2024-05-10 20:58

SAO PAULO, May 10 (Reuters) - Brazil's orange production is expected to hit its lowest level in more than three decades in 2024/25, research center Fundecitrus said on Friday, as farmers grapple with adverse climate conditions and a citrus disease known as greening. WHY IT'S IMPORTANT Brazil is the world's largest producer and exporter of orange juice, whose global stocks have been hovering around historic lows after four consecutive seasons of small crops in the South American country. Orange juice prices were pushed to near record highs last year on the reduced stocks. BY THE NUMBERS Brazil's main orange producing areas in the states of Sao Paulo and Minas Gerais are set to harvest 232.38 million 40.8-kg boxes this year, Fundecitrus said, down 24.36% from the previous cycle. That would be the lowest since 1988/89, when production stood at 214 million boxes, according to figures compiled both by Fundecitrus and orange juice exporters association CitrusBR. KEY QUOTES "The number surprised us. Climate effects have strongly affected the industry," Fundecitrus head Juliano Ayres said at an event. "For citrus production to remain competitive we must defeat greening - and we will," he added, referring to the disease, which results in stunted fruit. It's caused by bacteria carried in psyllids, or jumping plant lice. Sign up here. https://www.reuters.com/markets/commodities/brazils-orange-output-hit-over-30-year-low-disease-weather-2024-05-10/

2024-05-10 20:30

WASHINGTON, May 10 (Reuters) - The Federal Energy Regulatory Commission (FERC) is expected on Monday to issue a final rule to address the crunch in U.S. electricity transmission as the grid struggles to connect enormous amounts of clean power while demand surges. The long-awaited rule will attempt to ensure that a dozen fragmented U.S. regions adopt long-term plans to bring more transmission online. It will seek to coordinate state and local regulations and utility plans on ways to split costs among states for the build-out. President Joe Biden's administration has a goal of a carbon-free power sector by 2035. To meet that, the country needs to more than double regional transmission capacity and expand interregional transmission capacity more than fivefold, a U.S. Department of Energy study said in November. The U.S. also needs to reverse a steady decline in transmission investments, the study said. WHY IS THIS RULE IMPORTANT? Boosted by tax incentives in Biden's 2022 Inflation Reduction Act, the queue of power generation projects awaiting a connection to the electric grid is currently around 2,600 gigawatts, twice the amount of generation of the current U.S. power plant fleet. Princeton University researchers have found that the rate of transmission construction must double that of the last decade or at least 80% of the potential emissions reductions enabled by the IRA will be lost. Meanwhile, power demand is surging. "The situation at hand is a spike in demand, driven not only by the electrification of key industries, such as mobility, but by technology advancements like AI (artificial intelligence) and the accelerated development of data centers," said Allie Kelly, executive director of The Ray, a nonprofit focused on sustainable infrastructure. The U.S. transmission is also susceptible to increasingly intense storms and heatwaves, making investment in a more durable system important. WHAT WOULD THE RULE DO? The rule, as initially proposed, would force states, regional transmission organizations and utilities to work together on 20-year plans for approving new transmission projects. It would also likely require planners to establish a clear process for how transmission lines are selected and paid for by consumers across states. Some have called for the rule to define who the beneficiaries of a transmission project would be. Some regional organizations like the Midcontinent Independent System Operator in the Midwestern U.S. have already begun transmission planning and started new projects while others lag. The rule is expected to force all regions to take steps to ensure they can meet U.S. transmission needs. "The goal is to stimulate more transmission investment from the utility industry and push them to consider long-term changes in terms of clean energy and demand growth," said Ari Peskoe, director of the Electricity Law Initiative at Harvard Law School. WHO IS RESISTANT TO THESE CHANGES? Some utilities and Republican states have opposed the idea of FERC dictating cost-sharing for large projects and that some states would need to pay for transmission for another state’s clean energy policies. WHAT ELSE IS THE ADMINISTRATION DOING ON TRANSMISSION? The DOE has recently unveiled new measures aimed at boosting U.S. transmission capacity. Last month, it said it will upgrade 100,000 miles (160,930 km) of transmission lines over the next five years and the administration finalized a rule aimed at making federal permitting of new transmission lines more efficient. Energy Secretary Jennifer Granholm said the DOE would also direct over $330 million to support a new 285-mile (460 km) Idaho-Nevada transmission line, which will bring 2,000 Megawatts of transmission capacity to the West. This week, the DOE designated 10 regions that lack access to electricity where it will fast track permitting to expand transmission lines and direct billions of dollars in federal loans. Sign up here. https://www.reuters.com/world/us/us-agency-unveil-plan-ease-power-transmission-crunch-2024-05-10/

2024-05-10 20:27

Geely-owned Zeekr valued at $6.8 bln at open First major Chinese listing in the US since 2021 Chinese EV makers looking to boost exports Shares of EV makers have been hit hard of late May 10 (Reuters) - Zeekr's (ZK.N) New Tab, opens new tab shares rose almost 35% above their initial public offering price on Friday in a strong start for the electric-vehicle maker, the first major U.S. market debut by a China-based company since 2021. The company successfully pulled off its U.S. flotation as it seeks to stand out among a crowded group of Chinese electric-vehicle makers competing for a bigger share of the European market. Its first day of trading ironically comes at a time when U.S. President Joe Biden's administration plans on boosting tariffs on Chinese vehicle imports to the United States. "The capital markets in New York are very favorable for new energy vehicles. Zeekr is a global brand, and choosing to list in New York further demonstrates its global capabilities," said CEO Conghui An, who is also the president of Zeekr's parent company, Geely Holding Group. Zeekr is the premium brand of Chinese automaker Geely, which also owns Sweden's Volvo Cars and the UK's Lotus. It was formed in 2021 to tap into growing Chinese demand for premium models and has since delivered nearly 200,000 cars, mostly in China, according to its IPO filing. Fierce competition in China among domestic rivals and with Tesla (TSLA.O) New Tab, opens new tab has eroded EV makers' profits, prompting them to look at other markets for expansion. The debut gave Zeekr a fully diluted valuation of $6.8 billion, or about half the $13 billion it fetched after a funding round last year. Chinese automakers BYD (002594.SZ) New Tab, opens new tab, SAIC (600104.SS) New Tab, opens new tab and Great Wall Motor (601633.SS) New Tab, opens new tab are all targeting Europe, rolling out electric models as they seek to compete with legacy European automakers on their turf. Chinese EV sales in Europe have soared in recent years. Zeekr's CEO said Geely aspires to become the Volkswagen Group (VOWG.DE) New Tab, opens new tab of this era of new energy vehicles, comparing the company to Europe's top automaker. Within Geely, Zeekr's mission is to address the luxury EV market segment, he said. Zeekr's shares traded as high as $29.36 after opening at $26, compared with its IPO price of $21. The stock closed at $28.26, up 34.6%. EV CHALLENGES Shares of EV companies in the United States have lost substantial value in recent months, including Tesla, the leading U.S. EV maker, which has dropped 30% this year. Rivian Automotive (RIVN.O) New Tab, opens new tab has lost 85% since its IPO in November 2021, while Lucid Group (LCID.O) New Tab, opens new tab is left with a fourth of what it fetched when it signed a deal with a blank-check firm earlier that year. Zeekr, however, upsized its IPO, indicating strong demand from investors. It sold 21 million American depositary shares to raise $441 million. It had earlier planned to sell 17.5 million ADSs at a price between $18 and $21 apiece. Since the start of the year, the company's deliveries have overtaken its nearest competitors. Zeekr delivered 49,148 vehicles in the first four months ended April 30, while Xpeng delivered 31,214 units and Nio delivered 45,673 cars during the same period, according to regulatory filings and press releases. The share flotation comes during rising tension between the world's two biggest economies over trade, intellectual property, Taiwan and China's stance on the Russia-Ukraine war. The discount to last year's valuation could help draw in investors, said Dan Coatsworth, investment analyst at AJ Bell. "They're able to buy into a growing business at a fraction of last year's valuation. Everyone loves a perceived bargain." The number of Chinese companies that have pursued stock market flotations in the U.S. in the past few years has dropped, after Chinese ride-hailing giant Didi Global was forced to delist its shares following a backlash from Chinese regulators. Beijing has since softened its stance and released a set of rules last year to revive such listings, after the U.S. accounting watchdog and China resolved a longstanding audit dispute in December 2022. Sign up here. https://www.reuters.com/business/autos-transportation/chinas-zeekr-set-debut-nyse-after-upsized-ipo-2024-05-10/

2024-05-10 20:26

BEIJING, May 10 (Reuters) - Erratic rainfall in China's southwest is frustrating a multibillion-dollar push to green an aluminium industry that accounts for almost 60% of global output and, by some estimates, emits more carbon dioxide than Australia. Lured by official promises of cheap hydropower, China Hongqiao Group (1378.HK) New Tab, opens new tab and a handful of other coal-reliant smelters several years ago began moving 6.56 million metric tons of capacity - about 15% of China's total - from the northern rust belt to the mountainous and ethnically diverse Yunnan province, known for tea, coffee and wild mushrooms. The opportunity to cut electricity bills and help the world's top polluter tackle global warming seemed like a safe bet. But as Yunnan's rivers and reservoirs dwindled amid poor rainfall, which some experts attribute to climate change, so did the reliability of electricity. Reuters interviews with almost two dozen industry figures and analysts, as well as company filings and official documents, found insufficient hydropower has meant that only a little over half of the planned aluminium capacity shift has materialised. Some smelters are slowing or scaling back their already-delayed plans and others are seeking alternative locations. "The power cuts in the past two years have made it clear that Yunnan can't be sustained as a major producing region," said one Yunnan industry figure who, as with others, spoke on the condition of anonymity due to the issue's sensitivity. Despite growing demand for low-carbon products and strong industry profits in recent years, eight employees at four Yunnan smelters said they have had to cut production by 10% to 40%. Muyi Yang, an adjunct fellow at the University of Technology Sydney who researches energy policy, said any supply disruptions would delay China's broader energy transition because aluminium is used in many clean technologies. In addition to hindering China's climate goals, the hydro crunch has caused volatility in global aluminium prices and imperilled the potential for producers to cash in on demand for "green" metal, according to the analysts and industry sources. Hongqiao's plan to move almost 4 million tons of production from Shandong province to Yunnan involved building two plants near the Vietnam border, in Wenshan and Honghe prefectures, each with capacity of roughly 2 million tons. The 17 billion yuan ($2.35 billion) Wenshan factory opened in 2020 and was intended to reach full capacity in August 2022, the director of the industrial park where it is located told state media in 2021. But unstable hydropower has prevented that, two industry figures said. At Honghe, production was due to begin in March 2023, according to a December 2021 overview of projects published by the Yunnan Department of Industry and Information Technology. Yet, initial production capacity of just 500,000 tons will be ready in the middle of this year, according to a person familiar with the matter. Chen Xinlin, a senior metals and mining consultant at Wood Mackenzie, said Honghe's capacity may not be commissioned this year due to the "hydropower bottleneck". Hongqiao and its parent, Shandong Weiqiao Pioneering Group, did not respond to Reuters questions about the matter, and the Yunnan government declined to comment. China's environment and industry ministries, and the top planning agency, the National Development and Reform Commission (NDRC), did not respond to requests for comment. GREEN DREAMS Aluminium accounts for about 3% of the world's direct industrial carbon dioxide, according to the International Energy Agency. For China, that meant cleaning up the sector would be crucial to its goals, formalised in 2020, of ensuring the country's carbon emissions peak by the end of this decade and reach net zero by 2060. Part of the allure of aluminium made from hydropower or other clean energy is that producers may be able to charge premiums as global manufacturers raise their carbon standards for materials, though only a tiny proportion of green aluminium currently attracts such a premium. Besides Hongqiao, producers including industry leader Aluminium Corporation of China (601600.SS) New Tab, opens new tab, known as Chinalco, were drawn to Yunnan by provincial authorities' offer of discounted greener power at 0.25 yuan per kilowatt hour (kWh), less than half of what they were paying in northern China. Chinalco announced in 2018 that it would move 1.2 million tons to Yunnan, and suppliers including anode producer Sunstone Development (603612.SS) New Tab, opens new tab followed. Neither responded to requests for comment. The new smelters brought in staff from China's north, with factory canteens serving braised noodles and shaobing, a flatbread stuffed with meat, to give workers a taste of home. The plants produce silver-coloured ingots cast from molten aluminium into square-shaped bundles. These are collected by trucks and delivered to factories for processing into goods such as car parts, window frames and beer cans. A 2022 World Economic Forum report anticipated New Tab, opens new tab that 2 to 3 million tons of primary aluminium production would move annually to China's southwest, mostly Yunnan, from 2020 to 2025, tapering to 90,000 to 100,000 tons per year by 2060. The pace has been much slower. Officials had been aware that power was a potential constraint. "Solving power supply issues is the first thing Wenshan needs to work on to develop a green aluminium industry," He Chun, deputy bureau chief of the Wenshan Energy Bureau, told state media in 2021. But rains proved uncooperative. Yunnan's Water Resources Department said in January that severe drought had persisted for a fifth year, leading to reduced hydropower generation. On April 16, Wenshan officials warned of extreme drought conditions in Yanshan county, where several aluminium plants are located, including a Hongqiao smelter. Average rainfall so far this year is down 37%, according to the Wenshan government. Adding to the smelters' dilemma, the NDRC in 2021 banned discounted power rates for aluminium producers. 'MAY THERE BE MORE RAIN' In interviews with Reuters, 10 of the industry figures at smelters that moved to Yunnan described higher-than-expected electricity rates and periodic orders from the energy provider, China Southern Power Grid, to shut down on short notice. Electricity rates had risen to 0.47 to 0.50 yuan per kWh, seven of these people said, still below what smelters paid in the north. China Southern did not respond to a faxed request for comment. Producers including Chinalco-owned Yunnan Aluminium (000807.SZ) New Tab, opens new tab and Henan Shenhuo Coal & Power (000933.SZ) New Tab, opens new tab, neither of which responded to requests for comment, have cited Yunnan's power-supply problems in financial filings. In its 2023 annual report, Shenhuo warned that further increases in electricity rates or supply disruptions would create uncertainty for its operations. Yunnan has sought to free up electricity by curbing transfers to other provinces. The provincial government has also said it will accelerate construction of wind and solar power, as well as more hydropower stations, and bolster its capacity for thermal power, which mainly comes from coal. But frustrated smelting-industry figures talk of looking elsewhere. "No one dares to stick with their relocation plan" because of Yunnan's power issues, said a manager at a Yunnan smelter. Analysts expect more capacity to shift to northwestern China, where there is more access to power, including from coal that can assure stable supply for smelters. In May 2023, Weiqiao's chairman Zhang Bo announced plans with Shandong Chuangxin Group to build a green aluminium base in Inner Mongolia, powered by wind and solar, according to a statement on the regional government's website. For now, Yunnan smelter operators are looking to the skies. "May there be more rain, that's the best thing we can wish for," said one smelter employee. ($1 = 7.2448 Chinese yuan renminbi) Sign up here. https://www.reuters.com/world/china/chinas-push-greener-aluminium-hit-by-erratic-rains-power-cuts-2024-05-10/

2024-05-10 20:04

CANOAS, Brazil, May 10 (Reuters) - Rains returned to Rio Grande do Sul on Friday as the death toll from historic floods in Brazil's southernmost state reached 126, according to local authorities, climbing from 113 earlier in the day. Storms and floods battering the state, home to some 10.9 million people, have also displaced almost 340,000 while another 141 people are still unaccounted for, civil defense said. Heavy rains have caused several rivers and lakes in the region to hit their highest levels ever, while floods blocked streets and disrupted logistics, triggering a shortage of essential goods in certain areas. Almost two million people have been affected so far, civil defense said in their latest update on Friday evening. Weather forecaster MetSul said that most Rio Grande do Sul cities should experience rains on Friday, adding there is a high risk of storms. They should persist until Monday, it added in a statement. The state is at a geographical meeting point between tropical and polar atmospheres, which has created a weather pattern with periods of intense rains and others of drought. Local scientists believe the pattern has been intensifying due to climate change. In Canoas, one of most affected cities near state capital Porto Alegre, over 6,000 people were staying in a college gymnasium turned into shelter. Aparecida de Fatima Fagundes said she had been struggling to sleep there as she could not stop thinking about "the worst day" of her life. "I keep remembering people saying 'help', 'help'," she said. "It was horrible." State government said more than 385,000 people had no water services, while some 20 cities were out of telecom services. On Thursday, the federal government announced a package of aid measures to help Rio Grande do Sul, which included bringing forward payment of social benefits and providing cheaper credit to farmers and companies. Governor Eduardo Leite said earlier this week that initial calculations indicate that Rio Grande do Sul would need at least 19 billion reais ($3.68 billion) to rebuild from the damage, which has extended into farm areas around the capital. Sign up here. https://www.reuters.com/world/americas/death-toll-floods-southern-brazil-hits-113-2024-05-10/

2024-05-10 19:13

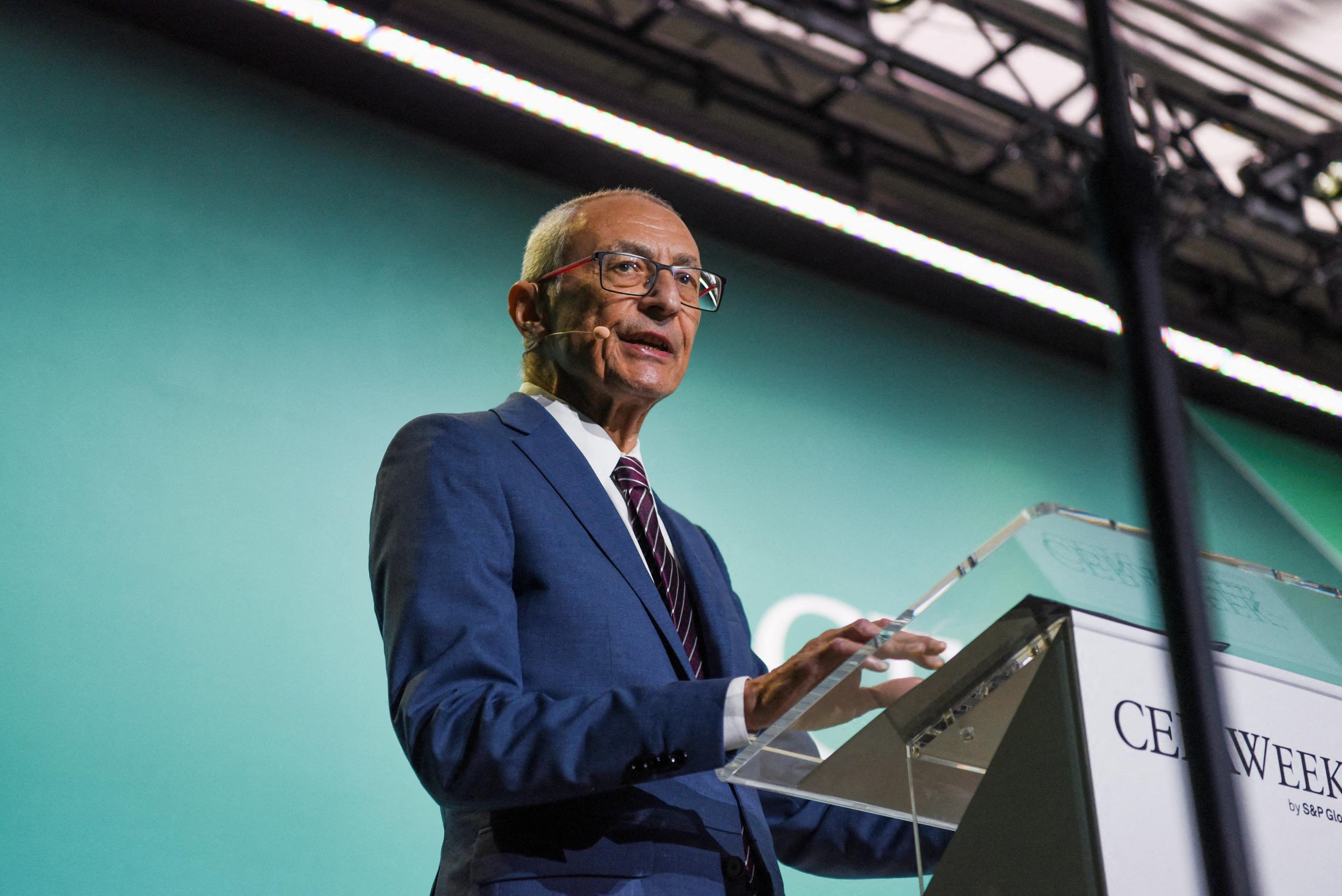

WASHINGTON, May 10 (Reuters) - The United States and China discussed Chinese overcapacity in solar and battery manufacturing, steel production and coal power during two days of bilateral meetings on climate change, senior State Department officials said on Friday. Top U.S. climate change diplomat John Podesta met Chinese counterpart Liu Zhenmin for their first formal bilateral meetings on May 8 and 9 in Washington, where they discussed how to work together ahead of the COP29 climate summit in Azerbaijan, as well as how to cooperate on methane reduction and deforestation, among other issues. A senior State Department official said during the meetings, the U.S. made clear that China's flooding of global markets with cheap solar panels and coal undercuts clean energy manufacturing in other countries. WHY IT’S IMPORTANT Liu's U.S. visit came as solar companies filed new trade petitions, asking the Biden administration to levy penalties on solar components from Chinese factories in four southeast Asian countries, citing unfair competition. The United States is also reportedly weighing setting tariffs on Chinese electric vehicles. Liu has warned of U.S. trade protectionism in recent public speeches. "The countercurrents of protectionism and unilateralism have further extended the climate change governance gap," he said in a speech in China in April, adding that constraints on Chinese solar panels and other technology would increase global costs of the clean energy transition. CONTEXT This was the first formal meeting between the world's two biggest greenhouse gas emitters since the COP28 summit ended in Dubai in December. The meeting was also the first glimpse of the tone of the bilateral relationship on climate between the new envoys. Their predecessors, former Secretary of State John Kerry and Chinese climate envoy Xie Zhenhua, had always been friendly, even during times of broader political tensions. The two had played a key role in brokering the final outcome at COP28, agreeing to bilateral language that paved the way for broad acceptance of an agreement by all countries to transition away from fossil fuels. Another senior State Department official said that the tone of the talks continued to be cordial and said the two delegations met for dinner at Podesta's home on Wednesday. WHAT'S NEXT The two countries made a strong commitment to complete their new national climate strategies under the Paris Agreement by February 2025 and adopt measures that are aligned with the goal included in the Paris Agreement to hold global warming to within 1.5 C above pre-industrial temperatures. The two countries said they would host a high-level meeting on sub-national cooperation on May 29-30 in California and would host a joint summit on methane and other non-CO2 gases at COP29. Sign up here. https://www.reuters.com/sustainability/climate-energy/us-discussed-overcapacity-chinese-solar-manufacturing-coal-climate-talks-2024-05-10/