2024-05-20 18:18

MOSCOW, May 20 (Reuters) - Russia's government on Monday suspended a ban on gasoline exports until June 30. In a statement published on Telegram, it said the ban would remain in place from July 1 to Aug. 31. "This decision was taken with due account of the domestic market for automobile fuel and to prevent a decline in refining volumes at specific refineries owing to excessive stocks of automobile fuel," the statement said. It also aimed, the statement said, to free up ports from volumes of fuel which had not been exported because of the restrictions. Interfax news agency, quoting the Energy Ministry, later said that the government was keeping close watch on the domestic fuel market and could extend a ban in future if needed. The government imposed the ban in March to offset excessive demand for petroleum products and to stabilise prices in the domestic market. Sign up here. https://www.reuters.com/business/energy/russia-suspends-ban-gasoline-exports-until-june-30-government-says-2024-05-20/

2024-05-20 16:34

AMELIA ISLAND, Florida, May 20 (Reuters) - The U.S. Federal Reserve is considering new rules to break the "stigma" around borrowing from the central bank's discount window to cover short-term cash needs, Fed vice chair for supervision Michael Barr said on Monday. "We've made good progress over the last year," since the failure of Silicon Valley Bank exposed gaps in the Fed's main lender-of-last-resort program, Barr said at an Atlanta Fed conference. "What we're hoping is that a requirement for discount window preparedness, pre-positioning of collateral, testing, will help to reduce stigma because we're obviously sending a signal that we want banks to use this." SVB before its March 2023 collapse had not recently tested its discount window access nor did it have adequate collateral posted there; though neither would have saved SVB, regulators say borrowing from the Fed could have allowed a more orderly failure and reduced the broader banking turmoil that ensued. U.S. financial regulators have since stepped up efforts to encourage banks to be ready to borrow in an emergency from the central bank. Banks in turn have boosted the collateral they stow at the Fed's discount window, to $2.6 trillion as of the end of last year, from $1.9 trillion a year earlier. But even that may not be enough to ensure that banks will borrow, analyst say, given banks' worry that tapping the discount window could make investors and supervisors question their soundness. "Every bank uniformly said that it's been hammered home to them by bank examiners ... that using the discount window is not okay," said Bank Policy Institute chief economist Bill Nelson, citing conversations he has had with 17 bank treasurers since the beginning of this years. Indeed, though the vast majority of banks have signed up to the discount window, Fed data show, fewer than half have the collateral in place to ensure they can borrow rapidly when needed. Regulators currently do not count borrowing capacity at the discount window as a liquidity resource, Nelson said, and doing so would go a long way toward ending stigma. Yale School of Management's Susan McLaughlin agreed, adding, "we should do everything we can to eliminate stigma." Among her proposals: to more clearly differentiate the Fed's lending program for strong banks and its program for weaker banks. The fact that both are currently offered under the discount window likely contributes to stigma, she said, and keeps banks from borrowing from the Fed until it's too late to be effective. Sign up here. https://www.reuters.com/markets/us/barr-requiring-discount-window-readiness-could-break-stigma-2024-05-20/

2024-05-20 15:04

May 20 (Reuters) - U.S.-based restaurant chain Red Lobster has filed for Chapter 11 bankruptcy protection in a Florida court after securing $100 million in financing commitments from its existing lenders, the company said on Sunday. The company listed its assets and liabilities to be between $1 billion and $10 billion, according to a court filing. Red Lobster said its restaurants will be open and operate as usual during the bankruptcy proceedings, and plans to reduce its locations as well as pursue a sale of substantially all its assets. The restaurant chain also said it has entered into a "stalking horse" purchase agreement to sell its business to an entity formed and controlled by its existing term lenders. "This restructuring is the best path forward for Red Lobster. It allows us to address several financial and operational challenges and emerge stronger and re-focused on our growth," said Jonathan Tibus, CEO of Red Lobster. Red Lobster has about 700 locations around the world, according to its website New Tab, opens new tab. Sign up here. https://www.reuters.com/legal/litigation/red-lobster-seeks-bankruptcy-protection-with-100-mln-financing-commitments-2024-05-20/

2024-05-20 14:08

BRASILIA, May 20 (Reuters) - Brazil's central bank announced on Monday that it has decided to divide the process of regulating crypto-assets and virtual asset service providers into phases, with regulatory proposals expected by the end of this year. The decision effectively delays the completion of the process following a 2022 law on the subject, which paved the way for subsequent regulation by the central bank. In a congressional hearing last year, the bank's director of regulation, Otavio Damaso, had projected regulation to be wrapped up by June 2024. After launching a public consultation on the matter in December 2023, which concluded in January, the central bank said it would now open a new consultation in the second half of this year. The central bank told Reuters that the first public consultation aimed to gather input from society, also addressing issues not covered by the 2022 law, such as the asset segregation of virtual asset service providers. This required "reasonable dedication from the teams involved in the regulatory work," it said, adding that the diversity of activities conducted by entities in the virtual assets sector and the various structures of these entities necessitated this preliminary effort. "The second public consultation, now focused on regulatory texts, aims to use the initial input to, once again with broad support from society, establish a robust regulatory framework," said the central bank. Sign up here. https://www.reuters.com/markets/currencies/brazil-central-bank-plans-year-end-proposal-crypto-regulation-2024-05-20/

2024-05-20 12:55

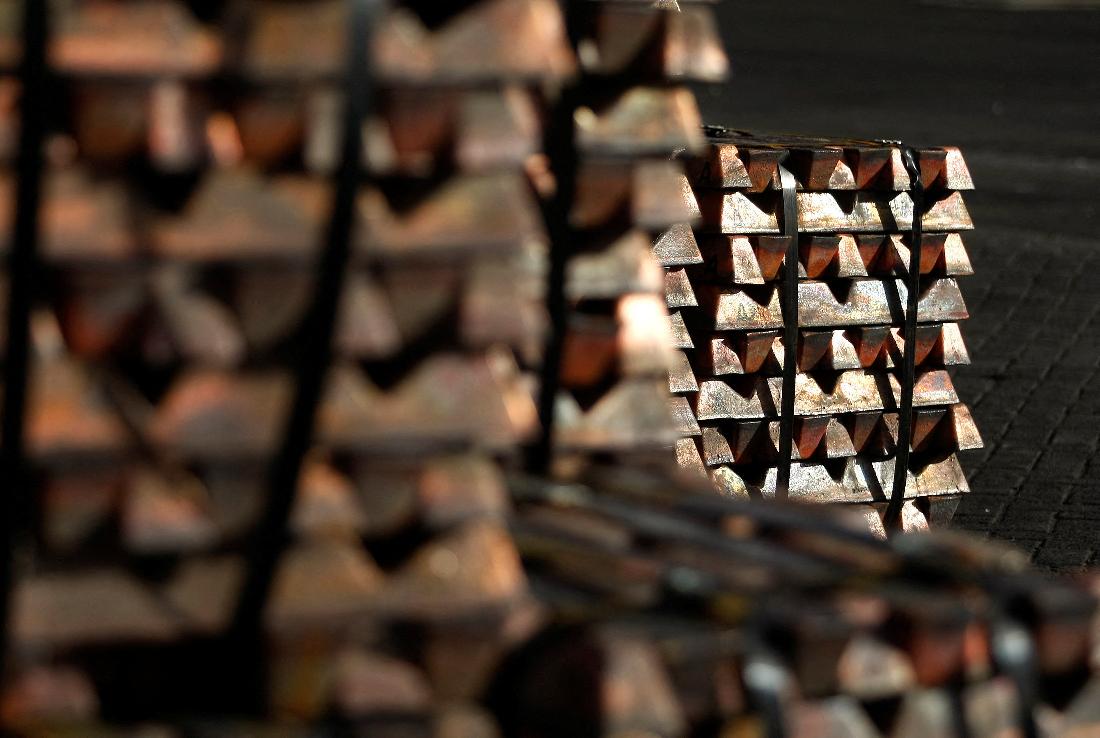

LONDON, May 20 (Reuters) - Copper surged to record highs on Monday as a recent rally triggered by short covering created momentum for speculators and funds to bet on higher prices of the metal. Below are the main facts about the copper market, sourced from the International Copper Study Group (ICSG), the International Copper Association (ICA), and Reuters data. INDUSTRIAL USES Copper is used in the power and construction industries and is widely expected to benefit in future from the green energy transition via additional demand from the electric vehicle sector and new applications including data centers for artificial intelligence (AI). Equipment manufacturing is currently the largest end-use sector for copper, followed by construction and infrastructure. Global apparent use of refined copper rose from 10 million metric tons in the late 1980s to 26.5 million tons in 2023 as Asia became the largest consumer with a 70% share of consumption. As of 2022, China was the largest consumer of refined copper with usage of 14.7 million tons. PRODUCTION CHAIN BY TYPE AND BY REGION Deposits of copper, one of the first metals used by humans, are widespread around the globe. Scrap accounts for significant amounts of global supply annually. Copper's primary production chain starts from the mining of copper-bearing ores, then moves to production of copper concentrates typically containing around 30% copper. The smelting process transforms concentrate into a matte containing 50-70% copper. The matte is processed into a blister copper of 98.5-99.5% copper content. In the next step, refined cathodes are produced with 99.99% copper content. Copper mine production totalled 22.4 million tons in 2023, with Chile, Peru and Democratic Republic of Congo (DRC) being the largest producers. Production of refined copper, including secondary or scrap, totalled 26.5 million tons in 2023, with China being the largest producer. MAJOR EXPORTERS AND IMPORTERS Global copper trade includes all major products in the processing chain - concentrates, blister and anode, cathode and ingots, scrap and semi-fabricated products. Chile, Peru and Indonesia are major exporters of copper ores and concentrates, while China, Japan and South Korea are major importers of these products. In the market for copper blister and anode, Zambia, Chile and DRC are major exporters, with China and India being major importers. For the refined copper trade, Chile, DRC and Russia are major exporters, while China, the U.S. and Italy are major importers. SUPPLY-DEMAND BALANCE The global 26.5 million-ton refined copper market was balanced in 2023, but faces a surplus of 162,000 metric tons this year and 94,000 tons in 2025, according to the ICSG, as refined production is forecast to rise by 2.8% in 2024 and 2.2% in 2025. However, the supply of copper from mines has been lower than expected so far this year due to the slower ramp-up of a number of projects, delays in new projects and the December closure of First Quantum's (FM.TO) New Tab, opens new tab major Cobre Panama mine. This has tightened the supply of copper concentrate to smelters in China and is visible in collapsing refining and treatment charges (TCs) in the country. Despite tight supply of copper concentrate, current demand for copper in China is relatively weak as inventories in warehouses monitored by the Shanghai Futures Exchange are near four-year highs and the premium to import copper into China's Yangshan area is at zero. Sign up here. https://www.reuters.com/markets/commodities/main-facts-about-copper-market-prices-hit-record-highs-2024-05-20/

2024-05-20 12:16

BENGALURU, May 20 (Reuters) - State-run explorer Oil India (OILI.NS) New Tab, opens new tab reported a higher-than-expected profit for the fourth quarter on Monday, helped by higher crude oil prices and strong demand. Its profit rose 13.5% to 20.29 billion rupees ($243.7 million) from a year earlier, beating analyst expectations of a 9% fall in profit to 16.20 billion rupees, according to LSEG data. Global crude oil prices rose nearly 14% during the March quarter, benefiting oil explorers. Revenue from Oil India's crude oil segment, which accounts for more than 70% of the explorer's total revenue, rose 13.8% in the quarter. The natural gas segment fell 17.4%. Oil India's overall revenue from operations rose 2% to 57.57 billion rupees, beating estimates of 56.18 billion rupees. Total expenses rose 8.8% to 40.65 billion rupees. The board also recommended an issue of bonus shares in a 1:2 ratio. Peer Oil And Natural Gas Corporation Ltd (ONGC.NS) New Tab, opens new tab is expected to report results later on Monday. Oil India's shares closed 1.2% higher on Friday at 647 rupees, gaining about 74% so far in 2024. ($1 = 83.2600 Indian rupees) Sign up here. https://www.reuters.com/markets/commodities/state-backed-oil-india-beats-profit-estimates-higher-crude-prices-2024-05-20/