mtdesk

Publish Date: Thu, 08 Jun 2023, 10:04 AM

What are Non-Farm Payrolls?

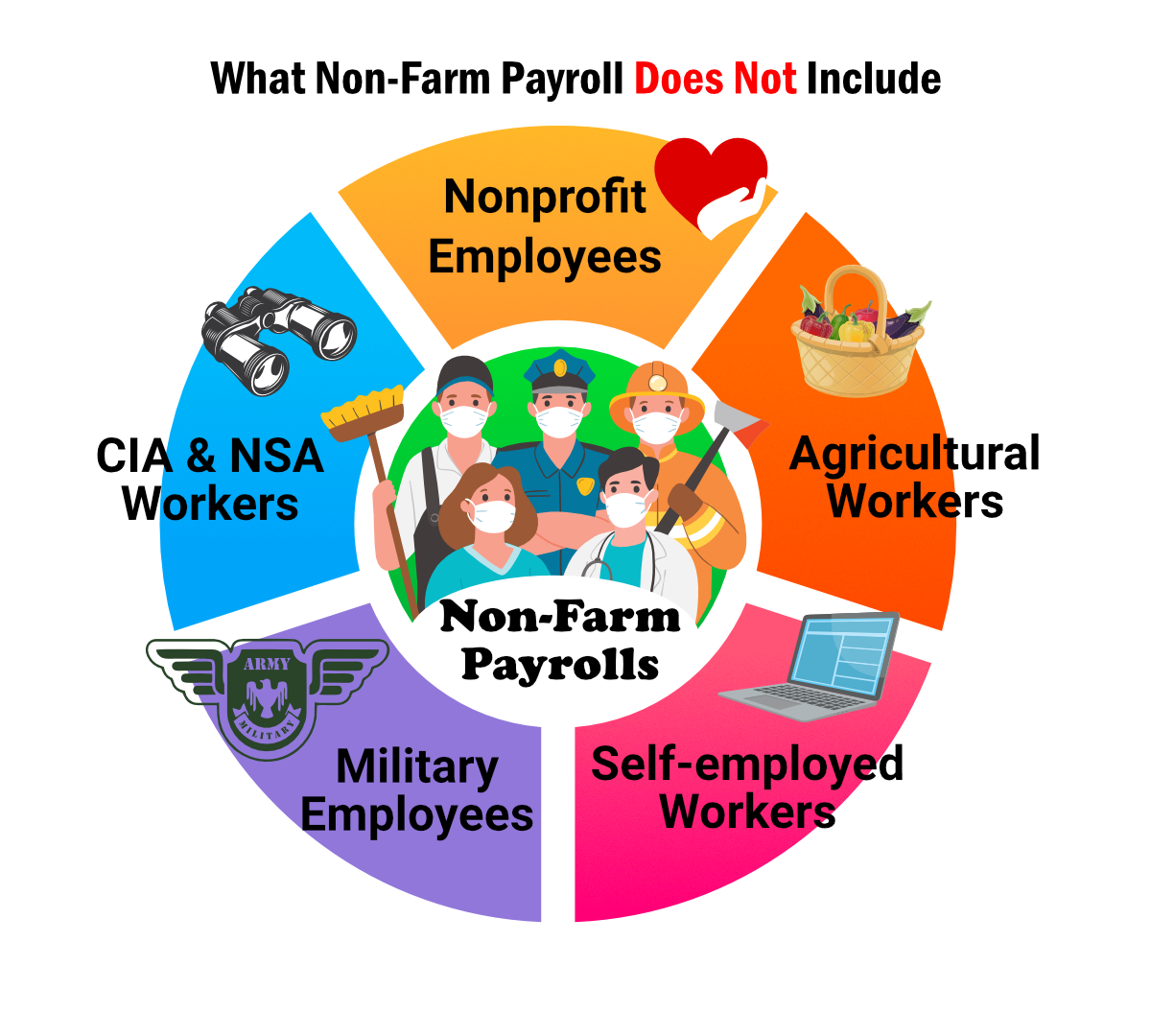

Non-Farm Payrolls (NFP) is a monthly economic indicator published by the U.S. Bureau of Labor Statistics. It represents the total number of paid workers, excluding farm workers, government employees, private household employees, and employees of nonprofit organizations. The NFP report provides valuable information about the employment situation in the United States, including changes in the number of jobs added or lost across various sectors of the economy.

How do Non-Farm Payrolls work?

Non-Farm Payrolls (NFP) function as a key labor market indicator that provides insights into employment trends in the United States. The process begins with the U.S. Bureau of Labor Statistics collecting data from a sample of businesses and government agencies across various industries and regions. These establishments report the number of employees on their payrolls during a specific reference period. Based on this data, the BLS estimates the total non-farm employment for the entire country. The NFP report is then released on a monthly basis, revealing the net change in employment, unemployment rate, and other related metrics. This data serves as a crucial tool for policymakers, economists, and investors to assess the strength of the labor market, make informed decisions, and gain insights into broader economic conditions.

Why is this important to investors?

- Labor market health: The NFP report provides a comprehensive overview of employment trends in the United States. Investors closely monitor the NFP data to assess the health of the labor market, including job creation, unemployment rates, and wage growth. A strong NFP report, indicating robust job growth and low unemployment, is generally viewed as a positive sign for the economy and can boost investor confidence.

- Economic growth and interest rates: The NFP report plays a crucial role in shaping expectations about economic growth and interest rate policies. A strong NFP reading suggests a growing economy and can lead investors to anticipate higher interest rates in the future. This expectation can impact bond yields, currency exchange rates, and the overall pricing of financial assets.

- Monetary policy decisions: The NFP report influences the decision-making process of central banks, including the U.S. Federal Reserve. Central banks often consider employment data, including NFP, when formulating monetary policy. Investors closely analyze the NFP report to gauge the potential impact on interest rate decisions and the overall monetary policy stance. Changes in monetary policy can have broad implications for various asset classes, making the NFP report an important consideration for investors.