2024-05-09 08:57

NEW YORK, May 8 (Reuters) - Sung Kook “Bill” Hwang, founder of the $36 billion private investment firm Archegos Capital Management which collapsed spectacularly in 2021, arrived in court on Wednesday for the start of his criminal trial. Here is a timeline of the fund's blow up - one of the biggest in years - which left global banks with $10 billion in losses: 1996-2001: Hwang, who moved to the United States as a child from South Korea, works at the late billionaire Julian Robertson’s pioneering hedge fund Tiger Management, where he hones his stock-picking skills. 2001: Hwang launches his own hedge fund, Tiger Asia Management. The firm was started with seed money from Robertson, making him part of an elite group of the billionaire's protégés dubbed the Tiger Cubs. 2012: Regulatory issues in Hong Kong and the United States lead Tiger Asia Management to shut down in 2012. Hwang pleads guilty to wire fraud relating to illegal trading of Chinese bank stocks and separately pays $44 million to U.S. authorities to settle insider trading charges. 2013: Hwang turns Tiger Asia into a family office, renaming it Archegos Capital Management in early 2013. March 2020: Operating from his Manhattan apartment as COVID-19 sweeps New York, Hwang begins amassing huge positions in a handful of securities, including media company ViacomCBS, using derivatives he trades with Wall Street banks. The trades allow Hwang to accumulate leveraged positions in the stocks without owning them and without having to disclose his stakes. March 2021: ViacomCBS announces a stock sale which sends its share price tanking, setting off alarm bells at Archegos' banks. Banks call on the fund for more collateral to cover the increased exposure on the swaps. But Archegos does not have enough liquidity to meet the calls. That leads to some banks dumping the stocks that back his swaps, causing big losses for Archegos and its lenders, such as Credit Suisse, now part of UBS (UBSG.S) New Tab, opens new tab, and Nomura Holdings (8604.T) New Tab, opens new tab. As banks begin to report losses, regulators including the SEC start probing the collapse of the fund. April 2022: Federal prosecutors charge Hwang with 11 criminal counts and Archegos' former chief financial officer, Patrick Halligan, with three criminal counts. Authorities allege Hwang and Halligan lied to banks in order to increase Archegos' credit lines and use the borrowed money to manipulate stock prices. Hwang faces charges of racketeering, securities fraud, securities fraud of counterparties and wire fraud along with seven counts of market manipulation. Halligan is charged with racketeering, wire fraud and securities fraud of counterparties. Both plead not guilty to charges and are released on bail. Hwang's attorneys' did not immediately respond to a request seeking comment. May 2024: Hwang and Halligan's trial kicks off. They are expected to argue that prosecutors are overreaching by pushing a novel market manipulation theory. Hwang and Archegos have argued that the SEC has failed to show how the New York-based firm traded deceptively or how its swaps trades, which they say are lawful, affected prices. Sign up here. https://www.reuters.com/business/finance/rise-fall-bill-hwangs-archegos-capital-management-2024-05-08/

2024-05-09 00:20

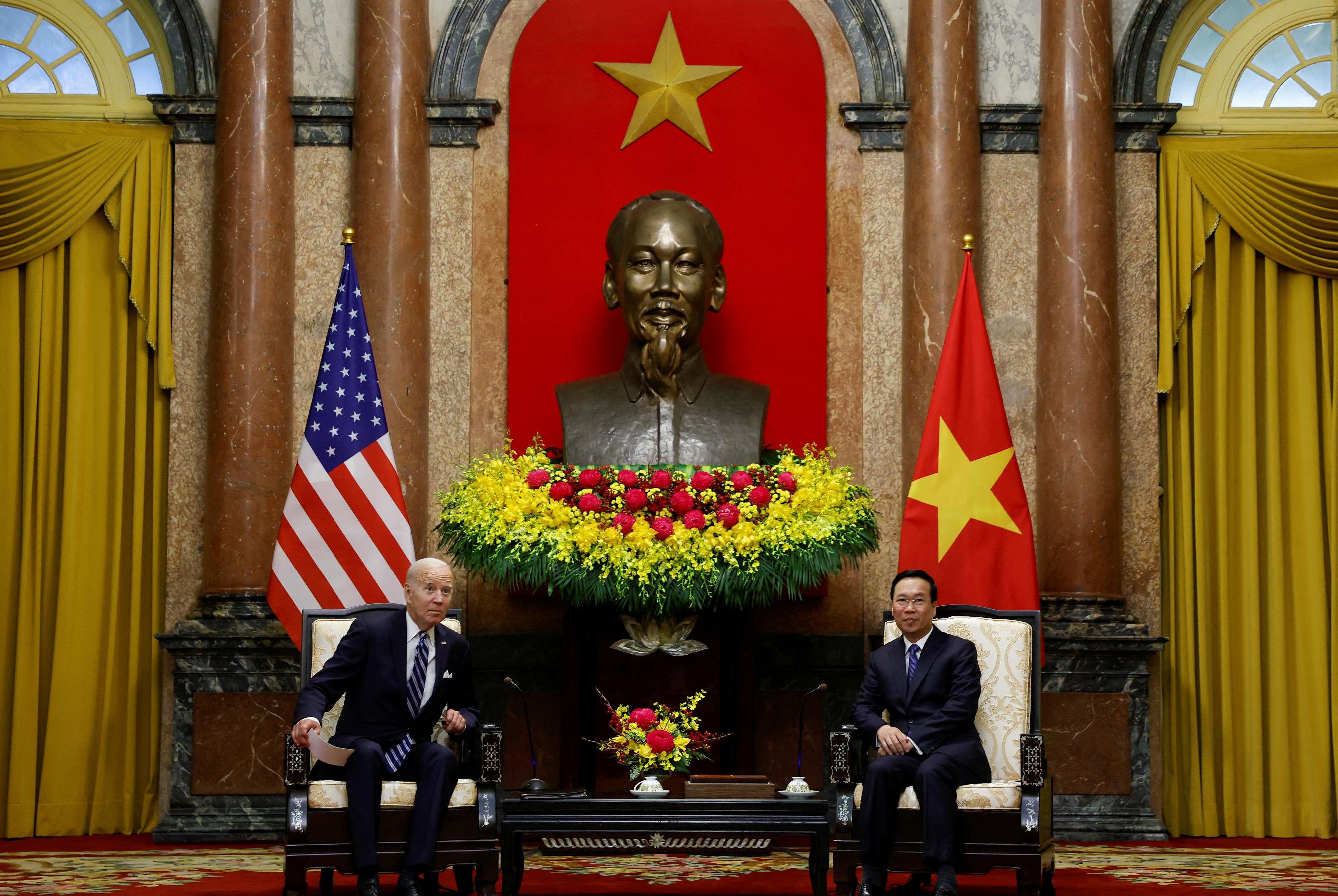

WASHINGTON, May 8 (Reuters) - U.S. President Joe Biden's bid to draw Vietnam closer as a strategic ally clashed with his desire for union workers' votes on Wednesday as trade lawyers sparred over whether the Commerce Department should upgrade the communist-ruled country to market economy status. The move, opposed by U.S. steelmakers, Gulf Coast shrimpers and American honey farmers, but backed by retailers and some other business groups, would reduce the punitive anti-dumping duties set on Vietnamese imports because of its current status as a non-market economy marked by heavy state influence. Vietnam's deepening economic ties to China loomed large in arguments on both sides of the issue at a virtual public hearing hosted by the Commerce Department as part of a review and decision due on July 26. Steptoe LLP attorney Eric Emerson, representing Vietnam's Ministry of Industry and Trade, said Vietnam should be graduated to market economy status because it has satisfied the six criteria used by the Commerce Department to judge whether countries have a market-driven economy, from currency convertibility and labor rights to investment openness and resource allocation. "Vietnam has demonstrated that its performance on these statutory factors is as good, or often better, than other countries that have previously been granted market economy status," he said, citing less government support for state firms than India and more openness to foreign investment than Indonesia, Canada and the Philippines. Vietnam has argued it should be freed of the non-market label because of recent economic reforms, saying retaining the moniker is bad for increasingly close two-way ties that Washington sees as a counterbalance to China. During Biden's visit to Hanoi last year, the two countries elevated ties to a comprehensive strategic partnership and U.S. Treasury Secretary Janet Yellen has promoted Vietnam as a "friend-shoring" destination to shift U.S. supply chains away from China. Upgrade proponent Samsung Electronics (005930.KS) New Tab, opens new tab has become one of the biggest employers in Vietnam because of the country's market-oriented changes, the South Korean firm's U.S public policy head Scott Thompson told the hearing. "Vietnam has emerged as a stable, secure supply chain partner of the United States ... to the ultimate benefit of the U.S. economy," Thompson said. CHINESE INFLUENCE But opponents of upgrading Vietnam - one of 12 economies labeled by Washington as non-market, including China, Russia, North Korea and Azerbaijan - argued that Hanoi's policy commitments have not been matched by concrete actions and it operates as a planned economy governed by the ruling Communist Party. They also said Vietnam's industries are highly dependent on investment and imports of inputs from China, many of which are already subject to U.S. anti-dumping duties. Jeffrey Gerrish, a former Trump administration trade official representing Steel Dynamics Inc (STLD.O) New Tab, opens new tab, said upgrading would unleash a flood of unfairly traded imports from Vietnam, which he said had become a platform for circumvention of U.S. tariffs by China. "Rather than countering Chinese influence, any such action would serve as a gift to China and Chinese interests," Gerrish said. Biden has heavily courted union votes in the looming November presidential election, particularly from steelworkers in the swing state of Pennsylvania. He has opposed Nippon Steel's (5401.T) New Tab, opens new tab proposed takeover of Pittsburgh-based U.S. Steel (X.N) New Tab, opens new tab, and called for sharply higher Section 301 tariffs on imports of Chinese steel. TARIFF CUT At the heart of the Commerce decision is whether to continue the higher tariff rates on Vietnamese goods in anti-dumping cases involving non-market economies. U.S. anti-dumping duties on Vietnamese frozen farmed shrimp are currently 25.76%, while similar duties on shrimp from Thailand, a market economy, are only 5.34%. Assertions of Vietnam's lawyers that rising Vietnamese wages are the result of labor-management bargaining also came under challenge. Human Rights Watch said Vietnam did not meet basic labor rights standards required for reclassification and that it was false to say that Vietnamese workers can organize unions or that their wages are the result of free bargaining. "Vietnam's Trade Union Law only allows government-controlled 'unions,'" it said in a statement after the hearing. Nazak Nikakhtar, a former Commerce Department official in the Trump administration now with the Wiley Rein law firm, said Hanoi employed the same oppressive policies and predatory economic practices as China and was likely to side with its powerful next-door neighbor over the U.S. Emerson, the lawyer representing Hanoi, said denial of market economy status would push Vietnam closer to China. Sign up here. https://www.reuters.com/business/us-weighs-upgrade-vietnam-market-economy-status-2024-05-08/

2024-05-08 23:23

May 9 (Reuters) - The platinum market faces its largest supply shortfall in 10 years in 2024 as shipments from Russia return to normal from last year's highs and industrial demand stays firm, Johnson Matthey (JMAT.L) New Tab, opens new tab said in a report on Thursday. The autocatalyst maker added that it expected all platinum group metals (PGM) - platinum, palladium, and rhodium - to remain in deficit in 2024. The three metals are used in autocatalysts that reduce emissions from vehicle engines, with platinum also used in other industry and for jewellery and investment. Johnson Matthey (JM) said it expected the platinum market's deficit to increase to 598,000 ounces this year from a shortfall of 518,000 ounces in 2023. It forecast platinum demand would stabilise at around 7.61 million ounces, with small decreases in automotive and jewellery balanced by an uptick in investment. Auto sector consumption is expected to slip 1.3% in 2024, while primary supply is projected to fall 2% as Russian shipments return to more normal levels following heavy selling of mined stocks in 2023, JM said. For palladium, JM said use by automakers would fall about 7%, reducing overall demand to 9.73 million ounces and cutting the market deficit to 358,000 ounces from 1.02 million ounces last year. For rhodium, auto consumption is also expected to fall - by about 6% - dragging total demand down 4% to 1.06 million ounces. The rhodium market is likely to be undersupplied by 65,000 ounces, down from 125,000 ounces in 2023, JM said. "Automotive and industrial users bought more metal than they needed during 2020-2022 to mitigate price and supply risks. Since then, consumers have been using up excess PGM inventory, and some have even sold metal back to the market," Rupen Raithatha, market research director at Johnson Matthey, said. At around $950 an ounce, palladium is trading lower than platinum at $960, pressured by growing demand concerns. Rhodium is trading around $4,700 an ounce, down about 84% from all-time highs reached in March 2021. PLATINUM (THOUSANDS OF OUNCES) PALLADIUM (THOUSANDS OF OUNCES) RHODIUM (THOUSANDS OF OUNCES) Source: Johnson Matthey Sign up here. https://www.reuters.com/markets/commodities/platinum-set-biggest-deficit-decade-2024-says-johnson-matthey-2024-05-08/

2024-05-08 23:16

New data center to be built on site of failed Foxconn investment Microsoft aims to create 2,000 permanent jobs Wisconsin is one of seven battleground states in 2024 election RACINE, Wisconsin, May 8 (Reuters) - U.S. President Joe Biden on Wednesday unveiled plans by Microsoft Corp (MSFT.O) New Tab, opens new tab to build a $3.3 billion data center in southeastern Wisconsin, drawing a sharp contrast to his Republican predecessor who had backed a previous $10 billion project at the same site that was significantly scaled back. Biden, on his fourth visit to Wisconsin this year, said Microsoft's investment would create thousands of jobs in the presidential election battleground state that his campaign sees as critical to his bid for a second term. The facility will be built where Biden's rival for the presidency, Donald Trump, announced a $10 billion investment by Taiwan electronics manufacturer Foxconn in 2017 that the company later drastically scaled back. Trump had called it "the eighth wonder of the world." "I'm here to talk about a great comeback story in America," Biden told about 200 people at Gateway Technical College's Sturtevant campus in a Midwestern state hit by manufacturing declines. The president said Microsoft's investment would "be transformative, not only here, but worldwide." "My predecessor made promises, which he broke," Biden said. "On my watch, we make promises and we keep promises." Foxconn in 2021 said it would invest $672 million at the site instead of the $10 billion initially planned and forecast 1,454 new jobs, down from 13,000 as its plans shifted and tax breaks were reduced amid local skepticism. Microsoft President Brad Smith said the U.S. company planned to invest $3.3 billion by the end of 2026 and use artificial intelligence to boost manufacturing and help workers. The White House said that investment would result in 2,300 union construction jobs and around 2,000 permanent jobs over time. It said nearly 4,000 jobs had been added in the nearby city of Racine since Biden took office, while about 1,000 manufacturing jobs were lost during the Trump administration. "We will train over 100,000 people in Wisconsin by the end of the decade so they have the AI skills to fill the jobs of tomorrow," Smith said. He credited Biden's legislation on infrastructure, chips and climate change with laying the groundwork for the investment. Microsoft will partner with Gateway Technical College to train 1,000 people for data center and other roles by 2030 and will work to train 1,000 business leaders to adopt AI in their operations, the White House added. BLACK VOTER SUPPORT After the Microsoft event, Biden shook hands and bantered with about 50 campaign volunteers from Racine's Black community, urging them to take Trump at his word when he threatened to reverse gains made during Biden's presidency. Biden is seeking to shore up support among Black voters ahead of the Nov. 5 presidential election, with national polls showing him essentially tied in a rematch with Trump, a Republican making his third bid for the White House after losing to Biden in 2020. Biden's campaign has launched a $14 million ad campaign, including ads targeting Black, Latino and Asian voters. On Thursday, it plans a blitz on what it says are Trump's attacks on healthcare. In Wisconsin, Biden ribbed his predecessor for the failed investment in Racine County. "Foxconn turned out to be just that - a con," he said. Representatives for Trump's campaign could not be immediately reached for comment. Foxconn (2317.TW) New Tab, opens new tab said in a statement that employment at its Wisconsin operations had grown 42% since 2020 and that it had become the surrounding county's largest taxpayer in recent years. "We are proud of the over 1,000 men and women who work at Foxconn Wisconsin," it said. Sign up here. https://www.reuters.com/world/us/biden-unveil-33-billion-microsoft-ai-investment-battleground-wisconsin-2024-05-08/

2024-05-08 22:55

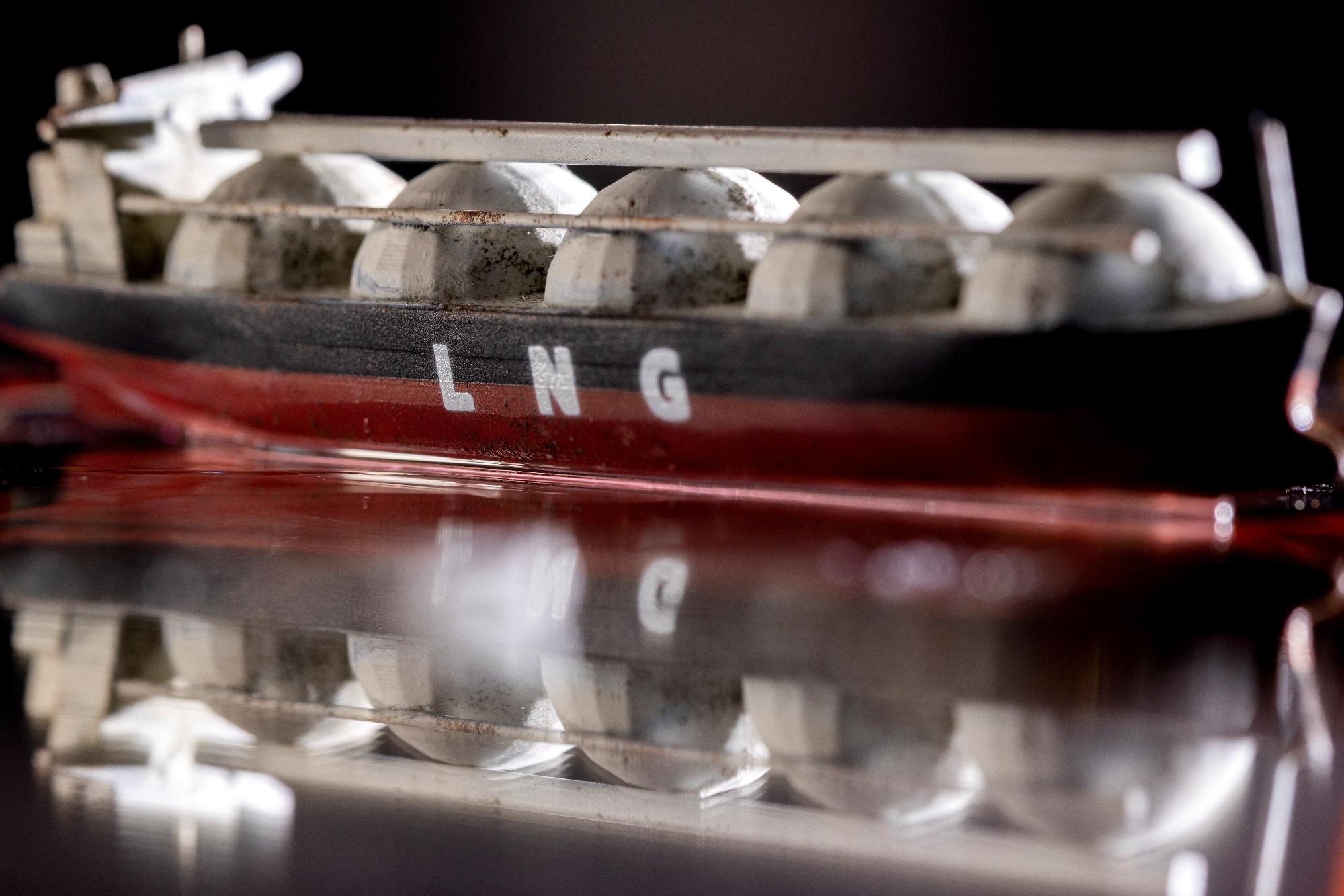

SYDNEY, May 9 (Reuters) - Australia's resources minister said on Thursday she backs the long-term exploration of potential natural gas projects, setting up a potential clash with opposition lawmakers and some in the incumbent Labor Party that oppose its use. Australia, one of the world's largest producers of liquefied natural gas (LNG), is committed to reducing its emissions to net zero by 2050. But Resources Minister Madeline King said in a column in the Australian Financial Review on Thursday, ahead of the launch of the government's Future Gas Strategy, that "gas is needed out to 2050 and beyond." "The energy transformation will take time – it will take investment in renewables, new industry processes, new technologies," she said. Australia supplies around a fifth of global LNG supply shipped last year, with the largest projects run by Chevron (CVX.N) New Tab, opens new tab and Woodside Energy Group (WDS.AX) New Tab, opens new tab in Western Australia. Woodside is developing the Scarborough LNG project in Western Australia and the Beetaloo Basin in the Northern Territory, both of which have faced strong opposition from environmental campaigners. "The strategy also makes it clear that we can't rely on past investments to get us through the next decades, as existing fields deplete," King said. "That will mean a continued commitment to exploration, and an openness to the kinds of foreign investment that have helped build the industry into the powerhouse it is today." The Labor Party led by Prime Minister Anthony Albanese, who faces reelection in a federal poll due next year, is reliant on the Greens and independent lawmakers to pass legislation in the Senate, the upper house of parliament, where Labor lacks a majority. Sign up here. https://www.reuters.com/sustainability/climate-energy/australia-backs-long-term-gas-exploration-despite-2050-climate-goals-2024-05-08/

2024-05-08 22:46

May 8 (Reuters) - Beyond Meat (BYND.O) New Tab, opens new tab posted a wider-than-expected quarterly loss and an 18% drop in revenue on Wednesday as its higher priced plant-based meat products hit volumes. WHY IT'S IMPORTANT Demand for Beyond Meat's products - including burger patty, sausages and ground beef - weakened as their customers such as McDonald's (MCD.N) New Tab, opens new tab and Yum Brands (YUM.N) New Tab, opens new tab saw sluggish consumer demand owing to sticky inflation. CONTEXT While Beyond Meat increased its prices in the current quarter, the company's volumes fell 16.1% as consumers kept a tight lid on spending. Despite price hikes, the company's margins came under pressure from higher manufacturing and material costs. It's gross margin in the quarter rose 4.9%, compared with a 6.7% rise last year. KEY QUOTE "It remains an uphill battle for the plant-based industry, as consumers are still tightening their belts and are less likely to try new premium grocery brands," said Blake Droesch, analyst from eMarketer. MARKET REACTION Shares of the company, which maintained its forecasts for annual revenue and gross margin, were down about 14% at $7.04 in trading after the bell. BY THE NUMBERS For the first quarter, the company posted revenue of $75.6 million, compared with analysts' average estimate of $75.2 million, according to LSEG data. In its U.S. food service segment, the company's revenue fell 16.2% to $12.3 million, compared to a decline of 5.3% to $14.7 million a year ago. On adjusted basis, Beyond Meat reported loss of 72 cents per share for the quarter ended March 30, compared with analysts' estimates of a loss of 67 cents per share. Sign up here. https://www.reuters.com/markets/commodities/beyond-meat-reports-wider-loss-quarterly-sales-decline-2024-05-08/