2024-05-08 22:33

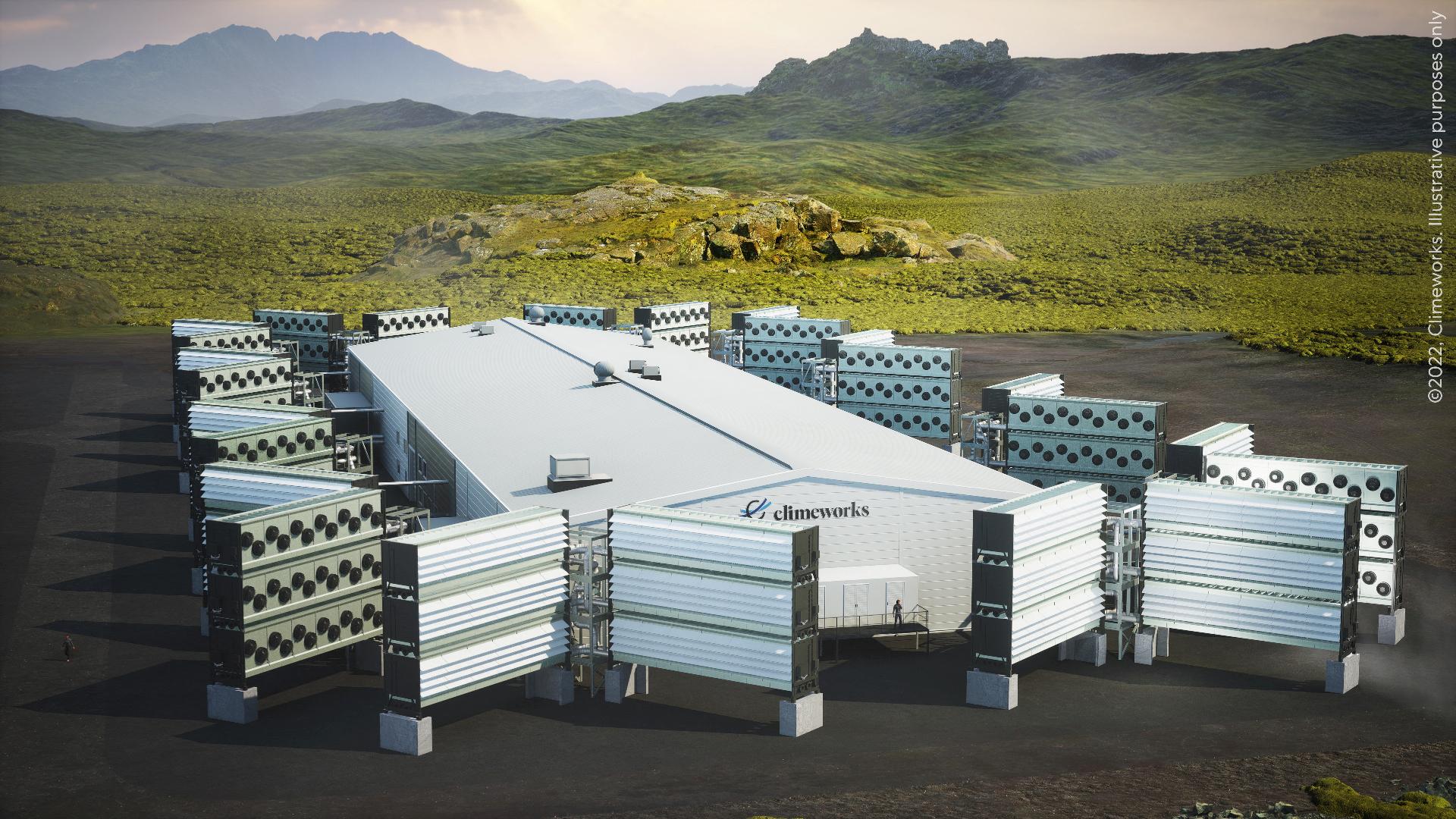

LONDON, May 8 (Reuters) - Climeworks has opened the world’s largest operational direct air capture (DAC) plant to suck carbon dioxide out of the atmosphere, with its Mammoth plant in Iceland almost ten times larger than the current record holder. Worsening climate change and inadequate efforts to cut emissions have led U.N. scientists to estimate billions of tons of carbon must be removed from the atmosphere annually to meet global climate goals. DAC works by using a technical process to suck carbon dioxide (CO2) out of the air and store it, usually underground. The Mammoth DAC plant has a capacity to capture 36,000 metric tons of CO2 a year and will be fully complete by the end of 2024. It is Climeworks' second commercial project, after the Orca plant, also in Iceland, which has a capacity of 4,000 tons a year and was previously the world's largest operational site. “Starting operations of our Mammoth plant is another proof point in Climeworks’ scale-up journey to megaton capacity by 2030 and gigaton by 2050,” Jan Wurzbacher, co-founder and co-CEO of Climeworks said. Climeworks is part of a consortium that has been selected for award negotiations under a U.S. programme for the technology to build a 1 million ton plant. The removal process is energy intensive, but Climeworks' plants in Iceland are powered by the country's renewable geothermal power plants. Critics of the technology say it is expensive and warn focusing on removing CO2 could deter companies from reducing their emissions as much as possible. Climeworks did not detail the cost per ton of removal at the Mammoth plant but said it is seeking to reduce costs of the technology to $400-600 per ton by 2030 and $200-350 per ton by 2040. Sign up here. https://www.reuters.com/business/environment/climeworks-opens-worlds-largest-plant-extract-co2-air-iceland-2024-05-08/

2024-05-08 22:24

HOUSTON, May 8 (Reuters) - Three insurance companies have rejected Chevron's (CVX.N) New Tab, opens new tab claim over the seizure last year of an oil cargo by Iran, according to a complaint filed on Tuesday in a U.S. court in California. The Chevron-chartered tanker Advantage Sweet was boarded by Iranian military New Tab, opens new tab in the Gulf of Oman in April 2023 and its crude oil cargo confiscated and later transferred to an Iranian vessel. Zurich American Insurance, Liberty Mutual Insurance and Great American Insurance asked a U.S. District Court in San Francisco to uphold their rejection of Chevron's $57 million claim under both marine cargo and war risks policies the company held. "The seizure of the crude oil and its later expropriation by Iran do not constitute 'warlike operations,'" the companies said of their denial of war risks coverage. Chevron's marine cargo policy also did not cover a seizure or confiscation, they told the court. A Chevron spokesperson said the company contests the denial of insurance coverage. "The military seizure by the Islamic Republic of Iran of the Advantage Sweet in international waters with Chevron's cargo aboard was a hostile act plainly covered by our insurance policies. We look forward to proving this in court," said Chevron spokesperson Christine Dobbyn. Chevron chartered the Advantage Sweet to transport crude oil to Houston from the Neutral Zone area shared by Saudi Arabia and Kuwait, the complaint said. Chevron has oil production operations in the zone. "Iranian Navy commandos boarded the Advantage Sweet while the vessel was in international waters in the Gulf of Oman on or about April 27, 2023 and seized control of the vessel and its cargo of crude oil," according to the complaint. Sign up here. https://www.reuters.com/business/energy/insurance-firms-deny-chevrons-57-million-claim-iran-oil-seizure-2024-05-08/

2024-05-08 22:22

PORTO ALEGRE, Brazil, May 8 (Reuters) - Authorities interrupted rescue efforts in flood-ravaged southern Brazil on Wednesday amid more rain and the risk of lightning and stiff winds that threaten to exacerbate a catastrophe that has already killed at least 100 people and left over 163,000 seeking shelter. The floods that began last week, caused by unusually heavy rains, have destroyed highways and bridges in the state of Rio Grande do Sul, which borders Uruguay and Argentina. "We've lost everything," said Adriana Freitas in state capital Porto Alegre, where the Guaiba River burst its banks and inundated city streets. "It's sad when we see the city, our house, in the middle of the water. It seems like it's over, that the world has ended." At least 128 people are still missing, the state's civil defense authority said, urging people living close to the Patos lagoon south of Porto Alegre to leave their homes immediately. Army soldiers used amphibious armored cars to rescue people from flooding in Canoas, just north of the city, where the waters have reached a depth of some three meters (10 ft) and the streets can only be navigated by boat. A Reuters journalist saw one team of local volunteer rescuers find about 20 dogs stranded on the second floor of an abandoned factory, offering food to those too fierce to take aboard. Porto Alegre city hall warned such civilian rescuers on Wednesday afternoon to halt their operations, given the forecast for rain, lightning storms and winds exceeding 80 km per hour (50 mph). In the Porto Alegre suburb of Eldorado do Sul, tractor driver Daniel Farias said he had spent days ferrying survivors to safety, carrying whole families out on his wheel loader, including pets. "I have been living in this tractor with my children, to survive this calamity. We believe it will pass," an exhausted Farias told Reuters. He said he had slept little and eaten less. RISK OF MORE FLOODS Brazil's national center for natural disasters warned that the southern area of Rio Grande do Sul state was under "high risk" of more flooding, with rainfall expected to restart after a brief hiatus. Weather forecaster MetSul said in a statement the region could face more "very large" floods "of serious proportions". In neighboring Uruguay, storms and flooding have closed highways and left nearly 800 people displaced and over 3,000 people without power, the government said. In Brazil, many residents in and around Porto Alegre, a city of 1.3 million people, have been living in darkness after power companies cut off electricity for security reasons. They have faced shortages of products, especially drinking water. Supermarket managers said there was no access for supply trucks or employees trying to get to work. Mineral water sales were restricted in some supermarkets. Volunteer rescue operations after dark in Porto Alegre were also hampered by looting, with police providing security using boats and even jet skis. "We are not going out to rescue people at night without an armed escort, because it has become too risky," volunteer Lauro Strogulski told Reuters. Sign up here. https://www.reuters.com/world/americas/death-toll-heavy-rains-brazil-hits-100-2024-05-08/

2024-05-08 22:17

HOUSTON, May 8 (Reuters) - Occidental Petroleum (OXY.N) New Tab, opens new tab hopes to close its acquisition of shale oil producer CrownRock before its second-quarter earnings call, CEO Vicki Hollub said on Wednesday. The event typically falls in early August. Occidental in December proposed to buy Permian producer CrownRock in a $12 billion cash-and-stock deal including debt. It wants to expand its presence in the largest U.S. oilfield as part of a wider consolidation wave among shale producers. "By that time, I believe, we will have closed," Hollub told analysts, in response to a question on when the company expects to incorporate CrownRock into its oil production guidance. The company is answering a second request for information on the acquisition by U.S. regulators and does not anticipate any impediments, Hollub said. Excluding the acquisition, Occidental said it plans to increase oil production in the Permian Basin from current operations by 18,000 barrels per day in the second half of 2024, with gains in efficiency allowing it to reduce the rig count, onshore operations executive Richard Jackson said. Its first-quarter profit beat analysts' consensus estimate on better-than-expected oil output. But shares fell more than 2% to close at $63.68 on Wednesday. Occidental reaffirmed its plans to sell $4.5 billion to $6 billion of assets within 18 months of closing the CrownRock purchase. Proceeds will help reduce the company's principal debt to $15 billion or below. Occidental plans to resume its share buybacks after its debt target is met. "Assets within our portfolio have garnered much interest, and our teams have commenced the early stages of the divestiture process," Hollub said. Occidental hopes "that high level of interest translates into appropriate levels of offers" for the assets, Hollub added. "It all comes down to valuation, and that is going to make the difference for us because we do have options," she said. Sign up here. https://www.reuters.com/business/energy/occidental-says-crownrock-deal-could-close-by-august-2024-05-08/

2024-05-08 22:13

May 8 (Reuters) - Bumble (BMBL.O) New Tab, opens new tab beat Wall Street estimates for first-quarter revenue on Wednesday helped by growth in its paying users, sending the company's shares up more than 9% in aftermarket trading. The company, which offers dating apps such as Bumble, Badoo, and Fruitz, has benefited from its marketing efforts to tap younger users and women. Last week, Bumble unveiled its anticipated app refresh, with a new logo, a move announced in February, that includes new features such as allowing women to set a question that their potential match could respond to. "We plan to roll out more experience-focused features this year to help our community better navigate the modern dating scene," CEO Lidiane Jones said. In the first quarter, global Bumble downloads growth rose 18% from a year earlier, according to market intelligence firm Sensor Tower. "I think this outperformance in Q1 demonstrates Bumble's ability to drive domestic and international growth within its core Bumble brand against the backdrop of recent management changes and a difficult macroeconomic environment for online dating," M Science analyst Chandler Willison said. The Austin, Texas-based company's first-quarter revenue rose 10.2% to $267.8 million, beating analysts' average estimate of $265.5 million, according to LSEG data. It reported earnings per share of 19 cents, compared with analysts' estimate of 7 cents per share, according to LSEG data. Total paying users across Bumble's apps increased to about 4 million in the first-quarter ended March 31, from 3.5 million a year earlier. Bumble expects second-quarter revenue between $269 million and $275 million, below analysts' estimate of $278.6 million. Citi analysts said in a note on Wednesday that while the second-quarter forecast was below expectations, investor sentiment was low enough to look past that as Bumble maintained its full-year outlook. Sign up here. https://www.reuters.com/markets/us/bumble-forecasts-second-quarter-revenue-below-estimates-2024-05-08/

2024-05-08 21:53

May 8 (Reuters) - Nutrien (NTR.TO) New Tab, opens new tab, the world's biggest fertilizer producer, beat first-quarter profit estimates on Wednesday, on strong demand for crop nutrients from North America owing to early planting and lower inventory. The company's U.S.-listed shares were up 1% at $55.99 in aftermarket trade. An early start to spring planting season in the region helped fertilizer demand, according to RBC Capital Markets analysts. Adjusted core profit at Nutrien Ag Solutions, the company's retail segment, was at $77 million in the reported quarter, compared with an adjusted core loss of $34 million a year ago. Quarterly sales volumes for crop nutrients, its biggest segment, was at 1.46 million tonnes in North America, up 22.5% from a year ago. Net earnings, however, stood at $165 million in the quarter, down 71.4% from the previous year, due to low demand in South America. Reuters had reported that the company is mulling divestments in South America, replacing management and halting an acquisition spree in Brazil after steep losses in the region. Since April last year, at least eight senior executives or managers were fired or had quit the company, including members of Brazil's entire supply management team, CEO and chief financial officer for Latin America. Nutrien's troubles in South America emerged with fertilizer companies struggling with volatility in global markets, after Russia's invasion of Ukraine sent prices skyrocketing in 2022 only to collapse the following year as farmers held off on purchases and global supplies stabilized. The world's biggest fertilizer producer reported an adjusted profit of 46 cents per share for the quarter ended March 31, compared with analysts' average estimate of 39 cents per share, according to LSEG data. Sign up here. https://www.reuters.com/markets/commodities/nutrien-beats-first-quarter-profit-estimates-2024-05-08/