2024-05-10 00:51

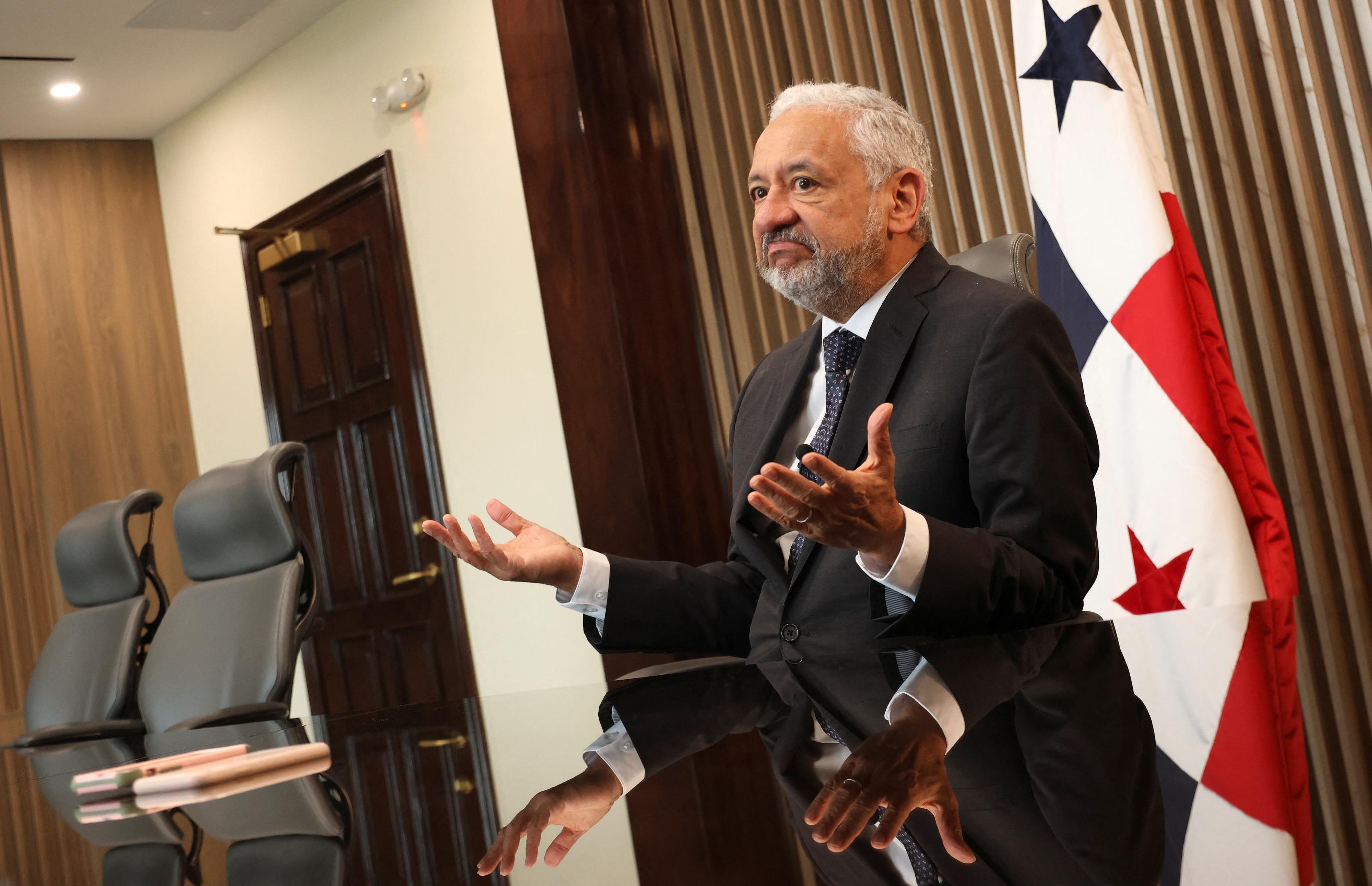

PANAMA CITY, May 9 (Reuters) - The Panama Canal is in talks with U.S. liquefied natural gas (LNG) producers on how to meet increased demand for crossings as water levels recover after a prolonged drought, the canal's administrator Ricaurte Vasquez told Reuters in an interview. The canal is typically used by U.S. Gulf Coast exporters to send LNG cargoes to Asia via the Pacific Ocean, but from last year low water levels forced cuts to daily crossings, driving many producers to seek more costly or longer alternative routes. In April, LNG transits through the canal's Neopanamax locks only amounted to 4.9% of crossings while container ships snared some 61.6% of the transits. Following increased rainfall that has replenished water levels, tensions have begun to ease and the canal is examining future opportunities, Vasquez said on Wednesday. Canal authorities might need to modify slot allocations to secure more passage for LNG customers, so the administration is working on a survey to be sent to its transport clients to identify their needs, especially in terms of frequency and permits, he said. The administrator said there is an opportunity to attract exports from new U.S. LNG plants, which would require getting permits, without detailing which facilities are being eyed by the entity. Companies including top U.S. LNG exporter Cheniere Energy have complained about having to endure long and costly waiting periods to cross the canal as LNG vessels lack priority passage. Vasquez said the canal is looking for ways to guarantee crossings for those vessels, adding the number of slots available for LNG producers will be made public after studies are completed and a consensus is reached with the companies involved. Key industry players will come to Panama likely this month for talks, Vasquez said without naming the parties. "We will talk and define parameters. They have very big aspirations in which they would like to have a canal dedicated to them but that is not possible, since this is a canal that should be open to every type of commerce internationally," Vasquez said. PRESSING NEED TO SECURE WATER The Panama Canal has proposed building water reservoirs as a solution to mitigate climate change related shortages, though it is still waiting for the government to grant it access to the areas where they could be built. President-elect Jose Raul Mulino told Reuters on Wednesday he would move to speed those permits. Mulino will take office on July 1. Scarcity has raised water's value, with Vasquez saying the canal will move to present an updated price scheme that match the new realities and customers' needs next year. The water reservoirs could be ready in 2030, though the canal's administration still needs to secure permits and strike agreements with nearby communities. Vasquez expressed confidence the canal would do so after undertaking proper consultations and providing necessary guarantees, adding that the waterway has a 15-year history of working with them. Sign up here. https://www.reuters.com/business/energy/panama-canal-talks-with-us-lng-producers-increase-transit-2024-05-10/

2024-05-10 00:34

SYDNEY, May 10 (Reuters) - The national carrier of the Pacific Island nation of Vanuatu may be sold to a private operator, liquidator EY said on Friday, with large numbers of tourists stranded after Air Vanuatu cancelled flights to Australia and New Zealand. The Vanuatu government, which owns the airline, put the carrier into voluntary liquidation on Thursday, a day after it cancelled international flights, citing extended maintenance requirements for its aircraft. "We may end up with some kind of sale of the business to a private operator," EY Strategy and Transactions Partner Morgan Kelly told a press conference in Sydney. As EY assesses how to make the airline's operations sustainable, a partnership arrangement with another airline could also be involved, Kelly added. EY said it was working with the airline's management to resume normal operations as soon as possible after safety and maintenance checks, but it could not set a date. "All flights have been grounded with immediate effect," the carrier said in a notice on its website. Many customers have been affected and partner airlines have suspended codeshare arrangements between Vanuatu and Australia, Kelly added. The carrier operates only four planes between the country's islands - which rely heavily on tourism - and to destinations such as Australia, New Zealand and other South Pacific islands. EY said its appointment followed a challenging period for the global aviation industry, including labour shortages, inflation affecting input costs and credit costs. Vanuatu has been particularly affected after cyclones disrupted tourism activity. The outlook for the airline is positive, despite pressures on the broader industry, and Air Vanuatu is a "strategically vital national carrier", EY said in a statement. The first meeting of creditors is to be set shortly, while the current management team will stay, it added. In a statement, Virgin Australia (IPO-VIR.AX) New Tab, opens new tab said it would add two flights a week in May and June between Brisbane and Vanuatu, after the Australian government asked it to increase capacity. The airline has also applied to the International Air Services Commission to increase seat capacity to Vanuatu, with plans to add seven more services from Australia's east coast, it added in Friday's statement. Australian carrier Qantas Airways (QAN.AX) New Tab, opens new tab said it was supporting codeshare customers booked onto Air Vanuatu flights. Fiji Airways has offered seats on its flights to stranded Fijian nationals holding Air Vanuatu tickets. Sign up here. https://www.reuters.com/business/aerospace-defense/air-vanuatu-put-into-voluntary-liquidation-aims-resume-operations-2024-05-10/

2024-05-10 00:14

Fed's Logan says policy may not be tight enough Dollar rises after consumer sentiment data, yen weaker Speculators cut U.S. crude oil net longs, CFTC says US drillers cut oil rig count to lowest since Nov - Baker Hughes NEW YORK, May 10 (Reuters) - Oil prices fell by nearly $1 a barrel on Friday as comments from U.S. central bank officials indicated higher-for-longer interest rates, which could hinder demand from the world's largest crude consumers. Brent crude futures settled at $82.79 a barrel, down $1.09, or 1.3%. U.S. West Texas Intermediate crude settled at $78.26 a barrel, down $1.00, or 1.3%. For the week, Brent logged a 0.2% loss, while WTI recorded a rise of 0.2%. Dallas Federal Reserve President Lorie Logan on Friday said it was unclear whether monetary policy was tight enough to bring down inflation to the U.S. central bank's 2% goal. Higher interest rates typically slow economic activity and weaken oil demand. Atlanta Fed President Raphael Bostic also told Reuters he thought inflation was likely to slow under current monetary policy, enabling the central bank to begin reducing its policy rate in 2024 - though perhaps by only a quarter of a percentage point and not until the final months of the year. "The two Fed speakers certainly seemed to put the kibosh on the prospect of rate cuts," said John Kilduff, a partner at Again Capital. The U.S. dollar strengthened after the Fed officials' comments, making greenback-denominated commodities more expensive for buyers using other currencies. Higher-for-longer U.S. interest rates could also dampen demand. Oil prices were also under pressure from rising U.S. fuel inventories approaching the typically robust summer driving season, said Jim Ritterbusch of Ritterbusch and Associates. "Given the price decline of the past month and the weaker-than-expected demand trends for U.S. gasoline and diesel, some bearish demand adjustment would appear likely," Ritterbusch said. Next week, U.S. inflation data could influence Fed decisions on rates. Oil drew little support from the U.S. oil rig count, which is an indicator of future supply, despite energy services firm Baker Hughes data showing the number of oil rigs fell by three to 496 this week, their lowest since November. Money managers, meanwhile, cut their net long U.S. crude futures and options positions in the week to May 7 by 56,517 contracts to 82,697, the U.S. Commodity Futures Trading Commission said. Data on Thursday showing China imported more oil in April than the same month last year also helped keep oil prices from moving lower. China's exports and imports returned to growth in April after contracting the previous month. The European Central Bank, meanwhile, looks increasingly likely to start cutting rates in June. In Europe, a Ukrainian drone attack set an oil refinery in Russia's Kaluga region on fire, RIA state news agency reported on Friday, the latest salvo from Kyiv in what has become a series of tit-for-tat attacks on energy infrastructure. Conflict in the Middle East also continues after Israeli forces bombarded areas of the southern Gaza city of Rafah on Thursday, according to Palestinian residents, after a lack of progress in the latest round of negotiations to halt hostilities in Gaza. Sign up here. https://www.reuters.com/business/energy/oil-prices-up-stronger-chinese-data-middle-east-conflict-2024-05-10/

2024-05-09 23:52

SHANGHAI, May 10 (Reuters) - Currency markets are reading subtle signals from Chinese authorities as an indication they are slowly nudging the yuan lower to regain export competitiveness, but analysts say protracted yuan weakening is neither the intent nor desirable. The biggest signal of tolerance for a weaker yuan has come via the People's Bank of China's (PBOC) daily reference rate , or fixing, around which the yuan is allowed to trade. Having used the fixing to contain the yuan's fall from November even as currencies of trade rivals such as Japan and South Korea tumbled, the PBOC's fixings have since mid-April become less rigid and even slightly biased to weaken the currency. State-owned Chinese banks, which frequently step into markets to buy the yuan, have also been less conspicuous. Based on nominal exchange rates, a bit of yuan depreciation makes sense. It has declined about 2% against the dollar this year, but an index of its value against its major trading partners (.CFSCNYI) New Tab, opens new tab is up nearly 3%, given the sharp 9% drop in the Japanese yen and the Korean won's 5% drop against the dollar in that period. "The PBOC will likely continue to allow the yuan to soften modestly against the dollar at the pace that the central bank feels comfortable with," said Tommy Wu, senior China economist at Commerzbank. "This is especially true given that the currencies of China's trading partners have depreciated against the dollar, which in turn pushed up the yuan currency basket." Several global investment banks expect the tightly managed yuan to drop to 7.3 per dollar in the coming months, about 1% weaker than current levels around 7.22. That's a modest decline, reflecting what most analysts suspect is the PBOC's mindfulness of the risks a weak currency while keeping an eye on trade competitiveness. "We do not expect to see any significant one-off depreciations, instead a willingness for it to move gradually, and for the currency to weaken, but with lower volatility," said Nathan Swami, head of currency trading at Citi. The PBOC did not immediately respond to Reuters request for comments. UNNECESSARY There's little evidence to show the relative strength in the yuan, despite the massive outflows from China's anaemic markets and economy, is hurting its vast export sector. New export orders are rising, manufacturing surveys show. Exports of photovoltaic products, electric vehicles and lithium batteries, dubbed as China's "three new things" that have replaced traditional labour-intensive household appliances, furniture and clothing exports, have contributed notably. Their exports totalled 1.06 trillion yuan ($146.7 billion) in 2023, up a third from a year earlier. A Shanghai-based photovoltaic exporter, who wanted to go only by her family name Zhu, says her business has not been squeezed by Korean and Japanese products becoming cheaper. "For some products, Chinese brands have dominated the market. It is hard for Japanese and Korean brands to squeeze in ... Currency fluctuation is certainly an important factor, but I don't see huge impact yet," Zhu said. Chinese manufacturers are also seeing their costs falling thanks to deflationary forces from weak consumption and investment at home. Adjusted for inflation, the yuan is at its weakest since the 2008 global financial crisis, according to Goldman Sachs' estimates. China's consumer inflation has hovered at nearly zero over the past year. "That alone confers a degree of competitiveness," said Frederic Neumann, chief Asia economist at HSBC. "So even if the currency went to 7 (to the dollar), they would still be probably more competitive on a two- or three-year basis." On the flipside, the terms of trade have turned against China as prices of oil and other commodities it imports stay high. Neumann says a bit of currency depreciation could be part of Beijing's policy toolkit to raise prices of manufacturing inputs and give exporters a bit of extra incentive. But too much risks hurting consumers already scarred by the collapse in property and stock markets. Per capita spending during the Labour Day holiday is down 11.5% from pre-COVID levels in 2019, according Reuters calculations based on official data. China's dominance as an exporter is another worry. "The problem in China's case is that, if they depreciate the currency now, they risk leading to global backlash. They're already facing a lot of other countries complaining about China's increasing competitiveness," said HSBC's Neumann. "If you depreciate the currency a little bit, maybe you can help export margins a bit, but you're not going to raise your export volumes that much. So there's a limited there's less of a benefit from a depreciation here than for a small country." ($1 = 7.2258 Chinese yuan) Sign up here. https://www.reuters.com/markets/currencies/why-chinas-tolerance-cheaper-currency-may-be-temporary-2024-05-09/

2024-05-09 22:33

Dow gains for 7th session; S&P hits highest close since Apr. 9 Weekly jobless claims rise more than expected Roblox slumps after bookings forecast cut Focus on next week's inflation readings Indexes up: Dow 0.85%, S&P 0.51%, Nasdaq 0.27% May 9 (Reuters) - The Dow Jones Industrial Average closed higher on Thursday, the seventh straight daily advance for the benchmark, as all three major U.S. indexes gained after weekly jobless claims data offered fresh hope for interest-rate cuts. U.S. Federal Reserve policy has been the main driver of investor sentiment in 2024. Renewed hopes the central bank will cut rates have pushed the Dow (.DJI) New Tab, opens new tab to its biggest rally since December. It closed at its highest since April 1. Other benchmarks also benefited. After a flat day on Wednesday, the S&P 500 (.SPX) New Tab, opens new tab resumed its upward trajectory and closed above 5,200 points for the first time since April 9. U.S. equity markets have clawed back losses incurred during April on fears the Fed may ultimately raise interest rates, and as tensions in the Middle East threatened to escalate. "We've almost had a full recovery of that," said Brad Bernstein, managing director at UBS Private Wealth Management. For the quarter thus far, the Dow is 1.1% lower, the S&P 500 is 0.8% down and the Nasdaq Composite (.IXIC) New Tab, opens new tab is off 0.2%. While next week's producer and consumer prices readings are regarded as the next key signpost, other data have buoyed investor rate-cut hopes. The number of Americans filing new claims for unemployment benefits increased more than expected to a seasonally adjusted 231,000 last week, data showed. Economists polled by Reuters had forecast 215,000 claims. Last week's data showing slowing job growth in April and job openings falling to a three-year low in March had investors pricing in one or two rate cuts by the Fed this year. Prior to that, traders were pricing in just one rate cut. Declining U.S. Treasury yields also supported stocks since higher rates offer investors less risk while also making borrowing to fuel growth more expensive. The yield on the 10-year note was at 4.46% on Thursday, down from 4.7% two weeks ago. "In the last few days, we've had some interesting events which have really helped calm the bond market," said Bernstein, noting factors including the U.S. Treasury and Fed announcing plans to buy Treasuries. Lower yields are particularly supportive for tech megacap stocks, Apple (AAPL.O) New Tab, opens new tab, Amazon.com (AMZN.O) New Tab, opens new tab and Meta Platforms META.O> rose between 0.6% and 1%. The S&P 500 (.SPX) New Tab, opens new tab gained 26.41 points, or 0.51%, to 5,214.08 points, while the Nasdaq Composite (.IXIC) New Tab, opens new tab gained 43.51 points, or 0.27%, to 16,346.27. The Dow Jones Industrial Average (.DJI) New Tab, opens new tab rose 331.37 points, or 0.85%, to 39,387.76. Ten of the 11 major S&P sectors rose, led by a 2.3% rise in the real estate index (.SPLRCR) New Tab, opens new tab. Data center operator Equinix (EQIX.O) New Tab, opens new tab surged 11.5% after its first-quarter results. On the flip side, chip designer Arm Holdings dipped 2.3% as its full-year revenue forecast came in below expectations. Bigger rival Nvidia (NVDA.O) New Tab, opens new tab, which is still to report this earnings season, slipped 1.8%. Roblox (RBLX.N) New Tab, opens new tab slumped 22.1% after the video-gaming platform cut its annual bookings forecast, in a sign that people were dialing back spending amid an uncertain economic outlook and elevated levels of inflation. Robinhood Markets (HOOD.O) New Tab, opens new tab was 3.1% lower, despite the online brokerage beating estimates for first-quarter profit, thanks to robust crypto trading volumes and rate hikes that boosted its net interest revenue. Meanwhile, Spirit Airlines (SAVE.N) New Tab, opens new tab jumped 12.9%, having hit a record low earlier this week. Sign up here. https://www.reuters.com/markets/us/futures-dip-higher-treasury-yields-jobless-claims-data-awaited-2024-05-09/

2024-05-09 21:59

MELBOURNE/TOKYO, May 9 (Reuters) - Japanese steelmakers have raised concerns with Australian authorities that BHP Group (BHP.AX) New Tab, opens new tab could become too dominant in the global supply of coking coal if it goes ahead with a takeover of Anglo American (AAL.L) New Tab, opens new tab. Australia is the world's biggest exporter of coking coal and top supplier to Japan, making up around 60% of its imports, with most of the steel-making ingredient coming from the state of Queensland, where BHP and Anglo American are the two largest producers. Steelmakers' concerns about BHP's coking coal market power could derail a deal if the Australian giant comes back with a revised bid for Anglo American, after being rebuffed with a $39 billion offer last month. "BHP already has a large share of the supply of high-quality hard coking coal in the seaborne trade, and we will take measures to ensure that further oligopolisation will not impede sound price formation and stable supply," a JFE Steel spokesperson said, declining to elaborate on what measures they could take. Representatives of Japanese steelmakers met with Queensland government officials raising alarm bells that if a deal went ahead it would concentrate the world's top quality coking coal mines in the state's Bowen Basin in the hands of BHP, two people familiar with the talks said. The combined group would control 44 million tons, or about 13%, of the seaborne coking coal market, data from consultants Wood Mackenzie shows. That comes even as BHP's production has fallen after sales of some mines in recent years. "In general, we are against the (BHP-Anglo) union as it would create a supplier with a huge market share, especially in the hard-coking coal market," said a source at a Japanese steel maker, adding that it was closely monitoring the situation. "We, for our part, would not want BHP to buy Anglo and gain a stronger price competition power." Queensland Deputy Premier and Treasurer Cameron Dick said BHP would need to ensure its coal remains competitive or risk losing state government support. "We work closely with our Japanese customers and are aware of their concerns," Dick told Reuters. "BHP needs to explain to Japanese steelmakers and the market more broadly how it will ensure the ongoing supply of steelmaking coal remains competitive," he said. BHP declined to comment for this story but has said expanding in high quality coking coal was a main driver of its tilt for Anglo. Anglo American declined to comment. COKING COAL SQUEEZE Japan’s Fair Trade Commission has the authority to investigate a BHP-Anglo American transaction and could block a deal if it found it would harm Japanese companies, two anti-trust lawyers in Tokyo said. However, if a deal was deemed anti-competitive, the commission would likely ask BHP to offer a remedy, which could include a coal divestment, one of the two lawyers said. They both declined to be named due to the sensitivity of the issue. The Fair Trade Commission declined to comment whether it has received any request to examine the BHP-Anglo deal. Like JFE, Kobe Steel (5406.T) New Tab, opens new tab said it is keeping a close eye on the proposed deal and a potential increase in BHP's market power. Nippon Steel (5401.T) New Tab, opens new tab was not immediately available for comment. Key among steelmakers' concerns is that BHP has stressed it will not invest to expand production in Queensland after the state hiked coal royalties without industry consultation, a source familiar with the matter told Reuters. BHP CEO Mike Henry said last year the company "will not be investing any further growth dollars in Queensland under the current conditions". Anglo's Moranbah North and Grosvenor mines are effectively an extension of BHP's Goonyella mine, which produces a type of coal favoured by Japan and India. The Japanese are facing growing competition from India for that coal. BHP already sends 40% of its coking coal to India and expects the country's demand for the steel-making ingredient to double by the end of the decade, CFO Vandita Pant said in March. Japan could lobby anti-trust authorities in other jurisdictions to block a deal if it believes there will be an impact to the competitiveness of the global coking market, as it did when BHP made a bid for its iron ore rival Rio Tinto in 2007, one of the lawyers said. Queensland could also complicate a deal. "The transfer of mineral assets in Queensland are subject to a number of state government approvals. No resources company should take those approvals for granted," Treasurer Dick said. Sign up here. https://www.reuters.com/markets/deals/bhp-anglo-american-deal-raises-alarm-japans-steel-industry-2024-05-09/