2024-05-10 11:47

MUMBAI, May 10 (Reuters) - India's foreign exchange reserves (INFXR=ECI) New Tab, opens new tab halted a three-week losing streak and stood at $641.59 billion as of May 3, coming off seven-week lows, data from the central bank showed on Friday. The reserves rose by $3.7 billion in the reporting week, the biggest gain in nearly two months. They had fallen by a total of $10.6 billion in the previous three weeks. The Reserve Bank of India (RBI) intervenes in the foreign exchange market to curb excess volatility in the rupee. Changes in foreign currency assets are caused by the RBI's intervention as well as the appreciation or depreciation of foreign assets held in the reserves. Foreign exchange reserves also include India's reserve tranche position in the International Monetary Fund. For the week to which the foreign exchange data pertains, the rupee traded in a range of 83.34 to 83.5250 against the dollar and had logged marginal weekly losses. The currency settled at 83.50 on Friday and declined nearly 0.1% week-on-week. FOREIGN EXCHANGE RESERVES (in million U.S. dollars) --------------------------------------------------------- May 03 April 26 2024 2024 --------------------------------------------------------- Foreign currency assets 564,161 559,701 Gold 54,880 55,533 SDRs 18,051 18,048 Reserve Tranche Position 4,499 4,639 ---------------------------------------------------------- Total 641,590 637,922 ---------------------------------------------------------- Source text: (https://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx New Tab, opens new tab) Sign up here. https://www.reuters.com/world/india/indias-foreign-exchange-reserves-come-off-seven-week-lows-2024-05-10/

2024-05-10 11:43

May 10 (Reuters) - Stock markets in United Arab Emirates closed lower on Friday, as investors turned cautious after the latest round of negotiations between Israel and Hamas failed to achieve the ceasefire and fighting escalated in the southern most city of Gaza. Israeli tanks captured the main road dividing the eastern and western halves of Rafah on Friday, effectively encircling the entire eastern side of the city in the southern Gaza Strip. Abu Dhabi's benchmark index (.FTFADGI) New Tab, opens new tab dropped 0.3%, extending losses to second session, after Abu Dhabi's largest listed firm International Holding Company (IHC.AD) New Tab, opens new tab shed 0.6% and real estate giant Aldar Properties (ALDAR.AD) New Tab, opens new tab dropped 1.6%. Dubai's main index (.DFMGI) New Tab, opens new tab edged 0.2% down, pressured by losses in real estate sector, as blue-chip developer Emaar Properties (EMAR.DU) New Tab, opens new tab slipped 0.9%, while its construction arm Emaar Development (EMAARDEV.DU) New Tab, opens new tab decreased 1.4%. Among the losers, foreign currency exchange firm Al Ansari Financial Services (ALANSARI.DU) New Tab, opens new tab slumped 1.9% after the firm reported 26% decline in its first-quarter net profit to 98.7 million dirhams ($26.88 million) However, Dubai index recorded 0.7% weekly gains, ending five week of losing streak, while Abu Dhabi posted 0.6% increase after three week of losses, according to LSEG data. Oil prices - a key catalyst for the Gulf's financial market- drifted 0.6% higher to %84.39 a barrel after data this week signalled growing demand in the U.S. and China, the world's two largest crude users. ($1 = 3.6724 UAE dirham) Sign up here. https://www.reuters.com/markets/currencies/uae-markets-fall-escalating-conflict-region-2024-05-10/

2024-05-10 11:40

MADRID, May 10 (Reuters) - The European Union needs to offer more incentives if it wants industry in the bloc to navigate the green energy transition while being competitive with global rivals, the chairman of Spanish oil company Repsol (REP.MC) New Tab, opens new tab said on Friday. "We need an efficient energy transition which doesn't harm European industry," Antonio Brufau told shareholders at the company's annual general meeting. The oil major's chaimran said that Europe needed "more carrots, less stick", pointing to policies introduced in the United States under the Inflation Reduction Act as a positive example. Brufau also criticised the "electrification obsession" in Europe, calling for a willingness to embrace all technologies able to reduce emissions, such as renewable gases. The United States is a key market for Repsol, which is targeting more deals in the country. Sign up here. https://www.reuters.com/sustainability/climate-energy/european-industry-needs-more-green-incentives-says-repsol-chairman-2024-05-10/

2024-05-10 11:38

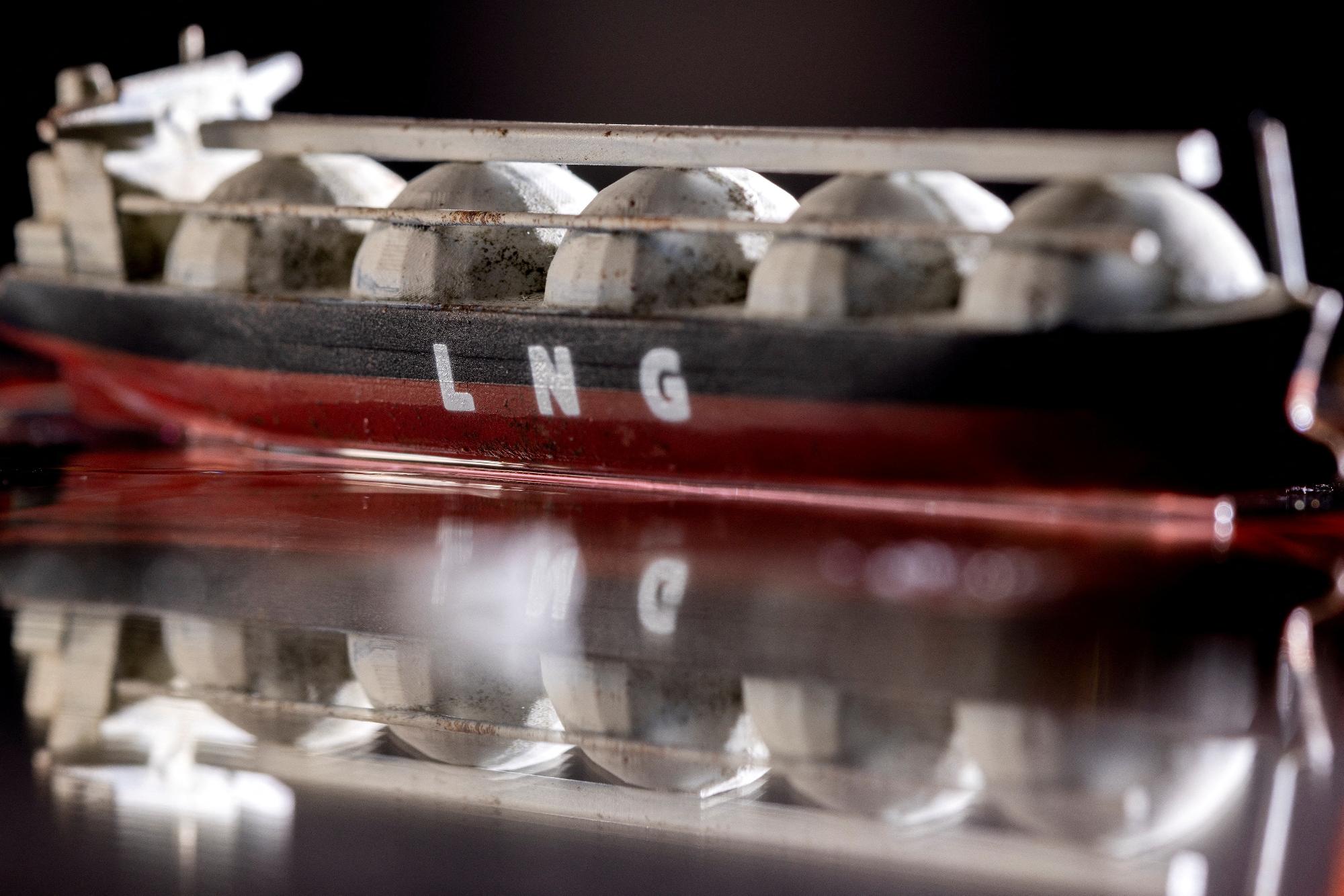

LONDON, May 10 (Reuters) - Asian spot liquefied natural gas prices rose this week on stronger demand amid high temperatures in north and south China, pushing European buyers to bid at relatively narrow discounts to attract sellers. The average LNG price for June delivery into north-east Asia rose to $10.50 per million British thermal units (mmBtu), from $10.40/mmBtu in the previous week, industry sources estimated. "We have seen Asian and European prices rise higher, mostly following news of the Gorgon LNG outage," said Ryhana Rasidi, LNG analyst at data analytics firm Kpler. "However, we estimate the impact of the outage to be limited in the short term and downward pressure is expected on prices due to the low-demand shoulder season in Europe and Northeast Asia, where gas/LNG stocks remain sufficient for now," she said. Chevron Australia said last week it was working to resume full production at its Gorgon gas facility after a mechanical fault caused one LNG production train to go offline. Analysts expect the affected production train to be offline for up to five weeks. However, South Korean and Japanese buyers seemed content to hold back from the spot market and rely on high terminal inventories to meet an upsurge in domestic demand, said Samuel Good, head of LNG pricing at commodity pricing agency Argus. In the United States, Good said production has risen at Freeport LNG export terminal, with feedgas supply levels in recent days suggesting the equivalent of two trains at the three-train facility were operating at near-capacity. "Nominated supply for Thursday was greater than this, implying that three trains were already — or close to being — operational though not all at capacity. That said, this has been partially offset by the start of maintenance at the country's Cameron terminal, which is understood to be planned downtime," he added. In Europe, gas storage facilities were last seen nearly 63% full, leaving the continent in a strong position during the net injection season. S&P Global Commodity Insights assessed its daily North West Europe LNG Marker (NWM) price benchmark for cargoes delivered in June on an ex-ship (DES) basis at $9.587/mmBtu on May 9, a $0.19/mmBtu discount to the June gas price at the Dutch TTF hub. Argus assessed the June delivery price at $9.60/mmBtu, while Spark Commodities assessed it at $9.548/mmBtu. LNG freight rates lacked direction again this week with rates in both basins drifting slightly lower - the Atlantic spot rate estimated at $42,000/day on Friday and the Pacific spot rate at $45,750/day, said Henry Bennett, chief operating officer at Spark Commodities. Argus' Good said continued low spot charter rates, and a substantial list of open carriers on offer in the prompt market, have cut the opportunity cost for subletting spare shipping, with delivery to Asia instead of Europe generally offering the potential to such firms to recoup at least some of their fleet costs. Sign up here. https://www.reuters.com/business/energy/asian-spot-lng-prices-rise-signs-stronger-demand-2024-05-10/

2024-05-10 11:35

May 10 (Reuters) - Pipeline operator Enbridge (ENB.TO) New Tab, opens new tab beat market estimates for first-quarter profit on Friday, as demand remained strong amid an uptick in oil production across North America. Improvements in technology have driven rapid growth in U.S. oil production over the past few years, benefiting pipeline operators such as Enbridge. The company recorded strong demand for its Flanagan South Pipeline and the Enbridge Ingleside Energy Center, the largest crude oil storage and export terminal by volume in the United States. Its U.S.-listed shares rose 1.1% premarket. Adjusted core profit at its liquids pipelines segment rose to C$2.46 billion ($1.80 billion) from C$2.34 billion last year. Transport volumes at Enbridge's Mainline - North America's biggest oil pipeline network - rose marginally from last year, helped by a surge in Canadian oil sands production and a delay in the start-up of a government-owned rival pipeline to the second quarter. "In Liquids, we saw high utilization across our systems including another quarter of strong Mainline performance," said CEO Greg Ebel. The company, which transports nearly a fifth of the natural gas consumed in the U.S., said adjusted core earnings from its gas transmission segment rose 7.1% to C$1.27 billion. On an adjusted basis, Enbridge reported a quarterly profit of 92 Canadian cents per share for the three months ended March 31, compared with analysts' average estimate of 81 Canadian cents per share, according to LSEG data. ($1 = 1.3680 Canadian dollars) Sign up here. https://www.reuters.com/business/energy/enbridge-beats-first-quarter-profit-estimates-2024-05-10/

2024-05-10 11:29

A look at the day ahead in U.S. and global markets from Mike Dolan World stock indexes (.MIWD00000PUS) New Tab, opens new tab have shaken off a month of doubts to come back within 0.5% of record highs on signs of a loosening U.S. labor market, falling European interest rates and another Hong Kong (.HSI) New Tab, opens new tab surge. Wall Street's wobble appears to be over, with the S&P 500 (.SPX) New Tab, opens new tab jumping on Thursday to its highest close since April 1 on an unexpected jump in weekly jobless claims that re-stoked Federal Reserve easing expectations. And futures extended those gains ahead of Friday's bell. The returning calm was evident in subsiding volatility gauges, with the VIX 'fear index' (.VIX) New Tab, opens new tab closing on Thursday at its lowest since January and the MOVE index (.MOVE) New Tab, opens new tab of Treasury volatility ebbing to near 6-week lows too. With Fed futures now 90% priced for a quarter-point U.S. interest rate cut by September and a decent 30-year Treasury auction completing a heavy week of new debt sales without much trouble, Treasury yields edged lower. San Francisco Fed chief Mary Daly on Thursday claimed she was still in "wait-and-see mode" but added: "We've had three stubborn months of data, but I still see monetary policy is working ... I do think that we're seeing, in a really positive way, disinflation." The global picture was also lifted by Thursday's indication from the Bank of England that its policymakers were shifting tack to join the European Central Bank in a likely first rate cut as soon as next month - adding to cuts already seen in Switzerland and Sweden this year. With money markets now seeing a 50-50 chance of a June BoE move, 10-year British government bond yields fell to their lowest level in a month on Friday. Encouraging for both the ECB and BoE is the fact that diverging from the Fed trajectory has not significantly weakened either the euro or sterling in the process. Minutes from the ECB's most recent meeting will be watched closely later today. The pan-European STOXX 600 (.STOXX) New Tab, opens new tab climbed almost 1% on Friday to an all-time high, with Germany's benchmark (.GDAXI) New Tab, opens new tab also touching a new record. The macro picture is far from crystal clear, however. Data released on Friday showed Britain's first-quarter economic growth bounced back stronger than many had expected and the Atlanta Fed's closely-watched U.S. real-time GDP estimate is tracking growth back above 4% - despite economic surprise indexes at their most negative in more than a year. But if disinflation does resume, the punchy growth signals and above-forecast first-quarter earnings season may well provide the perfect backdrop for stock markets. The critical U.S. consumer price inflation report is due next week. Elsewhere, Asia bourses were also buoyed by the global picture. Hong Kong's Hang Seng (.HSI) New Tab, opens new tab surged more than 2% to 9-month highs and is now tracking year-to-date gains of 11% - ahead of equivalent gains in the S&P500. Bloomberg News reported China is considering a proposal to exempt individual investors from paying dividend taxes on Hong Kong stocks bought via the Stock Connect system. Mainland Chinese shares (.CSI300) New Tab, opens new tab were more subdued despite this week's upbeat April trade numbers, with deteriorating bilateral relations with Washington proving a drag. U.S. President Joe Biden's administration on Thursday added 37 Chinese entities to a trade restriction list, including some for allegedly supporting the spy balloon that flew over the United States last year. And Biden is also set to announce new China tariffs as soon as next week targeting strategic sectors, including electric vehicles, a source told Reuters. What's more, the proportion of European firms that rank China as a top investment destination has hit a record low, a European business lobby group said on Friday. Key diary items that may provide direction to U.S. markets later on Friday: * European Central Bank meeting minutes * University of Michigan April household survey, U.S. April Federal Budget; Canada April employment report * Federal Reserve Board Governor Michelle Bowman, Fed Vice Chair for Supervision Michael Barr, Dallas Fed President Lorie Logan, Minneapolis Fed chief Neel Kashkari all speak; Bank of England chief economist Huw Pill and BoE policymaker Swati Dhingra speak Sign up here. https://www.reuters.com/markets/us/global-markets-view-usa-2024-05-10/