2024-05-14 04:38

A look at the day ahead in European and global markets from Tom Westbrook Stocks near record highs and Bill Hwang and Roaring Kitty in the headlines lend this week an air of deja vu ahead of U.S. inflation data. British labour numbers, German sentiment, U.S. producer prices, an appearance from Jerome Powell and earnings releases due through Tuesday take a back seat to Wednesday's CPI figure. As in 2021, it's expected to begin with a 3 and markets are trying to guess whether signs of inflation picking up were a blip or a trend. A downside surprise is likely to loosen the shackles on stock rallies in Hong Kong, London and New York. Britain's FTSE (.FTSE) New Tab, opens new tab already stands by record highs, having touched that peak only on Friday, as did Europe's STOXX 600 index (.STOXX) New Tab, opens new tab. The S&P 500 (.SPX) New Tab, opens new tab is close to topping March's record high. The Hang Seng (.HSI) New Tab, opens new tab has added 20% in a rally that is entering a fourth week. Recent Chinese economic data show some steadiness but investors have found encouragement on the policy front. Rumblings from the Politburo in the direction of property support, marketing plans for special bond sales and falling lending point to monetary policy reaching its limits and has fed expectations of spending to support the economy. Currency markets were largely marking time ahead of the CPI release with the dollar trading firmly and pushing the yen to its weakest since it was swinging wildly at the start of May, when traders reckoned Japanese authorities had intervened. GameStop (GME.N) New Tab, opens new tab and other so-called meme stocks soared Monday after flag bearer Roaring Kitty - real name Keith Gill - posted on X.com for the first time in three years, in perhaps a hint at the froth that could be unleashed if CPI undershoots. Key developments that could influence markets on Tuesday: Economics: German ZEW surveys, British wages, U.S. PPI Earnings: Bayer, Veolia, Vodafone, Alibaba Speeches: Fed's Powell, BoE's Pill Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-2024-05-14/

2024-05-14 02:01

TOKYO, May 14 (Reuters) - The Japanese government will closely work with the Bank of Japan on currency market matters to ensure there is no friction between their mutual policy objectives, finance minister Shunichi Suzuki said on Tuesday. "We'll closely monitor the currency and take all possible measures," Suzuki said, adding it is important for the exchange rate to move in a stable manner reflecting fundamentals. The finance minister played down the market's focus on a specific exchange rate level, giving little away about the suspected round of interventions by Tokyo when the yen slumped past 160-per-dollar late last month. The yen has since bounced solidly and was last fetching around 156.40. In a regular post-cabinet meeting press conference, Suzuki said the government is also watching interest rate movements closely. His comments were made in response to a query on the BOJ's unexpected reduction in the amount of Japanese government bonds it offered to buy in a regular purchase operation on Monday. From a general standpoint, it is also important to take action to "smooth out" excessive fluctuations in the foreign exchange market, the finance minister said. Sign up here. https://www.reuters.com/markets/currencies/japan-will-keep-close-communication-with-boj-forex-finance-minister-says-2024-05-14/

2024-05-14 01:39

RIO DE JANEIRO, May 13 (Reuters) - Brazilian state-run oil firm Petrobras (PETR4.SA) New Tab, opens new tab posted a 38% fall in its first-quarter net recurring profit from a year earlier on Monday, missing analysts' expectations on the result and its dividend, hit by weaker sales volumes. Net recurring profit fell to 23.9 billion reais ($4.63 billion) for the quarter ended in March, well below analysts' estimate of 30.2 billion reais, according to LSEG data. The firm approved a payment of 13.45 billion reais ($2.61 billion) in dividends and interest on equity to shareholders, amounting to around 1.04 reais per common and non-voting share. Citigroup analysts had predicted dividends of $3 billion. Petrobras said the result was mainly due to lower sales, a drop in oil prices and a narrower profit margin on diesel sales compared with last year's fourth quarter. The company also blamed the devaluing of the real in the period. The firm's adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) for the period shrank about 17% from the same period of 2023 to 60.04 billion reais. The LSEG poll expected a result of 67.92 billion reais. Revenue fell about 15%, to 117.7 billion reais on the same comparison, though the average Brent price was higher than a year earlier. Sales of oil, gas and derivatives amounted to 2.92 million barrels of oil equivalent per day, a 4.6% decrease year-on-year. The decline was due in part to an increase of biofuel in the mixture of fuel sold in the country, said the firm when it released its production figures last month. ($1 = 5.1570 reais) Sign up here. https://www.reuters.com/business/energy/brazils-petrobras-reports-38-drop-first-quarter-profit-2024-05-14/

2024-05-14 00:34

LIMA, May 13 (Reuters) - Peru's state-owned Petroperu oil company, which needs for $2.2 billion in imminent financial help, proposed on Monday that the government consider installing private management at the firm as the best way to overcome its cash crunch. The company, which forecasts millions of dollars in additional losses this year, said it had sent the proposal to President Dina Boluarte, describing its current financial condition as "extremely grave." Private management "is the best option to bring about the return of financial self-sufficiency," it said in a statement. Boluarte's office did not immediately respond to a request for comment. The unusual request comes at a time when Boluarte's government is carrying out a selection process for a new state-controlled board for the company, following several other management shake-ups at the troubled firm. Petroperu, which refines imported crude oil, has previously said it was evaluating an injection of private capital along with offering a minority stake in the company. In 2022, it lost its coveted investment grade rating from credit agencies due to a crisis after a $6.5 billion rehabilitation at its Talara refinery that was financed with bonds, loans plus government funds. Since then, Petroperu has received three capital injections from the government, the last one totaling $1.3 billion backed by loans and announced in February. After nearly three decades of not producing any crude oil domestically, Petroperu recently began to produce small amounts over three areas that were operated by private producers until they reverted to government control after the contracts expired last year. Sign up here. https://www.reuters.com/markets/commodities/perus-state-oil-firm-petroperu-seeks-private-management-overcome-cash-crisis-2024-05-14/

2024-05-14 00:20

WASHINGTON, May 13 (Reuters) - President Joe Biden signed a ban on Russian enriched uranium into law on Monday, the White House said, in the latest effort by Washington to disrupt President Vladimir Putin's invasion of Ukraine. The ban on imports of the fuel for nuclear power plants begins in about 90 days, although it allows the Department of Energy to issue waivers in case of supply concerns. Russia is the world's top supplier of enriched uranium, and about 24% of the enriched uranium used by U.S. nuclear power plants come from the country. The law also unlocks about $2.7 billion in funding in previous legislation to build out the U.S. uranium fuel industry. "Today, President Biden signed into law a historic series of actions that will strengthen our nation’s energy and economic security by reducing, and ultimately eliminating, our reliance on Russia for civilian nuclear power," Jake Sullivan, the national security adviser, said in a statement. Sullivan said the law "delivers on multilateral goals we have set with our allies and partners," including a pledge last December with Canada, France, Japan and the United Kingdom to collectively invest $4.2 billion to expand enrichment and conversion capacity of uranium. The waivers, if implemented by the Energy Department, allow all the Russian uranium imports the U.S. normally imports through 2027. Sign up here. https://www.reuters.com/world/biden-signs-ban-imports-russian-nuclear-reactor-fuel-into-law-2024-05-14/

2024-05-13 22:42

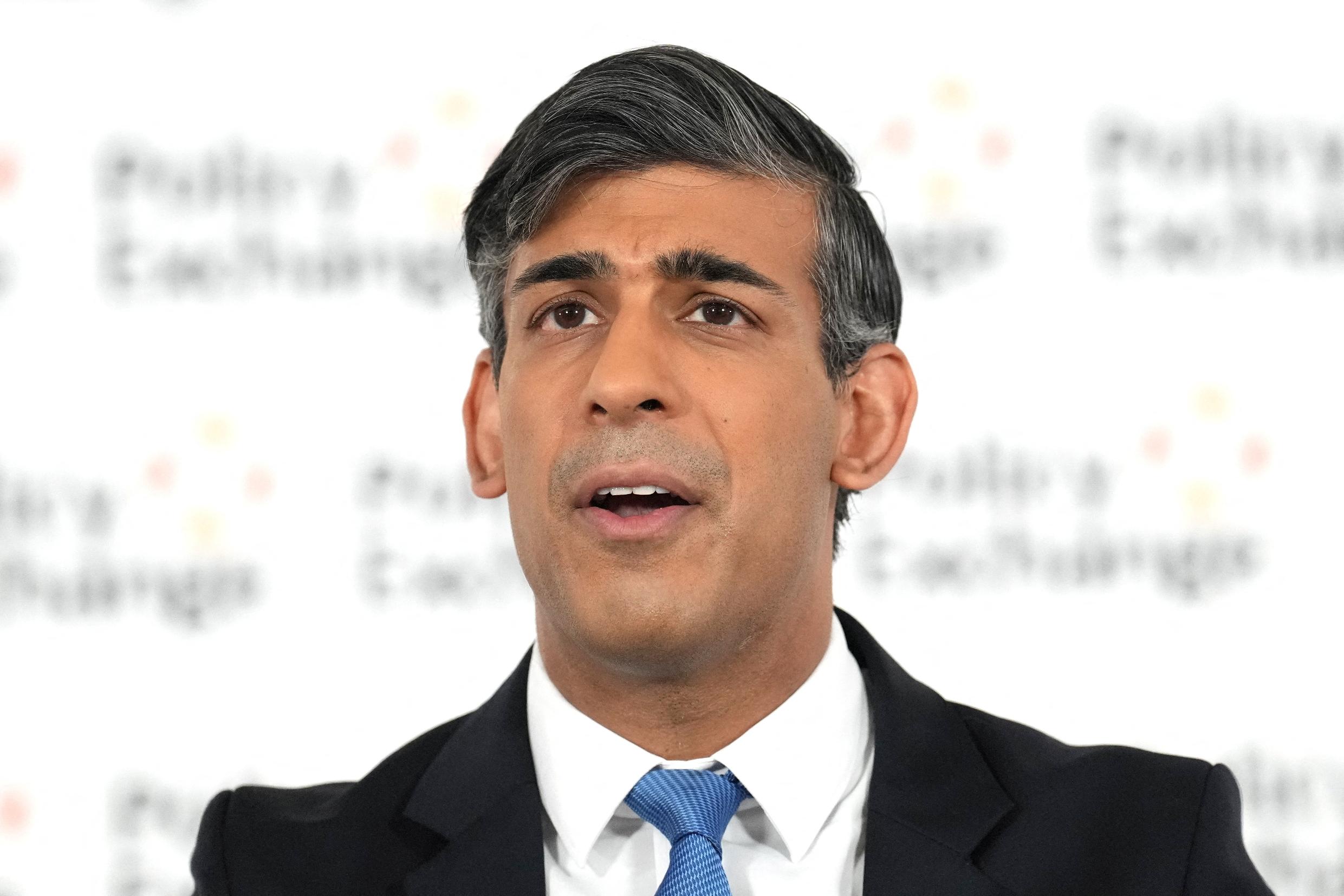

LONDON, May 13 (Reuters) - British Prime Minister Rishi Sunak will set out his plans on Tuesday to improve food security and to cut reliance on imports from other countries. The government will also publish a new annual UK Food Security Index to track the impacts of external factors, such as the Russia-Ukraine war or extreme weather events. WHY IS IT IMPORTANT? Britain is expected to hold a national election later in the year, which Sunak's Conservative Party is predicted to lose heavily to the opposition Labour Party. Like many other countries, it has been hit by surging inflation and a cost of living crisis, stoked in part by the war between Russia and Ukraine hitting grain exports. Britain's ability to feed itself is set to be reduced by nearly a 10th this year as farmers across the country reel from one of the wettest winters on record, non-profit think tank ECIU said on Monday. KEY QUOTES "This package of support will help farmers produce more British food, delivers on our long-term plan to invest in our rural communities, and ensures the very best of our homegrown products end up on our plates," Sunak said. "I know for many farmers, the impact of adverse weather in recent months has made working the land even harder, but my message is clear, our support for you is unwavering." BY THE NUMBERS Excerpts of the Food Security Index released ahead of its full publication show the country produced about 17% of the fruit and 55% of the vegetables consumed by British households. Sign up here. https://www.reuters.com/world/uk/rishi-sunak-lays-out-uk-food-security-plan-withstand-climate-war-2024-05-13/