2024-05-10 05:19

NEW YORK, May 10 (Reuters) - A host of U.S. companies are faced with a problem they had not expected to confront this year: a rising dollar. Many market participants believed the dollar would fall on the back of interest rate cuts that both investors and the Federal Reserve had penciled in for 2024. Those cuts are yet to come, and the U.S. dollar index (.DXY) New Tab, opens new tab, which measures the greenback's strength against a basket of currencies, is up 4% in 2024 and has climbed about 16% in the last three years. While those gains reflect the relative strength of the U.S. economy, a rising dollar can be a problem for some companies. A strong U.S. currency makes it more expensive for multinational companies to convert foreign profits into dollars, while also hurting the competitiveness of exporters' products. Companies guarding against dollar strength must also devote resources to hedging strategies that offset the effects of the rising currency on their bottom lines. All told, every 10% year over year rise in the dollar shaves some 3% from S&P 500 earnings, according to estimates from BofA Global Research. The dollar's strength in the latest quarter comes during a period of robust corporate profits. With well over 80% of the S&P 500 having reported first quarter results, companies are on track to have increased earnings by 7.8%, up from an expectation of 5.1% growth in April, according to LSEG IBES. Nonetheless, companies from Apple Inc (AAPL.O) New Tab, opens new tab and IBM (IBM.N) New Tab, opens new tab to Procter & Gamble(PG.N) New Tab, opens new tab have mentioned foreign exchange as a headwind. The strong dollar "has caused a lot of consternation," said Andrew Gage, senior vice president at treasury and finance solutions firm Kyriba. "CFOs are asking their treasury teams to be much more diligent in managing the risk that comes from that strong dollar." The dollar’s gains are being fueled by U.S. economic strength, which is eroding expectations for how deeply the Fed will be able to cut rates this year. Investors are pricing in around 50 basis points of rate cuts for 2024, compared to more than 150 basis points forecast at the beginning of the year, futures markets show. Yields in the U.S. stand above those in many other economies as a result, bolstering the dollar's appeal over other currencies. "Nearly all FX practitioners were expecting the dollar to be weaker this year with the anticipation of lower U.S. interest rates," said Amo Sahota, director at foreign exchange risk management firm Klarity FX in San Francisco. "Corporates were licking their lips, essentially waiting for that to play through." Not all S&P 500 companies are equally affected by the dollar's swings. The information technology, materials and communication services sectors top the list with the most international revenue exposure, garnering as much as 57%, 52% and 48% of their total revenue respectively from abroad, data from FactSet showed. In the latest quarter, Coca-Cola (KO.N) New Tab, opens new tab reported a 9% currency headwind, noting it was driven by currency devaluation in markets experiencing intense inflation. Conglomerate 3M (MMM.N) New Tab, opens new tab said foreign currency negatively impacted adjusted margins by a larger-than-expected 0.6 percentage points, while Apple called out nearly four percentage points of negative impact from foreign exchange on its quarterly revenue. To prevent exchange rate moves creating big swings in earnings, businesses use various hedging strategies including those that employ forward and options contracts. Some firms that advise companies on managing FX risk noted a rise in hedging activity in recent weeks, though quieter currency markets have made hedging a less urgent issue for some companies even as the dollar has risen. In March, Deutsche Bank’s index of currency volatility (.DBCVIX) New Tab, opens new tab fell to its lowest level since September 2021. "Towards the end of the first quarter, we did see some complacency on the hedging front. Currency volatility fell to a multi-year low, which led to a lack of a sense of urgency," said John Doyle, head of trading and dealing at Monex USA in Washington. "However, we have seen a recent uptick in hedging over the past month and a half." Karl Schamotta, chief market strategist at payments company Corpay, said the subdued level of currency volatility may be making some companies "almost too complacent about the risks they are facing." Analysts at BofA Global Research said that while they believe the dollar will eventually weaken over the medium term, “the turning point has become harder to time.” "The case to hedge USD upside risks for the rest of the year has materially grown for U.S. corporates," they said. Sign up here. https://www.reuters.com/markets/us/dollars-stubborn-strength-dents-us-companies-earnings-cheer-2024-05-10/

2024-05-10 05:10

Bullion up over 3% so far in the week Focus on US PPI and CPI data due next week Silver, platinum, palladium up for the week May 10 (Reuters) - Gold prices strengthened on Friday and were on track for their best week since early April, as weak U.S. employment figures fuelled bets of interest rates cuts by the Federal Reserve this year. Spot gold gained 1.1% to $2,372.46 per ounce by 1203 GMT, hitting its highest in more than two weeks. Prices have risen over 3% so far in the week. U.S. gold futures jumped 1.7% to $2,379.30. On the gold market, "focus is likely to be on the development of consumer prices in the U.S. after progress in the fight against inflation has been considered insufficient in recent months and interest rate hopes have been scaled back," Commerzbank said in a note. Gold extended gains after jumping 1% on Thursday in response to data showing the number of Americans filing new claims for unemployment benefits increased more than expected last week. Investors are now looking forward to the U.S. producer price index and consumer price index data due next week for fresh clues on the Fed's rate trajectory. According to the CME FedWatch Tool New Tab, opens new tab, traders are pricing in about a 68% chance of a Fed rate cut in September. Lower interest rates reduce the opportunity cost of holding non-yielding gold. However, there is "considerable" uncertainty about where U.S. inflation will head in the coming months, San Francisco Federal Reserve President Mary Daly said on Thursday. Meanwhile, Palestinian residents reported about Israeli forces bombarding the city of Rafah in the Gaza Strip on Thursday, while an Israeli official confirmed the end of indirect negotiations with Hamas. "The next target for the gold can be seen in the region of $2,380," De Casa said. Spot silver rose 0.8% to $28.56, platinum firmed 1.7% to $990.73 and palladium added 1.9% to $985.81. All three metals were up for the week. Sign up here. https://www.reuters.com/markets/commodities/gold-set-best-week-five-renewed-us-rate-cut-hopes-2024-05-10/

2024-05-10 04:54

MUMBAI, May 10 (Reuters) - The Indian rupee was little changed on Friday as dollar demand from local oil companies and tepid sentiment surrounding Indian equities amid worries over the country's election results offset positive cues from a dip in U.S. bond yields. The rupee was at 83.4850 against the U.S. dollar as of 10:10 a.m. IST, barely changed from its previous close at 83.5025. "General dollar buying pressure has been there for the last few days but don't think the rupee will see significant moves as the RBI should be there below 83.50," a foreign exchange trader at a foreign bank said. Traders expect the central bank's interventions will keep sharp declines in the rupee at bay. "The equity market is nervous" about the general election results, due on June 4, which is likely to maintain some pressure on the local currency, the trader added. Concerns over the results have prompted foreign investors to pull out about $2 billion from Indian equities in May so far. Benchmark Indian equity indices, the BSE Sensex and Nifty 50, were in the green on Friday after falling 1.4% and 1.5%, respectively, in the previous session. "There could be modest knee-jerk weakness in INR FX and risk assets if BJP (India's ruling party) loses some seats and maintains a majority," MUFG Bank said in a Friday note. "Conversely, a greater seat share win ... will be perceived much more positively by markets, with INR FX and risk assets likely rallying in the aftermath." The dollar index was at 105.3 after declining about 0.3% on Thursday as U.S. jobless claims rose more than expected, signalling softness in the labour market. Most Asian currencies were rangebound. U.S. bond yields also dipped as odds of a September rate cut by the Federal Reserve inched up to 67%, up from 62% a week before, according to the CME's FedWatch tool. Sign up here. https://www.reuters.com/markets/currencies/rupee-flat-oil-companies-dollar-buys-nervous-equities-cap-upside-2024-05-10/

2024-05-10 04:37

A look at the day ahead in European and global markets from Ankur Banerjee Investors are wearing their risk-on hats ahead of the weekend as renewed hopes of monetary easing take hold, a day after the Bank of England opened the door to rate cuts, taking London stocks to record highs and weighing on the sterling. Key economic data, including first quarter GDP figures for the UK, will likely sway the markets on Friday. Britain's FTSE 100 has risen more than 8% so far this year, more than double its 3.8% gain in 2023 and the blue-chip index (.FTSE) New Tab, opens new tab will aim to clock a sixth straight session of gains, a run not seen since August. The pound slid to over a two-week low after BOE's move but steadied at $1.2517 in Asian hours. The currency is down 1.6% this year against the dollar. The BOE paved the way on Thursday for the start of interest rate cuts as soon as next month and Governor Andrew Bailey said there could be more reductions than investors expect. Money market traders still see around a 45% chance of a rate cut at next month's policy meeting, while around 58 basis points of easing is priced by year end. That's in stark contrast to U.S. rates with markets not expecting the Fed to move until at least November and are pricing in 45 bps of cuts this year. However, the latest data showed signs of easing jobs market, boosting some expectations around rate cuts this year. Meanwhile, yen wobbles continue with the currency was last at 155.70 per dollar, with Japanese officials reiterating that they'll take appropriate actions when needed. The more things change, the more they stay the same. Bank of Japan data suggests Tokyo spent an estimated $60 billion to pull the frail yen off the 34 year low of 164.245 last week. Tokyo has not confirmed whether it intervened in the market last week. In company news, the focus will be on the fallout of Spanish bank BBVA (BBVA.MC) New Tab, opens new tab launching a hostile 12.23 billion euro ($13.1 billion) all-share takeover bid for Sabadell (SABE.MC) New Tab, opens new tab that triggered immediate government opposition. Hostile takeovers are rare in European banking and can end up embroiled in months of negotiations as politicians weigh in and regulators worry about potential instability. Elsewhere, Apple (AAPL.O) New Tab, opens new tab apologised after an advertisement for its latest iPad Pro model sparked criticism by showing an animation of musical instruments and other symbols of creativity being crushed, according to Ad Age magazine. Key developments that could influence markets on Friday: Economic events: UK prelim Q1 GDP, UK industrial March output and UK business investment Sign up here. https://www.reuters.com/markets/europe/global-markets-view-europe-2024-05-10/

2024-05-10 04:21

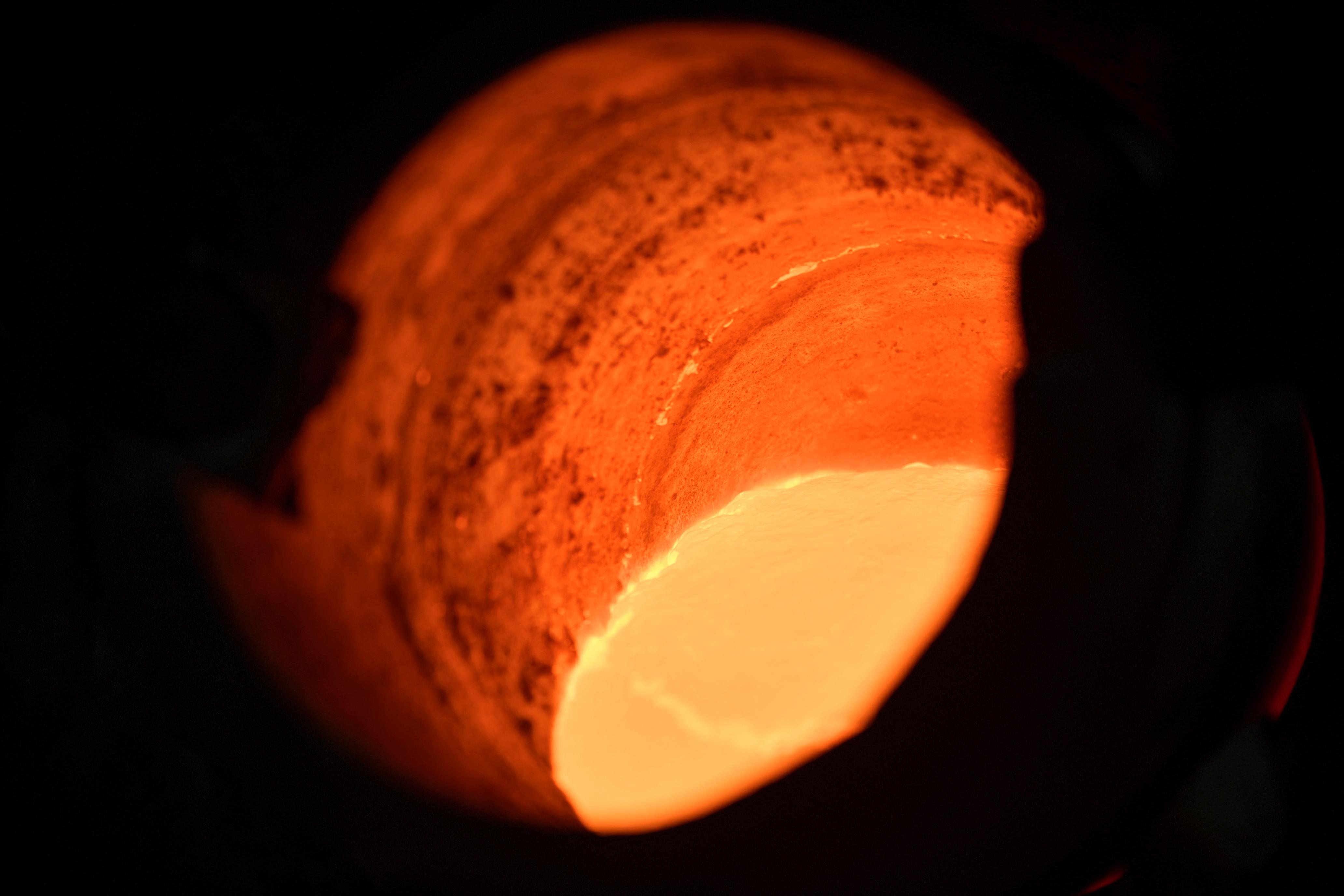

SINGAPORE, May 9 (Reuters) - While Chandra Asra's deal to buy Shell's Singapore refinery will see it join the ranks of Southeast Asia's largest petrochemicals players, it is taking on the risk of running an aging facility in a highly competitive sector. In taking over Shell's Bukom facility, which dates to 1961, Indonesia's Chandra Asri Pacific (TPIA.JK) New Tab, opens new tab will acquire an asset that is less efficient than more modern plants but which gives it a second naphtha cracker, expands its product portfolio, and renders unnecessary plans to build a greenfield complex in its home country, analysts and industry insiders said. Owning a refinery for the first time will also provide Chandra a ready source of feedstock, from crude oil facilitated by Swiss trading house Glencore (GLEN.L) New Tab, opens new tab, its minority partner in the deal, which can help sell its products into global markets. "Glencore as its partner means Chandra Asri can harness this trading giant's strengths in not only the trading sphere but also on the logistical front," said Salmon Lee, head of polyester at Wood Mackenzie. "It's a very significant step in Chandra Asri's stepping up its game in the increasingly competitive petrochemical industry," he added. The companies did not disclose the value of the deal, but brokerage Jefferies estimated sale proceeds of $300 million to $500 million. Shell last year invited more than a dozen companies, including numerous Chinese petrochemicals firms, to look at its Bukom assets in a process managed by Goldman Sachs, sources have said, with Chandra Asri one of the earliest to show interest. The purchase, to close by year-end, will give Chandra Asri nearly 2 million metric tons per year of ethylene capacity, leapfrogging it into Southeast Asia's top three, according to Reuters calculations, behind Thailand's PTT Global Chemical and Siam Cement Group's facilities in Thailand and Vietnam. Chandra Asri had planned a second Indonesian cracker with a target start-up date of 2026-2027 but industry sources said the acquisition of Shell's cracker offered a cheaper option in a high-cost environment. "We see a possibility that Chandra Asri may no longer proceed with its plan to build a second Indonesia cracker project given the geographical diversification after M&A," Citi analyst Oscar Yee wrote. Asked about its previous expansion plan, Chandra Asri told Reuters: "As an integral part of our growth strategy, we actively seek opportunities to build partnerships with diverse entities, both to nurture organic business and pursue strategic M&A." COMPETITION, RISK With the Bukom purchase, Chandra will steal a competitive march on rival Lotte Chemical Indonesia's planned 1 million ton per year cracker, expected to come online in mid-to-late 2025. However, the aging Singapore plant brings challenges given an industry-wide squeeze on petrochemical margins. Most steam cracker operator margins in Asia, excluding China, were negative in 2023, with an upturn likely only in 2028, Wood Mackenzie calculations show. A September report by the consultant said Bukom was the weakest integrated refinery-petrochemical site in Shell’s portfolio, with integrated net cash margins below the global weighted industry average of $14 a barrel. Northeast Asian plants making naphtha-based monoethylene glycol, a major product at Shell's site, averaged losses of $94 a ton in 2022 and 2023 due to overcapacity and weak China demand, said analyst Ann Sun from market intelligence firm ICIS. Singapore is also set to increase its carbon emissions tax from S$5 ($3.69) a ton now to S$25 in 2024-2025, S$45 in 2026-2027 and S$50-S$80 by 2030, which analysts say could add millions of dollars to refiners' costs. ($1 = 1.3560 Singapore dollars) Sign up here. https://www.reuters.com/markets/deals/chandra-asri-purchase-shell-singapore-refinery-brings-scale-risk-2024-05-09/

2024-05-10 02:46

MUMBAI, May 10 (Reuters) - The Indian rupee on Friday will be aided by the drop in U.S. Treasury yields on indications that the U.S. labour market is cooling, while contending with dollar outflows spurred by worries over the election results. Non-deliverable forwards indicate the rupee will open at 83.48-83.50 to the U.S. dollar, compared with 83.5025 in the previous session. Worries over the Indian election results, due on June 4, have prompted foreigners to take out money from equities, pushing the benchmark Nifty 50 index to a three-week low. Foreigners have taken out $2 billion from Indian equities in May so far. They took out more than $800 million on Thursday, per provisional data provided by exchanges, amid nervousness that Prime Minister Narendra Modi's party may not chalk up the landslide victory that was forecasted in opinion polls. The rupee "in a way" has not felt an impact of this election uncertainty, which "you can attribute largely" to how the Reserve Bank of India has managed the currency, an FX trader at a bank said. "We probably spend more time near 83.50, with the underlying bias on the upside (for USD/INR pair)." U.S. Treasury yields dropped on Thursday amid initial jobless claims rising more than expected. This follows data that showed that non-farm payrolls rose by the least in six months, tentative signs that the labour market may finally be softening. While too much should not be read into one round of data, the incoming data will be watched very closely for further evidence that the labour market momentum may be slowing, ANZ Bank said in a note. Meanwhile, investors are eyeing the key U.S. inflation data due next Wednesday. There is "considerable" uncertainty about where inflation will head in coming months, San Francisco Fed President Mary Daly said on Thursday, while adding she still has faith that price pressures are continuing to cool. KEY INDICATORS: ** One-month non-deliverable rupee forward at 83.56; onshore one-month forward premium at 8 paisa ** Dollar index at 105.30 ** Brent crude futures up 0.4% at $84.2 per barrel ** Ten-year U.S. note yield at 4.46% ** As per NSDL data, foreign investors sold a net $639 mln worth of Indian shares on May 8 ** NSDL data shows foreign investors sold a net $63.8 mln worth of Indian bonds on May 8 Sign up here. https://www.reuters.com/markets/currencies/rupee-helped-by-dip-us-yields-while-election-uncertainty-weighs-2024-05-10/