2024-05-16 22:50

May 16 (Reuters) - Applied Materials (AMAT.O) New Tab, opens new tab forecast third-quarter results above Wall Street estimates on Thursday, following strong demand for its semiconductor tools, but failed to meet lofty investor expectations. The company's shares, which have rallied about 32% so far this year, fell about 1.2% in extended trading. Applied Materials has benefited from growing demand for wafer fabrication equipment, which are sophisticated and expensive machinery to make semiconductors, as its customers are investing heavily to produce artificial intelligence chips. "Investors are nudging the share price down because they were looking for a more solid beat and outlook," Michael Ashley Schulman, chief investment officer at Running Point Capital said, adding that the results do not knock "the wind out of a semiconductor chip recovery theme". A surge in the requirement of high-performance computing and data centers has also driven demand for memory semiconductors such as dynamic random access memory (DRAM) and flash memory, helping chip tools suppliers. Applied Materials forecast third-quarter revenue of about $6.65 billion, plus or minus $400 million, compared with analysts' estimates of $6.58 billion, according to LSEG data. The company expects third-quarter adjusted profit per share between $1.83 and $2.19, compared with estimates of $1.98. Applied Materials, which supplies chipmaking tools to Samsung Electronics (005930.KS) New Tab, opens new tab and Taiwan Semiconductor Manufacturing Co (2330.TW) New Tab, opens new tab, reported that 43% of its total revenue came from China in the second quarter. End markets are mixed with weak industrial and auto markets, but strong image sensors, power chips, microcontrollers and other markets, Applied Materials Chief Financial Officer Brice Hill said on a post-earnings call. The company, which is the largest semiconductor equipment maker in the United States, reported second-quarter revenue of $6.65 billion, beating estimates of $6.54 billion. On an adjusted basis, Applied Materials earned $2.09 per share, compared with estimates of $1.99. Sign up here. https://www.reuters.com/technology/applied-materials-forecasts-third-quarter-revenue-above-estimates-2024-05-16/

2024-05-16 22:36

May 16 (Reuters) - Retail investor darlings GameStop (GME.N) New Tab, opens new tab and AMC (AMC.N) New Tab, opens new tab fell for a second straight session on Thursday, as excitement over the social media return of "Roaring Kitty," who was the central figure in 2021 meme-stock rally, fizzles out. Shares of the videogame retailer GameStop tumbled 30% to close at $27.67 after jumping as high as $64.83 on Tuesday. Theater chain AMC closed 15.3% lower at $4.64. Both companies' shares have fallen sharply from gains in the first two sessions of the week following a series of posts from Keith Gill's X account "Roaring Kitty," whose bullish calls on GameStop were a reason for the 2021 meme-stock frenzy. Unlike 2021, when Reddit users banded together to target highly shorted stocks that burned the bearish bets of hedge funds, institutional investors too were part of the meme-stock mania, Vanda Research, which tracks retail investor flows, said. "The short sellers three years ago were completely surprised by the magnitude of the mass purchases and ultimately overwhelmed by the size of the short squeeze," said Rick Meckler, partner at Cherry Lane Investments. "They have likely learned from that experience and left themselves less exposed thereby reducing the potential for extended upward pressure." Short interests, or bets on a stock's decline, have stayed mostly flat for both GameStop and AMC this week, analytics firm Ortex Technologies said. Short sellers took unrealized losses worth $1.14 billion this week from their bets against the two struggling companies and were set to make just about $460 million in paper gains on Thursday, it said. Meanwhile, hedge fund Renaissance Technologies placed a new bet for GameStop shares to rise further and significantly increased its long position in AMC during the first quarter, according to a filing. GameStop stock is down over 70% from its 2021 intraday peak, while AMC is 99% off its all-time high. Since he recently resumed posting on Sunday, Gill has posted over clips of movies on social media platform X. He did not respond to a Reuters request for comment on what the posts might mean or whether he planned on making his investments public again. The former chair of the U.S. Securities and Exchange Commission, Jay Clayton, told CNBC on Wednesday that the posts have triggered "a wave of euphoric and speculative buying in the retail (trading) community, which is never a good thing," adding that it was not illegal to say, "I like a stock". Other highly shorted stocks that rallied this week were lower on Thursday. Tupperware (TUP.N) New Tab, opens new tab fell almost 8%, while U.S.-listed BlackBerry lost about 6%. OPTIONS TRADERS RUSH IN Options activity remained strong. GameStop and AMC were among the top ten securities with highest options volume by 11:15 a.m. EDT (1515 GMT), with the majority of traders buying call options, which bet on a stock's rise, data New Tab, opens new tab from Options Clearing Corp showed. The pace of borrowing for margin trading by U.S. investors, however, has been restrained compared with the GameStop short squeeze in January 2021, J.P. Morgan strategists said in a note. "Retail investors are once bitten twice shy after they ended up losing a lot of money last time round," said Ben Laidler, global markets strategist at digital brokerage eToro. "Even though there are more retail investors today, you're not seeing that follow through into the rally this time as you saw last time." Sign up here. https://www.reuters.com/technology/gamestop-amc-slide-meme-stocks-rally-loses-steam-2024-05-16/

2024-05-16 22:15

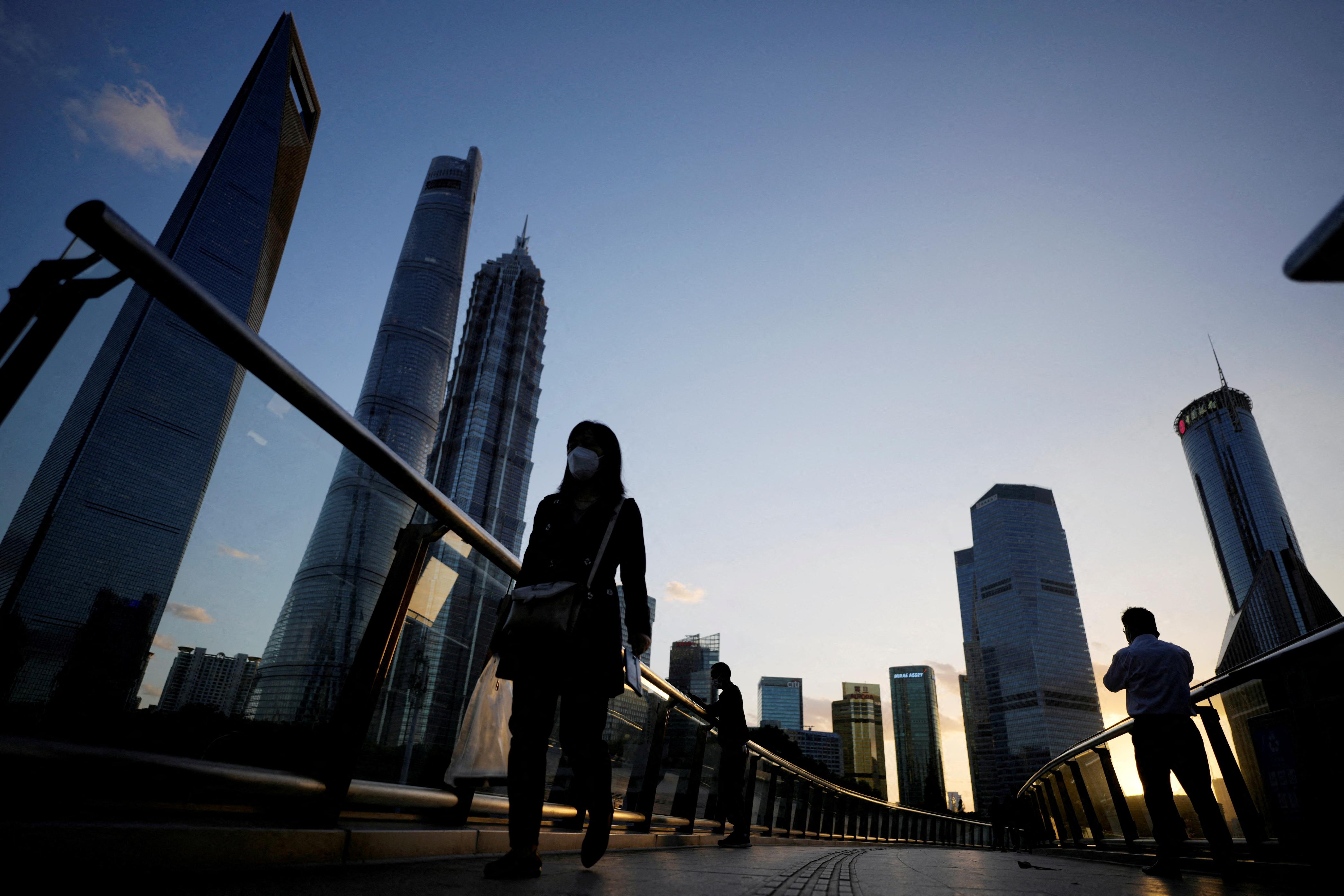

May 17 (Reuters) - A look at the day ahead in Asian markets. Asian markets go into Friday's session looking to end a strong week on a positive note, and there appears to be no obvious reason why the recent upswing should reverse unless investors opt for a bout of profit taking ahead of the weekend. China's monthly 'data dump', when Beijing simultaneously lands several top-tier economic indicators, could go a long way to setting the market tone across Asia on Friday. The MSCI Asia ex-Japan stock index is eyeing a sixth consecutive rise, which would mark its best run since January last year. Barring a slide of almost 3%, the index will close the week in positive territory for a fourth week. Wall Street ended a touch lower on Thursday, but not before the Dow Jones Industrials hit 40,000 points for the first time, while the dollar and bond yields ticked higher. On the week, the dollar and yields are lower, and stocks are higher. Broadly speaking, economic and inflation data this week from the world's largest economy were soft, refueling investors' belief that U.S. interest rates will be cut soon. A batch of top-tier indicators from China on Friday will shed light on how well - or otherwise - the world's second largest economy is performing, and whether it is on track to meet authorities' 5% GDP growth target for this year. China's economic surprises index is at a three-month low, evidence that activity has been weaker than expected or forecasts were too high to begin with. If there is a consensus, it is gravitating around the former rather than the latter. The latest house prices, retail sales, urban investment, industrial production and unemployment figures are broadly expected to show economic activity accelerated last month. The dark cloud of deflation hangs heavily over the economy - the prolonged decline in producer prices could yet drag consumer prices lower - so a set of numbers in line with, or exceeding expectations on Friday would be welcome news for China bulls and policymakers alike. Chinese bond yields have slumped to all-time lows and the U.S.-China yield spread has ballooned to historic wides. These extreme scenarios have cooled in recent weeks - encouraging economic numbers on Friday will likely extend that 'normalization' further. Figures from Japan on Thursday, meanwhile, showed that the world's third-largest economy fared much worse in the first quarter than economists had expected, as first quarter GDP shrank at an annualized rate of 2.0%. That's the kind of number that could make the Bank of Japan think twice about its policy 'normalization'. The yen and Japanese bond yields retreated on Thursday but are still slightly higher on the week. Here are key developments that could provide more direction to markets on Friday: - China house prices, retail sales, urban investment, industrial production, unemployment (April) - Malaysia GDP (Q1) - Hong Kong GDP (Q1) Sign up here. https://www.reuters.com/markets/asia/global-markets-view-asia-graphic-pix-2024-05-16/

2024-05-16 21:38

May 16 (Reuters) - Reddit (RDDT.N) New Tab, opens new tab has partnered with OpenAI to bring its content to popular chatbot ChatGPT, the companies said on Thursday, sending the social media platform's shares up 12% in extended trade. The deal underscores Reddit's attempt to diversify beyond its advertising business, and follows its recent partnership with Alphabet (GOOGL.O) New Tab, opens new tab to make its content available for training Google's AI models. ChatGPT and other OpenAI products will use Reddit's application programming interface, the means by which Reddit distributes its content, following the new partnership. OpenAI will also become a Reddit advertising partner, the company said. Ahead of Reddit's March IPO, Reuters reported that Reddit struck its deal with Alphabet, worth about $60 million per year. Investors view selling its data to train AI models as a key source of revenue beyond Reddit's advertising business. The social media company earlier this month reported strong revenue growth and improving profitability in the first earnings since its market debut, indicating that its Google deal and its push to grow its ads business were paying off. Reddit's shares rose 10.5% to $62.31 after the bell. As of Wednesday's close, the stock is up nearly 12% since its market debut in March. Sign up here. https://www.reuters.com/markets/deals/openai-strikes-deal-bring-reddit-content-chatgpt-2024-05-16/

2024-05-16 21:28

PORTO ALEGRE, May 16 (Reuters) - Brazil's southernmost state is planning at least four "tent cities" to accommodate some 8,000 people currently in improvised shelters due to the historic floods that have devastated the region. Heavy rains since the end of April caused record floods that killed at least 151 people in the state of Rio Grande do Sul and left more than 100 still missing, according to state officials. Roughly half a million people have fled their homes, with over 77,000 currently in public shelters. Scientists warn it may take a month or more for the flooding to subside, and many residents have no homes left to return to. The state government is planning temporary structures, with individual bedrooms and collective bathrooms, kitchens and laundry for thousands of people now sheltering in schools, churches and sports arenas, said Vice-Governor Gabriel Souza. "Part of these people, unfortunately, have nowhere to go", he told Reuters in a telephone interview. Many public buildings serving as shelters will need to return to their normal functions, he added, and the volunteers serving their need to resume their routines. Souza said the government has identified locations in state capital Porto Alegre and nearby Canoas and Sao Leopoldo that meet requirements to host the structures. Authorities are also seeking at least one more serviceable location in the heavily flooded city of Guaiba. Of the roughly 50,000 people in public shelters in those four cities, the state government estimates that around 15% will need longer-term accommodation in the temporary structures. The majority are expected to either return to their homes or find alternatives such as staying with relatives. The United Nations refugee agency (UNHCR) has announced the donation to Rio Grande do Sul of 108 units of a temporary structure normally used in refugee camps. "These are those little houses that are modular, they can be assembled in different ways, whether to accommodate families or individuals, or to form, for example, a support space for volunteers," said UNHCR official Silvia Sander. Sign up here. https://www.reuters.com/world/americas/brazil-flooding-forces-plan-tent-cities-house-displaced-2024-05-16/

2024-05-16 21:11

WASHINGTON, May 16 (Reuters) - Data this week offered the U.S. Federal Reserve good news on two fronts but policymakers haven't openly shifted views yet about the timing of rate cuts investors are convinced will start this year. Comments from Fed officials including the vice chair of the rate-setting Federal Open Market Committee, New York Fed President John Williams, acknowledged the positive turn this week when U.S. government agencies reported that consumer prices rose more slowly than expected in April, and that retail spending had not increased at all during the month in a possible sign consumers are pulling back. But that hasn't yet prompted policymakers to say anything concrete about when rates might fall, indicating as did Fed Chair Jerome Powell earlier in the week that while the baseline outlook remained for inflation to fall, they didn't trust it fully after three months in which inflation data disappointed. "I don't see any indicators now telling me ... there's a reason to change the stance of monetary policy now," Williams said in an interview with Reuters, adding that he did not expect the case for a rate cut to fall into place "in the very near term." In comments on CNBC on Thursday, Richmond Fed President Thomas Barkin said the April retail sales number still means spending was growing at a "good" pace even if not a "great" one, noting that firms particularly in the service sector tell him they continue to plan price increases. "I do believe we are on the right path. I do believe inflation is coming down," Barkin said. But "to get to 2% sustainably it is going to take a little bit more time," he said, with more of the "edge" coming off of consumer demand, and businesses on the services side of the economy getting the message, as many in the goods sector have received, that customers will stop buying if prices get too high. "Customers and competitors are going to have to teach people that they don't have pricing power," Barkin said. Cleveland Fed President Loretta Mester said she still regarded progress on inflation this year as "disappointing" and, pointing to a recent rise in public expectations about near-term inflation, added that if long-term expectations also begin to increase the Fed may need to be open to further rate increases. Holding the policy rate at the 5.25% to 5.5% range where it has been since July "is prudent...as we gain clarity about the path of inflation," Mester said. "Should developments in inflation and inflation expectations warrant it, policymakers will need to be open to tightening policy further." Like other policymakers, however, Mester said that was not her base case, and the April Consumer Price Index report was the first in four months that arguably boosted policymakers' faith that the drop in inflation seen last year might resume and become steady enough to bring their 2% inflation target within reach. Chicago Fed President Austan Goolsbee said in particular that slowed shelter inflation in April left him "optimistic" the pace of price increases will continue to drop. Atlanta Fed president Raphael Bostic, in comments Thursday at an event in Jacksonville, agreed the April easing of shelter inflation was "a pretty significant development." But he added, in a note of caution, that "one data point is not a trend. One change does not determine...the next three months." Indeed, the flow of data between now and the Fed's upcoming meetings leaves officials with a narrow window to build the case for a rate cut before the central bank's September 17-18 meeting - the current betting favorite among investors in contracts tied to the Fed's policy rate. Between now and the Fed's June 11-12 meeting, policymakers will receive just one additional report on the Personal Consumption Expenditures price index, the statistic used to set the 2% inflation target. The index rose at a 2.7% annual rate as of March, and, with many of the components of the April release already in hand, analysts expect little if any change when the new data is published on May 31. By their July 30-31 meeting, however, officials will have received a full suite of data about the economy's performance through the first half of the year, including inflation and job reports through June, and a report on economic growth and employment costs for the second quarter of the year. If data continues to show inflation declining, that could allow policymakers to amend what has been a standing reference in their policy statement to "elevated" inflation, a change analysts say will be needed to open the door to rate cuts. The July meeting will be followed in August by the Fed's annual research conference in Jackson Hole, a forum Fed chairs have often used to shape public expectations about monetary policy. In a sign of the primacy inflation still holds in the global policy debate, however, the International Monetary Fund on Thursday cautioned the Fed not to move too soon. "The recent inflation data are overall higher than we would like to see," said IMF spokesperson Julie Kozack. "This reinforces the need for the Fed to be cautious." Sign up here. https://www.reuters.com/markets/us/fed-remains-cautious-cuts-even-data-improves-2024-05-16/