2024-05-17 05:26

MUMBAI, May 17 (Reuters) - The Indian rupee was largely unchanged on Friday as dollar sales from state-run banks, likely on behalf of the Reserve Bank of India (RBI), curbed weakness in the currency even as its Asian peers slipped. The rupee was at 83.48 against the U.S. dollar as of 10:40 a.m. IST, barely changed from its close at 83.50 in the previous session. The RBI likely sold U.S. dollars near 83.50 levels to cap depreciation of the rupee, four traders told Reuters. Interventions from the central bank have helped limit the weakness in the rupee over the last few trading sessions despite pressure from elevated outflows from Indian equities and dollar demand from local importers, including oil companies, traders said. Foreign investors have sold $3.3 billion worth of Indian equities in May so far, the highest monthly outflow since January last year, amid nervousness about the upcoming outcome of the country's national elections. "While a large dollar inflow may cause some temporary appreciation in the rupee, it's likely to stay in the 83.40-83.55 band till the election outcome," a foreign exchange trader at a state-run bank said. India's election results are due on June 4. The dollar index rose 0.1% to 104.6, while Asian currencies weakened with the Korean won down 0.8% and leading losses. Major Asian currencies had rallied on Thursday as softer-than-expected U.S. inflation data boosted hopes of rate cuts by the Federal Reserve but the rupee largely remained on the sidelines. The dollar-rupee pair is expected to be rangebound in the near term as dips continue to see strong buying interest, Apurva Swarup, vice president at Shinhan Bank India, said. Sign up here. https://www.reuters.com/world/india/rupee-little-changed-likely-rbi-intervention-counters-slip-asian-peers-2024-05-17/

2024-05-17 05:22

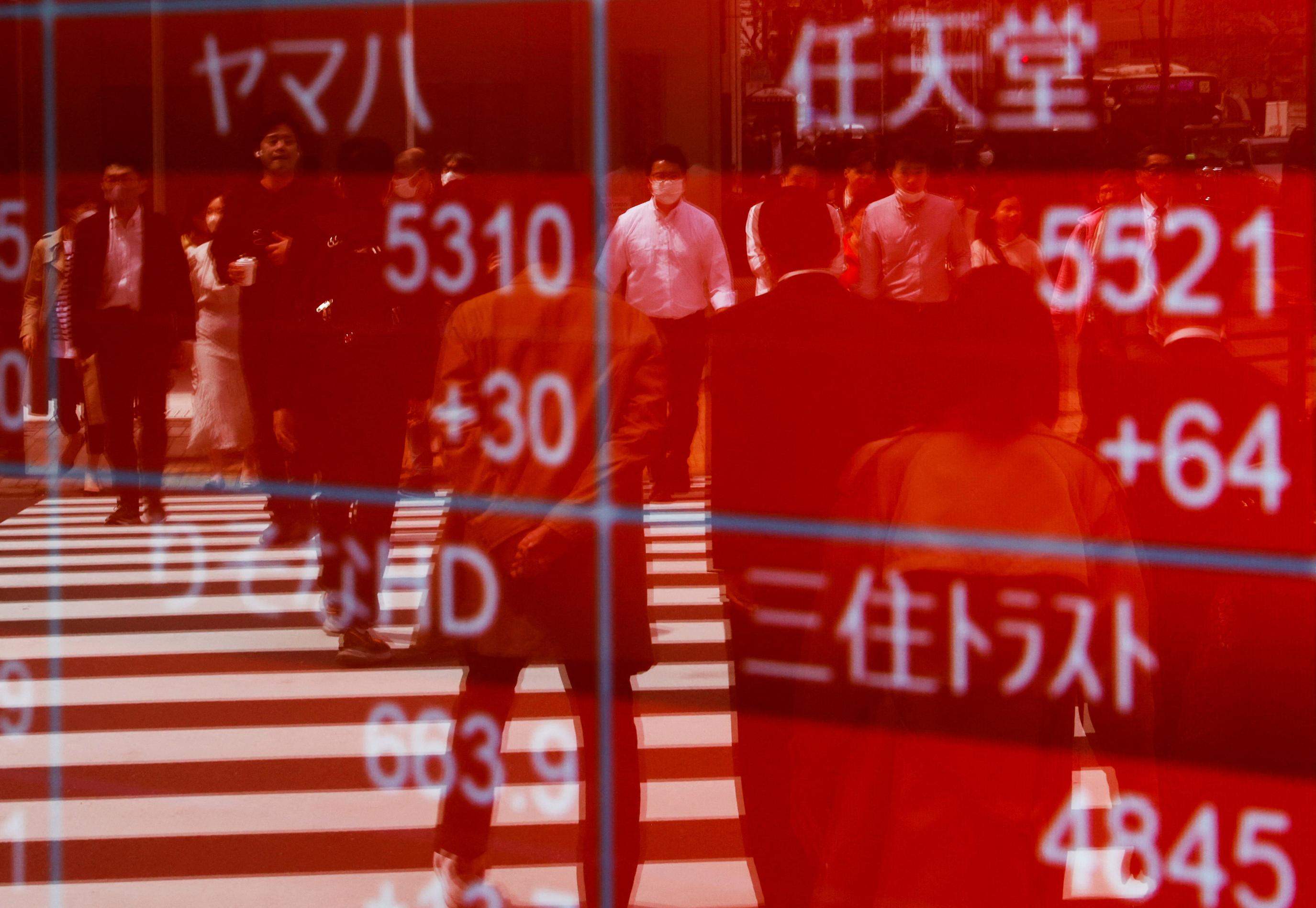

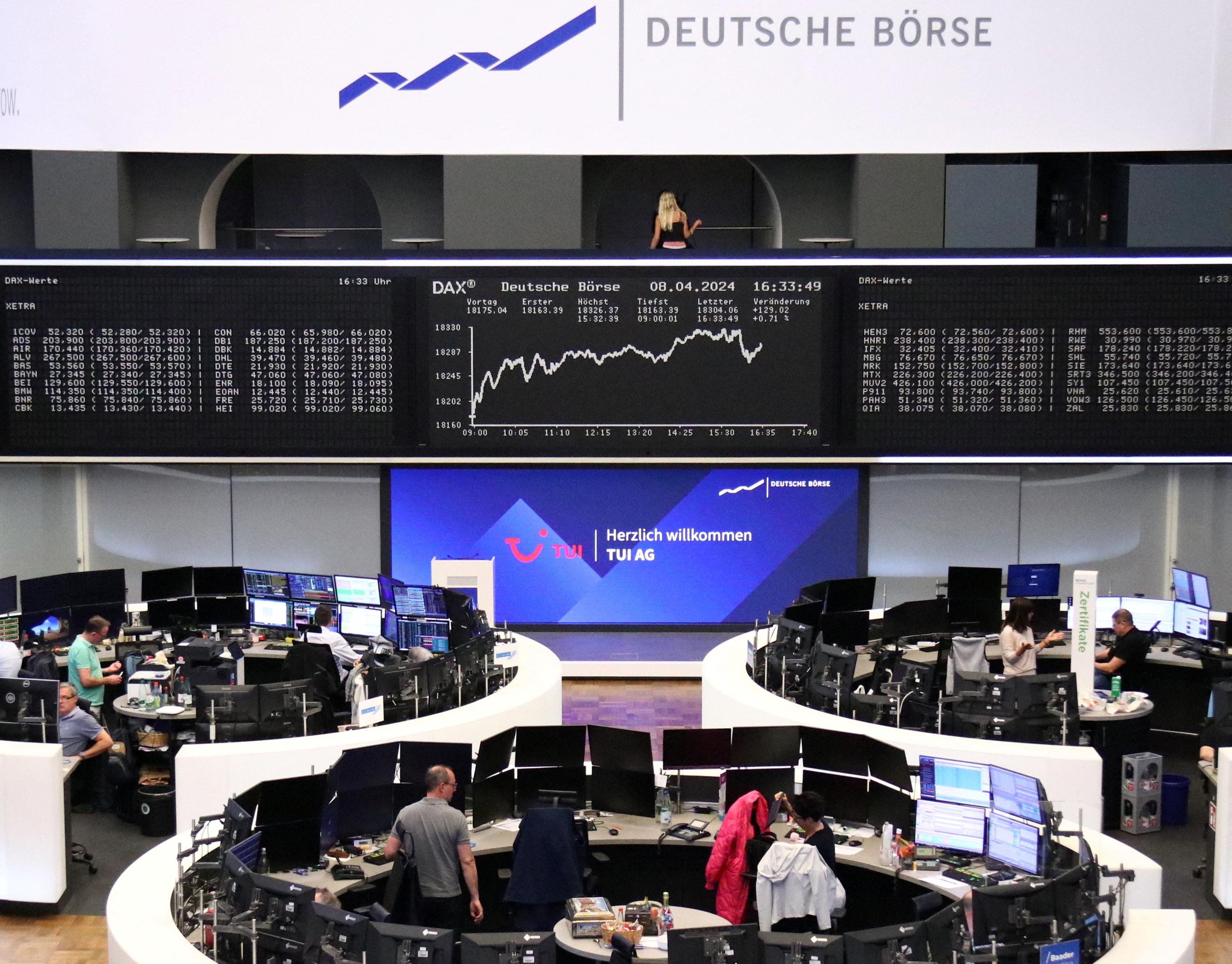

Dow closes above 40,000 level for first time Treasury yields rise Nickel and copper prices surge; gold also gains NEW YORK, May 17 (Reuters) - A world stock index rose for a seventh straight session and U.S. Treasury yields also gained on Friday as investors tried to assess the timing of potential interest rate cuts by the Federal Reserve this year. The Dow Jones Industrial Average closed above 40,000 for the first time, and all three major U.S. stock indexes posted strong gains for the week. Copper surged to a 26-month peak after China announced fresh support for its ailing property sector, while nickel prices touched their highest level since August 2023 amid unrest in nickel producer New Caledonia. Gold prices also gained. Data from earlier this week showing softening consumer prices in April boosted expectations that the U.S. central bank will be able to cut rates twice this year, beginning in September. Much depends, however, on what happens with price pressures in the coming months and Fed officials have hinted U.S. rates may not fall anytime soon. On Friday, Fed Governor Michelle Bowman repeated her view that inflation will fall further with the policy rate held steady, but said she has seen no improvement on inflation this year and remains willing to hike rates should progress stall or reverse. Minutes from the Fed's most recent policy meeting are due next week and may offer more detail on what Fed officials are looking at to begin cutting rates. The meeting from April 30–May 1, however, took place before Wednesday's CPI data. The Dow Jones Industrial Average (.DJI) New Tab, opens new tab rose 134.21 points, or 0.34%, to 40,003.59, the S&P 500 (.SPX) New Tab, opens new tab gained 6.17 points, or 0.12%, to 5,303.27 and the Nasdaq Composite (.IXIC) New Tab, opens new tab lost 12.35 points, or 0.07%, to 16,685.97. For the week, the Dow gained 1.2%, the S&P 500 rose 1.5% and the Nasdaq climbed 2.1%. "People are now looking at the next catalyst. Most likely it's going to be whether or not the Fed actually cuts," said Robert Pavlik, senior portfolio manager at Dakota Wealth. MSCI's gauge of stocks across the globe (.MIWD00000PUS) New Tab, opens new tab rose 0.88 points, or 0.11%, to 794.96, and was set for a seventh session of gains and another record high close. The index was also set to post gains for the week. The STOXX 600 (.STOXX) New Tab, opens new tab index fell 0.13%. A report showed European Central Bank board member Isabel Schnabel advocated caution about further interest rate cuts after a likely first one in June. In Treasuries, the yield on benchmark U.S. 10-year notes rose 4.3 basis points to 4.42% versus 4.377% late on Thursday. The U.S. dollar was mostly flat against other major currencies. The dollar index , which measures the greenback against a basket of currencies including the yen and the euro, fell 0.02% to 104.48, with the euro up 0.05% at $1.087. Against the Japanese yen , the dollar strengthened 0.18% at 155.65. The Japanese currency has weakened this year as the Bank of Japan has kept monetary policy loose while higher U.S. rates have drawn money toward U.S. bonds and the dollar. Tokyo is suspected to have intervened on at least two days in late April and early May to support the yen after it tumbled to lows last seen more than three decades ago. Three-month nickel on the London Metal Exchange (LME) surged 5.2% to $20,820 a metric ton by 1600 GMT after touching $21,365, the highest since August 2023. LME copper climbed 2.3% to $10,662 per ton, the strongest since March 2022. Gold prices, aided by China's stimulus measures, also rose. Spot gold rose 1.5% to $2,412.83 per ounce. Oil prices rose, with global benchmark Brent crude recording its first weekly gain in three weeks. U.S. crude gained 83 cents to settle at $80.06 a barrel and Brent rose 71 cents to settle at $83.98 per barrel. Sign up here. https://www.reuters.com/markets/global-markets-wrapup-1pix-2024-05-17/

2024-05-17 04:32

A look at the day ahead in European and global markets from Ankur Banerjee The cold harsh reality of the Federal Reserve likely keeping interest rates higher for longer to combat inflation has put a lid on the post-U.S. CPI exuberance, with the listless mood set to continue at European bourses. The final euro zone inflation reading for April headlines economic data on Friday and traders will hope the report will cement what has been known for a while: A rate cut from the European Central Bank (ECB) is on the way in June. But what comes after that is less clear. ECB board member Isabel Schnabel said the central bank may lower rates in June, but should be cautious about further cuts in borrowing costs given uncertainty over the outlook, Japan's Nikkei newspaper reported. Traders have priced in 70 basis points of ECB cuts this year - a lot more than the 46 bps of easing priced in for the Fed. Data this week showed a cooling U.S. consumer price index (CPI), prompting market participants to swiftly price in at least two rate cuts this year. However, Fed officials saying rates may need to stay higher for longer and a report showing a tight labour market have led to another shift in expectations. Markets are now fully pricing in one cut in November, with 68% chance of a cut in September - so we are roughly back where we were before the CPI data in terms of U.S. rate expectations. Across the pond, the pan-European STOXX 600 (.STOXX) New Tab, opens new tab will aim to get back on track after snapping a nine-day winning streak on Thursday. The index is poised for a second week of gain. The euro will also aim to close out its strongest week against the U.S. dollar in two-and-half months and the euro zone inflation reading might give it a lift. In company news, market focus will be on HSBC (HSBA.L) New Tab, opens new tab, after Bloomberg reported the lender's largest shareholder, Ping An Insurance Group of China (601318.SS) New Tab, opens new tab, is considering options to reduce its 8% stake. The insurer has been offloading shares in the London-headquartered banking group. Elsewhere, a positive forecast from retail bellwether Walmart (WMT.N) New Tab, opens new tab on Thursday signalled a resilient U.S. shopper. Key developments that could influence markets on Friday: Economic events: Euro zone April inflation data Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-2024-05-17/

2024-05-17 03:50

May 16 (Reuters) - A severe storm packing hurricane-force winds pummeled Houston on Thursday, killing at least four people, blowing windows out of high-rise buildings and leaving some 800,000 homes without power as much of the city was plunged into darkness, the mayor said. Much of downtown Houston and its commercial district were littered with fallen power lines and glass from shattered windows following the storm, with traffic and street lights knocked out across the city, the mayor, John Whitmire said in an interview on local television station KRIV. Speaking from the city's emergency operations center, Whitmire said the thunderstorm raked the Gulf Coast city in southeast Texas, the state's most populous urban center, with winds howling at 80-100 miles per hour (129-161 kph). He urged members of the public to stay indoors and to especially avoid the heavily hit downtown area, which he said was left darkened and strewn with broken glass. "The message right now is to stay home," he said, adding that public schools would be closed on Friday and that local authorities were asking all non-essential workers to likewise take the day off. The mayor said at least four storm-related fatalities had been confirmed, mostly from fallen trees. "Over 800,000 families are without power right now," he added. Whitmire delivered similar initial storm assessments during a brief televised news conference carried live a short time after his interview. The mayor said the severe weather had caught many residents by surprise, recounting that he was attending a little league baseball game when the storm hit, "and we had very little time to get to cover." The National Weather Service also issued a flood watch for the Houston area from heavy rains associated with the storm. Sign up here. https://www.reuters.com/world/us/four-deaths-confirmed-severe-storm-that-ravaged-houston-2024-05-17/

2024-05-17 03:00

MUMBAI, May 17 (Reuters) - The Indian rupee is expected to hold a narrow range on Friday on a recovery in the dollar index post the U.S. inflation data-fuelled selloff, while portfolio and corporate flows will be in focus. Non-deliverable forwards indicate rupee will open mostly unchanged from 83.50 to the U.S. dollar in the previous session. The rupee did not benefit from the broad selloff in the dollar on Thursday after the softer-than-expected U.S. inflation data. "What can you say when there is not the slightest bit happening on a big news day. Expect yet one more quiet day, with a 3-4 paisa range off the 83.50 level," an FX trader at a bank said. "The way things have been, I am inclined to think that we will have to wait till the election exit polls and results to have any form of tradable move." India's national election results are due on June 4 and exit polls will be out post the final phase of elections that will be held on June 1. Till then, you will have narrow intraday moves based on how flows pan out, a senior treasury official at a bank said. "Particularly what the large custodial banks are up to and whether importers will pick up their hedging activity." The dollar index and U.S. yields were higher, in a reversal from the moves after the U.S. inflation data came in. Asian currencies were down following Thursday's rally. The number of Americans filing new claims for unemployment benefits dropped last week, which indicated underlying strength in the U.S. labour market and that interest rates could remain higher for longer. Alluding to the move higher in U.S. yields, ING Bank said Federal Reserve speakers "again suggested that rates would need to remain higher for longer" Comments made by policymakers on Thursday indicated that they haven't openly shifted views yet about the timing of rate cuts investors are convinced will start this year. KEY INDICATORS: ** One-month non-deliverable rupee forward at 83.56; onshore one-month forward premium at 7.25 paise ** Dollar index up at 104.64 ** Brent crude futures up 0.4% at $83.6 per barrel ** Ten-year U.S. note yield at 4.37% ** As per NSDL data, foreign investors sold a net $280.1mln worth of Indian shares on May. 15 ** NSDL data shows foreign investors bought a net $156.6mln worth of Indian bonds on May. 15. Sign up here. https://www.reuters.com/world/india/rupee-focus-recovery-dollar-index-flows-2024-05-17/

2024-05-17 02:10

BENGALURU, May 17 (Reuters) - Lokeswara Reddy, an Indian farmer with two decades of experience, has seen his crops flourish after lean years, thanks to earth-observation satellites. Shifting climate patterns, high input costs, a scarcity of labour and erratic weather began to disrupt his earnings about 10 years ago, said Reddy, 52, currently a contract farmer with global giant Syngenta. Satellite data, gathered and crunched by Indian startup Cropin and provided to him by Syngenta, now gives him optimal sowing times, weather warnings, and better use of irrigation and pesticides, he said. Reddy said that over the last decade he has increased his net profit to 20,000 rupees ($240) per acre on corn at his farm in the southern Indian state of Andhra Pradesh, up from 5,000 - 10,000 rupees. "We are on a surer footing when it comes to agricultural practices; (using satellite data) safeguards us from climate change, pest and disease, problems with irrigation scheduling," he said. The Indian government, which just relaxed foreign investment rules for the space sector, is leaning heavily into the use of satellite data to solve problems on the ground, with agriculture a key focus. Reuters spoke to 11 experts and farmers, six startups in the industry and three NGOs who said space technology and big data were primed to help Indian agriculture reach new heights. "India's path to leadership in the new space race lies in utilizing the power of data, and applications within the agricultural sector offer immense potential," said Pawan Goenka, chairman of the Indian National Space Promotion and Authorization Centre, the country's space regulatory body. Market Research Future, an India-based data analysis firm, says the global space agriculture market will be worth $11.51 billion by 2032, up from $4.99 billion in 2023. Although China holds the largest market share, the sector is growing faster in India than anywhere else in the Asia-Pacific region, it said. Cropin, founded in 2010 and backed by both Google and the Gates Foundation, recently signed a deal with Amazon Web Services to crunch satellite data to solve for global food insecurity. Cropin's partnership with farmers, the World Bank and the government of India in 244 villages digitised more than 30,000 farm plots, covering 77 crop varieties across climate-zones, a company project analysis in 2019 showed. The study showed 92% of the farmers involved increased their average yield by 30% and their farm revenue by nearly 37%. The company got similar results in Africa. AGRITECH PUSH Cropin and others are tapping into a burgeoning sector. The use of satellite data for crop insurance and horticulture has a market potential of about $1.35 billion over the next 5 years, Deloitte said in a report. Baring Private Equity-backed SatSure, another Indian startup, crunches earth observation data to inform loan analysis. Chief Executive Officer Prateep Basu said there are about 70 million active farmer bank accounts in the country, representing roughly 38% of the total pool. That makes up about $200 billion of all lenders' loan books, he said. India has 2,743 agricultural tech startups, many of which incorporate satellite data or other space technology. Funding hit a high of $1.3 billion in 2021; companies gathered $394.4 million in 2023 and $136.7 million so far in 2024. But there are barriers to large-scale adoption of space technology in agriculture. The average landholding size for farmers in India is just 1.08 hectares. That fragmentation, coupled with poverty and low levels of literacy, pose challenges for tech adoption, industry experts said. "Agriculture has never been a tech-forward sector and often farmers want to rely on traditional practices, or the wisdom of their forefathers," said Raghunath Reddy, a Syngenta manager. In India, McKinsey says agricultural technology has the potential to grow farmers' incomes by 25% to 35%. Indian Finance Minister Nirmala Sitharaman, in her 2023 budget speech, announced a 703 million rupee ($8.42 million) accelerator fund to boost agritech startups. In March 2023, the government said the fund was supporting 1,138 such companies. For farmers like Reddy, agriculture tech has meant better living standards - over the past few years he has bought a car and bought a new house in town. "This increase in earnings also means better education for my son, who has plans to be a software engineer abroad, in the U.S. or London. At the end of the day, we want a better future for our kids," Reddy said. ($1 = 83.4680 Indian rupees) Sign up here. https://www.reuters.com/world/india/space-data-fuels-indias-farming-innovation-drive-2024-05-17/