2024-05-16 11:27

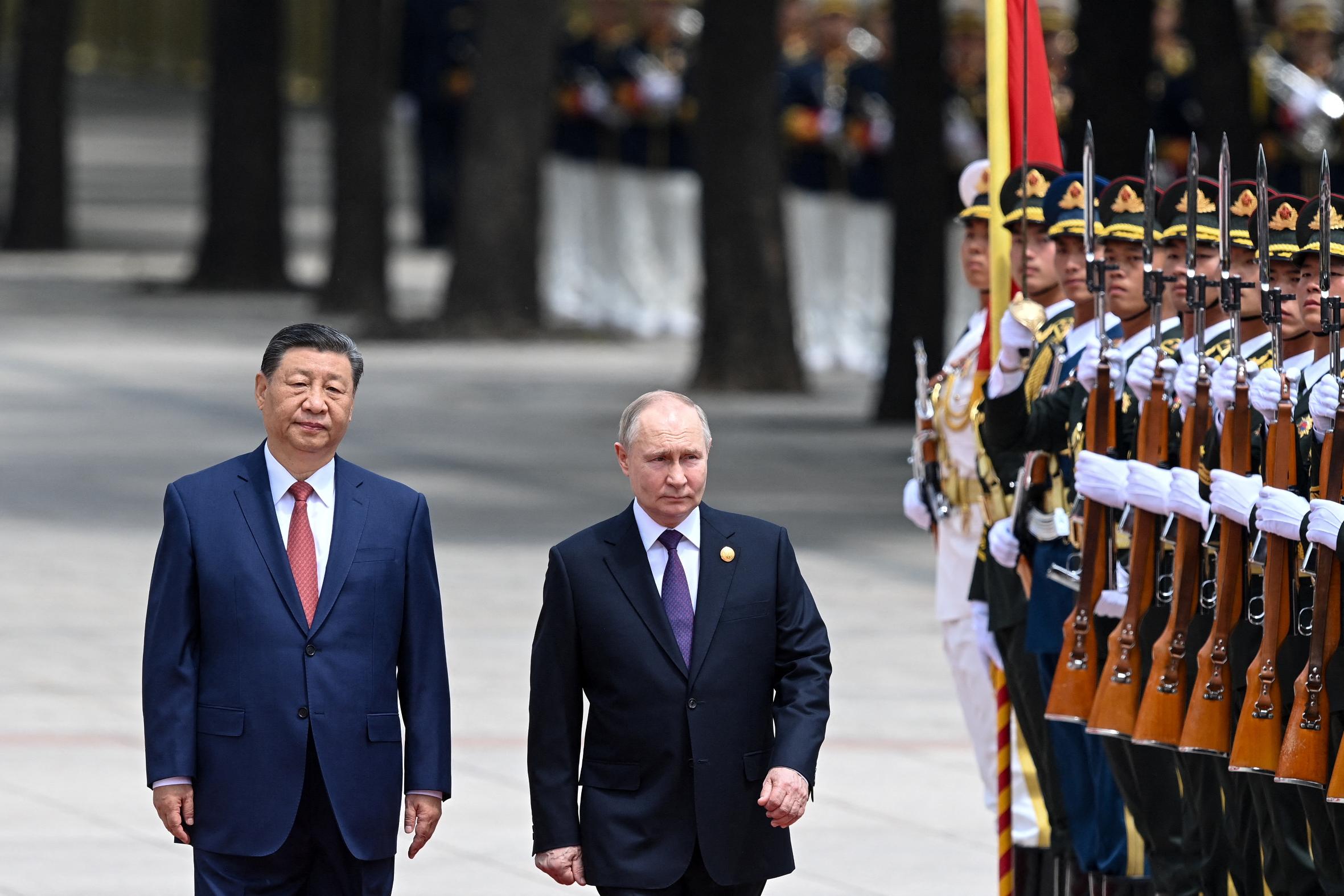

MOSCOW, May 16 (Reuters) - Russian President Vladimir Putin and Chinese President Xi Jinping agreed on Thursday to deepen their "strategic partnership" while scolding the United States for a series of moves that they said threatened their countries. Following are the key points of the joint statement New Tab, opens new tab, which is 7,000 words long in Russian, on "the deepening of the comprehensive partnership and strategic cooperation entering a new era." * Russia and China "are determined to defend their legitimate rights and interests, resist any attempts to hinder the normal development of bilateral ties, interfere in the internal affairs of the two states, and limit the economic, technological or foreign policy potential of Russia and China." * TAIWAN: Russia "reaffirms its commitment to the principle of 'one China', recognizes that Taiwan is an integral part of China, opposes the independence of Taiwan in any form, and firmly supports the actions of the Chinese Side to protect its own sovereignty and territorial integrity, as well as to unify the country. * UKRAINE: "The Russian side positively assesses China's objective and unbiased position on the Ukrainian issue." China "supports the efforts of the Russian side to ensure security and stability, national development and prosperity, sovereignty and territorial integrity, and opposes outside interference in Russia's internal affairs." * UNITED STATES: Russia and China have serious concerns at "U.S. attempts to violate the strategic balance": - U.S. global missile defence and deploying parts of it in regions around the world and in space. - Developing high-precision non-nuclear weapons for potential “decapitation” strikes - "Extended nuclear deterrence" with allies including Australia. eg AUKUS - Plans to deploy ground-based intermediate-range and shorter-range missiles (INF) in the Asia-Pacific and European regions, including their transfer to its allies. - "The parties strongly condemn these extremely destabilizing steps, which pose a direct threat to the security of Russia and China." - "The parties oppose the hegemonic attempts of the United States to change the balance of power in Northeast Asia by building up military power and creating military blocs and coalitions." "The United States still thinks in terms of the Cold War and is guided by the logic of bloc confrontation, putting the security of 'narrow groups' above regional security and stability, which creates a security threat for all countries in the region. The US must abandon this behavior. *NORTH KOREA: "The parties oppose the actions of intimidation in the military sphere carried out by the United States and its allies, which provoke further confrontation with the DPRK, fraught with armed incidents and escalation of the situation on the Korean Peninsula." * NUCLEAR WAR: "There can be no winners in a nuclear war and it should never be fought." * MARKETS: increase the share of national currencies in bilateral trade; encourage debt issuance in both markets; develop insurance and financial markets. * INDUSTRY: develop civil aircraft construction, shipbuilding, carmakers, machine tool industry, electronics industry, metallurgy, iron ore mining, chemical industry and forestry. * AGRICULTURE: expand mutual access of agricultural products, increase the volume of trade in soybeans, pig breeding, water production, grain, fat and oil, fruits and vegetables, nuts and other products. * TECHNOLOGY: develop cooperation in information and communication technologies, including artificial intelligence, communications, software, Internet of things, open source, network and data security, video games, radio frequency coordination, specialised education and industry research activity. * ENERGY: "Strive for the stability and sustainability of the global energy market, strengthening value chains in the fuel and energy complex. Develop market-based cooperation in the field of oil, natural gas, liquefied natural gas (LNG), coal and electricity, ensure the stable operation of relevant cross-border infrastructure and the creation conditions for unimpeded transportation of energy resources." * NUCLEAR: Deepen partnership in peaceful nuclear energy. Including thermonuclear fusion, fast neutron reactors and the closed nuclear fuel cycle. Sign up here. https://www.reuters.com/world/what-is-putin-xis-new-era-strategic-partnership-2024-05-16/

2024-05-16 11:22

BENGALURU, May 16 (Reuters) - GAIL (India) (GAIL.NS) New Tab, opens new tab, India's top natural gas distributor, posted a smaller-than-expected quarterly profit on Thursday, hurt by weakness in its natural gas marketing business. Net profit rose more than three-fold to 21.77 billion rupees ($260.8 million) for the March quarter, but fell short of analysts' estimate of 28.29 billion rupees, according to LSEG data. The state-run company's natural gas marketing segment, which accounts for the bulk of its overall revenue, declined nearly 10%. Lower gas marketing margins due to a fall in spot LNG prices have been weighing on distribution companies, analysts said. The company's total revenue slipped 0.9% to 32.33 billion rupees during the January-March period. Shares of GAIL, which have risen about 20% so far this year, settled 2.6% lower on Thursday. ($1 = 83.4700 Indian rupees) Sign up here. https://www.reuters.com/business/energy/gail-india-misses-q4-profit-estimates-gas-marketing-segment-weighs-2024-05-16/

2024-05-16 10:12

WASHINGTON, May 16 (Reuters) - Donald Trump would likely push to replace the head of the International Energy Agency if he wins the U.S. presidential election to shift the energy watchdog's focus back to maximizing fossil fuel output instead of fighting climate change, according to people familiar with the matter. The Paris-based IEA has provided research and data to industrialized governments for more than half a century to help guide policy around energy security, supply and investment. The United States provides around a quarter of the group's funding. In recent years, the organization has broadened its focus beyond oil and gas supply to include clean energy, as member governments seek input on meeting their goals under the Paris climate agreement and accelerate a transition away from fossil fuel reliance. That shift gathered pace during President Joe Biden's tenure – resulting in prescriptions on energy policy that angered global oil producers including Saudi Arabia, and which clash with Trump's self-described ‘drill, baby, drill’ energy agenda aimed at boosting the traditional oil and gas industries. Reuters spoke with five people familiar with Trump's thinking on energy, including donors, policy experts and former Trump administration officials, all of whom said Biden's predecessor would likely pressure the IEA to bring it in line with his pro-fossil fuel policies if he was re-elected in November. The Trump campaign declined requests for comment on the issue. Trump has not spoken publicly about the IEA. Fellows at the Heritage Foundation, an organization that has drafted a policy blueprint for a new Republican administration and which is in regular contact with the Trump campaign, said they are suggesting the U.S. use its clout within the agency to push for the replacement of the IEA's director, Fatih Birol. "The U.S. should definitely come up with a strategy to replace the leadership at the IEA," said Mario Loyola, a senior research fellow at Heritage, attacking what he called Birol's focus on "net-zero fairytales" as "fossil fuel demand continues to increase." Birol declined to comment for this article. The IEA's director is elected by member nations, but the U.S. has outsized influence in the group because of its funding and geopolitical clout. The IEA's other 30 members are predominantly European, but also include Japan, Australia, New Zealand, Canada, Mexico and South Korea. A Trump push for the IEA to tilt back toward emphasizing fossil fuels in the global energy mix would go against the stated position and energy policies of the EU and other key members of the IEA. A new Trump administration would prioritize other energy policy moves first, like reversing the Biden administration's pause on liquefied natural gas export licenses, expanding domestic drilling or withdrawing the United States from the Paris climate accord, said Heritage fellow Mike McKenna, a former Trump energy policy adviser who is in contact with the campaign. "I could see it being a year-two focus to change leadership at IEA," he said. Trump considered cutting U.S. funding to the IEA during his presidency but opted to keep it in place, in part because of the relatively low price tag, Dave Banks, special assistant for international energy and environment at the National Security Council when Trump was president, told Reuters. The U.S. pays about $6 million per year in IEA dues. But things could change if he is re-elected. "There is a feeling among Republicans that the IEA is really run by the Europeans and prioritizes European energy security views, which aligns with Democratic priorities," Banks said. CLIMATE TRUTH TELLER Since his 2015 appointment as director of the IEA, Birol has pushed the agency to make fighting climate change central to its analyses. The agency projects oil demand will peak at the end of this decade. In 2021, shortly after President Joe Biden took office, the IEA published a report that said a swift end to new drilling investment globally was necessary if countries were to limit the global temperature rise to 1.5 degrees Celsius as targeted by the Paris Agreement. The Organization of the Petroleum Exporting Countries (OPEC), which groups Saudi Arabia and other big oil producers, has repeatedly clashed with the IEA since, and last year accused it of vilifying oil producers. Birol had worked for OPEC at its Vienna headquarters in the early 1990s. Birol's green turn led U.S. Republican lawmakers to accuse the IEA of aligning too closely with the policy agenda of the Biden administration, with two top Republican lawmakers saying in March that the agency has morphed into an "energy transition cheerleader New Tab, opens new tab". John Kerry, who served as Biden's top U.S. climate envoy until March, told Reuters just before he stepped down from the post that the Biden administration "worked very closely with the IEA," relying on its modeling and analysis to shape some of its key policies to decarbonize the U.S. economy by 2050. Kerry pushed back against the assertion that the IEA has an ideological bent towards green causes. "Because of the climate crisis, and the leadership at IEA, they're really focused on becoming the truth teller about the climate challenge," Kerry told Reuters in March. The IEA has defended its analyses as independent and fact-driven. “The IEA scenarios…are the product of an independent and detailed analytical effort, informed by the latest data on markets, policies and technological costs,” Birol said in an April letter in response to Republican lawmakers. But if Trump were re-elected as president, the agency would face pressure to return to its original focus on oil and gas supply issues. "I strongly expect that if President Trump wins, the U.S. will use its leverage in the IEA, working with like-minded members like Japan, to restore the agency to its past role as an objective, non-political security watchdog and energy analysis and forecasting agency," said Bob McNally, president of consultancy Rapidan Energy. Dan Eberhart, a Trump campaign donor and CEO of Colorado drilling firm Canary, said it was all a matter of perspective. "Trump's priority has always been energy security for the U.S.," he said. "As far as the IEA's work is discouraging needed investment in traditional energy development, Trump is going to view that as a risk to America's economy and security." Sign up here. https://www.reuters.com/business/energy/second-trump-presidency-would-target-ieas-green-focus-advisers-say-2024-05-16/

2024-05-16 10:05

16 May 2024 - A look at the day ahead in U.S. and global markets from Mike Dolan World stocks (.MIWD000000PUS) New Tab, opens new tab notched new records and the dollar (.DXY) New Tab, opens new tab nursed its worst day of the year as fears of an overheating U.S. economy dissipate - stirring hopes that the coast is clearing for Federal Reserve easing at last. Even though markets jumped the gun late Tuesday, the slightly softer U.S. consumer price inflation report for April and many encouraging details under the bonnet supercharged both the S&P500 (.SPX) New Tab, opens new tab and Nasdaq (.IXIC) New Tab, opens new tab to all-time highs and dragged Treasury yields down to the lowest in more than a month. Futures have held those moves overnight as Asia stocks were dragged into the slipstream too - helped by the relief of the dollar's biggest one-day drop of 2024 on Wednesday. Central to the new-found ebullience on Wall Street has been the puncturing of stock (.VIX) New Tab, opens new tab and bond market (.MOVE) New Tab, opens new tab volatility to the lowest in four months and six weeks respectively. The ebbing of monthly CPI gains last month is cause for considerable relief after three months of sticky price gains - with measures of easier services and shelter inflation of particular note for the wary Fed. Annual core and headline CPI inflation slipped to 3.6% and 3.4% in that order. Although a noted policy dove, Chicago Fed boss Austan Goolsbee welcomed the retreat in housing inflation in particular. "I'm optimistic that we're continuing on this downward trajectory," he said late on Wednesday. Two quarter-point Fed rate cuts are back in the futures strip for this year, with a first move almost fully priced by September and even a one-in-three chance now that the Fed may cut as soon as July. A surprise stalling of retail sales growth last month, sub-forecast housing indicators for May and a bigger drop in New York manufacturing sentiment this month also tempered the growth picture - and the combination has dragged the Atlanta Fed's real-time GDP growth estimate back below 4%. The U.S. economic surprise index is still tracking at its most negative since January 2023. Alongside today's industry readout, markets will now watch closely on Thursday to see if last week's outsize jump in weekly jobless claims holds true. Egging on global markets at large is the fact that U.S. inflation relief -- and the sharp dollar recoil - solidify expectations that the European Central Bank will cut rates next month and money markets also put a greater than 50% chance the Bank of England will ease in June too. Underscoring the much tamer inflation picture in the euro zone - where annual CPI inflation is running at just 2.4% - Italy reported on Thursday that its annual inflation rate fell below 1% last month. As to overall global growth, Japan surprised with news of a deeper contraction in economic activity in the first quarter than forecast. The economy there shrank 2.0% annualised in January-March from the prior quarter, faster than the expected 1.5% drop as the weakening yen hit consumption. But the weak growth readout may cut across speculation of another imminent Bank of Japan tightening there. Back on Wall St, the stocks rally has been broad-based across tech megacaps (.NDX) New Tab, opens new tab and small caps (.RUT) New Tab, opens new tab after a bumper earnings season. Walmart (WMT.N) New Tab, opens new tab reports later on Thursday but many will already now be looking to artificial intelligence bellwether Nvidia's (NVDA.O) New Tab, opens new tab update next week. In company news, Netflix (NFLX.O) New Tab, opens new tab said on Wednesday its ad-supported tier has reached 40 million global monthly active users, from 5 million a year earlier, a sign that its push to attract new users with the cheaper plan is paying off. Key diary items that may provide direction to U.S. markets later on Thursday: * US weekly jobless claims, April industrial production, April import/export prices, April housing starts, May Philadelphia Fed business survey * US corporate earnings: Walmart, Deere, Applied Materials, Copart, Take-Two Interactive Software * Federal Reserve Vice Chair for Supervision Michael Barr testifies at Senate Banking, Housing, and Urban Affairs Committee hearing; Cleveland Fed President Loretta Mester, Philadelphia Fed chief Patrick Harker, Richmond Fed chief Thomas Barkin and Atlanta Fed boss Raphael Bostic all speak; Bank of England policymaker Megan Greene speaks * US Treasury sells 4-week bills Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-2024-05-16/

2024-05-16 09:58

JERUSALEM, May 16 (Reuters) - The Tel Aviv Stock Exchange (TASE) is planning to alter its schedule and add Friday to the trading week in a bid to strengthen the Israeli bourse's global profile, it said on Thursday. The exchange hopes a decision to shift away from Israel's Sunday to Thursday work week to one that overlaps more with Wall Street and European bourses will win inclusion in global index provider MSCI's Europe category. The announcement comes as shares have recovered from the Oct. 7 Hamas attack on Israel that pushed the broad Tel Aviv 125 index (.TA125) New Tab, opens new tab down 12% in October. The index is now up 8% since Oct. 5, although MSCI's index of world shares (.MIWD00000PUS) New Tab, opens new tab has risen more than 20% over the same period. Reassigning Israel to a new region like Europe could open the door to more passive inflows for the Israeli capital markets, but MSCI in 2022 rejected shifting the country to a new region, citing differing market trading days as a key reason. MSCI, which provides equity, fixed income and hedge fund indexes, upgraded Israel to a developed market from an emerging one in 2010. Under the TASE's proposal, in collaboration with the Israel Securities Authority and Bank of Israel, trading would move to either Monday through Friday or Sunday through Friday in which trading on Sundays would begin at 12.00 local time (0900 GMT). Trading volume on Sundays is usually far lower than the rest of the week and trading ends 90 minutes earlier on that day. It was yet to be decided how extended trading would fit around the start of Shabbat - the Jewish sabbath - on Friday afternoon when most Israeli businesses close. The shekel currency, however, is already traded on Fridays and more services keep running during Shabbat in Tel Aviv than in most other Israeli cities. The TASE asked that public comments on the plans be submitted by June 30. In January, Israel's securities regulator told Reuters that Israel would eventually move to a Monday to Friday trading week in order to be included in the MSCI Europe category. The TASE noted that currently, after trading ends in Israel on Thursday afternoon, trading on international exchanges continues for two more sessions. "It effects on local participants and particularly on global investors, who consistently stress that the unique trading methods in Israel pose a real hindrance," the bourse said, adding that local investors remain exposed to fluctuations on those two days and can only address them on Sunday. "Aligning TASE's trading days to global standards would help improve the accessibility of the local market to active and passive international investors and international primary dealers, which is likely to enhance liquidity in the local market," it said. "The participation of global investors in the local capital market is crucial for both local companies and the Israeli economy." In addition to facilitating Israel's inclusion in the MSCI Europe index, the change would also mean an additional trading day for government bonds. "The potential overall benefits could increase international activity, enhance market liquidity and enable local institutional investors to increase their activity on the local capital market, encouraging other local participants to join in," the TASE said. Sign up here. https://www.reuters.com/world/middle-east/tel-aviv-stock-exchange-align-trading-week-with-global-bourses-2024-05-16/

2024-05-16 09:51

LONDON, May 16 (Reuters) - The Bank of England allotted 14.444 billion pounds ($18.30 billion) of one-week funds in its short-term repo operation on Thursday, the largest usage of the facility since it launched in October 2022, after previous records were set in recent weeks. The BoE uses the weekly repo to help keep money market rates close to its official Bank Rate while it takes reserves out of the financial system with its quantitative tightening (QT) programme. Under QT, the BoE is selling a large chunk of the government bonds that it bought over the past 15 years via its quantitative easing programme, and allowing others to mature. ($1 = 0.7894 pounds) Sign up here. https://www.reuters.com/world/uk/bank-england-allots-record-amount-short-term-repo-operation-2024-05-16/