2024-05-21 04:31

A look at the day ahead in European and global markets from Kevin Buckland Stock market momentum is waning as a dearth of fresh economic clues sees the feverish punting over the pace of Federal Reserve rate cuts finally settle down. Most Asian equity indexes declined on Tuesday, led by the Hang Seng's more than 2% retreat from the previous session's multi-month high. Japan's Nikkei stood out as the sole beneficiary of the Nasdaq's record run overnight into Nvidia's much-anticipated earnings on Wednesday. AI fever aside, the Fed sits squarely at the center of the market universe, with all asset classes in its orbit. That includes crude oil, gold and base metals, and soaring cryptocurrencies, even if idiosyncratic drivers are also at play. Investors rushed to reintroduce Fed easing bets after a long-in-coming downside CPI surprise last week, but Fed officials have been less sanguine, collectively striking a cautious posture. As it stands now, about 40 basis points of easing are priced in for this year, with a quarter-point reduction by November considered a lock, much like where odds stood a week ago. More Fedspeak is in store today, with Governor Christopher Waller and no fewer than four regional Fed bosses taking the podium at various events. Minutes of the Fed's last policy meeting due Wednesday will be valuable, but predate the softening in CPI after three straight months of upside surprises. Elsewhere, Bank of England Governor Andrew Bailey gives a lecture at the London School of Economics. UK CPI will be closely watched, but isn't due till Wednesday. Tuesday's local data docket is light, with the highlight around Europe being German producer price figures for April. Key developments that could influence markets on Tuesday: -Germany producer prices (April) -BoE Governor Andrew Bailey speaks -Fed Governor Waller, New York Fed's Williams, Atlanta Fed's Bostic, Cleveland Fed's Mester, Boston Fed's Collins, Richmond Fed's Barkin all speak at various events Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-graphic-2024-05-21/

2024-05-21 03:04

MUMBAI, May 21 (Reuters) - The Indian rupee is expected to open flat-to-slightly weaker on Tuesday amid a decline in Asian peers and an uptick on the dollar index. Non-deliverable forwards indicate rupee will open at 83.33-83.36 to the U.S. dollar compared with 83.3350 on Friday. Indian financial markets were closed on Monday. The rupee, which had been holding a narrow range around 83.50, managed a rally in the afternoon session on Friday. Dollar offers from public sector banks, small stop losses were among the reasons cited for the move higher. "I doubt there will be a follow through to the mini break down (on USD/INR on Friday), taking into account how Asia is," a currency trader at a bank said. "And anyway, you expect the dip-buying importers to step in." Asian currencies declined on Tuesday with the offshore Chinese yuan dipping to near 7.25 to the dollar and the Japanese yen slipping to 156.50. Other currencies were down between 0.4% and 0.7% while the dollar index inched up to 104.68. The dollar index and U.S. Treasury yields have recovered a large part of their decline that was triggered by the softer-than-expected U.S. inflation data. The expectations on the extent of rate cuts the Federal Reserve will deliver this year are back to what it was before the inflation data. Fed speakers continued to reinforce that they were cautious about inflation and policy rates. Fed Vice Chair Philip Jefferson said that while the last inflation data was encouraging, it is too early to tell if the recent inflation slowdown will last. Reflecting the cautious Fedspeak, the dollar has firmed up, ANZ Bank said in a note. The minutes of the May Fed meeting will be released this week and will shed further light on the anxiety over the higher inflation readings in the first quarter, it said. KEY INDICATORS: ** One-month non-deliverable rupee forward at 83.40/83.43; onshore one-month forward premium at 8 paise ** Dollar index up at 104.66 ** Brent crude futures down 0.5% at $83.3 per barrel ** Ten-year U.S. note yield at 4.45% ** As per NSDL data, foreign investors sold a net $74.5mln worth of Indian shares on May. 16 ** NSDL data shows foreign investors bought a net $109.7mln worth of Indian bonds on May. 16 Sign up here. https://www.reuters.com/world/india/rupee-run-into-dollar-strength-after-unexpected-rally-2024-05-21/

2024-05-21 01:33

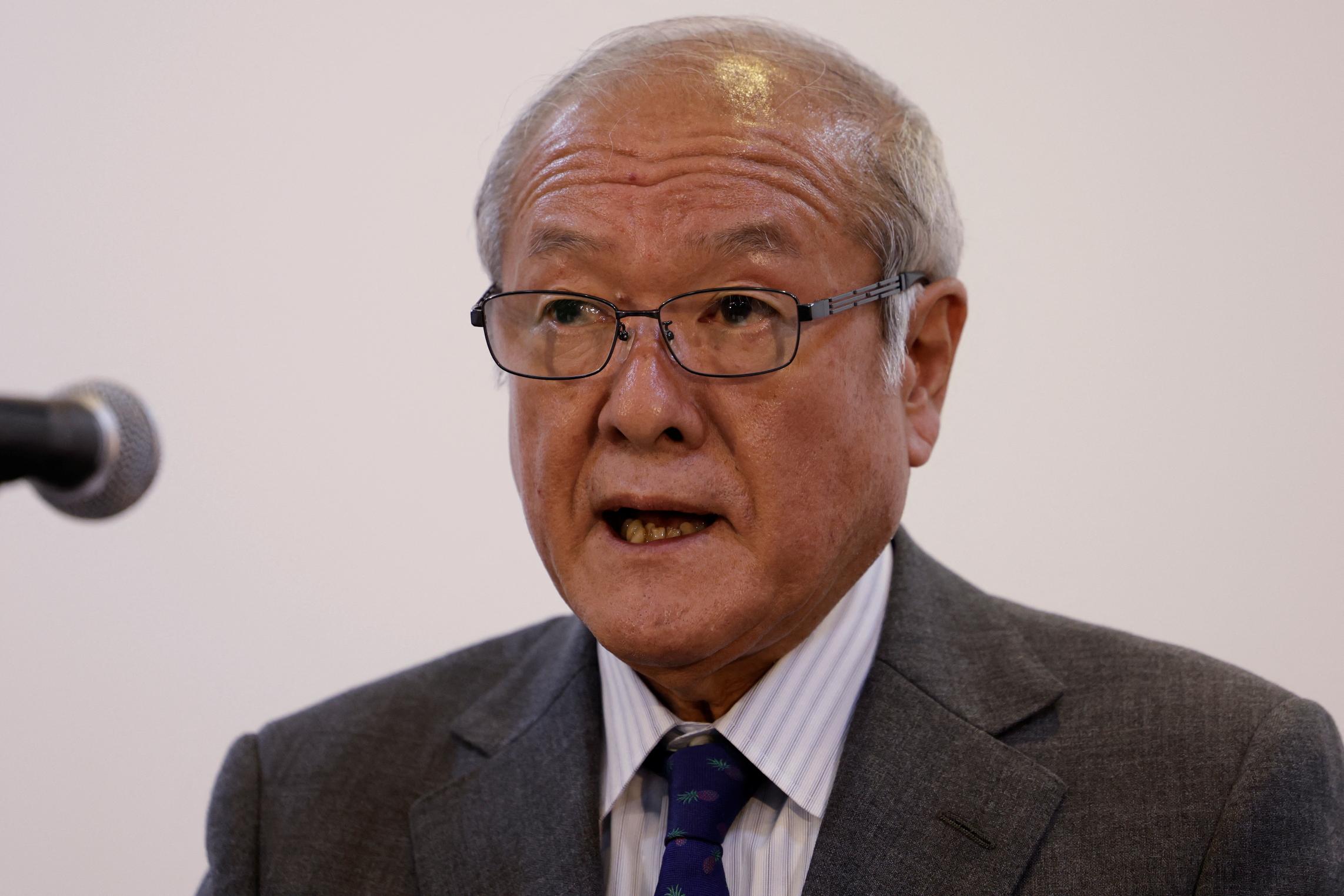

TOKYO, May 21 (Reuters) - Japanese Finance Minister Shunichi Suzuki said on Tuesday he was concerned about the negative implications of the current weakness in the yen and its effect on incentives to increase wages. "One of our major goals is to achieve wage increases that exceed the rise in prices," Suzuki said. "On the other hand, if prices continue to remain high, it will be difficult to reach this target even if wages rise." While a weak yen is a boon to exporters, it has become a headache for Japanese policymakers as it hurts consumption by pushing up the cost of raw material imports. The yen's slump past 160-per-dollar late last month triggered a suspected round of interventions by Tokyo. The Japanese currency has bounced since then and was last fetching around 156.45. In a regular post-cabinet meeting press conference, Suzuki reiterated that the foreign exchange rates should be set by markets reflecting fundamentals and that it was desirable for the currency to move in a stable manner. The government will monitor the currency market closely and take appropriate action as necessary, he said. Responding to questions about benchmark Japan government bond yields hitting the highest in more than a decade on Monday, Suzuki said it is important for the government to closely monitor the market and communicate with traders. The 10-year JGB yield traded around 0.979% in morning deals. "The government would implement appropriate debt management policies to ensure the stable issuance of government bonds," Suzuki said. Sign up here. https://www.reuters.com/markets/currencies/japan-concerned-about-negative-aspects-weak-yen-wage-hikes-finance-minister-says-2024-05-21/

2024-05-21 00:38

BOK to hold base rate at 3.50% on May 23 BENGALURU, May 21 (Reuters) - The Bank of Korea will keep its key policy rate unchanged for an 11th straight meeting on Thursday and through next quarter, followed by a half point cut in Q4 after the likely start of policy easing from many global peers, a Reuters poll found. South Korea's economy grew at the fastest pace in over two years last quarter thanks to strong exports, suggesting the economy may not need an immediate rate cut from the central bank. Bolstering the higher-for-longer rate view was elevated inflation and a weak currency. Already down nearly 5% for the year, any further weakening of the won , would likely drive up import costs and exacerbate inflationary pressures. All 43 economists in the May 14-20 Reuters poll expected the central bank to leave the base rate (KROCRT=ECI) New Tab, opens new tab on hold at 3.50% on May 23. Median forecasts showed interest rates remaining unchanged through the third quarter before a 50 basis-point cut by end-2024. In an April survey, the consensus view predicted 25 basis-point cuts in Q3 and Q4. "Considering the uncertainty of the timing of the Federal Reserve's interest rate cut and the higher dollar exchange rate level, the monetary policy committee will also maintain its cautious stance in lowering interest rates," said Jihee Min, fixed income analyst at Mirae Asset Securities. The BOK, among the first to kick-off its policy tightening cycle in August 2021, was expected to lag its global peers on the timing of the first cut. The European Central Bank and the Fed were expected to ease in June and September, respectively. Although median forecasts showed interest rates on hold until end-Q3, a strong minority of 17 of 39 economists forecast a cut to 3.25% by the end of next quarter. Among those who provided forecasts until end-2024, a slim majority, or 19 of 37, expected interest rates at 3.00%, while the rest said 3.25%. "The BOK is likely to signal that a rate cut is unlikely in the next three months but still possible by the end of 2024," noted Bum Ki Son, analyst at Barclays. "Growth momentum remains two-tiered with strong net exports, versus a still-soft domestic outlook. The soft domestic demand growth outlook and relatively muted perceived growth still suggest that the next move will be a cut." Last month the BOK said the economy could grow at a faster pace this year than its earlier projection of 2.1%. A separate Reuters poll in April showed the economy expanding 2.2% in 2024. (For other stories from the Reuters global economic poll:) Sign up here. https://www.reuters.com/markets/asia/bank-korea-hold-rates-may-23-first-cut-pushed-q4-2024-05-21/

2024-05-21 00:04

May 20 (Reuters) - Chesapeake Energy (CHK.O) New Tab, opens new tab, a top U.S. natural gas producer, began laying off employees this week after completing the divestiture of its oil assets last year, the company said on Monday. This week's layoffs follow its divestment of its Eagle Ford assets, not the company's pending merger with Southwestern Energy (SWN.N) New Tab, opens new tab, Chesapeake said. The company did not specify the size or scope of the layoffs. Chesapeake in 2022 said it would exit the Eagle Ford shale field in south Texas, making it a pure-play natural gas producer. In early 2023 it sold some of those assets to INEOS Energy for $1.4 billion, and later that year completed the divestiture by selling the remaining assets to SilverBow Resources for $700 million. The Oklahoma City, Oklahoma-based company is in the process of completing a $7.4 billion merger with Southwestern Energy. That deal is set to close in the second half of this year, later than originally anticipated after U.S. Federal Trade Commission sought additional information. Natural gas producers have been hit this year by low prices, which fell some 20% in the first quarter due to high inventories and softer-than-expected demand. Chesapeake missed Wall Street estimates for profit, and many companies - including Chesapeake - have curtailed production as a response. As part of that deal, the company will replace current General Counsel Benjamin Russ with Southwestern General Counsel Chris Lacy, according to a regulatory filing on May 7. Sign up here. https://www.reuters.com/business/energy/top-us-natural-gas-producer-chesapeake-energy-cuts-jobs-2024-05-21/

2024-05-20 23:54

TORONTO, May 20 (Reuters) - An employee died Sunday at a Nutrien (NTR.TO) New Tab, opens new tab potash mine in Saskatchewan, temporarily shuttering the operation as the company conducts an investigation, the company said Monday. The death took place at the railcar-loading facility at Nutrien's mine near the town of Rocanville, about 250 km (150 miles) east of the provincial capital Regina. Potash is a primary ingredient in agricultural fertilizers. In a statement the company said it is conducting an internal investigation and is cooperating with authorities. "Our current focus is on ensuring we have support services available to all those involved," the statement said, adding that the company is "unlikely to have further details until the completion of internal and external investigations." Sign up here. https://www.reuters.com/markets/commodities/nutrien-potash-mine-canada-closed-investigation-after-fatal-accident-2024-05-20/