year-on-year to the lowest level in 16 months, official data and Reuters calculations show. The country's solar power expansion is slowing due to tighter curbs on supplying excess power from rooftop solar into the grid and changes in electricity pricing that are denting the economics of new solar projects. Forecasts show China's solar build this year will be heavily outpaced by growth in its photovoltaic (PV) module manufacturing capacity, raising the prospect the country will export more solar panels despite a trade backlash in Europe and the U.S. The main factor slowing the expansion of distributed solar - installations built near the point of use, mostly on rooftops - is that there is not enough storage or transmission capacity to soak up the excess power generated when the sun is shining. That in turn is leading regulators to take away some of the price support that led to the rapid growth of distributed solar. "In the next couple of years, this is going to be a huge problem that all provinces will face as grids are oversaturated, the infrastructure is overwhelmed," said Cosimo Ries, an analyst with Trivium China, a policy research group. The problem has hit several regions that were heavy adopters of distributed solar, which made up 42% of the national solar fleet last year, but is especially acute in provinces such as Shandong in the north. State broadcaster CCTV said up to 50-70% of distributed solar generation is being curtailed in Shandong, which means grid managers have had to stop that amount of supply coming into the grid in order to maintain balances with demand. China has tried to limit curtailment of renewable energy to 5%, in line with rates of 1.5-4% in most big markets, according to the International Energy Agency. But in a survey of six provinces' ability to absorb distributed solar, China's energy regulator last year found five expected to have to impose restrictions on new projects in 2024. Hebei and Henan provinces - two of the "three big drivers" of distributed solar along with Shandong - have already seen an "absolute collapse" in installations, Ries said. "These two provinces are very worrying." In November, Henan province directed companies and local regulators to come up with action plans to increase grid capacity to support the "healthy development" of distributed solar. State planner the National Development and Reform Commission did not respond to a faxed request for comment, and its Henan and Hebei offices could not be reached. The North China Energy Regulatory Bureau declined to comment and the Henan energy regulator did not respond. FORECASTS DIVERGE China's rapid solar rollout has put it on track to meet its renewable goals years ahead of schedule, with installed solar capacity of 655 gigawatts (GW) as of March, the most in the world by far, well ahead of second-placed United States with upwards of 179 GW at the end of 2023. But forecasts for the solar rollout this year vary sharply. S&P Global Commodity Insights expects new installations to rise 4% in 2024 from 217 GW last year, saying first-quarter additions were stronger than expected even with the March drop-off, while Rystad analysts see a 6% increase. In contrast, the China Electricity Council expects new installations to drop by 20% this year, while a Chinese PV industry association in February forecast they could fall 12%. Lagging grid investment and uncertainty created by ongoing electricity market reforms loom as challenges, said Holly Hu, S&P Global Commodity Insight's principal analyst for clean energy tech. The country's solar surge was facilitated by government support that encouraged an explosion in equipment manufacturing that has crushed global solar panel prices, prompting complaints from trading partners. For this year, analysts expect China to add 500-600 GW of PV module production capacity, a 60-70% increase, well above growth in solar projects. That would force manufacturers to export even more to markets such as Europe and the U.S., which doubled tariffs on cells used to make solar panels from 25% to 50%. PRICING CHANGE FALLOUT Renewable generators previously enjoyed a guarantee that grid operators would buy nearly all of their power at a rate tied to the coal index. That guarantee was lifted on April 1 and took effect earlier in some places, three industry experts said. Now, renewable generation is increasingly subject to less favourable market pricing. Shenhua Energy, a state-run coal and power firm, said in its 2023 annual report that prices for its solar power fell 34.2% year-on-year to 283 yuan per kilowatt-hour (kWh), while its coal power prices fell just 2.4% to 406 yuan per kWh. Wang Xiuqiang, a researcher at consultancy Beijing Linghang, attributed the lower solar prices and profitability to a higher proportion of market-based pricing. At the same time, grid companies are dialling back the 5% curtailment limit, "creating the risk for project owners that their generation might not be bought", said David Fishman of Shanghai-based energy consultancy the Lantau Group. Curtailment for Huaneng Power International, a major state-owned generator, rose to 7.7% in the first quarter from 3.1% a year earlier, Jefferies analysts said in a client note, citing Huaneng management. In a further challenge, the easiest-to-site projects have already been largely developed, said Shi Lida, research manager at Yongan Guofu Asset Management. At sites still available, rooftops may need to be reinforced, grid connections may be limited, or hours of sunlight may be short. "If your costs don't continue to fall, the investment will not be cost effective," Shi said. Sign up here. https://www.reuters.com/business/energy/chinas-blistering-solar-power-growth-runs-into-grid-blocks-2024-05-22/

2024-05-22 06:01

PERTH, May 22 (Reuters) - Australia's natural gas producers are increasingly confident that their fuel is vital to the energy transition and will play a role across Asia up to and beyond the 2050 net-zero emissions targets of companies and countries. This optimism was on full display at the industry's annual gathering in the capital city of Western Australia state, which is also home to the bulk of the country's liquefied natural gas (LNG) production. Australia was the world's biggest LNG exporter until being overtaken by the United States last year. But it's not only a powerhouse in supplying the super-chilled fuel, as Australia dominates seaborne exports of metallurgical coal used to make steel and ranks second behind Indonesia in shipments of thermal coal, used mainly to generate electricity. The annual conference of the Australian Energy Producers, held this week in Perth, was characterised by repeated statements from a variety of industry leaders about how vital natural gas is, and will remain, in the energy transition. The reality is somewhat more nuanced than the bullish narratives, and the industry is largely correct about some of its assumptions, optimistic on others and also currently falling well short of what's needed to actually put Australia, and the Asian customers of its energy exports, on a path to net-zero emissions. There are several key arguments that the natural gas and LNG industry make to support their view about how essential their product is, but the most important effectively still boils down to saying they are better than coal. The accepted position is that using LNG to generate power in an Asian country produces about half the carbon emissions than using imported thermal coal, meaning that the industry is correct in saying they are better than coal. Displacing coal does help the decarbonisation process, but reducing emissions is only a step towards net-zero. Ultimately, if you are burning a fossil fuel, you are creating emissions that you have to capture and store, or offset in some other way, if you want to achieve net-zero targets. This is where the optimism shown by the industry gets more tricky. For natural gas to have an ongoing role in the energy transition, several things need to happen, and some of them are largely beyond the control of the industry. CARBON PRICE The main requirement is a price on carbon emissions, and not just in each country, there needs to be some form of unified Asian carbon tax and credit system that allows for trading, investment and cooperation between energy exporting countries and those that import. A carbon tax helps LNG displace coal and also provides a major incentive for the industry to invest to abate its own emissions. A strong focus in the conference this year was Carbon Capture and Storage (CCS), with speaker after speaker once again saying how vital this technology will be to getting to net-zero. The problem is the industry has been saying this for years, and doing very little to advance significant projects. Australian oil and gas producer Santos is one of the few that has actually built a plant to capture emissions at its Moomba gas hub in central Australia, which is expected to start operations later this year. The plant aims to store an initial 1.7 million metric tons of carbon dioxide, which while useful is tiny fraction of Australia's annual greenhouse gas emissions of 432 million tons in 2022. There are other CCS projects under consideration, but even if all of them came to fruition, they would still only be the first steps on a very long decarbonisation road. Australia does have competitive advantages for CCS, including suitable geology and depleted reservoirs that can be used for injecting carbon emissions. But there isn't yet the carbon pricing or regulatory framework that will allow for the importation of carbon dioxide from countries in Asia where sequestration opportunities are low, such as Japan and South Korea. CCS is also likely to work far better for abating the upstream production of oil and gas, but will be very expensive to implement at the point of combustion in Asian energy importers such as Japan. Capturing carbon emissions at a power plant would cost at least $100 per ton for 1 million tons per annum, according to data from consultants Wood Mackenzie, a price point that would currently render the electricity generated economically unviable without additional support. "We see CCS as last mile decarbonisation," Wood Mackenzie analyst Stephanie Chiang told Reuters in an interview on Tuesday. This is why a carbon price is the essential piece of the puzzle. It gives certainty to investment decisions, it is technology agnostic insofar as it will allow companies to work out the best method for them to abate, and if high enough, it will allow for fossil fuels to remain in the energy mix through CCS. The opinions expressed here are those of the author, a columnist for Reuters. Sign up here. https://www.reuters.com/markets/commodities/australias-lng-sector-is-long-term-bullish-needs-carbon-price-russell-2024-05-22/

2024-05-22 05:56

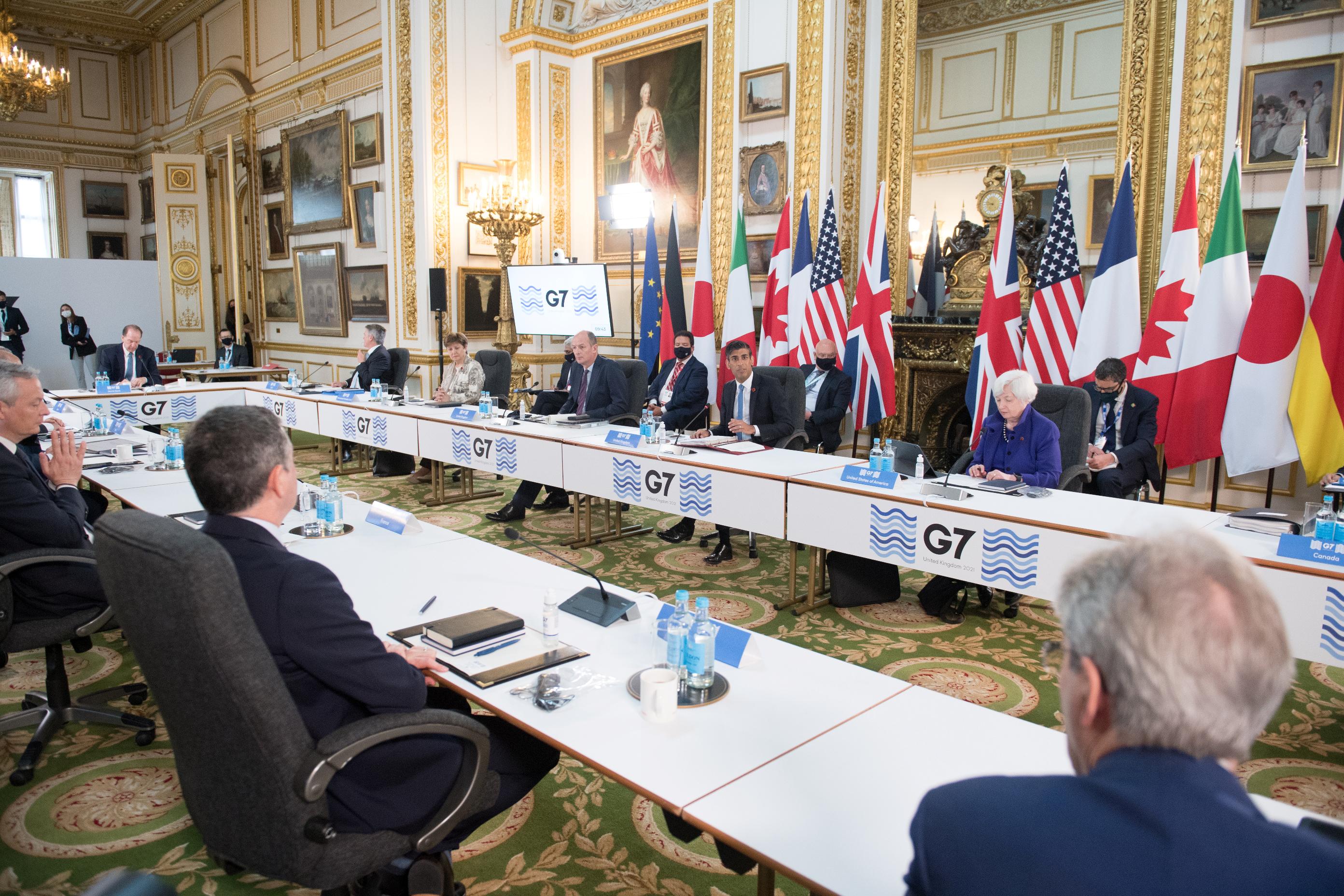

G7 finance chiefs gather in Stresa, Italy on May 24-25 US pushing for Ukraine loan backed by Russian assets Technical aspects elusive, deal not expected this week G7 seeking united front against Chinese trade threat Global corporate tax, wealth tax also on G7 table ROME, May 22 (Reuters) - G7 finance chiefs meeting in Italy this week will attempt to find common ground on pulling forward earnings on frozen Russian assets to boost funding for Ukraine's war effort and pushing back on China's growing export strength in key sectors, officials said. Finance ministers and central bankers from the Group of Seven wealthy democracies - the United States, Japan, Germany, France, Britain, Italy and Canada - will gather in the northern Italian lakeside town of Stresa on Friday and Saturday. G7 negotiators have been discussing for weeks how to best exploit some $300 billion worth of Russian financial assets, such as major currencies and government bonds, which were frozen shortly after Moscow invaded Ukraine in February 2022. The United States is pushing to find a way to bring forward the future income from those assets, to back a loan that could provide it with as much as $50 billion in the near term. However, several officials from G7 countries, including the U.S., said many legal and technical aspects need to be hammered out, and a detailed accord is not expected to be reached in Stresa. "We're not looking for term sheets over the weekend," a senior U.S. Treasury official said, referring to legal documents that describe basic investment terms and conditions. Instead, the official said on condition of anonymity that the G7 ministers are trying to build consensus around a plan for that would give Ukraine enough money up front to meet medium-term war and civilian needs and signal to Russia that it "cannot outlast" Western powers financially. The talks are aimed at presenting a proposal to G7 heads of government who will meet in Puglia, southern Italy, on June 13 to 15. Who would administer the loan - the World Bank or some other body - how it would be guaranteed, how future profits can be estimated and what would happen in the event of a peace deal with Russia are all aspects still to be clarified. European officials are particularly cautious, with one EU diplomat saying it would take "weeks if not months" for a final decision to be made. 'LEGAL IMPLICATIONS' Italy holds the G7 presidency this year and its Economy Minister Giancarlo Giorgetti said last week the U.S. proposals on the use of the Russian assets had "quite serious legal implications" which still need clarifying. Russia has repeatedly warned the West of consequences if its assets are touched and accused Washington of bullying Europe to take more radical steps to thwart it in Ukraine. The prospects for global trade will be another central topic in Stresa after the United States last week unveiled steep tariff hikes on an array of Chinese imports including electric vehicle batteries, computer chips and medical products. Giorgetti said after the U.S. move that a "trade war" was being fought reflecting geopolitical tensions and warned of the risk of "fragmentation" to global commerce. The United States is not calling on its partners to take similar measures against China, but an official said it was likely to push for the G7 communique to express common concern for what it calls Beijing's industrial "overcapacity". U.S. Treasury Secretary Janet Yellen said in Frankfurt on Tuesday the United States and Europe needed to address the threat from Chinese imports in a "strategic and united way" to keep manufacturers viable on both sides of the Atlantic and foster development of their domestic clean energy industries. French Finance Minister Bruno Le Maire echoed her sentiments, saying on Wednesday that Europe and the G7 must "stand united" in the face of Chinese industrial overcapacity. TAX TALKS Other topics to be discussed in Stresa, according to an official programme issued by the Italian presidency, will include the impact of artificial intelligence on the global economy, and a "stocktaking" on sanctions against Russia. Taxation will also be on the agenda, with Italy trying to revive a deal on a global minimum tax on multinationals which was signed by around 140 countries in 2021, but has not been fully implemented due to opposition in the U.S. and elsewhere. A proposal for a global wealth tax on billionaires, which has been promoted by Brazil and France among the broader Group of 20 developed countries, would also be discussed in Stresa but was meeting U.S. resistance, one of the officials said. (This story has been refiled to remove the repeated words 'several officials said' in paragraph 5) Sign up here. https://www.reuters.com/world/g7-finance-chiefs-seek-common-line-russian-assets-china-2024-05-22/