mtdesk

Publish Date: Thu, 08 Jun 2023, 10:03 AM

What is the FED Interest Rate Decision?

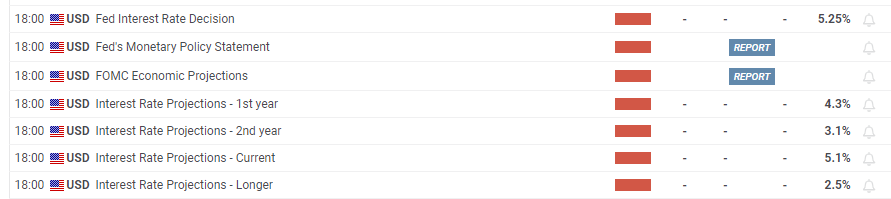

Source: FXStreet - FED Interest Rate Decision on 14 June 2023

The Federal Reserve Interest Rate Decision refers to the announcement made by the Federal Open Market Committee (FOMC), the policymaking body of the Federal Reserve System, regarding changes to the target range for the federal funds rate. This decision, which typically occurs during FOMC meetings, determines whether the Fed will raise, lower, or maintain interest rates.

How Does the Federal Funds Rate Work?

The Federal Funds Rate is the interest rate at which banks and financial institutions lend reserve balances to each other overnight. It is set by the Federal Open Market Committee (FOMC) and serves as a benchmark for other short-term interest rates in the economy. Through open market operations, the Federal Reserve influences the supply of reserves in the banking system to achieve the desired Federal Funds Rate target. The Federal Funds Rate impacts borrowing costs for businesses and consumers, and changes in the rate can have implications for economic activity and inflation. It is closely monitored by market participants and provides insights into the Federal Reserve's monetary policy stance and outlook for the economy.

Why is this important to investors?

- Bond prices and yields: Interest rate changes directly affect bond prices and yields. When the Fed raises interest rates, bond prices tend to decline, leading to higher yields. Conversely, when the Fed lowers interest rates, bond prices generally rise, resulting in lower yields.

- Stock market volatility: The Fed Interest Rate Decision can influence stock market performance and volatility. Lower interest rates can stimulate economic growth, boost corporate earnings, and potentially lead to higher stock prices. Conversely, higher interest rates may dampen economic activity and profitability, potentially impacting stock market returns.

- Currency exchange rates: Interest rate differentials between countries can affect currency exchange rates. When the Fed raises interest rates, it can attract foreign capital, strengthening the U.S. dollar relative to other currencies. This can impact international investments, trade competitiveness, and currency hedging strategies.

- Investment allocation and risk management: The Fed Interest Rate Decision influences the overall economic and financial landscape. Investors consider interest rate changes when making decisions about asset allocation, risk management, and portfolio diversification. Adjustments in interest rates can impact the relative attractiveness of different asset classes, such as stocks, bonds, commodities, or real estate.

- Yield on savings and income investments: Interest rate decisions affect the yield on savings accounts, money market funds, and other income-generating investments. When the Fed raises rates, it can lead to higher interest payments on savings and fixed-income instruments.