2024-05-10 09:46

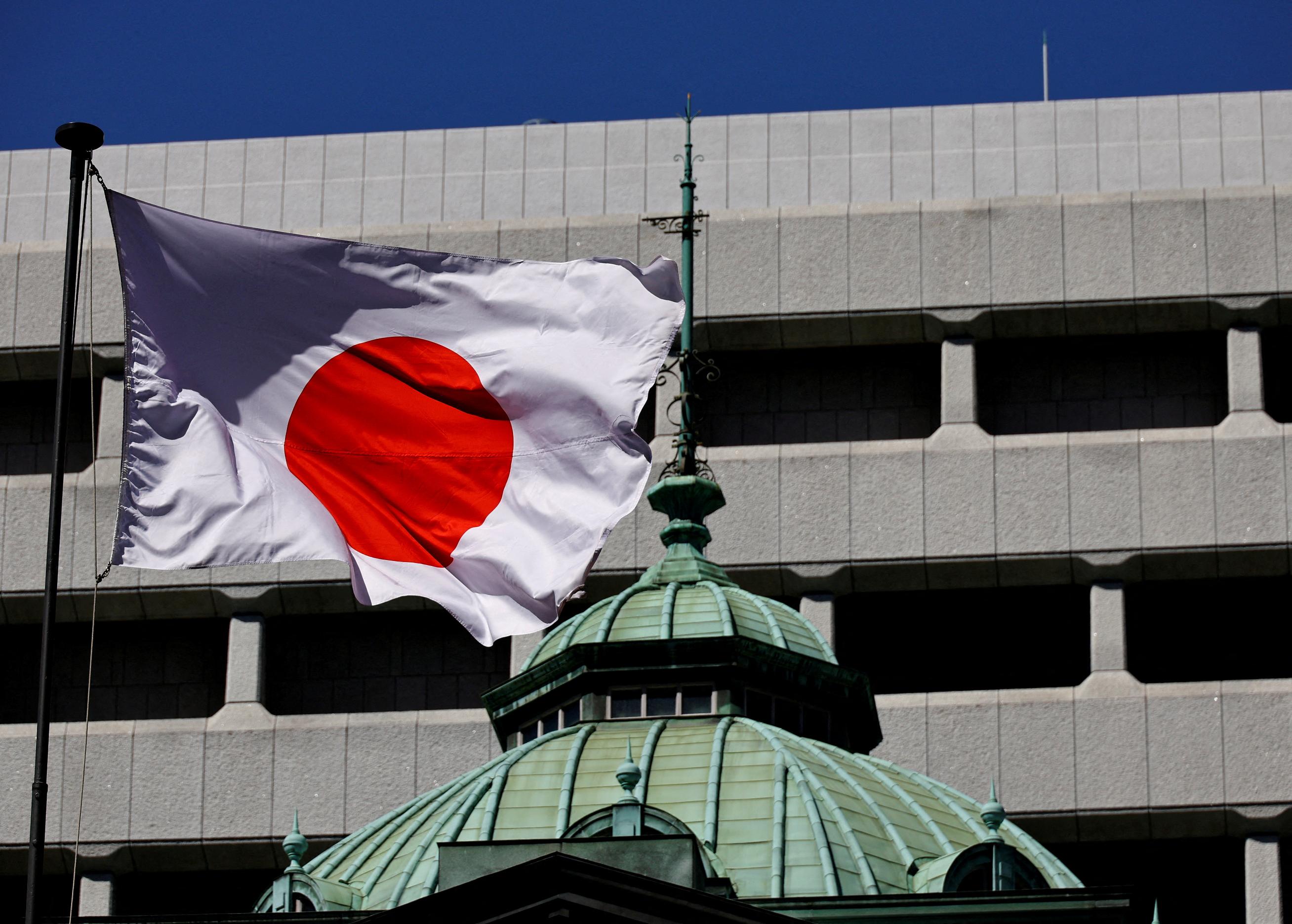

TOKYO, May 10 (Reuters) - Private-sector members of a key government panel on Friday urged the Bank of Japan to be vigilant to the risk of sharp declines in the yen currency triggering "excessive" price rises that hurt private demand. Despite some positive signs in corporate earnings, stock prices and wages, consumption is lacking strength as the yen's continued declines push up inflation, the private-sector members said in a policy proposal submitted to the Council on Economic and Fiscal Policy (CEFP). "As sharp yen declines and rising commodity prices could have a major impact on prices, it's important to closely monitor those developments," the proposal said. "Given that excessive price hikes could curb private demand, we hope the BOJ guides monetary policy appropriately to achieve its 2% inflation target in a sustainable and stable manner," it said. While a weaker currency has helped Japan's powerful exporters, the proposals underscore growing public concern over the disadvantages of a weak yen, such as hurting consumption by pushing up the cost of raw material imports. The Japanese authorities are suspected to have intervened on at least two separate occasions last week to support the yen after it hit lows last seen more than three decades ago. It remains under pressure, though, given the wide gap between Japanese rates that remain near zero even after the BOJ's landmark decision to end negative rates in March, and much higher U.S. and other rates that draw funds away from the yen. BOJ Governor Kazuo Ueda has said the central bank will scrutinise how the yen's recent declines affect the economy and inflation. Policy proposals by the private-sector members usually serve as basis for discussions at the top economic council, which sets the government's long-term economic policy and priorities. Sign up here. https://www.reuters.com/markets/asia/govt-panel-members-urge-boj-vigilance-weak-yens-impact-demand-2024-05-10/

2024-05-10 09:27

LONDON, May 10 (Reuters) - The pound rose on Friday after data showed the British economy beat expectations in the first quarter of the year, growing 0.6% and leaving behind 2023's mild recession. Sterling was last up 0.1% at $1.2537, having traded at $1.2516 before the figures were released. The pound is slightly higher so far in May but has fallen 1.5% this year as the dollar has risen on the back of a strong U.S. economy. The Office for National Statistics data showed that Britain's economic output grew by a stronger-than-expected 0.6% in the January-to-March period, compared with the previous quarter. A Reuters poll of economists had pointed to a 0.4% expansion. "The UK economy started the year with a bang," said Henry Cook, senior economist at lender MUFG. "Recession is firmly in the rear-view mirror." The euro slipped 0.1% against the pound to 86.04 pence. The Bank of England on Thursday held interest rates at a 16-year high of 5.25% but noted that inflation was moving in the right direction, while a deputy governor voted for a rate cut, both signs that borrowing costs could well start to fall in the second or third quarters. Inflation has slowed to 3.2% in March from a peak of 11.1% in October 2022. The next data is due on May 22. "Today's figures may give the BoE some pause for thought, but the focus will remain on key upcoming data on inflation and wage growth," said Cook. "Provided that these data points move in the right direction, today's good news on economic activity in isolation is unlikely to derail initial monetary easing." Sterling rose 0.2% on Thursday after U.S. data showed that weekly jobless claims rose more than expected last week, adding to signs that the country's labour market was weakening and the Federal Reserve was likely to cut rates this year. However, the dollar remains up around 3.9% in 2024 thanks to strong U.S. growth. The dollar index , which tracks the currency against six peers, was flat at 105.23. Sign up here. https://www.reuters.com/markets/currencies/sterling-rises-after-uk-economy-beats-expectations-exits-recession-2024-05-10/

2024-05-10 08:01

TAIPEI, May 10 (Reuters) - A 5.8 magnitude earthquake struck off Taiwan's east coast on Friday, the island's weather administration said, with no immediate reports of damage. The earthquake shook buildings in the capital, Taipei. The quake, off the coast of Hualien county, had a depth of 10 km (6.2 miles), the weather administration said. Taiwan has been hit by around 1,400 aftershocks since a 7.2 magnitude quake struck Hualien last month, killing 17 people. Taiwan lies near the junction of two tectonic plates and is prone to earthquakes. More than 100 people were killed in a quake in southern Taiwan in 2016, while a 7.3 magnitude quake killed more than 2,000 people in 1999. Sign up here. https://www.reuters.com/world/asia-pacific/taiwan-rattled-by-58-magnitude-quake-no-immediate-reports-damage-2024-05-10/

2024-05-10 07:39

HARARE, May 10 (Reuters) - Zimbabwe will fine businesses using inflated exchange rates as the government battles to maintain the value of its newly introduced gold-backed currency, the Zimbabwe Gold (ZiG). Any business using an exchange rate higher than the official rate of 13.5 ZiG per U.S. dollar will be liable for a fine of 200,000 ZiG ($14,815), according to a government notice seen by Reuters. Anyone offering "goods or services at an exchange rate above the prevailing interbank foreign currency selling rate" would be guilty of a civil infringement, read the notice, issued late on Thursday. The government has been making efforts to keep the ZiG afloat since its launch in early April, with authorities launching a blitz on illegal foreign currency traders last month. Some businesses such as supermarkets have been charging a premium above the market rate for customers paying in the new currency, while the ZiG is being rejected by informal traders. Zimbabwe's Treasury on Tuesday moved to enforce the use of the ZiG as the official unit of exchange for transactions. This is Zimbabwe's fourth attempt at having a local currency within a decade, with the southern African country dumping the Zimdollar last month after it lost 70% value since the start of the year. Sign up here. https://www.reuters.com/world/africa/zimbabwe-fine-businesses-not-using-official-new-exchange-rate-2024-05-10/

2024-05-10 07:15

SINGAPORE, May 10 (Reuters) - Chinese refiners will lift less Saudi crude oil in June than in May, people with knowledge of the matter said on Friday. The supply cuts come after the world's top exporter Saudi Aramco hiked official selling prices (OSPs) for most of its crude to Asia to the highest in five months despite weak refining margins. The volume of Saudi crude to be loaded for China is estimated to fall by 5.8 million barrels in June from 45 million barrels in May, the sources said. These include supply cuts of 6.8 million barrels to state and private refiners as well as a 1 million barrel increase for one of the private refiners, the sources said. The cuts were mainly for Arab Medium and Arab Heavy crude, they said. Some of the cuts for Arab Heavy were also made by Aramco, the sources said, adding that Saudi Arabia will likely require more crude to fuel power plants during summer. Chinese refiners are lifting less Saudi crude because of the high OSPs as well as weak margins, two of the sources said. Three other Northeast Asian refiners will receive full contractual supplies in June. Aramco did not immediately respond to requests for comment outside of its office hours. Sign up here. https://www.reuters.com/business/energy/saudi-crude-oil-supply-china-fall-58-mln-bbls-june-may-sources-say-2024-05-10/

2024-05-10 06:53

MANILA, May 10 (Reuters) - The Philippines said on Friday it aimed to add three more processing plants in the effort to develop a downstream industry for its abundant nickel resources, after nations such as China and the United States expressed interest in the mining sector. The Southeast Asian nation is looking to follow neighbouring Indonesia, which lured major investment in processing plants for its huge deposits of nickel ore after banning unprocessed exports in 2020. Environment Minister Maria Antonia Yulo-Loyzaga, whose agency also regulates mining, said the Philippines should boost its capacity to process nickel, a key component in producing EV batteries. Australia, Britain, Canada and European Union nations had also shown interest in the Philippines, she said. "We do wish we were part of the value chain, rather than just the supply chain," Loyzaga told a briefing. "We want to be able to foster an environment that will encourage investments in processing by making sure we're able to facilitate exploration, and facilitate extraction in a responsible way." Ceferino Rodolfo, the undersecretary for trade, said the Philippines was targeting three more processing plants to boost its capacity and add value to its nickel output. He did not give details, however. The country now has two nickel processing plants, both partly owned by the biggest ore producer, Nickel Asia Corp. Processing its nickel ore output would be the ideal scenario for the Philippines, said Economic Planning Secretary Arsenio Balisacan, and the time was right as its seeks to add value to its production of minerals. "This energy transition issue has made our critical minerals not just an economic value proposition, but also has implications for energy security, national security," Balisacan told reporters on the sidelines of a mining forum. With its large untapped mineral deposits, the Philippines is studying possible incentives for mining companies, he added. The latest government figures show that the Philippines, a major supplier of nickel ore to top metals consumer China, produced 35.14 million dry metric tons last year, an increase of 19% on the year. Sign up here. https://www.reuters.com/markets/commodities/philippines-says-us-china-eyeing-mining-opportunities-especially-nickel-2024-05-10/