georgemiller

Publish Date: Mon, 30 Sep 2024, 07:30 AM

Key takeaways

- Social issues related to matters such as wages and treatment of workers have been growing in recent years and pose risks to economies if the underlying causes go unaddressed.

- Related to this, companies with higher employee morale and more positive stakeholder impacts tend to achieve better productivity and outcomes, potentially leading to stock market outperformance.

- Accordingly, considering societal impacts is in investor interests, particularly as we navigate important issues such as climate change, growing income inequality and the advance of AI.

Learning About ESG is an educational series that connects environmental, social and governance topics with investing.

Join us each issue to see how global developments can have implications for investors. The better we understand ESG, the bigger the role it can play in our everyday lives – and investment portfolios – contributing to a better world.

Today we finance a number of industries that significantly contribute to greenhouse gas emissions. We have a strategy to help our customers to reduce their emissions and to reduce our own. For more information visit www.hsbc.com/sustainability.

The importance of a ‘just transition’

At the centre of this transition are people whose livelihoods will be affected by the momentous shift - from workers facing redundancy, to consumers impacted by energy prices and local economies that depend on oil revenue. A just transition will ensure that individual countries, communities or workers don’t bear a disproportionate burden as we shift to a low-carbon economy. This requires supporting communities reliant on carbon-intensive sectors to adapt their industries and train the workforce accordingly. Without this support, negative social outcomes can damage economies.

Emerging markets are an important element of this story. Over the past few decades, a substantial portion of carbon-intensive industrial activity has been relocated from developed to emerging countries. This has been largely due to lower production costs and less scrutiny over environmental issues. Fast-growing emerging economies in Asia are now driving emissions growth – with the region accounting for roughly half of global emissions.

Of course, environmental damage must be limited globally, which requires substantial change. While yet to be fulfilled, USD100 billion per year committed in climate finance to developing countries through the COP climate summits can support the objectives of a just transition, by helping facilitate the industrial change needed in these markets.

Achieving a just transition has important financial implications for investors. Social issues related to shifting industries and job opportunities poses risks to political structures and economic growth. Furthermore, higher levels of morale in the labour market fosters better productivity, as supported by a prominent study of stock market returns from 1984 to 2009, with materially better performance by companies with high employee satisfaction.

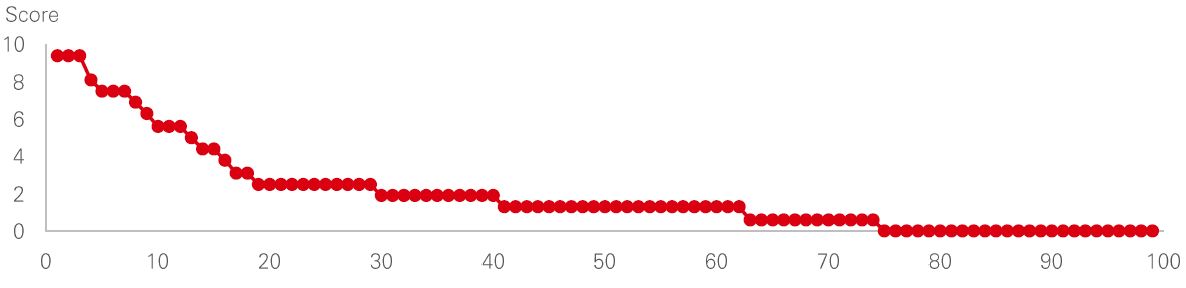

Clearly the oil industry is key to a just transition. Yet, of 100 companies assessed globally, roughly a quarter received a score of zero in an analysis of efforts to support a just transition. Societal and financial implications support growing investor scrutiny on this.

Oil and gas company 2023 just transition assessment scores (out of 20)

Source: HSBC Asset Management, World Benchmarking Alliance Climate and Energy Benchmark Report, 29 June 2023.

The value of the social pillar of ESG

A portfolio of the top 25 companies to work for, as ranked by the Great Place to Work Institute, has significantly outperformed the broader equity market over the last decade. While such a concentrated portfolio creates inherent biases, it aligns with prior academic research demonstrating that companies with higher employee morale and a more positive impact on communities in which they operate achieve better productivity and performance.

Similarly, MSCI research delved into the performance impacts of the individual components of ESG (environmental, social and governance considerations). Analysing returns over the last decade, stocks with top quintile ‘S’ scores outperformed their bottom quintile peers, with the outperformance being more significant than equivalent comparisons for ‘E’ or ‘G’ scores. The performance advantage has been particularly evident in recent years, perhaps reflecting improved productivity from those companies that invested in their staff during the pandemic.

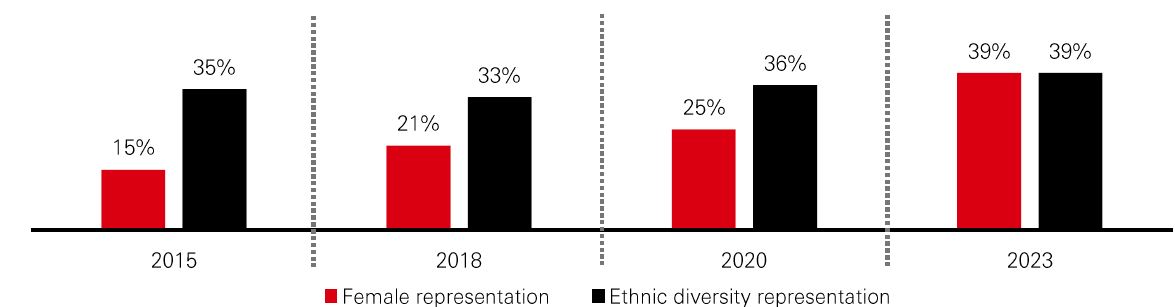

When considering company morale and impacts on the communities in which they operate, whether company leadership reflects those communities can likewise be an indicator for performance and productivity.

Various studies demonstrate a positive link between diversity and company performance. That is, companies with more diverse leadership have delivered better results, which is intuitive given the proven benefits of decision-making that incorporates different perspectives, such as those most relevant to local communities and customers. Per the chart below, the most diverse firms have seen an increase in their levels of outperformance, measured by profitability, over the years.

Cause and effect for this outperformance can be complicated by a combination of factors. Nonetheless, data broadly support the argument that societal considerations are as important as any ESG pillars. Accordingly, making such considerations a priority is in the best interests of long-term investors.

Greater diversity on executive teams aligns with financial outperformance

Difference in likelihood of outperformance of 1st versus 4th quartile

Past performance is not an indicator of future returns. Source: McKinsey & Company, December 2023.

Society and shareholder interests aligned

Inequality, another important societal issue, has increasingly been a topic of discussion due to strikes and other large-scale labour action in recent years. Income and wealth inequality has been on the rise almost everywhere since the 1980s and is now at its most severe since the early 20th century.

This points to a need for improvement in workforce treatment and poverty reduction. In the absence of progress, we should expect more systemic issues such as breakdowns in social cohesion and disruptions to political stability. This will create turbulence in financial systems and hinder economic growth.

Any discussion of investment in the workforce today would be incomplete without mentioning developments in artificial intelligence. Rapid progress in the technology has contributed to much angst around societal risks, from data privacy to the widescale elimination of human jobs. Accordingly, discussions among regulators, industry leaders and academics on these matters have picked up steam.

The EU is taking significant strides in formally addressing concerns, with a proposed AI Act outlining a comprehensive governance framework around AI systems, extending from product development to data privacy. Other steps will surely follow.

Regulations aside, while AI will certainly improve automation and reduce the need for certain human tasks, it will also enhance human productivity. Companies best positioned to succeed will prioritise training their workforces with the relevant skills to work alongside new AI capabilities and increase output.

All of this discussion leads to the conclusion that incorporating social considerations within an ESG framework is in line with investors’ interests. For those seeking investment solutions focused more specifically on social considerations, we expect momentum to build with relevant offerings given evidence supporting potential performance benefits. Even more importantly, growing demand along with pressure from both investors and asset managers can help drive progress, including in laggard areas such as oil & gas.

Glossary

ESG: A set of Environmental, Social and Governance criteria that investors can apply to analyse and identify material risks and growth opportunities in investments.

Just transition: Seeks to ensure that the benefits of a green economy transition are shared widely, while also supporting those who stand to lose economically.

https://www.hsbc.com.my/wealth/insights/esg/learning-about-esg/2024-05-24/